444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Israel container glass market represents a dynamic and evolving sector within the country’s manufacturing landscape, driven by robust demand from food and beverage industries, pharmaceuticals, and cosmetics sectors. Container glass manufacturing in Israel has experienced steady growth, supported by increasing consumer preference for sustainable packaging solutions and the country’s strategic position as a regional hub for trade and commerce.

Market dynamics indicate that Israel’s container glass industry benefits from advanced manufacturing technologies, skilled workforce, and proximity to key export markets in Europe, Asia, and Africa. The sector demonstrates resilience with annual growth rates consistently outpacing regional averages, while maintaining focus on innovation and environmental sustainability.

Industry participants are increasingly investing in energy-efficient production processes and lightweight glass technologies to meet evolving consumer demands and regulatory requirements. The market shows particular strength in premium glass packaging segments, reflecting Israel’s position as a quality-focused manufacturing destination with export penetration rates reaching significant levels across multiple international markets.

The Israel container glass market refers to the domestic production, distribution, and consumption of glass containers used for packaging various products including beverages, food items, pharmaceuticals, cosmetics, and industrial applications within Israel’s borders and for export purposes.

Container glass encompasses a wide range of products manufactured through specialized glass-forming processes, including bottles, jars, vials, and custom-designed packaging solutions. The market involves multiple stakeholders including raw material suppliers, glass manufacturers, packaging companies, end-user industries, and distribution networks that collectively contribute to the sector’s value chain.

Market scope extends beyond traditional packaging applications to include specialized glass containers for high-value products, pharmaceutical packaging requiring stringent quality standards, and innovative packaging solutions that support Israel’s growing technology and biotechnology sectors.

Israel’s container glass market demonstrates remarkable resilience and growth potential, positioning itself as a significant player in the regional glass packaging industry. The market benefits from strong domestic demand coupled with expanding export opportunities, particularly in premium and specialized glass packaging segments.

Key market drivers include increasing consumer awareness of sustainable packaging, growing food and beverage industry, expanding pharmaceutical sector, and rising demand for premium packaging solutions. The market shows adoption rates of advanced manufacturing technologies reaching impressive levels, enabling Israeli manufacturers to compete effectively in international markets.

Strategic positioning of Israeli container glass manufacturers focuses on high-quality products, innovative designs, and specialized applications that command premium pricing. The industry’s emphasis on research and development, combined with access to skilled technical workforce, creates competitive advantages that support sustained market growth and international expansion.

Market intelligence reveals several critical insights that shape the Israel container glass industry’s trajectory and competitive landscape:

Primary growth drivers propelling the Israel container glass market include increasing consumer preference for sustainable packaging solutions, with environmental consciousness driving demand for recyclable glass containers across multiple industry segments.

Food and beverage industry expansion represents a significant market driver, particularly in premium alcoholic beverages, specialty foods, and health-conscious consumer products. The sector benefits from Israel’s growing reputation for high-quality food production and innovative beverage manufacturing, creating sustained demand for premium glass packaging solutions.

Pharmaceutical sector growth drives demand for specialized glass containers meeting stringent regulatory requirements. Israel’s position as a global pharmaceutical manufacturing hub, with pharmaceutical production growth rates exceeding regional averages, creates consistent demand for high-quality glass vials, bottles, and specialized packaging solutions.

Export market opportunities continue expanding as Israeli manufacturers establish strong relationships with international customers seeking reliable, high-quality glass packaging suppliers. The country’s trade agreements and strategic partnerships facilitate market access and support sustained export growth.

Energy costs represent a significant constraint for container glass manufacturers, as glass production requires substantial energy inputs for melting and forming processes. Rising energy prices impact production costs and competitiveness, particularly when competing with manufacturers in regions with lower energy costs.

Raw material availability and pricing fluctuations create operational challenges for glass manufacturers. Dependence on imported raw materials for specialized glass formulations exposes manufacturers to supply chain disruptions and currency exchange rate variations that affect production costs and profitability.

Environmental regulations impose increasing compliance costs and operational constraints on glass manufacturing facilities. While supporting long-term sustainability objectives, regulatory requirements for emissions control, waste management, and energy efficiency necessitate significant capital investments that impact short-term profitability.

Competition from alternative packaging materials, particularly plastic and flexible packaging solutions, challenges traditional glass container applications. Cost-sensitive market segments may shift toward alternative packaging options, requiring glass manufacturers to demonstrate superior value propositions and specialized capabilities.

