444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Israel life and non-life insurance market represents a dynamic and rapidly evolving sector within the country’s robust financial services landscape. This comprehensive market encompasses traditional life insurance products, health insurance coverage, property and casualty insurance, and emerging digital insurance solutions that cater to Israel’s technologically advanced population. The market demonstrates remarkable resilience and innovation, driven by regulatory reforms, demographic shifts, and increasing consumer awareness about financial protection.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 6.2% over recent years. The Israeli insurance landscape benefits from a well-established regulatory framework, competitive market structure, and strong consumer confidence in financial institutions. Digital transformation has become a key differentiator, with insurtech companies and traditional insurers investing heavily in technology-driven solutions to enhance customer experience and operational efficiency.

Regional characteristics of the Israeli market include high insurance penetration rates, sophisticated risk assessment capabilities, and a growing emphasis on personalized insurance products. The market serves approximately 9.5 million residents across diverse demographic segments, from young professionals in Tel Aviv’s tech hub to agricultural communities in rural regions. Life insurance adoption has reached approximately 78% penetration rate among eligible adults, while non-life insurance segments show varying adoption patterns across different coverage types.

The Israel life and non-life insurance market refers to the comprehensive ecosystem of insurance products and services offered to individuals, families, and businesses throughout Israel. This market encompasses two primary categories: life insurance products that provide financial protection against mortality risks and long-term savings solutions, and non-life insurance products covering property, casualty, health, and specialty risks.

Life insurance components include term life policies, whole life insurance, universal life products, and annuities designed to provide income replacement and wealth transfer solutions. These products serve essential roles in financial planning, offering beneficiaries financial security and helping policyholders build long-term wealth through investment-linked policies.

Non-life insurance segments encompass motor insurance, property insurance, health insurance, travel insurance, and commercial lines covering business risks. These products provide immediate protection against specific perils and losses, enabling individuals and businesses to transfer risk and maintain financial stability during unexpected events.

Strategic positioning of the Israel insurance market reflects a mature, competitive landscape characterized by strong regulatory oversight, technological innovation, and evolving consumer preferences. The market benefits from Israel’s stable economic environment, advanced healthcare system, and high levels of financial literacy among consumers.

Key performance indicators demonstrate robust market health, with insurance density reaching significant levels across both life and non-life segments. The sector maintains strong solvency ratios, with major insurers reporting capital adequacy ratios exceeding 150% of regulatory requirements. Digital adoption rates have accelerated dramatically, with approximately 68% of new policies now initiated through digital channels.

Market consolidation trends show increasing collaboration between traditional insurers and insurtech startups, creating hybrid business models that combine established distribution networks with innovative technology platforms. Customer satisfaction scores have improved consistently, with leading insurers achieving Net Promoter Scores above 45, indicating strong customer loyalty and positive market sentiment.

Regulatory developments continue shaping market dynamics, with recent reforms focusing on consumer protection, digital innovation frameworks, and enhanced transparency requirements. These changes create opportunities for market expansion while ensuring sustainable growth and consumer confidence.

Demographic transformation significantly influences market dynamics, with Israel’s young population driving demand for innovative insurance products and digital-first customer experiences. The market responds to changing lifestyle patterns, urbanization trends, and evolving risk profiles across different age cohorts.

Competitive dynamics reflect a balanced market structure where established players leverage their distribution networks and brand recognition while innovative companies introduce disruptive technologies and customer-centric approaches. Market share distribution shows the top five insurers controlling approximately 72% of total market premiums, creating opportunities for specialized providers and niche market players.

Economic prosperity serves as a fundamental driver for insurance market expansion, with Israel’s strong GDP growth and rising disposable incomes enabling increased insurance spending across all demographic segments. The country’s robust economy supports consumer confidence and willingness to invest in long-term financial protection products.

Regulatory reforms have created a more competitive and transparent market environment, encouraging innovation and improving consumer choice. Recent legislative changes have streamlined licensing processes for new entrants while maintaining rigorous standards for consumer protection and financial stability.

Technological advancement accelerates market growth through improved operational efficiency, enhanced customer experiences, and new product development capabilities. Digital transformation initiatives have reduced operational costs by approximately 25% for leading insurers while improving customer satisfaction and retention rates.

Demographic trends including population growth, urbanization, and changing family structures create new insurance needs and market opportunities. The growing middle class demonstrates increasing awareness of financial planning importance and willingness to purchase comprehensive insurance coverage.

