444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The IT Operations Management market represents a rapidly evolving sector focused on optimizing technology infrastructure and ensuring seamless business operations across diverse industries. This comprehensive market encompasses various solutions designed to monitor, manage, and maintain IT systems while maximizing operational efficiency and minimizing downtime. Organizations worldwide are increasingly recognizing the critical importance of robust IT operations management to support digital transformation initiatives and maintain competitive advantages in today’s technology-driven landscape.

Market dynamics indicate substantial growth potential driven by increasing complexity of IT environments, rising demand for cloud-based solutions, and growing emphasis on automation and artificial intelligence integration. The market demonstrates strong momentum with enterprises investing heavily in advanced monitoring tools, performance optimization platforms, and comprehensive management solutions. Digital transformation initiatives across various sectors continue to fuel demand for sophisticated IT operations management capabilities.

Regional expansion patterns show significant adoption across North America, Europe, and Asia-Pacific regions, with emerging markets demonstrating accelerated growth rates. The market benefits from technological advancements including machine learning, predictive analytics, and automated incident response systems that enhance operational efficiency and reduce manual intervention requirements.

The IT Operations Management market refers to the comprehensive ecosystem of software solutions, platforms, and services designed to monitor, manage, and optimize information technology infrastructure and operations within organizations. This market encompasses tools and technologies that enable businesses to maintain system availability, ensure performance optimization, manage incidents effectively, and support continuous service delivery across complex IT environments.

Core components of IT operations management include network monitoring, application performance management, infrastructure monitoring, incident management, change management, and service desk operations. These integrated solutions provide organizations with real-time visibility into their IT infrastructure while enabling proactive problem resolution and strategic capacity planning.

Modern IT operations management solutions leverage advanced technologies such as artificial intelligence, machine learning, and automation to deliver intelligent insights, predictive capabilities, and streamlined workflows that reduce operational complexity and enhance overall system reliability.

Strategic analysis of the IT Operations Management market reveals a dynamic sector experiencing robust growth driven by digital transformation initiatives, increasing IT infrastructure complexity, and growing demand for automated management solutions. The market demonstrates significant expansion potential across multiple industry verticals including healthcare, financial services, manufacturing, and telecommunications.

Key market drivers include rising adoption of cloud computing, increasing focus on DevOps practices, growing emphasis on proactive monitoring, and expanding requirements for compliance and security management. Organizations are prioritizing operational efficiency and seeking comprehensive solutions that can integrate seamlessly with existing technology stacks while providing enhanced visibility and control.

Technology innovation continues to reshape the market landscape with artificial intelligence and machine learning capabilities becoming standard features in modern IT operations management platforms. These advanced technologies enable predictive analytics, automated incident response, and intelligent resource optimization that significantly improve operational outcomes.

Market segmentation analysis reveals strong growth across various deployment models including on-premises, cloud-based, and hybrid solutions, with cloud adoption showing particularly strong momentum due to scalability benefits and reduced infrastructure requirements.

Comprehensive market analysis reveals several critical insights that define the current IT Operations Management landscape and future growth trajectory:

Digital transformation initiatives serve as the primary catalyst driving IT Operations Management market expansion, with organizations across all sectors investing in modernization efforts that require sophisticated monitoring and management capabilities. These initiatives demand comprehensive visibility into complex IT environments and automated management processes that can support rapid scaling and deployment requirements.

Cloud adoption acceleration continues to fuel market growth as enterprises migrate workloads to cloud platforms and require specialized tools for managing hybrid and multi-cloud environments. The complexity of distributed architectures necessitates advanced monitoring solutions that can provide unified visibility across diverse infrastructure components and service delivery models.

Increasing IT complexity driven by microservices architectures, containerization, and DevOps practices creates substantial demand for intelligent operations management solutions. Organizations need sophisticated tools that can handle dynamic environments, automated deployments, and continuous integration workflows while maintaining optimal performance and reliability.

Regulatory compliance requirements across various industries drive adoption of comprehensive IT operations management solutions that provide detailed audit trails, compliance reporting, and security monitoring capabilities. These requirements particularly impact highly regulated sectors including healthcare, financial services, and government organizations.

Cost optimization pressures encourage organizations to invest in IT operations management solutions that can identify inefficiencies, optimize resource utilization, and reduce operational expenses through automation and intelligent resource allocation.

Implementation complexity represents a significant barrier for many organizations considering IT operations management solutions, particularly those with legacy systems and complex existing infrastructure. The challenge of seamless integration with diverse technology stacks often requires substantial planning, customization, and technical expertise that can delay deployment timelines.

