444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy aesthetic market represents one of Europe’s most sophisticated and rapidly evolving beauty and cosmetic treatment sectors. Italian consumers demonstrate exceptional demand for advanced aesthetic procedures, driven by cultural emphasis on beauty, fashion consciousness, and increasing disposable income. The market encompasses a comprehensive range of services including non-invasive treatments, surgical procedures, skincare solutions, and advanced cosmetic technologies.

Market dynamics indicate robust growth patterns with the sector experiencing a 12.5% annual growth rate in recent years. This expansion reflects Italy’s position as a leading European destination for aesthetic treatments, supported by world-class medical facilities, skilled practitioners, and innovative treatment methodologies. The market benefits from strong domestic demand while attracting significant medical tourism from neighboring countries.

Regional distribution shows concentrated activity in major metropolitan areas including Milan, Rome, Florence, and Naples, where 75% of aesthetic clinics operate. These urban centers serve as hubs for advanced aesthetic treatments, combining traditional Italian craftsmanship with cutting-edge medical technology. The market’s sophistication reflects Italy’s broader beauty and fashion industry leadership.

The Italy aesthetic market refers to the comprehensive ecosystem of medical and cosmetic procedures, products, and services designed to enhance physical appearance and address aesthetic concerns within the Italian healthcare and beauty sectors. This market encompasses both surgical interventions and non-invasive treatments performed by qualified medical professionals in specialized clinics, hospitals, and aesthetic centers.

Core components include facial rejuvenation procedures, body contouring treatments, dermatological services, injectable treatments, laser therapies, and advanced skincare solutions. The market serves diverse consumer segments seeking aesthetic enhancement, anti-aging solutions, corrective procedures, and preventive treatments. Italian aesthetic practices emphasize natural-looking results that enhance individual beauty rather than dramatic transformations.

Professional standards within the market maintain strict regulatory compliance, ensuring treatments are performed by licensed medical professionals using approved technologies and products. This commitment to quality and safety distinguishes the Italian market as a premium destination for aesthetic treatments both domestically and internationally.

Strategic positioning of the Italy aesthetic market demonstrates exceptional growth potential driven by evolving consumer preferences, technological advancement, and increasing acceptance of aesthetic treatments across demographic segments. The market benefits from Italy’s reputation for excellence in beauty, fashion, and medical care, creating a unique competitive advantage in the European aesthetic landscape.

Key growth drivers include rising disposable income, changing social attitudes toward aesthetic treatments, technological innovation, and expanding treatment accessibility. The market shows particular strength in minimally invasive procedures, which account for 68% of total treatments performed annually. This trend reflects consumer preference for natural-looking results with minimal downtime.

Market segmentation reveals diverse opportunities across age groups, with millennials and Generation X representing the largest consumer segments. Treatment categories show strong performance in facial aesthetics, body contouring, and preventive skincare solutions. The market’s resilience during economic fluctuations demonstrates the prioritization Italian consumers place on personal appearance and self-care.

Future prospects indicate continued expansion supported by technological advancement, increasing treatment accessibility, and growing medical tourism. The market’s evolution toward personalized treatment approaches and combination therapies positions Italy as a leader in innovative aesthetic care delivery.

Consumer behavior analysis reveals sophisticated treatment preferences with Italian clients seeking natural enhancement rather than dramatic transformation. This approach aligns with cultural values emphasizing timeless beauty and elegance. Treatment frequency shows increasing adoption of maintenance protocols, with clients scheduling regular sessions to maintain results.

Cultural influence serves as a primary market driver, with Italian society’s emphasis on beauty, style, and personal presentation creating strong demand for aesthetic treatments. This cultural foundation supports market growth by normalizing aesthetic procedures as part of regular self-care routines. Fashion industry presence in major Italian cities reinforces beauty standards and aesthetic awareness.

Economic prosperity enables increased consumer spending on discretionary services including aesthetic treatments. Rising disposable income levels, particularly among urban professionals, support market expansion. The growing middle class demonstrates willingness to invest in appearance enhancement and anti-aging solutions, viewing these treatments as valuable lifestyle investments.

Technological advancement drives market growth through improved treatment efficacy, reduced downtime, and enhanced patient comfort. Innovation in laser technology, injectable products, and minimally invasive techniques expands treatment options and attracts new consumer segments. Digital integration improves patient consultation processes and treatment planning.

Demographic trends including population aging and increased life expectancy create sustained demand for anti-aging treatments. Simultaneously, younger consumers embrace preventive aesthetic care, expanding the market base. Social media influence increases aesthetic awareness and treatment acceptance across demographic groups.

