444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Ireland data center construction market represents one of Europe’s most dynamic and rapidly expanding digital infrastructure sectors. Ireland has emerged as a critical hub for international technology companies seeking strategic European operations, driven by favorable regulatory environments, competitive corporate tax structures, and robust connectivity infrastructure. The market encompasses the design, construction, and development of purpose-built facilities housing servers, networking equipment, and supporting infrastructure for cloud computing, enterprise applications, and digital services.

Market dynamics indicate sustained growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This expansion reflects Ireland’s positioning as a preferred destination for hyperscale data centers, colocation facilities, and enterprise data infrastructure. The country’s strategic location between North America and continental Europe, combined with reliable renewable energy sources and skilled workforce availability, continues attracting significant international investment in data center construction projects.

Dublin region dominates the market landscape, accounting for approximately 75% of total data center capacity across Ireland. However, emerging regional developments in Cork, Galway, and other strategic locations are diversifying the geographic distribution of data center infrastructure. The market serves diverse client segments including cloud service providers, telecommunications companies, financial services institutions, and multinational corporations requiring secure, scalable digital infrastructure solutions.

The Ireland data center construction market refers to the comprehensive ecosystem of planning, designing, building, and commissioning specialized facilities that house critical digital infrastructure components. These facilities provide secure, climate-controlled environments for servers, storage systems, networking equipment, and supporting technologies that enable cloud computing, data processing, and digital service delivery across various industries and applications.

Data center construction encompasses multiple specialized disciplines including electrical engineering, mechanical systems, structural design, security implementation, and environmental controls. Projects typically involve complex coordination between architects, engineers, contractors, and technology specialists to deliver facilities meeting stringent uptime requirements, energy efficiency standards, and regulatory compliance obligations. The construction process addresses unique challenges including power distribution, cooling systems, fire suppression, physical security, and connectivity infrastructure.

Modern data centers in Ireland incorporate advanced technologies such as modular construction techniques, intelligent building management systems, renewable energy integration, and sustainable design principles. The market includes various facility types from small enterprise data centers to massive hyperscale facilities spanning hundreds of thousands of square feet, each requiring specialized construction approaches and technical expertise.

Ireland’s data center construction market continues experiencing robust expansion driven by increasing digital transformation initiatives, cloud adoption acceleration, and growing data generation across industries. The market benefits from Ireland’s strategic advantages including EU membership, English-speaking workforce, stable political environment, and competitive business climate attracting international technology investments.

Key growth drivers include the proliferation of cloud services, edge computing requirements, artificial intelligence applications, and Internet of Things deployments requiring distributed data processing capabilities. Major technology companies have established significant data center footprints in Ireland, creating substantial demand for specialized construction services and supporting infrastructure development.

Construction activity spans diverse project types from greenfield hyperscale developments to retrofit and expansion projects for existing facilities. The market demonstrates strong pipeline visibility with multiple large-scale projects in various development phases. Sustainability considerations increasingly influence design decisions, with renewable energy adoption rates reaching 65% for new data center projects across Ireland.

Market challenges include land availability constraints in prime locations, grid capacity limitations, planning permission complexities, and skilled labor shortages in specialized construction trades. However, ongoing infrastructure investments, regulatory support, and industry collaboration initiatives address these challenges while maintaining Ireland’s competitive positioning in the European data center landscape.

Strategic market insights reveal several critical trends shaping Ireland’s data center construction landscape:

Digital transformation acceleration across industries represents the primary driver of Ireland’s data center construction market growth. Organizations increasingly rely on cloud computing, big data analytics, and digital services requiring robust, scalable infrastructure support. The COVID-19 pandemic significantly accelerated digital adoption trends, creating sustained demand for data processing and storage capabilities.

Cloud service expansion by major technology providers continues driving large-scale data center development projects. Companies such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform require substantial infrastructure investments to serve European markets from Irish facilities. This hyperscale demand creates opportunities for specialized construction companies and supporting service providers.

Regulatory advantages position Ireland favorably for international data center investments. EU membership provides regulatory certainty for data protection compliance, while competitive corporate tax rates and business-friendly policies attract multinational technology companies. The country’s stable political environment and robust legal framework provide additional investment security for long-term infrastructure projects.

Connectivity infrastructure excellence supports Ireland’s data center market growth. Multiple submarine cables connecting Ireland to North America and continental Europe provide exceptional international connectivity. Domestic fiber networks and telecommunications infrastructure enable efficient data transmission and support diverse client connectivity requirements.

