444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Israel telecommunication market represents one of the most technologically advanced and competitive telecommunications ecosystems in the Middle East region. Israel’s telecommunications infrastructure has evolved rapidly over the past decade, driven by significant government investments, technological innovation, and increasing consumer demand for high-speed connectivity. The market demonstrates exceptional growth potential with a projected compound annual growth rate (CAGR) of 6.2% through the forecast period, positioning Israel as a regional leader in telecommunications advancement.

Market dynamics in Israel’s telecommunications sector are characterized by intense competition among major service providers, substantial infrastructure modernization initiatives, and widespread adoption of next-generation technologies. The country’s strategic focus on digital transformation has resulted in 95% mobile penetration rates and increasingly sophisticated network capabilities. 5G network deployment has accelerated significantly, with coverage expanding to major urban centers and industrial zones, supporting Israel’s position as a technology hub in the region.

Consumer behavior patterns indicate strong demand for integrated telecommunications services, with businesses and individuals seeking comprehensive solutions that combine mobile, fixed-line, and internet services. The market benefits from Israel’s highly educated population and tech-savvy consumer base, driving adoption of advanced telecommunications services and creating opportunities for service providers to introduce innovative offerings.

The Israel telecommunication market refers to the comprehensive ecosystem of communication services, infrastructure, and technologies that enable voice, data, and multimedia transmission across Israel’s geographic territory. This market encompasses mobile network operators, fixed-line service providers, internet service providers, and emerging technology platforms that facilitate digital communication and connectivity solutions for residential, commercial, and government sectors.

Telecommunications infrastructure in Israel includes extensive fiber-optic networks, cellular tower installations, satellite communication systems, and data centers that support the country’s digital economy. The market covers traditional services such as voice calling and text messaging, as well as advanced offerings including high-speed internet, cloud services, IoT connectivity, and enterprise communication solutions that drive business productivity and innovation.

Israel’s telecommunication market demonstrates remarkable resilience and growth momentum, supported by robust infrastructure investments and technological innovation initiatives. The market benefits from strong regulatory frameworks that promote competition while ensuring service quality and consumer protection. Major market players continue to expand their service portfolios, investing heavily in network modernization and customer experience enhancement programs.

Key growth drivers include increasing demand for high-speed internet services, rapid adoption of cloud-based solutions, and growing requirements for enterprise connectivity solutions. The market has witnessed 78% fiber-optic coverage in urban areas, significantly improving service quality and enabling advanced telecommunications applications. Mobile data consumption has increased substantially, with average monthly usage reaching new highs as consumers embrace streaming services, remote work applications, and digital entertainment platforms.

Strategic initiatives by telecommunications providers focus on network expansion, service diversification, and customer retention programs. The market’s competitive landscape encourages innovation and service improvement, resulting in enhanced value propositions for consumers and businesses. Government support for digital infrastructure development continues to drive market expansion and technological advancement across the telecommunications sector.

Market intelligence reveals several critical insights that shape Israel’s telecommunications landscape and influence strategic decision-making among industry participants:

Primary market drivers propelling growth in Israel’s telecommunications sector stem from technological advancement, consumer demand evolution, and strategic government initiatives. Digital transformation initiatives across various industries have created substantial demand for reliable, high-speed telecommunications services that support business operations and enable innovative applications.

Consumer behavior changes significantly influence market dynamics, with increasing reliance on mobile devices for communication, entertainment, and business activities. The widespread adoption of remote work practices has intensified demand for robust internet connectivity and advanced communication tools, driving telecommunications providers to enhance their service offerings and network capabilities.

Government support for digital infrastructure development plays a crucial role in market expansion, with substantial investments in national broadband initiatives and smart city projects. Regulatory frameworks that promote competition and innovation encourage telecommunications providers to invest in network modernization and service enhancement programs, benefiting consumers through improved service quality and competitive pricing.

Technological innovation continues to drive market growth, with emerging technologies such as Internet of Things (IoT), artificial intelligence, and edge computing creating new opportunities for telecommunications service providers. Enterprise digitization trends require sophisticated communication solutions that support business transformation and operational efficiency improvements.

