444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Israel data center rack market represents a dynamic and rapidly evolving sector within the country’s robust technology infrastructure landscape. As Israel continues to establish itself as a global technology hub, the demand for sophisticated data center solutions has experienced unprecedented growth. The market encompasses various rack configurations, including open frame racks, enclosed server cabinets, and wall-mounted enclosures, each serving specific operational requirements across diverse industry verticals.

Market dynamics indicate that Israel’s strategic position as the “Startup Nation” has significantly influenced data center infrastructure development. The country’s thriving technology ecosystem, combined with increasing digitalization across traditional industries, has created substantial demand for reliable and scalable data center rack solutions. Current market trends show a 12.5% annual growth rate in rack deployment across Israeli facilities, driven primarily by cloud service providers and enterprise data centers.

Regional concentration remains heavily focused in the Tel Aviv metropolitan area and surrounding technology corridors, where approximately 68% of data center infrastructure is currently deployed. This geographic clustering reflects Israel’s concentrated high-tech industry presence and the strategic advantages of proximity to major telecommunications hubs and international connectivity points.

The Israel data center rack market refers to the comprehensive ecosystem of physical infrastructure solutions designed to house, organize, and protect critical IT equipment within Israeli data center facilities. These specialized mounting systems provide essential support for servers, networking equipment, storage devices, and power distribution units while ensuring optimal airflow management and accessibility for maintenance operations.

Data center racks in the Israeli context encompass standardized 19-inch and 23-inch mounting solutions that comply with international specifications while addressing local regulatory requirements and environmental considerations. The market includes both traditional steel rack constructions and advanced aluminum alternatives, each offering distinct advantages in terms of weight, thermal management, and electromagnetic interference protection.

Market scope extends beyond basic mounting hardware to include integrated cable management systems, environmental monitoring capabilities, and security features specifically designed for Israel’s unique operational environment. This comprehensive approach ensures that data center operators can maintain high availability standards while meeting stringent security requirements common in Israeli technology infrastructure.

Strategic market analysis reveals that Israel’s data center rack market is experiencing robust expansion driven by accelerating digital transformation initiatives across both public and private sectors. The market demonstrates strong fundamentals supported by increasing cloud adoption, edge computing deployment, and growing cybersecurity infrastructure requirements. MarkWide Research analysis indicates that enterprise modernization efforts account for approximately 42% of current market demand.

Technology evolution within the Israeli market shows a clear shift toward intelligent rack solutions incorporating advanced monitoring and management capabilities. Organizations are increasingly prioritizing energy efficiency and sustainability, leading to greater adoption of optimized airflow designs and environmentally conscious materials. The integration of IoT sensors and predictive maintenance capabilities has become a standard requirement for new deployments.

Competitive landscape features a mix of international suppliers and local system integrators, with Israeli companies demonstrating particular strength in customized solutions and rapid deployment capabilities. The market benefits from Israel’s advanced manufacturing capabilities and strong engineering expertise, enabling local adaptation of global rack technologies to meet specific regional requirements and security standards.

Primary market drivers include Israel’s position as a regional technology hub and the increasing demand for localized data processing capabilities. The following key insights shape current market dynamics:

Digital transformation initiatives across Israeli enterprises represent the primary catalyst for data center rack market expansion. Organizations are modernizing legacy infrastructure to support cloud-native applications, artificial intelligence workloads, and advanced analytics platforms. This technological evolution requires sophisticated rack solutions capable of accommodating diverse equipment types while maintaining optimal performance characteristics.

Government digitalization programs have created substantial demand for secure and reliable data center infrastructure. Israeli public sector organizations are implementing comprehensive digital services platforms, requiring robust rack solutions that can support critical government applications while meeting stringent security and availability requirements. The emphasis on data sovereignty has further accelerated local data center development.

Startup ecosystem growth continues to drive demand for flexible and scalable data center solutions. Israel’s vibrant technology startup community requires access to professional-grade infrastructure that can scale rapidly as companies grow. This dynamic environment favors rack solutions that offer modularity and easy reconfiguration capabilities to accommodate changing business requirements.

