444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The IT & Telecom Optoelectronics Market represents a rapidly evolving sector that combines optical and electronic technologies to enable high-speed data transmission, communication systems, and advanced computing applications. This dynamic market encompasses a wide range of products including optical transceivers, laser diodes, photodetectors, optical amplifiers, and fiber optic components that form the backbone of modern telecommunications infrastructure and information technology systems.

Market dynamics indicate substantial growth driven by increasing demand for high-bandwidth applications, cloud computing services, and the proliferation of data centers worldwide. The market is experiencing significant expansion with a projected CAGR of 8.2% over the forecast period, fueled by technological advancements in 5G networks, Internet of Things (IoT) applications, and artificial intelligence systems requiring ultra-fast data processing capabilities.

Regional distribution shows North America maintaining approximately 35% market share, followed by Asia-Pacific with 32% market share, reflecting the concentration of major technology companies and telecommunications infrastructure investments in these regions. The market’s growth trajectory is supported by increasing adoption of fiber-to-the-home (FTTH) deployments and enterprise network upgrades across various industry verticals.

The IT & Telecom Optoelectronics Market refers to the comprehensive ecosystem of optical and electronic devices that convert electrical signals to optical signals and vice versa, enabling high-speed data transmission and communication across telecommunications networks and information technology infrastructure. This market encompasses the design, manufacturing, and deployment of sophisticated components that leverage the properties of light and photons to achieve superior performance in data communication applications.

Optoelectronic devices serve as critical enablers for modern digital communication systems, providing the essential interface between electronic circuits and optical transmission media. These technologies facilitate the seamless flow of information across vast distances with minimal signal degradation, supporting everything from internet connectivity and mobile communications to enterprise networking and data center operations.

The IT & Telecom Optoelectronics Market stands at the forefront of technological innovation, driving the digital transformation across industries through advanced optical communication solutions. The market demonstrates robust growth potential, supported by increasing bandwidth requirements and the global shift toward high-speed connectivity solutions.

Key growth drivers include the rapid deployment of 5G networks, which account for approximately 28% of market demand, along with expanding data center infrastructure and cloud computing adoption. The market benefits from continuous technological advancements in silicon photonics, coherent optical systems, and integrated photonic circuits that enhance performance while reducing costs.

Market segmentation reveals diverse applications spanning telecommunications infrastructure, enterprise networking, data centers, and consumer electronics. The telecommunications segment maintains the largest market share, driven by ongoing network modernization initiatives and the global rollout of next-generation communication technologies.

Strategic market insights reveal several critical trends shaping the IT & Telecom Optoelectronics landscape:

Primary market drivers propelling the IT & Telecom Optoelectronics Market include the exponential growth in data traffic and bandwidth requirements across global networks. The increasing adoption of bandwidth-intensive applications such as video streaming, virtual reality, and augmented reality creates sustained demand for high-performance optical communication solutions.

5G network deployment represents a significant growth catalyst, with telecommunications operators investing heavily in optical infrastructure to support ultra-low latency and high-speed connectivity requirements. The technology enables massive machine-type communications and enhanced mobile broadband services that rely extensively on advanced optoelectronic components.

Data center expansion continues to drive market growth as cloud service providers and enterprises scale their infrastructure to meet growing computational demands. The shift toward hyperscale data centers requires sophisticated optical interconnect solutions that can handle massive data volumes while maintaining energy efficiency and reliability.

Digital transformation initiatives across industries accelerate the adoption of optoelectronic technologies as organizations modernize their network infrastructure to support remote work, digital services, and automated operations. This trend is particularly pronounced in sectors such as healthcare, education, and financial services.

Market restraints affecting the IT & Telecom Optoelectronics Market include high initial capital investment requirements for advanced optical systems and infrastructure upgrades. The complexity of optoelectronic technologies often necessitates specialized expertise and training, creating barriers for smaller organizations and emerging markets.

Technical challenges related to signal integrity, thermal management, and component reliability in harsh operating environments pose ongoing concerns for market participants. The need for precise manufacturing tolerances and quality control measures increases production costs and complexity.

