444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Iran diabetes drugs and devices market represents a critical healthcare sector experiencing significant transformation amid evolving patient needs and technological advancement. Iran’s diabetes prevalence has reached concerning levels, with approximately 8.5% of the adult population affected by this chronic condition, creating substantial demand for comprehensive therapeutic solutions and monitoring devices.

Market dynamics in Iran’s diabetes care sector reflect a complex interplay of domestic manufacturing capabilities, international partnerships, and regulatory frameworks designed to ensure patient access to essential medications and devices. The market encompasses insulin preparations, oral antidiabetic medications, glucose monitoring systems, insulin delivery devices, and emerging digital health solutions tailored to local healthcare infrastructure.

Healthcare infrastructure development across Iran has accelerated the adoption of advanced diabetes management technologies, with urban centers leading the integration of sophisticated monitoring systems and treatment protocols. The market demonstrates robust growth potential, driven by increasing disease awareness, expanding healthcare coverage, and government initiatives supporting diabetes prevention and management programs.

Regional distribution patterns show concentrated market activity in major metropolitan areas including Tehran, Isfahan, and Mashhad, while rural healthcare initiatives are gradually expanding access to essential diabetes care products. The market’s evolution reflects Iran’s commitment to addressing non-communicable diseases through comprehensive healthcare strategies and international collaboration in pharmaceutical development.

The Iran diabetes drugs and devices market refers to the comprehensive ecosystem of pharmaceutical products, medical devices, and healthcare technologies specifically designed for the prevention, diagnosis, monitoring, and treatment of diabetes mellitus within Iran’s healthcare system. This market encompasses both Type 1 and Type 2 diabetes management solutions, including therapeutic medications, blood glucose monitoring equipment, insulin delivery systems, and supportive care technologies.

Market scope includes prescription medications such as insulin formulations, metformin, sulfonylureas, and newer therapeutic classes, alongside medical devices including glucometers, continuous glucose monitors, insulin pens, pumps, and lancets. The definition extends to encompass digital health platforms, telemedicine solutions, and patient education resources that support comprehensive diabetes management within Iran’s unique healthcare landscape.

Regulatory framework governing this market involves Iran’s Food and Drug Administration oversight, import regulations, domestic manufacturing standards, and healthcare reimbursement policies that collectively shape market access and product availability for Iranian patients with diabetes.

Iran’s diabetes drugs and devices market demonstrates remarkable resilience and growth potential despite regional challenges, with increasing prevalence rates driving sustained demand for innovative therapeutic solutions. The market benefits from a combination of domestic pharmaceutical manufacturing capabilities and strategic international partnerships that ensure consistent product availability and technological advancement.

Key market drivers include rising diabetes incidence rates, particularly Type 2 diabetes linked to lifestyle changes and urbanization, alongside growing awareness of diabetes complications and the importance of early intervention. Government healthcare initiatives have prioritized diabetes management, resulting in expanded insurance coverage and subsidized access to essential medications and monitoring devices.

Market segmentation reveals strong performance across multiple therapeutic categories, with insulin products maintaining dominant market share while oral antidiabetic medications show rapid adoption rates. Device segments demonstrate increasing sophistication, with traditional glucometers evolving toward connected health solutions and advanced monitoring systems.

Competitive landscape features a mix of domestic pharmaceutical companies, international partnerships, and emerging technology providers, creating a dynamic environment that fosters innovation while maintaining cost-effective treatment options for diverse patient populations across Iran’s healthcare system.

Market intelligence reveals several critical insights shaping Iran’s diabetes care landscape:

These insights collectively demonstrate the market’s evolution toward more comprehensive, technology-enabled diabetes care solutions that address both clinical effectiveness and patient accessibility within Iran’s healthcare framework.

Primary market drivers propelling Iran’s diabetes drugs and devices market include demographic shifts, lifestyle changes, and healthcare system modernization initiatives that collectively create sustained demand for advanced diabetes management solutions.

