444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The IT integration in healthcare market represents a transformative sector that is revolutionizing how medical institutions manage patient data, streamline operations, and deliver care services. This rapidly expanding market encompasses the seamless connection of various healthcare information systems, electronic health records, medical devices, and administrative platforms to create unified, efficient healthcare ecosystems. Healthcare organizations worldwide are increasingly recognizing the critical importance of integrated IT solutions to improve patient outcomes, reduce operational costs, and enhance overall care quality.

Market dynamics indicate robust growth driven by the increasing adoption of digital health technologies, government initiatives promoting healthcare digitization, and the growing need for interoperability among healthcare systems. The market is experiencing significant momentum with a projected CAGR of 12.4% over the forecast period, reflecting the urgent demand for comprehensive IT integration solutions across healthcare facilities of all sizes.

Key market segments include hospital information systems, electronic health record integration, medical device connectivity, laboratory information management systems, and telehealth platform integration. The market serves diverse healthcare stakeholders including hospitals, clinics, diagnostic centers, pharmaceutical companies, and healthcare payers, each requiring tailored integration solutions to meet their specific operational requirements.

The IT integration in healthcare market refers to the comprehensive ecosystem of technologies, services, and solutions that enable seamless connectivity and data exchange between various healthcare information systems, medical devices, and administrative platforms within healthcare organizations. This integration facilitates the unified management of patient information, clinical workflows, and operational processes to improve healthcare delivery efficiency and patient outcomes.

Healthcare IT integration encompasses multiple components including electronic health record systems, hospital information systems, laboratory information management systems, radiology information systems, pharmacy management systems, and medical device integration platforms. The primary objective is to eliminate data silos, reduce manual processes, and create a cohesive digital healthcare environment that supports evidence-based decision-making and streamlined care coordination.

Integration solutions typically involve middleware platforms, application programming interfaces, data exchange standards, and interoperability frameworks that enable different healthcare systems to communicate effectively. This technological convergence allows healthcare providers to access comprehensive patient information, automate clinical workflows, and maintain regulatory compliance while delivering high-quality patient care.

Healthcare IT integration has emerged as a critical enabler of modern healthcare delivery, driving significant improvements in operational efficiency, patient safety, and care quality across healthcare organizations globally. The market is characterized by increasing demand for comprehensive integration solutions that can seamlessly connect disparate healthcare systems and enable real-time data sharing among healthcare stakeholders.

Market growth is primarily fueled by regulatory mandates for healthcare digitization, increasing adoption of electronic health records, growing emphasis on patient-centered care, and the need for cost-effective healthcare delivery models. Healthcare organizations are investing heavily in integration technologies to achieve meaningful use requirements, improve clinical outcomes, and enhance patient engagement through connected care platforms.

Technology advancement in areas such as cloud computing, artificial intelligence, machine learning, and mobile health applications is creating new opportunities for innovative integration solutions. The market is witnessing increased adoption of cloud-based integration platforms that offer scalability, flexibility, and cost-effectiveness compared to traditional on-premise solutions.

Regional markets show varying adoption patterns, with North America leading in terms of technology deployment and regulatory compliance, while emerging markets in Asia-Pacific and Latin America present significant growth opportunities driven by healthcare infrastructure modernization initiatives and increasing healthcare spending.

Healthcare IT integration market insights reveal several critical trends shaping the industry landscape and driving adoption across healthcare organizations worldwide:

Healthcare digitization initiatives represent the primary driver propelling IT integration market growth, as healthcare organizations worldwide embrace digital transformation to improve operational efficiency and patient care quality. Government regulations and incentive programs are encouraging healthcare providers to adopt integrated electronic health record systems and achieve meaningful use requirements, creating substantial demand for comprehensive integration solutions.

Patient safety concerns are driving increased adoption of integrated healthcare systems that reduce medical errors through improved information sharing and clinical decision support capabilities. Healthcare organizations recognize that fragmented IT systems contribute to communication gaps and potential patient safety risks, making integration solutions essential for maintaining high-quality care standards.

