444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Iraq air freight transport market represents a critical component of the nation’s logistics infrastructure, serving as a vital link between Iraq and global trade networks. This sector has experienced significant transformation following decades of reconstruction efforts and economic diversification initiatives. The market encompasses domestic and international cargo transportation services, supporting various industries including oil and gas, manufacturing, agriculture, and consumer goods distribution.

Market dynamics indicate robust growth potential driven by Iraq’s strategic geographical position as a gateway between Europe, Asia, and the Middle East. The sector benefits from increasing trade volumes, infrastructure modernization projects, and growing demand for time-sensitive cargo transportation. Key airports including Baghdad International Airport, Basra International Airport, and Erbil International Airport serve as primary hubs for air freight operations, handling diverse cargo types from perishable goods to industrial equipment.

Growth trajectories suggest the market is expanding at a compound annual growth rate (CAGR) of 8.2%, reflecting increasing economic activity and international trade partnerships. The sector’s development aligns with Iraq’s broader economic reconstruction goals and efforts to diversify beyond oil-dependent revenues. Infrastructure investments in airport facilities, cargo handling equipment, and logistics technologies continue to enhance operational capabilities and service quality standards.

The Iraq air freight transport market refers to the comprehensive ecosystem of cargo transportation services utilizing aircraft to move goods within Iraq and between Iraq and international destinations. This market encompasses various stakeholders including airlines, freight forwarders, logistics service providers, cargo handling companies, and supporting infrastructure facilities.

Core components of this market include scheduled cargo flights, charter services, express delivery operations, and specialized transportation for high-value or time-sensitive shipments. The sector serves multiple functions including facilitating international trade, supporting supply chain operations, enabling e-commerce growth, and providing essential logistics services for various industries operating within Iraq’s economy.

Strategic positioning of Iraq’s air freight transport market reflects the country’s emergence as a significant logistics hub in the Middle East region. The market demonstrates resilience and growth potential despite historical challenges, with increasing participation from international carriers and logistics providers. Current market conditions indicate strong demand across multiple sectors, particularly in oil and gas equipment transportation, consumer goods distribution, and agricultural exports.

Key performance indicators show that cargo volumes have increased by 15.3% over the past two years, driven by enhanced security conditions, improved infrastructure, and growing business confidence. The market benefits from Iraq’s strategic location, abundant natural resources, and increasing integration with global supply chains. Investment flows into airport infrastructure and cargo handling facilities continue to support capacity expansion and service quality improvements.

Competitive landscape features a mix of international airlines, regional carriers, and domestic logistics providers, creating a dynamic environment for service innovation and market development. The sector’s growth trajectory aligns with broader economic recovery initiatives and government policies supporting trade facilitation and logistics sector development.

Market intelligence reveals several critical insights shaping the Iraq air freight transport sector’s development and future prospects:

Economic reconstruction initiatives serve as primary catalysts driving growth in Iraq’s air freight transport market. The country’s ongoing efforts to rebuild and modernize its economy create substantial demand for cargo transportation services across multiple sectors. Infrastructure development projects require specialized equipment and materials transportation, while growing industrial activities generate consistent freight volumes.

Strategic geographical positioning provides significant competitive advantages, enabling Iraq to serve as a logistics hub connecting Europe, Asia, and the Middle East. This positioning attracts international trade flows and creates opportunities for transit cargo operations. Oil and gas sector activities continue to generate substantial freight demand for specialized equipment, machinery, and technical components required for exploration, production, and refining operations.

Trade liberalization policies and improved international relations are expanding market access and creating new business opportunities. Growing consumer spending power and urbanization trends drive demand for imported goods, while agricultural exports create opportunities for specialized cargo transportation services. Technology adoption in logistics operations enhances service quality and operational efficiency, attracting more customers and expanding market reach.

Security concerns continue to present challenges for air freight operations, requiring enhanced safety protocols and potentially limiting service expansion in certain regions. While conditions have improved significantly, ongoing security considerations influence operational costs and service planning decisions. Infrastructure limitations in some secondary airports restrict cargo handling capabilities and limit service accessibility for certain regions.