High initial investment costs associated with comprehensive IT operations management platforms can deter smaller organizations and budget-conscious enterprises from adopting advanced solutions. The total cost of ownership includes licensing fees, implementation services, training requirements, and ongoing maintenance expenses that may strain limited IT budgets.

Skills shortage in the IT operations management domain creates challenges for organizations seeking to maximize the value of their technology investments. The lack of qualified professionals with expertise in modern operations management tools and practices can limit effective implementation and ongoing optimization efforts.

Data security concerns related to centralized monitoring and management platforms may cause hesitation among organizations handling sensitive information. Concerns about data privacy, compliance requirements, and potential security vulnerabilities can slow adoption decisions, particularly in highly regulated industries.

Vendor lock-in risks associated with proprietary platforms and specialized tools can create long-term concerns about flexibility and migration capabilities, causing organizations to carefully evaluate strategic implications before committing to specific solutions.

Artificial intelligence integration presents substantial opportunities for IT operations management solution providers to develop innovative capabilities that can deliver predictive insights, automated remediation, and intelligent optimization. The growing sophistication of AI technologies enables the creation of self-healing systems and proactive management capabilities that significantly enhance operational efficiency.

Edge computing expansion creates new market opportunities as organizations deploy distributed computing resources that require specialized monitoring and management capabilities. The proliferation of IoT devices and edge infrastructure generates demand for solutions that can effectively manage geographically dispersed assets and ensure consistent performance across diverse environments.

Industry-specific solutions represent significant growth opportunities for vendors who can develop tailored IT operations management platforms that address unique requirements of specific sectors such as healthcare, manufacturing, retail, and telecommunications. These specialized offerings can command premium pricing and establish strong competitive differentiation.

Small and medium enterprise market expansion offers substantial growth potential as cloud-based solutions become more accessible and affordable for organizations with limited IT resources. The development of simplified platforms and managed service offerings can unlock this previously underserved market segment.

Sustainability initiatives create opportunities for IT operations management solutions that can optimize energy consumption, reduce carbon footprints, and support environmental compliance objectives. Organizations increasingly prioritize green IT practices that align with corporate sustainability goals.

Competitive landscape evolution within the IT Operations Management market demonstrates increasing consolidation as larger technology vendors acquire specialized solution providers to expand their portfolio offerings. This trend creates comprehensive platforms that combine multiple operational capabilities while potentially reducing the number of independent vendors in the market.

Technology convergence is reshaping market dynamics as traditional IT operations management tools integrate with security operations, DevOps platforms, and business intelligence solutions. This convergence creates unified ecosystems that provide holistic visibility and control across entire technology stacks.

Customer expectations continue to evolve toward solutions that offer intuitive user interfaces, self-service capabilities, and mobile accessibility. Organizations demand user-friendly platforms that can be effectively utilized by diverse stakeholders without extensive technical training or specialized expertise.

Pricing model innovation is transforming market dynamics with vendors offering flexible consumption-based pricing, subscription models, and outcome-based pricing structures that align costs with actual value delivered. These alternative pricing approaches make advanced solutions more accessible to organizations with varying budget constraints.

Partnership ecosystems are becoming increasingly important as solution providers collaborate with cloud platforms, system integrators, and technology vendors to deliver comprehensive offerings that address complex customer requirements through integrated solutions.

Comprehensive research approach employed in analyzing the IT Operations Management market combines primary and secondary research methodologies to ensure accurate and reliable market insights. The research framework incorporates quantitative analysis of market trends, competitive positioning, and growth projections alongside qualitative assessment of industry dynamics and strategic implications.

Primary research activities include structured interviews with industry executives, technology vendors, end-users, and subject matter experts to gather firsthand insights about market conditions, challenges, and opportunities. These stakeholder perspectives provide valuable context for understanding market dynamics and future growth potential.

Secondary research sources encompass industry reports, company financial statements, regulatory filings, technology publications, and academic research to establish comprehensive market understanding. The integration of diverse data sources ensures robust analysis and validates key findings through multiple perspectives.

Data validation processes include cross-referencing information across multiple sources, conducting follow-up interviews for clarification, and applying statistical analysis techniques to ensure accuracy and reliability of market projections and trend analysis.

Market modeling techniques utilize advanced analytical frameworks to project growth trajectories, assess competitive dynamics, and identify emerging opportunities within the IT Operations Management market landscape.

