444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Israel data center market represents a dynamic and rapidly evolving sector within the country’s robust technology ecosystem. Israel’s strategic position as a global technology hub has positioned its data center infrastructure at the forefront of digital transformation initiatives across the Middle East and beyond. The market demonstrates exceptional growth momentum, driven by increasing digitalization, cloud adoption, and the country’s reputation as the “Startup Nation.”

Market expansion is characterized by significant investments in hyperscale facilities, edge computing infrastructure, and sustainable data center technologies. The sector benefits from Israel’s advanced telecommunications infrastructure, skilled workforce, and favorable regulatory environment that supports technological innovation. Growth projections indicate the market is expanding at a compound annual growth rate (CAGR) of 8.2%, reflecting strong demand from both domestic enterprises and international organizations seeking reliable data center services in the region.

Strategic advantages include Israel’s political stability, advanced cybersecurity capabilities, and proximity to major European and Asian markets. The country’s data center market serves as a critical gateway for multinational corporations expanding their digital presence across emerging markets. Investment patterns show increasing focus on colocation services, which currently represent approximately 45% of the total market share, followed by managed hosting and cloud services.

The Israel data center market refers to the comprehensive ecosystem of facilities, services, and infrastructure that provide secure, reliable, and scalable computing resources for storing, processing, and managing digital information within Israel’s borders. This market encompasses various service models including colocation, managed hosting, cloud services, and edge computing solutions that serve both domestic and international clients.

Data center facilities in Israel range from large-scale hyperscale operations to smaller enterprise-focused centers, all designed to meet stringent security, reliability, and performance standards. The market includes both traditional data centers and modern cloud-native facilities that support emerging technologies such as artificial intelligence, Internet of Things (IoT), and big data analytics. Service providers offer comprehensive solutions including infrastructure management, security services, disaster recovery, and business continuity planning.

Market participants include global technology giants, regional service providers, telecommunications companies, and specialized data center operators who collectively create a competitive landscape that drives innovation and service excellence throughout the sector.

Israel’s data center market stands as a testament to the country’s technological prowess and strategic importance in the global digital economy. The sector demonstrates remarkable resilience and growth potential, supported by robust infrastructure investments and increasing demand for digital services across various industry verticals.

Key market characteristics include strong government support for digital infrastructure development, significant private sector investments, and growing adoption of cloud-first strategies among Israeli enterprises. The market benefits from the country’s advanced cybersecurity expertise, which has become a critical differentiator in attracting international clients seeking secure data center services.

Growth drivers encompass the rapid digitalization of traditional industries, increasing data generation from IoT devices, and the expansion of e-commerce and fintech sectors. Market penetration of cloud services has reached approximately 62% among Israeli enterprises, indicating strong momentum toward digital transformation initiatives.

Competitive dynamics feature both established global players and innovative local providers who leverage Israel’s technological expertise to deliver cutting-edge solutions. The market’s strategic position enables it to serve as a regional hub for data center services, attracting investments from multinational corporations seeking to establish presence in the Middle East and North Africa region.

Strategic positioning of Israel’s data center market reveals several critical insights that define its current trajectory and future potential. The market demonstrates exceptional adaptability to emerging technologies and changing customer requirements, positioning itself as a leader in innovation-driven data center solutions.

Digital transformation initiatives across Israeli enterprises serve as the primary catalyst for data center market expansion. Organizations are increasingly adopting cloud-first strategies, requiring robust infrastructure to support their digital operations. Enterprise adoption of hybrid cloud models has accelerated significantly, with approximately 73% of Israeli companies implementing some form of hybrid infrastructure strategy.

Government digitalization programs contribute substantially to market growth through initiatives aimed at modernizing public services and improving citizen engagement. These programs require extensive data processing capabilities and secure infrastructure, driving demand for both public and private data center services. Smart city projects across major Israeli urban centers further amplify infrastructure requirements.

Startup ecosystem expansion creates continuous demand for scalable, flexible data center solutions. Israel’s vibrant startup community requires infrastructure that can adapt quickly to changing business needs and support rapid scaling. Venture capital investments in Israeli technology companies continue to drive infrastructure requirements as startups grow into established enterprises.

International business expansion by Israeli companies necessitates reliable data center infrastructure to support global operations. Companies expanding into international markets require infrastructure that can provide consistent performance and security across multiple geographical regions. Cross-border data flows and compliance requirements further emphasize the need for sophisticated data center capabilities.

