444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Israel Intensive Care Unit (ICU) beds and surfaces market represents a critical segment of the country’s healthcare infrastructure, experiencing substantial growth driven by technological advancements and increasing healthcare demands. Israel’s healthcare system has consistently demonstrated excellence in medical innovation and patient care delivery, positioning the ICU beds and surfaces market as a vital component of critical care infrastructure. The market encompasses specialized hospital beds, therapeutic surfaces, and advanced positioning systems designed specifically for intensive care environments.

Market dynamics indicate robust expansion fueled by an aging population, rising prevalence of chronic diseases, and continuous investments in healthcare modernization. The Israeli healthcare sector’s emphasis on technological innovation has created significant demand for advanced ICU beds featuring integrated monitoring systems, pressure redistribution surfaces, and automated positioning capabilities. Healthcare facilities across Israel are increasingly adopting sophisticated bed technologies to enhance patient outcomes and optimize clinical workflows.

Growth projections suggest the market will experience a compound annual growth rate (CAGR) of 6.8% over the forecast period, driven by expanding critical care capacity and modernization initiatives. The integration of smart technologies and IoT-enabled monitoring systems has transformed traditional ICU beds into comprehensive patient management platforms, contributing to market expansion and improved clinical outcomes.

The Israel Intensive Care Unit (ICU) beds and surfaces market refers to the specialized healthcare equipment sector focused on providing advanced bedding solutions and therapeutic surfaces for critically ill patients in Israeli medical facilities. This market encompasses a comprehensive range of products including electric ICU beds, pressure-relieving mattresses, therapeutic overlays, and integrated monitoring systems designed to support intensive care protocols and enhance patient recovery outcomes.

ICU beds and surfaces represent sophisticated medical devices engineered to address the unique requirements of critical care environments, including patient positioning, pressure ulcer prevention, infection control, and clinical accessibility. These systems integrate advanced materials, electronic controls, and therapeutic technologies to create optimal healing environments for patients requiring intensive medical supervision and life-support interventions.

Israel’s ICU beds and surfaces market demonstrates strong growth momentum, supported by the country’s advanced healthcare infrastructure and commitment to medical excellence. The market benefits from government healthcare investments representing approximately 7.5% of GDP, enabling continuous modernization of critical care facilities and adoption of innovative bed technologies.

Key market drivers include the increasing elderly population, rising incidence of cardiovascular diseases, and growing demand for specialized critical care services. Israeli hospitals are prioritizing patient safety technologies, with pressure ulcer prevention systems showing 85% adoption rates in major medical centers. The market’s competitive landscape features both international manufacturers and domestic innovators developing cutting-edge solutions tailored to Israeli healthcare requirements.

Technological advancement remains a primary market characteristic, with smart bed systems incorporating artificial intelligence, predictive analytics, and automated patient monitoring capabilities. These innovations support Israel’s position as a global leader in medical technology development and healthcare delivery excellence.

Strategic market insights reveal several critical trends shaping the Israel ICU beds and surfaces landscape:

Primary market drivers propelling growth in Israel’s ICU beds and surfaces sector include demographic shifts, technological innovation, and healthcare policy initiatives. The aging population represents a fundamental driver, with individuals over 65 years comprising an increasing percentage of the population and requiring more intensive medical interventions.

Chronic disease prevalence continues rising, particularly cardiovascular conditions, diabetes, and respiratory disorders that frequently require critical care management. Israeli healthcare facilities are experiencing increased ICU utilization rates of approximately 78%, driving demand for additional bed capacity and advanced therapeutic surfaces.

Healthcare digitization initiatives promote adoption of smart bed technologies that integrate with electronic health records and hospital information systems. Government support for medical technology innovation encourages development and deployment of advanced ICU bed solutions, positioning Israel as a regional leader in critical care technology.

Quality improvement programs emphasize patient safety and outcome optimization, creating demand for beds with pressure ulcer prevention capabilities, fall prevention systems, and enhanced monitoring features. The focus on evidence-based care drives adoption of therapeutic surfaces with proven clinical effectiveness in improving patient outcomes and reducing complications.