International connectivity expansion has positioned Israel as an increasingly important regional data hub. New submarine cable landings and improved international connectivity are attracting global content providers and cloud services to establish local presence, creating significant demand for high-capacity rack infrastructure capable of supporting intensive traffic loads.

High implementation costs represent a significant barrier for smaller organizations seeking to establish or expand data center capabilities. Advanced rack solutions with integrated monitoring and management features require substantial capital investment, potentially limiting adoption among cost-sensitive market segments. The total cost of ownership, including ongoing maintenance and upgrade requirements, can be prohibitive for some potential users.

Space constraints in Israel’s densely populated technology corridors create challenges for data center expansion. Limited availability of suitable real estate for large-scale data center development restricts market growth potential and increases facility costs. Organizations must often compromise between optimal rack density and available floor space, impacting overall efficiency and scalability.

Skilled workforce limitations pose ongoing challenges for data center rack deployment and maintenance. The specialized knowledge required for proper rack installation, configuration, and ongoing management is in high demand across Israel’s technology sector. This skills shortage can delay project implementations and increase operational costs for data center operators.

Regulatory complexity surrounding data center operations and security requirements can complicate rack selection and deployment processes. Organizations must navigate multiple compliance frameworks while ensuring that rack solutions meet all applicable standards. This regulatory burden can extend project timelines and increase implementation costs, particularly for organizations serving multiple industry verticals.

Edge computing expansion presents significant opportunities for specialized rack solutions designed for distributed deployment scenarios. As organizations implement edge computing strategies to reduce latency and improve application performance, demand for compact and efficient rack systems suitable for remote locations continues to grow. This trend creates opportunities for innovative rack designs optimized for unmanned operation and remote monitoring.

Artificial intelligence infrastructure requirements are driving demand for high-performance rack solutions capable of supporting GPU-intensive workloads. Israeli organizations at the forefront of AI development require specialized cooling and power distribution capabilities within their rack infrastructure. This emerging market segment offers opportunities for premium rack solutions with advanced thermal management features.

Sustainability initiatives are creating demand for environmentally conscious rack solutions that minimize energy consumption and environmental impact. Organizations seeking to reduce their carbon footprint are increasingly interested in rack systems manufactured from recycled materials and designed for energy efficiency. This trend presents opportunities for innovative suppliers offering sustainable rack alternatives.

Hybrid cloud adoption is generating demand for flexible rack solutions that can accommodate diverse equipment types and deployment models. Organizations implementing hybrid cloud strategies require rack infrastructure that can seamlessly integrate on-premises and cloud resources. This market opportunity favors suppliers offering modular and adaptable rack solutions with comprehensive management capabilities.

Supply chain considerations significantly influence Israel’s data center rack market dynamics. The country’s reliance on imported rack components and materials creates potential vulnerabilities to global supply chain disruptions. However, Israel’s strong local manufacturing capabilities and engineering expertise enable rapid adaptation and customization of international rack designs to meet specific local requirements.

Technology innovation cycles drive continuous evolution in rack design and functionality. Israeli organizations typically adopt new technologies rapidly, creating demand for cutting-edge rack solutions that can accommodate emerging equipment types and performance requirements. This dynamic environment rewards suppliers who can quickly adapt their offerings to support new technology trends and customer requirements.

Competitive intensity within the market has increased as both international suppliers and local providers compete for market share. This competition has driven improvements in product quality, service levels, and pricing flexibility while encouraging innovation in rack design and functionality. Organizations benefit from increased choice and improved value propositions across all market segments.

Customer sophistication continues to increase as Israeli organizations develop deeper expertise in data center operations and infrastructure management. This trend has elevated expectations for rack suppliers, requiring comprehensive technical support, detailed documentation, and ongoing consultation services. Suppliers must demonstrate clear value propositions and technical competency to succeed in this demanding market environment.

Comprehensive market analysis was conducted through multiple research methodologies to ensure accurate and reliable insights into Israel’s data center rack market. Primary research included direct interviews with data center operators, IT infrastructure managers, and rack suppliers operating within the Israeli market. These discussions provided valuable insights into current market conditions, emerging trends, and future requirements.

