444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The IoT smart poles market represents a revolutionary transformation in urban infrastructure, combining traditional street lighting with advanced connectivity and smart city technologies. These intelligent infrastructure solutions integrate multiple functionalities including LED lighting, wireless communication, environmental monitoring, traffic management, and public safety features into a single pole structure. Smart poles serve as the backbone of connected cities, enabling seamless data collection and transmission while supporting various IoT applications.

Market dynamics indicate robust growth driven by increasing urbanization, government initiatives for smart city development, and the growing need for energy-efficient lighting solutions. The integration of 5G networks has particularly accelerated adoption, with smart poles serving as ideal platforms for small cell deployment. According to MarkWide Research analysis, the market is experiencing significant expansion across developed and emerging economies, with adoption rates reaching 35% in major metropolitan areas globally.

Technology convergence has enabled smart poles to become multifunctional platforms supporting various applications from environmental monitoring to electric vehicle charging. The market encompasses diverse pole types including decorative smart poles, utility smart poles, and hybrid solutions designed for specific urban environments. LED lighting integration remains the primary driver, offering energy savings of up to 60% compared to traditional lighting systems.

The IoT smart poles market refers to the comprehensive ecosystem of intelligent street lighting and infrastructure solutions that integrate Internet of Things technologies, sensors, communication systems, and data analytics capabilities into traditional pole structures. These advanced systems transform conventional street furniture into connected platforms that support multiple smart city applications while providing enhanced lighting, connectivity, and urban services.

Smart poles represent the convergence of lighting technology, telecommunications infrastructure, and IoT sensors, creating multifunctional urban assets that serve as data collection points, communication hubs, and service delivery platforms. The market encompasses hardware components, software platforms, installation services, and ongoing maintenance solutions that enable cities to deploy and manage these intelligent infrastructure systems effectively.

Market expansion in the IoT smart poles sector is driven by accelerating smart city initiatives, increasing demand for energy-efficient lighting solutions, and the rapid deployment of 5G networks requiring dense infrastructure support. Cities worldwide are recognizing the value proposition of smart poles as cost-effective platforms for multiple urban services, leading to widespread adoption across various geographic regions.

Technology integration continues to evolve, with modern smart poles incorporating advanced features such as environmental sensors, traffic monitoring cameras, public Wi-Fi hotspots, emergency call systems, and electric vehicle charging stations. The market benefits from strong government support, with public sector investments accounting for 70% of total deployments globally, while private sector participation is growing through public-private partnerships.

Regional dynamics show varying adoption patterns, with North America and Europe leading in terms of technology sophistication and deployment scale, while Asia-Pacific markets demonstrate the highest growth rates driven by rapid urbanization and smart city investments. The market faces challenges related to high initial investment costs and integration complexity, but long-term benefits including energy savings, operational efficiency, and revenue generation opportunities continue to drive adoption.

Strategic insights reveal several critical factors shaping the IoT smart poles market landscape:

Smart city initiatives represent the primary growth driver, with governments worldwide investing heavily in urban digitization and intelligent infrastructure development. Cities recognize smart poles as foundational elements for comprehensive smart city ecosystems, enabling integrated service delivery and data-driven urban management. Government funding programs and policy support create favorable conditions for market expansion.

Energy efficiency mandates drive adoption as municipalities seek to reduce operational costs and meet sustainability targets. Smart poles offer immediate energy savings through LED technology and adaptive lighting controls, while providing long-term operational benefits through remote monitoring and predictive maintenance capabilities. Environmental regulations increasingly favor energy-efficient lighting solutions.

5G network deployment creates substantial demand for smart poles as small cell hosting platforms. Telecommunications operators require dense infrastructure networks to support 5G coverage, making smart poles ideal solutions that combine connectivity infrastructure with existing urban furniture. The convergence of lighting and telecommunications infrastructure offers compelling economic benefits for cities and operators.

