444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Israel credit cards market represents a dynamic and rapidly evolving financial services sector that has undergone significant transformation in recent years. Digital payment adoption has accelerated dramatically, with contactless transactions experiencing growth rates of approximately 45% annually across major Israeli cities. The market encompasses traditional banking institutions, fintech companies, and emerging digital payment platforms that serve Israel’s tech-savvy population of over 9 million consumers.

Market dynamics in Israel reflect the country’s position as a global technology hub, where innovation in financial services drives consumer expectations for seamless, secure, and convenient payment solutions. The regulatory environment, overseen by the Bank of Israel, has fostered competition while maintaining strict security standards that protect consumers and financial institutions alike.

Consumer behavior patterns indicate a strong preference for premium credit card products, with rewards programs and cashback incentives driving adoption rates of approximately 68% among eligible adults. The market serves diverse demographics, from young professionals in Tel Aviv’s tech sector to traditional consumers in Jerusalem and other major urban centers.

The Israel credit cards market refers to the comprehensive ecosystem of credit card issuance, processing, and related financial services operating within Israel’s borders. This market encompasses all forms of credit card products, from basic consumer cards to premium business solutions, along with the supporting infrastructure of payment processors, merchant services, and regulatory frameworks that enable secure electronic transactions.

Market participants include major Israeli banks such as Bank Hapoalim, Bank Leumi, and Mizrahi Tefahot, alongside international card networks like Visa, Mastercard, and American Express. The ecosystem also incorporates emerging fintech companies that provide innovative payment solutions, mobile wallet services, and alternative credit assessment technologies that serve both banked and underbanked populations.

Strategic market positioning reveals that Israel’s credit cards market operates as one of the most technologically advanced payment ecosystems in the Middle East region. The market benefits from high smartphone penetration rates exceeding 85% of the adult population, creating favorable conditions for mobile payment integration and digital wallet adoption.

Key market characteristics include strong regulatory oversight, robust cybersecurity measures, and innovative product development that addresses the unique needs of Israeli consumers. The market demonstrates resilience through economic cycles, supported by stable employment rates and growing disposable income levels across major metropolitan areas.

Competitive landscape analysis shows intense rivalry among traditional banks and emerging fintech players, driving continuous innovation in rewards programs, interest rates, and digital service offerings. Consumer loyalty programs have become increasingly sophisticated, with partnerships spanning retail, travel, and entertainment sectors.

Market intelligence reveals several critical insights that shape the Israel credit cards landscape:

Technological advancement serves as the primary catalyst driving Israel’s credit cards market expansion. The country’s reputation as the “Startup Nation” creates an environment where financial innovation thrives, leading to the development of cutting-edge payment technologies that enhance user experience and security protocols.

Consumer lifestyle changes significantly influence market growth, particularly among younger demographics who prefer digital-first financial services. The rise of e-commerce platforms, subscription-based services, and gig economy participation creates sustained demand for flexible credit solutions that adapt to modern spending patterns.

Government digitization initiatives accelerate market development through policies that promote cashless transactions and digital payment adoption. Tax incentives for electronic payments and reduced bureaucracy for digital financial services create favorable conditions for market expansion across both urban and rural areas.

Economic stability factors including steady GDP growth, low unemployment rates, and increasing household incomes support credit card adoption and usage frequency. The mature banking sector provides reliable infrastructure for credit assessment, risk management, and customer service delivery that builds consumer confidence in credit products.

Regulatory complexity presents significant challenges for market participants, particularly new entrants seeking to navigate Israel’s comprehensive financial services regulations. Compliance costs and lengthy approval processes can limit innovation speed and increase operational expenses for credit card issuers and payment processors.

Cybersecurity concerns create ongoing challenges as financial institutions must continuously invest in advanced security measures to protect against evolving cyber threats. The high-profile nature of Israel’s technology sector makes it an attractive target for cybercriminals, requiring substantial resources for threat prevention and response capabilities.

Market saturation in urban areas limits growth opportunities as most eligible consumers already possess multiple credit cards. Competition for market share intensifies among established players, leading to margin pressure and increased marketing costs to attract and retain customers.

Economic sensitivity affects consumer credit behavior during periods of economic uncertainty or geopolitical tensions. Credit utilization patterns can shift rapidly, impacting issuer profitability and requiring adaptive risk management strategies to maintain portfolio quality.

Digital wallet integration presents substantial growth opportunities as consumers increasingly adopt mobile payment solutions. The convergence of credit cards with digital wallets, cryptocurrency platforms, and buy-now-pay-later services creates new revenue streams and customer engagement models for forward-thinking financial institutions.