Cost reduction pressures in healthcare delivery are motivating organizations to implement integrated IT solutions that streamline administrative processes, eliminate duplicate data entry, and optimize resource utilization. Integration platforms enable healthcare providers to achieve operational efficiencies that translate into significant cost savings while maintaining or improving care quality.

Value-based care models are creating demand for integrated healthcare IT systems that support population health management, care coordination, and outcome measurement capabilities. Healthcare organizations transitioning from fee-for-service to value-based payment models require comprehensive integration solutions to track patient outcomes and demonstrate care quality improvements.

Telehealth expansion has accelerated the need for robust IT integration platforms that can seamlessly connect remote care delivery systems with existing healthcare infrastructure. The growing adoption of telehealth services requires integrated solutions that maintain continuity of care and ensure comprehensive patient information access across virtual and in-person care settings.

Implementation complexity poses significant challenges for healthcare organizations considering IT integration solutions, as the process often requires extensive system modifications, staff training, and workflow redesign. Many healthcare providers struggle with the technical complexity of integrating legacy systems with modern healthcare IT platforms, leading to extended implementation timelines and increased project costs.

High capital investment requirements for comprehensive IT integration solutions can be prohibitive for smaller healthcare organizations with limited budgets. The substantial upfront costs associated with integration platform licensing, implementation services, and ongoing maintenance create financial barriers that may delay or prevent adoption among resource-constrained healthcare providers.

Data security concerns surrounding healthcare information integration create hesitation among healthcare organizations regarding the adoption of connected systems. The increasing frequency of cybersecurity threats targeting healthcare data makes organizations cautious about expanding their digital footprint through integrated IT solutions, particularly when dealing with sensitive patient information.

Interoperability challenges between different healthcare IT vendors and systems continue to limit the effectiveness of integration initiatives. The lack of standardized data formats and communication protocols across healthcare technology vendors creates technical barriers that complicate integration efforts and may require custom development solutions.

Regulatory compliance complexity adds layers of difficulty to healthcare IT integration projects, as organizations must ensure that integrated systems meet various healthcare data privacy, security, and reporting requirements. The evolving regulatory landscape creates uncertainty and additional compliance costs that may discourage some healthcare organizations from pursuing comprehensive integration initiatives.

Artificial intelligence integration presents tremendous opportunities for healthcare IT integration platforms to deliver advanced analytics, predictive modeling, and automated clinical decision support capabilities. Healthcare organizations are increasingly interested in AI-powered integration solutions that can analyze integrated data streams to identify patterns, predict patient outcomes, and recommend optimal treatment approaches.

Internet of Medical Things expansion creates significant opportunities for integration platforms that can seamlessly connect and manage data from diverse medical devices, wearable sensors, and remote monitoring equipment. The growing ecosystem of connected medical devices requires sophisticated integration solutions that can handle real-time data streams and provide actionable insights to healthcare providers.

Cloud-native integration platforms offer substantial growth opportunities as healthcare organizations seek scalable, flexible, and cost-effective integration solutions. Cloud-based platforms provide advantages including reduced infrastructure requirements, automatic updates, enhanced accessibility, and improved disaster recovery capabilities that appeal to healthcare organizations of all sizes.

Emerging market expansion represents significant growth potential for healthcare IT integration vendors, as developing countries invest in healthcare infrastructure modernization and digital health initiatives. These markets present opportunities for tailored integration solutions that address specific regional healthcare challenges and regulatory requirements.

Specialized integration solutions for niche healthcare segments such as mental health, long-term care, and specialty clinics offer opportunities for vendors to develop targeted platforms that address unique workflow and integration requirements. These specialized markets often have distinct needs that generic integration platforms may not fully address, creating opportunities for customized solutions.

