444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Investment crowdfunding has emerged as a popular alternative financing model, revolutionizing the way startups, small businesses, and real estate developers raise capital. Unlike traditional fundraising methods, such as bank loans or venture capital, investment crowdfunding allows companies to raise funds from a large number of individual investors through online platforms. This market offers investors the opportunity to diversify their investment portfolios and support innovative projects while providing entrepreneurs with access to capital and a broader investor base.

Meaning

Investment crowdfunding, also known as equity crowdfunding or securities-based crowdfunding, involves the sale of securities (e.g., shares, bonds, or convertible notes) to investors through online platforms or portals. Companies seeking funding pitch their business ideas or projects to potential investors on these platforms, offering equity ownership or debt instruments in exchange for capital. Investors can browse through various investment opportunities, conduct due diligence, and make investment decisions based on their preferences, risk tolerance, and investment objectives.

Executive Summary

The investment crowdfunding market has experienced significant growth in recent years, driven by the democratization of finance, advancements in technology, and regulatory reforms aimed at facilitating capital formation and entrepreneurship. This market offers numerous benefits for both investors and issuers, including access to capital, investment diversification, transparency, and regulatory compliance. However, challenges such as investor protection, market liquidity, and regulatory uncertainty remain key considerations for stakeholders navigating the investment crowdfunding landscape.

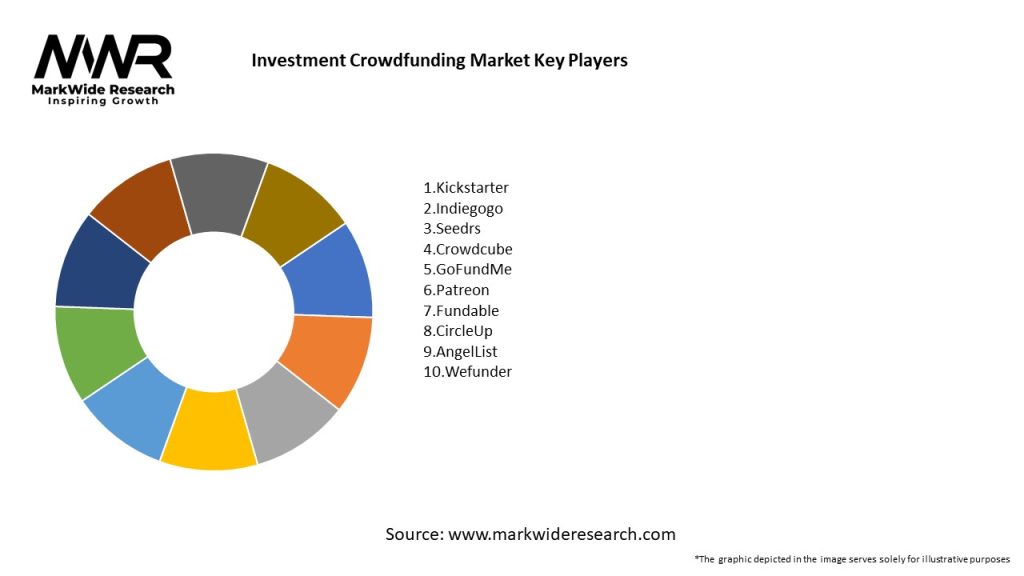

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The investment crowdfunding market operates in a dynamic environment shaped by technological advancements, regulatory changes, market trends, and investor preferences. These dynamics influence the growth, evolution, and competitiveness of the crowdfunding ecosystem, requiring platform operators, investors, and issuers to adapt and innovate to stay ahead in the market.

Regional Analysis

The investment crowdfunding market exhibits regional variations in terms of market size, regulatory frameworks, investor demographics, and investment preferences. While mature markets such as the United States, the United Kingdom, and Europe lead in terms of market maturity and investment activity, emerging markets in Asia, Latin America, and Africa offer untapped potential for crowdfunding platforms and investors seeking growth opportunities.