High infrastructure costs represent a significant challenge for data center market expansion in Israel. The substantial capital investments required for establishing and maintaining modern data center facilities can limit market entry for smaller providers and increase operational costs for existing players. Energy costs in Israel are relatively high compared to other regional markets, impacting operational profitability.

Limited physical space in prime locations constrains the development of large-scale data center facilities, particularly in major urban centers where demand is highest. Real estate availability and zoning restrictions can delay project implementation and increase development costs. Geographic constraints require innovative approaches to facility design and location selection.

Skilled workforce shortage in specialized technical areas can limit service quality and operational efficiency. While Israel has a strong technology workforce, the specific expertise required for advanced data center operations remains in high demand. Competition for talent from other technology sectors can drive up labor costs and create recruitment challenges.

Regulatory compliance complexity associated with data protection and privacy requirements can increase operational costs and complexity. International clients often require compliance with multiple regulatory frameworks, necessitating sophisticated governance and control systems. Cross-border data transfer regulations continue to evolve, creating ongoing compliance challenges.

Edge computing expansion presents substantial growth opportunities as organizations seek to reduce latency and improve performance for real-time applications. The proliferation of IoT devices and autonomous systems creates demand for distributed computing infrastructure closer to data sources. 5G network deployment will further accelerate edge computing adoption, creating new market segments for specialized data center services.

Artificial intelligence and machine learning workloads require specialized infrastructure optimized for high-performance computing. Israeli companies are at the forefront of AI innovation, creating demand for GPU-accelerated computing resources and specialized storage solutions. AI adoption rates among Israeli enterprises have reached approximately 38%, indicating significant growth potential.

Sustainability initiatives create opportunities for providers who can offer environmentally responsible data center solutions. Growing corporate focus on environmental, social, and governance (ESG) criteria drives demand for green data center technologies. Renewable energy integration and carbon-neutral operations become increasingly important competitive differentiators.

Regional expansion opportunities allow Israeli data center providers to leverage their expertise in serving neighboring markets. The country’s strategic position and technological capabilities make it an attractive base for regional operations. Cross-border partnerships and joint ventures can facilitate market expansion while sharing risks and resources.

Competitive intensity within Israel’s data center market continues to drive innovation and service improvement across all market segments. Market consolidation trends are balanced by the entry of specialized providers focusing on niche segments such as edge computing and AI-optimized infrastructure. This dynamic creates opportunities for both established players and innovative newcomers.

Technology evolution significantly impacts market dynamics as providers must continuously invest in infrastructure upgrades to remain competitive. Cloud adoption acceleration has fundamentally altered customer expectations regarding scalability, flexibility, and service delivery models. Providers must adapt their offerings to meet evolving customer requirements while maintaining operational efficiency.

Customer behavior patterns show increasing preference for hybrid and multi-cloud strategies, requiring data center providers to offer seamless integration capabilities across different platforms and services. Service customization becomes increasingly important as customers seek tailored solutions that address specific business requirements and compliance needs.

Investment patterns reflect growing confidence in the market’s long-term potential, with both domestic and international investors committing substantial resources to infrastructure development. Partnership strategies between global technology companies and local providers create synergies that enhance service capabilities and market reach.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with industry executives, technology leaders, and key stakeholders across the Israeli data center ecosystem. These interviews provide firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, financial statements, and regulatory documents to establish market context and validate primary findings. Data triangulation techniques ensure consistency and reliability of information across multiple sources and research methodologies.

Market modeling utilizes advanced analytical techniques to project market trends and identify growth patterns. Quantitative analysis includes statistical modeling of market drivers, competitive dynamics, and customer behavior patterns. Qualitative insights complement quantitative findings to provide comprehensive market understanding.

Expert validation processes involve review and verification of research findings by industry experts and thought leaders. Peer review mechanisms ensure research quality and accuracy while maintaining objectivity and analytical rigor throughout the research process.

Tel Aviv metropolitan area dominates Israel’s data center market, accounting for approximately 55% of total market capacity. The region benefits from excellent connectivity infrastructure, proximity to major enterprises, and availability of skilled technical workforce. Hyperscale facilities in the Tel Aviv area serve both domestic and international clients, leveraging the city’s status as Israel’s economic center.

Jerusalem region represents a growing market segment, driven by government digitalization initiatives and the presence of major educational institutions. Data sovereignty requirements for government and public sector organizations create demand for locally-operated facilities with enhanced security capabilities. The region accounts for approximately 25% of market share.