Market constraints affecting Israel’s telecommunications sector include infrastructure investment requirements, regulatory compliance costs, and competitive pricing pressures that impact profitability margins. Capital expenditure demands for network modernization and expansion require significant financial resources, potentially limiting the pace of infrastructure development and service enhancement initiatives.

Regulatory compliance requirements impose additional operational costs and administrative burdens on telecommunications providers, particularly regarding data protection, consumer privacy, and service quality standards. Market saturation in certain segments creates challenges for service providers seeking to maintain growth rates and market share expansion.

Cybersecurity concerns require substantial investments in security infrastructure and monitoring systems, adding to operational costs while ensuring network protection and customer data security. Technological complexity associated with advanced telecommunications systems demands specialized expertise and ongoing training investments for technical personnel.

Economic fluctuations can impact consumer spending patterns and business investment decisions, potentially affecting demand for premium telecommunications services and advanced technology solutions. International competition from global technology providers may pressure local telecommunications companies to enhance their competitive positioning and service differentiation strategies.

Significant opportunities exist within Israel’s telecommunications market, driven by emerging technologies, evolving consumer needs, and expanding business applications. 5G network deployment presents substantial growth potential, enabling new service categories and revenue streams through enhanced connectivity capabilities and innovative applications.

Internet of Things (IoT) applications offer extensive opportunities for telecommunications providers to develop specialized connectivity solutions for smart cities, industrial automation, and consumer devices. Edge computing implementations require advanced telecommunications infrastructure, creating opportunities for service providers to offer specialized hosting and connectivity services.

Enterprise cloud services represent a growing market segment, with businesses increasingly adopting cloud-based communication and collaboration solutions. Cybersecurity services integration with telecommunications offerings provides opportunities for comprehensive security solutions that address growing concerns about digital threats and data protection.

International expansion opportunities allow Israeli telecommunications companies to leverage their technological expertise and innovative solutions in regional and global markets. Strategic partnerships with technology companies and content providers can enhance service portfolios and create new revenue opportunities through integrated service offerings.

Market dynamics in Israel’s telecommunications sector reflect the interplay between technological advancement, competitive pressures, and evolving customer expectations. Innovation cycles drive continuous service enhancement and infrastructure modernization, with telecommunications providers investing heavily in next-generation technologies to maintain competitive advantages.

Competitive intensity remains high among major market participants, resulting in aggressive pricing strategies, service differentiation initiatives, and customer acquisition programs. Market consolidation trends may reshape the competitive landscape, potentially leading to enhanced operational efficiencies and expanded service capabilities through strategic mergers and acquisitions.

Customer expectations continue to evolve, with increasing demands for seamless connectivity, reliable service quality, and integrated solutions that address multiple communication needs. Service personalization becomes increasingly important as providers seek to differentiate their offerings and enhance customer satisfaction levels.

Technology convergence creates opportunities for telecommunications providers to expand beyond traditional services into adjacent markets such as entertainment, cloud computing, and digital services. Regulatory evolution influences market dynamics through policy changes that affect competition, pricing, and service delivery standards across the telecommunications sector.

Comprehensive research methodology employed in analyzing Israel’s telecommunications market incorporates multiple data collection approaches and analytical frameworks to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with industry executives, telecommunications service providers, regulatory officials, and key stakeholders across the value chain.

Secondary research encompasses extensive analysis of industry reports, government publications, financial statements, and regulatory filings from major telecommunications companies operating in Israel. Market data validation processes involve cross-referencing information from multiple sources to ensure consistency and accuracy of market intelligence.

Quantitative analysis techniques include statistical modeling, trend analysis, and market sizing methodologies that provide robust foundations for market projections and growth forecasts. Qualitative assessment methods incorporate expert opinions, industry insights, and strategic analysis to understand market dynamics and competitive positioning factors.

Data triangulation approaches ensure research findings are validated through multiple analytical perspectives and information sources. Continuous monitoring of market developments, regulatory changes, and technological innovations ensures research insights remain current and relevant for strategic decision-making purposes.

