444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Ireland data center power market represents a critical infrastructure segment experiencing unprecedented growth driven by digital transformation initiatives and increasing cloud adoption across Europe. Ireland’s strategic position as a gateway to European markets has attracted major technology companies to establish significant data center operations, creating substantial demand for reliable power solutions. The market encompasses various power infrastructure components including uninterruptible power supplies (UPS), backup generators, power distribution units (PDUs), and advanced power management systems.

Market dynamics indicate robust expansion with the sector experiencing a compound annual growth rate of 12.5% as organizations prioritize digital infrastructure investments. The increasing deployment of hyperscale data centers by global technology giants has fundamentally transformed Ireland’s power infrastructure landscape. Dublin region continues to dominate the market, accounting for approximately 75% of total data center power installations, while emerging locations like Cork and Limerick are gaining traction.

Sustainability initiatives are reshaping market priorities, with renewable energy integration becoming a key differentiator for data center operators. The Irish government’s commitment to carbon neutrality by 2050 has accelerated adoption of green power solutions, driving innovation in energy-efficient technologies and renewable energy sourcing strategies.

The Ireland data center power market refers to the comprehensive ecosystem of electrical infrastructure, power management systems, and energy solutions specifically designed to support data center operations across the Republic of Ireland. This market encompasses all power-related components and services required to ensure continuous, reliable, and efficient electrical supply to data processing facilities.

Core components include primary power distribution systems, backup power generation equipment, uninterruptible power supplies, power conditioning equipment, monitoring systems, and energy management software. The market also covers associated services such as installation, maintenance, monitoring, and optimization of power infrastructure to meet the demanding requirements of modern data centers.

Strategic importance extends beyond technical specifications to encompass regulatory compliance, environmental sustainability, and operational efficiency considerations that define Ireland’s position as a leading European data center hub.

Ireland’s data center power market has emerged as a cornerstone of the country’s digital economy, supported by favorable regulatory frameworks, strategic geographic positioning, and robust telecommunications infrastructure. The market demonstrates exceptional resilience and growth potential, driven by increasing digitalization across industries and Ireland’s role as a European technology hub.

Key market drivers include the expansion of cloud services, growing demand for edge computing solutions, and increasing focus on data sovereignty requirements. Major international technology companies have established significant operations in Ireland, creating a multiplier effect that drives demand for sophisticated power infrastructure solutions. Energy efficiency improvements of up to 35% efficiency gains through advanced power management systems are becoming standard expectations.

Market challenges center around grid capacity constraints, regulatory compliance requirements, and the need to balance rapid growth with environmental sustainability objectives. However, these challenges are driving innovation in power technologies and creating opportunities for specialized solution providers to develop cutting-edge infrastructure solutions.

Strategic market insights reveal several critical trends shaping the Ireland data center power landscape:

Digital transformation acceleration represents the primary driver of Ireland’s data center power market expansion. Organizations across all sectors are migrating critical workloads to cloud platforms, creating sustained demand for reliable data center infrastructure. The shift toward remote work models and digital service delivery has intensified requirements for robust, scalable power solutions.

Ireland’s strategic advantages as a European data center hub continue to attract international investment. The country’s stable political environment, favorable tax policies, skilled workforce, and excellent connectivity to both European and North American markets make it an ideal location for data center operations. Government support initiatives have facilitated infrastructure development and streamlined regulatory processes.

Cloud service expansion by major technology providers is driving demand for hyperscale data center facilities requiring sophisticated power infrastructure. The growing adoption of artificial intelligence, machine learning, and big data analytics applications is increasing computational requirements and corresponding power demands. Edge computing deployment is creating additional market opportunities for distributed power solutions.

Regulatory compliance requirements related to data protection, financial services, and healthcare are driving demand for locally-hosted data processing capabilities. Ireland’s membership in the European Union provides regulatory alignment that appeals to multinational organizations seeking compliant data center solutions.

Grid capacity limitations represent a significant constraint on market expansion, particularly in high-demand regions like Dublin. The existing electrical infrastructure requires substantial upgrades to support large-scale data center deployments, creating potential bottlenecks for rapid market growth. Planning permission processes for new electrical infrastructure can extend project timelines and increase development costs.

Environmental concerns regarding energy consumption and carbon emissions are creating regulatory pressures that may limit certain types of data center developments. Local communities and environmental groups are increasingly scrutinizing large-scale data center projects, potentially affecting approval processes and operational requirements.