Renewable energy availability increasingly influences data center location decisions. Ireland’s abundant wind resources and growing renewable energy capacity align with corporate sustainability commitments. Green energy adoption in data centers has reached 60% penetration rates, supporting environmental objectives while reducing operational costs.

Land availability constraints present significant challenges for data center construction in prime locations, particularly around Dublin where demand concentration is highest. Limited suitable sites with appropriate zoning, power access, and connectivity infrastructure create competitive pressures and potentially inflate development costs for new projects.

Grid capacity limitations in certain regions restrict large-scale data center development opportunities. Electrical infrastructure upgrades require substantial lead times and coordination with utility providers, potentially delaying project timelines and increasing development complexity. Some areas experience temporary moratoriums on new high-power connections pending grid reinforcement projects.

Planning permission complexities can extend project development timelines and create uncertainty for investors. Environmental impact assessments, public consultation processes, and regulatory approvals require careful navigation and can result in project delays or modifications. Local community concerns about data center developments occasionally complicate approval processes.

Skilled labor shortages in specialized construction trades impact project delivery capabilities and costs. Data center construction requires expertise in electrical systems, mechanical engineering, security installations, and technology integration. Competition for qualified professionals across the construction industry creates wage pressures and potential scheduling constraints.

Environmental regulations increasingly influence data center design and construction requirements. Sustainability mandates, energy efficiency standards, and carbon reduction targets add complexity and potentially increase construction costs. Compliance with evolving environmental policies requires ongoing adaptation of design standards and construction practices.

Edge computing expansion creates substantial opportunities for distributed data center construction across Ireland’s regional markets. As applications require lower latency and local data processing capabilities, smaller facilities serving specific geographic areas become increasingly valuable. This trend opens markets beyond traditional Dublin concentration areas.

Retrofit and modernization projects represent significant growth opportunities as existing facilities require upgrades to meet evolving technology requirements and efficiency standards. Legacy data centers need power system enhancements, cooling system improvements, and technology infrastructure updates to remain competitive and compliant with current standards.

Sustainable construction solutions offer competitive advantages for companies developing expertise in green building technologies, renewable energy integration, and energy-efficient design approaches. As environmental considerations become more prominent in client decision-making, specialized capabilities in sustainable data center construction become valuable differentiators.

Modular construction techniques present opportunities for companies investing in prefabricated building systems and standardized construction approaches. These methods can reduce construction timelines, improve quality control, and provide cost advantages for certain project types, particularly smaller edge computing facilities and standardized designs.

International expansion opportunities exist for Irish construction companies developing data center expertise. The skills and experience gained in Ireland’s dynamic market can be leveraged for projects in other European markets and international locations where similar infrastructure development is occurring.

Supply and demand dynamics in Ireland’s data center construction market reflect strong underlying growth drivers balanced against capacity constraints and resource limitations. Demand consistently exceeds available construction capacity, creating favorable conditions for established contractors while attracting new market entrants seeking growth opportunities.

Technology evolution continuously influences construction requirements and methodologies. Advances in server efficiency, cooling technologies, and power distribution systems require ongoing adaptation of design standards and construction practices. Energy efficiency improvements of 25-30% in new facilities compared to older generations demonstrate the impact of technological advancement on construction specifications.

Competitive dynamics involve both international construction companies and specialized local contractors competing for projects across different market segments. Large hyperscale projects typically attract international firms with extensive resources, while smaller projects and specialized work often favor local companies with regional expertise and relationships.

Investment patterns show sustained capital allocation to Irish data center infrastructure from both domestic and international sources. Private equity, infrastructure funds, and corporate investments support ongoing construction activity. Foreign direct investment accounts for approximately 80% of major data center projects in Ireland, reflecting international confidence in the market.

Regulatory dynamics continue evolving as policymakers balance economic development objectives with environmental sustainability goals. Planning policies, building codes, and environmental regulations adapt to address data center industry growth while ensuring responsible development practices.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Ireland’s data center construction market. Primary research includes extensive interviews with industry participants, construction companies, technology providers, and regulatory officials to gather firsthand perspectives on market conditions, trends, and challenges.

Secondary research incorporates analysis of government statistics, industry reports, planning applications, construction permits, and regulatory filings to quantify market activity and identify development patterns. Public databases, corporate announcements, and industry publications provide additional data sources for market sizing and trend analysis.

Stakeholder engagement involves consultation with key market participants including construction contractors, engineering firms, technology suppliers, real estate developers, and end-user organizations. These interactions provide insights into market dynamics, competitive positioning, and future development expectations that inform comprehensive market assessment.

