444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Israel ceramic market represents a dynamic and rapidly evolving sector that has established itself as a cornerstone of the country’s manufacturing and construction industries. This comprehensive market encompasses a diverse range of ceramic products, including traditional pottery, advanced technical ceramics, decorative tiles, sanitaryware, and innovative industrial applications. Israel’s ceramic industry has demonstrated remarkable resilience and growth, driven by technological innovation, strategic geographical positioning, and strong domestic demand from both residential and commercial sectors.

Market dynamics indicate that the Israeli ceramic sector has experienced consistent expansion, with growth rates reaching approximately 6.2% annually over recent years. The industry benefits from Israel’s strategic location at the crossroads of Europe, Asia, and Africa, facilitating efficient export operations and access to diverse raw materials. Domestic consumption remains robust, supported by ongoing construction projects, urban development initiatives, and increasing consumer preference for high-quality ceramic products in residential and commercial applications.

Technological advancement has positioned Israel as a regional leader in ceramic innovation, particularly in advanced ceramics for electronics, aerospace, and medical applications. The market’s strength lies in its ability to combine traditional craftsmanship with cutting-edge manufacturing technologies, creating products that meet both local and international quality standards. Export activities contribute significantly to market growth, with Israeli ceramic products gaining recognition in European and North American markets for their quality and design excellence.

The Israel ceramic market refers to the comprehensive ecosystem of ceramic product manufacturing, distribution, and consumption within Israel’s borders, encompassing both traditional and advanced ceramic applications. This market includes the production and trade of various ceramic materials such as pottery, tiles, sanitaryware, technical ceramics, and specialized industrial components used across multiple sectors including construction, electronics, healthcare, and consumer goods.

Ceramic products in the Israeli context span from decorative and functional household items to sophisticated technical ceramics used in high-tech industries. The market encompasses raw material sourcing, manufacturing processes, product development, quality control, distribution networks, and end-user applications. Traditional ceramics include pottery, tiles, and sanitaryware, while advanced ceramics cover electronic components, biomedical implants, and industrial applications requiring superior mechanical and thermal properties.

Market scope extends beyond domestic production to include import and export activities, making Israel a significant player in the regional ceramic trade. The industry integrates local clay resources, imported raw materials, and advanced manufacturing technologies to create products that serve both domestic needs and international markets, establishing Israel as a notable ceramic manufacturing hub in the Middle East region.

Israel’s ceramic market demonstrates exceptional growth potential and strategic importance within the country’s industrial landscape. The sector has evolved from traditional pottery and tile manufacturing to encompass advanced technical ceramics serving high-tech industries, positioning Israel as a regional innovation leader. Market performance reflects strong fundamentals, with consistent demand growth driven by construction sector expansion, technological advancement, and increasing export opportunities.

Key market drivers include robust construction activity, growing demand for advanced ceramics in electronics and medical applications, and increasing consumer preference for premium ceramic products. The industry benefits from approximately 78% capacity utilization across major manufacturing facilities, indicating healthy demand-supply dynamics. Export growth has been particularly notable, with international sales representing an increasing share of total market revenue.

Strategic positioning within the Mediterranean region provides Israel’s ceramic industry with competitive advantages in terms of logistics, raw material access, and market reach. The sector’s integration with Israel’s broader high-tech ecosystem has fostered innovation in advanced ceramics, creating new market opportunities and enhancing the industry’s long-term sustainability. Investment flows continue to support capacity expansion and technological upgrades, ensuring the market’s continued evolution and competitiveness.

Market segmentation reveals distinct growth patterns across different ceramic categories, with technical ceramics showing the highest growth potential due to increasing demand from electronics and medical device industries. Construction ceramics maintain steady demand supported by ongoing residential and commercial development projects throughout Israel.

Construction sector growth serves as the primary driver for Israel’s ceramic market, with ongoing residential and commercial development projects creating sustained demand for tiles, sanitaryware, and decorative ceramic products. The government’s commitment to housing development and infrastructure improvement has resulted in approximately 12% annual growth in construction-related ceramic consumption.

Technological innovation within Israel’s high-tech sector drives demand for advanced technical ceramics used in electronics, telecommunications, and medical devices. The country’s position as a global technology hub creates unique opportunities for ceramic manufacturers to develop specialized products for cutting-edge applications. Research and development investments in ceramic materials science continue to unlock new applications and market opportunities.

Export market expansion provides significant growth impetus, with Israeli ceramic products gaining recognition for quality and innovation in international markets. Strategic trade relationships and preferential agreements facilitate market access, while the industry’s focus on premium products enables competitive positioning despite higher production costs. Tourism industry support also contributes to demand for traditional and decorative ceramics, creating additional revenue streams for manufacturers.