Technology evolution continues to reshape the healthcare IT integration landscape, with emerging technologies such as blockchain, edge computing, and advanced analytics creating new possibilities for secure, efficient, and intelligent integration solutions. Healthcare organizations are increasingly seeking integration platforms that can leverage these advanced technologies to improve data security, reduce latency, and provide enhanced analytical capabilities.

Vendor ecosystem dynamics are evolving as traditional healthcare IT vendors expand their integration capabilities while new technology companies enter the market with innovative solutions. This competitive landscape is driving innovation and creating more comprehensive integration platforms that can address diverse healthcare organization needs through single-vendor solutions.

Regulatory environment changes continue to influence market dynamics as government agencies update healthcare data sharing requirements, interoperability standards, and cybersecurity mandates. Healthcare organizations must adapt their integration strategies to comply with evolving regulations while maintaining operational efficiency and patient care quality.

Healthcare delivery model transformation toward value-based care, population health management, and patient-centered approaches is creating new requirements for integration platforms that can support these evolving care models. Integration solutions must adapt to support new workflows, data sharing requirements, and outcome measurement capabilities demanded by modern healthcare delivery approaches.

Market consolidation trends are evident as larger healthcare IT vendors acquire specialized integration companies to expand their platform capabilities and market reach. This consolidation is creating more comprehensive integration solutions while potentially reducing the number of independent vendors in the market, affecting pricing and innovation dynamics.

Comprehensive market analysis for the healthcare IT integration market employs a multi-faceted research approach combining primary and secondary research methodologies to ensure accurate and reliable market insights. The research framework incorporates quantitative and qualitative analysis techniques to provide a holistic view of market trends, competitive dynamics, and growth opportunities.

Primary research activities include extensive interviews with healthcare IT executives, integration platform vendors, healthcare providers, and industry experts to gather firsthand insights about market trends, challenges, and opportunities. Survey methodologies are employed to collect quantitative data from healthcare organizations regarding their integration needs, adoption patterns, and technology preferences.

Secondary research sources encompass industry reports, government publications, regulatory documents, vendor white papers, and academic research to supplement primary findings and validate market trends. Financial analysis of public companies in the healthcare IT integration space provides insights into market performance and growth trajectories.

Market segmentation analysis utilizes statistical modeling techniques to identify key market segments, assess their growth potential, and understand competitive dynamics within each segment. Geographic analysis incorporates regional healthcare spending data, regulatory environments, and technology adoption patterns to provide comprehensive regional market insights.

Data validation processes include triangulation of findings across multiple sources, expert review panels, and statistical verification to ensure research accuracy and reliability. The methodology incorporates continuous monitoring of market developments to maintain current and relevant market intelligence throughout the research period.

North America dominates the healthcare IT integration market, accounting for approximately 42% market share, driven by advanced healthcare infrastructure, stringent regulatory requirements, and high technology adoption rates among healthcare organizations. The region benefits from government initiatives promoting healthcare digitization, substantial healthcare IT investments, and a mature ecosystem of integration technology vendors.

United States leads regional market growth with widespread adoption of electronic health records, meaningful use requirements, and increasing focus on interoperability standards. Healthcare organizations in the US are investing heavily in comprehensive integration platforms to meet regulatory compliance requirements and improve operational efficiency.

Europe represents the second-largest regional market with approximately 28% market share, characterized by diverse regulatory environments across countries and increasing emphasis on healthcare digitization initiatives. The European market benefits from government funding for healthcare IT modernization and growing adoption of integrated care delivery models.

Asia-Pacific emerges as the fastest-growing regional market with projected growth rates of 15.2% CAGR, driven by healthcare infrastructure development, increasing healthcare spending, and government initiatives promoting digital health adoption. Countries such as China, India, and Japan are investing significantly in healthcare IT integration to modernize their healthcare delivery systems.

Latin America and Middle East & Africa represent emerging markets with substantial growth potential as these regions invest in healthcare infrastructure modernization and digital health initiatives. These markets present opportunities for cost-effective integration solutions tailored to local healthcare delivery requirements and regulatory environments.

