444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Israel data center server market represents a dynamic and rapidly evolving sector within the country’s robust technology ecosystem. As one of the world’s leading innovation hubs, Israel has established itself as a critical player in the global data center infrastructure landscape. The market encompasses a comprehensive range of server solutions, from traditional rack-mounted systems to cutting-edge hyperconverged infrastructure platforms that power the nation’s digital transformation initiatives.

Market growth in Israel’s data center server segment is driven by the country’s exceptional concentration of technology companies, research institutions, and multinational corporations establishing regional headquarters. The market demonstrates remarkable resilience and expansion potential, with growth rates consistently outpacing regional averages at approximately 12.5% CAGR over the forecast period. This growth trajectory reflects Israel’s strategic position as a technology bridge between Europe, Asia, and the Middle East.

Enterprise adoption of advanced server technologies has accelerated significantly, with organizations increasingly investing in high-performance computing solutions to support artificial intelligence, machine learning, and big data analytics workloads. The market benefits from Israel’s world-renowned cybersecurity expertise, creating unique demand for servers with enhanced security features and compliance capabilities.

Cloud infrastructure development continues to reshape the server landscape, with major cloud service providers expanding their presence in Israel and driving demand for hyperscale server deployments. Local enterprises are simultaneously modernizing their on-premises infrastructure while adopting hybrid cloud strategies, creating sustained demand across multiple server categories and deployment models.

The Israel data center server market refers to the comprehensive ecosystem of server hardware, software, and related infrastructure solutions deployed within Israeli data centers to support computing, storage, and networking requirements. This market encompasses traditional physical servers, virtualized environments, cloud-native architectures, and emerging edge computing platforms that collectively form the backbone of Israel’s digital economy.

Server infrastructure in this context includes rack-mounted servers, blade servers, tower servers, and specialized high-performance computing systems designed to handle diverse workloads ranging from basic web hosting to complex artificial intelligence processing. The market also encompasses server management software, operating systems, virtualization platforms, and associated hardware components such as processors, memory, storage devices, and networking equipment.

Data center environments within Israel serve multiple purposes, including enterprise computing, cloud services, content delivery, disaster recovery, and research computing. These facilities range from small enterprise server rooms to large-scale hyperscale data centers operated by global cloud providers and local telecommunications companies, each requiring specific server configurations optimized for their intended applications.

Strategic positioning of Israel’s data center server market reflects the country’s unique advantages in technology innovation, cybersecurity expertise, and strategic geographic location. The market demonstrates exceptional growth momentum driven by increasing digitalization across industries, expanding cloud adoption, and the proliferation of data-intensive applications requiring robust server infrastructure.

Market dynamics are characterized by strong demand from multiple sectors, including financial services, healthcare, telecommunications, defense, and the thriving startup ecosystem. Israeli organizations are investing heavily in server modernization to support digital transformation initiatives, with particular emphasis on artificial intelligence, machine learning, and advanced analytics capabilities that require high-performance computing resources.

Technology trends shaping the market include the adoption of ARM-based processors, software-defined infrastructure, containerization, and edge computing solutions. These trends are driving demand for more efficient, scalable, and flexible server architectures that can adapt to rapidly changing business requirements while maintaining the security and reliability standards essential for Israeli enterprises.

Competitive landscape features a mix of global technology leaders and specialized local providers, creating a dynamic environment that fosters innovation and competitive pricing. The market benefits from Israel’s strong relationships with international technology companies and its position as a preferred location for research and development activities in the server and data center sectors.

Market segmentation reveals distinct growth patterns across different server categories and deployment models. The following key insights highlight the most significant trends and opportunities:

Technology adoption patterns demonstrate Israel’s leadership in implementing cutting-edge server technologies, with organizations often serving as early adopters for innovative solutions that subsequently gain global traction. This trend positions the Israeli market as a valuable testing ground for server manufacturers and technology providers seeking to validate new products and services.

Digital transformation initiatives across Israeli enterprises represent the primary driver of server market growth. Organizations are modernizing their IT infrastructure to support cloud-first strategies, data analytics capabilities, and digital customer experiences. This transformation requires substantial investments in server hardware capable of handling increased computational demands while maintaining high availability and security standards.