Data validation processes ensure accuracy and reliability of market information through cross-referencing multiple sources, verification of statistical data, and validation of key findings with industry experts. MarkWide Research employs rigorous quality control procedures to maintain high standards of market intelligence and analysis.

Analytical frameworks incorporate quantitative and qualitative assessment methodologies to evaluate market size, growth rates, competitive dynamics, and future prospects. Statistical analysis, trend identification, and scenario modeling provide comprehensive understanding of market conditions and development trajectories.

Dublin region maintains dominant market position, representing the largest concentration of data center construction activity in Ireland. The area benefits from established technology ecosystem, superior connectivity infrastructure, skilled workforce availability, and proximity to international business operations. Greater Dublin accounts for approximately 70% of total construction value in the Irish data center market.

Cork region emerges as a significant secondary market, attracting data center investments due to available land, competitive costs, and growing technology sector presence. The region offers advantages including renewable energy access, skilled workforce, and supportive local government policies. Several major projects in development phases indicate growing market importance.

Galway area demonstrates increasing data center construction activity, particularly for companies seeking alternative locations to Dublin concentration. The region provides cost advantages, available development sites, and access to renewable energy resources. University partnerships and technology sector growth support workforce development for data center operations.

Regional diversification trends reflect efforts to distribute data center infrastructure beyond Dublin concentration, driven by land availability, cost considerations, and risk mitigation strategies. Non-Dublin regions now represent approximately 25% of new project announcements, indicating geographic expansion of construction activity.

Border regions present emerging opportunities for data center development, particularly locations with cross-border connectivity advantages and competitive operational costs. Strategic positioning near Northern Ireland and UK markets provides additional value propositions for certain client segments and application requirements.

Market leadership involves both international construction giants and specialized regional contractors competing across different project segments and client requirements. The competitive environment reflects diverse capabilities, expertise areas, and strategic positioning approaches.

Competitive differentiation factors include technical expertise, project delivery track record, sustainability capabilities, and client relationship strength. Companies increasingly invest in specialized skills, advanced construction methodologies, and sustainable building practices to maintain competitive advantages in the growing market.

By Facility Type:

By Construction Type:

By Client Segment:

Hyperscale data centers represent the highest-value construction segment, with individual projects often exceeding significant investment thresholds. These facilities require specialized expertise in large-scale electrical systems, advanced cooling technologies, and complex project coordination. Hyperscale projects account for approximately 60% of total construction value despite representing fewer individual projects.

Colocation facilities demonstrate steady growth driven by enterprise digital transformation and cloud adoption trends. These projects typically involve sophisticated design requirements to accommodate diverse client needs, flexible infrastructure configurations, and high-security standards. Construction complexity includes multiple client spaces, shared infrastructure systems, and scalable design approaches.

Edge computing centers emerge as a rapidly growing category, driven by applications requiring low-latency data processing and local service delivery. These smaller facilities present different construction challenges including distributed locations, standardized designs, and rapid deployment requirements. Edge facility construction is experiencing growth rates exceeding 15% annually.

Enterprise data centers continue representing significant construction opportunities, particularly for organizations requiring private, dedicated infrastructure. These projects often involve specialized security requirements, compliance considerations, and integration with existing corporate facilities. Construction approaches emphasize customization, security, and operational efficiency.

Retrofit and modernization projects gain importance as existing facilities require updates to meet evolving technology requirements and efficiency standards. These projects present unique challenges including operational continuity, phased construction approaches, and integration with existing systems while maintaining service availability.

Construction companies benefit from sustained demand growth, premium pricing opportunities, and long-term client relationships in the data center market. Specialized expertise development creates competitive advantages and barriers to entry, while project scale and complexity provide substantial revenue opportunities for qualified contractors.

Technology suppliers gain access to growing markets for specialized data center equipment, building systems, and infrastructure components. The Irish market provides opportunities for international suppliers to establish European operations and serve regional client requirements with local support capabilities.

Real estate developers benefit from strong demand for suitable development sites, particularly locations with appropriate zoning, power access, and connectivity infrastructure. Data center projects typically involve long-term lease commitments and stable revenue streams, providing attractive investment characteristics.

Local communities benefit from significant economic impacts including job creation, tax revenue generation, and infrastructure investment. Data center construction projects create employment opportunities across multiple skill levels and support local supply chains and service providers.

End-user organizations gain access to world-class data center infrastructure supporting digital transformation initiatives, cloud computing adoption, and business continuity requirements. Irish facilities provide strategic advantages including EU regulatory compliance, excellent connectivity, and competitive operational costs.

