444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Ion Beam Based Deposition market is a rapidly growing sector in the advanced materials industry. Ion beam based deposition is a technique that involves the deposition of thin films or coatings on a substrate using ion beams. This process is widely used in various applications, including semiconductor manufacturing, optical coatings, and thin film solar cells, among others.

Meaning

Ion Beam Based Deposition is a cutting-edge technology that involves the deposition of thin films on various surfaces using ion beams. It is a highly specialized process that finds applications in multiple industries, including electronics, optics, and medical devices. This innovative technique allows precise control over film thickness and composition, making it ideal for producing high-quality coatings with unique properties. Ion beam based deposition involves the use of energetic ions that are accelerated and directed towards a target material, causing the atoms to sputter off and form a thin film on the substrate. The ions can be selected based on their properties to create films with desired characteristics, such as improved hardness, adhesion, and optical properties.

Executive Summary

The Ion Beam Based Deposition market has experienced remarkable growth in recent years, driven by advancements in nanotechnology and the demand for superior materials in various applications. This technology has gained popularity due to its ability to produce thin films with exceptional precision and control, meeting the increasing requirements of industries across the globe. The market is expected to witness significant growth in the forecast period, driven by the expanding semiconductor and electronics industry, rising demand for high-performance optical coatings, and advancements in ion beam technology. Moreover, the growing need for advanced medical devices and the emergence of new applications in the energy sector are expected to further boost the market growth.

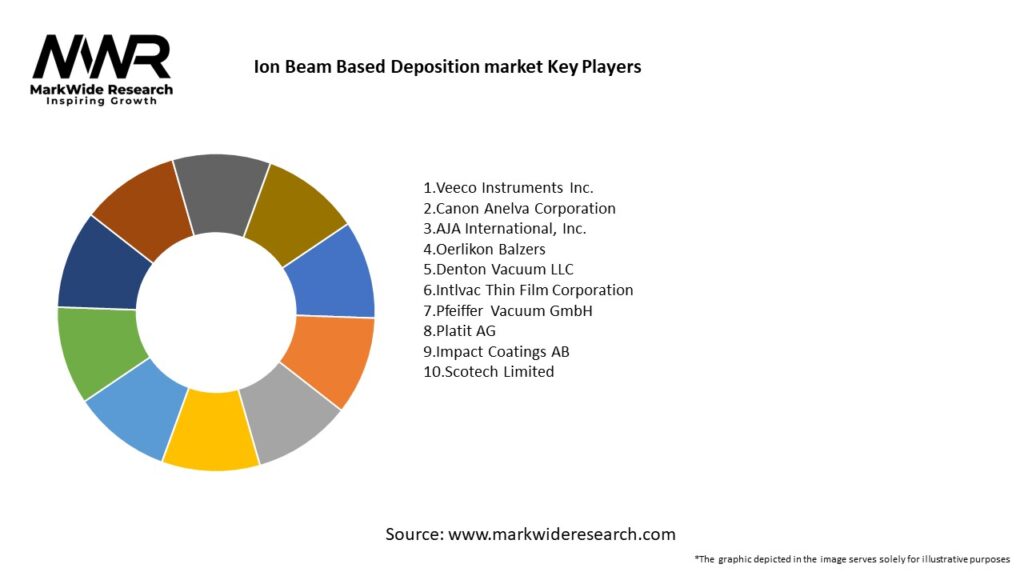

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Premium Positioning: Ion beam deposition is often reserved for premium coatings where superior film quality or interface performance is required.

R&D-Driven Adoption: Many installations are in research, pilot lines, and advanced laboratories, with gradual migration to production lines as throughput improves.

Hybrid System Growth: Toolmakers increasingly combine ion beam with magnetron sputtering or pulsed-DC systems to balance throughput and quality.

Materials Innovation: Growth in new materials—such as high-index optical coatings, transparent conductors, and layered nanocomposites—boosts demand for precise deposition control.

Cost Reduction Pressure: To expand adoption, system providers must improve source lifetime, reduce consumables, and increase deposition rates without sacrificing quality.