Regulatory complexities and bureaucratic processes can create delays and increase operational costs for freight forwarders and logistics providers. Economic volatility related to oil price fluctuations affects overall economic activity and freight demand patterns. Limited availability of skilled personnel in logistics and aviation sectors constrains operational capacity and service quality improvements.

Competition from alternative transportation modes, particularly road and maritime transport, affects market share for certain cargo types and routes. High operational costs associated with aviation fuel, insurance, and compliance requirements impact pricing competitiveness and profit margins for service providers.

E-commerce expansion presents substantial growth opportunities as online retail activities increase throughout Iraq. The growing demand for express delivery services and last-mile logistics solutions creates new market segments for air freight providers. Agricultural exports offer significant potential, particularly for perishable goods requiring rapid transportation to international markets.

Manufacturing sector development creates opportunities for specialized cargo services supporting industrial supply chains. Growing demand for high-value and time-sensitive shipments provides premium service opportunities with higher profit margins. Regional trade integration initiatives and improved diplomatic relations with neighboring countries expand market access and create new route opportunities.

Technology integration opportunities include implementing advanced cargo tracking systems, automated handling equipment, and digital logistics platforms to enhance service capabilities. Public-private partnerships in infrastructure development can accelerate capacity expansion and service quality improvements while sharing investment risks and costs.

Supply and demand dynamics in Iraq’s air freight transport market reflect the interplay between growing economic activity and evolving logistics infrastructure capabilities. Demand patterns show increasing volumes across multiple sectors, with particular strength in oil and gas equipment, consumer goods, and agricultural products. The market demonstrates seasonal variations with peak activity during harvest seasons for agricultural exports and increased consumer goods imports during holiday periods.

Pricing dynamics are influenced by fuel costs, capacity utilization rates, and competitive pressures from alternative transportation modes. Service differentiation strategies focus on reliability, speed, and specialized handling capabilities to justify premium pricing for high-value cargo segments. According to MarkWide Research analysis, operational efficiency improvements have resulted in 12.7% cost reductions for major logistics providers over the past year.

Market consolidation trends show increasing collaboration between international and domestic service providers, creating integrated logistics solutions and expanded service networks. Technology adoption rates continue to accelerate, with 78% of major operators implementing digital tracking and management systems to enhance customer service and operational visibility.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Iraq’s air freight transport sector. Primary research activities include structured interviews with industry executives, logistics managers, government officials, and key stakeholders across the air freight value chain. These interviews provide firsthand insights into market conditions, operational challenges, and growth opportunities.

Secondary research encompasses analysis of government statistics, industry reports, trade publications, and regulatory documents to establish market baselines and identify trends. Data validation processes involve cross-referencing multiple sources and conducting follow-up interviews to verify key findings and assumptions.

Market modeling techniques utilize statistical analysis and forecasting methods to project future market developments and identify growth scenarios. Stakeholder surveys provide quantitative data on market perceptions, service preferences, and investment intentions across different customer segments and geographic regions.

Baghdad region dominates the air freight transport market, accounting for approximately 45% of total cargo volumes due to its status as the political and economic center of Iraq. Baghdad International Airport serves as the primary hub for international cargo operations, offering the most comprehensive infrastructure and service capabilities. The region benefits from proximity to major industrial areas and serves as a distribution center for consumer goods throughout central Iraq.

Kurdistan Region represents the second-largest market segment, contributing approximately 28% of air freight activities. Erbil International Airport serves as the primary gateway for the region, handling significant volumes of oil and gas equipment, consumer goods, and agricultural products. The region’s relative stability and business-friendly environment attract international logistics providers and create favorable conditions for market growth.

Basra region accounts for approximately 18% of market share, primarily serving the oil and gas industry with specialized cargo transportation services. Basra International Airport handles equipment and materials for petroleum sector operations, while also supporting agricultural exports from southern Iraq. The remaining 9% of market activity is distributed across other regional airports including Najaf, Mosul, and Sulaymaniyah, serving local economic activities and specialized cargo requirements.

Market structure features a diverse mix of international airlines, regional carriers, and domestic logistics providers competing across different service segments and geographic markets. Leading international players bring advanced operational capabilities and global network connectivity, while domestic providers offer local market knowledge and specialized services.