Sustainable packaging trends create substantial opportunities for container glass manufacturers as consumers and businesses increasingly prioritize environmentally responsible packaging solutions. Glass containers’ recyclability and premium perception position Israeli manufacturers favorably in markets emphasizing sustainability.

Pharmaceutical industry expansion offers significant growth opportunities, particularly in specialized glass packaging for biotechnology products, vaccines, and high-value medications. Israel’s strong pharmaceutical sector and growing biotechnology industry create domestic demand while supporting export opportunities to global pharmaceutical companies.

Premium consumer goods represent an expanding market opportunity as Israeli manufacturers develop capabilities in luxury packaging, custom designs, and specialized glass formulations. The growing global market for premium alcoholic beverages, cosmetics, and specialty foods creates demand for high-quality glass packaging solutions.

Technology integration opportunities enable manufacturers to develop smart packaging solutions, incorporating sensors, tracking capabilities, and interactive features that add value for end users and differentiate products in competitive markets.

Supply chain dynamics in the Israel container glass market reflect the industry’s integration with global raw material suppliers and international customer networks. MarkWide Research analysis indicates that successful manufacturers maintain diversified supplier relationships and flexible production capabilities to respond to changing market conditions.

Competitive dynamics emphasize quality, innovation, and customer service rather than pure cost competition. Israeli manufacturers compete effectively by focusing on specialized applications, technical expertise, and reliable delivery performance that justify premium pricing in international markets.

Technology adoption dynamics show automation penetration rates reaching high levels across leading manufacturers, enabling improved efficiency, quality consistency, and cost competitiveness. Investment in advanced manufacturing technologies supports both domestic market leadership and international expansion objectives.

Market consolidation trends indicate increasing cooperation between manufacturers and downstream partners, creating integrated value chains that enhance market responsiveness and customer satisfaction while supporting sustainable growth strategies.

Market research methodology employed comprehensive primary and secondary research approaches to analyze the Israel container glass market, incorporating industry expert interviews, manufacturer surveys, and detailed analysis of production data, trade statistics, and market trends.

Primary research activities included structured interviews with key industry participants, including glass manufacturers, raw material suppliers, equipment providers, and major customers across food and beverage, pharmaceutical, and consumer goods industries. Survey responses provided insights into market dynamics, competitive positioning, and future growth expectations.

Secondary research sources encompassed industry publications, government trade statistics, regulatory filings, company annual reports, and international trade databases. Analysis of historical production data, export-import statistics, and industry performance metrics provided quantitative foundation for market assessment and trend analysis.

Data validation processes ensured accuracy and reliability through cross-referencing multiple sources, expert review, and statistical analysis techniques. Market projections and trend analysis incorporated both quantitative modeling and qualitative expert judgment to provide comprehensive market insights.

Geographic distribution of Israel’s container glass manufacturing capacity shows concentration in industrial regions with access to transportation infrastructure, energy supplies, and skilled workforce. Northern regions account for significant production capacity, benefiting from proximity to raw material sources and export facilities.

Central Israel hosts major manufacturing facilities serving domestic markets, particularly food and beverage industries concentrated in this region. The area’s industrial infrastructure and logistics networks support efficient distribution to domestic customers while maintaining access to international shipping facilities.

Southern regions demonstrate growing importance in specialized glass manufacturing, particularly for pharmaceutical and high-tech applications. Investment in advanced manufacturing facilities in these areas reflects strategic positioning for future growth and export market development.

Export market analysis shows European markets representing substantial portions of Israeli container glass exports, with market share percentages reflecting strong competitive positioning in premium packaging segments. Asian markets demonstrate growing importance, while North American opportunities continue expanding through strategic partnerships and quality certifications.

Market leadership in Israel’s container glass industry reflects companies’ capabilities in technology, quality, and customer service rather than pure scale advantages. Leading manufacturers demonstrate strong competitive positioning through specialized capabilities and international market presence.

Competitive strategies emphasize differentiation through quality, innovation, and customer service. Leading companies invest heavily in research and development, advanced manufacturing technologies, and international market development to maintain competitive advantages in premium market segments.

By Product Type:

By End-User Industry:

By Glass Type:

Beverage containers represent the largest category within Israel’s container glass market, driven by strong domestic wine industry, growing craft beer segment, and premium spirits packaging. Wine bottle production benefits from Israel’s expanding wine industry and international recognition, with export growth rates supporting sustained demand for high-quality glass bottles.

Pharmaceutical packaging demonstrates the highest growth potential, supported by Israel’s position as a global pharmaceutical manufacturing hub. Specialized glass vials and containers for biotechnology products command premium pricing and require advanced manufacturing capabilities that Israeli producers are well-positioned to provide.