Regional market analysis reveals distinct characteristics and growth patterns across different geographic areas within Israel’s telecommunications landscape. Central region including Tel Aviv metropolitan area demonstrates the highest concentration of telecommunications infrastructure and service adoption, accounting for approximately 45% of total market activity due to dense population and business concentration.

Northern regions show strong growth potential driven by industrial development and technology sector expansion, with telecommunications providers investing significantly in network infrastructure to support business growth and residential connectivity needs. Southern regions present emerging opportunities as government initiatives promote economic development and population growth in these areas.

Jerusalem district maintains significant market importance due to government institutions, educational facilities, and growing technology sector presence. Coastal areas benefit from high population density and strong economic activity, driving demand for advanced telecommunications services and premium connectivity solutions.

Rural connectivity initiatives supported by government programs aim to reduce digital divide and ensure comprehensive telecommunications coverage across all geographic regions. Border regions require specialized telecommunications solutions that address security considerations while providing reliable connectivity for residents and businesses.

Israel’s telecommunications market features a competitive landscape dominated by several major service providers that compete across multiple service segments and customer categories. Market leadership positions are established through network quality, service innovation, and customer satisfaction initiatives.

Competitive strategies among market participants include network modernization investments, service portfolio expansion, and customer experience enhancement programs. Market differentiation efforts focus on service quality, pricing competitiveness, and innovative technology implementations that address evolving customer needs and preferences.

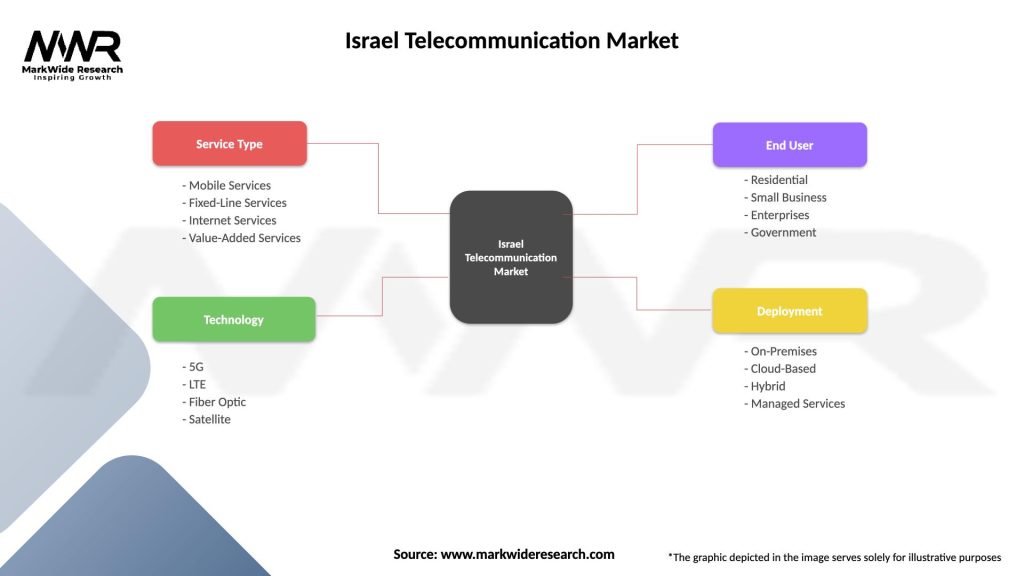

Market segmentation analysis reveals distinct customer categories and service segments that define Israel’s telecommunications market structure and growth opportunities:

By Service Type:

By Customer Segment:

Mobile telecommunications category demonstrates the strongest growth momentum, driven by increasing smartphone adoption and mobile data consumption patterns. 5G service deployment creates new opportunities for premium service offerings and enhanced customer experiences through improved network capabilities and reduced latency.

Fixed broadband services maintain steady demand as remote work and digital entertainment consumption drive requirements for high-speed internet connectivity. Fiber-optic infrastructure expansion enables telecommunications providers to offer competitive broadband services with enhanced reliability and performance characteristics.