Competitive strategies focus on service differentiation, operational efficiency, and strategic partnerships to capture market share and enhance profitability. Market positioning varies from premium express services to cost-effective bulk cargo transportation, serving different customer segments and cargo types.

By Cargo Type: The market segments into general cargo, specialized freight, perishable goods, dangerous goods, and express packages. General cargo represents the largest segment, including consumer goods, textiles, and manufactured products. Specialized freight encompasses oil and gas equipment, industrial machinery, and oversized cargo requiring special handling procedures.

By Service Type: Market segmentation includes scheduled cargo services, charter operations, express delivery, and integrated logistics solutions. Scheduled services provide regular capacity and predictable transit times, while charter operations offer flexibility for large shipments and specialized requirements.

By End-User Industry: Key sectors include oil and gas, manufacturing, agriculture, retail and e-commerce, healthcare, and automotive. The oil and gas sector generates substantial freight volumes for equipment and technical components, while retail and e-commerce drive demand for consumer goods and express delivery services.

By Geographic Coverage: Services segment into domestic routes, regional international connections, and intercontinental operations. Regional routes to neighboring Middle Eastern countries represent the largest segment, while intercontinental services connect Iraq to European, Asian, and other global markets.

Express and Time-Sensitive Cargo: This premium segment demonstrates the highest growth rates, driven by e-commerce expansion and increasing demand for rapid delivery services. Service providers in this category focus on speed, reliability, and advanced tracking capabilities to justify premium pricing. Market penetration rates show 23% annual growth in express delivery volumes, reflecting changing customer expectations and business requirements.

Industrial and Heavy Cargo: This segment serves oil and gas, construction, and manufacturing industries with specialized handling requirements. Operational capabilities include oversized cargo handling, specialized packaging, and coordinated logistics solutions. The segment benefits from ongoing infrastructure development projects and industrial expansion activities throughout Iraq.

Perishable and Agricultural Goods: Growing agricultural exports create opportunities for specialized cargo services with temperature-controlled transportation and rapid transit capabilities. Market development focuses on establishing cold chain logistics infrastructure and developing relationships with international buyers and distributors.

Consumer Goods and E-commerce: Increasing consumer spending and online retail growth drive demand for efficient cargo transportation and last-mile delivery services. Service innovation includes integrated logistics solutions combining air freight with ground transportation and warehousing services.

Airlines and Cargo Carriers benefit from growing market demand, diversified revenue streams, and opportunities for premium service offerings. Operational advantages include high-value cargo segments, consistent demand from multiple industries, and potential for long-term customer relationships. The market offers opportunities for capacity utilization optimization and route network expansion.

Freight Forwarders and Logistics Providers gain access to comprehensive service portfolios, integrated logistics solutions, and value-added services. Business opportunities include customs clearance, warehousing, distribution, and specialized handling services that enhance customer relationships and increase profit margins.

Shippers and Importers benefit from improved supply chain efficiency, reduced inventory costs, and enhanced market access. Operational benefits include faster delivery times, reliable service schedules, and specialized handling capabilities for sensitive or high-value cargo. Access to global markets through air freight connections supports business expansion and international trade activities.

Government and Economic Development stakeholders benefit from enhanced trade facilitation, increased economic activity, and improved international connectivity. Strategic advantages include job creation, tax revenue generation, and positioning Iraq as a regional logistics hub supporting broader economic diversification goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation initiatives are revolutionizing air freight operations through implementation of advanced tracking systems, automated cargo handling equipment, and integrated logistics platforms. Technology adoption rates show that 85% of major operators have invested in digital solutions to enhance customer service and operational visibility. These innovations improve efficiency, reduce costs, and provide competitive advantages in service delivery.

Sustainability Focus is driving adoption of fuel-efficient aircraft, optimized routing systems, and environmentally responsible logistics practices. Green logistics initiatives include carbon footprint reduction programs, alternative fuel exploration, and waste minimization strategies. Customers increasingly consider environmental impact in logistics provider selection decisions.