Demographic transitions represent a fundamental driver, with Iran’s aging population experiencing higher diabetes incidence rates alongside urbanization trends that contribute to sedentary lifestyles and dietary changes. The growing middle class demonstrates increased healthcare awareness and willingness to invest in quality diabetes management products and services.

Government healthcare initiatives have significantly impacted market growth through expanded insurance coverage, subsidized medication programs, and national diabetes prevention campaigns. Healthcare infrastructure development includes specialized diabetes clinics, trained healthcare professionals, and integrated care protocols that support comprehensive patient management.

Technological advancement drives market evolution through the introduction of smart glucose monitoring systems, connected insulin delivery devices, and mobile health applications that enhance patient engagement and clinical outcomes. These innovations address traditional challenges in diabetes management while improving treatment adherence and quality of life.

International collaboration has facilitated access to advanced pharmaceutical formulations and medical devices through strategic partnerships, technology transfer agreements, and regulatory harmonization efforts that expand treatment options for Iranian patients.

Market constraints affecting Iran’s diabetes drugs and devices sector include economic challenges, regulatory complexities, and healthcare infrastructure limitations that impact product accessibility and market development.

Economic factors present significant challenges, including currency fluctuations that affect imported medical devices and pharmaceutical raw materials, alongside budget constraints that limit healthcare spending and patient out-of-pocket expenses for advanced diabetes management technologies.

Regulatory barriers include complex import procedures, lengthy approval processes for new medications and devices, and stringent quality control requirements that can delay market entry for innovative products. These factors particularly impact access to cutting-edge diabetes technologies and newer therapeutic formulations.

Healthcare infrastructure limitations in rural areas restrict access to specialized diabetes care, advanced monitoring equipment, and trained healthcare professionals. This geographic disparity creates uneven market development and limits the reach of comprehensive diabetes management programs.

Patient education gaps contribute to suboptimal treatment adherence and delayed diagnosis, reducing overall market potential and clinical effectiveness of available diabetes management solutions. Cultural factors and health literacy levels influence patient engagement with modern diabetes care approaches.

Significant opportunities exist within Iran’s diabetes drugs and devices market, driven by unmet medical needs, technological innovation potential, and expanding healthcare access initiatives that create pathways for market growth and patient benefit.

Digital health transformation presents substantial opportunities through telemedicine platforms, mobile health applications, and remote monitoring solutions that can bridge geographic healthcare gaps while providing cost-effective diabetes management support. These technologies offer particular value in rural areas and for patients with limited mobility.

Domestic manufacturing expansion opportunities include local production of generic diabetes medications, basic monitoring devices, and consumable supplies that can reduce import dependence while creating employment and technology transfer benefits. Government support for pharmaceutical manufacturing creates favorable conditions for market development.

Prevention programs represent untapped market potential through early screening initiatives, lifestyle intervention programs, and community health education campaigns that can reduce long-term healthcare costs while creating demand for preventive care products and services.

International partnerships offer opportunities for technology transfer, joint ventures, and collaborative research initiatives that can accelerate access to advanced diabetes management solutions while building local expertise and manufacturing capabilities.

Market dynamics in Iran’s diabetes drugs and devices sector reflect complex interactions between healthcare policy, economic conditions, technological advancement, and patient needs that collectively shape market evolution and competitive positioning.

Supply chain dynamics involve domestic pharmaceutical production, international sourcing of advanced medical devices, and distribution networks that must navigate regulatory requirements while ensuring consistent product availability. MarkWide Research analysis indicates that supply chain optimization has improved product availability by 18% over recent years.

Pricing dynamics balance affordability requirements with quality standards, involving government price controls, insurance reimbursement policies, and competitive pressures that influence market access and company profitability. Generic medication adoption has increased cost-effectiveness while maintaining therapeutic efficacy.

Innovation dynamics drive market differentiation through research and development investments, clinical trial participation, and technology adoption that enhance treatment outcomes and patient experience. The integration of artificial intelligence and data analytics into diabetes management represents an emerging dynamic with significant potential impact.