North American market maintains the largest share of global IT Operations Management adoption, driven by the presence of major technology companies, advanced digital infrastructure, and high enterprise technology spending. The region demonstrates mature market characteristics with approximately 40% market share and continued investment in next-generation operations management capabilities.

European market dynamics reflect strong growth momentum fueled by digital transformation initiatives, regulatory compliance requirements, and increasing cloud adoption across diverse industry sectors. The region shows steady expansion with particular strength in countries such as Germany, United Kingdom, and France, representing approximately 28% market share.

Asia-Pacific region exhibits the highest growth potential with rapid digitalization, expanding IT infrastructure investments, and increasing adoption of cloud-based solutions across emerging economies. The region demonstrates accelerated growth rates with China, India, and Japan leading market expansion efforts, capturing approximately 25% market share.

Latin American markets show emerging opportunities driven by digital transformation initiatives and increasing recognition of IT operations management importance. Countries such as Brazil, Mexico, and Argentina demonstrate growing adoption of modern operations management solutions.

Middle East and Africa represent developing markets with significant growth potential as organizations invest in digital infrastructure and modernization initiatives. The region shows increasing interest in cloud-based IT operations management solutions that can support rapid scaling requirements.

Market leadership within the IT Operations Management sector is characterized by a mix of established technology giants and specialized solution providers who compete across various market segments and deployment models:

Competitive strategies focus on innovation, strategic acquisitions, partnership development, and expansion into emerging markets to maintain market position and drive growth.

Deployment model segmentation reveals distinct market preferences and growth patterns across different implementation approaches:

Organization size segmentation shows varying adoption patterns and solution requirements:

Industry vertical segmentation demonstrates diverse application scenarios and specialized requirements:

Infrastructure monitoring represents the foundational category within IT operations management, providing essential visibility into servers, networks, storage systems, and cloud resources. This category demonstrates steady growth driven by increasing infrastructure complexity and hybrid cloud adoption. Organizations prioritize solutions that offer comprehensive monitoring capabilities across diverse technology stacks.

Application performance monitoring has emerged as a critical category focused on ensuring optimal user experience and application availability. The category shows strong expansion driven by digital transformation initiatives and increasing reliance on business-critical applications. Modern solutions incorporate artificial intelligence to provide predictive insights and automated optimization capabilities.

IT service management encompasses incident management, change management, and service desk operations that support end-to-end service delivery. This category demonstrates consistent demand as organizations seek to improve service quality and operational efficiency through standardized processes and automated workflows.

Security operations integration represents an emerging category that combines traditional IT operations management with cybersecurity monitoring and response capabilities. This convergence addresses the growing need for unified visibility across IT and security domains to enable faster threat detection and response.

Cloud operations management has become increasingly important as organizations migrate workloads to cloud platforms and require specialized tools for managing multi-cloud environments. This category shows rapid growth driven by cloud adoption acceleration and the complexity of distributed architectures.

Enterprise organizations benefit from comprehensive IT operations management solutions through improved system reliability, reduced downtime, and enhanced operational efficiency. These solutions enable proactive monitoring and automated incident response that minimize business disruption while optimizing resource utilization and reducing operational costs.

IT departments gain significant advantages through centralized visibility, streamlined workflows, and automated processes that reduce manual intervention requirements. Modern platforms provide intelligent insights that enable data-driven decision making and strategic capacity planning while improving overall service quality.

Business stakeholders realize value through improved service availability, faster problem resolution, and better alignment between IT operations and business objectives. Comprehensive monitoring and management capabilities support digital initiatives and ensure technology infrastructure can effectively support business growth requirements.

Solution vendors benefit from expanding market opportunities, increasing customer demand for integrated platforms, and growing emphasis on subscription-based business models. The market evolution toward comprehensive solutions creates opportunities for vendors to expand their addressable market and increase customer lifetime value.

System integrators and service providers gain opportunities to deliver specialized implementation services, managed operations offerings, and ongoing optimization support. The complexity of modern IT environments creates substantial demand for professional services and expertise in operations management best practices.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration continues to reshape the IT Operations Management landscape with advanced machine learning algorithms enabling predictive analytics, automated incident response, and intelligent resource optimization. Organizations increasingly expect AI-powered capabilities that can identify patterns, predict failures, and automatically remediate issues without human intervention.

Observability evolution represents a significant trend moving beyond traditional monitoring toward comprehensive observability that provides deep insights into system behavior, performance patterns, and user experience metrics. This approach enables holistic understanding of complex distributed systems and supports proactive optimization efforts.