Service Integration trends show growing demand for comprehensive logistics solutions combining air freight with ground transportation, warehousing, and distribution services. Value-added services include customs clearance, packaging, assembly, and last-mile delivery capabilities that enhance customer relationships and increase revenue per shipment.

Regional Connectivity expansion focuses on developing new routes and increasing flight frequencies to key trading partner countries. Network development strategies emphasize connecting Iraq to emerging markets and establishing hub operations for regional cargo distribution.

Infrastructure modernization projects continue across major airports, with significant investments in cargo terminal expansions, automated handling systems, and ground support equipment. Baghdad International Airport completed a major cargo facility upgrade, increasing handling capacity by 35% and improving operational efficiency. These developments enhance service capabilities and support growing freight volumes.

Strategic partnerships between international airlines and domestic logistics providers are expanding service networks and operational capabilities. MWR data indicates that collaborative arrangements have increased by 42% over the past year, reflecting industry efforts to leverage complementary strengths and expand market reach.

Regulatory improvements include streamlined customs procedures, electronic documentation systems, and simplified import/export processes that reduce transit times and operational costs. Government initiatives focus on trade facilitation and creating business-friendly environments for logistics sector development.

Technology implementations encompass advanced cargo tracking systems, automated sorting equipment, and digital logistics platforms that enhance operational efficiency and customer service quality. These investments support capacity expansion and service differentiation strategies across the competitive landscape.

Strategic positioning recommendations emphasize leveraging Iraq’s geographic advantages to develop hub operations serving regional and intercontinental trade flows. Market participants should focus on building comprehensive service portfolios that combine air freight with complementary logistics services to enhance customer value propositions and increase revenue per customer.

Investment priorities should target technology adoption, infrastructure development, and human capital development to support sustainable growth and competitive positioning. Operational excellence initiatives including process optimization, quality management, and customer service enhancement are essential for market success and customer retention.

Partnership strategies should focus on developing strategic alliances with international carriers, logistics providers, and technology companies to access advanced capabilities and expand market reach. Risk management approaches should address security concerns, regulatory compliance, and economic volatility through diversified service portfolios and flexible operational strategies.

Market development efforts should prioritize emerging segments including e-commerce, agricultural exports, and specialized cargo services that offer higher growth potential and profit margins. Customer relationship strategies should emphasize service reliability, transparency, and value-added services that differentiate providers in competitive markets.

Growth projections indicate continued expansion of Iraq’s air freight transport market, driven by economic recovery, infrastructure development, and increasing integration with global supply chains. Market forecasts suggest sustained growth rates of 8-10% annually over the next five years, supported by diversifying economic activities and improving business conditions.

Technology integration will accelerate, with advanced logistics platforms, automated handling systems, and digital tracking capabilities becoming standard operational requirements. Service evolution will focus on integrated logistics solutions, specialized cargo handling, and value-added services that enhance customer relationships and increase profitability.

Infrastructure development will continue with airport expansions, cargo facility upgrades, and ground transportation improvements supporting capacity growth and service quality enhancements. Regional connectivity will expand through new route development and increased flight frequencies to key trading partner countries.

Market maturation will bring increased competition, service standardization, and customer sophistication, requiring continuous innovation and operational excellence for sustainable success. Regulatory environment improvements will support trade facilitation and create more favorable conditions for business development and international investment.

The Iraq air freight transport market presents significant opportunities for growth and development, supported by strategic geographic positioning, economic recovery initiatives, and increasing integration with global trade networks. Market dynamics indicate robust demand across multiple sectors, driven by infrastructure development, e-commerce expansion, and diversifying economic activities beyond traditional oil and gas dependence.

Success factors for market participants include strategic positioning, operational excellence, technology adoption, and comprehensive service portfolios that address evolving customer requirements. The sector’s development trajectory aligns with broader economic reconstruction goals and government policies supporting trade facilitation and logistics sector advancement.

Future prospects remain positive, with continued growth expected across key market segments and geographic regions. Strategic investments in infrastructure, technology, and human capital development will support sustainable expansion and competitive positioning in regional and international markets. The Iraq air freight transport market represents a critical component of the nation’s economic development strategy and offers substantial opportunities for stakeholders committed to long-term market development and operational excellence.