Regulatory dynamics continue evolving through policy updates, international harmonization efforts, and quality assurance improvements that affect market entry requirements and operational compliance for diabetes care providers and product manufacturers.

Research methodology for analyzing Iran’s diabetes drugs and devices market employs comprehensive data collection and analysis techniques that ensure accurate market assessment and reliable insights for stakeholders and decision-makers.

Primary research involves structured interviews with healthcare professionals, diabetes specialists, hospital administrators, and pharmaceutical industry executives to gather firsthand insights about market trends, challenges, and opportunities. Patient surveys and focus groups provide valuable perspectives on treatment preferences and unmet needs.

Secondary research encompasses analysis of government health statistics, pharmaceutical industry reports, academic publications, and international diabetes care guidelines to establish market context and benchmark performance against global standards. Healthcare database analysis provides quantitative insights into prescription patterns and device utilization.

Market modeling techniques include statistical analysis of historical trends, correlation studies between demographic factors and diabetes prevalence, and forecasting models that account for policy changes and technological advancement. Cross-validation methods ensure data accuracy and reliability.

Expert validation processes involve consultation with clinical specialists, healthcare economists, and industry analysts to verify findings and ensure research conclusions accurately reflect market realities and future potential within Iran’s unique healthcare environment.

Regional market analysis reveals significant variations in diabetes drugs and devices adoption across Iran’s diverse geographic and demographic landscape, with distinct patterns of healthcare access, disease prevalence, and treatment preferences.

Tehran metropolitan area dominates market activity with approximately 28% of total market share, driven by concentrated healthcare infrastructure, higher income levels, and greater access to advanced diabetes management technologies. The capital region serves as a hub for pharmaceutical distribution and medical device importation.

Isfahan and Mashhad represent secondary market centers with combined market share of 22%, benefiting from established healthcare networks, university medical centers, and regional distribution capabilities that support comprehensive diabetes care delivery to surrounding provinces.

Northern provinces including Gilan and Mazandaran demonstrate above-average diabetes prevalence rates linked to dietary patterns and lifestyle factors, creating focused demand for culturally appropriate treatment approaches and patient education programs.

Southern and southeastern regions face healthcare access challenges that limit market penetration for advanced diabetes technologies, though government initiatives are expanding basic medication availability and monitoring device access through rural health networks and mobile clinic programs.

Border provinces benefit from cross-border healthcare cooperation and trade relationships that facilitate access to diabetes medications and devices, while also presenting unique regulatory and quality assurance considerations for market participants.

Competitive landscape in Iran’s diabetes drugs and devices market features a diverse mix of domestic pharmaceutical companies, international partners, and emerging technology providers that collectively serve the country’s growing diabetes patient population.