Artificial intelligence adoption continues to accelerate across multiple industries, creating significant demand for specialized server configurations optimized for machine learning workloads. Israeli companies, particularly in the cybersecurity, fintech, and healthcare sectors, are implementing AI-driven solutions that require high-performance computing infrastructure with advanced GPU capabilities and optimized memory architectures.

Cloud service expansion by major international providers has created substantial demand for hyperscale server deployments within Israeli data centers. These expansions support growing demand for cloud services from local enterprises while establishing Israel as a regional hub for cloud computing services serving the broader Middle East and European markets.

Cybersecurity requirements unique to the Israeli market drive demand for servers with enhanced security features, including hardware-based encryption, secure boot capabilities, and integrated threat detection systems. The country’s focus on cybersecurity excellence creates opportunities for server vendors offering specialized security-enhanced products and services.

Startup ecosystem growth contributes significantly to server demand, as Israel’s vibrant technology startup community requires scalable infrastructure solutions that can adapt to rapid business growth. These organizations often prefer flexible server architectures that support both on-premises and cloud deployments, creating demand for hybrid-ready server solutions.

High implementation costs associated with advanced server technologies can limit adoption among smaller Israeli enterprises and startups with constrained budgets. The initial capital investment required for modern server infrastructure, including associated software licensing, implementation services, and ongoing maintenance, creates barriers for organizations seeking to modernize their IT environments.

Skills shortage in specialized server administration and management capabilities affects market growth potential. While Israel has a highly skilled technology workforce, the rapid evolution of server technologies and the increasing complexity of modern data center environments create ongoing challenges in finding qualified personnel to manage sophisticated server deployments effectively.

Regulatory compliance requirements specific to Israeli data protection and privacy laws can complicate server deployment decisions and increase implementation costs. Organizations must ensure their server infrastructure meets local regulatory requirements while maintaining compatibility with international standards, creating additional complexity in server selection and configuration processes.

Supply chain dependencies on international server manufacturers can create vulnerabilities in procurement and delivery schedules. Global supply chain disruptions, component shortages, and geopolitical factors can impact server availability and pricing, affecting planned infrastructure upgrades and expansions within the Israeli market.

Energy infrastructure limitations in certain regions of Israel can constrain large-scale server deployments, particularly for energy-intensive high-performance computing applications. Power availability and cooling requirements for modern server installations require careful planning and may limit deployment options in some geographic areas.

Edge computing expansion presents significant opportunities as Israeli organizations implement IoT solutions, real-time analytics, and distributed computing architectures. The growing need for low-latency processing capabilities creates demand for edge-optimized servers deployed closer to data sources and end users, opening new market segments for specialized server solutions.

Government digitalization initiatives offer substantial opportunities for server vendors as Israeli public sector organizations modernize their IT infrastructure. These initiatives encompass smart city projects, digital government services, and public sector cloud adoption, creating sustained demand for secure, compliant server solutions designed for government applications.

Research and development expansion in Israeli universities and research institutions drives demand for high-performance computing servers supporting scientific research, academic computing, and collaborative research projects. The country’s strong research ecosystem creates opportunities for specialized server configurations optimized for computational research workloads.

Regional hub development positions Israel as a strategic location for international companies establishing Middle Eastern and European operations. This trend creates opportunities for data center server deployments supporting regional business operations, disaster recovery sites, and content delivery networks serving broader geographic markets.

Startup incubation programs and technology accelerators create ongoing demand for flexible, scalable server infrastructure that can support rapidly growing technology companies. These programs often require server solutions that can scale efficiently from startup to enterprise levels, creating opportunities for innovative pricing and service models.

Supply and demand equilibrium in the Israel data center server market reflects the complex interplay between rapidly growing demand and evolving supply chain capabilities. Demand growth consistently outpaces supply availability, particularly for specialized server configurations optimized for artificial intelligence and high-performance computing applications, creating pricing pressure and extended delivery timelines for certain product categories.

Technology evolution cycles significantly impact market dynamics, with server refresh cycles accelerating due to rapid advances in processor technology, memory architectures, and software capabilities. Israeli organizations are increasingly adopting shorter depreciation cycles for server hardware to maintain competitive advantages through access to latest-generation technologies and improved performance capabilities.