Market Drivers

Optical Coatings Demand: High-performance optical lenses, mirrors, lasers, and AR coatings demand ultra-precise, low-defect films.

Semiconductor & Microelectronics: Critical gate dielectrics, barrier layers, and interface engineering at the nanoscale require ion-beam-enhanced deposition.

Photonics & MEMS Devices: Micro‑optics, waveguides, and sensor surfaces benefit from dense, stable films produced via ion beams.

Advanced Materials R&D: Emerging materials such as perovskites, 2D materials, and novel alloys require controlled deposition methods in research labs.

Reliability & Longevity Needs: Applications in aerospace, defense, and high-reliability optics demand coatings with high environmental stability and adhesion.

Market Restraints

High Capital & Operating Costs: Ion beam tools are expensive to acquire and maintain; ion sources and vacuum systems add to OPEX.

Throughput Limitations: Ion beam deposition tends to be slower compared to conventional sputtering or CVD, limiting adoption in high-volume manufacturing.

Complexity in Scaling: Uniformity over large substrates and scaling for full-wafer or large optics is technically challenging.

Competition from Alternative Techniques: High-precision ALD, PECVD, or conventional sputtering can satisfy many needs at lower cost.

Consumable & Wear Issues: Ion sources and beam optics require maintenance or replacement, adding to total cost.

Market Opportunities

High-End Optical Manufacturing: Large optics for telescopes, lithography, precision mirrors, and laser components present premium opportunities.

Quantum & Photonic Devices: Ion beam deposition’s ability to produce high-purity, dense films supports quantum devices, integrated photonics, and sensor surfaces.

Hybrid Production Tools: Combining ion beam with higher-rate processes offers a pathway to bridge quality and throughput.

Customization & Prototyping Services: Offering contract coating services for advanced R&D and small-batch production.

Emerging Materials & 2D Films: Deposition of graphene, transition-metal dichalcogenides, or oxide heterostructures for specialty electronics and sensors.

Market Dynamics

Supply-Side Factors:

Tool manufacturers compete on source stability, beam uniformity, substrate handling, and integration.

Ion source lifetime, beam optics design, and reliability are key differentiators.

Providers focus on modular upgrade paths (ion beam attachment modules) for existing deposition tools.

Demand-Side Factors:

Researchers and high-end manufacturers prioritize film quality, adhesion, and interface control.

Demand from pilot, prototyping, and small-batch production segments leads adoption before full-scale manufacturing.

Economic & Policy Factors:

Research funding and government grants for photonics, quantum, and advanced manufacturing support adoption.

Intellectual property and proprietary materials may drive demand for contract deposition services rather than in-house investments.

Regional Analysis

North America & Europe: Strong presence of research institutions, defense, and optics manufacturing who are primary users of ion beam deposition.

Asia-Pacific: Growth in semiconductor, photonics, and display sectors in China, Japan, South Korea, and Taiwan drives demand for advanced deposition tools.

Japan and South Korea: Particularly active in precision optics, memory, and high-end photonics using ion-beam-enhanced layers.

China: Rapid transition to domestic tool adoption and local coating service providers, though cost pressures remain high.

Emerging Markets (India, Southeast Asia): Slowly adopting for advanced R&D segments, especially in universities and startups.

Competitive Landscape

Leading Companies in the Ion Beam Based Deposition Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

