444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Ireland telecom market represents one of Europe’s most dynamic and technologically advanced telecommunications ecosystems, characterized by robust infrastructure development and exceptional digital connectivity. Ireland’s telecommunications sector has emerged as a cornerstone of the country’s digital economy, supporting everything from multinational corporations to local businesses with cutting-edge communication solutions. The market demonstrates remarkable resilience and growth potential, driven by increasing demand for high-speed internet services, mobile connectivity, and enterprise-grade telecommunications solutions.

Market dynamics indicate sustained expansion across multiple segments, with the sector experiencing a compound annual growth rate (CAGR) of 4.2% over recent years. This growth trajectory reflects Ireland’s strategic position as a European technology hub and its commitment to digital infrastructure modernization. The telecommunications landscape encompasses traditional fixed-line services, mobile communications, broadband internet, and emerging technologies such as 5G networks and Internet of Things (IoT) connectivity.

Infrastructure investment continues to drive market evolution, with telecommunications providers investing heavily in fiber-optic networks, 5G deployment, and network modernization initiatives. The market benefits from strong regulatory support, competitive pricing structures, and increasing consumer adoption of digital services. Enterprise customers represent a significant growth driver, as businesses increasingly rely on sophisticated telecommunications solutions to support remote work, cloud computing, and digital transformation initiatives.

The Ireland telecom market refers to the comprehensive ecosystem of telecommunications services, infrastructure, and technologies operating within the Republic of Ireland, encompassing mobile communications, fixed-line services, broadband internet, data transmission, and emerging digital connectivity solutions that serve residential, business, and government customers across the nation.

Telecommunications services in Ireland include voice communications through traditional landlines and mobile networks, high-speed internet access via fiber-optic and wireless technologies, data transmission services for businesses, and specialized solutions such as cloud connectivity and managed network services. The market encompasses both infrastructure providers who build and maintain the physical networks and service providers who deliver telecommunications solutions to end users.

Market participants range from established international telecommunications giants to innovative local service providers, creating a competitive landscape that drives innovation and service quality improvements. The sector includes network operators, mobile virtual network operators (MVNOs), internet service providers (ISPs), and specialized telecommunications solution providers serving various market segments.

Ireland’s telecommunications market stands as a testament to the country’s commitment to digital excellence and technological advancement. The sector has evolved from traditional voice-centric services to a comprehensive digital ecosystem supporting Ireland’s position as a leading European technology destination. Market growth is primarily driven by increasing demand for high-speed broadband services, mobile data consumption, and enterprise telecommunications solutions.

Key market segments demonstrate varying growth patterns, with mobile services maintaining strong momentum due to smartphone adoption and data usage increases. Fixed broadband services continue expanding as fiber-optic infrastructure deployment accelerates across urban and rural areas. Enterprise services represent a particularly lucrative segment, with businesses investing in advanced telecommunications solutions to support digital transformation initiatives.

Competitive dynamics feature both established operators and emerging service providers competing across price, service quality, and innovation dimensions. The market benefits from regulatory frameworks that promote competition while ensuring service quality and consumer protection. Technology adoption rates remain high, with Irish consumers and businesses demonstrating strong appetite for advanced telecommunications services and emerging technologies.

Strategic market insights reveal several critical trends shaping Ireland’s telecommunications landscape. The sector demonstrates remarkable adaptability to changing consumer preferences and technological advancements, positioning Ireland as a leader in European telecommunications innovation.

Primary market drivers propelling Ireland’s telecommunications sector forward include technological advancement, changing consumer behavior, and supportive regulatory environments. These factors create a favorable ecosystem for sustained market growth and innovation.

Digital transformation initiatives across Irish businesses drive significant demand for advanced telecommunications services. Companies require reliable, high-speed connectivity to support cloud computing, remote work arrangements, and digital collaboration tools. This enterprise demand creates substantial revenue opportunities for telecommunications providers offering sophisticated business solutions.

Consumer lifestyle changes significantly impact market dynamics, with Irish households consuming increasing amounts of digital content through streaming services, online gaming, and social media platforms. The average household data consumption increased by 35% over recent years, driving demand for higher-capacity broadband services and unlimited mobile data plans.