Standardization issues across different technology platforms and vendor ecosystems can limit interoperability and create integration challenges for end users. The rapid pace of technological evolution sometimes outpaces standard development processes, leading to compatibility concerns.

Supply chain vulnerabilities have become increasingly apparent, particularly regarding critical raw materials and specialized manufacturing capabilities concentrated in specific geographic regions. These dependencies can impact product availability and pricing stability.

Emerging opportunities in the IT & Telecom Optoelectronics Market are driven by the convergence of multiple technology trends and evolving market demands. The development of silicon photonics technology presents significant potential for cost reduction and performance enhancement in optical communication systems.

Internet of Things (IoT) applications create new market segments requiring specialized optoelectronic solutions for sensor networks, smart city infrastructure, and industrial automation systems. The growing emphasis on edge computing and distributed processing architectures opens opportunities for innovative optical interconnect solutions.

Quantum communication represents a long-term opportunity as research and development efforts progress toward practical quantum networking applications. Early investment in quantum-compatible optoelectronic technologies positions companies for future market leadership.

Sustainable technology development offers opportunities for companies focusing on energy-efficient and environmentally friendly optoelectronic solutions. The increasing emphasis on corporate sustainability and regulatory requirements drives demand for green technology alternatives.

Market dynamics in the IT & Telecom Optoelectronics sector reflect the complex interplay between technological innovation, regulatory frameworks, and evolving customer requirements. The market demonstrates strong cyclical patterns aligned with telecommunications infrastructure investment cycles and technology refresh schedules.

Competitive intensity continues to increase as traditional telecommunications equipment manufacturers compete with emerging technology companies and specialized optoelectronics providers. This competition drives innovation while putting pressure on profit margins and requiring continuous investment in research and development.

Customer consolidation among major telecommunications operators and cloud service providers creates both opportunities and challenges for optoelectronics suppliers. While larger customers offer significant volume potential, they also demand competitive pricing and comprehensive solution portfolios.

Technology convergence blurs traditional market boundaries as optoelectronic components become integrated into broader system solutions. This trend requires suppliers to develop comprehensive capabilities spanning hardware, software, and services to remain competitive in the evolving marketplace.

Research methodology for analyzing the IT & Telecom Optoelectronics Market employs a comprehensive approach combining primary and secondary research techniques to ensure accurate and reliable market insights. The methodology incorporates quantitative analysis of market data, qualitative assessment of industry trends, and expert interviews with key stakeholders across the value chain.

Primary research involves direct engagement with industry participants including manufacturers, suppliers, system integrators, and end users to gather firsthand insights on market conditions, technology trends, and future requirements. This approach provides valuable perspectives on emerging opportunities and potential challenges facing the market.

Secondary research encompasses analysis of industry publications, regulatory filings, patent databases, and technical literature to identify market trends and technological developments. The research methodology also includes examination of competitive landscapes, pricing trends, and supply chain dynamics affecting market participants.

Data validation processes ensure the accuracy and reliability of market information through cross-referencing multiple sources and expert review. The methodology incorporates statistical analysis techniques to identify significant trends and forecast future market developments with appropriate confidence intervals.

Regional analysis reveals distinct market characteristics and growth patterns across major geographic markets. North America maintains market leadership with approximately 35% market share, driven by substantial investments in 5G infrastructure, data center expansion, and advanced telecommunications networks by major service providers and technology companies.

Asia-Pacific region demonstrates the highest growth potential, accounting for 32% market share and experiencing rapid expansion due to increasing digitalization initiatives, smart city projects, and telecommunications infrastructure development across emerging economies. Countries such as China, India, and South Korea lead regional growth through significant government investments and private sector initiatives.

European markets represent approximately 25% market share, characterized by strong emphasis on energy efficiency, sustainability, and regulatory compliance. The region benefits from advanced manufacturing capabilities and research institutions driving innovation in optoelectronic technologies.

Emerging markets in Latin America, Middle East, and Africa show increasing adoption of optoelectronic solutions, though market penetration remains relatively low compared to developed regions. These markets present significant long-term growth opportunities as telecommunications infrastructure continues to modernize and expand.