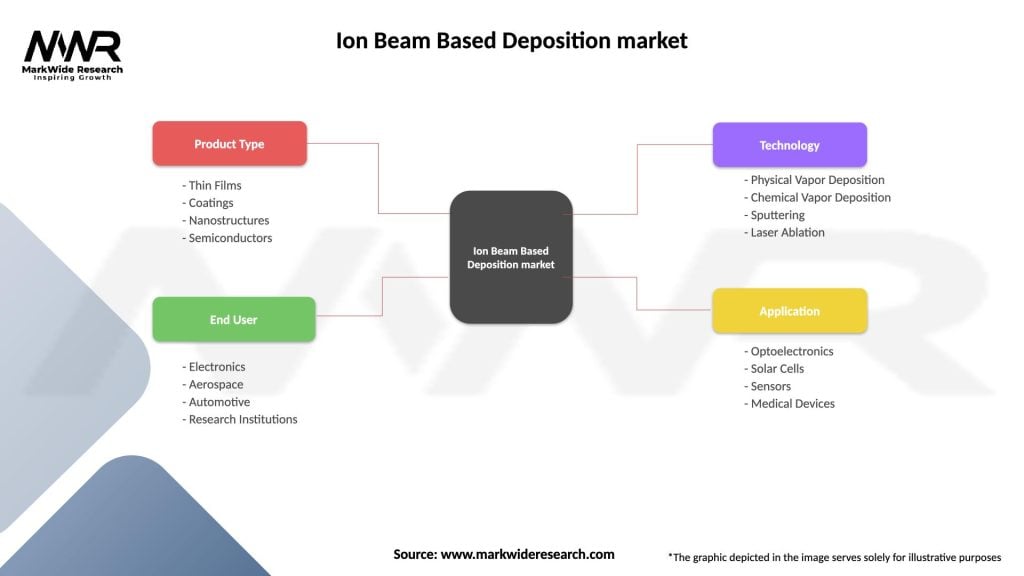

Segmentation

By Technique:

Ion Beam Sputter Deposition (IBSD)

Ion Beam Assisted Deposition (IBAD)

Hybrid Ion Beam-enabled deposition (e.g., combining magnetron sputtering + ion assistance)

By End Use / Application:

Optical Coatings (AR, mirror, laser optics)

Microelectronics (dielectrics, barrier layers)

Photonics & MEMS

Research & Prototyping Services

Other Specialty Fields (e.g., aerospace, sensor surfaces)

By End-User Sector:

Research Institutions / Universities

Advanced Packaging / Microelectronics Firms

Optics & Photonics Manufacturers

Sensor and MEMS Device Producers

Contract Coating Houses

By Region:

North America

Europe

Asia-Pacific

Rest of World

Category-wise Insights

IBSD (Ion Beam Sputter Deposition): Favored where ultra-dense, highly controlled films are required (e.g. high-precision optics).

IBAD (Ion Beam Assisted Deposition): Useful where combining a deposition source with ion bombardment improves film properties (e.g., adhesion, stress).

Hybrid Systems: Balance between deposition rate and film quality—often used in scaling from lab to pilot-scale.

Key Benefits for Industry Participants and Stakeholders

Superior Film Quality: Dense, low-defect films offer better optical, electrical, and mechanical performance.

Improved Adhesion and Stability: Ion assistance helps anchor the film and reduce delamination in extreme environments.

Customization and Precision: Enables unique multilayer stacks, gradient films, interfaces, and compositional control.

Service Model Viability: Contract coating providers can monetize high-end demand without requiring clients to invest in tools.

R&D Enabler: Supports advanced materials innovation that might be impossible with standard deposition.

SWOT Analysis

Strengths:

Exceptional film control and quality compared to conventional methods.

Strong adoption among high-end optics, photonics, and advanced materials sectors.

Flexibility and material variety.

Weaknesses:

High cost, complexity, and relatively low throughput.

Scaling challenges and maintenance burden.

Narrower addressable market compared to mainstream deposition techniques.

Opportunities:

Hybrid tool adoption enabling mid-scale production.

Expanding into quantum, photonic integration, and sensor fabrication domains.

Contract service models lowering entry barriers.

Advanced materials (e.g. 2D, perovskites) requiring precise deposition techniques.

Threats:

Competitive alternative techniques improving (e.g. ALD, CVD, atomic layer-based methods).

Economic pressure restricting capital investments in specialized tools.

Reliability and maintenance issues impacting uptime and cost.

Market Key Trends

Hybrid Deposition Systems: Increasing adoption of ion beam modules that combine with sputtering or evaporation to improve film attributes at moderate rates.

Throughput Improvement Focus: Manufacturers developing higher-current ion sources, wider beams, and substrate scanning to improve deposition rates.

Digital Process Control: Automation, feedback loops, and beam diagnostics are enhancing reproducibility and reducing waste.

Application in Emerging Technologies: Adoption in quantum computing, photonic integration, AR/VR optics, and novel sensor surfaces.