Haifa and northern regions benefit from industrial concentration and proximity to major technology companies. Manufacturing sector digitalization drives demand for industrial IoT and edge computing solutions. The region’s strategic location near major ports and transportation hubs provides logistical advantages for data center operations.

Southern regions including Beersheba and surrounding areas represent emerging opportunities for data center development. Government incentives for technology development in peripheral areas, combined with lower real estate costs, make these regions attractive for large-scale facility development. Renewable energy potential in southern regions aligns with sustainability objectives.

Market leadership is distributed among several key players who bring different strengths and capabilities to the Israeli data center market. The competitive environment fosters innovation while ensuring customers have access to diverse service options and pricing models.

Competitive strategies focus on differentiation through specialized services, enhanced security capabilities, and superior customer support. Innovation initiatives include development of AI-optimized infrastructure, sustainable cooling technologies, and advanced automation systems that improve operational efficiency and service quality.

Service type segmentation reveals distinct market dynamics across different data center service categories. Colocation services maintain the largest market share, providing flexible infrastructure solutions for organizations seeking to maintain direct control over their IT assets while benefiting from shared facilities and services.

By Service Type:

By Organization Size:

By Industry Vertical:

Hyperscale data centers represent the fastest-growing segment within Israel’s market, driven by increasing demand for cloud services and large-scale computing resources. These facilities typically exceed 10,000 square feet and are designed to support massive scalability requirements. Hyperscale adoption has increased by approximately 42% annually as organizations migrate to cloud-first architectures.

Edge computing facilities emerge as a critical growth category, supporting applications requiring ultra-low latency and real-time processing capabilities. 5G network deployment accelerates edge computing adoption across industries including autonomous vehicles, smart manufacturing, and augmented reality applications. These facilities are typically smaller but strategically located to minimize latency.

Enterprise data centers continue to serve organizations with specific security, compliance, or performance requirements that cannot be met through shared infrastructure. Hybrid cloud strategies often incorporate enterprise data centers as part of multi-cloud architectures that balance cost, performance, and control requirements.

Specialized facilities cater to unique requirements such as high-performance computing, artificial intelligence workloads, and research applications. These facilities feature specialized cooling, power, and networking infrastructure optimized for specific use cases. GPU-accelerated computing demand has grown significantly, requiring specialized infrastructure design and management capabilities.

Cost optimization represents a primary benefit for organizations utilizing Israeli data center services. Shared infrastructure models reduce capital expenditure requirements while providing access to enterprise-grade facilities and services. Organizations can achieve significant cost savings compared to building and maintaining private data center facilities.

Enhanced security capabilities provide stakeholders with access to advanced cybersecurity technologies and expertise that would be difficult to replicate internally. Israeli cybersecurity leadership translates into superior protection against evolving threats and compliance with international security standards.

Scalability and flexibility enable organizations to adapt quickly to changing business requirements without significant infrastructure investments. On-demand resource allocation supports business growth while minimizing unused capacity costs. This flexibility is particularly valuable for startups and rapidly growing companies.

Business continuity benefits include comprehensive disaster recovery and backup services that ensure operational resilience. Redundant infrastructure and geographic distribution minimize risks associated with natural disasters, power outages, or other disruptions. Service level agreements typically guarantee 99.9% uptime or higher.

Access to innovation allows stakeholders to leverage cutting-edge technologies without direct investment in research and development. Technology partnerships between data center providers and technology vendors ensure access to latest innovations in computing, storage, and networking technologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation emerges as a dominant trend shaping Israel’s data center market evolution. Green data center initiatives focus on renewable energy adoption, efficient cooling systems, and carbon footprint reduction. Organizations increasingly evaluate data center providers based on environmental performance and sustainability commitments. Energy efficiency improvements of up to 30% are achievable through modern cooling and power management technologies.

Artificial intelligence integration revolutionizes data center operations through predictive maintenance, automated resource allocation, and intelligent cooling management. AI-driven optimization reduces operational costs while improving performance and reliability. Machine learning algorithms analyze usage patterns to optimize resource allocation and predict infrastructure requirements.

Edge computing proliferation drives development of distributed data center architectures that bring computing resources closer to end users and devices. 5G network deployment accelerates edge computing adoption across industries requiring ultra-low latency applications. This trend creates demand for smaller, strategically located facilities throughout Israel.