The competitive landscape of the IT & Telecom Optoelectronics Market features a diverse ecosystem of established technology leaders, specialized component manufacturers, and emerging innovation companies. Market participants compete across multiple dimensions including technology performance, cost efficiency, reliability, and comprehensive solution portfolios.

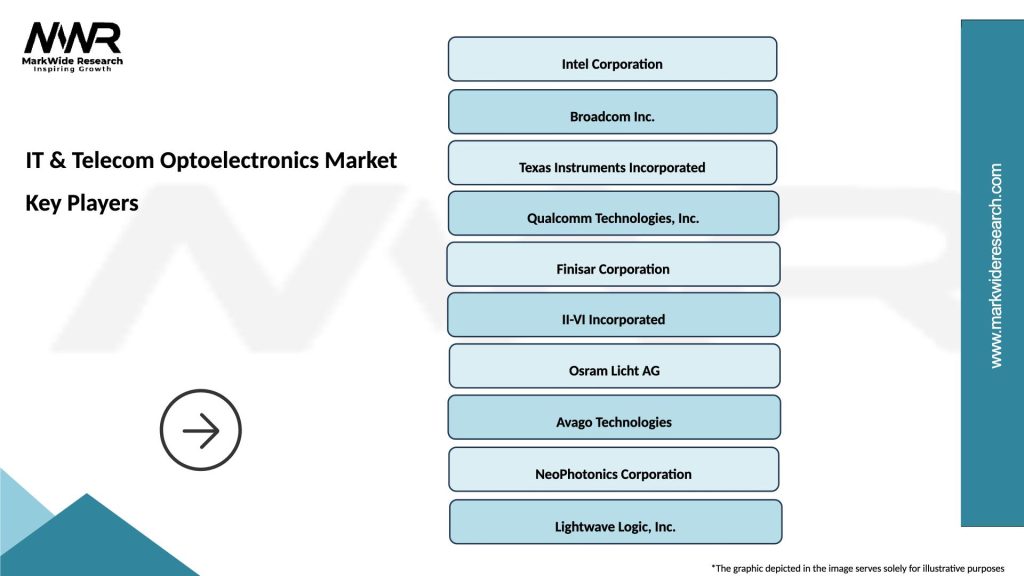

Leading market participants include:

Competitive strategies focus on continuous innovation, strategic partnerships, and vertical integration to enhance market position and customer value proposition. Companies invest heavily in research and development to maintain technological leadership and address evolving market requirements.

Market segmentation of the IT & Telecom Optoelectronics Market reveals diverse application areas and technology categories serving different customer requirements and use cases. The segmentation analysis provides insights into market dynamics and growth opportunities across various market segments.

By Product Type:

By Application:

By Technology:

Category-wise analysis reveals distinct market characteristics and growth patterns across different product categories within the IT & Telecom Optoelectronics Market. Each category demonstrates unique value propositions and addresses specific customer requirements in the broader optical communication ecosystem.

Optical Transceivers represent the largest market category, driven by increasing demand for high-speed data transmission in telecommunications networks and data centers. The category benefits from continuous technology evolution toward higher data rates and improved power efficiency, with 40% adoption rate for next-generation transceivers in new deployments.

Laser Diodes demonstrate strong growth potential across multiple applications including optical communication, industrial processing, and sensing systems. The category is characterized by ongoing innovation in wavelength optimization, power efficiency, and reliability improvements for demanding operating environments.

Photodetectors show steady growth driven by expanding applications in optical sensing, automotive systems, and industrial automation. The category benefits from technological advancements in sensitivity, response time, and integration capabilities with electronic processing circuits.

Optical Amplifiers maintain importance in long-distance communication systems and submarine cable networks. The category focuses on improving gain characteristics, noise performance, and operational reliability for critical infrastructure applications.

Industry participants in the IT & Telecom Optoelectronics Market realize significant benefits through participation in this dynamic and growing sector. The market offers opportunities for revenue growth, technological innovation, and strategic positioning in the evolving digital economy.

