444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Internet of Things (IoT) has revolutionized various industries, and the life insurance sector is no exception. The IoT-based life insurance market is witnessing significant growth and is poised to transform the way life insurance policies are offered and managed. With the integration of IoT devices and technologies, insurance providers can gather real-time data, analyze customer behavior, and offer personalized policies tailored to individual needs. This market overview provides an in-depth analysis of the IoT-based life insurance market, highlighting its meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants and stakeholders, SWOT analysis, key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and a comprehensive conclusion.

Meaning

The Internet of Things (IoT) refers to the network of interconnected physical devices, vehicles, appliances, and other objects embedded with sensors, software, and connectivity capabilities that enable them to collect and exchange data. In the context of life insurance, IoT-based solutions involve the use of devices such as wearables, health trackers, and smart home systems to gather data related to policyholders’ health, habits, and lifestyle. This data is then utilized by insurance providers to assess risk, determine premiums, and offer personalized insurance policies that align with the policyholder’s needs and behaviors.

Executive Summary

The IoT-based life insurance market is experiencing rapid growth due to the increasing adoption of connected devices and advancements in data analytics. Insurance companies are leveraging IoT technology to gain insights into policyholders’ behavior, enhance risk assessment accuracy, and streamline policy management processes. The market is witnessing a surge in innovative insurance products, such as usage-based insurance and pay-as-you-live policies, which utilize real-time data collected from IoT devices to adjust premiums based on actual usage patterns and behaviors. This executive summary provides a concise overview of the market’s key highlights and trends, paving the way for a comprehensive understanding of the IoT-based life insurance market.

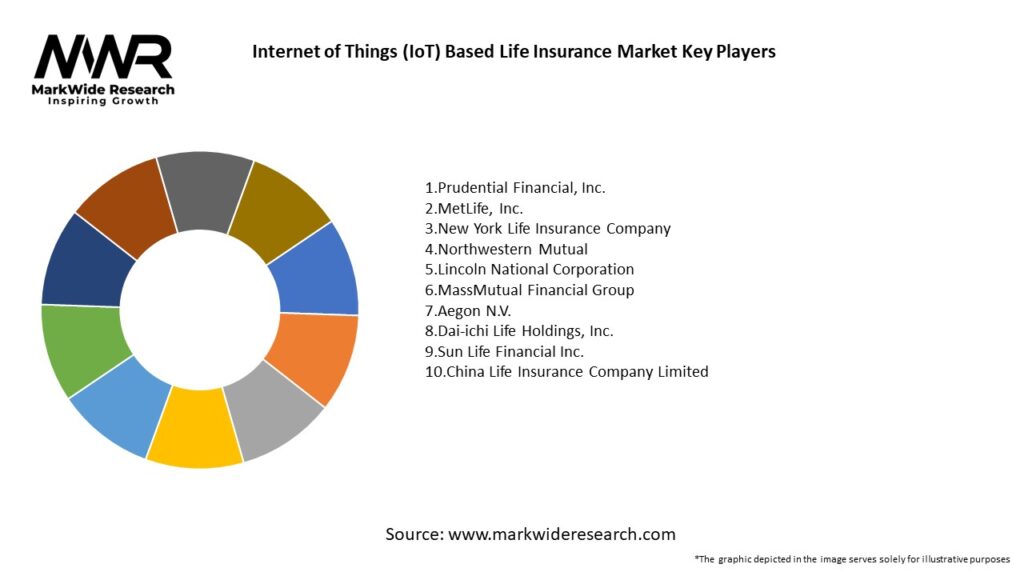

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The IoT-based life insurance market is driven by a combination of factors, including technological advancements, changing consumer expectations, and regulatory developments. The market dynamics are shaped by the continuous evolution of IoT devices, the increasing availability of data analytics tools, and the demand for personalized insurance solutions. Insurance companies are adapting to this changing landscape by investing in IoT infrastructure, collaborating with technology providers, and leveraging data-driven insights to enhance risk assessment accuracy and customer experience.