Government stakeholders benefit from foreign direct investment attraction, technology sector development, and economic diversification objectives. Data center investments support Ireland’s positioning as a European technology hub while generating substantial tax revenues and employment opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping Ireland’s data center construction market. Environmental considerations increasingly influence design decisions, construction methodologies, and operational planning. Green building certifications are now standard requirements for major projects, with LEED and BREEAM adoption rates reaching 85% for new facilities.

Modular construction adoption accelerates across the industry, driven by advantages including faster deployment, improved quality control, and cost optimization. Prefabricated building systems and standardized design approaches enable more efficient project delivery while maintaining high performance standards. This trend particularly benefits edge computing facilities and standardized facility types.

Artificial intelligence integration in building management systems and construction processes improves operational efficiency and project delivery capabilities. Smart building technologies, predictive maintenance systems, and automated controls become standard features in modern data center construction projects, enhancing performance and reducing operational costs.

Renewable energy integration becomes increasingly sophisticated, with projects incorporating on-site generation, energy storage systems, and grid integration capabilities. Power purchase agreements with renewable energy providers and corporate sustainability commitments drive demand for clean energy solutions in data center construction.

Regional diversification continues as organizations seek alternatives to Dublin concentration, driven by cost considerations, risk mitigation strategies, and land availability. This trend creates construction opportunities in previously underserved regions while supporting national economic development objectives.

Major project announcements continue demonstrating strong market momentum, with several hyperscale facilities in various development phases across Ireland. These projects represent substantial construction opportunities and validate Ireland’s continued attractiveness for international data center investments.

Infrastructure investments by utility companies and government agencies address grid capacity constraints and support continued market growth. Electrical infrastructure upgrades, renewable energy projects, and connectivity improvements enhance Ireland’s competitive positioning for future data center developments.

Regulatory developments include updated planning guidelines, environmental standards, and building codes addressing data center construction requirements. These changes reflect policymaker efforts to balance economic development objectives with sustainability goals and community considerations.

Technology partnerships between construction companies, technology suppliers, and research institutions advance innovation in data center construction methodologies and building systems. Collaborative initiatives focus on sustainability improvements, construction efficiency, and operational optimization.

Workforce development programs address skilled labor requirements through training initiatives, educational partnerships, and industry collaboration. These efforts support construction industry capacity building and ensure availability of qualified professionals for complex data center projects.

MarkWide Research recommends that construction companies invest in specialized data center expertise and sustainable building capabilities to capitalize on market growth opportunities. Companies should develop comprehensive service offerings spanning design, construction, and commissioning to provide integrated solutions for complex projects.

Strategic positioning should emphasize technical expertise, sustainability credentials, and proven project delivery track records. Companies investing in green building technologies, renewable energy integration, and advanced construction methodologies will gain competitive advantages in the evolving market landscape.

Geographic diversification strategies should consider opportunities in regional markets beyond Dublin concentration. Companies establishing capabilities in Cork, Galway, and other emerging locations can access growing demand while potentially achieving better project margins and reduced competition.

Partnership development with technology suppliers, engineering firms, and specialized contractors can enhance service capabilities and project delivery efficiency. Collaborative approaches enable companies to offer comprehensive solutions while managing project complexity and technical requirements.

Workforce investment in specialized skills development and training programs will address labor constraints while building competitive capabilities. Companies prioritizing employee development and technical expertise will be better positioned for sustained growth in the demanding data center construction market.

Long-term growth prospects for Ireland’s data center construction market remain highly positive, supported by sustained digital transformation trends, cloud computing adoption, and Ireland’s strategic advantages for European operations. MWR analysis projects continued market expansion with annual growth rates of 7-9% over the next five years.

Technology evolution will continue influencing construction requirements, with advances in server efficiency, cooling systems, and building automation creating opportunities for specialized contractors. Edge computing expansion and artificial intelligence applications will drive demand for distributed infrastructure and specialized facility types.

Sustainability requirements will become increasingly stringent, with environmental performance becoming a key differentiator for construction companies and facility operators. Carbon neutrality commitments and renewable energy mandates will drive innovation in green building technologies and sustainable construction practices.

Regional development will accelerate as organizations seek alternatives to Dublin concentration and government policies support balanced national development. This trend will create construction opportunities across Ireland while potentially reducing cost pressures in traditional high-demand areas.

Market maturation will lead to increased specialization, with construction companies developing niche expertise in specific facility types, client segments, or technical capabilities. Successful companies will differentiate through technical excellence, sustainability leadership, and comprehensive service offerings.

Ireland’s data center construction market represents one of Europe’s most dynamic and promising infrastructure sectors, driven by robust digital transformation trends, strategic geographic advantages, and favorable business environment. The market demonstrates sustained growth momentum with strong pipeline visibility and continued international investment attraction.