Urbanization trends increase the need for intelligent infrastructure solutions that can adapt to growing urban populations and changing service requirements. Smart poles provide scalable platforms for expanding urban services without requiring additional physical infrastructure, making them attractive solutions for rapidly growing cities.

High initial investment costs present significant barriers to adoption, particularly for smaller municipalities with limited budgets. Smart pole systems require substantial upfront capital for hardware, installation, and system integration, creating financial challenges despite long-term operational savings. Budget constraints often delay or limit deployment scope.

Technical complexity in system integration and interoperability creates implementation challenges. Smart poles must integrate multiple technologies, communication protocols, and software platforms, requiring specialized expertise and careful planning. Integration difficulties can lead to project delays and cost overruns.

Cybersecurity concerns regarding connected infrastructure create hesitation among some municipalities. Smart poles collect and transmit sensitive data, making them potential targets for cyber attacks. Data privacy regulations and security requirements add complexity and cost to deployments.

Maintenance complexity increases operational challenges as smart poles incorporate multiple systems requiring different maintenance approaches and expertise. Traditional lighting maintenance teams may lack the technical skills needed for advanced IoT systems, necessitating training or outsourcing arrangements.

Revenue generation opportunities through advertising displays, data services, and telecommunications hosting create attractive business models for cities and private partners. Smart poles can generate ongoing revenue streams that offset initial investment costs and provide sustainable funding for urban services. Digital advertising integration offers particularly compelling monetization potential.

Electric vehicle infrastructure integration presents significant growth opportunities as cities expand EV charging networks. Smart poles provide ideal platforms for EV charging stations, combining lighting, connectivity, and charging services in single installations. EV adoption growth of 25% annually drives demand for integrated charging solutions.

Environmental monitoring capabilities enable cities to address air quality, noise pollution, and climate change challenges through comprehensive sensor networks. Smart poles provide distributed monitoring platforms that support environmental compliance and public health initiatives. Climate action requirements create growing demand for environmental monitoring solutions.

Public safety enhancement through integrated security cameras, emergency communication systems, and crowd monitoring capabilities offers substantial value for urban safety initiatives. Smart poles can improve emergency response times and crime prevention while providing citizens with enhanced security features.

Technology evolution continues to expand smart pole capabilities and reduce costs, making solutions more accessible to diverse markets. Advances in LED efficiency, sensor technology, and wireless communication create more compelling value propositions while improving system reliability and performance. Component costs have decreased by 30% over the past three years.

Competitive landscape intensification drives innovation and price competition, benefiting end users through improved solutions and more favorable pricing. Established lighting manufacturers compete with technology companies and telecommunications providers, creating diverse solution offerings and partnership opportunities.

Regulatory support through smart city policies, energy efficiency standards, and telecommunications infrastructure requirements creates favorable market conditions. Government initiatives often include specific provisions for smart lighting and connected infrastructure, providing clear market direction and funding opportunities.

Partnership models evolution enables more flexible deployment approaches, including leasing arrangements, performance contracts, and revenue-sharing agreements. These models reduce financial barriers and risk for municipalities while providing sustainable business models for solution providers.

Comprehensive analysis of the IoT smart poles market employs multiple research methodologies to ensure accuracy and completeness. Primary research includes extensive interviews with industry stakeholders, including smart pole manufacturers, system integrators, municipal officials, and technology providers. Survey data collection from over 200 industry participants provides quantitative insights into market trends and adoption patterns.

Secondary research encompasses analysis of industry reports, government publications, technology specifications, and market intelligence from various sources. Financial analysis of public companies, patent research, and regulatory document review provide additional market insights. Data triangulation methods ensure reliability and accuracy of market assessments.

Market modeling utilizes statistical analysis and forecasting techniques to project market growth and identify key trends. Geographic analysis covers major markets including North America, Europe, Asia-Pacific, and emerging regions. Scenario analysis evaluates various growth trajectories based on different adoption rates and technology development paths.