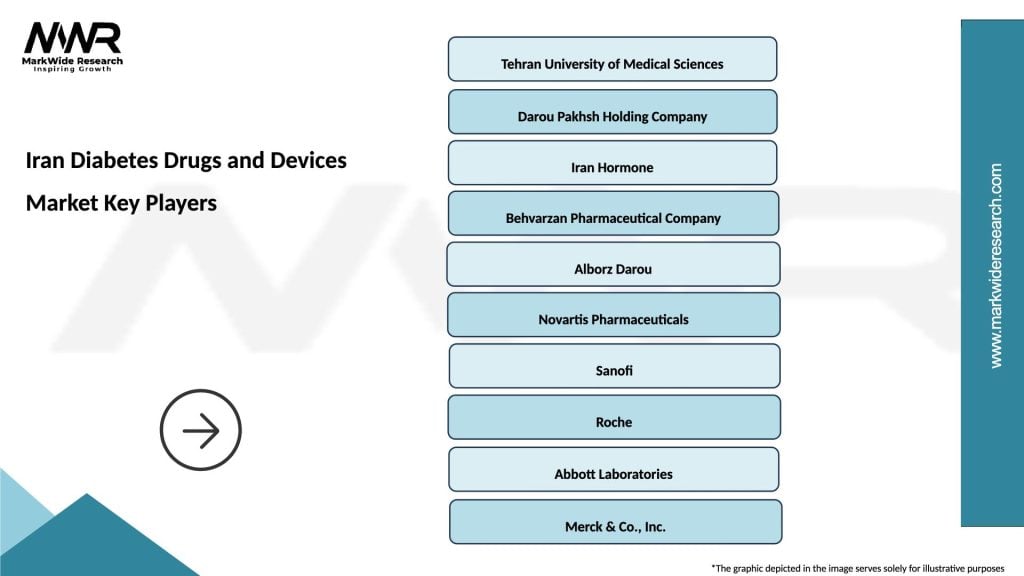

Leading market participants include:

Market competition centers on product quality, pricing strategies, distribution efficiency, and patient support services, with companies differentiating through innovation, accessibility, and comprehensive care solutions tailored to Iranian healthcare needs.

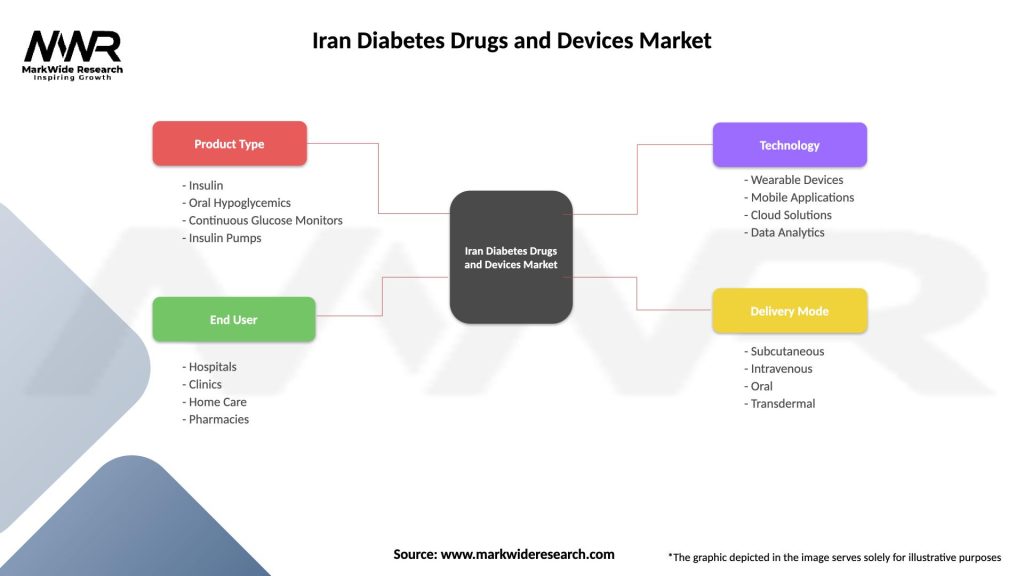

Market segmentation analysis reveals distinct categories within Iran’s diabetes drugs and devices market, each with unique characteristics, growth patterns, and competitive dynamics that influence overall market development.

By Product Type:

By Diabetes Type:

By End User:

Category analysis provides detailed insights into specific market segments within Iran’s diabetes drugs and devices landscape, revealing growth opportunities and competitive positioning across therapeutic and device categories.

Insulin Category: Represents the largest therapeutic segment with strong demand for both human insulin and analog formulations. Long-acting insulin products demonstrate particular growth due to improved patient compliance and clinical outcomes. Domestic production capabilities have strengthened market stability while international partnerships ensure access to advanced formulations.

Oral Medications Category: Shows robust growth driven by Type 2 diabetes prevalence and cost-effective treatment options. Metformin combinations lead market adoption while newer therapeutic classes including SGLT-2 inhibitors and GLP-1 agonists gain traction among healthcare providers seeking improved glycemic control.

Monitoring Devices Category: Traditional glucometers maintain market dominance while continuous glucose monitoring systems represent the fastest-growing subsegment. Smart connectivity features and data integration capabilities drive premium product adoption among tech-savvy patients and progressive healthcare providers.