Government policy support through national broadband initiatives and digital strategy frameworks creates favorable conditions for market expansion. Public investment in telecommunications infrastructure, particularly in rural areas, complements private sector investments and ensures comprehensive national coverage.

Technological innovation continues driving market evolution, with 5G networks, fiber-optic infrastructure, and emerging technologies creating new service opportunities. These technological advances enable telecommunications providers to offer enhanced services while improving operational efficiency and customer experience.

Market challenges facing Ireland’s telecommunications sector include infrastructure investment requirements, regulatory compliance costs, and competitive pricing pressures that can impact profitability and growth potential.

Infrastructure deployment costs represent significant financial challenges, particularly for fiber-optic network expansion and 5G rollout initiatives. The substantial capital investments required for network modernization can strain operator resources and impact short-term profitability, especially for smaller service providers competing against well-funded international operators.

Regulatory compliance requirements create operational complexities and additional costs for telecommunications providers. Data protection regulations, network security standards, and consumer protection requirements necessitate ongoing investments in compliance systems and processes, potentially limiting resources available for network expansion and service innovation.

Market saturation in certain segments, particularly mobile services, creates challenges for customer acquisition and revenue growth. With high penetration rates across most demographic segments, operators must focus on customer retention and value-added services rather than simple subscriber growth strategies.

Competitive pricing pressures from multiple service providers can compress profit margins and limit investment capacity. Price competition, while beneficial for consumers, can challenge operator sustainability and their ability to fund necessary infrastructure investments and service improvements.

Emerging opportunities within Ireland’s telecommunications market present significant potential for growth and innovation, driven by technological advancement and evolving customer needs across residential and business segments.

5G network deployment creates substantial opportunities for service differentiation and revenue generation. Advanced mobile networks enable new applications including augmented reality, autonomous vehicles, and industrial IoT solutions, opening previously unavailable market segments for telecommunications providers.

Enterprise cloud connectivity represents a rapidly expanding opportunity as Irish businesses accelerate digital transformation initiatives. Companies require sophisticated networking solutions to connect distributed workforces, support cloud applications, and enable secure data transmission, creating demand for managed services and premium connectivity solutions.

Rural broadband expansion through government-supported initiatives presents opportunities for infrastructure investment and service provision in previously underserved areas. The National Broadband Plan creates structured opportunities for telecommunications providers to expand their coverage footprint while supporting national digital inclusion objectives.

Smart city initiatives across Irish municipalities create demand for specialized telecommunications infrastructure supporting traffic management, environmental monitoring, and public safety systems. These applications require reliable, low-latency connectivity solutions that telecommunications providers can deliver through advanced network technologies.

Market dynamics within Ireland’s telecommunications sector reflect the interplay between technological innovation, competitive forces, regulatory frameworks, and evolving customer expectations. These dynamics create a complex but opportunity-rich environment for market participants.

Competitive intensity remains high across all market segments, with established operators, new entrants, and international players competing for market share. This competition drives continuous service improvement, pricing optimization, and innovation in service delivery, ultimately benefiting consumers and business customers through enhanced value propositions.

Technology convergence blurs traditional boundaries between telecommunications, media, and technology services. Operators increasingly offer bundled solutions combining connectivity, content, and cloud services, creating new revenue streams while addressing comprehensive customer needs through integrated service portfolios.

Customer expectations continue evolving toward higher service quality, faster speeds, and more comprehensive solutions. Irish consumers and businesses expect reliable, high-performance connectivity that supports their digital lifestyles and business operations, driving continuous network investment and service enhancement initiatives.

Regulatory evolution adapts to technological changes and market developments, balancing competition promotion with consumer protection and infrastructure investment incentives. According to MarkWide Research analysis, regulatory frameworks increasingly focus on enabling innovation while ensuring fair competition and service quality standards.

Comprehensive research methodology employed in analyzing Ireland’s telecommunications market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research activities include structured interviews with telecommunications industry executives, regulatory officials, and key stakeholders across the Irish market. These interviews provide firsthand insights into market trends, competitive dynamics, and strategic priorities shaping sector development.

Secondary research analysis encompasses examination of industry reports, regulatory filings, financial statements, and market data from telecommunications operators and industry associations. This analysis provides quantitative foundations for market size estimations, growth projections, and competitive positioning assessments.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop robust market forecasts and identify key growth drivers. These methodologies account for various market variables including technological adoption rates, regulatory changes, and economic factors affecting telecommunications demand.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and sensitivity analysis of key assumptions. This rigorous approach provides confidence in market insights and recommendations for industry stakeholders.