Small business market expansion offers significant potential as Israel’s entrepreneurial ecosystem continues growing. Specialized business credit cards with expense management tools, accounting software integration, and flexible credit limits can capture market share among startups and established SMEs seeking sophisticated financial solutions.

Cross-border payment solutions represent emerging opportunities given Israel’s strong international business connections and growing tourism sector. Credit cards optimized for international usage, with competitive foreign exchange rates and global merchant acceptance, can differentiate providers in an increasingly connected marketplace.

Sustainable finance initiatives create opportunities for environmentally conscious credit products that appeal to younger consumers. Carbon footprint tracking, sustainable merchant rewards, and green financing options can establish competitive advantages while supporting Israel’s environmental sustainability goals.

Competitive intensity characterizes the Israel credit cards market, with established banks competing against innovative fintech companies and international payment providers. This competition drives continuous product innovation, improved customer service standards, and competitive pricing strategies that benefit consumers while challenging traditional business models.

Technology adoption cycles significantly influence market dynamics, as rapid implementation of new payment technologies creates both opportunities and disruption risks. Financial institutions must balance innovation investments with operational stability while meeting evolving consumer expectations for seamless digital experiences.

Regulatory evolution shapes market dynamics through policy changes that affect competition, consumer protection, and operational requirements. MarkWide Research analysis indicates that regulatory adaptability has become a key competitive factor, with agile institutions gaining market advantages through faster compliance and product development cycles.

Consumer behavior shifts create dynamic market conditions as spending patterns, payment preferences, and loyalty expectations evolve rapidly. The ability to anticipate and respond to these changes determines market success, requiring sophisticated data analytics and customer insight capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Israel’s credit cards market. Primary research includes structured interviews with industry executives, consumer surveys, and focus groups that capture qualitative insights about market trends, consumer preferences, and competitive positioning strategies.

Secondary research components encompass analysis of financial reports, regulatory filings, industry publications, and government statistics that provide quantitative data about market performance, growth trends, and regulatory developments. This approach ensures comprehensive coverage of market dynamics from multiple perspectives.

Data validation processes include cross-referencing multiple sources, statistical analysis of survey responses, and expert review panels that verify findings accuracy and relevance. Market modeling techniques project future trends based on historical data patterns, economic indicators, and industry expert insights.

Analytical frameworks incorporate Porter’s Five Forces analysis, SWOT assessments, and competitive benchmarking studies that evaluate market structure, competitive intensity, and strategic positioning opportunities for market participants across different segments and geographic regions.

Tel Aviv metropolitan area dominates Israel’s credit cards market, accounting for approximately 42% of total transaction volume due to its concentration of high-income professionals, technology companies, and international businesses. The region shows the highest adoption rates for premium credit products and innovative payment technologies, driven by sophisticated consumer preferences and robust economic activity.

Jerusalem region represents a significant market segment with unique characteristics including diverse demographic composition, government sector employment, and tourism-related spending patterns. Credit card usage patterns reflect the area’s mix of traditional and modern commerce, with growing adoption of contactless payments in retail and hospitality sectors.

Haifa and northern regions demonstrate steady market growth supported by industrial activity, port commerce, and technology sector development. The area shows increasing penetration of business credit cards among manufacturing and logistics companies, while consumer adoption follows national trends with slight regional variations in product preferences.

Southern regions including Beersheba and surrounding areas represent emerging market opportunities with growing population centers and economic development initiatives. Credit card penetration rates are expanding as infrastructure development and business growth create demand for sophisticated financial services among both consumers and commercial entities.