Healthcare system evolution drives demand for supplementary health insurance products as consumers seek enhanced medical coverage and access to private healthcare services. Rising healthcare costs motivate individuals to secure additional protection beyond basic national health insurance coverage.

Regulatory complexity presents ongoing challenges for market participants, particularly smaller insurers and new entrants who must navigate sophisticated compliance requirements and capital adequacy standards. The regulatory burden can limit innovation speed and increase operational costs for some market players.

Economic volatility affects consumer spending patterns and insurance purchasing decisions, particularly during periods of uncertainty or recession. Economic downturns can lead to policy lapses, reduced premium payments, and delayed new business acquisition across both life and non-life segments.

Intense competition pressures profit margins and requires continuous investment in technology, marketing, and product development. Price competition in commoditized insurance segments can erode profitability and limit resources available for innovation and customer service improvements.

Cybersecurity risks pose increasing threats to insurance companies handling sensitive customer data and financial information. The cost of implementing robust cybersecurity measures and potential losses from data breaches create ongoing operational challenges and financial exposures.

Talent shortage in specialized areas such as actuarial science, data analytics, and digital technology limits growth potential and innovation capabilities for many insurance companies. Competition for skilled professionals drives up labor costs and can impact service quality.

Digital transformation creates substantial opportunities for insurers to develop innovative products, improve customer engagement, and optimize operational processes. Insurtech partnerships enable traditional insurers to access cutting-edge technologies and reach new customer segments through digital-native approaches.

Underserved market segments present significant growth potential, particularly among young professionals, small business owners, and rural communities who may lack adequate insurance coverage. Targeted product development and distribution strategies can capture these emerging opportunities.

Product diversification opportunities include cyber insurance, climate-related coverage, and specialized products for Israel’s thriving technology sector. The growing startup ecosystem and established tech companies require sophisticated insurance solutions for unique risks and exposures.

Regional expansion possibilities exist through partnerships with international insurers and reinsurers, enabling Israeli companies to access broader markets and diversify their risk portfolios. Cross-border collaboration can enhance product offerings and operational capabilities.

Sustainability initiatives offer opportunities to develop green insurance products, sustainable investment options, and environmentally conscious business practices that appeal to socially responsible consumers and institutional clients.

Competitive landscape evolution reflects ongoing consolidation among traditional insurers while new entrants introduce innovative business models and technology-driven solutions. Market dynamics show established players adapting their strategies to compete with agile startups and maintain market position.

Customer behavior patterns demonstrate increasing preference for digital interactions, personalized products, and transparent pricing structures. Consumer expectations continue rising, with customers demanding seamless omnichannel experiences and real-time service delivery across all touchpoints.

Technology adoption accelerates across all market segments, with artificial intelligence, machine learning, and blockchain technologies transforming underwriting, claims processing, and customer service operations. Operational efficiency gains from technology implementation have improved processing times by approximately 40% for leading market participants.

Regulatory environment continues evolving to balance innovation encouragement with consumer protection and market stability. Recent regulatory changes have introduced more flexible frameworks for product approval while maintaining rigorous standards for financial solvency and customer treatment.

Investment performance significantly impacts life insurance product competitiveness and overall market attractiveness. Insurers must balance investment returns with risk management requirements while meeting policyholder expectations for competitive returns on investment-linked products.

Comprehensive analysis of the Israel life and non-life insurance market employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. The research approach combines quantitative data analysis with qualitative market intelligence to provide a complete market perspective.

Primary research activities include structured interviews with industry executives, regulatory officials, and key market participants to gather firsthand insights about market trends, challenges, and opportunities. Survey methodologies capture consumer preferences, purchasing behaviors, and satisfaction levels across different insurance segments.

Secondary research sources encompass regulatory filings, company annual reports, industry publications, and government statistics to establish market baselines and validate primary research findings. Data triangulation ensures consistency and accuracy across multiple information sources.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market projections and identify key growth drivers. Advanced analytics help quantify market relationships and predict future developments under various economic and regulatory conditions.

Expert validation processes involve consultation with industry specialists, academic researchers, and market analysts to verify findings and ensure research conclusions reflect current market realities and future prospects accurately.

Geographic distribution of insurance market activity reflects Israel’s urban concentration patterns, with major metropolitan areas including Tel Aviv, Jerusalem, and Haifa accounting for approximately 65% of total premium volume. These urban centers demonstrate higher insurance penetration rates and greater product sophistication compared to rural regions.