Market leadership in healthcare IT integration is characterized by a diverse ecosystem of established healthcare IT vendors, specialized integration platform providers, and emerging technology companies offering innovative solutions. The competitive landscape includes both comprehensive platform providers and niche solution specialists serving specific integration requirements.

Competitive strategies focus on platform comprehensiveness, interoperability capabilities, cloud deployment options, and specialized industry expertise. Vendors are increasingly emphasizing artificial intelligence integration, mobile accessibility, and regulatory compliance features to differentiate their offerings in the competitive marketplace.

By Component:

By Deployment Model:

By Application:

By End User:

Electronic Health Record Integration represents the largest market segment, driven by regulatory mandates and the critical need for comprehensive patient information access across healthcare organizations. This category focuses on seamless integration between EHR systems and other healthcare IT platforms to enable complete patient care coordination and clinical decision support.

Hospital Information System Integration encompasses comprehensive platforms that connect administrative, clinical, and financial systems within hospital environments. These solutions address complex workflow requirements and enable healthcare organizations to achieve operational efficiency while maintaining high-quality patient care standards.

Medical Device Integration is experiencing rapid growth as healthcare organizations seek to connect diverse medical equipment with their information systems. This category includes integration of monitoring devices, diagnostic equipment, and therapeutic devices to enable real-time data collection and automated clinical workflows.

Laboratory Information Management Integration focuses on connecting laboratory systems with clinical and administrative platforms to streamline test ordering, result reporting, and quality management processes. These solutions are essential for healthcare organizations seeking to improve laboratory efficiency and clinical decision-making capabilities.

Telehealth Platform Integration has gained significant momentum, particularly following the expansion of remote care services. This category addresses the need to seamlessly connect telehealth platforms with existing healthcare IT infrastructure to maintain continuity of care and comprehensive patient information access.

Healthcare Providers benefit from IT integration solutions through improved operational efficiency, enhanced patient safety, and streamlined clinical workflows. Integration platforms enable healthcare organizations to reduce manual processes, eliminate data silos, and provide comprehensive patient information access that supports evidence-based clinical decision-making and care coordination.

Patients experience significant benefits including improved care coordination, reduced medical errors, and enhanced access to their health information through integrated patient portals and mobile applications. IT integration enables healthcare providers to deliver more personalized, efficient, and effective care services that improve overall patient satisfaction and health outcomes.

Healthcare Administrators gain substantial advantages through integrated systems that provide comprehensive operational visibility, automated reporting capabilities, and streamlined administrative processes. Integration solutions enable healthcare organizations to achieve regulatory compliance, optimize resource utilization, and make data-driven decisions that improve organizational performance.

IT Integration Vendors benefit from growing market demand for comprehensive integration solutions and opportunities to develop innovative platforms that address evolving healthcare technology requirements. The expanding market provides vendors with opportunities for revenue growth, market expansion, and technology innovation in the healthcare IT space.

Technology Partners including cloud service providers, cybersecurity vendors, and analytics companies benefit from increased demand for complementary technologies that support healthcare IT integration initiatives. These partnerships create opportunities for collaborative solutions that address comprehensive healthcare organization technology requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Cloud-first Integration Strategies are becoming predominant as healthcare organizations recognize the scalability, flexibility, and cost advantages of cloud-based integration platforms. This trend is driving migration from traditional on-premise solutions to cloud-native platforms that offer enhanced accessibility, automatic updates, and reduced infrastructure requirements.

Artificial Intelligence Integration is transforming healthcare IT integration platforms by enabling predictive analytics, automated clinical decision support, and intelligent data processing capabilities. Healthcare organizations are increasingly seeking AI-powered integration solutions that can analyze integrated data streams to provide actionable insights and improve clinical outcomes.

API-first Architecture is gaining momentum as healthcare organizations demand flexible, modular integration solutions that can easily connect with diverse healthcare applications and systems. This architectural approach enables healthcare providers to build customized integration ecosystems that can adapt to changing technology requirements and organizational needs.

