444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Interlaminar Device market is a rapidly growing and evolving sector within the electronics and semiconductor industry. These devices play a crucial role in enhancing the overall performance and reliability of electronic products. Interlaminar devices are used to connect multiple layers of a circuit board, providing improved electrical connectivity, thermal management, and mechanical stability.

Meaning

Interlaminar devices, also known as interlayer devices or interposers, are thin structures inserted between different layers of a printed circuit board (PCB) or a semiconductor package. Their purpose is to establish a reliable connection between these layers, enabling seamless communication and efficient signal transmission across the board.

Executive Summary

The Interlaminar Device market has been witnessing significant growth in recent years due to the increasing demand for high-performance electronic products in various industries such as consumer electronics, automotive, aerospace, and telecommunications. The escalating need for compact and lightweight devices has further driven the adoption of interlaminar devices to optimize space utilization and enhance functionality.

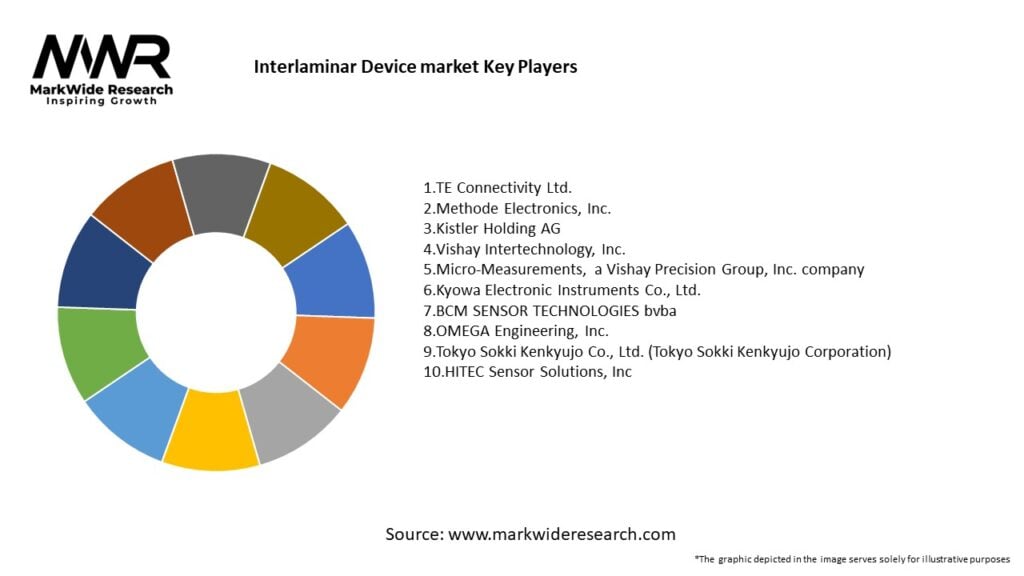

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Motion-preserving appeal: Interlaminar devices attract interest because they can potentially preserve segmental mobility while offering stabilization.

Surgeon Learning Curve: Adoption depends heavily on surgeon familiarity, training, and evidence support, making educational programs crucial.

Adjunct to Fusion Techniques: Many interlaminar products are designed to integrate with interbody fusion or supplemental fixation strategies.

Material and Surface Innovation: Advances such as porous coatings, anti‑subsidence features, and composite polymers influence outcomes and adoption.

Growing Use in Adjacent Segment Disease: Interlaminar devices are increasingly used to treat or prevent degeneration adjacent to prior fusion constructs.

Market Drivers

Growing Incidence of Spinal Disorders: Aging populations and sedentary lifestyles increase degenerative spine conditions amenable to interlaminar intervention.

Minimally Invasive Technique Demand: Surgeons and patients favor less invasive procedures with faster recovery, making interlaminar options more attractive.

Advances in Device Technology: Improved materials, biomechanical designs, and surgical tools make interlaminar systems more reliable.

Adjunct Use in Multi-level Constructs: Combining interlaminar devices with interbody and pedicle systems supports segmental control and stress management.

Emergence of Emerging Markets: Developing regions expanding spine surgery capacity increase demand for alternative stabilization options.

Market Restraints

Limited Long-Term Clinical Data: Lack of long-term comparative studies and outcome benchmarks can hinder broad adoption.

Cost and Reimbursement Barriers: In many markets, reimbursement frameworks favor traditional fusion or disc replacement techniques.

Surgical Preference and Inertia: Many spine surgeons remain familiar with conventional instrumentation and may resist adopting new device classes.