Technology Manufacturers benefit from:

End Users and System Integrators realize benefits including:

Investors and Financial Stakeholders benefit from market growth potential, technological innovation, and strong demand fundamentals driving long-term value creation in the optoelectronics sector.

SWOT Analysis provides comprehensive assessment of the IT & Telecom Optoelectronics Market’s internal strengths and weaknesses, along with external opportunities and threats affecting market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the IT & Telecom Optoelectronics Market reflect the convergence of technological innovation, changing customer requirements, and evolving industry dynamics. These trends provide insights into future market development and strategic opportunities for market participants.

Silicon Photonics Integration emerges as a transformative trend, enabling cost-effective manufacturing of optical components using established semiconductor fabrication processes. This technology trend promises to democratize access to advanced optical solutions while improving performance and reducing costs.

Coherent Optical Technology adoption accelerates across telecommunications networks, enabling higher data rates and improved spectral efficiency. The trend toward coherent systems supports the growing bandwidth requirements of 5G networks and data center interconnects with 60% efficiency improvement over traditional systems.

Artificial Intelligence Integration transforms network management and optimization through intelligent monitoring, predictive maintenance, and automated configuration of optical systems. This trend enhances network reliability while reducing operational costs and complexity.

Edge Computing Deployment drives demand for compact, high-performance optical solutions supporting distributed computing architectures. The trend toward edge processing requires innovative optical interconnect solutions optimized for space-constrained environments.

Sustainability Focus influences product development and manufacturing processes as companies prioritize energy efficiency and environmental responsibility. This trend drives innovation in power-efficient optoelectronic solutions and sustainable manufacturing practices.

Recent industry developments highlight the dynamic nature of the IT & Telecom Optoelectronics Market and demonstrate the continuous innovation driving market evolution. These developments reflect strategic initiatives by market participants to enhance competitive position and address emerging market opportunities.

Technology Partnerships between optoelectronics manufacturers and system integrators accelerate the development and deployment of advanced optical solutions. These collaborations combine complementary expertise and resources to address complex customer requirements and market challenges.

Manufacturing Capacity Expansion initiatives by leading companies respond to growing market demand and supply chain resilience requirements. Strategic investments in production facilities and automation technologies enhance manufacturing efficiency and product quality.

Research and Development Investments focus on next-generation technologies including quantum communication, advanced silicon photonics, and integrated optical systems. According to MarkWide Research analysis, R&D spending in the sector has increased by 15% annually over the past three years.

Standards Development activities by industry organizations establish technical specifications and interoperability requirements for emerging optical technologies. These efforts facilitate market adoption and ensure compatibility across different vendor solutions.

Acquisition Activities reshape the competitive landscape as companies seek to acquire specialized technologies, manufacturing capabilities, and market access. Strategic acquisitions enable companies to expand their product portfolios and strengthen their competitive position.

Industry analysts recommend several strategic approaches for companies operating in the IT & Telecom Optoelectronics Market to capitalize on growth opportunities while managing competitive challenges and market risks.

Technology Investment Strategy should prioritize emerging technologies with strong growth potential, particularly silicon photonics and coherent optical systems. Companies should balance investments between incremental improvements to existing products and breakthrough innovations that could create new market opportunities.

Market Diversification across application segments and geographic regions reduces concentration risk and provides multiple growth vectors. Companies should develop comprehensive solution portfolios addressing different customer segments while maintaining focus on core competencies and competitive advantages.

Partnership Development with system integrators, telecommunications operators, and technology companies enhances market reach and accelerates solution deployment. Strategic partnerships should focus on complementary capabilities and shared value creation rather than simple vendor-customer relationships.

Supply Chain Optimization requires attention to resilience, cost efficiency, and quality control. Companies should develop diversified supplier networks while investing in vertical integration for critical components and processes that provide competitive differentiation.

Talent Development in specialized technical areas ensures companies maintain innovation capabilities and operational excellence. Investment in workforce development and retention strategies becomes increasingly important as competition for skilled professionals intensifies.