North America leads the smart poles market in terms of technology adoption and deployment sophistication, with the United States and Canada implementing large-scale smart city initiatives. The region benefits from strong government support, advanced telecommunications infrastructure, and high municipal budgets for technology investments. Market penetration reaches 45% in major metropolitan areas.

Europe demonstrates strong growth driven by EU smart city policies and environmental regulations promoting energy-efficient lighting solutions. Countries including the United Kingdom, Germany, and Netherlands lead in deployment scale and technology innovation. European markets show particular strength in integrated environmental monitoring and public safety applications.

Asia-Pacific exhibits the highest growth rates globally, driven by rapid urbanization, government smart city investments, and growing telecommunications infrastructure needs. China, India, and Southeast Asian countries are implementing massive smart pole deployments as part of comprehensive urban development programs. Regional growth rates exceed 15% annually.

Middle East and Africa present emerging opportunities driven by urban development projects and government modernization initiatives. Smart city developments in the UAE, Saudi Arabia, and South Africa create demand for advanced infrastructure solutions including smart poles.

Market leadership is distributed among several categories of companies, each bringing different strengths and capabilities to the smart poles ecosystem:

Strategic partnerships between lighting manufacturers, telecommunications companies, and technology providers create comprehensive solution offerings that address diverse customer requirements. Collaboration models enable companies to leverage complementary strengths while expanding market reach.

By Component:

By Application:

By End User:

LED Lighting Integration represents the foundation of most smart pole deployments, providing immediate energy savings and operational benefits. Advanced LED systems with dimming controls and adaptive lighting capabilities offer energy reductions of 50-70% compared to traditional lighting. Color temperature adjustment and dynamic lighting control enhance user experience and safety.

5G Small Cell Integration creates significant value for telecommunications operators and cities seeking to monetize infrastructure investments. Smart poles provide ideal platforms for small cell deployment, offering power, connectivity, and strategic locations for network coverage. Revenue sharing models between cities and operators create sustainable funding mechanisms.

Environmental Sensing capabilities enable cities to monitor air quality, noise levels, and weather conditions through distributed sensor networks. Real-time environmental data supports public health initiatives, regulatory compliance, and climate action programs. Data accuracy improvements of 40% compared to traditional monitoring stations make smart poles attractive for environmental agencies.

Public Safety Features including security cameras, emergency call boxes, and gunshot detection systems enhance urban safety and emergency response capabilities. Integrated public safety systems improve response times and crime prevention while providing citizens with enhanced security features and peace of mind.

Municipalities benefit from reduced energy costs, improved operational efficiency, and enhanced citizen services through smart pole deployments. Cities can achieve energy savings of 40-60% while gaining valuable data insights for urban planning and service optimization. Revenue generation opportunities through advertising and telecommunications hosting provide additional financial benefits.

Technology Providers gain access to growing markets with substantial long-term revenue potential through hardware sales, software licensing, and ongoing service contracts. The recurring revenue model from maintenance and data services provides stable income streams and customer relationships.

Telecommunications Operators benefit from cost-effective infrastructure deployment platforms for 5G networks and small cell systems. Smart poles reduce deployment costs and accelerate network rollout while providing strategic locations for coverage optimization.

Citizens experience improved urban services including better lighting, enhanced safety, environmental monitoring, and connectivity services. Smart poles contribute to improved quality of life through more responsive city services and enhanced urban environments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Edge Computing Integration represents a significant trend as smart poles incorporate local processing capabilities to reduce latency and improve real-time response. Edge computing enables advanced applications including traffic optimization, emergency response, and predictive maintenance while reducing bandwidth requirements and improving system reliability.

Artificial Intelligence integration enhances smart pole capabilities through automated decision-making, predictive analytics, and adaptive system optimization. AI-powered systems can automatically adjust lighting levels, detect anomalies, and optimize energy consumption based on usage patterns and environmental conditions.

Modular Design approaches enable flexible deployment and future expansion capabilities. Modular smart poles allow cities to start with basic lighting functionality and add features over time based on budget availability and service requirements. Upgrade flexibility reduces long-term technology risks and enables gradual capability expansion.