Delivery Systems Category: Insulin pens have largely replaced traditional syringes due to convenience and accuracy benefits. Smart insulin pens with dose tracking and connectivity features represent emerging opportunities, while insulin pump adoption remains limited but growing among Type 1 diabetes patients.

Industry participants and stakeholders in Iran’s diabetes drugs and devices market realize substantial benefits through market participation, strategic positioning, and value creation across the healthcare ecosystem.

Pharmaceutical Companies benefit from:

Healthcare Providers gain:

Patients experience:

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Iran’s diabetes drugs and devices sector reflect global healthcare evolution adapted to local needs, regulatory environment, and patient preferences.

Digital Integration represents a transformative trend with increasing adoption of connected glucose meters, smartphone applications for diabetes management, and telemedicine consultations. MWR analysis indicates that digital health engagement among diabetes patients has grown by 40% annually, driven by improved internet connectivity and smartphone penetration.

Personalized Medicine gains momentum through genetic testing, individualized treatment protocols, and precision dosing strategies that optimize therapeutic outcomes while minimizing adverse effects. Healthcare providers increasingly adopt personalized approaches based on patient-specific factors and treatment response patterns.

Preventive Care Focus shifts market emphasis toward early detection, lifestyle intervention programs, and community health initiatives that address diabetes risk factors before clinical diagnosis. This trend creates opportunities for screening devices, educational resources, and preventive care technologies.

Biosimilar Adoption accelerates as healthcare systems seek cost-effective alternatives to branded insulin products while maintaining therapeutic efficacy. Regulatory frameworks supporting biosimilar approval and physician confidence in these products drive market penetration.

Integrated Care Models promote comprehensive diabetes management through coordinated healthcare delivery, multidisciplinary care teams, and patient-centered treatment approaches that address both clinical and psychosocial aspects of diabetes care.

Recent industry developments demonstrate significant progress in Iran’s diabetes drugs and devices market through regulatory improvements, technology adoption, and strategic partnerships that enhance patient care and market accessibility.

Regulatory Advancements include streamlined approval processes for essential diabetes medications, updated quality standards for medical devices, and expanded insurance coverage for diabetes management products. These developments improve market access while ensuring patient safety and product efficacy.

Manufacturing Expansion involves new pharmaceutical production facilities, technology transfer agreements for insulin manufacturing, and local assembly of glucose monitoring devices. These initiatives reduce import dependence while creating employment and building technical expertise.

Digital Health Initiatives encompass government-supported telemedicine programs, mobile health applications for diabetes management, and electronic health record integration that improves care coordination and patient outcomes.

International Partnerships facilitate access to advanced diabetes technologies through joint ventures, distribution agreements, and collaborative research programs that bring global expertise to Iran’s healthcare system while respecting local regulatory requirements.

Healthcare Infrastructure improvements include specialized diabetes centers, upgraded hospital equipment, and expanded rural health networks that increase access to comprehensive diabetes care across diverse geographic regions.

Strategic recommendations for stakeholders in Iran’s diabetes drugs and devices market focus on sustainable growth, patient benefit, and market development that addresses current challenges while capitalizing on emerging opportunities.

For Pharmaceutical Companies:

For Healthcare Providers:

For Government and Policymakers:

Future market outlook for Iran’s diabetes drugs and devices sector indicates sustained growth driven by demographic trends, technological advancement, and healthcare system evolution that collectively create favorable conditions for market expansion and patient benefit.

Market growth projections suggest continued expansion at a robust pace, with diabetes prevalence expected to increase by 15% over the next five years due to aging population and lifestyle factors. This demographic shift will drive sustained demand for comprehensive diabetes management solutions across all therapeutic and device categories.

Technology integration will accelerate through artificial intelligence applications, advanced glucose monitoring systems, and digital health platforms that enhance clinical decision-making and patient engagement. MarkWide Research forecasts that connected health solutions will achieve 60% market penetration among urban diabetes patients within the next decade.

