444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Insurance Automation market has been witnessing significant growth in recent years, driven by advancements in technology and the need for increased operational efficiency in the insurance industry. Automation has emerged as a game-changer, revolutionizing traditional insurance processes and offering various benefits to insurers, policyholders, and other stakeholders. This comprehensive report aims to provide insights into the Insurance Automation market, including its meaning, key market insights, drivers, restraints, opportunities, regional analysis, competitive landscape, segmentation, and more.

Meaning:

Insurance automation refers to the use of advanced technologies, such as artificial intelligence (AI), machine learning, robotic process automation (RPA), and data analytics, to streamline and optimize various processes within the insurance industry. These technologies enable insurance companies to automate repetitive tasks, improve operational efficiency, enhance customer experiences, and make data-driven decisions. By leveraging automation, insurers can significantly reduce manual efforts, lower costs, and stay competitive in the rapidly evolving market.

Executive Summary:

The insurance automation market has witnessed substantial growth in recent years, driven by the increasing demand for operational efficiency, the need to enhance customer experiences, and the rising adoption of emerging technologies across the insurance sector. As insurers seek ways to expedite claims processing, underwriting, and policy administration, automation solutions have emerged as a key enabler. This report delves into the key market insights, drivers, restraints, opportunities, and competitive landscape of the insurance automation market.

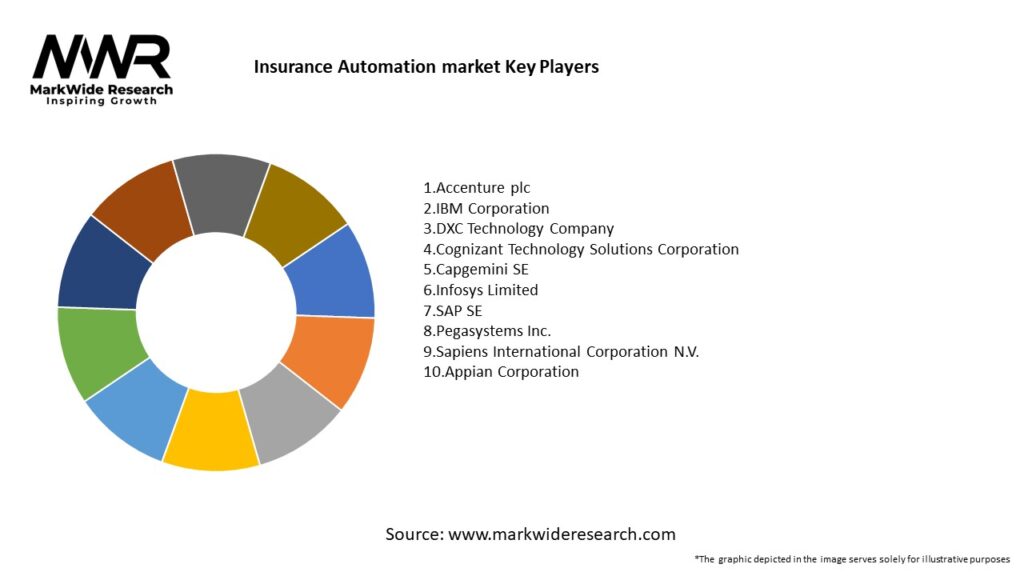

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The insurance automation market is driven by a convergence of factors, including technological advancements, evolving customer expectations, and the pursuit of operational excellence. The interplay between market drivers and restraints determines the pace of adoption and the overall market trajectory. As the industry continues to evolve, insurance companies must embrace automation to maintain competitiveness and relevance in the digital era.

Regional Analysis:

The adoption of insurance automation varies across regions, influenced by factors such as technological infrastructure, regulatory environment, and customer demands. Developed regions like North America and Europe are at the forefront of automation adoption due to their robust technological capabilities and higher awareness of the benefits. Meanwhile, emerging economies in Asia-Pacific and Latin America present significant growth opportunities as insurance markets expand and digitalization gains momentum.