Sustainability Focus drives demand for environmentally friendly smart pole solutions including solar power integration, recyclable materials, and carbon footprint reduction. Cities increasingly prioritize sustainable infrastructure solutions that support climate action goals and environmental stewardship.

Strategic partnerships between lighting manufacturers and telecommunications companies create comprehensive smart pole solutions that address both lighting and connectivity requirements. Recent collaborations enable integrated 5G small cell deployment with advanced lighting systems, creating compelling value propositions for cities and operators.

Technology standardization efforts through industry organizations and standards bodies aim to improve interoperability and reduce deployment complexity. MWR analysis indicates that standardization progress has accelerated adoption rates by 25% in markets with established standards frameworks.

Government initiatives including smart city funding programs and infrastructure investment plans provide substantial market support. Recent legislation in multiple countries specifically includes provisions for smart lighting and connected infrastructure, creating clear market opportunities and funding mechanisms.

Product innovation continues with advanced sensor integration, improved energy efficiency, and enhanced connectivity capabilities. New product launches demonstrate ongoing technology evolution and expanding application possibilities for smart pole systems.

Market participants should focus on developing comprehensive solution portfolios that address multiple customer requirements through integrated platforms. Companies that can provide end-to-end solutions including hardware, software, and services will be best positioned for market success. Partnership strategies with complementary technology providers can accelerate capability development and market reach.

Technology investment in edge computing, AI integration, and advanced analytics capabilities will differentiate leading solutions and create competitive advantages. Companies should prioritize R&D investments in next-generation technologies that enhance smart pole value propositions and enable new application possibilities.

Geographic expansion strategies should prioritize high-growth markets in Asia-Pacific and emerging regions where urbanization and smart city investments create substantial opportunities. Local partnerships and market-specific solution adaptation will be critical for success in diverse geographic markets.

Business model innovation including leasing arrangements, performance contracts, and revenue-sharing agreements can reduce customer barriers and accelerate adoption. Flexible financing and risk-sharing models make smart pole solutions more accessible to budget-constrained municipalities.

Market evolution will be driven by continued urbanization, 5G network deployment, and increasing focus on sustainable infrastructure solutions. The convergence of lighting, telecommunications, and IoT technologies will create more sophisticated and valuable smart pole platforms that serve as critical urban infrastructure components.

Technology advancement will enable more capable and cost-effective solutions through improved LED efficiency, advanced sensor integration, and enhanced connectivity options. Cost reductions of 20-30% over the next five years will make smart poles accessible to smaller municipalities and emerging markets.

Application expansion will extend smart pole capabilities into new areas including autonomous vehicle support, drone charging stations, and advanced environmental monitoring. The platform approach will enable continuous capability expansion and service enhancement over system lifetimes.

Market maturation will bring improved standards, simplified deployment processes, and more competitive pricing. As the market matures, focus will shift from basic functionality to advanced applications and value-added services that differentiate solutions and create sustainable competitive advantages.

The IoT smart poles market represents a transformative opportunity in urban infrastructure development, combining energy efficiency, connectivity, and smart city capabilities in integrated solutions. Market growth is driven by strong fundamentals including urbanization trends, government smart city initiatives, 5G deployment requirements, and increasing focus on sustainable infrastructure solutions.

Success factors for market participants include comprehensive solution portfolios, strategic partnerships, technology innovation, and flexible business models that address diverse customer requirements. The market offers substantial opportunities for companies that can navigate technical complexity while delivering compelling value propositions to municipalities and other end users.

Future prospects remain highly positive as cities worldwide recognize the value of intelligent infrastructure solutions that provide multiple benefits through single installations. The convergence of lighting, telecommunications, and IoT technologies creates a compelling market opportunity that will continue expanding as technology costs decrease and capabilities improve. Market participants that invest in technology development, partnership strategies, and market expansion will be well-positioned to capitalize on this growing opportunity in the evolving smart cities landscape.