Tel Aviv metropolitan area represents the largest insurance market segment, driven by high concentrations of technology companies, financial services firms, and affluent professionals. The region shows strong demand for comprehensive life insurance coverage, executive benefits packages, and specialized commercial insurance products.

Jerusalem region exhibits unique market characteristics influenced by diverse demographic composition, including secular and religious communities with varying insurance needs and preferences. The market demonstrates steady growth in both life and non-life segments, with particular strength in health insurance and property coverage.

Northern regions including Haifa and surrounding areas show robust industrial insurance demand driven by manufacturing, petrochemical, and port activities. Commercial insurance segments perform strongly, while personal lines insurance adoption continues expanding among growing residential populations.

Southern regions present emerging market opportunities as population growth and economic development create new insurance needs. Agricultural insurance products show particular relevance in these areas, along with standard personal lines coverage for expanding residential communities.

Market leadership remains concentrated among established insurance groups that have built strong brand recognition, extensive distribution networks, and comprehensive product portfolios over decades of operation. These market leaders continue adapting their strategies to address evolving customer needs and competitive pressures.

Competitive strategies focus on digital transformation, customer experience enhancement, and product innovation to maintain market position and attract new customers. Leading insurers invest heavily in technology platforms, data analytics capabilities, and omnichannel distribution strategies.

Market share dynamics show gradual shifts as smaller insurers and new entrants gain traction through specialized products, superior customer service, or innovative technology solutions. Customer retention rates average approximately 85% across major insurers, indicating strong customer loyalty and satisfaction levels.

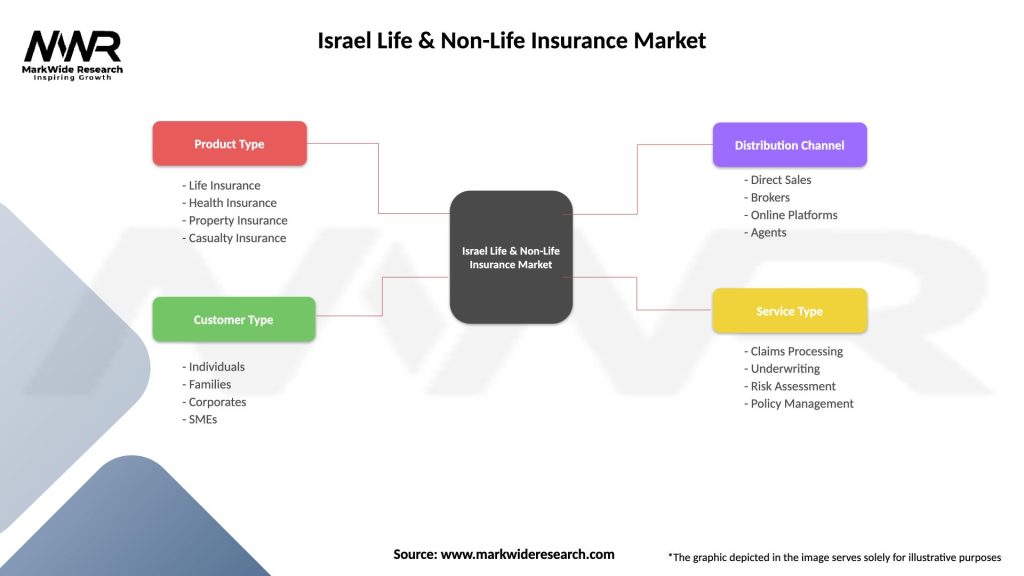

Product segmentation divides the market into distinct categories based on coverage types, customer segments, and distribution channels. This segmentation approach enables detailed analysis of market dynamics and growth opportunities within specific insurance sectors.

By Product Type:

By Customer Segment:

By Distribution Channel:

Life insurance segment demonstrates steady growth driven by increasing financial awareness and retirement planning needs among Israel’s aging population. Product innovation focuses on investment-linked policies, flexible premium structures, and digital policy management capabilities that appeal to tech-savvy consumers.

Health insurance category shows robust expansion as consumers seek enhanced medical coverage beyond basic national health insurance benefits. Premium growth rates in health insurance exceed 8% annually, reflecting strong demand for private medical services and specialized treatments.

Motor insurance segment remains highly competitive with standardized products and price-sensitive consumers. Telematics adoption and usage-based insurance models gain traction, with approximately 22% of new motor policies incorporating some form of behavioral monitoring or mileage-based pricing.