Market restraints affecting the Israel ICU beds and surfaces sector include budget constraints, implementation challenges, and regulatory complexities. Healthcare budget limitations can restrict large-scale equipment purchases, particularly for smaller medical facilities with limited capital resources.

High initial investment costs associated with advanced ICU bed systems may delay adoption, especially for facilities operating under tight financial constraints. The complexity of technology integration with existing hospital infrastructure can create implementation challenges and require significant IT support resources.

Staff training requirements for sophisticated bed systems may strain human resources and require ongoing education investments. Maintenance and service costs for advanced technologies can impact total cost of ownership, influencing purchasing decisions and budget planning.

Regulatory approval processes for new medical devices may create delays in market entry for innovative products. Space constraints in existing ICU facilities can limit adoption of larger, more feature-rich bed systems, requiring facility modifications or renovations.

Significant market opportunities exist within Israel’s ICU beds and surfaces sector, driven by technological advancement, healthcare expansion, and demographic trends. The development of AI-powered bed systems presents opportunities for predictive patient monitoring and automated care protocols that enhance clinical outcomes.

Telemedicine integration creates opportunities for remote patient monitoring capabilities built into ICU bed platforms, supporting distributed care models and specialist consultation services. The growing emphasis on personalized medicine opens opportunities for beds with customizable therapeutic features tailored to individual patient needs.

Export potential represents a substantial opportunity, with Israeli medical technology companies well-positioned to serve regional and international markets. The development of modular bed systems that can be easily upgraded or reconfigured offers opportunities for flexible, future-proof solutions.

Sustainability initiatives create opportunities for eco-friendly bed materials and energy-efficient systems that align with environmental responsibility goals. Home care expansion presents opportunities for portable or semi-portable ICU-grade beds that support transitional care and home-based intensive monitoring.

Market dynamics in Israel’s ICU beds and surfaces sector reflect the interplay between technological innovation, healthcare demands, and economic factors. Supply chain considerations have become increasingly important, with facilities seeking reliable suppliers and local service support capabilities.

Competitive pressures drive continuous product innovation and feature enhancement, with manufacturers focusing on differentiation through advanced technologies and clinical effectiveness. The market demonstrates strong price sensitivity balanced against quality requirements, creating demand for cost-effective solutions that maintain high clinical standards.

Healthcare consolidation trends influence purchasing patterns, with larger health systems leveraging economies of scale for equipment procurement. Clinical evidence requirements increasingly influence product selection, with healthcare facilities demanding documented outcomes data and peer-reviewed research supporting bed system effectiveness.

Regulatory evolution continues shaping market dynamics, with updated safety standards and performance requirements influencing product development cycles. The integration of cybersecurity considerations into connected bed systems has become a critical market dynamic, requiring robust data protection and network security features.

Comprehensive research methodology employed for analyzing Israel’s ICU beds and surfaces market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes structured interviews with healthcare administrators, clinical staff, and medical equipment procurement specialists across Israeli hospitals and medical centers.

Secondary research encompasses analysis of healthcare industry reports, government healthcare statistics, medical device registration data, and clinical literature related to ICU bed technologies and patient outcomes. Market surveys conducted among healthcare facilities provide insights into purchasing patterns, technology preferences, and future investment plans.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure research findings accuracy. Quantitative analysis incorporates market sizing methodologies, growth rate calculations, and trend analysis based on historical data and forward-looking projections.

Qualitative research explores market dynamics, competitive positioning, and strategic considerations through in-depth discussions with industry stakeholders and subject matter experts. The methodology ensures comprehensive coverage of market segments, geographic regions, and technology categories within Israel’s ICU beds and surfaces landscape.

Regional analysis of Israel’s ICU beds and surfaces market reveals distinct patterns across different geographic areas and healthcare districts. Central District hospitals, including major medical centers in Tel Aviv and surrounding areas, account for approximately 42% of market demand, driven by high patient volumes and advanced medical facilities.

Jerusalem District represents a significant market segment with specialized medical centers and teaching hospitals driving demand for advanced ICU bed technologies. The region’s focus on medical research and clinical excellence creates opportunities for innovative bed systems with research capabilities and data collection features.