Secondary research activities encompassed analysis of industry reports, government publications, and technology vendor documentation to establish market context and validate primary research findings. Particular attention was paid to Israeli technology sector developments, regulatory changes, and infrastructure investment patterns that influence data center rack demand.

Market segmentation analysis was performed to identify distinct customer groups and application areas within the Israeli data center rack market. This analysis considered factors such as organization size, industry vertical, deployment model, and specific technical requirements to develop comprehensive market understanding.

Competitive landscape evaluation included assessment of major suppliers, their product offerings, market positioning, and competitive strategies. This analysis provided insights into market structure, pricing dynamics, and opportunities for differentiation within the Israeli market context.

Tel Aviv metropolitan area dominates Israel’s data center rack market, accounting for approximately 72% of total market activity. This concentration reflects the region’s status as Israel’s primary technology hub, hosting numerous multinational corporations, startups, and cloud service providers. The area benefits from excellent international connectivity, skilled workforce availability, and proximity to major business centers.

Jerusalem region represents a growing market segment, particularly driven by government digitalization initiatives and the presence of major research institutions. The area’s focus on secure government applications creates demand for specialized rack solutions with enhanced security features. Academic and research organizations in the region also contribute to steady demand for high-performance computing infrastructure.

Haifa and northern regions show increasing data center activity, supported by the area’s strong industrial base and growing technology sector presence. Major technology companies have established significant operations in the region, creating demand for enterprise-grade data center infrastructure. The region’s lower real estate costs compared to Tel Aviv make it attractive for large-scale data center development.

Southern regions present emerging opportunities, particularly as organizations seek cost-effective alternatives to central Israel locations. Government initiatives to promote technology development in peripheral areas are beginning to generate data center investment, though market activity remains limited compared to central regions. MWR analysis suggests this region may experience 15% annual growth in coming years.

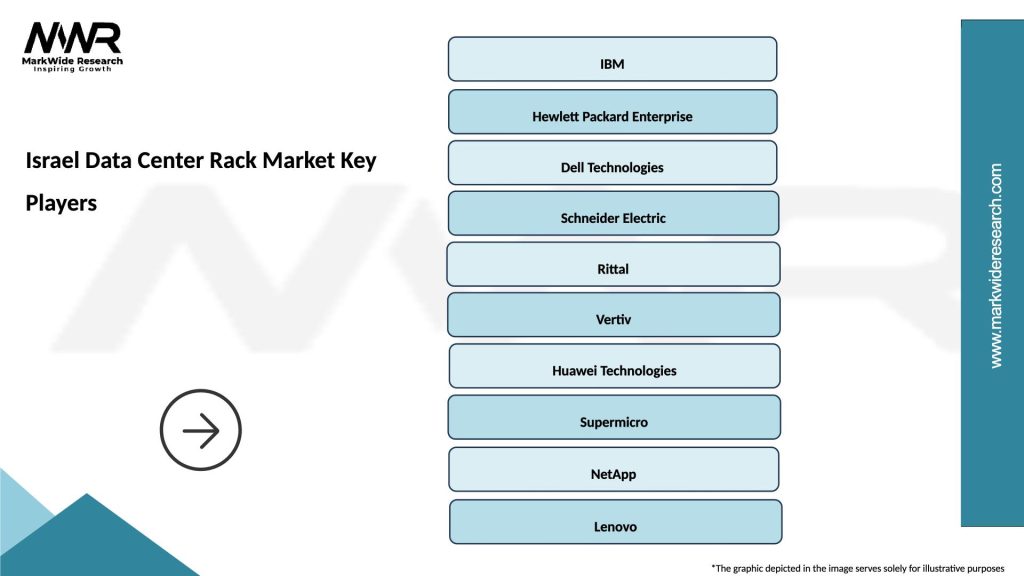

Market leadership is distributed among several key players, each bringing distinct strengths and capabilities to the Israeli data center rack market:

Competitive differentiation focuses on technical innovation, local support capabilities, and ability to meet specific Israeli market requirements. Suppliers emphasizing security features, rapid deployment, and comprehensive technical support tend to achieve stronger market positions. The ability to provide customized solutions for unique applications has become increasingly important for competitive success.