Economic sensitivity represents a significant market restraint, as aesthetic treatments are often considered discretionary spending that may be reduced during economic uncertainty. Cost considerations limit treatment accessibility for some consumer segments, particularly for more expensive surgical procedures or comprehensive treatment programs.

Regulatory complexity creates operational challenges for aesthetic providers, requiring substantial compliance investments and ongoing regulatory monitoring. Strict licensing requirements and safety protocols, while ensuring quality, may limit market entry for new providers and increase operational costs for existing practitioners.

Competition intensity from neighboring European markets offering similar services at competitive prices may impact medical tourism revenues. Additionally, increasing competition from non-medical aesthetic providers offering basic treatments may pressure traditional medical aesthetic practices.

Cultural conservatism in certain regions or demographic segments may limit treatment adoption, particularly for more invasive procedures. Traditional attitudes toward aging and natural beauty may resist aesthetic intervention, constraining market expansion in specific areas or populations.

Medical tourism expansion presents substantial growth opportunities as Italy’s reputation for medical excellence and aesthetic expertise attracts international patients. Package offerings combining treatments with cultural experiences leverage Italy’s tourism appeal, creating unique value propositions for international clients seeking aesthetic enhancement.

Technology integration offers opportunities for market differentiation through adoption of cutting-edge treatment modalities, artificial intelligence-assisted treatment planning, and personalized therapy protocols. Telemedicine applications enable remote consultations and follow-up care, expanding service accessibility and patient convenience.

Demographic targeting reveals opportunities in underserved segments including male consumers, who show 35% growth in treatment adoption, and younger demographics seeking preventive care. Specialized treatment programs addressing specific concerns or demographic needs can capture emerging market segments.

Geographic expansion into secondary cities and regional markets offers growth potential as aesthetic awareness increases beyond major metropolitan areas. Franchise models and satellite clinic development can extend market reach while maintaining quality standards and brand consistency.

Supply chain evolution demonstrates increasing sophistication with direct relationships between Italian aesthetic providers and global technology manufacturers. This integration ensures access to latest innovations while maintaining competitive pricing. Product availability shows improvement in treatment variety and technology options available to practitioners.

Competitive landscape features both established medical aesthetic practices and emerging specialized clinics, creating dynamic market conditions. Competition drives innovation in treatment offerings, patient experience, and pricing strategies. Market consolidation trends show larger groups acquiring smaller practices to achieve economies of scale.

Consumer education initiatives by industry associations and leading practitioners improve treatment understanding and safety awareness. This education reduces treatment hesitancy and supports informed decision-making. Digital marketing strategies increasingly influence consumer treatment choices and provider selection.

Seasonal fluctuations impact treatment scheduling and revenue patterns, with providers developing strategies to manage demand variations. Treatment bundling and maintenance programs help stabilize revenue streams while providing enhanced patient value.

Comprehensive analysis of the Italy aesthetic market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive surveys of aesthetic practitioners, clinic operators, and consumers to gather firsthand market intelligence and trend identification.

Secondary research incorporates analysis of industry publications, regulatory filings, professional association reports, and academic studies related to aesthetic medicine in Italy. This approach provides historical context and validates primary research findings through triangulation of data sources.

Market segmentation analysis utilizes demographic data, treatment statistics, and geographic distribution patterns to identify market opportunities and trends. MarkWide Research methodology includes both quantitative analysis of market metrics and qualitative assessment of industry dynamics and competitive positioning.

Expert interviews with leading aesthetic practitioners, industry executives, and regulatory officials provide insights into market challenges, opportunities, and future developments. This qualitative research component enhances understanding of market nuances and emerging trends that quantitative data alone cannot capture.

Northern Italy dominates the aesthetic market with 45% market share, led by Milan’s position as a fashion and beauty capital. The region benefits from high disposable income, cultural emphasis on appearance, and concentration of luxury aesthetic clinics. Lombardy and Veneto regions show particularly strong performance in premium aesthetic treatments.

Central Italy represents 30% of market activity, with Rome serving as the primary hub for aesthetic treatments. The region attracts both domestic and international patients seeking high-quality aesthetic care. Tuscany’s medical tourism sector contributes significantly to regional aesthetic market growth through combination treatment and vacation packages.

Southern Italy accounts for 25% of market share with growing demand for aesthetic treatments in major cities including Naples, Bari, and Palermo. The region shows increasing treatment adoption rates and expanding clinic infrastructure. Economic development in southern regions supports market growth through increased consumer spending power.