Real-time Data Processing capabilities are becoming essential requirements for healthcare IT integration platforms as organizations seek immediate access to clinical information for time-sensitive decision-making. This trend is driving development of integration solutions that can handle high-volume, real-time data streams from diverse healthcare systems and medical devices.

Patient-centric Integration focuses on connecting systems and applications that directly impact patient experience and engagement, including patient portals, mobile health applications, and remote monitoring platforms. Healthcare organizations are prioritizing integration solutions that enhance patient access to health information and enable active participation in care management.

Interoperability Standardization efforts are accelerating as healthcare organizations and technology vendors collaborate to establish common data exchange standards and communication protocols. This trend is reducing integration complexity and enabling more seamless connectivity between different healthcare IT systems and platforms.

Regulatory Initiatives continue to shape the healthcare IT integration landscape with government agencies implementing new interoperability requirements and data sharing mandates. Recent developments include updated meaningful use criteria, enhanced cybersecurity requirements, and patient data access regulations that are driving increased adoption of comprehensive integration solutions.

Strategic Partnerships between healthcare IT vendors, cloud service providers, and technology companies are creating more comprehensive integration platforms that address diverse healthcare organization requirements. These collaborations are enabling vendors to offer end-to-end solutions that combine integration capabilities with complementary technologies such as analytics, security, and mobile applications.

Acquisition Activities in the healthcare IT integration market are consolidating capabilities and expanding vendor portfolios to offer more comprehensive solutions. Major healthcare IT companies are acquiring specialized integration platform providers to enhance their interoperability capabilities and market reach.

Technology Innovations including blockchain integration, edge computing capabilities, and advanced analytics are being incorporated into healthcare IT integration platforms to address emerging requirements for data security, real-time processing, and intelligent automation. These innovations are creating new possibilities for secure, efficient, and intelligent healthcare data integration.

Market Expansion activities by leading integration platform vendors into emerging markets are creating new growth opportunities and driving global adoption of healthcare IT integration solutions. Vendors are developing region-specific solutions that address local regulatory requirements and healthcare delivery models.

MarkWide Research analysis indicates that healthcare organizations should prioritize comprehensive integration strategies that address both current operational needs and future technology requirements. Organizations should evaluate integration platforms based on scalability, interoperability capabilities, security features, and vendor stability to ensure long-term success of their integration initiatives.

Investment Focus should emphasize cloud-based integration platforms that offer flexibility, scalability, and reduced total cost of ownership compared to traditional on-premise solutions. Healthcare organizations should consider hybrid deployment models that provide the benefits of cloud computing while maintaining control over sensitive data and critical systems.

Vendor Selection criteria should include comprehensive platform capabilities, proven implementation experience, robust security features, and strong customer support services. Healthcare organizations should prioritize vendors that demonstrate expertise in healthcare-specific integration requirements and regulatory compliance capabilities.

Implementation Strategy recommendations include phased deployment approaches that minimize operational disruption while enabling healthcare organizations to realize integration benefits incrementally. Organizations should invest in comprehensive staff training and change management processes to ensure successful adoption of integrated systems.

Future Preparation should focus on integration platforms that can accommodate emerging technologies such as artificial intelligence, Internet of Medical Things, and advanced analytics. Healthcare organizations should select solutions that provide flexibility to integrate new technologies and adapt to evolving healthcare delivery models.

Market Growth Trajectory indicates continued robust expansion of the healthcare IT integration market driven by increasing digitization of healthcare delivery, regulatory requirements for interoperability, and growing emphasis on value-based care models. MarkWide Research projects sustained growth with increasing adoption across healthcare organizations of all sizes and geographic regions.

Technology Evolution will continue to enhance integration platform capabilities with artificial intelligence, machine learning, and advanced analytics becoming standard features rather than optional add-ons. Future integration platforms will offer intelligent automation capabilities that can optimize healthcare workflows and provide predictive insights for clinical decision-making.