Competitive intensity among server vendors has increased significantly as global manufacturers recognize Israel’s strategic importance as a technology market. This competition drives innovation in product offerings, pricing strategies, and service delivery models, ultimately benefiting Israeli customers through improved value propositions and enhanced support capabilities.

Market consolidation trends affect both vendor landscape and customer preferences, with larger technology companies acquiring specialized server manufacturers and Israeli enterprises consolidating their vendor relationships to achieve better pricing and simplified management. These trends influence procurement strategies and long-term technology roadmaps across the market.

Economic factors including currency fluctuations, interest rates, and global economic conditions impact server investment decisions and procurement timing. Israeli organizations must balance immediate infrastructure needs with economic uncertainties, leading to more strategic and phased approaches to server deployments and technology upgrades.

Primary research approach encompasses comprehensive interviews with key stakeholders across the Israel data center server ecosystem, including enterprise IT decision-makers, data center operators, server vendors, system integrators, and technology consultants. These interviews provide detailed insights into market trends, purchasing behaviors, technology preferences, and future infrastructure planning across different industry sectors and organization sizes.

Secondary research analysis incorporates extensive review of industry reports, vendor documentation, government publications, academic research, and technology trend analyses specific to the Israeli market. This research foundation ensures comprehensive coverage of market dynamics, competitive landscape, and regulatory environment factors affecting server adoption and deployment decisions.

Market sizing methodology utilizes multiple data sources and validation techniques to ensure accuracy and reliability of market assessments. The approach combines top-down analysis based on overall IT spending patterns with bottom-up analysis derived from specific server deployment data and vendor sales information within the Israeli market.

Trend analysis framework examines historical market data, current deployment patterns, and forward-looking indicators to identify emerging trends and growth opportunities. This analysis incorporates technology adoption curves, economic indicators, and industry-specific factors that influence server infrastructure investment decisions across different market segments.

Validation processes include cross-referencing data sources, conducting follow-up interviews with key market participants, and comparing findings with broader regional and global market trends to ensure consistency and accuracy of research conclusions and market projections.

Tel Aviv metropolitan area dominates the Israel data center server market, accounting for approximately 45% of total server deployments due to its concentration of technology companies, financial institutions, and multinational corporations. The region benefits from excellent telecommunications infrastructure, proximity to international connectivity points, and access to skilled technical workforce, making it the preferred location for large-scale data center investments and server deployments.

Jerusalem region represents a significant market segment focused primarily on government, healthcare, and educational institutions requiring specialized server configurations for secure, compliant computing environments. The region’s server market is characterized by emphasis on security features, regulatory compliance capabilities, and integration with existing government IT infrastructure systems.

Haifa and northern regions demonstrate strong growth in server deployments supporting the area’s expanding technology sector, including semiconductor companies, research institutions, and manufacturing organizations. This region shows particular strength in high-performance computing server segments supporting industrial applications and scientific research activities.

Southern regions including Beer Sheva and surrounding areas are experiencing rapid server market growth driven by government initiatives to develop the region as a technology hub. The area benefits from lower operational costs, government incentives, and strategic location advantages, attracting data center investments and associated server deployments.

Coastal regions benefit from proximity to submarine cable landing points and international connectivity infrastructure, making them attractive locations for content delivery networks, cloud service providers, and international companies requiring high-bandwidth server deployments. These areas show strong growth in hyperscale server segments supporting cloud and content delivery applications.

Market leadership in the Israel data center server market is characterized by intense competition among global technology giants and specialized local providers. The competitive environment fosters innovation and drives continuous improvement in product offerings, pricing strategies, and customer service capabilities.

Competitive strategies focus on differentiation through technology innovation, security features, energy efficiency, and comprehensive service offerings. Vendors are increasingly emphasizing software-defined capabilities, artificial intelligence optimization, and hybrid cloud compatibility to address evolving customer requirements in the Israeli market.

Partnership ecosystems play crucial roles in competitive positioning, with server vendors establishing relationships with local system integrators, software providers, and cloud service companies to deliver comprehensive solutions. These partnerships enable vendors to address specific Israeli market requirements and provide localized support capabilities.

By Server Type: The Israel data center server market demonstrates diverse segmentation patterns reflecting varied organizational requirements and deployment scenarios. Rack-mounted servers maintain the largest market share due to their versatility and standardization, while blade servers show strong adoption in space-constrained environments requiring high-density computing capabilities.

