444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Islamic finance is a rapidly growing sector within the global financial market. With its unique principles and values derived from Islamic law (Shariah), Islamic finance offers an alternative approach to conventional finance that adheres to ethical and moral standards. This market overview delves into the meaning, key insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, and more within the Islamic finance market.

Islamic finance refers to financial activities that comply with the principles of Shariah, the Islamic legal framework derived from the Quran and the teachings of the Prophet Muhammad. It prohibits the payment or receipt of interest (riba), speculation (gharar), and engagement in unethical or haram (forbidden) activities such as gambling, alcohol, and pork-related industries. Islamic finance operates on the principles of risk-sharing (mudarabah), profit and loss sharing (musharakah), and asset-backed transactions (ijara).

Executive Summary

The Islamic finance market has witnessed significant growth over the past decade, driven by increasing awareness among individuals and governments about the benefits of Islamic finance. This market offers a wide range of products and services, including Islamic banking, Islamic insurance (takaful), Islamic mutual funds, and sukuk (Islamic bonds). It has gained prominence not only in Muslim-majority countries but also in non-Muslim-majority regions, attracting both Islamic and non-Islamic investors.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Islamic finance market operates within a dynamic ecosystem influenced by various factors. These dynamics include changing regulatory landscapes, evolving customer preferences, technological advancements, global economic conditions, geopolitical factors, and environmental sustainability.

Regional Analysis

The Islamic finance market exhibits regional variations in terms of market size, maturity, regulatory frameworks, and cultural acceptance. Major regions contributing to the growth of Islamic finance include:

Each region has unique characteristics and offers distinct opportunities and challenges for market participants.

Competitive Landscape

Leading Companies in the Islamic Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

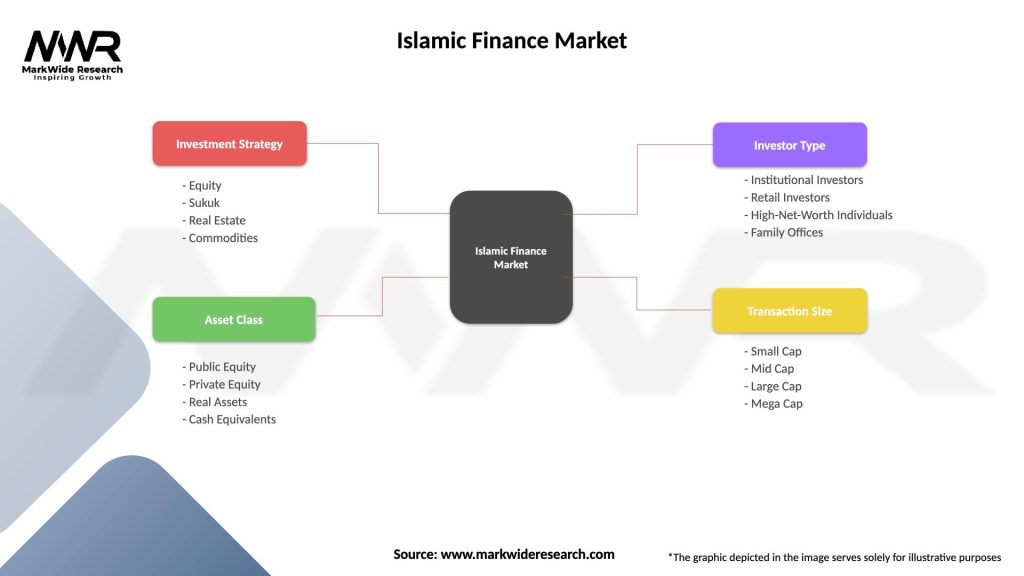

The Islamic finance market can be segmented based on the following factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had both short-term and long-term impacts on the Islamic finance market. In the short term, the market faced challenges due to economic disruptions, reduced consumer spending, and increased credit risk. However, the pandemic also highlighted the resilience and stability of Islamic finance, leading to increased interest in its ethical and sustainable features.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Islamic finance market looks promising, driven by factors such as increasing awareness, favorable regulatory environments, the growing Muslim population, and the demand for ethical and sustainable financial solutions. The market is expected to witness further expansion globally, with non-Muslim-majority regions playing a significant role in its growth. Technological innovations, the integration of ESG principles, and collaborations between Islamic and conventional financial institutions will shape the future landscape of Islamic finance.

Conclusion

The Islamic finance market represents a unique and rapidly growing sector within the global financial industry. With its adherence to ethical and moral principles derived from Shariah, Islamic finance offers an alternative financial system that appeals to a diverse range of individuals, businesses, and governments. The market’s future holds immense potential for growth, driven by increasing awareness, expanding product offerings, supportive regulatory frameworks, and the integration of technology. As the market evolves, it is crucial for industry participants, regulators, and stakeholders to work together to ensure standardization, education, and the continued development of ethical and sustainable financial solutions.

What is Islamic Finance?

Islamic Finance refers to financial activities that comply with Islamic law (Sharia). It prohibits interest (riba) and promotes risk-sharing, ethical investments, and social justice, making it distinct from conventional finance.

What are the key players in the Islamic Finance Market?

Key players in the Islamic Finance Market include institutions like Al Baraka Banking Group, Dubai Islamic Bank, and Qatar Islamic Bank, which offer Sharia-compliant financial products and services, among others.

What are the growth factors driving the Islamic Finance Market?

The Islamic Finance Market is driven by increasing demand for ethical investment options, the growth of Muslim populations seeking compliant financial services, and the expansion of Islamic banking products in non-Muslim countries.

What challenges does the Islamic Finance Market face?

Challenges in the Islamic Finance Market include a lack of standardization in Sharia compliance, limited awareness among potential customers, and competition from conventional financial institutions that may offer more familiar products.

What opportunities exist in the Islamic Finance Market?

Opportunities in the Islamic Finance Market include the potential for growth in emerging markets, the development of innovative financial products tailored to diverse consumer needs, and increasing collaboration between Islamic and conventional financial institutions.

What trends are shaping the Islamic Finance Market?

Trends in the Islamic Finance Market include the rise of fintech solutions offering Sharia-compliant services, increased focus on sustainable and socially responsible investing, and the growing integration of Islamic finance principles in global financial markets.

Islamic Finance Market

| Segmentation Details | Description |

|---|---|

| Investment Strategy | Equity, Sukuk, Real Estate, Commodities |

| Asset Class | Public Equity, Private Equity, Real Assets, Cash Equivalents |

| Investor Type | Institutional Investors, Retail Investors, High-Net-Worth Individuals, Family Offices |

| Transaction Size | Small Cap, Mid Cap, Large Cap, Mega Cap |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Islamic Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at