Consumer preference evolution toward premium and sustainable products drives market premiumization, with increasing willingness to pay for high-quality ceramic products that offer superior performance and aesthetic appeal. Environmental consciousness among consumers and businesses creates demand for eco-friendly ceramic products and sustainable manufacturing practices.

Raw material costs present significant challenges for Israeli ceramic manufacturers, as many essential materials must be imported, creating exposure to international price volatility and supply chain disruptions. Energy costs associated with high-temperature ceramic firing processes add to production expenses, particularly given Israel’s relatively high energy prices compared to regional competitors.

Limited domestic clay resources restrict the industry’s ability to achieve complete raw material self-sufficiency, requiring strategic sourcing relationships and inventory management to ensure consistent production. Competition from low-cost producers in Asia and other regions challenges Israeli manufacturers, particularly in commodity ceramic segments where price sensitivity is high.

Skilled labor shortages in specialized ceramic manufacturing techniques create production constraints and increase labor costs. The industry requires workers with specific technical skills in ceramic processing, quality control, and advanced manufacturing technologies. Environmental regulations impose additional compliance costs and operational constraints, requiring investments in emission control and waste management systems.

Market size limitations within Israel’s domestic market restrict growth potential for manufacturers focused primarily on local sales, necessitating export market development to achieve scale economies. Economic volatility in regional markets can impact export opportunities and create uncertainty for long-term planning and investment decisions.

Advanced ceramics development presents substantial opportunities as Israel’s high-tech industries continue expanding and requiring specialized ceramic components for electronics, medical devices, and aerospace applications. The growing demand for biocompatible ceramics in medical implants and dental applications aligns with Israel’s strengths in medical technology innovation.

Export market diversification offers significant growth potential, particularly in emerging markets where Israeli ceramic products can command premium pricing based on quality and technological sophistication. Strategic partnerships with international distributors and manufacturers can facilitate market entry and scale expansion beyond current geographic limitations.

Sustainable ceramic solutions represent an emerging opportunity as environmental consciousness drives demand for eco-friendly building materials and products. Development of recycled ceramic products and energy-efficient manufacturing processes can create competitive advantages and access to environmentally conscious market segments.

Smart ceramic technologies incorporating sensors, self-cleaning properties, and antimicrobial features present opportunities for product differentiation and premium positioning. Customization capabilities using advanced manufacturing technologies can serve niche markets requiring specialized ceramic solutions, particularly in industrial and technical applications.

Supply chain dynamics within Israel’s ceramic market reflect a complex interplay of domestic production capabilities and international sourcing requirements. The industry has developed sophisticated logistics networks to manage raw material imports while maintaining efficient distribution of finished products to domestic and export markets. Inventory management strategies have evolved to balance cost efficiency with supply security, particularly given geopolitical considerations affecting regional trade flows.

Competitive dynamics showcase a market structure combining established manufacturers with innovative startups, creating a diverse ecosystem that fosters both stability and innovation. Market consolidation trends have emerged as larger players seek to achieve economies of scale, while specialized manufacturers focus on niche segments requiring technical expertise and customization capabilities.

Technology adoption continues reshaping market dynamics, with digital manufacturing technologies, automation, and quality control systems enhancing production efficiency and product consistency. Innovation cycles in ceramic materials science create opportunities for market disruption and competitive repositioning, particularly in advanced technical ceramics segments.

Regulatory dynamics influence market operations through environmental standards, safety requirements, and trade policies. The industry has adapted to increasingly stringent environmental regulations while maintaining competitiveness through efficiency improvements and sustainable practices. Market responsiveness to regulatory changes has become a key competitive factor, with proactive compliance strategies providing market advantages.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into Israel’s ceramic market dynamics. Primary research included extensive interviews with industry executives, manufacturers, distributors, and end-users across various ceramic market segments to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompassed analysis of industry reports, government statistics, trade association data, and academic publications to establish market baselines and validate primary research findings. Data triangulation methods ensured consistency and reliability across different information sources, while statistical analysis techniques identified significant trends and correlations within the market data.

Market segmentation analysis utilized both quantitative and qualitative approaches to understand distinct market dynamics across different ceramic product categories and application areas. Competitive intelligence gathering included analysis of company financial reports, product portfolios, and strategic initiatives to assess market positioning and competitive dynamics.