By Rack Type:

By End User:

By Application:

Open frame racks continue to dominate the Israeli market, representing approximately 58% of total deployments. These solutions are particularly popular among cloud service providers and large enterprise data centers where maximum equipment density and airflow optimization are critical requirements. The preference for open frame designs reflects Israel’s focus on high-performance computing applications and the need for efficient cooling in the country’s warm climate.

Enclosed server cabinets show strong growth in security-conscious applications, particularly within government and financial services sectors. These solutions provide essential physical security features while maintaining accessibility for maintenance operations. The integration of advanced locking mechanisms and environmental monitoring capabilities makes enclosed cabinets ideal for sensitive applications requiring comprehensive protection.

Wall-mount solutions are experiencing rapid adoption growth, driven by edge computing deployment trends and space optimization requirements. Israeli organizations implementing distributed computing strategies increasingly rely on compact wall-mount enclosures for remote locations and branch office deployments. These solutions offer excellent space efficiency while providing necessary protection for critical equipment.

Intelligent rack systems incorporating IoT sensors and remote monitoring capabilities represent the fastest-growing category segment. Israeli organizations are increasingly prioritizing predictive maintenance capabilities and real-time environmental monitoring to optimize data center operations. This trend toward intelligent infrastructure reflects the country’s advanced technology adoption patterns and focus on operational efficiency.

Data center operators benefit from improved operational efficiency through optimized rack solutions that enhance equipment organization, airflow management, and maintenance accessibility. Modern rack systems enable higher equipment density while maintaining optimal operating conditions, directly impacting facility utilization and operational costs. Advanced cable management features reduce installation time and improve long-term maintainability.

IT equipment manufacturers gain from standardized mounting solutions that ensure compatibility across diverse deployment scenarios. Rack standardization enables manufacturers to optimize their products for specific mounting configurations while ensuring broad market compatibility. This standardization reduces support complexity and enables more efficient product development cycles.

System integrators benefit from modular rack solutions that simplify installation processes and reduce project complexity. Standardized rack systems enable more predictable project timelines and reduce the risk of compatibility issues during deployment. Comprehensive documentation and support resources further enhance integrator capabilities and project success rates.

End-user organizations achieve improved infrastructure reliability, enhanced security, and better total cost of ownership through professional rack solutions. Proper rack implementation reduces equipment failure rates, improves maintenance efficiency, and enables more effective capacity planning. Organizations also benefit from improved compliance capabilities and enhanced physical security features.

Strengths:

Weaknesses:

Opportunities:

Threats:

Intelligent infrastructure integration represents the most significant trend shaping Israel’s data center rack market. Organizations are increasingly implementing rack solutions with embedded sensors, remote monitoring capabilities, and predictive maintenance features. This trend toward smart infrastructure reflects Israel’s advanced technology adoption patterns and focus on operational optimization through data-driven insights.

Sustainability and energy efficiency have become critical considerations for rack selection and deployment decisions. Israeli organizations are prioritizing solutions that minimize energy consumption, utilize recycled materials, and support circular economy principles. This environmental focus is driving innovation in rack design and materials selection while creating opportunities for suppliers offering sustainable alternatives.

Modular and scalable designs are gaining prominence as organizations seek infrastructure solutions that can adapt to changing requirements. The rapid pace of technology evolution in Israel’s dynamic market environment requires rack solutions that can accommodate diverse equipment types and support flexible reconfiguration. This trend favors suppliers offering comprehensive modular rack ecosystems.

Edge computing optimization is driving demand for specialized rack solutions designed for distributed deployment scenarios. Israeli organizations implementing edge computing strategies require compact, efficient, and remotely manageable rack systems suitable for unmanned operation. This trend is creating opportunities for innovative rack designs optimized for edge environments while maintaining enterprise-grade reliability and security features.