DevOps integration is driving convergence between development and operations teams, creating demand for platforms that support continuous integration, continuous deployment, and collaborative workflows. This trend emphasizes automation capabilities and real-time feedback mechanisms that accelerate software delivery cycles.

Multi-cloud management has become essential as organizations adopt hybrid and multi-cloud strategies that require unified visibility and control across diverse infrastructure platforms. Solutions must provide consistent management capabilities regardless of underlying cloud providers or deployment models.

Security operations convergence reflects growing recognition that IT operations and security operations must work together to address modern threat landscapes. This trend drives development of integrated platforms that combine traditional operations management with security monitoring and response capabilities.

Self-healing systems represent an emerging trend toward autonomous operations management that can automatically detect, diagnose, and resolve issues without human intervention. These systems leverage advanced automation and artificial intelligence to maintain optimal performance and availability.

Strategic acquisitions continue to reshape the competitive landscape as major technology vendors acquire specialized IT operations management companies to expand their portfolio capabilities and market reach. Recent acquisition activity demonstrates consolidation trends and the importance of comprehensive platform offerings in meeting customer requirements.

Partnership announcements between cloud providers and IT operations management vendors are creating integrated solutions that offer seamless deployment and management capabilities. These partnerships enable deeper integration with cloud platforms and provide customers with unified operational experiences.

Product launches featuring advanced artificial intelligence and machine learning capabilities are becoming standard across the industry, with vendors investing heavily in next-generation technologies that can deliver predictive insights and automated optimization capabilities.

Industry certifications and compliance initiatives are driving development of specialized solutions that address regulatory requirements in sectors such as healthcare, financial services, and government. These developments create market differentiation opportunities for vendors who can demonstrate compliance capabilities.

Open source initiatives are gaining momentum as organizations seek to avoid vendor lock-in and maintain flexibility in their operations management strategies. The growth of open source solutions is creating new competitive dynamics and alternative deployment options.

MarkWide Research analysis indicates that organizations should prioritize IT operations management solutions that offer comprehensive artificial intelligence capabilities, seamless cloud integration, and flexible deployment options to support evolving business requirements. The research emphasizes the importance of strategic planning and careful vendor evaluation to ensure long-term success.

Investment priorities should focus on platforms that can scale effectively with business growth, integrate seamlessly with existing technology stacks, and provide advanced automation capabilities that reduce operational complexity. Organizations should evaluate solutions based on total cost of ownership rather than initial licensing costs alone.

Implementation strategies should emphasize phased deployment approaches that allow organizations to realize value incrementally while minimizing disruption to existing operations. Successful implementations require strong project management, adequate training programs, and ongoing optimization efforts.

Vendor selection criteria should include evaluation of technical capabilities, financial stability, customer support quality, and strategic roadmap alignment with organizational objectives. Organizations should prioritize vendors who demonstrate innovation leadership and commitment to long-term customer success.

Skills development initiatives should focus on building internal expertise in modern IT operations management practices, automation technologies, and data analytics capabilities. Organizations should invest in training programs and certification initiatives to maximize the value of their technology investments.

Market evolution projections indicate continued strong growth driven by digital transformation acceleration, increasing IT infrastructure complexity, and growing emphasis on operational efficiency. The market is expected to maintain robust expansion with projected growth rates exceeding 12% CAGR over the next five years as organizations prioritize technology investments that support business agility and competitiveness.

Technology advancement will continue to reshape the market landscape with artificial intelligence, machine learning, and automation becoming standard features across all solution categories. Future platforms will offer autonomous capabilities that can self-optimize, predict issues, and automatically implement remediation actions with minimal human intervention.

Industry adoption patterns suggest expanding penetration across small and medium enterprises as cloud-based solutions become more accessible and affordable. The democratization of advanced capabilities will enable organizations of all sizes to benefit from sophisticated IT operations management tools and practices.

Integration trends point toward comprehensive platforms that combine IT operations management with security operations, business intelligence, and workflow automation capabilities. These unified solutions will provide holistic visibility and control across entire technology ecosystems while simplifying vendor relationships and reducing complexity.

Geographic expansion opportunities remain significant in emerging markets where digital infrastructure investments are accelerating and organizations are recognizing the importance of professional IT operations management practices. MWR projections indicate particularly strong growth potential in Asia-Pacific and Latin American regions where technology adoption rates continue to accelerate.

The IT Operations Management market represents a dynamic and rapidly evolving sector that plays a critical role in supporting digital transformation initiatives and maintaining operational excellence across diverse industries. Market analysis reveals substantial growth potential driven by increasing IT infrastructure complexity, accelerating cloud adoption, and growing emphasis on automation and artificial intelligence integration.