Interoperability Achievement is expected to improve significantly as industry standardization efforts mature and healthcare organizations implement comprehensive integration strategies. The future healthcare IT landscape will feature seamless data exchange between diverse systems, enabling truly connected care delivery across healthcare networks.

Global Market Expansion will accelerate as emerging markets invest in healthcare infrastructure modernization and digital health initiatives. Developing countries present substantial growth opportunities for integration platform vendors offering cost-effective solutions tailored to local healthcare delivery requirements and regulatory environments.

Innovation Acceleration will drive development of next-generation integration platforms that incorporate emerging technologies such as blockchain for secure data sharing, edge computing for real-time processing, and quantum computing for advanced analytics capabilities. These innovations will create new possibilities for intelligent, secure, and efficient healthcare data integration.

Healthcare IT integration represents a critical enabler of modern healthcare delivery, providing the technological foundation necessary for efficient, safe, and effective patient care in an increasingly digital healthcare environment. The market demonstrates strong growth potential driven by regulatory requirements, operational efficiency needs, and the ongoing transformation of healthcare delivery models toward value-based care and patient-centered approaches.

Market dynamics indicate continued expansion across all segments and geographic regions, with cloud-based solutions, artificial intelligence integration, and comprehensive interoperability capabilities emerging as key differentiators in the competitive landscape. Healthcare organizations are increasingly recognizing that successful IT integration is essential for achieving operational excellence, regulatory compliance, and improved patient outcomes.

Future success in the healthcare IT integration market will depend on vendors’ ability to deliver comprehensive, scalable, and secure platforms that can adapt to evolving healthcare technology requirements and regulatory environments. Organizations that invest in robust integration strategies today will be better positioned to leverage emerging technologies and deliver high-quality, efficient healthcare services in the digital health era.

What is IT Integration in Healthcare?

IT Integration in Healthcare refers to the process of combining various information technology systems and software applications within healthcare organizations to improve data sharing, streamline operations, and enhance patient care. This integration facilitates better communication among healthcare providers, patients, and administrative staff.

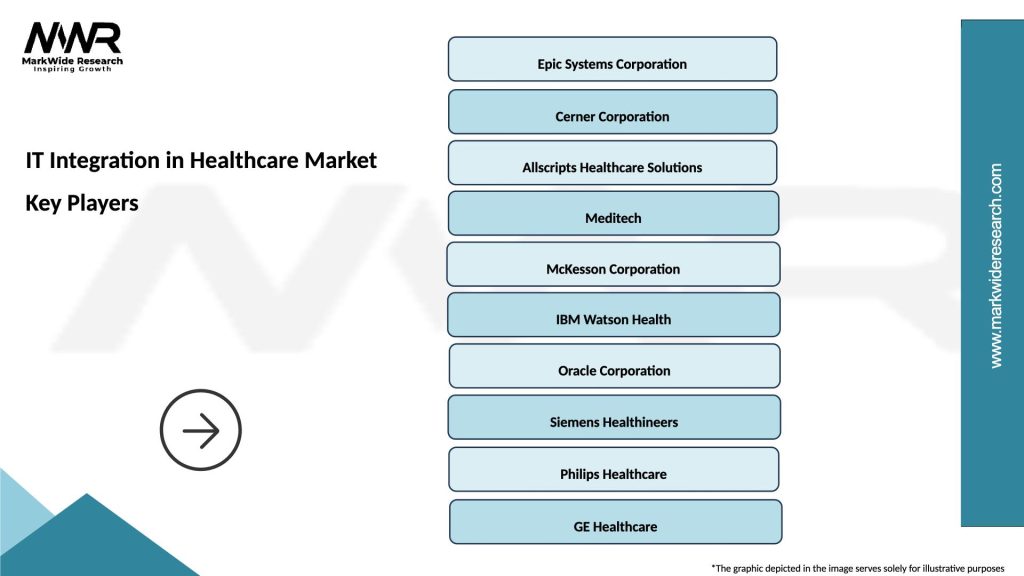

What are the key players in the IT Integration in Healthcare Market?

