444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Iran oil and gas exploration and production market is a vital sector that significantly impacts the country’s economy. Iran is renowned for its extensive oil and gas reserves, making it a prominent player in the global energy landscape. The country’s strategic location and abundant resources have attracted international attention, leading to significant investments in the exploration and production of oil and gas reserves. This article provides comprehensive insights into the Iran oil and gas exploration and production market, including its meaning, executive summary, key market insights, market drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, key trends, Covid-19 impact, key industry developments, analyst suggestions, future outlook, and a concluding note.

Meaning

The Iran oil and gas exploration and production market refers to the process of discovering, extracting, and refining oil and gas reserves found within the territorial boundaries of Iran. This market encompasses various activities, such as geological surveys, drilling exploratory wells, and establishing production facilities to extract and process the hydrocarbons. Iran holds substantial oil and natural gas reserves, making this market a crucial aspect of its economy and global energy supply.

Executive Summary

The Iran oil and gas exploration and production market have been pivotal to the country’s economic growth and development. With abundant reserves and favorable geology, Iran has attracted numerous international players to invest in its energy sector. The market has witnessed significant advancements in technology, resulting in improved exploration techniques and efficient production processes. However, political and economic challenges have also influenced the industry, impacting its growth and potential. This executive summary offers a concise overview of the critical aspects of the Iran oil and gas exploration and production market, providing a glimpse into its opportunities and challenges.

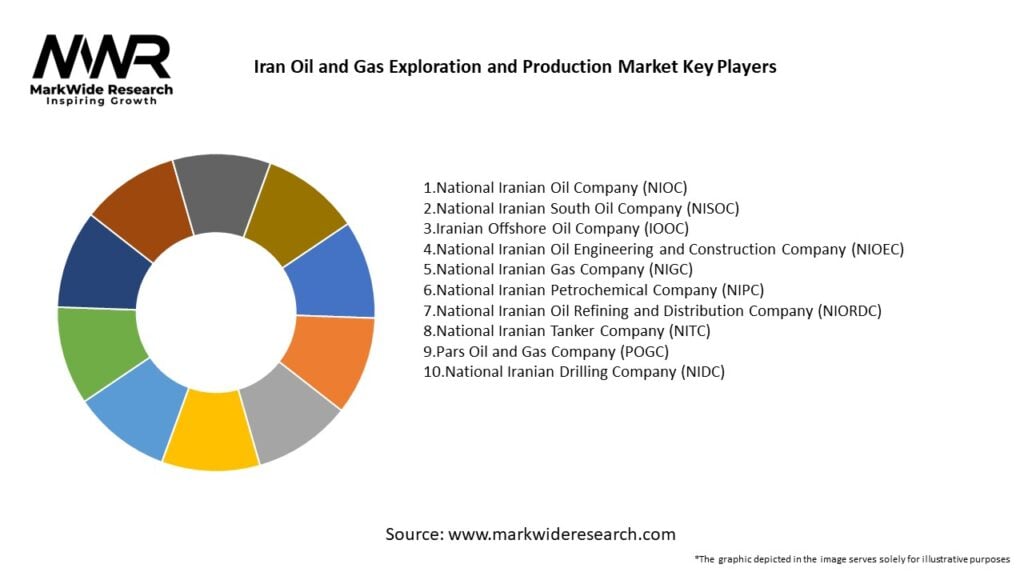

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the Iran Oil and Gas Exploration and Production Market:

Large Reserves of Oil and Gas: Iran has the fourth-largest oil reserves and the second-largest gas reserves in the world. This makes the country a central player in global energy markets and a critical source of hydrocarbons.

International Investment and Trade Opportunities: The gradual lifting of sanctions over recent years, and the potential for further easing, is creating opportunities for foreign investments. Many global energy companies are keen to enter the Iranian market, given its large reserves and untapped fields.

Technological Advancements: The modernization of exploration and production techniques, including the adoption of advanced drilling technologies, improved seismic analysis, and enhanced oil recovery techniques, is boosting production capacity and efficiency.

Energy Demand: Both domestic and international energy demand for oil and natural gas is increasing. Iran is in a position to meet domestic needs while also supplying international markets, particularly in Asia.

Government Support: The Iranian government continues to offer favorable incentives for foreign and domestic investments, including tax breaks and profit-sharing agreements with international oil companies (IOCs) and national oil companies (NOCs), encouraging exploration and production activities.

Market Restraints

Despite the market’s growth potential, the Iran Oil and Gas Exploration and Production Market faces several challenges:

Sanctions and Geopolitical Risks: The long-standing sanctions, particularly those imposed by the United States and the European Union, have limited access to international capital and technology. These sanctions also restrict the country’s ability to export oil and gas at full capacity.

Aging Infrastructure: Much of Iran’s oil and gas extraction infrastructure is aging, and significant investments are needed to modernize equipment and improve operational efficiency.