Property insurance market benefits from rising property values and increased awareness of natural disaster risks. Climate change concerns drive demand for comprehensive coverage including flood, earthquake, and extreme weather protection.

Commercial insurance lines serve Israel’s diverse business community, from technology startups requiring cyber liability coverage to established manufacturers needing comprehensive risk management solutions. Cyber insurance adoption has accelerated significantly, with penetration rates reaching approximately 35% among medium and large businesses.

Insurance companies benefit from market growth opportunities, technological advancement possibilities, and regulatory support for innovation. The stable economic environment and sophisticated consumer base provide favorable conditions for sustainable business development and profitability improvement.

Consumers gain access to comprehensive insurance protection, competitive pricing, and enhanced service quality through market competition and regulatory oversight. Digital transformation improves customer experience through streamlined processes, faster claims settlement, and convenient policy management tools.

Regulatory authorities achieve market stability, consumer protection objectives, and innovation promotion through balanced oversight approaches. The regulatory framework supports market development while maintaining financial system integrity and consumer confidence.

Technology providers find substantial opportunities to serve insurance companies with innovative solutions including artificial intelligence, blockchain, and data analytics platforms. The market’s technology adoption rate creates sustained demand for advanced insurance technology solutions.

Distribution partners including agents, brokers, and digital platforms benefit from growing insurance demand and commission opportunities. Multi-channel strategies enable distribution partners to serve diverse customer preferences and expand their market reach effectively.

Reinsurance companies participate in risk sharing and capacity provision for Israeli insurers, supporting market growth and stability. International reinsurance relationships enable local insurers to write larger risks and expand their product offerings.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first strategies dominate market evolution as insurers prioritize online customer acquisition, mobile-friendly policy management, and automated claims processing. Customer expectations for digital experiences continue rising, forcing traditional insurers to accelerate their technology transformation initiatives.

Personalization trends drive product development toward customized coverage options, flexible pricing structures, and individualized risk assessment methodologies. Data analytics capabilities enable insurers to offer more precise pricing and tailored products that better match customer needs and risk profiles.

Sustainability integration becomes increasingly important as insurers incorporate environmental, social, and governance considerations into their business strategies. Green insurance products and sustainable investment options appeal to environmentally conscious consumers and institutional clients.

Insurtech collaboration accelerates as traditional insurers partner with technology startups to access innovative solutions and enhance their competitive positioning. These partnerships enable rapid innovation while leveraging established distribution networks and regulatory expertise.

Usage-based insurance models gain popularity, particularly in motor insurance, where telematics technology enables pricing based on actual driving behavior and mileage. Behavioral data utilization improves risk assessment accuracy and rewards safe behaviors with premium discounts.

Omnichannel distribution strategies integrate traditional and digital channels to provide seamless customer experiences across all touchpoints. Customers expect consistent service quality whether interacting through agents, websites, mobile apps, or call centers.

Regulatory modernization initiatives have introduced updated frameworks supporting digital innovation while maintaining consumer protection standards. Recent regulatory changes streamline product approval processes and enable more flexible pricing methodologies for certain insurance segments.

Technology partnerships between established insurers and fintech companies create new distribution channels and enhance customer experience capabilities. MarkWide Research analysis indicates these collaborations have improved customer acquisition efficiency by approximately 30% for participating insurers.

Market consolidation activities include strategic acquisitions and mergers aimed at achieving operational synergies and expanding market reach. These transactions reshape competitive dynamics and create opportunities for enhanced product offerings and geographic expansion.

Product innovation launches introduce specialized coverage for emerging risks including cyber threats, climate change impacts, and gig economy workers. Insurers develop niche products targeting specific customer segments and unique risk exposures.

Digital platform investments by major insurers focus on customer portal enhancements, mobile application development, and artificial intelligence integration for improved underwriting and claims processing capabilities.

International expansion efforts by leading Israeli insurers include partnerships with global insurance companies and entry into regional markets through joint ventures and strategic alliances.

Strategic recommendations for market participants emphasize the importance of balanced growth strategies that combine digital innovation with traditional insurance expertise. Companies should prioritize customer experience improvements while maintaining operational efficiency and regulatory compliance.

Technology investment priorities should focus on customer-facing applications, data analytics capabilities, and automated processing systems that reduce costs while improving service quality. Digital transformation requires sustained investment and cultural change management to achieve desired outcomes.