Regional market dynamics within Ireland demonstrate distinct characteristics based on population density, economic activity, and infrastructure development patterns. Understanding these regional variations provides crucial insights for telecommunications providers developing targeted service strategies.

Dublin metropolitan area represents the largest telecommunications market concentration, accounting for approximately 42% of national market activity. The capital region demonstrates high demand for advanced business services, premium residential connectivity, and emerging technologies such as 5G networks. Dense population and business concentration create favorable economics for infrastructure investment and service innovation.

Cork and southern regions show strong growth potential driven by expanding technology sector presence and increasing business activity. The region benefits from significant multinational corporation presence, creating demand for enterprise-grade telecommunications solutions and supporting infrastructure development initiatives.

Western and rural regions present unique challenges and opportunities related to geographic dispersion and lower population density. Government broadband initiatives specifically target these areas, creating structured opportunities for telecommunications providers while addressing national digital inclusion objectives. Rural connectivity adoption rates have increased by 23% annually as infrastructure availability improves.

Northern regions benefit from cross-border connectivity opportunities and proximity to Northern Ireland markets. These areas demonstrate growing demand for business services as companies establish operations to serve both Irish and UK markets through strategic geographic positioning.

Competitive landscape within Ireland’s telecommunications market features a diverse mix of established operators, innovative service providers, and specialized solution companies competing across multiple service segments and customer categories.

Market competition drives continuous innovation in service delivery, pricing strategies, and customer experience enhancement. Operators differentiate through network quality, customer service, pricing models, and value-added services, creating dynamic competitive environment that benefits consumers and business customers.

Market segmentation within Ireland’s telecommunications sector reflects diverse customer needs, service requirements, and technology preferences across residential, business, and specialized application categories.

By Service Type:

By Customer Segment:

By Technology:

Mobile services category demonstrates the strongest growth momentum within Ireland’s telecommunications market, driven by increasing smartphone adoption and mobile data consumption. Mobile data traffic continues expanding at annual rates exceeding 25%, reflecting consumer preference for mobile-first digital experiences and applications.

Fixed broadband services show steady growth supported by fiber infrastructure expansion and increasing household internet usage. Work-from-home trends and streaming service adoption drive demand for higher-speed connections, with fiber broadband adoption reaching 67% in urban areas where infrastructure is available.

Enterprise telecommunications represents the highest-value market category, with businesses investing in advanced networking solutions to support digital transformation initiatives. Cloud connectivity, managed services, and cybersecurity solutions command premium pricing while delivering substantial value to business customers.

Emerging technology services including IoT connectivity, edge computing, and 5G applications create new revenue opportunities for telecommunications providers. These specialized services often command higher margins while positioning operators for future market expansion as technology adoption accelerates.

Telecommunications operators benefit from Ireland’s favorable market conditions including supportive regulatory frameworks, strong economic growth, and high technology adoption rates. These factors create sustainable revenue opportunities while supporting long-term business development and infrastructure investment strategies.

Technology vendors and equipment suppliers gain access to a sophisticated market that values innovation and quality, creating opportunities for advanced product deployment and partnership development. Ireland’s position as a European technology hub provides strategic advantages for companies seeking to establish regional presence.

Enterprise customers benefit from competitive telecommunications markets that drive service innovation, pricing optimization, and quality improvements. Businesses can access world-class connectivity solutions that support their operational requirements and strategic objectives while benefiting from competitive pricing structures.

Consumers enjoy high-quality telecommunications services at competitive prices, with multiple provider options and comprehensive service coverage across urban and rural areas. Government initiatives ensure service availability while market competition drives continuous improvement in service quality and customer experience.

Government and public sector organizations benefit from robust telecommunications infrastructure that supports economic development, digital government initiatives, and public service delivery. Strong telecommunications capabilities enhance Ireland’s competitiveness as a business destination and support national digital strategy objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital convergence represents a fundamental trend reshaping Ireland’s telecommunications landscape, with operators expanding beyond traditional connectivity services to offer integrated digital solutions. This convergence creates new revenue opportunities while requiring significant strategic and operational adaptations.