Major cloud providers have announced significant infrastructure investments in Israel, driving substantial demand for high-capacity rack solutions. These developments include establishment of new availability zones and expansion of existing facilities to support growing cloud adoption across Israeli enterprises. The investments represent substantial opportunities for rack suppliers capable of supporting large-scale deployments.

Government digitalization initiatives have accelerated following recent policy announcements aimed at modernizing public sector technology infrastructure. These programs require secure and compliant rack solutions capable of supporting sensitive government applications while meeting stringent availability requirements. The initiatives represent stable long-term demand for specialized rack configurations.

Cybersecurity infrastructure expansion has driven demand for specialized rack solutions with enhanced security features. Israeli organizations at the forefront of cybersecurity technology development require rack systems that provide comprehensive physical security while supporting high-performance computing requirements. This trend has created opportunities for suppliers offering security-optimized rack solutions.

International connectivity improvements through new submarine cable projects have positioned Israel as an increasingly important regional data hub. These infrastructure developments are attracting international content providers and cloud services to establish local presence, creating significant demand for professional-grade rack infrastructure capable of supporting intensive traffic loads and diverse equipment requirements.

Market participants should focus on developing comprehensive solution portfolios that address Israel’s unique combination of technical sophistication and security requirements. Success in this market requires deep understanding of local regulations, customer expectations, and operational environments. Suppliers should invest in local technical support capabilities and establish strong relationships with system integrators and consultants.

Product development strategies should emphasize modularity, scalability, and intelligent features that align with Israeli organizations’ rapid technology adoption patterns. MarkWide Research analysis suggests that solutions incorporating predictive maintenance capabilities and comprehensive monitoring features will achieve 25% higher adoption rates compared to traditional rack offerings.

Partnership strategies with local system integrators and technology consultants can provide valuable market access and customer relationship development opportunities. Israeli organizations typically prefer working with suppliers who demonstrate local presence and understanding of regional requirements. Building strong partner networks enables more effective market penetration and customer support delivery.

Investment priorities should focus on sustainability features, intelligent capabilities, and security enhancements that align with market trends and customer requirements. Organizations seeking to establish or expand their presence in Israel’s data center rack market should prioritize solutions that demonstrate clear value propositions in terms of operational efficiency, environmental impact, and total cost of ownership.

Market expansion is expected to continue at a robust pace, driven by ongoing digital transformation initiatives and Israel’s growing role as a regional technology hub. The combination of local demand growth and increasing international interest in Israeli data center capabilities creates favorable conditions for sustained market development. Edge computing deployment and artificial intelligence infrastructure requirements will drive demand for specialized rack solutions.

Technology evolution will continue to shape market requirements, with increasing emphasis on intelligent features, sustainability, and operational efficiency. Organizations will increasingly prioritize rack solutions that provide comprehensive monitoring capabilities, predictive maintenance features, and integration with broader data center management systems. This evolution will favor suppliers who can demonstrate innovation and adaptability.

Competitive dynamics are expected to intensify as both international suppliers and local providers compete for market share in this attractive market. Success will increasingly depend on ability to provide comprehensive solutions, local support, and specialized capabilities that address unique Israeli market requirements. Suppliers focusing on differentiation through technology innovation and customer service excellence will achieve stronger market positions.

Regulatory environment may continue to evolve, particularly regarding data security and environmental requirements. Organizations should monitor regulatory developments and ensure their rack solutions maintain compliance with applicable standards. The increasing focus on sustainability and energy efficiency may drive additional requirements that influence rack design and material selection decisions.

Israel’s data center rack market presents significant opportunities for suppliers capable of addressing the unique combination of technical sophistication, security requirements, and operational efficiency demands characteristic of this dynamic market. The country’s position as a global technology leader, combined with ongoing digital transformation initiatives and growing international connectivity, creates favorable conditions for sustained market growth and development.

Success factors in this market include deep understanding of local requirements, comprehensive technical support capabilities, and ability to provide innovative solutions that address emerging trends such as edge computing, artificial intelligence infrastructure, and sustainability requirements. Organizations that can demonstrate clear value propositions in terms of operational efficiency, security, and total cost of ownership will achieve stronger market positions.