Northern District healthcare facilities demonstrate growing adoption of advanced ICU beds, with regional medical centers investing in technology upgrades to serve diverse patient populations. The area’s emphasis on trauma care and emergency services drives demand for versatile bed systems with rapid positioning capabilities.

Southern District markets show increasing investment in critical care infrastructure, with new hospital developments and facility expansions creating demand for modern ICU bed systems. Haifa District benefits from proximity to medical technology companies and research institutions, fostering adoption of innovative bed technologies and clinical collaboration opportunities.

The competitive landscape in Israel’s ICU beds and surfaces market features a mix of international manufacturers and specialized medical equipment suppliers. Key market participants include:

Market competition centers on technological innovation, clinical effectiveness, and comprehensive service support. Companies are investing in research and development to create differentiated products with advanced features and proven clinical outcomes.

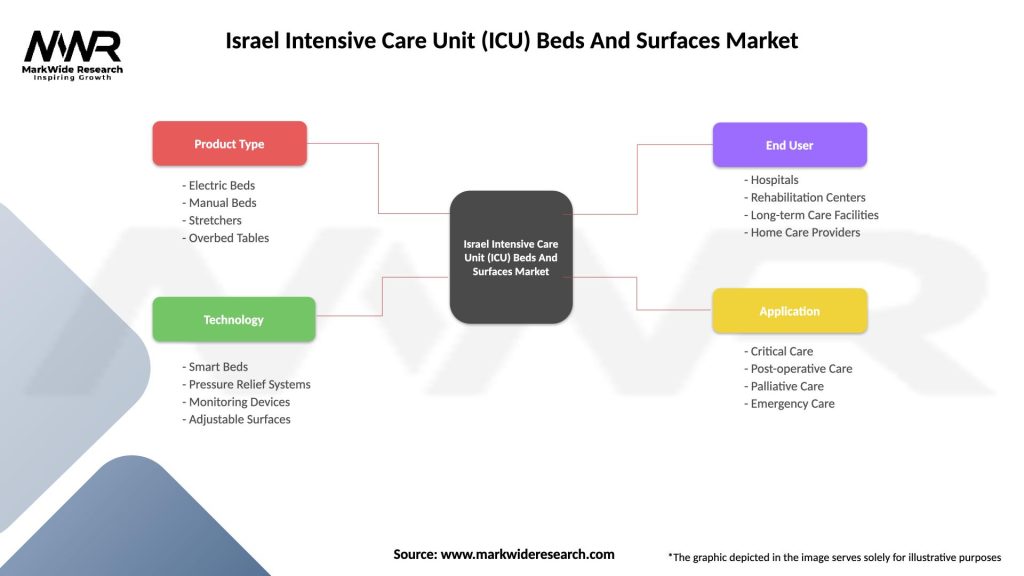

Market segmentation analysis reveals distinct categories within Israel’s ICU beds and surfaces sector, each addressing specific clinical requirements and facility needs.

By Product Type:

By Technology:

By End User:

Electric ICU beds dominate the market with approximately 72% market share, driven by their advanced functionality and clinical benefits. These systems offer precise positioning control, integrated monitoring capabilities, and enhanced patient safety features that support complex critical care protocols.

Therapeutic mattresses represent a rapidly growing segment, with healthcare facilities increasingly recognizing the importance of pressure ulcer prevention. Advanced materials including memory foam, gel-infused surfaces, and air-filled chambers provide superior patient comfort and clinical outcomes.

Smart bed technologies are gaining traction, with adoption rates increasing by 15% annually as hospitals embrace digital transformation initiatives. These systems provide valuable data insights, automated alerts, and integration with electronic health records to enhance care coordination.

Integrated bed systems appeal to facilities seeking comprehensive solutions that combine multiple functions in single platforms. These systems offer cost efficiencies and space optimization benefits while providing advanced clinical capabilities for complex patient care requirements.