Skilled workforce shortages in specialized power engineering and data center operations are constraining market growth. The rapid expansion of the sector has created competition for qualified professionals, driving up labor costs and potentially limiting the pace of new project implementations.

Capital investment requirements for advanced power infrastructure represent substantial financial commitments that may limit market participation to well-funded organizations. The complexity of modern data center power systems requires significant upfront investment and ongoing maintenance expenditures.

Renewable energy integration presents substantial opportunities for innovative power solution providers. Ireland’s abundant wind and solar resources, combined with government incentives for renewable energy adoption, create favorable conditions for sustainable data center power solutions. Energy storage technologies are becoming increasingly viable for grid stabilization and backup power applications.

Edge computing expansion is creating demand for distributed power infrastructure across multiple locations throughout Ireland. This trend opens opportunities for modular, standardized power solutions that can be deployed rapidly in smaller facilities. 5G network deployment will drive additional edge computing requirements and corresponding power infrastructure needs.

Artificial intelligence and machine learning applications are driving demand for high-performance computing infrastructure with specialized power requirements. These applications often require consistent, high-quality power delivery to support intensive computational workloads.

International expansion by Irish data center operators into other European markets creates opportunities for power solution providers to expand their geographic reach. The expertise developed in the Irish market can be leveraged to support similar projects across Europe.

Supply chain dynamics in the Ireland data center power market are characterized by a mix of international suppliers and local service providers. Global manufacturers of power equipment maintain strong presence through local distributors and service partners, while specialized installation and maintenance services are typically provided by Irish companies with deep local market knowledge.

Technology evolution is driving rapid changes in power infrastructure requirements. Advanced power management systems incorporating artificial intelligence and machine learning capabilities are improving efficiency and reliability while reducing operational costs. Efficiency improvements of up to 25% reduction in power consumption are being achieved through intelligent power management systems.

Competitive dynamics are intensifying as market growth attracts new entrants and existing players expand their capabilities. Companies are differentiating through specialized expertise, innovative solutions, and comprehensive service offerings that address the full lifecycle of data center power infrastructure.

Customer requirements are becoming increasingly sophisticated, with emphasis on sustainability, efficiency, reliability, and scalability. Data center operators are seeking integrated solutions that can adapt to changing requirements while maintaining optimal performance and compliance with evolving regulations.

Comprehensive market analysis for the Ireland data center power market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry stakeholders, including data center operators, power solution providers, utility companies, and regulatory officials.

Secondary research encompasses analysis of industry reports, government publications, regulatory filings, and company financial statements. Market data is cross-referenced across multiple sources to validate findings and identify emerging trends. MarkWide Research utilizes proprietary analytical frameworks to assess market dynamics and competitive positioning.

Quantitative analysis includes statistical modeling of market trends, growth projections, and segment performance. Data validation processes ensure consistency and accuracy across all research findings. Market sizing and forecasting methodologies incorporate multiple scenarios to account for various market development possibilities.

Expert consultation with industry specialists provides additional insights into technical developments, regulatory changes, and market dynamics. This qualitative input enhances the analytical framework and provides context for quantitative findings.

Dublin region dominates the Ireland data center power market, representing approximately 75% of total market activity. The concentration of international technology companies, excellent connectivity infrastructure, and proximity to financial services create strong demand for sophisticated power solutions. However, grid capacity constraints and planning restrictions are driving some development to alternative locations.

Cork region is emerging as a significant secondary market, accounting for approximately 15% of market share. The area offers advantages including lower land costs, available grid capacity, and government incentives for regional development. Several major data center projects are under development, creating opportunities for power infrastructure providers.

Other regions including Limerick, Galway, and Waterford represent the remaining 10% of market activity but show strong growth potential. These locations offer advantages for edge computing applications and distributed data center architectures. Government initiatives to promote regional development are supporting infrastructure investments in these areas.

Rural areas are gaining attention for large-scale data center developments due to land availability and renewable energy resources. However, grid infrastructure limitations may require substantial utility investments to support major projects.

Market leadership in Ireland’s data center power sector is characterized by a combination of global technology providers and specialized local service companies. The competitive environment emphasizes technical expertise, service quality, and ability to deliver complex integrated solutions.

Local service providers play crucial roles in installation, commissioning, and ongoing maintenance of power infrastructure. These companies often partner with international manufacturers to deliver comprehensive solutions tailored to Irish market requirements.