Competitive Landscape

Leading companies in the Investment Crowdfunding Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The investment crowdfunding market can be segmented based on various factors, including:

Segmentation enables crowdfunding platforms to target specific investor segments, customize investment offerings, and differentiate themselves in the market.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis provides an overview of the investment crowdfunding market’s strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Understanding these factors through a SWOT analysis helps stakeholders identify strategic opportunities, address weaknesses, and mitigate potential threats in the investment crowdfunding market.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had mixed effects on the investment crowdfunding market, with both challenges and opportunities emerging:

Challenges:

Opportunities:

Key Industry Developments

Analyst Suggestions

Future Outlook

The investment crowdfunding market is poised for continued growth and innovation, driven by technological advancements, regulatory reforms, and evolving investor preferences. Key trends such as regulatory evolution, blockchain integration, specialized platforms, and impact investing will shape the future trajectory of the crowdfunding ecosystem. As the market matures and regulatory frameworks evolve, investment crowdfunding is expected to play an increasingly significant role in democratizing access to capital, fostering entrepreneurship, and fueling economic growth globally.

Conclusion

Investment crowdfunding has emerged as a disruptive force in the finance industry, offering a decentralized, transparent, and inclusive model for raising capital and investing in innovative projects. Despite challenges such as regulatory complexity, investor risk, and market volatility, the investment crowdfunding market continues to evolve, driven by technological innovation, regulatory reforms, and shifting investor preferences. As the market matures and stakeholders adapt to changing dynamics, investment crowdfunding has the potential to democratize access to capital, drive economic growth, and empower individuals to participate in the global economy like never before. By embracing innovation, fostering investor trust, and promoting responsible investing practices, the investment crowdfunding ecosystem can unlock new opportunities, create value for stakeholders, and shape the future of finance in the digital age.

What is Investment Crowdfunding?

Investment crowdfunding is a method of raising capital through the collective effort of a large number of individuals, typically via online platforms. It allows startups and small businesses to access funding from a diverse pool of investors, often in exchange for equity or rewards.

What are the key players in the Investment Crowdfunding Market?

Key players in the Investment Crowdfunding Market include platforms like Kickstarter, Indiegogo, and SeedInvest, which facilitate the fundraising process for various projects. Additionally, companies such as Crowdcube and Fundable are also significant contributors to this space, among others.

What are the growth factors driving the Investment Crowdfunding Market?

The Investment Crowdfunding Market is driven by factors such as the increasing number of startups seeking alternative funding sources, the rise of digital platforms that simplify investment processes, and growing investor interest in supporting innovative projects. Additionally, regulatory changes have made it easier for individuals to invest in early-stage companies.

What challenges does the Investment Crowdfunding Market face?

The Investment Crowdfunding Market faces challenges such as regulatory compliance, which can vary significantly by region, and the potential for high-risk investments that may deter some investors. Additionally, the saturation of crowdfunding platforms can make it difficult for new projects to stand out.

What opportunities exist in the Investment Crowdfunding Market?

Opportunities in the Investment Crowdfunding Market include the potential for niche platforms targeting specific industries, such as technology or sustainable businesses, and the growing trend of community-driven funding initiatives. Furthermore, advancements in technology can enhance user experience and investor engagement.

What trends are shaping the Investment Crowdfunding Market?

Trends shaping the Investment Crowdfunding Market include the increasing use of social media for marketing campaigns, the rise of equity crowdfunding as a popular investment option, and a focus on sustainability and social impact projects. Additionally, the integration of blockchain technology is beginning to influence how investments are managed.

Investment Crowdfunding Market

| Segmentation Details | Description |

|---|---|

| Investment Strategy | Equity Crowdfunding, Debt Crowdfunding, Reward-Based Crowdfunding, Donation-Based Crowdfunding |

| Investor Type | Retail Investors, Accredited Investors, Institutional Investors, Angel Investors |

| Fund Structure | Closed-End Funds, Open-End Funds, Hybrid Funds, Real Estate Funds |

| Transaction Size | Small Scale, Medium Scale, Large Scale, Others |

Leading companies in the Investment Crowdfunding Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at