Hybrid cloud adoption continues to reshape customer requirements and service delivery models. Organizations seek seamless integration between on-premises infrastructure, private clouds, and public cloud services. Multi-cloud strategies become increasingly common as organizations avoid vendor lock-in while optimizing performance and costs.

Security enhancement remains a critical trend as cyber threats become more sophisticated and frequent. Zero-trust security models influence data center design and operations, requiring comprehensive identity verification and access controls. Advanced threat detection and response capabilities become standard features rather than premium services.

Major infrastructure investments by global cloud providers demonstrate confidence in Israel’s data center market potential. Microsoft’s expansion of Azure infrastructure includes significant investments in local data center capacity and specialized services for Israeli enterprises. These investments enhance service availability while reducing latency for local customers.

Strategic partnerships between international providers and local companies create synergies that benefit the entire market ecosystem. MarkWide Research analysis indicates that such partnerships have increased by approximately 35% over the past two years, reflecting growing market maturity and international recognition.

Government digitalization initiatives accelerate public sector adoption of cloud services and modern data center infrastructure. Smart city projects in major urban centers require sophisticated data processing capabilities and real-time analytics infrastructure. These initiatives create substantial demand for specialized data center services.

Cybersecurity integration becomes increasingly sophisticated as data center providers incorporate advanced threat detection and response capabilities into their standard service offerings. Israeli cybersecurity companies collaborate with data center operators to develop innovative security solutions that provide competitive advantages in global markets.

Sustainability certifications and green building standards become increasingly important for data center facilities. LEED certification and other environmental standards influence facility design and operations, reflecting growing corporate focus on environmental responsibility and sustainability.

Investment prioritization should focus on emerging technologies that provide sustainable competitive advantages. Edge computing infrastructure represents a particularly attractive opportunity given Israel’s strategic position and the growing demand for low-latency applications. Providers should consider developing distributed architectures that serve both domestic and regional markets.

Partnership strategies can accelerate market expansion while sharing risks and resources. International collaborations with global technology companies provide access to advanced technologies and broader customer bases. Local partnerships with telecommunications providers and system integrators can enhance service delivery capabilities and market reach.

Sustainability initiatives should be integrated into long-term strategic planning as environmental considerations become increasingly important for customer selection criteria. Renewable energy adoption and carbon-neutral operations provide competitive differentiation while addressing growing corporate sustainability requirements.

Talent development programs are essential for maintaining service quality and operational excellence as the market continues to grow. Skills training in emerging technologies such as AI, edge computing, and advanced security ensures workforce capabilities align with market evolution and customer requirements.

Customer experience enhancement through digital transformation of service delivery models can provide significant competitive advantages. Self-service portals, automated provisioning, and real-time monitoring capabilities improve customer satisfaction while reducing operational costs.

Market evolution over the next five years will be characterized by continued growth driven by digital transformation, emerging technologies, and regional expansion opportunities. MarkWide Research projections indicate sustained growth momentum with increasing adoption of hybrid cloud models and edge computing solutions across various industry sectors.

Technology advancement will focus on artificial intelligence integration, quantum computing preparation, and advanced automation systems that improve operational efficiency and service quality. 5G network deployment will accelerate edge computing adoption, creating new market segments and service opportunities for data center providers.

Regional expansion opportunities will enable Israeli data center providers to leverage their expertise in serving neighboring markets throughout the Middle East and North Africa region. Cross-border partnerships and joint ventures will facilitate market expansion while sharing risks and resources with local partners.

Sustainability transformation will become increasingly important as corporate environmental commitments drive demand for green data center solutions. Carbon neutrality goals and renewable energy adoption will influence facility design, operations, and customer selection criteria. Energy efficiency improvements of 25-30% are expected through advanced cooling and power management technologies.

Market consolidation may occur as smaller providers seek partnerships or acquisitions to compete effectively with larger international players. However, specialized providers focusing on niche markets or unique capabilities will continue to find opportunities for growth and differentiation.

Israel’s data center market represents a dynamic and rapidly evolving sector that combines technological innovation, strategic positioning, and exceptional growth potential. The market’s unique strengths in cybersecurity, technology leadership, and skilled workforce create sustainable competitive advantages that attract both domestic and international customers.

Growth trajectory remains positive, supported by strong fundamentals including digital transformation initiatives, government support, and increasing adoption of cloud services across various industry sectors. The market’s ability to adapt to emerging technologies and changing customer requirements positions it well for continued expansion and success.