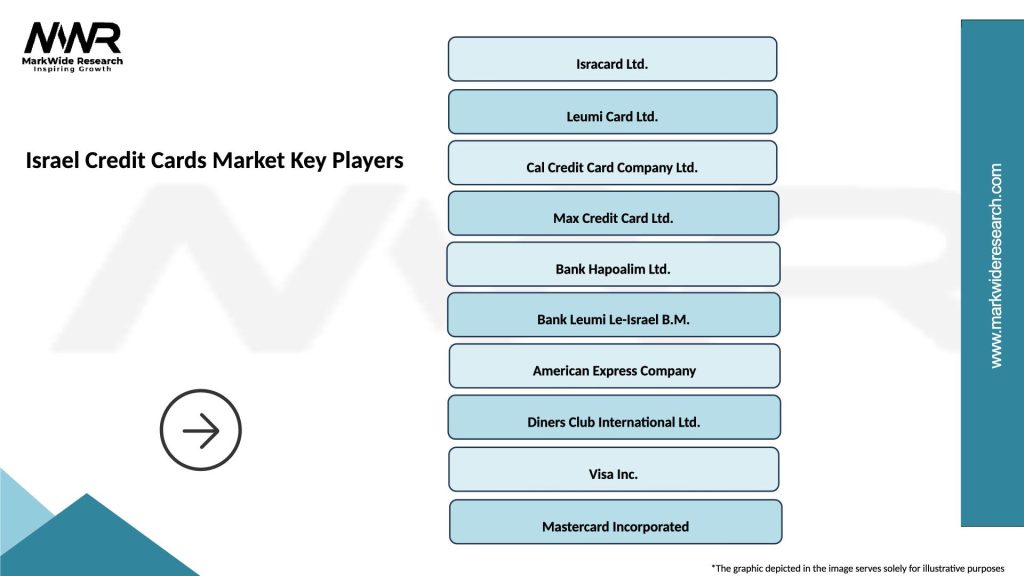

Market leadership in Israel’s credit cards sector is shared among several key players, each with distinct competitive advantages and market positioning strategies:

By Card Type:

By Customer Segment:

By Technology Platform:

Consumer credit cards represent the largest market segment, driven by widespread adoption among Israel’s middle and upper-middle class populations. These products emphasize rewards programs, cashback incentives, and lifestyle benefits that align with consumer spending patterns in retail, dining, and entertainment sectors.

Business credit cards show rapid growth as Israel’s entrepreneurial ecosystem expands and small businesses seek sophisticated financial management tools. Features including expense tracking, employee card management, and integration with accounting software create value propositions that differentiate business products from consumer offerings.

Premium credit cards demonstrate strong performance among affluent consumers who value exclusive benefits, travel rewards, and personalized service experiences. This segment shows resilience during economic downturns and generates higher profit margins for issuers through annual fees and increased transaction volumes.

Digital payment integration across all categories reflects Israel’s technology-forward consumer base, with mobile wallet adoption and contactless payments becoming standard expectations rather than premium features. This trend drives continuous innovation in user interface design and security protocols.

Financial institutions benefit from diversified revenue streams through interchange fees, annual fees, interest income, and cross-selling opportunities that enhance customer lifetime value. Credit cards serve as gateway products for broader banking relationships, enabling institutions to offer mortgages, investment services, and insurance products to established customers.

Merchants and retailers gain access to broader customer bases through credit card acceptance, with increased transaction values and improved cash flow management. Electronic payments reduce handling costs associated with cash transactions while providing valuable customer data for marketing and inventory management purposes.

Consumers enjoy enhanced purchasing power, fraud protection, rewards programs, and convenient payment methods that simplify daily financial transactions. Credit cards provide emergency financial resources, purchase protection, and travel benefits that add significant value beyond basic payment functionality.

Technology providers find opportunities in payment processing, security solutions, mobile applications, and data analytics services that support the credit cards ecosystem. The market’s emphasis on innovation creates sustained demand for advanced technologies that enhance user experience and operational efficiency.

Strengths:

Weaknesses:

Opportunities:

Threats:

Contactless payment adoption has accelerated dramatically, with usage rates increasing by approximately 55% annually as consumers prioritize convenience and hygiene considerations. This trend drives infrastructure investments in point-of-sale terminals and mobile payment capabilities across retail, hospitality, and service sectors.

Artificial intelligence integration transforms credit card services through personalized rewards recommendations, fraud detection algorithms, and automated customer service solutions. Machine learning capabilities enable real-time transaction analysis and customized product offerings that enhance customer satisfaction and operational efficiency.

Sustainability focus emerges as consumers increasingly consider environmental impact in financial decisions. Credit cards with carbon footprint tracking, sustainable merchant rewards, and paperless statements appeal to environmentally conscious customers while supporting corporate social responsibility initiatives.

Open banking initiatives create opportunities for enhanced financial services integration, allowing credit card providers to offer comprehensive financial management tools that aggregate data from multiple sources and provide holistic customer insights.

Digital transformation initiatives across major Israeli banks have accelerated mobile banking adoption and contactless payment integration. Recent investments in cloud infrastructure, API development, and customer experience platforms position traditional institutions to compete effectively with fintech challengers.

Regulatory modernization efforts by the Bank of Israel include updated guidelines for digital payments, cryptocurrency integration, and cross-border transactions. These developments create clearer frameworks for innovation while maintaining security and consumer protection standards.

Strategic partnerships between banks and technology companies have produced innovative products including biometric authentication, voice-activated payments, and integrated expense management solutions. MWR research indicates these collaborations are reshaping competitive dynamics and customer expectations.