By Component:

By Data Center Type:

By Power Rating:

Uninterruptible Power Supplies represent the largest segment of the Ireland data center power market, driven by critical uptime requirements and increasing power quality concerns. Modern UPS systems incorporate advanced battery technologies, intelligent monitoring capabilities, and modular designs that support scalable deployments. Lithium-ion battery adoption is growing rapidly, offering 50% longer lifespan compared to traditional lead-acid solutions.

Backup power generation continues to evolve with increasing focus on environmental compliance and fuel efficiency. Natural gas generators are gaining popularity due to lower emissions and reduced maintenance requirements compared to diesel alternatives. Hybrid power systems combining renewable energy sources with traditional backup generation are becoming more common.

Power distribution infrastructure is becoming increasingly intelligent, with smart PDUs providing detailed monitoring and control capabilities at the rack level. These systems enable precise power allocation, energy efficiency optimization, and predictive maintenance scheduling. Intelligent power management can achieve 15-20% efficiency improvements through optimized load balancing and power factor correction.

Monitoring and management systems are evolving to incorporate artificial intelligence and machine learning capabilities. These advanced systems can predict equipment failures, optimize power distribution, and automatically adjust system parameters to maintain optimal efficiency and reliability.

Data center operators benefit from improved reliability, efficiency, and scalability through advanced power infrastructure solutions. Modern power systems provide enhanced monitoring capabilities, predictive maintenance features, and automated optimization that reduce operational costs while improving service quality. Operational cost reductions of up to 30% decrease in maintenance expenses are achievable through intelligent power management systems.

Technology companies gain competitive advantages through reliable, scalable power infrastructure that supports rapid business growth and changing computational requirements. Advanced power solutions enable higher density deployments, improved energy efficiency, and enhanced sustainability credentials that appeal to environmentally conscious customers.

Power solution providers benefit from growing market demand, opportunities for innovation, and long-term service relationships with data center operators. The complexity of modern data center power requirements creates opportunities for specialized expertise and value-added services.

Government and regulatory bodies benefit from increased economic activity, job creation, and enhanced digital infrastructure that supports broader economic development objectives. The data center sector contributes significantly to Ireland’s position as a European technology hub.

Utility companies benefit from increased electricity demand and opportunities to develop specialized services for data center customers. However, they also face challenges related to grid capacity and the need for infrastructure investments to support large-scale data center deployments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration is becoming a defining trend in Ireland’s data center power market. Organizations are increasingly prioritizing renewable energy sourcing, energy efficiency optimization, and carbon footprint reduction. Green power adoption rates are increasing by approximately 40% annually as companies respond to environmental regulations and corporate sustainability commitments.

Edge computing proliferation is driving demand for distributed power infrastructure across multiple locations. This trend requires standardized, modular power solutions that can be deployed rapidly in smaller facilities while maintaining reliability and efficiency standards established in larger data centers.

Artificial intelligence integration in power management systems is improving operational efficiency and predictive maintenance capabilities. AI-powered systems can optimize power distribution, predict equipment failures, and automatically adjust system parameters to maintain optimal performance.

Modular infrastructure approaches are gaining popularity due to their flexibility, scalability, and reduced deployment times. Prefabricated power modules can be manufactured off-site and installed quickly, reducing construction timelines and improving quality control.

Energy storage integration is becoming more common as battery technologies improve and costs decrease. Energy storage systems provide grid stabilization, peak shaving capabilities, and enhanced backup power options that complement traditional generator systems.

Major infrastructure investments by international technology companies continue to drive market expansion. Recent announcements of significant data center projects demonstrate continued confidence in Ireland’s market potential and infrastructure capabilities.

Grid modernization initiatives by Irish utility companies are addressing capacity constraints and improving power quality for data center applications. These investments include smart grid technologies, renewable energy integration, and enhanced monitoring systems.

Regulatory framework evolution is providing clearer guidelines for data center development while addressing environmental concerns. New policies balance economic development objectives with sustainability requirements and community interests.

Technology partnerships between power solution providers and data center operators are driving innovation in integrated infrastructure solutions. These collaborations focus on improving efficiency, reliability, and sustainability while reducing total cost of ownership.

Workforce development programs are addressing skills shortages in data center operations and power engineering. Educational institutions and industry organizations are collaborating to develop specialized training programs that meet market requirements.