Island regions including Sicily and Sardinia demonstrate emerging market potential with growing aesthetic awareness and treatment accessibility. These areas benefit from medical tourism during peak vacation seasons while developing year-round domestic demand for aesthetic services.

Market leadership features a mix of established medical aesthetic groups, independent practitioners, and international clinic chains operating throughout Italy. Competition focuses on treatment quality, technology advancement, patient experience, and pricing strategies.

Competitive strategies emphasize differentiation through specialized expertise, advanced technology adoption, and superior patient experience. Many providers invest in continuing education, international certifications, and cutting-edge equipment to maintain competitive advantages.

By Treatment Type: The market segments into surgical procedures, non-surgical treatments, and skincare services. Non-surgical treatments dominate with 65% market share, including injectables, laser treatments, and radiofrequency procedures. Surgical procedures maintain steady demand for comprehensive aesthetic enhancement.

By Demographics: Age segmentation reveals diverse treatment preferences across generational groups. Ages 35-50 represent the largest consumer segment, seeking anti-aging and maintenance treatments. Younger consumers increasingly adopt preventive treatments, while older demographics focus on corrective procedures.

By Gender: Female consumers traditionally dominate the market, though male participation shows rapid 28% growth in recent years. Men increasingly seek facial treatments, hair restoration, and body contouring procedures, expanding the total addressable market.

By Price Range: Market segmentation includes premium, mid-range, and accessible treatment categories. Premium services command higher margins while accessible treatments expand market reach to broader consumer segments.

Facial Aesthetics represents the largest treatment category, encompassing injectables, laser treatments, and surgical procedures. Botulinum toxin treatments show consistent growth with high patient satisfaction rates. Dermal fillers maintain popularity for volume restoration and facial contouring applications.

Body Contouring demonstrates strong growth through non-invasive technologies including cryolipolysis, radiofrequency, and ultrasound treatments. These procedures appeal to consumers seeking body enhancement without surgical intervention. Combination treatments improve results and patient satisfaction.

Skin Rejuvenation encompasses laser treatments, chemical peels, and advanced skincare procedures. This category benefits from increasing awareness of skin health and preventive care. Customized treatment protocols address specific skin concerns and individual patient needs.

Hair Restoration shows emerging growth with advanced techniques including follicular unit extraction and platelet-rich plasma treatments. This category attracts both male and female consumers seeking natural-looking hair restoration solutions.

Healthcare providers benefit from aesthetic market participation through revenue diversification, higher profit margins, and enhanced patient relationships. Aesthetic services often generate superior returns compared to traditional medical services while building long-term patient loyalty through ongoing treatment relationships.

Technology manufacturers gain access to a sophisticated market demanding advanced treatment solutions. Italian aesthetic providers serve as early adopters of innovative technologies, providing valuable feedback for product development and market validation for broader European expansion.

Patients receive access to world-class aesthetic treatments combining Italian medical expertise with cutting-edge technology. Treatment outcomes emphasize natural-looking results that enhance individual beauty while maintaining safety and efficacy standards.

Economic stakeholders benefit from market growth through job creation, tax revenue generation, and medical tourism contributions to local economies. The aesthetic market supports broader healthcare infrastructure development and professional training programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Minimally Invasive Focus dominates current market trends with consumers preferring treatments requiring minimal downtime and producing natural-looking results. This trend drives innovation in injectable treatments, laser technologies, and radiofrequency procedures that deliver effective results without surgical intervention.

Personalized Treatment Approaches gain popularity as providers develop customized protocols addressing individual patient needs and aesthetic goals. Advanced consultation processes utilize digital imaging and treatment simulation to enhance patient understanding and satisfaction with expected outcomes.

Combination Therapies show increasing adoption as practitioners combine multiple treatment modalities to achieve superior results. These approaches optimize treatment efficacy while potentially reducing overall treatment costs and time requirements for patients.

Male Market Growth represents a significant trend with men increasingly seeking aesthetic treatments for facial rejuvenation, hair restoration, and body contouring. This demographic expansion requires specialized marketing approaches and treatment protocols adapted to male aesthetic preferences.

Technology Integration includes adoption of artificial intelligence for treatment planning, virtual reality for patient education, and advanced imaging systems for outcome prediction. Digital transformation enhances patient experience while improving treatment precision and safety.

Regulatory Updates include enhanced safety protocols for injectable treatments and updated licensing requirements for aesthetic practitioners. These developments strengthen patient safety while potentially creating barriers for new market entrants. Professional certification programs expand to ensure practitioner competency in emerging treatment modalities.