Food packaging applications show steady growth driven by increasing consumer preference for glass containers in premium food products. Specialty jars for gourmet foods, organic products, and artisanal food manufacturers create opportunities for value-added packaging solutions.

Industrial and specialty applications represent emerging growth categories, including laboratory glassware, technical containers, and specialized packaging for high-tech industries. These segments offer opportunities for differentiation and premium pricing through technical expertise and quality excellence.

Manufacturers benefit from Israel’s strategic location, skilled workforce, and advanced manufacturing infrastructure that enable competitive production costs and high-quality output. Access to international markets through trade agreements and established relationships creates opportunities for sustained export growth and market diversification.

Raw material suppliers gain from stable demand patterns and long-term relationships with established glass manufacturers. The industry’s focus on quality and specialized applications creates opportunities for premium raw materials and technical services that support higher margins and customer loyalty.

End-user industries benefit from reliable supply of high-quality glass packaging that meets international standards and regulatory requirements. Local production capabilities provide supply chain security, customization opportunities, and responsive customer service that support business growth and market competitiveness.

Export customers gain access to reliable, high-quality glass packaging suppliers with proven capabilities in specialized applications. Israeli manufacturers’ reputation for quality, innovation, and reliability creates value for international customers seeking dependable packaging partners.

Technology providers find opportunities in the industry’s continuous investment in advanced manufacturing technologies, automation systems, and quality control equipment. The sector’s emphasis on innovation and efficiency improvements creates sustained demand for technical solutions and services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as the dominant trend shaping Israel’s container glass market, with manufacturers investing heavily in energy-efficient production processes, recycled content utilization, and lightweight glass technologies. Environmental performance improvements reach significant levels as companies respond to customer demands and regulatory requirements.

Digital transformation accelerates across the industry, with manufacturers implementing advanced automation, data analytics, and quality control systems. Industry 4.0 adoption rates show substantial increases as companies leverage technology to improve efficiency, reduce costs, and enhance product quality.

Customization capabilities expand as manufacturers develop flexible production systems capable of handling smaller batch sizes and specialized designs. This trend supports premium market positioning and enables manufacturers to serve niche applications with higher margins and customer loyalty.

International partnerships strengthen as Israeli manufacturers establish strategic relationships with global customers, technology providers, and distribution networks. These partnerships facilitate market access, technology transfer, and business development opportunities that support sustained growth.

Technology investments represent major industry developments, with leading manufacturers upgrading production facilities with advanced furnace technologies, automated handling systems, and sophisticated quality control equipment. These investments enhance competitiveness and support expansion into new market segments.

Sustainability initiatives gain momentum as companies implement comprehensive environmental management programs, including energy efficiency improvements, waste reduction measures, and recycled content integration. MWR analysis indicates that sustainability investments create competitive advantages in international markets.

Market expansion activities include new facility development, capacity additions, and geographic expansion into emerging markets. Strategic investments in production capabilities support both domestic market growth and international expansion objectives.

Partnership developments encompass technology licensing agreements, joint ventures, and strategic alliances that enhance capabilities, market access, and competitive positioning. These partnerships enable Israeli manufacturers to leverage global expertise while maintaining local advantages.

Strategic focus recommendations emphasize continued investment in premium market segments where Israeli manufacturers can leverage quality advantages and technical expertise. Market positioning should emphasize sustainability, innovation, and reliability to differentiate from cost-focused competitors.

Technology adoption strategies should prioritize automation, digitalization, and advanced manufacturing processes that improve efficiency and quality while reducing costs. Investment in research and development capabilities supports long-term competitiveness and market leadership.

Market diversification efforts should expand geographic reach and customer base to reduce dependency risks and capture growth opportunities. Focus on emerging markets and specialized applications creates opportunities for sustainable growth and premium positioning.

Sustainability leadership represents a critical success factor, requiring comprehensive environmental management programs, energy efficiency improvements, and circular economy initiatives. These investments create competitive advantages and support long-term market positioning.

Growth projections for Israel’s container glass market indicate sustained expansion driven by domestic demand growth, export market opportunities, and increasing preference for sustainable packaging solutions. MarkWide Research forecasts suggest compound annual growth rates will remain robust across key market segments.

Technology evolution will continue transforming the industry, with advanced manufacturing processes, smart packaging solutions, and sustainable production technologies creating new opportunities and competitive advantages. Innovation adoption rates are expected to accelerate as manufacturers invest in future capabilities.