Service and Foundry Models: More organizations outsource ion beam deposition rather than building in-house capacity.

Key Industry Developments

High-Current Ion Source Launches: Equipment suppliers releasing more powerful ion sources to boost deposition rates.

Modular Ion Beam Attachments: Vendors offering retrofit modules for existing sputtering systems to add ion beam capability.

Foundry Coating Services Expansion: Coating houses expanding ion beam capability to service optical, MEMS, and quantum clients.

Process Library Development: Accumulation of best-practice recipes for common materials to reduce client ramp time.

Integration into Pilot Lines: Some semiconductor and photonic pilot lines incorporating ion beam modules for interface control and precision layers.

Analyst Suggestions

Enable Hybrid Tool Paths: Tool makers should offer modular ion beam add-ons to broaden addressable market.

Focus on Throughput Gains: Prioritize innovations that improve deposition rates without compromising film quality.

Promote Contract Coating Models: Reduce adoption barriers by offering service-level deposition capacity.

Target Emerging Tech Verticals: Engage early with quantum, AR/VR, and integrated photonics firms to establish presence.

Continuously Improve Reliability: Reduce maintenance intervals, consumable replacement and downtime to lower operating cost.

Future Outlook

The Ion Beam Based Deposition Market will remain specialized, but its adoption will deepen in high-value, precision sectors such as quantum devices, integrated photonics, and advanced optics. Hybrid deposition platforms and service models will help bridge the gap between lab-level performance and scalable production.

As advanced materials proliferate—2D materials, exotic dielectrics, quantum heterostructures—the demand for atomically precise, defect-minimized films will favor ion beam deposition. Equipment manufacturers will focus on throughput, reliability, and modular flexibility to expand market reach.

Conclusion

The Ion Beam Based Deposition Market occupies a strategic niche in thin-film and surface-engineering technology. Its unique advantages—film density, adhesion, customization—make it ideal for high-precision optical, electronic, and materials applications. Though its adoption is currently limited by cost, throughput, and complexity, the confluence of hybrid tools, service models, and emerging materials offers a pathway to broader inclusion. Stakeholders who invest in modular systems, process libraries, contract services, and scaling innovations will help drive the technology from specialist labs into more mainstream advanced manufacturing.

What is Ion Beam Based Deposition?

Ion Beam Based Deposition refers to a technique used to deposit thin films on substrates through the controlled bombardment of ions. This method is widely utilized in semiconductor manufacturing, optics, and materials science for creating precise coatings and structures.

What are the key players in the Ion Beam Based Deposition market?

Key players in the Ion Beam Based Deposition market include companies like Veeco Instruments, Applied Materials, and Oxford Instruments, which are known for their advanced deposition technologies and equipment, among others.

What are the growth factors driving the Ion Beam Based Deposition market?

The growth of the Ion Beam Based Deposition market is driven by the increasing demand for high-performance materials in electronics, the rise of nanotechnology applications, and advancements in thin film technologies for various industries.

What challenges does the Ion Beam Based Deposition market face?

The Ion Beam Based Deposition market faces challenges such as high equipment costs, the complexity of the deposition process, and competition from alternative deposition techniques that may offer lower costs or simpler operations.

What opportunities exist in the Ion Beam Based Deposition market?

Opportunities in the Ion Beam Based Deposition market include the growing adoption of this technology in the aerospace and automotive sectors, as well as the potential for innovations in materials that enhance performance and efficiency.

What trends are shaping the Ion Beam Based Deposition market?

Trends in the Ion Beam Based Deposition market include the development of more efficient ion sources, integration with other deposition techniques, and a focus on sustainability through the reduction of waste and energy consumption in manufacturing processes.

Ion Beam Based Deposition market

| Segmentation Details | Description |

|---|---|

| Product Type | Thin Films, Coatings, Nanostructures, Semiconductors |

| End User | Electronics, Aerospace, Automotive, Research Institutions |

| Technology | Physical Vapor Deposition, Chemical Vapor Deposition, Sputtering, Laser Ablation |

| Application | Optoelectronics, Solar Cells, Sensors, Medical Devices |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Ion Beam Based Deposition Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at