The future outlook for the IT & Telecom Optoelectronics Market remains highly positive, supported by fundamental technology trends and growing demand for high-speed connectivity solutions across multiple industry sectors. The market is positioned for sustained growth driven by digital transformation initiatives and emerging technology applications.

Technology evolution will continue to drive market expansion as next-generation optical solutions enable new applications and improve existing system performance. The integration of artificial intelligence, machine learning, and quantum technologies creates opportunities for innovative optical solutions that address complex communication and computing challenges.

Market expansion into emerging geographic regions and application segments provides significant growth potential over the forecast period. MWR projects that emerging markets will contribute approximately 25% of global market growth as telecommunications infrastructure development accelerates in developing economies.

Industry consolidation may accelerate as companies seek to achieve scale advantages and comprehensive solution portfolios. Strategic mergers and acquisitions will likely reshape the competitive landscape while creating opportunities for specialized companies with unique technologies or market positions.

Regulatory developments related to data security, network reliability, and environmental sustainability will influence technology requirements and market dynamics. Companies that proactively address regulatory trends will be better positioned for long-term success in the evolving market environment.

The IT & Telecom Optoelectronics Market represents a critical enabler of the digital economy, providing the essential infrastructure for high-speed communication and data processing applications. The market demonstrates strong growth fundamentals driven by increasing bandwidth requirements, 5G network deployment, and data center expansion across global markets.

Market participants benefit from diverse opportunities spanning telecommunications infrastructure, enterprise networking, and emerging applications in edge computing and IoT systems. The continuous evolution of optical technologies creates sustainable competitive advantages for companies that invest in innovation and maintain close relationships with customers and technology partners.

Strategic success in this dynamic market requires balanced investment in technology development, market expansion, and operational excellence. Companies that effectively navigate the complex competitive landscape while addressing evolving customer requirements will be well-positioned to capitalize on the substantial growth opportunities in the IT & Telecom Optoelectronics Market.

What is IT & Telecom Optoelectronics?

IT & Telecom Optoelectronics refers to the technology that combines optics and electronics to facilitate the transmission of data through light. This includes components like lasers, photodetectors, and optical fibers used in telecommunications and information technology applications.

What are the key players in the IT & Telecom Optoelectronics Market?

Key players in the IT & Telecom Optoelectronics Market include companies like Cisco Systems, Inc., Finisar Corporation, and Lumentum Holdings Inc., among others. These companies are involved in developing advanced optical components and systems for telecommunications.

What are the growth factors driving the IT & Telecom Optoelectronics Market?

The IT & Telecom Optoelectronics Market is driven by the increasing demand for high-speed data transmission, the expansion of broadband networks, and the rise of cloud computing services. Additionally, advancements in optical technologies are enhancing communication capabilities.

What challenges does the IT & Telecom Optoelectronics Market face?

Challenges in the IT & Telecom Optoelectronics Market include the high cost of optical components and the complexity of integrating these technologies into existing systems. Furthermore, competition from alternative technologies can hinder market growth.

What opportunities exist in the IT & Telecom Optoelectronics Market?

Opportunities in the IT & Telecom Optoelectronics Market include the growing adoption of 5G technology, which requires advanced optical solutions, and the increasing use of optoelectronics in data centers. These trends are expected to drive innovation and investment in the sector.

What trends are shaping the IT & Telecom Optoelectronics Market?

Trends in the IT & Telecom Optoelectronics Market include the development of integrated photonic circuits and the push towards more energy-efficient optical devices. Additionally, the rise of Internet of Things (IoT) applications is influencing the design and deployment of optoelectronic systems.

IT & Telecom Optoelectronics Market

| Segmentation Details | Description |

|---|---|

| Product Type | LED, Laser Diodes, Photodetectors, Optical Amplifiers |

| Technology | Fiber Optics, Free-Space Optics, Quantum Dots, Waveguide |

| End User | Telecommunications, Data Centers, Consumer Electronics, Automotive OEMs |

| Application | Networking, Sensing, Imaging, Display |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the IT & Telecom Optoelectronics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at