Enterprise telecommunications category shows significant growth potential as businesses adopt digital transformation initiatives and require sophisticated communication solutions. Cloud-based services integration with traditional telecommunications offerings creates comprehensive solutions that address evolving business communication needs.

Value-added services including cybersecurity, cloud storage, and digital entertainment represent growing revenue opportunities for telecommunications providers seeking to diversify their service portfolios and enhance customer relationships through integrated service offerings.

Telecommunications service providers benefit from expanding market opportunities, technological advancement capabilities, and diversified revenue streams that enhance business sustainability and growth potential. Network infrastructure investments create long-term competitive advantages and enable service differentiation in competitive market environments.

Consumers and businesses gain access to advanced telecommunications services that improve productivity, enable innovation, and enhance quality of life through reliable connectivity solutions. Competitive market dynamics result in improved service quality, competitive pricing, and continuous innovation that benefits end-users across all market segments.

Government and regulatory bodies achieve policy objectives related to digital infrastructure development, economic growth, and social connectivity through robust telecommunications market development. Economic benefits include job creation, technology sector growth, and enhanced international competitiveness through advanced telecommunications capabilities.

Technology vendors and suppliers benefit from growing demand for telecommunications equipment, software solutions, and professional services that support network modernization and service enhancement initiatives. Innovation ecosystem development creates opportunities for collaboration and technology advancement across the telecommunications value chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration represents the most significant trend shaping Israel’s telecommunications market, with businesses and consumers increasingly adopting digital services and requiring advanced connectivity solutions. 5G network deployment continues to expand, enabling new applications and service categories that drive market growth and innovation.

Service convergence trends show telecommunications providers expanding beyond traditional services into adjacent markets such as entertainment, cloud computing, and cybersecurity. Customer experience focus intensifies as providers invest in digital platforms, self-service capabilities, and personalized service offerings to enhance customer satisfaction and retention.

Sustainability initiatives gain importance as telecommunications companies implement environmentally responsible practices and energy-efficient technologies. Edge computing adoption accelerates, requiring telecommunications providers to develop specialized infrastructure and services that support distributed computing applications.

Artificial intelligence integration enhances network management, customer service, and operational efficiency across telecommunications operations. Cybersecurity emphasis increases as providers develop comprehensive security solutions integrated with telecommunications services to address growing digital security concerns.

Recent industry developments demonstrate the dynamic nature of Israel’s telecommunications market and ongoing transformation initiatives among major market participants. Network infrastructure investments continue at substantial levels, with providers upgrading equipment, expanding coverage, and implementing advanced technologies to enhance service capabilities.

Strategic partnerships between telecommunications providers and technology companies create integrated solutions that address evolving customer needs and market opportunities. Regulatory changes influence market dynamics through updated policies regarding spectrum allocation, service quality standards, and competitive practices.

Merger and acquisition activity shapes market structure as companies seek to achieve operational efficiencies, expand service portfolios, and strengthen competitive positions. International expansion initiatives by Israeli telecommunications companies demonstrate growing confidence and capability to compete in global markets.

Innovation investments focus on emerging technologies such as artificial intelligence, machine learning, and advanced analytics to improve network performance and customer service delivery. Sustainability programs implementation reflects growing environmental awareness and corporate responsibility initiatives across the telecommunications sector.

Strategic recommendations for telecommunications providers operating in Israel’s market emphasize the importance of continued innovation, customer-centric service development, and operational efficiency improvements. MarkWide Research analysis indicates that companies should prioritize 5G network expansion and advanced service development to maintain competitive advantages in evolving market conditions.

Investment priorities should focus on network modernization, cybersecurity capabilities, and customer experience enhancement initiatives that support long-term growth and market positioning objectives. Service diversification strategies can help providers reduce dependence on traditional telecommunications services while creating new revenue opportunities in adjacent markets.

Partnership development with technology companies, content providers, and enterprise solution vendors can enhance service portfolios and create comprehensive offerings that address complex customer requirements. Market expansion opportunities in regional markets should be evaluated based on technological expertise and competitive capabilities developed in the domestic market.