Healthcare providers benefit from advanced ICU beds and surfaces through improved patient outcomes, enhanced clinical efficiency, and reduced complications. Pressure ulcer prevention capabilities can reduce hospital-acquired conditions by up to 60%, resulting in significant cost savings and improved patient satisfaction scores.

Clinical staff experience improved workflow efficiency through integrated monitoring systems, automated documentation features, and ergonomic design elements that reduce physical strain. Patient positioning automation reduces manual handling requirements and supports consistent care protocols.

Patients and families benefit from enhanced comfort, improved safety features, and better clinical outcomes associated with advanced bed technologies. Infection control features and antimicrobial surfaces provide additional protection and peace of mind during critical care stays.

Healthcare administrators realize value through reduced liability exposure, improved quality metrics, and operational efficiencies. Data analytics capabilities support evidence-based decision making and continuous quality improvement initiatives.

Medical equipment manufacturers benefit from growing market demand, opportunities for innovation, and potential for long-term service relationships with healthcare facilities. Technology partnerships with Israeli healthcare providers can drive product development and market expansion opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend, with ICU beds incorporating predictive analytics and automated patient monitoring capabilities. These systems can anticipate patient needs, predict complications, and optimize care protocols based on real-time data analysis.

Sustainability focus is driving development of eco-friendly bed materials and energy-efficient systems. Healthcare facilities are increasingly prioritizing environmental responsibility in procurement decisions, creating demand for sustainable medical equipment solutions.

Modular design approaches allow healthcare facilities to customize bed configurations based on specific clinical requirements and budget constraints. This trend supports flexible procurement strategies and enables gradual technology upgrades over time.

Cybersecurity enhancement has become critical as connected bed systems require robust protection against cyber threats. Manufacturers are investing in advanced security features and encryption technologies to protect patient data and system integrity.

Patient-centered design emphasizes comfort, dignity, and family involvement in care processes. Modern ICU beds incorporate features that support patient autonomy and family interaction while maintaining clinical functionality and safety requirements.

Recent industry developments highlight the dynamic nature of Israel’s ICU beds and surfaces market. MarkWide Research analysis indicates significant investments in smart bed technologies, with major hospitals implementing comprehensive digital transformation initiatives.

Regulatory updates have introduced enhanced safety standards for medical beds, requiring manufacturers to implement additional testing protocols and quality assurance measures. These changes support improved patient safety while creating opportunities for innovative companies to differentiate their products.

Partnership agreements between Israeli hospitals and international bed manufacturers have facilitated technology transfer and local customization of advanced ICU bed systems. These collaborations support market growth while ensuring products meet specific Israeli healthcare requirements.

Research initiatives focusing on pressure ulcer prevention and patient mobility have generated new clinical evidence supporting advanced bed technologies. This research drives evidence-based purchasing decisions and supports market expansion for clinically proven solutions.

Training program development has become a key industry focus, with manufacturers and healthcare facilities collaborating to ensure optimal utilization of advanced bed technologies. These programs support successful implementation and maximize return on investment for healthcare providers.

Strategic recommendations for market participants include focusing on technology integration, clinical evidence development, and comprehensive service support. Healthcare providers should prioritize beds with proven clinical outcomes and strong manufacturer support capabilities.

Investment priorities should emphasize systems with upgrade potential and modular designs that support long-term value optimization. Staff training programs require adequate budget allocation to ensure successful technology adoption and optimal patient outcomes.

Manufacturers should focus on developing solutions tailored to Israeli healthcare requirements while maintaining international quality standards. Local partnerships and service capabilities will be critical for market success and customer satisfaction.

Procurement strategies should consider total cost of ownership, including maintenance, training, and upgrade costs. Pilot programs can help healthcare facilities evaluate new technologies before making large-scale investments.

Quality metrics and outcome measurement systems should be integrated into bed selection criteria to support evidence-based decision making. Vendor evaluation should include assessment of technical support capabilities and long-term partnership potential.

Future market prospects for Israel’s ICU beds and surfaces sector remain highly positive, with continued growth expected across all major segments. Technological advancement will drive market evolution, with AI-powered systems and IoT integration becoming standard features in advanced ICU environments.