Anatomical and Patient Limitations: Not all patients or pathologies are suitable; severe instability or deformity may require more robust constructs.

Risk of Device Failures: Subsidence, loosening, or migration are concerns if alignment or load-sharing is suboptimal.

Market Opportunities

Hybrid Interlaminar-Fusion Constructs: Devices designed to integrate seamlessly with fusion systems to optimize biomechanics.

Patient-Specific Designs: Custom-fit interlaminar devices based on imaging to optimize fit and performance.

Minimally Invasive Delivery Systems: Innovations to reduce incision size, muscle disruption, and operative time.

Emerging Economy Adoption: Markets in Asia, Latin America, and Eastern Europe growing spine surgery demand.

Biomaterials Innovation: Use of bioactive surfaces, polymer composites, or resorbable scaffolds to enhance fusion or device integration.

Market Dynamics

Supply-Side Factors:

Device manufacturers invest in R&D, surgeon training, and clinical studies.

Regulatory strategy—securing approvals in U.S., EU, Japan, etc.—is a key factor for global reach.

Partnerships with distributors, surgical groups, and spine centers accelerate adoption.

Demand-Side Factors:

Spine surgeons prefer devices validated by peer-reviewed studies and backed by support.

Hospitals and surgical centers evaluate cost, inventory footprint, and reimbursement margins.

Patients seek less invasive, shorter recovery options, influencing surgeon recommendation.

Economic & Policy Factors:

Reimbursement codes and health insurance policy determine adoption viability.

National frameworks for spinal surgery determine operating room investments and implant access.

Hospital procurement processes and competitive tendering influence device selection.

Regional Analysis

North America and Western Europe: Early adopters with access to advanced spine surgery infrastructure; interlaminar devices may see higher penetration.

Asia-Pacific (Japan, South Korea, China): Growing spine surgery markets, increasing demand for motion-preserving alternatives.

Latin America: Slowly emerging as a growth region as spine surgery infrastructure expands.

Middle East & Africa: Adoption tied to tertiary spine centers and healthcare investment.

Global Export Considerations: Manufacturers often enter less penetrated markets later, once clinical evidence is stronger.

Competitive Landscape

Leading Companies in the Interlaminar Device Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Device Type:

Interlaminar spacers

Dynamic interlaminar stabilization devices

Fusion-oriented interlaminar devices

Hybrid interlaminar constructs

By Material:

PEEK (Polyetheretherketone)

Titanium or titanium alloy

Composite materials (PEEK + titanium, carbon fiber)

Polymer-based or resorbable scaffolds

By Surgical Approach:

Open posterior techniques

Minimally invasive posterior techniques

By End Use Application:

Degenerative disc disease

Lumbar spinal stenosis

Adjacent-segment disease

Fusion supplementation

By Region:

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

Category-wise Insights

Spacers: Simple devices for modest decompression or distraction; relatively lower complexity and cost.

Dynamic Stabilizers: Provide controlled flexibility; more biomechanical design demands and surgeon acceptance barriers.

Fusion Interlaminar Devices: Combine structural support with fusion scaffolding; useful when fusion is desired without extensive instrumentation.

Hybrid Constructs: Combine interlaminar with pedicle systems to balance rigidity and motion; gaining interest for multilevel or borderline cases.

Key Benefits for Industry Participants and Stakeholders

Less Invasive Option: Reduced soft tissue disruption, shorter operative time, and faster recovery potential.

Motion Preservation: In suitable cases, maintaining some segment movement may reduce adjacent-segment degeneration.

Complement to Fusion Systems: Can serve as supplemental support or transitional devices in staged surgery.

Market Differentiation: Allows device manufacturers to offer alternatives beyond canonical fusion-only products.

Growth in Emerging Regions: Lower-cost interlaminar systems might expand access to spine care in developing markets.

SWOT Analysis

Strengths:

Motion-preserving appeal and incremental adoption potential.

Simpler implants relative to full fusion constructs.

Complementary with existing spinal implant portfolios.

Weaknesses:

Clinical evidence base is less extensive than fusion systems.

Limited suitable patient population (must meet anatomical/indication criteria).

Reimbursement risk, especially in markets favoring fusion solutions.

Opportunities:

Hybrid and customizable systems for multi-level cases.

Adoption in markets with cost-effective healthcare models and growing spine surgery infrastructure.

Advances in biomaterials and personalized implants.

Threats:

Fusion or disc replacement technologies may dominate preference if evidence is stronger.

Off-label use or complications could harm reputation.

Regulatory changes or reimbursement restrictions affecting implant markets.