Key players in the IT Integration in Healthcare Market include companies like Epic Systems, Cerner Corporation, and Allscripts Healthcare Solutions, which provide software solutions for electronic health records and interoperability. These companies focus on enhancing data exchange and improving healthcare delivery, among others.

What are the main drivers of growth in the IT Integration in Healthcare Market?

The main drivers of growth in the IT Integration in Healthcare Market include the increasing demand for efficient healthcare delivery, the need for improved patient outcomes, and the rising adoption of electronic health records. Additionally, regulatory requirements for data sharing and interoperability are also significant factors.

What challenges does the IT Integration in Healthcare Market face?

The IT Integration in Healthcare Market faces challenges such as data security concerns, high implementation costs, and resistance to change from healthcare professionals. These factors can hinder the adoption of integrated IT solutions in healthcare settings.

What opportunities exist in the IT Integration in Healthcare Market?

Opportunities in the IT Integration in Healthcare Market include the growing trend of telemedicine, advancements in cloud computing, and the increasing focus on patient-centered care. These trends create a demand for integrated solutions that enhance accessibility and efficiency in healthcare services.

What are the current trends in the IT Integration in Healthcare Market?

Current trends in the IT Integration in Healthcare Market include the rise of artificial intelligence and machine learning for data analysis, the shift towards value-based care, and the emphasis on interoperability standards. These trends aim to improve healthcare outcomes and streamline operations.

IT Integration in Healthcare Market

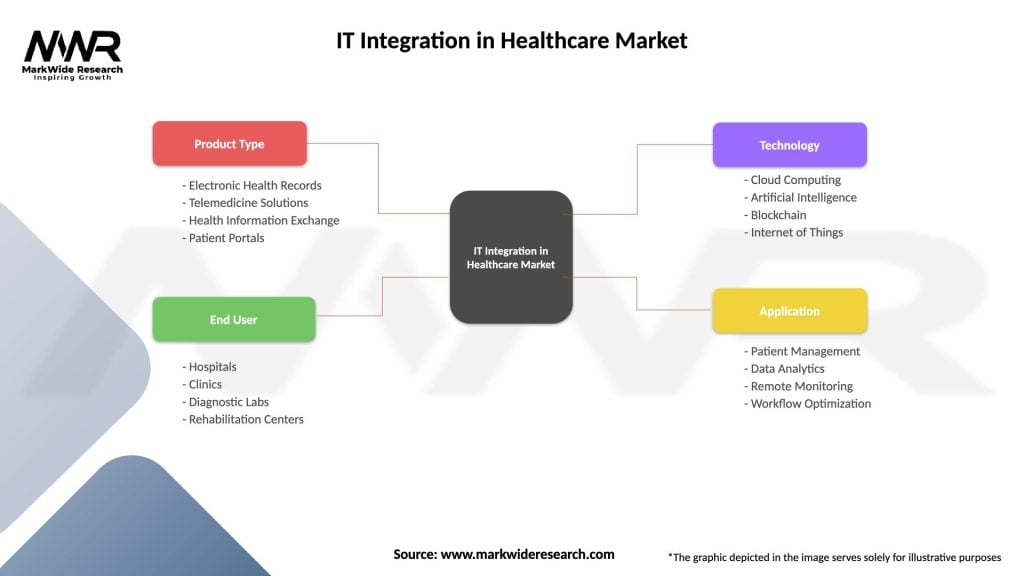

| Segmentation Details | Description |

|---|---|

| Product Type | Electronic Health Records, Telemedicine Solutions, Health Information Exchange, Patient Portals |

| End User | Hospitals, Clinics, Diagnostic Labs, Rehabilitation Centers |

| Technology | Cloud Computing, Artificial Intelligence, Blockchain, Internet of Things |

| Application | Patient Management, Data Analytics, Remote Monitoring, Workflow Optimization |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the IT Integration in Healthcare Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at