Strategic opportunities in edge computing, artificial intelligence, and sustainability initiatives provide pathways for market participants to differentiate their offerings and capture new growth segments. The country’s position as a regional technology hub creates additional opportunities for expansion into neighboring markets.

Future success will depend on continued investment in infrastructure, technology innovation, and talent development. Organizations that can effectively balance cost competitiveness with service excellence while embracing emerging technologies will be best positioned to capitalize on the market’s substantial growth potential and contribute to Israel’s continued leadership in the global technology ecosystem.

What is Data Center?

A data center is a facility used to house computer systems and associated components, such as telecommunications and storage systems. It is essential for managing and storing large amounts of data, providing services like cloud computing, data backup, and disaster recovery.

What are the key players in the Israel Data Center Market?

Key players in the Israel Data Center Market include companies like Bezeq International, MedOne, and Global Data Centers, which provide various services such as colocation, cloud services, and managed hosting, among others.

What are the growth factors driving the Israel Data Center Market?

The Israel Data Center Market is driven by factors such as the increasing demand for cloud services, the growth of big data analytics, and the rise in internet traffic. Additionally, the expansion of tech startups and the need for data security are contributing to market growth.

What challenges does the Israel Data Center Market face?

Challenges in the Israel Data Center Market include high operational costs, the need for skilled labor, and regulatory compliance issues. Additionally, the environmental impact of data centers and energy consumption are significant concerns.

What opportunities exist in the Israel Data Center Market?

Opportunities in the Israel Data Center Market include the potential for green data centers, advancements in cooling technologies, and the increasing adoption of edge computing. These trends can enhance efficiency and sustainability in data management.

What trends are shaping the Israel Data Center Market?

Trends in the Israel Data Center Market include the shift towards hybrid cloud solutions, the integration of artificial intelligence for operational efficiency, and the growing emphasis on data security and compliance. These trends are influencing how data centers operate and evolve.

Israel Data Center Market

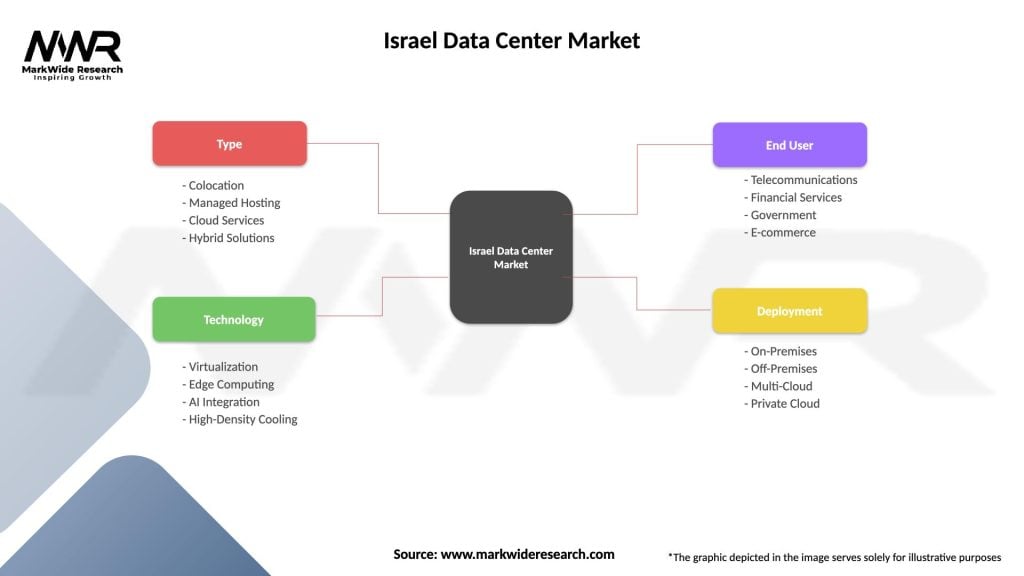

| Segmentation Details | Description |

|---|---|

| Type | Colocation, Managed Hosting, Cloud Services, Hybrid Solutions |

| Technology | Virtualization, Edge Computing, AI Integration, High-Density Cooling |

| End User | Telecommunications, Financial Services, Government, E-commerce |

| Deployment | On-Premises, Off-Premises, Multi-Cloud, Private Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Israel Data Center Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at