Technology Launches feature next-generation laser systems, advanced injectable products, and innovative body contouring devices. Italian aesthetic providers often serve as early adopters for European technology rollouts, providing valuable market feedback to manufacturers.

Market Consolidation trends include larger aesthetic groups acquiring independent practices to achieve economies of scale and expand geographic coverage. This consolidation may improve treatment standardization while potentially reducing competition in local markets.

International Partnerships develop between Italian aesthetic providers and international medical tourism companies, expanding patient referral networks and treatment accessibility for foreign patients seeking Italian aesthetic expertise.

Market positioning recommendations emphasize differentiation through specialized expertise, superior patient experience, and advanced technology adoption. MarkWide Research analysis suggests providers focus on building strong brand recognition and patient loyalty through consistent treatment quality and outcomes.

Geographic expansion strategies should target secondary cities with growing aesthetic awareness but limited competition. Providers can establish satellite locations or partnership arrangements to capture emerging market opportunities while managing operational complexity and investment requirements.

Technology investment priorities should focus on treatments showing strong growth potential including advanced body contouring systems, next-generation injectable products, and combination therapy platforms. Equipment financing strategies can help manage capital requirements while maintaining competitive treatment offerings.

Patient acquisition strategies should leverage digital marketing, patient referral programs, and medical tourism partnerships to expand patient base. Social media presence becomes increasingly important for reaching younger demographic segments and building brand awareness.

Market trajectory indicates continued growth driven by demographic trends, technology advancement, and increasing treatment acceptance across consumer segments. The market is projected to maintain strong double-digit growth over the next five years, supported by expanding treatment options and growing consumer awareness.

Technology evolution will likely introduce more precise, effective, and comfortable treatment options, further expanding market appeal. Artificial intelligence integration may revolutionize treatment planning and outcome prediction, enhancing patient satisfaction and treatment efficacy.

Demographic shifts suggest continued market expansion as younger consumers embrace preventive treatments and male participation increases. MWR projections indicate the male aesthetic market segment could represent 40% of total treatments within the next decade.

International growth opportunities through medical tourism expansion may significantly contribute to market development, positioning Italy as a leading European destination for aesthetic treatments. This growth requires continued investment in infrastructure, marketing, and service quality to maintain competitive advantages.

The Italy aesthetic market demonstrates exceptional growth potential supported by strong cultural foundations, advanced medical infrastructure, and evolving consumer preferences toward aesthetic enhancement. Market dynamics favor continued expansion through technology innovation, demographic diversification, and international patient attraction.

Strategic opportunities exist across multiple market segments including minimally invasive treatments, male aesthetics, and medical tourism development. Providers who invest in advanced technology, superior patient experience, and effective marketing strategies are positioned to capture significant market share in this growing sector.

Future success will depend on maintaining Italy’s reputation for aesthetic excellence while adapting to changing consumer preferences and competitive pressures. The market’s evolution toward personalized, technology-enhanced treatments creates opportunities for differentiation and premium positioning in the European aesthetic landscape.

What is Aesthetic?

Aesthetic refers to the principles and philosophy of beauty and artistic taste, often encompassing various forms of art, design, and personal expression. In the context of the Italy Aesthetic Market, it includes fashion, interior design, and visual arts that reflect Italy’s rich cultural heritage.

What are the key players in the Italy Aesthetic Market?

Key players in the Italy Aesthetic Market include luxury fashion brands like Gucci and Prada, as well as renowned design firms such as Bvlgari and Artemide. These companies are known for their innovative designs and contributions to the aesthetic landscape, among others.

What are the growth factors driving the Italy Aesthetic Market?

The Italy Aesthetic Market is driven by factors such as the increasing demand for luxury goods, the influence of Italian culture on global fashion trends, and the rise of social media showcasing aesthetic lifestyles. Additionally, tourism plays a significant role in promoting Italian aesthetics worldwide.

What challenges does the Italy Aesthetic Market face?

Challenges in the Italy Aesthetic Market include intense competition from emerging brands, changing consumer preferences towards sustainability, and economic fluctuations that can impact luxury spending. These factors can create hurdles for established companies and new entrants alike.

What opportunities exist in the Italy Aesthetic Market?

Opportunities in the Italy Aesthetic Market include the growing interest in sustainable fashion, the potential for digital transformation in marketing and sales, and the expansion of e-commerce platforms. These trends can help brands reach a broader audience and adapt to changing consumer behaviors.

What trends are shaping the Italy Aesthetic Market?