Market expansion opportunities will emerge from growing pharmaceutical industry, premium consumer goods demand, and international market development. Export growth potential remains strong, particularly in specialized applications and premium packaging segments.

Industry consolidation trends may accelerate as companies seek scale advantages, technology access, and market expansion opportunities. Strategic partnerships and acquisitions will likely play important roles in shaping the competitive landscape and market structure.

Israel’s container glass market demonstrates strong fundamentals and promising growth prospects, supported by quality leadership, strategic positioning, and continuous innovation. The industry’s focus on premium applications, sustainability, and international expansion creates sustainable competitive advantages that support long-term success.

Market dynamics favor companies that can leverage Israel’s strategic advantages while addressing challenges through technology adoption, operational excellence, and market diversification. The combination of domestic market stability and export growth opportunities provides a solid foundation for sustained industry development.

Future success will depend on continued investment in technology, sustainability, and market development initiatives that strengthen competitive positioning and capture emerging opportunities. The industry’s commitment to quality, innovation, and customer service positions Israeli container glass manufacturers favorably for continued growth and market leadership in the evolving global packaging landscape.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

What are the key players in the Israel Container Glass Market?

Key players in the Israel Container Glass Market include O-I Glass, Inc., and Ardagh Group, which are known for their extensive range of glass packaging solutions. Other notable companies include Verallia and Nampak, among others.

What are the growth factors driving the Israel Container Glass Market?

The growth of the Israel Container Glass Market is driven by increasing consumer demand for sustainable packaging solutions and the rising popularity of glass as a preferred material for food and beverage packaging. Additionally, the expansion of the food and beverage industry contributes to market growth.

What challenges does the Israel Container Glass Market face?

The Israel Container Glass Market faces challenges such as high production costs and competition from alternative packaging materials like plastics and metals. Additionally, fluctuations in raw material prices can impact profitability.

What opportunities exist in the Israel Container Glass Market?

Opportunities in the Israel Container Glass Market include the growing trend towards eco-friendly packaging and innovations in glass manufacturing technologies. The increasing demand for premium packaging in the cosmetics and pharmaceuticals sectors also presents significant growth potential.

What trends are shaping the Israel Container Glass Market?

Trends in the Israel Container Glass Market include a shift towards lightweight glass containers and the adoption of smart packaging technologies. Additionally, there is a rising focus on recycling and sustainability initiatives within the industry.

Israel Container Glass Market

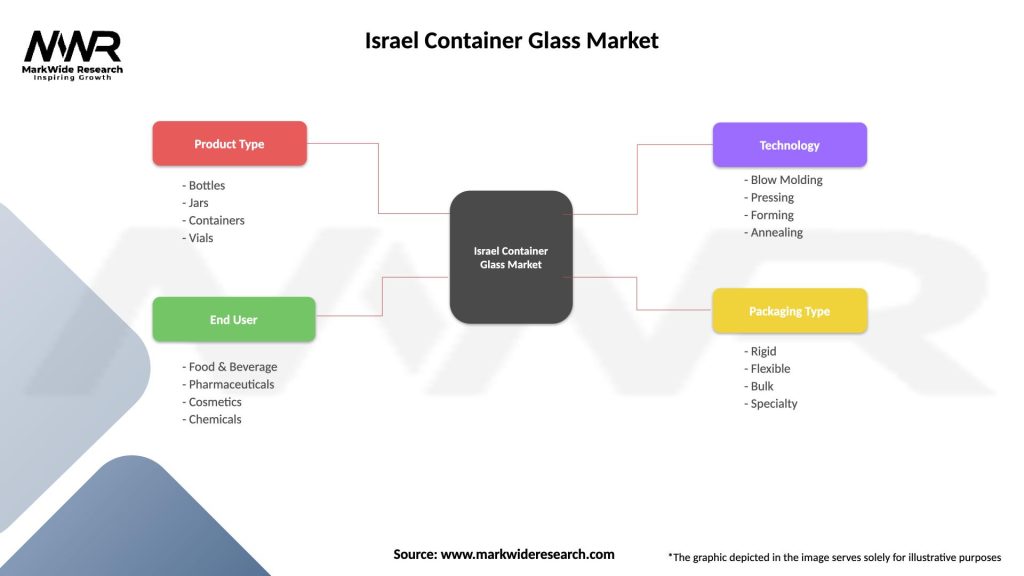

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Containers, Vials |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Chemicals |

| Technology | Blow Molding, Pressing, Forming, Annealing |

| Packaging Type | Rigid, Flexible, Bulk, Specialty |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Israel Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at