Operational excellence initiatives including process automation, artificial intelligence implementation, and workforce development programs can improve efficiency and service quality while reducing operational costs. Sustainability integration into business strategies addresses environmental concerns while potentially reducing operational costs through energy efficiency improvements.

Future market prospects for Israel’s telecommunications sector remain highly positive, supported by continued technological advancement, growing digital service adoption, and expanding business applications. Market growth projections indicate sustained expansion with a compound annual growth rate of 6.2% through the forecast period, driven by 5G deployment, IoT applications, and enterprise digital transformation initiatives.

Technology evolution will continue to reshape market dynamics, with emerging technologies such as 6G research, quantum communications, and advanced artificial intelligence creating new opportunities for service innovation and market expansion. Consumer behavior trends suggest increasing demand for integrated services, personalized offerings, and seamless connectivity across multiple devices and platforms.

Competitive landscape evolution may include further market consolidation, strategic partnerships, and new market entrants that challenge existing business models and service approaches. Regulatory developments will likely focus on promoting innovation while ensuring consumer protection, cybersecurity, and fair competition across the telecommunications market.

International opportunities for Israeli telecommunications companies appear promising, with potential for technology export, consulting services, and strategic partnerships in regional and global markets. MWR projections suggest that companies investing in advanced technologies and customer-centric strategies will achieve the strongest growth and market positioning in the evolving telecommunications landscape.

Israel’s telecommunication market demonstrates exceptional growth potential and technological sophistication, positioning the country as a regional leader in telecommunications innovation and service delivery. The market benefits from strong competitive dynamics, supportive regulatory frameworks, and continuous investment in advanced infrastructure that enables cutting-edge telecommunications services and applications.

Market fundamentals remain robust, with growing demand for high-speed connectivity, enterprise solutions, and emerging technology applications driving sustained growth across multiple service segments. Strategic opportunities in 5G deployment, IoT connectivity, and cloud-based services provide substantial potential for market expansion and revenue diversification among telecommunications providers.

Future success in Israel’s telecommunications market will depend on continued innovation, customer-centric service development, and strategic investments in next-generation technologies that address evolving market needs and competitive challenges. Companies that effectively balance technological advancement with operational efficiency and customer satisfaction will achieve the strongest market positions and growth outcomes in this dynamic and rapidly evolving telecommunications environment.

What is Telecommunication?

Telecommunication refers to the transmission of information over significant distances by electronic means. It encompasses various technologies such as mobile networks, internet services, and broadcasting, which are essential for communication in both personal and business contexts.

What are the key players in the Israel Telecommunication Market?

The Israel Telecommunication Market features several prominent companies, including Bezeq, Cellcom, and Partner Communications. These companies provide a range of services, including mobile, internet, and television, contributing to the competitive landscape of the market.

What are the growth factors driving the Israel Telecommunication Market?

Key growth factors in the Israel Telecommunication Market include the increasing demand for high-speed internet, the expansion of mobile services, and advancements in technology such as 5G. Additionally, the rise in digital content consumption is fueling the need for robust telecommunication infrastructure.

What challenges does the Israel Telecommunication Market face?

The Israel Telecommunication Market faces challenges such as regulatory hurdles, intense competition among service providers, and the need for continuous investment in infrastructure. These factors can impact profitability and service quality in the sector.

What opportunities exist in the Israel Telecommunication Market?

Opportunities in the Israel Telecommunication Market include the potential for growth in IoT services, the expansion of fiber-optic networks, and the increasing adoption of cloud-based solutions. These trends present avenues for innovation and service diversification.

What trends are shaping the Israel Telecommunication Market?

Trends in the Israel Telecommunication Market include the shift towards digital transformation, the rollout of 5G technology, and the growing importance of cybersecurity. These trends are influencing how companies operate and deliver services to consumers.

Israel Telecommunication Market

| Segmentation Details | Description |

|---|---|

| Service Type | Mobile Services, Fixed-Line Services, Internet Services, Value-Added Services |

| Technology | 5G, LTE, Fiber Optic, Satellite |

| End User | Residential, Small Business, Enterprises, Government |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Israel Telecommunication Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at