Current trends in the Italy Aesthetic Market include a focus on minimalism in design, the integration of technology in fashion, and a resurgence of vintage styles. Additionally, there is a growing emphasis on ethical production practices and the use of eco-friendly materials.

Italy Aesthetic Market

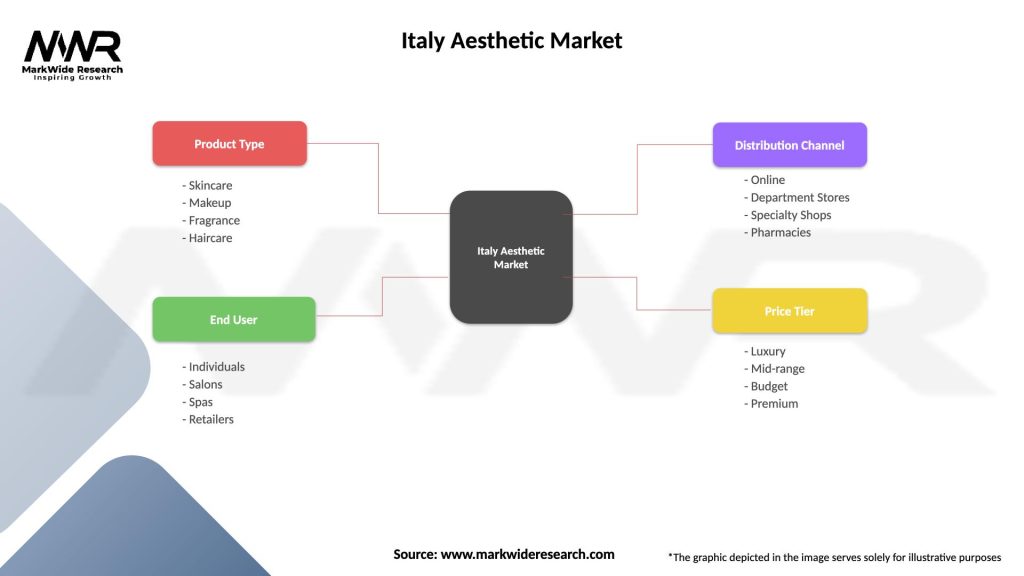

| Segmentation Details | Description |

|---|---|

| Product Type | Skincare, Makeup, Fragrance, Haircare |

| End User | Individuals, Salons, Spas, Retailers |

| Distribution Channel | Online, Department Stores, Specialty Shops, Pharmacies |

| Price Tier | Luxury, Mid-range, Budget, Premium |

Please note: The segmentation can be entirely customized to align with our client’s needs.

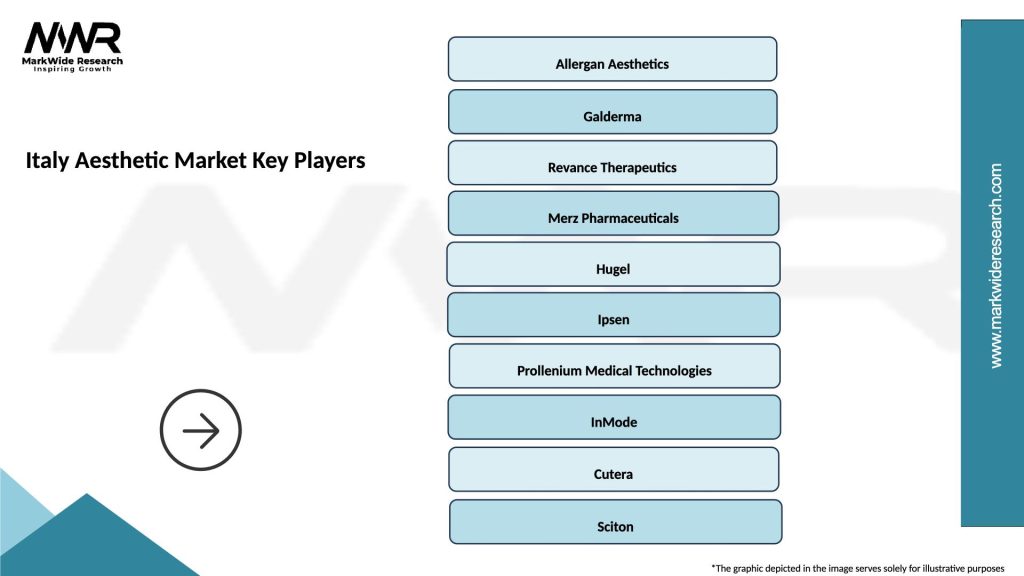

Leading companies in the Italy Aesthetic Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at