By Processor Architecture: Intel x86 processors maintain market dominance while ARM-based solutions show increasing adoption for specific workloads requiring energy efficiency and cost optimization.

By Application: Web hosting and cloud services represent the largest application segment, followed by enterprise applications and high-performance computing workloads requiring specialized server configurations.

By Organization Size: Large enterprises account for the majority of server deployments by volume, while small and medium enterprises drive growth in specific server categories optimized for cost-effectiveness and ease of management.

Enterprise Servers: Traditional enterprise server deployments continue to represent the foundation of Israel’s data center infrastructure, with organizations investing in modernization and capacity expansion to support digital transformation initiatives. These servers typically feature robust security capabilities, comprehensive management tools, and integration with existing enterprise software environments.

Cloud Infrastructure Servers: Hyperscale server deployments supporting cloud service providers demonstrate exceptional growth rates as major international cloud companies expand their Israeli operations. These servers emphasize standardization, automation capabilities, and cost optimization to support large-scale cloud service delivery.

High-Performance Computing Servers: Specialized HPC servers supporting research institutions, financial modeling, and artificial intelligence applications show strong demand growth. These systems require advanced processor architectures, high-speed interconnects, and specialized cooling solutions to handle computationally intensive workloads.

Edge Computing Servers: Emerging category of edge-optimized servers designed for deployment in distributed locations closer to data sources and end users. These servers emphasize compact form factors, environmental resilience, and remote management capabilities to support IoT and real-time processing applications.

Security-Enhanced Servers: Specialized server category addressing Israel’s unique cybersecurity requirements, featuring hardware-based security modules, encrypted storage capabilities, and integrated threat detection systems. These servers command premium pricing due to their specialized security features and compliance capabilities.

Enterprise Organizations benefit from access to cutting-edge server technologies that enable digital transformation, improve operational efficiency, and support innovative business models. Modern server infrastructure provides the foundation for artificial intelligence implementation, advanced analytics capabilities, and hybrid cloud strategies that drive competitive advantages in the Israeli market.

Technology Vendors gain access to a sophisticated market that serves as an early adopter of innovative server technologies and a testing ground for new products and services. The Israeli market’s emphasis on security and performance creates opportunities for premium product positioning and specialized solution development.

System Integrators benefit from strong demand for specialized implementation services, customization capabilities, and ongoing support for complex server deployments. The market’s technical sophistication creates opportunities for value-added services and long-term customer relationships.

Cloud Service Providers leverage Israel’s strategic location and advanced infrastructure to serve regional markets while benefiting from local technical expertise and favorable business environment. The growing demand for cloud services creates sustained opportunities for infrastructure expansion and service innovation.

Research Institutions gain access to advanced computing capabilities that support scientific research, academic collaboration, and technology development initiatives. High-performance server infrastructure enables breakthrough research in artificial intelligence, cybersecurity, and other technology domains where Israel maintains global leadership.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend shaping the Israel data center server market, with organizations across multiple sectors implementing AI-driven solutions requiring specialized server architectures. This trend drives demand for GPU-accelerated servers, high-bandwidth memory systems, and optimized storage configurations designed to handle machine learning workloads efficiently.

Edge Computing Adoption continues to accelerate as Israeli organizations implement IoT solutions, real-time analytics, and distributed computing architectures. This trend creates demand for compact, ruggedized servers capable of operating in diverse environmental conditions while providing reliable performance for latency-sensitive applications.

Hybrid Cloud Strategies influence server procurement decisions as organizations seek infrastructure solutions that seamlessly integrate on-premises and cloud environments. This trend drives demand for servers with cloud-native capabilities, software-defined features, and compatibility with major cloud platforms and management tools.

Security-First Architecture reflects Israel’s cybersecurity leadership and creates demand for servers with integrated security features, hardware-based encryption, and advanced threat detection capabilities. Organizations prioritize security considerations in server selection processes, often accepting premium pricing for enhanced security features.

Sustainability Focus drives adoption of energy-efficient server technologies as organizations seek to reduce environmental impact and operational costs. This trend influences server design priorities, data center cooling strategies, and procurement criteria across the Israeli market, with 65% of organizations considering energy efficiency as a primary selection factor.