MarkWide Research recommends that market participants focus on developing comprehensive sustainability strategies that address both regulatory requirements and customer expectations. Companies should invest in renewable energy integration capabilities and energy efficiency optimization technologies to maintain competitive positioning.

Strategic partnerships between power solution providers and data center operators should be prioritized to develop integrated solutions that address evolving market requirements. These relationships can drive innovation while ensuring solutions meet specific operational needs and performance standards.

Geographic diversification beyond the Dublin region should be considered to capitalize on emerging opportunities in Cork, Limerick, and other locations. Early market entry in developing regions can provide competitive advantages and access to available grid capacity.

Technology investment in artificial intelligence, machine learning, and IoT-enabled power management systems will be critical for maintaining competitive differentiation. These technologies can provide significant value through improved efficiency, reliability, and predictive maintenance capabilities.

Regulatory engagement with government agencies and industry organizations is essential for staying informed about policy developments and contributing to regulatory framework evolution. Active participation in industry discussions can help shape favorable market conditions.

Long-term market prospects for Ireland’s data center power market remain exceptionally positive, driven by continued digitalization, cloud adoption, and Ireland’s strategic position in the European technology landscape. MWR analysis projects sustained growth momentum with increasing sophistication in power infrastructure requirements and solutions.

Technology evolution will continue to drive market transformation, with artificial intelligence, edge computing, and renewable energy integration becoming standard requirements rather than differentiating features. Power solution providers must adapt to these changing requirements while maintaining reliability and cost-effectiveness.

Sustainability requirements will become increasingly stringent, driving innovation in renewable energy integration, energy efficiency optimization, and carbon footprint reduction. Companies that successfully address these requirements will gain significant competitive advantages in the evolving market landscape.

Market expansion beyond traditional data center applications into edge computing, 5G infrastructure, and emerging technologies will create new opportunities for power solution providers. These applications may require different approaches to power infrastructure design and deployment.

Regional development outside Dublin will accelerate as grid capacity constraints and planning restrictions drive investment to alternative locations. This geographic diversification will create opportunities for companies that can adapt their solutions to different market conditions and requirements.

Ireland’s data center power market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by digital transformation, cloud adoption, and the country’s strategic advantages as a European technology hub. The market demonstrates remarkable resilience and adaptability, successfully addressing challenges related to grid capacity, environmental sustainability, and evolving customer requirements.

Key success factors for market participants include technological innovation, sustainability integration, strategic partnerships, and geographic diversification. Companies that can effectively address these priorities while maintaining focus on reliability, efficiency, and cost-effectiveness will be well-positioned to capitalize on market opportunities.

Future market development will be characterized by increasing sophistication in power infrastructure requirements, growing emphasis on sustainability and renewable energy integration, and expansion into new applications including edge computing and 5G infrastructure. The market’s evolution will continue to be shaped by technological advancement, regulatory development, and changing customer expectations in Ireland’s dynamic digital economy.

What is Data Center Power?

Data Center Power refers to the electrical power supply and management systems that support the operation of data centers, which house computer systems and associated components. This includes power distribution, backup systems, and energy efficiency measures.