Market expansion is projected to accelerate, with growth rates potentially reaching 8.2% CAGR as healthcare facilities modernize their critical care infrastructure. The integration of telemedicine capabilities and remote monitoring systems will create new market opportunities and service models.

Innovation focus will continue emphasizing patient outcomes, clinical efficiency, and cost optimization. Personalized medicine trends will drive demand for customizable bed systems that adapt to individual patient requirements and treatment protocols.

Export opportunities will expand as Israeli medical technology companies leverage domestic market success to serve international customers. Regional market leadership positions Israeli suppliers to capture growing demand in neighboring countries and emerging markets.

Sustainability initiatives will increasingly influence purchasing decisions, creating opportunities for manufacturers developing eco-friendly bed technologies and circular economy solutions. The market’s future success will depend on balancing technological advancement with environmental responsibility and cost effectiveness.

Israel’s ICU beds and surfaces market demonstrates robust growth potential driven by technological innovation, demographic trends, and healthcare modernization initiatives. The market benefits from strong healthcare infrastructure, government support, and a culture of medical excellence that creates sustained demand for advanced critical care equipment.

Key success factors include technology integration, clinical evidence development, and comprehensive service support that ensures optimal patient outcomes and operational efficiency. The market’s future will be shaped by artificial intelligence, sustainability considerations, and personalized medicine trends that transform traditional bed systems into comprehensive patient care platforms.

Strategic opportunities exist for both healthcare providers and equipment manufacturers to capitalize on market growth through innovation, partnerships, and evidence-based solution development. The emphasis on patient safety, clinical effectiveness, and cost optimization will continue driving market evolution and creating value for all stakeholders in Israel’s healthcare ecosystem.

What is Intensive Care Unit (ICU) Beds And Surfaces?

Intensive Care Unit (ICU) Beds And Surfaces refer to specialized medical equipment designed for critically ill patients. These beds provide advanced features such as adjustable positioning, pressure relief surfaces, and integrated monitoring systems to enhance patient care and comfort.

What are the key players in the Israel Intensive Care Unit (ICU) Beds And Surfaces Market?

Key players in the Israel Intensive Care Unit (ICU) Beds And Surfaces Market include companies like Hill-Rom, Stryker, and Getinge, which are known for their innovative healthcare solutions and advanced ICU bed technologies, among others.

What are the growth factors driving the Israel Intensive Care Unit (ICU) Beds And Surfaces Market?

The growth of the Israel Intensive Care Unit (ICU) Beds And Surfaces Market is driven by factors such as the increasing prevalence of chronic diseases, the rising number of surgical procedures, and advancements in healthcare technology that enhance patient monitoring and comfort.

What challenges does the Israel Intensive Care Unit (ICU) Beds And Surfaces Market face?

The Israel Intensive Care Unit (ICU) Beds And Surfaces Market faces challenges such as high costs associated with advanced ICU beds, the need for regular maintenance and training, and regulatory compliance that can complicate market entry for new players.

What opportunities exist in the Israel Intensive Care Unit (ICU) Beds And Surfaces Market?

Opportunities in the Israel Intensive Care Unit (ICU) Beds And Surfaces Market include the development of smart beds with integrated technology for remote monitoring, increasing investments in healthcare infrastructure, and the growing demand for patient-centric care solutions.

What trends are shaping the Israel Intensive Care Unit (ICU) Beds And Surfaces Market?

Trends in the Israel Intensive Care Unit (ICU) Beds And Surfaces Market include the adoption of telemedicine solutions, the integration of artificial intelligence for patient management, and a focus on ergonomic designs that improve both patient and caregiver experiences.

Israel Intensive Care Unit (ICU) Beds And Surfaces Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electric Beds, Manual Beds, Stretchers, Overbed Tables |

| Technology | Smart Beds, Pressure Relief Systems, Monitoring Devices, Adjustable Surfaces |

| End User | Hospitals, Rehabilitation Centers, Long-term Care Facilities, Home Care Providers |

| Application | Critical Care, Post-operative Care, Palliative Care, Emergency Care |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Israel Intensive Care Unit (ICU) Beds And Surfaces Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at