Major cloud service expansions have significantly impacted the Israeli server market, with international providers establishing local data centers and expanding their infrastructure footprint. These developments create substantial demand for hyperscale server deployments while establishing Israel as a regional cloud services hub serving broader Middle Eastern and European markets.

Government digitalization initiatives continue to drive server market growth through public sector modernization projects, smart city implementations, and digital government service platforms. According to MarkWide Research analysis, these initiatives represent significant opportunities for server vendors specializing in secure, compliant infrastructure solutions.

Startup ecosystem expansion creates ongoing demand for flexible, scalable server infrastructure that can support rapidly growing technology companies. Recent developments include establishment of new technology incubators, venture capital investments, and international company expansions that collectively drive server market growth.

Research institution partnerships with international organizations have led to significant investments in high-performance computing infrastructure, creating demand for specialized server configurations optimized for scientific research and academic collaboration. These partnerships often involve multi-year infrastructure commitments and ongoing technology upgrades.

Cybersecurity sector growth continues to influence server market dynamics, with Israeli cybersecurity companies requiring specialized infrastructure to support security research, threat analysis, and product development activities. This sector’s growth creates sustained demand for security-enhanced server solutions and specialized computing environments.

Strategic positioning recommendations for server vendors include developing specialized solutions that address Israel’s unique market requirements, particularly in cybersecurity, artificial intelligence, and regulatory compliance areas. Vendors should consider establishing local partnerships and support capabilities to better serve the sophisticated Israeli customer base and compete effectively against established market players.

Product development priorities should focus on security-enhanced features, AI optimization capabilities, and energy efficiency improvements that align with Israeli market preferences and regulatory requirements. Vendors should also consider developing edge computing solutions and hybrid cloud architectures that support the country’s growing IoT and distributed computing initiatives.

Market entry strategies for new vendors should emphasize partnership development with local system integrators, technology consultants, and industry specialists who understand the Israeli market’s unique characteristics and customer requirements. Successful market entry often requires demonstration of security capabilities and compliance with local regulatory standards.

Investment recommendations for organizations include prioritizing server infrastructure modernization to support digital transformation initiatives while maintaining focus on security and compliance requirements. Organizations should consider phased upgrade approaches that balance immediate needs with long-term technology roadmaps and budget constraints.

Technology adoption guidance suggests organizations should evaluate emerging technologies such as ARM processors, software-defined infrastructure, and edge computing solutions that may provide competitive advantages and operational efficiencies. Early adoption of these technologies can position organizations for future growth and innovation opportunities.

Market growth trajectory for the Israel data center server market remains strongly positive, driven by continued digital transformation, artificial intelligence adoption, and expanding cloud services. MWR projects sustained growth rates exceeding regional averages as Israeli organizations continue investing in advanced server infrastructure to maintain competitive advantages and support innovative business models.

Technology evolution will continue to reshape the server landscape, with emerging processor architectures, memory technologies, and software-defined capabilities creating new opportunities and challenges. Organizations that proactively adopt these technologies while maintaining security and compliance standards will be best positioned for future success in the evolving market environment.

Market consolidation trends are expected to continue as larger technology companies acquire specialized server manufacturers and Israeli enterprises consolidate their vendor relationships. This consolidation will likely result in more comprehensive solution offerings and improved economies of scale, benefiting customers through enhanced value propositions and simplified procurement processes.

Regional expansion opportunities position Israel as a potential hub for serving broader Middle Eastern and European markets, creating additional growth drivers for the server market. International companies establishing regional operations in Israel will contribute to sustained server demand growth and market development over the forecast period.

Innovation leadership in areas such as artificial intelligence, cybersecurity, and edge computing will continue to drive demand for specialized server configurations and create opportunities for premium product positioning. Israeli organizations’ willingness to adopt cutting-edge technologies ensures continued market growth and development in advanced server segments.

The Israel data center server market represents a dynamic and strategically important segment of the global server industry, characterized by sophisticated customer requirements, rapid technology adoption, and strong growth potential. The market benefits from Israel’s position as a global technology innovation hub, creating unique opportunities for server vendors and driving demand for advanced infrastructure solutions across multiple industry sectors.