Environmental Concerns: The oil and gas industry is facing growing scrutiny over environmental concerns, particularly regarding emissions, water usage, and the long-term sustainability of resource extraction.

Technological Gaps: While there has been some progress in adopting advanced exploration and production technologies, Iran still lags behind many global players in terms of cutting-edge technology. Overcoming this gap will be crucial for boosting production rates.

Financial Barriers: Due to sanctions and economic isolation, accessing global financial markets for investment has been a challenge. This restricts the capacity for growth and the adoption of new technologies.

Market Opportunities

The Iran Oil and Gas Exploration and Production Market presents numerous opportunities:

Increased International Investments: As the international sanctions are eased, there is a potential for major energy companies to invest in Iran’s oil and gas infrastructure, driving exploration and production activities forward.

Enhanced Oil Recovery (EOR): Given the aging oil fields, there is a growing opportunity for adopting enhanced oil recovery technologies to extract more oil from existing fields, increasing overall production capacity.

Gas Field Development: The South Pars gas field is a major asset that is still being developed, and additional investments in gas field exploration and production can help meet growing domestic and international demand for natural gas.

Modernization of Infrastructure: Upgrading the country’s infrastructure, including pipelines, refineries, and storage facilities, presents a significant opportunity for improving efficiency and reducing the costs associated with oil and gas extraction and transportation.

Diversification of Energy Sources: While oil and gas remain dominant, Iran has opportunities to diversify its energy sector by investing in alternative energy sources, including renewables, which will help balance the country’s energy mix and support sustainability goals.

Market Dynamics

The Iran Oil and Gas Exploration and Production Market is characterized by several key dynamics:

Geopolitical and Economic Shifts: Political changes, both domestically and internationally, play a significant role in shaping the market. Fluctuating geopolitical dynamics, including the potential for easing sanctions and trade agreements, can affect market growth.

Technological Evolution: The need for improved drilling technologies, seismic tools, and EOR techniques is pushing the evolution of exploration and production processes. Iran’s ability to integrate these technologies will determine its success in boosting oil and gas output.

Competition from Other Energy Sources: The increasing adoption of renewable energy sources worldwide is presenting competition to traditional oil and gas producers. However, LNG and natural gas remain competitive alternatives to coal and oil, particularly in power generation.

Price Volatility: The price of oil and gas can be volatile, influenced by global supply-demand dynamics, political instability, and technological advances in extraction. These fluctuations impact the profitability of exploration and production activities in Iran.

Regional Analysis

Iran’s geographical position places it in a significant position in the global energy landscape. The country’s proximity to key global energy markets, especially in Asia, makes it a strategic supplier of oil and gas.

Southern Region: The southern region of Iran is home to the bulk of the country’s oil fields, including the rich reservoirs in Khuzestan and the South Pars gas field in the Persian Gulf. This region remains the focus of exploration and production efforts.

Northern and Central Regions: While the northern and central parts of Iran are less developed in terms of oil and gas extraction, there are opportunities for exploration in unexplored regions, especially for natural gas resources.

Border Regions: Iran shares borders with several countries that are key players in the energy sector, such as Iraq, Turkmenistan, and Azerbaijan. This geographic advantage presents opportunities for cross-border trade and energy infrastructure development.

Competitive Landscape

Leading Companies in Iran Oil and Gas Exploration and Production Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

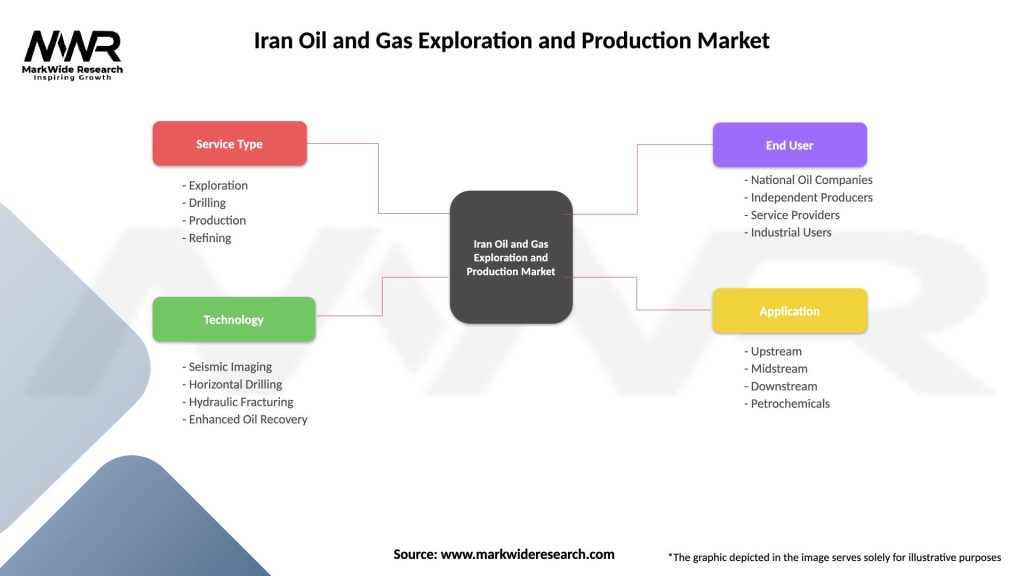

Segmentation

The Iran Oil and Gas Exploration and Production Market can be segmented based on the following:

By Type: Crude Oil, Natural Gas, LNG.