Expert consultation with industry specialists, technology experts, and market analysts provided additional validation and insights into market projections and trend analysis. MarkWide Research methodologies ensured comprehensive coverage of market factors while maintaining analytical rigor and objectivity throughout the research process.

Geographic distribution of Israel’s ceramic market reveals concentrated manufacturing activity in the central and northern regions, where proximity to ports, transportation infrastructure, and skilled labor pools provide operational advantages. Central Israel accounts for approximately 45% of total production capacity, benefiting from access to Tel Aviv’s commercial networks and logistics infrastructure.

Northern regions contribute significantly to traditional ceramic production, leveraging historical expertise in pottery and tile manufacturing while adapting to modern market demands. The area’s proximity to raw material sources and established manufacturing traditions support continued industry presence. Southern regions show growing importance in advanced ceramics manufacturing, particularly near high-tech industrial clusters.

Export corridors through major ports facilitate international market access, with Mediterranean shipping routes providing efficient connections to European markets. Regional specialization has emerged, with different areas focusing on specific ceramic product categories based on local advantages and market positioning strategies.

Urban market concentration in major cities drives demand for premium ceramic products, while rural areas maintain traditional pottery and craft ceramic segments. Regional development policies support ceramic industry growth through infrastructure investments and business incentives, particularly in areas seeking economic diversification.

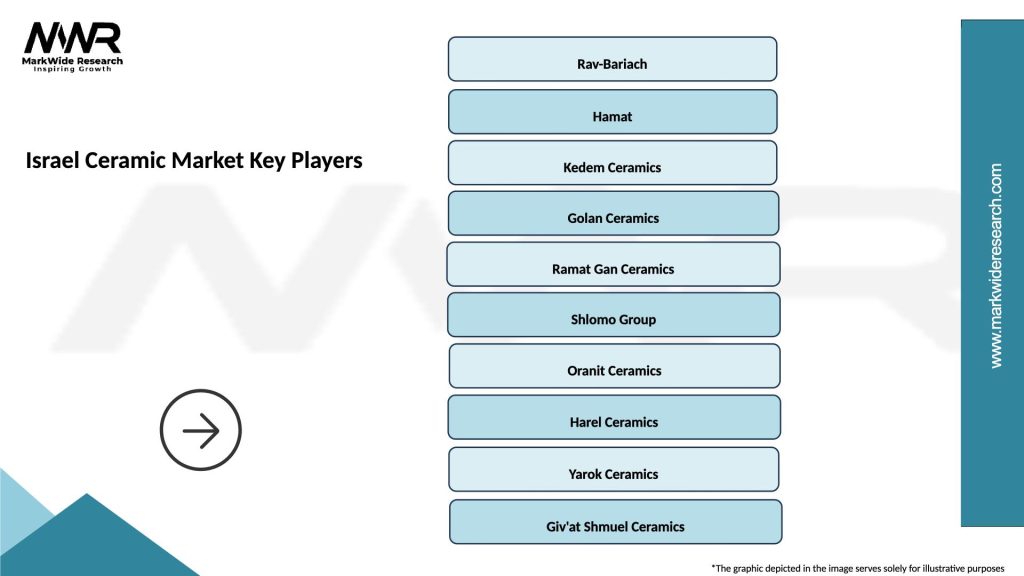

Market leadership in Israel’s ceramic sector is distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment combines established manufacturers with innovative companies developing advanced ceramic technologies.

Competitive strategies emphasize innovation, quality differentiation, and market specialization, with companies investing heavily in research and development to maintain technological advantages. Strategic partnerships and international collaborations enable market expansion and technology transfer, enhancing competitive positioning in global markets.

Product-based segmentation reveals distinct market dynamics across different ceramic categories, each with unique demand drivers, competitive landscapes, and growth trajectories. Technical ceramics represent the highest-growth segment, driven by increasing demand from electronics and medical device industries.

By Product Type:

By Application:

By End-User:

Traditional ceramics maintain cultural significance and steady market demand, with approximately 25% of total market volume attributed to pottery, decorative items, and cultural artifacts. This segment benefits from tourism industry support and growing appreciation for handcrafted products among domestic consumers. Artisan producers continue to innovate within traditional frameworks, incorporating contemporary design elements while preserving cultural authenticity.

Construction ceramics represent the largest market segment by volume, driven by ongoing residential and commercial development projects. Tile manufacturing has evolved to include advanced surface treatments, digital printing technologies, and sustainable production methods. Premium positioning strategies focus on design innovation, durability, and environmental performance to differentiate from commodity imports.