Market positioning strategies should leverage unique competitive advantages whether through specialized expertise, superior customer service, or innovative product offerings. Differentiation becomes increasingly important in competitive market segments with standardized products.

Partnership opportunities with insurtech companies, technology providers, and distribution partners can accelerate innovation and market expansion while sharing development costs and risks. Strategic alliances enable access to new capabilities and customer segments.

Risk management enhancement should incorporate emerging threats including cyber risks, climate change impacts, and economic volatility into comprehensive risk assessment and mitigation strategies. Proactive risk management supports sustainable growth and profitability.

Customer engagement improvement through omnichannel strategies, personalized communications, and value-added services can strengthen customer relationships and reduce churn rates in competitive market segments.

Growth projections for the Israel life and non-life insurance market indicate continued expansion driven by demographic trends, economic development, and increasing insurance awareness. MWR analysis suggests the market will maintain steady growth momentum with particular strength in health insurance and technology-related coverage segments.

Technology integration will accelerate across all market segments, with artificial intelligence, machine learning, and blockchain technologies becoming standard components of insurance operations. Digital adoption rates are projected to reach 85% of all customer interactions within the next five years.

Product evolution will continue toward more personalized, flexible, and comprehensive coverage options that address emerging risks and changing customer needs. Climate-related insurance products and cyber coverage will experience particularly strong growth as awareness of these risks increases.

Regulatory development will likely focus on balancing innovation encouragement with consumer protection, potentially introducing new frameworks for insurtech companies and digital insurance distribution. Regulatory clarity will support market growth and innovation.

Market structure changes may include further consolidation among traditional insurers and increased market share for technology-enabled companies that successfully combine innovation with insurance expertise. Competitive dynamics will reward companies that effectively serve customer needs through superior products and service delivery.

International connectivity will increase as Israeli insurers expand their global presence and international companies seek opportunities in Israel’s dynamic market. Cross-border partnerships and investments will enhance market sophistication and competitive intensity.

Market assessment reveals the Israel life and non-life insurance market as a dynamic, technology-driven sector with substantial growth potential and strong competitive dynamics. The market benefits from favorable economic conditions, regulatory support for innovation, and sophisticated consumer demand that drives continuous improvement in products and services.

Strategic opportunities exist for market participants who successfully combine traditional insurance expertise with digital innovation capabilities. Companies that prioritize customer experience, operational efficiency, and product innovation are well-positioned to capture market share and achieve sustainable growth in this evolving landscape.

Future success in the Israeli insurance market will depend on adaptability, technological sophistication, and deep understanding of customer needs across diverse market segments. The market’s continued evolution toward digitalization, personalization, and comprehensive risk management creates opportunities for innovative companies while challenging traditional business models to transform and modernize their approaches.

What is Life & Non-Life Insurance?

Life & Non-Life Insurance refers to the two main categories of insurance products. Life insurance provides financial protection to beneficiaries upon the policyholder’s death, while non-life insurance covers various risks such as property damage, liability, and health-related expenses.

What are the key players in the Israel Life & Non-Life Insurance Market?

Key players in the Israel Life & Non-Life Insurance Market include Harel Insurance Investments & Financial Services, Clal Insurance Enterprises Holdings, and Menora Mivtachim Group, among others.

What are the growth factors driving the Israel Life & Non-Life Insurance Market?

The growth of the Israel Life & Non-Life Insurance Market is driven by increasing awareness of insurance products, a growing middle class, and advancements in technology that enhance customer experience and product offerings.

What challenges does the Israel Life & Non-Life Insurance Market face?

The Israel Life & Non-Life Insurance Market faces challenges such as regulatory changes, intense competition among insurers, and the need for digital transformation to meet evolving consumer expectations.

What opportunities exist in the Israel Life & Non-Life Insurance Market?

Opportunities in the Israel Life & Non-Life Insurance Market include the expansion of digital insurance platforms, the introduction of personalized insurance products, and the potential for growth in underinsured segments of the population.

What trends are shaping the Israel Life & Non-Life Insurance Market?

Trends shaping the Israel Life & Non-Life Insurance Market include the rise of insurtech companies, increased focus on customer-centric services, and the integration of artificial intelligence in underwriting and claims processing.

Israel Life & Non-Life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Life Insurance, Health Insurance, Property Insurance, Casualty Insurance |

| Customer Type | Individuals, Families, Corporates, SMEs |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| Service Type | Claims Processing, Underwriting, Risk Assessment, Policy Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Israel Life & Non-Life Insurance Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at