Market fundamentals remain strong, supported by continued digital transformation initiatives, artificial intelligence adoption, and expanding cloud services that collectively drive sustained demand for modern server infrastructure. The market’s emphasis on security, performance, and innovation creates opportunities for premium product positioning and specialized solution development that addresses Israel’s unique requirements and regulatory environment.

Future prospects for the Israel data center server market are exceptionally positive, with growth drivers including government digitalization initiatives, startup ecosystem expansion, and the country’s evolving role as a regional technology hub. Organizations that strategically invest in server infrastructure modernization while maintaining focus on security and compliance will be well-positioned to capitalize on emerging opportunities and maintain competitive advantages in the rapidly evolving digital economy.

What is Data Center Server?

Data Center Server refers to the specialized computing hardware used in data centers to manage, store, and process data. These servers are designed for high performance, reliability, and scalability to support various applications and services.

What are the key players in the Israel Data Center Server Market?

Key players in the Israel Data Center Server Market include companies like Mellanox Technologies, Supermicro, and IBM, which provide a range of server solutions and technologies tailored for data center operations, among others.

What are the growth factors driving the Israel Data Center Server Market?

The Israel Data Center Server Market is driven by the increasing demand for cloud computing services, the rise of big data analytics, and the growing need for enhanced data security and compliance solutions across various industries.

What challenges does the Israel Data Center Server Market face?

Challenges in the Israel Data Center Server Market include high operational costs, the complexity of managing diverse server environments, and the need for continuous upgrades to keep pace with technological advancements.

What future opportunities exist in the Israel Data Center Server Market?

Future opportunities in the Israel Data Center Server Market include the expansion of edge computing, the integration of artificial intelligence in server management, and the increasing adoption of green technologies to enhance energy efficiency.

What trends are shaping the Israel Data Center Server Market?

Trends shaping the Israel Data Center Server Market include the shift towards hyper-converged infrastructure, the growing importance of data privacy regulations, and the rise of automation in server management to improve operational efficiency.

Israel Data Center Server Market

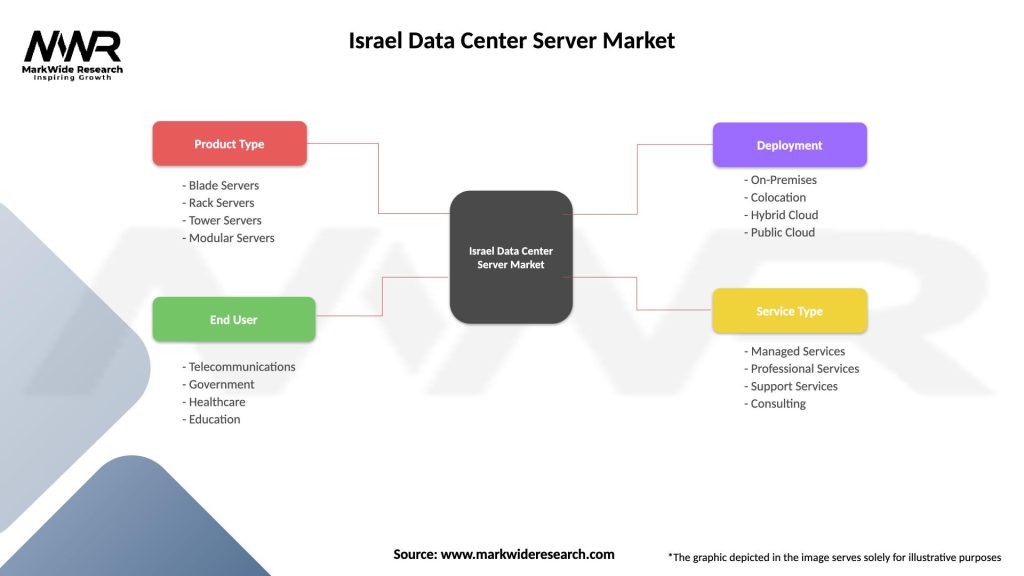

| Segmentation Details | Description |

|---|---|

| Product Type | Blade Servers, Rack Servers, Tower Servers, Modular Servers |

| End User | Telecommunications, Government, Healthcare, Education |

| Deployment | On-Premises, Colocation, Hybrid Cloud, Public Cloud |

| Service Type | Managed Services, Professional Services, Support Services, Consulting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Israel Data Center Server Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at