Regional Analysis

The IoT-based life insurance market is witnessing substantial growth across various regions. North America leads the market, driven by the presence of major insurance companies, advanced technological infrastructure, and a high level of consumer awareness. Europe is also a prominent market, with countries such as the United Kingdom, Germany, and France embracing IoT-based insurance solutions. The Asia Pacific region, particularly China and India, offers significant growth opportunities due to the increasing adoption of connected devices and a rising middle-class population. Other regions, such as Latin America and the Middle East, are also witnessing a gradual uptake of IoT-based life insurance, presenting potential growth avenues for market players.

Competitive Landscape

Leading Companies in the Internet of Things (IoT) Based Life Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The IoT-based life insurance market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the IoT-based life insurance market. The crisis has accelerated the adoption of IoT devices and digital solutions, as insurers seek contactless ways to interact with policyholders. The pandemic highlighted the importance of remote monitoring and telehealth services, which can be facilitated through IoT devices. Additionally, the pandemic-induced health concerns have increased the demand for personalized health insurance, incentivizing healthy behaviors and offering coverage for telemedicine consultations. However, the market also faced challenges due to disruptions in supply chains, reduced consumer spending, and economic uncertainties.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the IoT-based life insurance market looks promising, with significant growth potential. The integration of IoT devices, advanced analytics, and AI technologies will continue to shape the market landscape. Insurers will further refine risk assessment models, streamline claims processing, and offer more personalized insurance products. As IoT adoption continues to expand globally, emerging markets will become key growth drivers for the IoT-based life insurance industry. The market will witness increased collaboration between insurance companies, technology providers, and healthcare organizations, fostering innovation and delivering enhanced value to policyholders.

Conclusion

The IoT-based life insurance market is experiencing rapid growth, driven by the increasing adoption of connected devices, advancements in data analytics, and the demand for personalized insurance solutions. By leveraging IoT technology, insurance companies can gather real-time data, improve risk assessment accuracy, and offer tailored policies to policyholders. However, challenges such as data privacy, regulatory complexities, and integration issues need to be addressed. Despite these challenges, the future outlook for the IoT-based life insurance market is promising, with continued innovation and collaboration expected to drive market growth and deliver enhanced value to industry participants and stakeholders.

What is Internet of Things (IoT) Based Life Insurance?

Internet of Things (IoT) Based Life Insurance refers to life insurance products that utilize IoT technology to collect data from connected devices. This data can include health metrics, lifestyle habits, and environmental factors, which help insurers assess risk and tailor policies accordingly.

What are the key players in the Internet of Things (IoT) Based Life Insurance Market?

Key players in the Internet of Things (IoT) Based Life Insurance Market include companies like John Hancock, Allianz, and MetLife, which are leveraging IoT technology to enhance customer engagement and risk assessment, among others.

What are the growth factors driving the Internet of Things (IoT) Based Life Insurance Market?

The growth of the Internet of Things (IoT) Based Life Insurance Market is driven by increasing consumer demand for personalized insurance products, advancements in data analytics, and the rising adoption of wearable health devices that provide real-time health monitoring.

What challenges does the Internet of Things (IoT) Based Life Insurance Market face?

The Internet of Things (IoT) Based Life Insurance Market faces challenges such as data privacy concerns, regulatory compliance issues, and the need for significant investment in technology infrastructure to effectively utilize IoT data.

What future opportunities exist in the Internet of Things (IoT) Based Life Insurance Market?

Future opportunities in the Internet of Things (IoT) Based Life Insurance Market include the development of innovative insurance products that integrate AI and machine learning, expansion into emerging markets, and partnerships with tech companies to enhance data collection and analysis.

What trends are shaping the Internet of Things (IoT) Based Life Insurance Market?

Trends shaping the Internet of Things (IoT) Based Life Insurance Market include the increasing use of telematics for risk assessment, the rise of health and wellness apps that connect with insurance policies, and a growing focus on customer-centric services that leverage IoT data.

Internet of Things (IoT) Based Life Insurance Market

| Segmentation Details | Description |

|---|---|

| End User | Individuals, Families, Corporates, Small Businesses |

| Technology | Wearable Devices, Mobile Applications, Smart Sensors, Cloud Computing |

| Service Type | Policy Management, Claims Processing, Risk Assessment, Customer Support |

| Offering | Term Life, Whole Life, Universal Life, Variable Life |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Internet of Things (IoT) Based Life Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at