By Application: Upstream, Midstream, Downstream.

By Region: Southern Iran, Northern Iran, Central Iran, Border Regions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Iran Oil and Gas Exploration and Production Market offers several benefits:

Abundant Resources: Iran’s large reserves of oil and gas offer substantial opportunities for exploration, production, and export.

Strategic Location: Iran’s geographic position makes it a critical player in the energy supply chain, especially for gas exports to Asia and Europe.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had significant implications for the Iran oil and gas exploration and production market. The global economic slowdown and fluctuations in energy demand resulted in reduced oil and gas prices, affecting market revenues. Additionally, health and safety measures disrupted operational activities, leading to production delays and logistical challenges.

Key Industry Developments

This section outlines the key industry developments that have shaped the Iran oil and gas exploration and production market in recent times. It may cover policy changes, major discoveries, technological breakthroughs, and significant investments. Industry developments provide insights into the market’s growth trajectory and help stakeholders identify new opportunities.

Analyst Suggestions

Based on expert analysis, this section offers suggestions and recommendations for industry participants to navigate challenges and optimize their operations. Analyst suggestions may include strategies to enhance efficiency, capitalize on emerging trends, mitigate risks, and foster sustainable growth in the Iran oil and gas exploration and production market.

Future Outlook

The future outlook provides a forward-looking perspective on the Iran oil and gas exploration and production market. It considers factors such as anticipated policy changes, technological advancements, and evolving market dynamics. The outlook offers valuable insights for investors and industry participants to make informed decisions and plan for long-term growth.

Conclusion

In conclusion, the Iran oil and gas exploration and production market are a vital component of the country’s economy, driven by its substantial reserves and strategic importance in the global energy landscape. While the market presents numerous opportunities for growth, it also faces challenges due to geopolitical tensions and international sanctions. However, recent diplomatic developments and easing of sanctions offer new possibilities for foreign investments and collaborations. Industry participants must remain adaptive to market dynamics, leverage technology, and embrace sustainable practices to thrive in this dynamic sector. The Iran oil and gas exploration and production market holds the potential to play a crucial role in meeting the world’s energy demands and driving economic development within the country.

What is Oil and Gas Exploration and Production?

Oil and Gas Exploration and Production refers to the processes involved in locating and extracting oil and natural gas resources from the earth. This includes geological surveys, drilling, and production techniques aimed at maximizing resource recovery.

What are the key players in the Iran Oil and Gas Exploration and Production Market?

Key players in the Iran Oil and Gas Exploration and Production Market include National Iranian Oil Company (NIOC), Pars Oil and Gas Company, and Iranian Offshore Oil Company, among others.

What are the growth factors driving the Iran Oil and Gas Exploration and Production Market?

The growth of the Iran Oil and Gas Exploration and Production Market is driven by increasing global energy demand, the country’s vast hydrocarbon reserves, and advancements in extraction technologies that enhance production efficiency.

What challenges does the Iran Oil and Gas Exploration and Production Market face?

The Iran Oil and Gas Exploration and Production Market faces challenges such as international sanctions, aging infrastructure, and environmental concerns that hinder investment and operational efficiency.

What opportunities exist in the Iran Oil and Gas Exploration and Production Market?

Opportunities in the Iran Oil and Gas Exploration and Production Market include potential foreign investments, the development of new oil fields, and the adoption of innovative technologies to improve extraction and processing methods.

What trends are shaping the Iran Oil and Gas Exploration and Production Market?

Trends in the Iran Oil and Gas Exploration and Production Market include a focus on sustainable practices, increased use of digital technologies for exploration, and a shift towards enhancing local content in oil and gas projects.

Iran Oil and Gas Exploration and Production Market

| Segmentation Details | Description |

|---|---|

| Service Type | Exploration, Drilling, Production, Refining |

| Technology | Seismic Imaging, Horizontal Drilling, Hydraulic Fracturing, Enhanced Oil Recovery |

| End User | National Oil Companies, Independent Producers, Service Providers, Industrial Users |

| Application | Upstream, Midstream, Downstream, Petrochemicals |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Iran Oil and Gas Exploration and Production Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at