5G network deployment accelerates across major Irish cities, enabling advanced applications including augmented reality, autonomous systems, and industrial IoT solutions. 5G coverage expansion reaches 78% of urban areas, supporting new service categories and enhanced customer experiences.

Sustainability initiatives gain prominence as telecommunications operators invest in energy-efficient technologies and renewable energy sources. Environmental considerations increasingly influence network design decisions and operational strategies, reflecting growing corporate and consumer environmental awareness.

Edge computing integration with telecommunications networks enables low-latency applications and improved service performance. This trend creates opportunities for operators to offer value-added services while supporting emerging technologies requiring distributed computing capabilities.

Artificial intelligence adoption transforms network operations, customer service, and service optimization processes. AI technologies enable predictive maintenance, automated customer support, and personalized service recommendations, improving operational efficiency while enhancing customer satisfaction.

National Broadband Plan implementation continues progressing with significant infrastructure investments targeting rural and underserved areas. This government-led initiative creates structured opportunities for telecommunications providers while addressing national digital inclusion objectives through comprehensive coverage expansion.

5G spectrum allocation and network deployment initiatives enable advanced mobile services across Ireland’s major population centers. Operators invest substantially in next-generation infrastructure while developing new service categories that leverage enhanced network capabilities.

Fiber infrastructure expansion accelerates through both private investment and public-private partnerships, targeting comprehensive national coverage. These initiatives support high-speed broadband availability while creating competitive advantages for participating telecommunications providers.

Cybersecurity framework enhancement addresses growing security concerns through improved network protection measures and customer data safeguards. Industry collaboration with government agencies strengthens overall telecommunications security while maintaining service reliability and customer trust.

International connectivity improvements through submarine cable investments and enhanced European network connections support Ireland’s position as a digital gateway between Europe and North America. These infrastructure developments benefit both domestic and international telecommunications services.

Strategic recommendations for telecommunications operators in Ireland emphasize the importance of balanced investment strategies that address both infrastructure modernization and service innovation requirements. MWR analysis suggests operators should prioritize 5G deployment in high-value markets while maintaining comprehensive 4G coverage across all service areas.

Customer experience enhancement should remain a primary focus area, with operators investing in digital customer service platforms, personalized service offerings, and proactive network management systems. Superior customer experience increasingly differentiates successful operators in competitive markets.

Enterprise market development presents significant opportunities for revenue growth and margin improvement. Operators should develop comprehensive business service portfolios including cloud connectivity, managed services, and cybersecurity solutions that address evolving enterprise requirements.

Partnership strategies with technology companies, content providers, and application developers can create new revenue streams while enhancing service value propositions. Strategic alliances enable operators to offer comprehensive solutions without requiring extensive internal development investments.

Rural market expansion through government broadband initiatives should be pursued strategically, balancing infrastructure investment requirements with long-term revenue potential. Successful rural expansion can create competitive advantages while supporting national digital inclusion objectives.

Future market prospects for Ireland’s telecommunications sector remain highly positive, supported by continued technology advancement, strong economic fundamentals, and favorable regulatory environments. The market is projected to maintain steady growth with annual expansion rates of 4.5% over the medium term.

Technology evolution will continue driving market transformation, with 5G networks, fiber infrastructure, and emerging technologies creating new service opportunities and revenue streams. MarkWide Research projects that advanced technology adoption will accelerate, with 5G penetration reaching 85% of the addressable market within five years.

Enterprise digital transformation will remain a key growth driver, with businesses increasing telecommunications spending to support cloud computing, remote work, and digital collaboration requirements. This trend creates sustainable revenue opportunities for operators offering sophisticated business solutions.

Rural connectivity expansion through government initiatives will continue improving national coverage while creating new market opportunities. Comprehensive broadband availability will support economic development in rural areas while expanding the addressable market for telecommunications providers.

Emerging applications including IoT, smart cities, and autonomous systems will create demand for specialized connectivity solutions and network capabilities. These applications represent significant long-term growth opportunities for operators investing in advanced network technologies and service capabilities.

Ireland’s telecommunications market stands as a dynamic and opportunity-rich sector characterized by strong fundamentals, competitive dynamics, and favorable growth prospects. The market benefits from advanced infrastructure, supportive regulatory frameworks, and high technology adoption rates that create sustainable competitive advantages for both operators and the broader Irish economy.