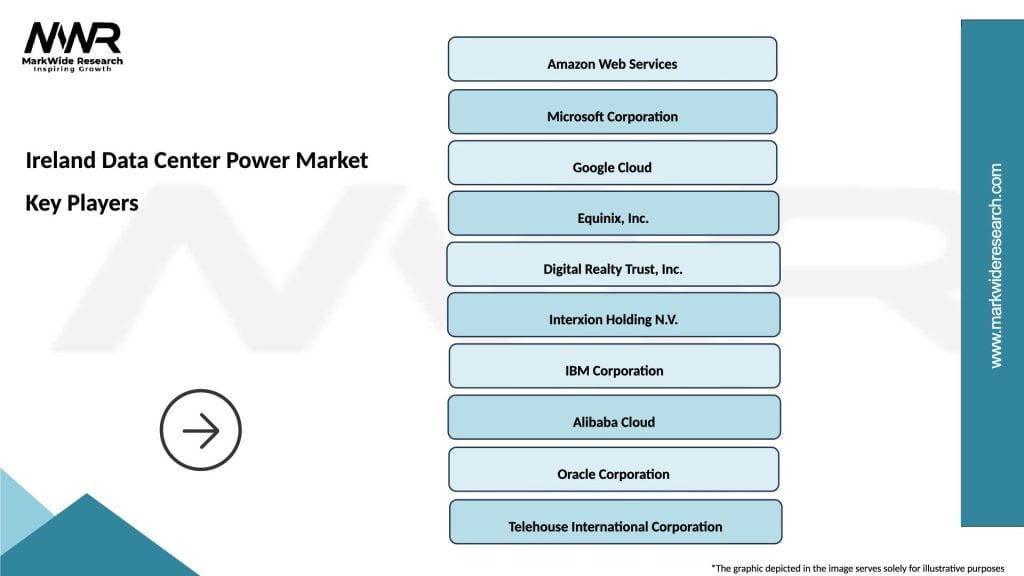

What are the key players in the Ireland Data Center Power Market?

Key players in the Ireland Data Center Power Market include companies like Amazon Web Services, Microsoft, and Google, which are heavily investing in data center infrastructure. Additionally, local firms such as EirGrid and ESB Networks play significant roles in power supply and management, among others.

What are the growth factors driving the Ireland Data Center Power Market?

The growth of the Ireland Data Center Power Market is driven by increasing demand for cloud computing services, the rise of big data analytics, and the expansion of digital services. Additionally, the push for energy efficiency and sustainability in data center operations is also a significant factor.

What challenges does the Ireland Data Center Power Market face?

The Ireland Data Center Power Market faces challenges such as regulatory hurdles, high energy costs, and the environmental impact of increased energy consumption. Additionally, the need for reliable power supply and infrastructure development poses ongoing challenges.

What opportunities exist in the Ireland Data Center Power Market?

Opportunities in the Ireland Data Center Power Market include advancements in renewable energy integration, innovations in energy storage solutions, and the development of more efficient cooling technologies. These factors can enhance sustainability and reduce operational costs for data centers.

What trends are shaping the Ireland Data Center Power Market?

Trends shaping the Ireland Data Center Power Market include the increasing adoption of green energy solutions, the implementation of advanced power management systems, and the growth of edge computing. These trends are influencing how data centers operate and manage their energy consumption.

Ireland Data Center Power Market

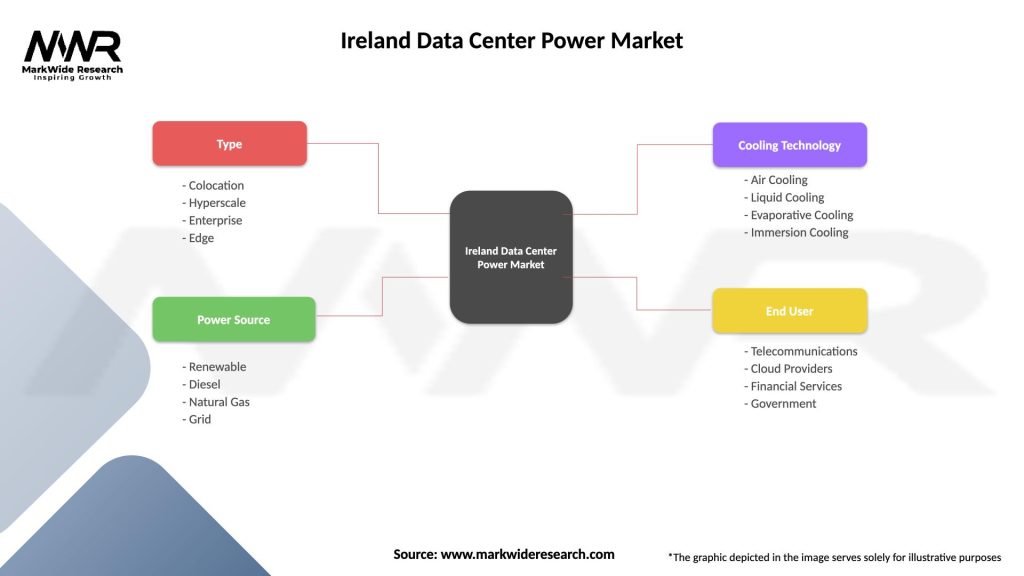

| Segmentation Details | Description |

|---|---|

| Type | Colocation, Hyperscale, Enterprise, Edge |

| Power Source | Renewable, Diesel, Natural Gas, Grid |

| Cooling Technology | Air Cooling, Liquid Cooling, Evaporative Cooling, Immersion Cooling |

| End User | Telecommunications, Cloud Providers, Financial Services, Government |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Ireland Data Center Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at