Market Key Trends

Evidence Generation: Increased clinical trials and registries aimed at validating long-term outcomes.

Hybrid Systems: Greater adoption of systems combining interlaminar and pedicle constructs for balanced stabilization.

Minimally Invasive Instrumentation: Smaller implants and percutaneous delivery tools reduce surgical morbidity.

Material Innovation: Porous coatings, composite blends, and anti-subsidence features improve interface.

Emerging Market Expansion: Device firms targeting growth regions with adaptable, lower-cost systems.

Key Industry Developments

Design Iterations: Improvements in footprint, curvature matching, and load-sharing geometry.

Clinical Publications: New studies reporting on adjacent-segment incidence or motion preservation benefits.

Surgeon Training Programs: Workshops and cadaver labs to build familiarity and confidence.

Regulatory Approvals in New Markets: Devices entering markets like Asia and Latin America with localized versions.

Instrumentation Enhancements: Developing specialized insertion tools, alignment guides, and navigation support.

Analyst Suggestions

Prioritize Clinical Evidence: Device companies must invest in long-term, comparative, and registry studies to support adoption.

Focus on Hybrid Use Cases: Emphasize how interlaminar implants complement fusion constructs, especially in borderline stability cases.

Invest in Surgeon Education: Build confidence and familiarity through hands-on training and surgical proctoring.

Customize for Markets: Offer modular designs or less expensive versions tailored for emerging markets.

Integrate Digital Tools: Navigation, preoperative planning software, and patient-specific templating enhance precision and adoption.

Future Outlook

The Interlaminar Device Market is expected to grow gradually as spine surgery evolves toward less invasive, motion-preserving approaches. Clinical outcomes and long-term data will strongly influence adoption rates; successful devices will likely combine hybrid design flexibility, easy surgical workflow, and validated performance.

Emerging markets will represent growth opportunities once reimbursement and surgical infrastructure mature. The most successful vendors will integrate instrument advances, targeted surgeon training, and adaptable product lines to profitably expand interlaminar adoption globally.

Conclusion

The Interlaminar Device Market stands at the intersection of innovation and clinical cautiousness. While its potential to offer less invasive stabilization is compelling, its expansion depends on robust clinical validation, surgeon acceptance, cost-effectiveness, and product flexibility. Device manufacturers who align technological excellence with evidence, education, and market adaptation are poised to lead next-generation spine solutions.

The Interlaminar Device market is witnessing a transformative phase, driven by the growing electronics industry and the demand for high-performance electronic products. With continuous technological advancements and increasing applications in diverse industries, interlaminar devices are set to play a pivotal role in shaping the future of electronics and semiconductor systems. Manufacturers, stakeholders, and end-users must collaborate and innovate to capitalize on the opportunities and address the challenges in this dynamic and competitive market.

What is an Interlaminar Device?

An Interlaminar Device is a medical implant used in spinal surgeries to provide stability and support to the intervertebral space. These devices are designed to alleviate pain and improve mobility in patients with spinal disorders.

What are the key companies in the Interlaminar Device market?

Key companies in the Interlaminar Device market include Medtronic, NuVasive, and Stryker, which are known for their innovative spinal solutions and advanced surgical technologies, among others.

What are the drivers of growth in the Interlaminar Device market?

The growth of the Interlaminar Device market is driven by the increasing prevalence of spinal disorders, advancements in minimally invasive surgical techniques, and a rising aging population that requires spinal interventions.

What challenges does the Interlaminar Device market face?

The Interlaminar Device market faces challenges such as high surgical costs, potential complications associated with spinal surgeries, and stringent regulatory approvals that can delay product launches.

What opportunities exist in the Interlaminar Device market?

Opportunities in the Interlaminar Device market include the development of new materials for implants, the integration of smart technologies for better patient outcomes, and expanding applications in emerging markets.

What trends are shaping the Interlaminar Device market?

Trends in the Interlaminar Device market include the increasing adoption of robotic-assisted surgeries, the focus on patient-specific implants, and the growing emphasis on post-operative care and rehabilitation solutions.

Interlaminar Device market

| Segmentation Details | Description |

|---|---|

| Product Type | Single-Layer, Multi-Layer, Composite, Coated |

| End User | Hospitals, Clinics, Research Institutions, Rehabilitation Centers |

| Technology | 3D Printing, Injection Molding, Laser Cutting, CNC Machining |

| Application | Spinal Surgery, Orthopedic Procedures, Pain Management, Neurological Treatments |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Interlaminar Device Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at