Strategic market positioning requires telecommunications providers to balance traditional service excellence with innovation in emerging technologies and service categories. Success in this market depends on understanding evolving customer needs, investing appropriately in infrastructure modernization, and developing comprehensive service portfolios that address diverse market requirements.

Future success in Ireland’s telecommunications market will be determined by operators’ ability to adapt to technological change, deliver superior customer experiences, and capitalize on emerging opportunities in enterprise services, 5G applications, and digital transformation support. The market’s continued evolution presents substantial opportunities for well-positioned participants committed to innovation and service excellence.

What is Telecom?

Telecom refers to the transmission of information over significant distances by electronic means. It encompasses various services such as telephone, internet, and broadcasting, which are essential for communication in both personal and business contexts.

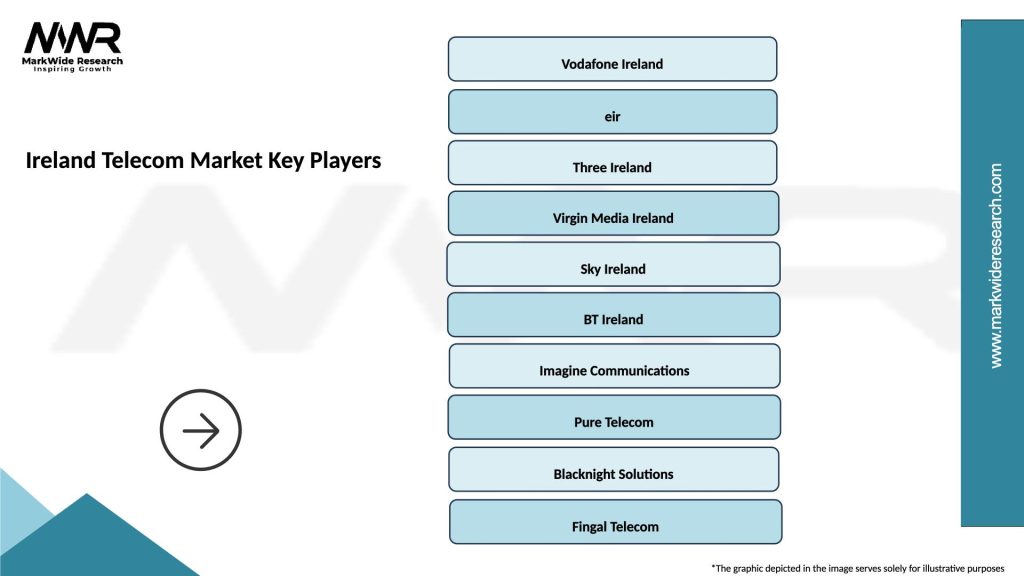

What are the key players in the Ireland Telecom Market?

Key players in the Ireland Telecom Market include Eir, Vodafone Ireland, and Three Ireland, which provide a range of services from mobile and fixed-line telephony to broadband and digital television, among others.

What are the growth factors driving the Ireland Telecom Market?

The growth of the Ireland Telecom Market is driven by increasing demand for high-speed internet, the expansion of mobile services, and the rise of digital content consumption. Additionally, advancements in technology such as 5G are also contributing to market growth.

What challenges does the Ireland Telecom Market face?

The Ireland Telecom Market faces challenges such as regulatory pressures, competition among service providers, and the need for continuous investment in infrastructure. These factors can impact service quality and pricing strategies.

What opportunities exist in the Ireland Telecom Market?

Opportunities in the Ireland Telecom Market include the potential for growth in IoT services, the expansion of fiber-optic networks, and the increasing adoption of cloud-based solutions. These trends can enhance connectivity and service offerings.

What trends are shaping the Ireland Telecom Market?

Trends shaping the Ireland Telecom Market include the shift towards mobile-first services, the integration of artificial intelligence in customer service, and the growing emphasis on cybersecurity. These trends are influencing how telecom companies operate and engage with customers.

Ireland Telecom Market

| Segmentation Details | Description |

|---|---|

| Service Type | Mobile, Fixed Line, Broadband, VoIP |

| Customer Type | Residential, Business, Government, Educational |

| Technology | 5G, Fiber Optic, DSL, Satellite |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Ireland Telecom Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at