Future market development will be shaped by continued technology evolution, changing customer requirements, and evolving regulatory environments. Suppliers who invest in innovation, local presence, and customer relationship development will be best positioned to capitalize on the substantial opportunities presented by Israel’s growing data center infrastructure market and its expanding role as a regional technology hub.

What is Data Center Rack?

Data Center Racks are standardized frames or enclosures used to house servers, networking equipment, and other hardware in data centers. They provide organization, cooling, and security for critical IT infrastructure.

What are the key players in the Israel Data Center Rack Market?

Key players in the Israel Data Center Rack Market include companies like Schneider Electric, Rittal, and Vertiv, which offer a range of solutions for data center infrastructure, among others.

What are the growth factors driving the Israel Data Center Rack Market?

The growth of the Israel Data Center Rack Market is driven by the increasing demand for cloud computing, the rise in data generation, and the need for efficient data management solutions across various industries.

What challenges does the Israel Data Center Rack Market face?

Challenges in the Israel Data Center Rack Market include the high costs of advanced infrastructure, the complexity of integrating new technologies, and the need for compliance with stringent regulations.

What opportunities exist in the Israel Data Center Rack Market?

Opportunities in the Israel Data Center Rack Market include the expansion of data centers to support emerging technologies like AI and IoT, as well as the growing trend towards sustainable and energy-efficient solutions.

What trends are shaping the Israel Data Center Rack Market?

Trends in the Israel Data Center Rack Market include the adoption of modular data center designs, increased focus on energy efficiency, and the integration of advanced cooling technologies to enhance performance.

Israel Data Center Rack Market

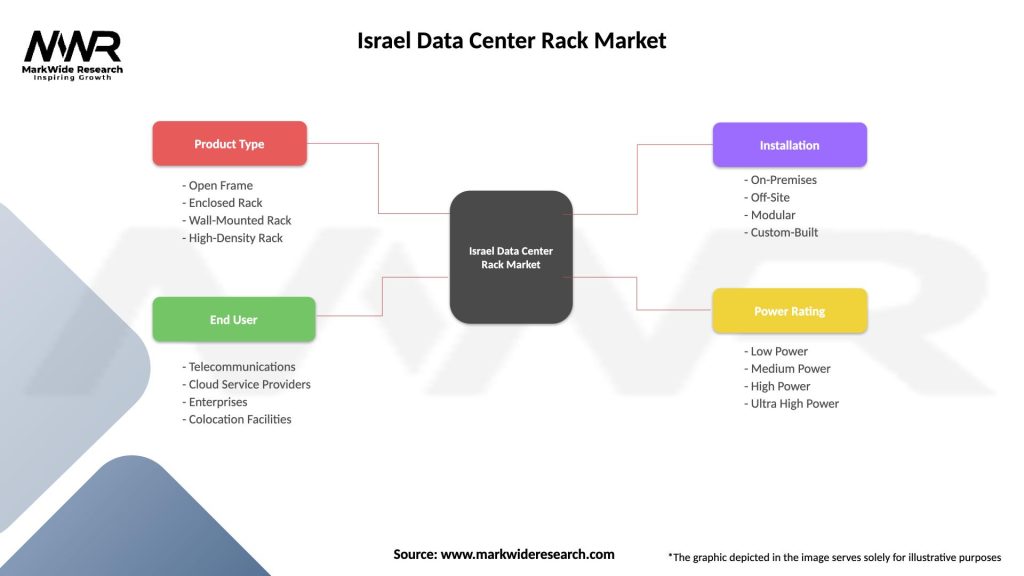

| Segmentation Details | Description |

|---|---|

| Product Type | Open Frame, Enclosed Rack, Wall-Mounted Rack, High-Density Rack |

| End User | Telecommunications, Cloud Service Providers, Enterprises, Colocation Facilities |

| Installation | On-Premises, Off-Site, Modular, Custom-Built |

| Power Rating | Low Power, Medium Power, High Power, Ultra High Power |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Israel Data Center Rack Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at