Healthcare infrastructure development will expand access to specialized diabetes care through telemedicine networks, mobile health units, and community health programs that address geographic disparities while maintaining cost-effective care delivery.

International collaboration will strengthen through technology transfer agreements, joint research initiatives, and regulatory harmonization efforts that facilitate access to innovative diabetes management solutions while building local expertise and manufacturing capabilities.

Prevention focus will intensify through population health initiatives, early screening programs, and lifestyle intervention strategies that address diabetes risk factors before clinical manifestation, potentially reducing long-term healthcare costs and improving population health outcomes.

Iran’s diabetes drugs and devices market represents a dynamic and essential healthcare sector characterized by significant growth potential, evolving patient needs, and strategic opportunities for stakeholders committed to improving diabetes care outcomes. The market demonstrates resilience and adaptability in addressing challenges while capitalizing on technological advancement and healthcare system modernization.

Market fundamentals remain strong, supported by increasing diabetes prevalence, government healthcare initiatives, and expanding access to essential medications and monitoring devices. The combination of domestic manufacturing capabilities and international partnerships creates a robust foundation for sustained market development and patient benefit.

Future success in this market will depend on continued innovation, strategic collaboration, and patient-centered approaches that address the unique needs of Iran’s diverse population while leveraging global best practices in diabetes care. Stakeholders who invest in technology integration, healthcare infrastructure, and comprehensive care models will be best positioned to contribute to improved patient outcomes while achieving sustainable business growth.

The Iran diabetes drugs and devices market stands at a critical juncture where demographic trends, technological possibilities, and healthcare policy alignment create unprecedented opportunities for transformative impact on diabetes care delivery and patient quality of life throughout the country.

What is Diabetes Drugs and Devices?

Diabetes Drugs and Devices refer to the medications and tools used to manage diabetes, including insulin, oral hypoglycemics, glucose meters, and insulin pumps. These products are essential for maintaining blood sugar levels and preventing complications associated with diabetes.

What are the key players in the Iran Diabetes Drugs and Devices Market?

Key players in the Iran Diabetes Drugs and Devices Market include companies like Tehran Chemie, Darou Pakhsh, and Zahravi Pharmaceutical Company. These companies are involved in the production and distribution of diabetes medications and monitoring devices, among others.

What are the growth factors driving the Iran Diabetes Drugs and Devices Market?

The growth of the Iran Diabetes Drugs and Devices Market is driven by the increasing prevalence of diabetes, rising awareness about diabetes management, and advancements in medical technology. Additionally, government initiatives to improve healthcare access contribute to market expansion.

What challenges does the Iran Diabetes Drugs and Devices Market face?

The Iran Diabetes Drugs and Devices Market faces challenges such as regulatory hurdles, limited access to advanced technologies, and economic sanctions affecting the import of high-quality products. These factors can hinder the availability and affordability of essential diabetes care solutions.

What opportunities exist in the Iran Diabetes Drugs and Devices Market?

Opportunities in the Iran Diabetes Drugs and Devices Market include the potential for local manufacturing of diabetes products, increasing investment in healthcare infrastructure, and the growing demand for innovative diabetes management solutions. These factors can enhance market growth and accessibility.

What trends are shaping the Iran Diabetes Drugs and Devices Market?

Trends in the Iran Diabetes Drugs and Devices Market include the rise of digital health technologies, such as mobile health applications for diabetes management, and the development of smart insulin delivery systems. These innovations aim to improve patient outcomes and enhance the overall management of diabetes.

Iran Diabetes Drugs and Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin, Oral Hypoglycemics, Continuous Glucose Monitors, Insulin Pumps |

| End User | Hospitals, Clinics, Home Care, Pharmacies |

| Technology | Wearable Devices, Mobile Applications, Cloud Solutions, Data Analytics |

| Delivery Mode | Subcutaneous, Intravenous, Oral, Transdermal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Iran Diabetes Drugs and Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at