Key success factors for market participants include continuous innovation, strategic partnerships, comprehensive platform development, and focus on customer success outcomes. Organizations seeking to maximize value from IT operations management investments should prioritize solutions that offer scalable architectures, advanced analytics capabilities, and seamless integration with existing technology stacks.

Future market dynamics will be shaped by technological advancement, changing customer expectations, and evolving competitive landscapes that favor vendors who can deliver comprehensive, intelligent, and user-friendly solutions. The continued convergence of IT operations with security operations, DevOps practices, and business intelligence will create new opportunities for innovation and market differentiation while driving sustained growth across the sector.

What is IT Operations Management?

IT Operations Management refers to the processes and services that organizations use to manage their IT infrastructure and operations. This includes monitoring, managing, and optimizing IT services, ensuring system reliability, and aligning IT with business goals.

What are the key players in the IT Operations Management Market?

Key players in the IT Operations Management Market include ServiceNow, BMC Software, and IBM, among others. These companies provide various solutions for IT service management, automation, and performance monitoring.

What are the main drivers of growth in the IT Operations Management Market?

The main drivers of growth in the IT Operations Management Market include the increasing complexity of IT environments, the need for improved operational efficiency, and the rising demand for automation in IT processes. Organizations are also focusing on enhancing service delivery and user experience.

What challenges does the IT Operations Management Market face?

Challenges in the IT Operations Management Market include the rapid pace of technological change, integration issues with legacy systems, and the shortage of skilled IT professionals. These factors can hinder the effective implementation of IT operations strategies.

What opportunities exist in the IT Operations Management Market?

Opportunities in the IT Operations Management Market include the growing adoption of cloud-based solutions, the rise of artificial intelligence for IT operations (AIOps), and the increasing focus on cybersecurity. These trends are driving innovation and creating new service offerings.

What trends are shaping the IT Operations Management Market?

Trends shaping the IT Operations Management Market include the shift towards DevOps practices, the integration of machine learning for predictive analytics, and the emphasis on user-centric IT service delivery. These trends are transforming how organizations manage their IT operations.

IT Operations Management Market

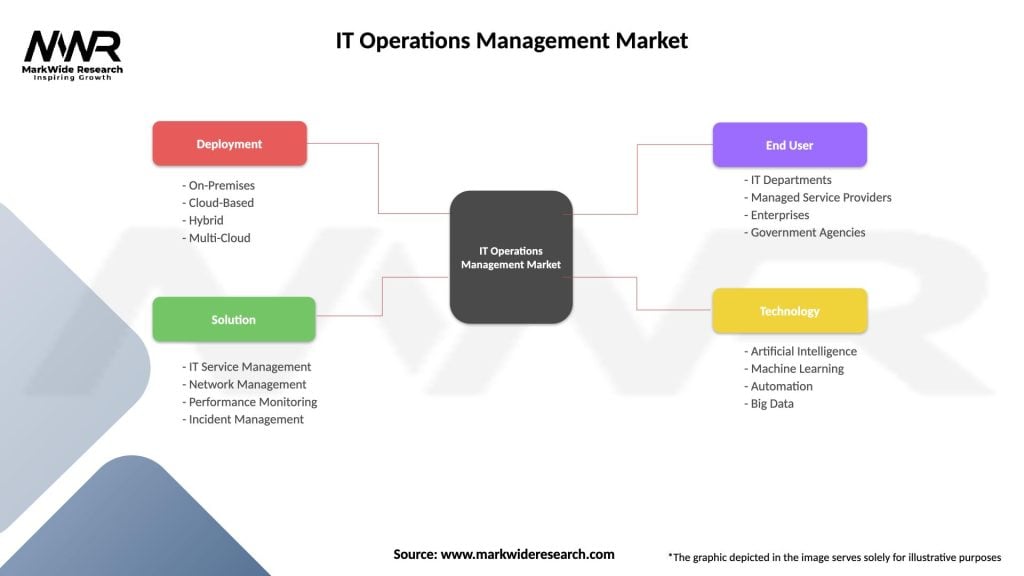

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud-Based, Hybrid, Multi-Cloud |

| Solution | IT Service Management, Network Management, Performance Monitoring, Incident Management |

| End User | IT Departments, Managed Service Providers, Enterprises, Government Agencies |

| Technology | Artificial Intelligence, Machine Learning, Automation, Big Data |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the IT Operations Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at