International expansion by Israeli fintech companies brings global best practices to the domestic market while creating opportunities for local banks to enhance their technology capabilities through partnerships and acquisitions.

Product differentiation strategies should focus on unique value propositions that address specific customer segments rather than competing solely on price or basic features. Successful institutions will develop specialized products for entrepreneurs, international travelers, and environmentally conscious consumers with tailored benefits and services.

Technology investment priorities should emphasize customer experience enhancement, security infrastructure, and data analytics capabilities that enable personalized service delivery. Institutions that successfully integrate artificial intelligence and machine learning into their operations will gain sustainable competitive advantages.

Partnership development with fintech companies, merchants, and service providers can create ecosystem advantages that increase customer engagement and transaction volumes. Strategic alliances should focus on complementary capabilities rather than direct competition to maximize mutual benefits.

Risk management evolution must adapt to changing threat landscapes including cybersecurity risks, economic volatility, and regulatory changes. Proactive risk assessment and mitigation strategies will become increasingly important for maintaining market position and profitability.

Market evolution over the next five years will be characterized by continued digital transformation, with mobile-first payment solutions becoming the dominant interface for credit card interactions. MarkWide Research projections indicate that traditional physical cards will increasingly serve as backup payment methods rather than primary transaction tools.

Competitive landscape changes will likely include consolidation among smaller players and increased collaboration between traditional banks and fintech companies. Market leaders will emerge through superior technology integration, customer experience delivery, and adaptive business model innovation.

Regulatory developments are expected to support continued innovation while strengthening consumer protection and cybersecurity requirements. New frameworks for cryptocurrency integration, cross-border payments, and data privacy will shape operational strategies and competitive positioning.

Consumer behavior trends will drive demand for more personalized, sustainable, and integrated financial services that extend beyond traditional credit card functionality. Success will depend on institutions’ ability to anticipate and respond to evolving customer expectations while maintaining operational efficiency and profitability.

Israel’s credit cards market stands at a pivotal juncture where technological innovation, regulatory evolution, and changing consumer preferences converge to create both opportunities and challenges for market participants. The market’s foundation of technological sophistication, regulatory stability, and affluent consumer demographics provides a strong platform for continued growth and development.

Strategic success factors will increasingly center on digital transformation capabilities, customer experience excellence, and adaptive business models that respond quickly to market changes. Institutions that effectively balance innovation with risk management while maintaining customer trust and regulatory compliance will capture the greatest market opportunities.

Future market dynamics will be shaped by the continued integration of artificial intelligence, sustainable finance initiatives, and cross-border payment solutions that reflect Israel’s position as a global technology and business hub. The market’s evolution will serve as a model for other developed economies seeking to modernize their financial services sectors while maintaining security and stability.

What is Credit Cards?

Credit cards are financial tools that allow consumers to borrow funds from a pre-approved limit to make purchases or withdraw cash. They are widely used for various transactions, including online shopping, travel expenses, and everyday purchases.

What are the key players in the Israel Credit Cards Market?

The Israel Credit Cards Market features several key players, including Bank Hapoalim, Leumi Card, and Isracard. These companies offer a range of credit card products tailored to different consumer needs, among others.

What are the growth factors driving the Israel Credit Cards Market?

The Israel Credit Cards Market is driven by factors such as increasing consumer spending, the rise of e-commerce, and the growing adoption of contactless payment technologies. Additionally, promotional offers and loyalty programs are encouraging more users to opt for credit cards.

What challenges does the Israel Credit Cards Market face?

The Israel Credit Cards Market faces challenges such as rising competition from alternative payment methods, concerns over consumer debt, and regulatory scrutiny. These factors can impact the growth and profitability of credit card issuers.

What opportunities exist in the Israel Credit Cards Market?

Opportunities in the Israel Credit Cards Market include the potential for innovative financial products, partnerships with fintech companies, and the expansion of digital payment solutions. These trends can enhance customer experience and drive market growth.

What trends are shaping the Israel Credit Cards Market?

Trends in the Israel Credit Cards Market include the increasing use of mobile wallets, the integration of rewards programs, and a focus on cybersecurity measures. These trends are influencing consumer preferences and the overall landscape of credit card offerings.

Israel Credit Cards Market

| Segmentation Details | Description |

|---|---|

| Product Type | Standard Cards, Premium Cards, Business Cards, Prepaid Cards |

| Customer Type | Individuals, Small Businesses, Corporates, Students |

| Payment Method | Contactless, Online Payments, Mobile Wallets, EMV Chip |

| Service Type | Rewards Programs, Cashback Offers, Travel Benefits, Insurance Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Israel Credit Cards Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at