Technical ceramics show the highest growth potential, with demand increasing approximately 15% annually as Israel’s high-tech industries expand. This segment requires significant technical expertise and investment in advanced manufacturing equipment, creating barriers to entry that protect established players. Innovation cycles in materials science continue to create new application opportunities and market segments.

Industrial ceramics serve critical functions in manufacturing and processing industries, with demand closely tied to industrial production levels and capital investment cycles. Refractory ceramics for high-temperature applications represent a specialized niche requiring technical expertise and customer-specific customization capabilities.

Manufacturers benefit from Israel’s strategic location providing access to European, Asian, and African markets through efficient logistics networks. The country’s high-tech ecosystem creates unique opportunities for advanced ceramic applications and technology development partnerships. Innovation support through government programs and academic institutions facilitates research and development activities, enhancing competitive positioning.

Suppliers and distributors gain from the market’s stability and growth trajectory, with diverse customer bases reducing concentration risk. Export opportunities provide revenue diversification and growth potential beyond domestic market limitations. Strong quality standards and brand recognition in international markets support premium pricing strategies.

End-users benefit from access to high-quality ceramic products meeting international standards while supporting local manufacturing capabilities. Customization options and technical support services provide added value, particularly for specialized applications requiring specific performance characteristics.

Investors find attractive opportunities in a market combining stability with growth potential, supported by strong fundamentals and export capabilities. Technology companies can leverage ceramic industry partnerships to develop innovative materials and applications, creating synergies with Israel’s broader high-tech ecosystem.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is reshaping Israel’s ceramic industry through adoption of advanced manufacturing technologies, including 3D printing, digital surface decoration, and automated quality control systems. Industry 4.0 implementation enables greater production flexibility, customization capabilities, and operational efficiency improvements across manufacturing operations.

Sustainability initiatives are gaining momentum as manufacturers implement eco-friendly production processes, develop recyclable ceramic products, and reduce energy consumption through technological improvements. Circular economy principles are being integrated into product design and manufacturing processes, creating competitive advantages in environmentally conscious markets.

Advanced material development continues driving innovation in technical ceramics, with new formulations offering enhanced performance characteristics for specialized applications. Nanotechnology integration enables development of ceramics with unique properties such as self-cleaning surfaces, antimicrobial functionality, and enhanced durability.

Customization demand is increasing across all market segments, with customers seeking personalized ceramic solutions tailored to specific applications and aesthetic preferences. Mass customization capabilities using digital manufacturing technologies enable efficient production of customized products without significant cost penalties.

Export market focus intensifies as manufacturers seek growth opportunities beyond domestic market limitations, with particular emphasis on premium product segments where Israeli ceramics can command competitive pricing despite higher production costs.

Technology partnerships between ceramic manufacturers and high-tech companies have accelerated development of advanced ceramic applications in electronics, medical devices, and aerospace sectors. Research collaborations with academic institutions continue to drive innovation in ceramic materials science and manufacturing processes.

Capacity expansion projects have been initiated by major manufacturers to meet growing demand and support export market development. Manufacturing modernization investments focus on automation, energy efficiency, and quality improvement to enhance competitive positioning in international markets.

Strategic acquisitions and partnerships have reshaped the competitive landscape, with companies seeking to expand capabilities, access new markets, and achieve operational synergies. International joint ventures facilitate technology transfer and market access, particularly in emerging markets where local partnerships provide strategic advantages.

Sustainability certifications and environmental compliance initiatives have become increasingly important for market access and competitive positioning. Green manufacturing investments demonstrate industry commitment to environmental responsibility while creating operational efficiencies and cost savings.

Digital marketing and e-commerce platforms have expanded market reach and customer engagement capabilities, particularly important for reaching international customers and niche market segments. MarkWide Research analysis indicates that digital transformation initiatives have improved customer acquisition and retention rates across the industry.

Strategic focus on advanced ceramics development should be prioritized given the segment’s high growth potential and alignment with Israel’s high-tech industry strengths. Investment allocation toward research and development capabilities will be crucial for maintaining technological leadership and competitive differentiation in premium market segments.

Export market diversification strategies should emphasize emerging markets where Israeli ceramic products can establish strong positions before competition intensifies. Market entry approaches should leverage Israel’s reputation for quality and innovation while addressing local market requirements and preferences.

Sustainability integration across all operations will become increasingly important for market access and competitive positioning. Environmental performance improvements should focus on energy efficiency, waste reduction, and sustainable raw material sourcing to meet evolving customer and regulatory requirements.

Digital transformation investments should prioritize manufacturing automation, quality control systems, and customer engagement platforms to enhance operational efficiency and market responsiveness. Technology adoption strategies should balance cost considerations with competitive advantages gained through advanced capabilities.