What is Air Freight Transport?

Air Freight Transport refers to the shipment of goods via air carriers, which is a crucial component of the logistics and supply chain industry. It is often used for time-sensitive deliveries and can include various types of cargo such as perishables, electronics, and pharmaceuticals.

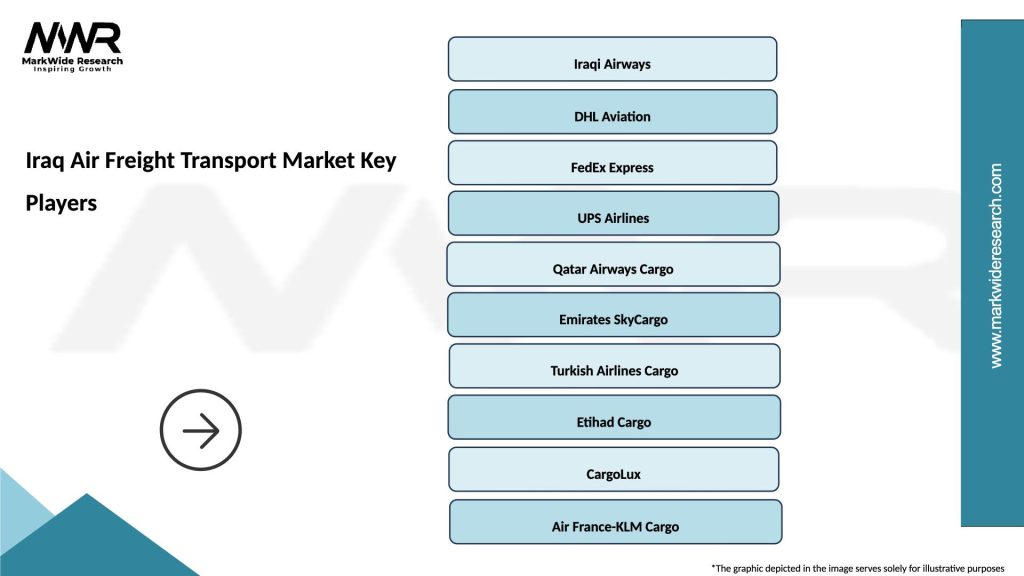

What are the key players in the Iraq Air Freight Transport Market?

Key players in the Iraq Air Freight Transport Market include Iraqi Airways, Qatar Airways, and Emirates SkyCargo, among others. These companies provide essential air cargo services that facilitate international trade and logistics.

What are the main drivers of growth in the Iraq Air Freight Transport Market?

The main drivers of growth in the Iraq Air Freight Transport Market include increasing demand for rapid delivery services, expansion of e-commerce, and the need for efficient supply chain solutions. Additionally, improvements in airport infrastructure are enhancing air freight capabilities.

What challenges does the Iraq Air Freight Transport Market face?

The Iraq Air Freight Transport Market faces challenges such as political instability, regulatory hurdles, and limited infrastructure in certain regions. These factors can impact the reliability and efficiency of air freight services.

What opportunities exist in the Iraq Air Freight Transport Market?

Opportunities in the Iraq Air Freight Transport Market include the potential for growth in logistics services, increased foreign investment, and the expansion of trade routes. The rise of e-commerce also presents new avenues for air freight services.

What trends are shaping the Iraq Air Freight Transport Market?

Trends shaping the Iraq Air Freight Transport Market include the adoption of advanced tracking technologies, increased focus on sustainability, and the integration of digital platforms for logistics management. These trends are enhancing operational efficiency and customer service.

Iraq Air Freight Transport Market

| Segmentation Details | Description |

|---|---|

| Service Type | Express Delivery, Standard Freight, Charter Services, Cargo Handling |

| End User | Manufacturers, Retailers, E-commerce, Government Agencies |

| Technology | Automated Systems, Tracking Solutions, Cold Chain Logistics, Ground Support Equipment |

| Capacity | Small Aircraft, Medium Aircraft, Large Aircraft, Cargo Ships |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Iraq Air Freight Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at