What is IoT Smart Poles?

IoT Smart Poles are advanced street lighting solutions that integrate Internet of Things (IoT) technology to enhance urban infrastructure. They typically feature sensors, cameras, and communication systems to monitor environmental conditions, improve energy efficiency, and provide data for smart city applications.

What are the key companies in the IoT Smart Poles Market?

Key companies in the IoT Smart Poles Market include Philips Lighting, Siemens, and GE Current, which are known for their innovative smart lighting solutions and integration of IoT technologies in urban environments, among others.

What are the growth factors driving the IoT Smart Poles Market?

The growth of the IoT Smart Poles Market is driven by the increasing demand for smart city initiatives, the need for energy-efficient lighting solutions, and the rising adoption of connected devices in urban areas. These factors contribute to enhanced public safety and improved urban management.

What challenges does the IoT Smart Poles Market face?

The IoT Smart Poles Market faces challenges such as high initial installation costs, concerns over data privacy and security, and the need for robust infrastructure to support IoT connectivity. These issues can hinder widespread adoption in some regions.

What opportunities exist in the IoT Smart Poles Market?

Opportunities in the IoT Smart Poles Market include the potential for integrating renewable energy sources, such as solar panels, and expanding applications in traffic management and environmental monitoring. These advancements can enhance the functionality and sustainability of urban infrastructure.

What trends are shaping the IoT Smart Poles Market?

Trends in the IoT Smart Poles Market include the increasing use of artificial intelligence for data analysis, the development of multi-functional poles that support various urban services, and the growing emphasis on sustainability and energy efficiency in urban planning.

IoT Smart Poles Market

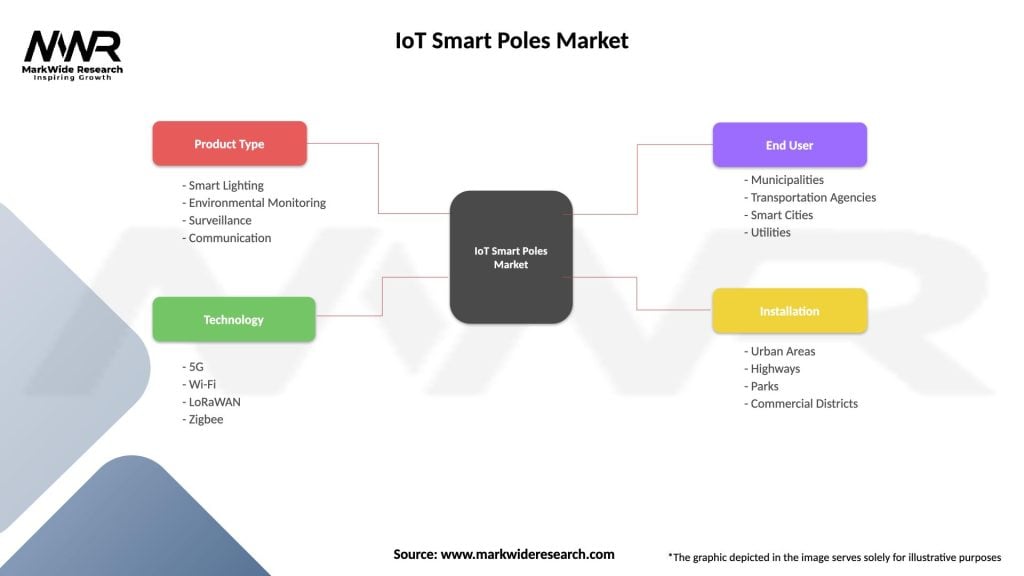

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Lighting, Environmental Monitoring, Surveillance, Communication |

| Technology | 5G, Wi-Fi, LoRaWAN, Zigbee |

| End User | Municipalities, Transportation Agencies, Smart Cities, Utilities |

| Installation | Urban Areas, Highways, Parks, Commercial Districts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the IoT Smart Poles Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at