Partnership development with international distributors, technology companies, and research institutions can accelerate market expansion and innovation capabilities. Collaborative approaches should focus on creating mutual value while maintaining competitive advantages in core competency areas.

Long-term growth prospects for Israel’s ceramic market remain positive, supported by continued expansion in high-tech industries, ongoing construction activity, and increasing export market penetration. Market evolution is expected to favor companies with strong innovation capabilities, advanced manufacturing technologies, and effective international market strategies.

Advanced ceramics segment is projected to maintain the highest growth rates, with demand increasing approximately 12-15% annually as new applications emerge in electronics, medical devices, and aerospace sectors. MWR projections indicate that technical ceramics could represent up to 35% of total market value within the next five years, reflecting the segment’s premium positioning and growth potential.

Technology integration will continue reshaping industry operations, with smart manufacturing, artificial intelligence, and advanced materials science driving innovation and competitive differentiation. Sustainability requirements will become increasingly important for market access and customer acceptance, necessitating continued investment in environmental performance improvements.

Export market expansion is expected to accelerate, with international sales potentially representing 60% or more of total industry revenue as manufacturers successfully penetrate new geographic markets. Premium positioning strategies focusing on quality, innovation, and specialized applications will be crucial for maintaining competitiveness against low-cost producers.

Industry consolidation trends may continue as companies seek scale advantages and complementary capabilities through strategic partnerships and acquisitions. Market structure evolution will likely favor companies with strong financial resources, advanced technologies, and established international market presence.

Israel’s ceramic market demonstrates exceptional resilience and growth potential, positioning itself as a significant player in both regional and international ceramic industries. The market’s evolution from traditional pottery and construction ceramics to advanced technical applications reflects the industry’s adaptability and innovation capabilities. Strategic advantages including geographic location, high-tech integration, and quality reputation provide strong foundations for continued growth and market expansion.

Future success will depend on the industry’s ability to leverage technological capabilities, expand international market presence, and maintain competitive advantages in premium market segments. The growing importance of advanced ceramics in high-tech applications aligns perfectly with Israel’s broader economic strengths, creating synergies that support long-term sustainability and growth. Investment priorities should focus on innovation, sustainability, and international market development to capitalize on emerging opportunities while addressing competitive challenges.

Market participants who successfully navigate the evolving landscape through strategic positioning, technological advancement, and effective international expansion will be well-positioned to benefit from the sector’s continued growth and development. The Israel ceramic market represents a dynamic and promising industry segment with significant potential for value creation and competitive success in the global marketplace.

What is Ceramic?

Ceramic refers to a wide range of inorganic, non-metallic materials that are typically made from clay and other raw materials. These materials are known for their durability, heat resistance, and aesthetic appeal, making them suitable for various applications including pottery, tiles, and sanitary ware.

What are the key players in the Israel Ceramic Market?

Key players in the Israel Ceramic Market include companies such as Koor Industries, Ramat Gan Ceramics, and Hamat Group, which are known for their innovative designs and high-quality products. These companies compete in various segments such as tiles, tableware, and sanitary products, among others.

What are the growth factors driving the Israel Ceramic Market?

The Israel Ceramic Market is driven by factors such as increasing urbanization, rising demand for aesthetically pleasing interior designs, and the growth of the construction industry. Additionally, the trend towards sustainable building materials is also contributing to market expansion.

What challenges does the Israel Ceramic Market face?

Challenges in the Israel Ceramic Market include fluctuations in raw material prices, competition from alternative materials, and environmental regulations that impact production processes. These factors can affect profitability and operational efficiency for manufacturers.

What opportunities exist in the Israel Ceramic Market?

Opportunities in the Israel Ceramic Market include the growing demand for eco-friendly products and the potential for technological advancements in manufacturing processes. Additionally, expanding export markets for ceramic products present further growth avenues.

What trends are shaping the Israel Ceramic Market?

Trends in the Israel Ceramic Market include the increasing popularity of custom designs and the integration of smart technology in ceramic products. Furthermore, there is a rising interest in sustainable practices, leading to innovations in eco-friendly ceramics.

Israel Ceramic Market

| Segmentation Details | Description |

|---|---|

| Product Type | Floor Tiles, Wall Tiles, Porcelain, Stoneware |

| Application | Residential, Commercial, Industrial, Hospitality |

| End User | Contractors, Architects, Homeowners, Designers |

| Distribution Channel | Retail Stores, Online Sales, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Israel Ceramic Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at