Key success factors for market participants include technical expertise development, sustainability capability building, and strategic positioning across diverse client segments and project types. Companies investing in specialized skills, advanced construction methodologies, and comprehensive service offerings will be best positioned to capitalize on growth opportunities while navigating market challenges.

Future prospects remain highly positive, supported by continued digitalization trends, cloud computing expansion, and Ireland’s competitive advantages for European data center operations. The market will continue evolving toward greater sustainability, regional diversification, and technological sophistication, creating opportunities for innovative construction companies and supporting service providers.

What is Data Center Construction?

Data Center Construction refers to the process of building facilities that house computer systems and associated components, such as telecommunications and storage systems. These centers are crucial for managing data and supporting cloud computing, big data analytics, and various IT services.

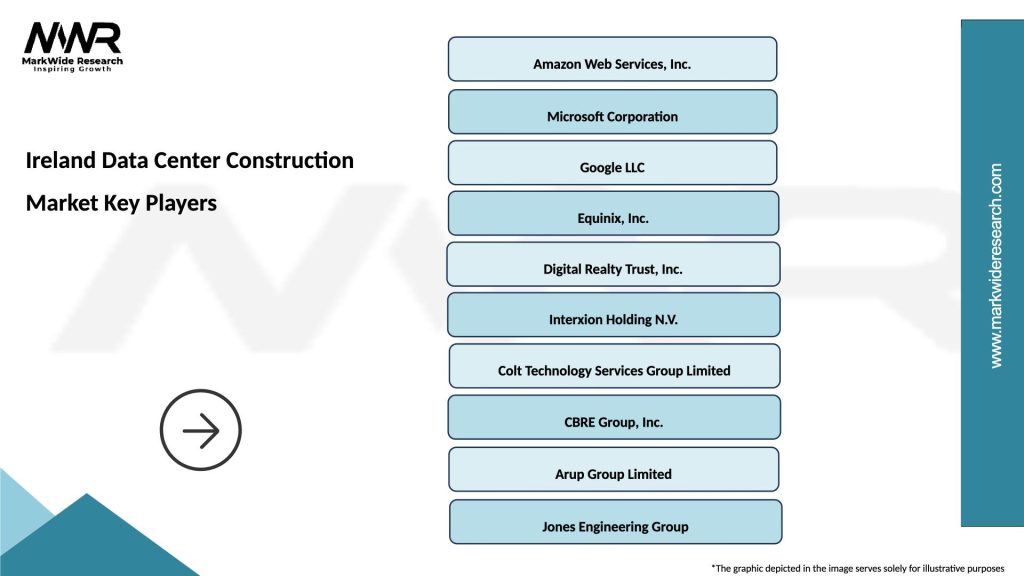

What are the key players in the Ireland Data Center Construction Market?

Key players in the Ireland Data Center Construction Market include companies like Amazon Web Services, Microsoft, and Google, which are heavily investing in data center infrastructure. Other notable companies include Equinix and Digital Realty, among others.

What are the growth factors driving the Ireland Data Center Construction Market?

The growth of the Ireland Data Center Construction Market is driven by the increasing demand for cloud services, the rise of big data analytics, and the expansion of e-commerce. Additionally, favorable government policies and investments in renewable energy are contributing to this growth.

What challenges does the Ireland Data Center Construction Market face?

The Ireland Data Center Construction Market faces challenges such as high energy consumption, regulatory hurdles, and the need for sustainable practices. Additionally, the competition for land and resources can pose significant obstacles for new projects.

What opportunities exist in the Ireland Data Center Construction Market?

Opportunities in the Ireland Data Center Construction Market include the potential for innovation in energy-efficient technologies and the growing trend of edge computing. Furthermore, the increasing focus on sustainability presents avenues for developing green data centers.

What trends are shaping the Ireland Data Center Construction Market?

Trends shaping the Ireland Data Center Construction Market include the adoption of modular data center designs, advancements in cooling technologies, and the integration of artificial intelligence for operational efficiency. These trends are enhancing the performance and sustainability of data centers.

Ireland Data Center Construction Market

| Segmentation Details | Description |

|---|---|

| Type | Modular, Containerized, Traditional, Hybrid |

| Technology | Cooling Systems, Power Distribution, Fire Suppression, Security Solutions |

| End User | Telecommunications, Cloud Providers, Enterprises, Government |

| Capacity | Small Scale, Medium Scale, Large Scale, Enterprise Level |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Ireland Data Center Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at