Competitive Landscape:

Leading Companies in the Insurance Automation Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

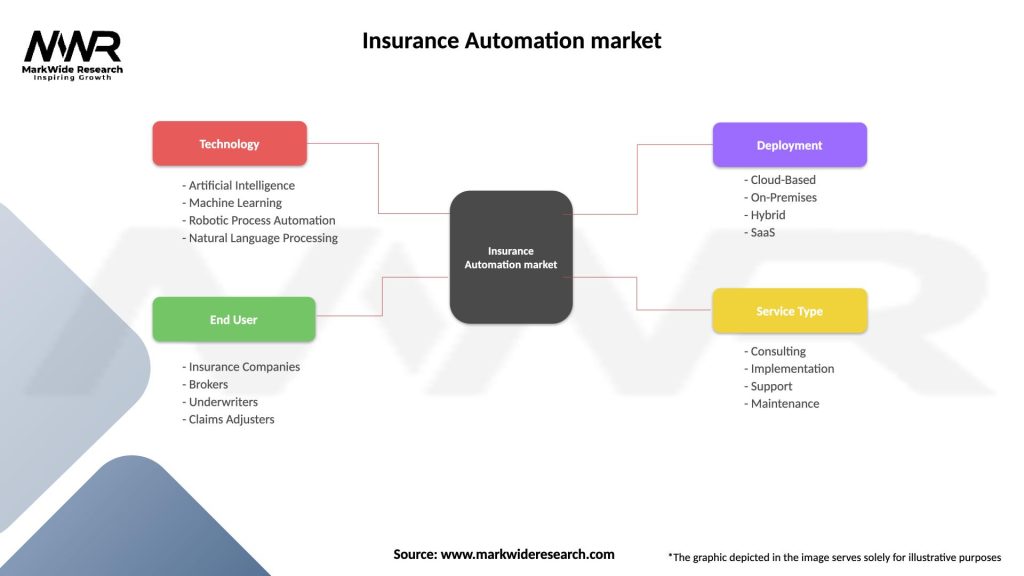

Segmentation:

The insurance automation market can be segmented based on technology, deployment model, insurance type, and region. Technology segments may include AI, ML, RPA, and data analytics. Deployment models may consist of on-premises and cloud-based solutions. Insurance types could encompass life insurance, health insurance, property and casualty insurance, and others.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The COVID-19 pandemic accelerated the adoption of automation in the insurance industry. With physical interactions restricted, insurers turned to automation to continue operations and deliver services remotely. Claims processing, customer support, and policy management were some of the areas where automation played a crucial role during the pandemic.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The future of the insurance automation market looks promising, with the widespread adoption of advanced technologies expected to revolutionize the industry. As AI, ML, and RPA continue to evolve, automation solutions will become more sophisticated, enabling insurance companies to offer personalized and seamless experiences to their customers.

Conclusion:

In conclusion, the insurance automation market is experiencing significant growth driven by the need for operational efficiency, enhanced customer experiences, and the advancement of AI and ML technologies. While initial investments and data security concerns remain challenges, the benefits of automation outweigh the drawbacks, and the market is poised for further expansion. As the insurance landscape continues to evolve, embracing automation will be imperative for insurers to thrive in the digital era. Continuous innovation, strategic partnerships, and a customer-centric approach will be key factors shaping the future of the insurance automation market.

What is Insurance Automation?

Insurance Automation refers to the use of technology to streamline and enhance various processes within the insurance industry, including underwriting, claims processing, and customer service. This technology aims to improve efficiency, reduce costs, and enhance customer experience.

What are the key players in the Insurance Automation market?

Key players in the Insurance Automation market include companies like Guidewire Software, Duck Creek Technologies, and Insurity, which provide solutions for policy administration and claims management, among others.

What are the main drivers of growth in the Insurance Automation market?

The main drivers of growth in the Insurance Automation market include the increasing demand for operational efficiency, the need for improved customer experience, and the rising adoption of digital technologies in the insurance sector.

What challenges does the Insurance Automation market face?

Challenges in the Insurance Automation market include data security concerns, the complexity of integrating new technologies with legacy systems, and the need for regulatory compliance across different regions.

What opportunities exist in the Insurance Automation market?

Opportunities in the Insurance Automation market include the potential for artificial intelligence and machine learning to enhance risk assessment and fraud detection, as well as the growing trend of personalized insurance products tailored to individual customer needs.

What trends are shaping the Insurance Automation market?

Trends shaping the Insurance Automation market include the increasing use of chatbots for customer service, the rise of insurtech startups offering innovative solutions, and the growing emphasis on data analytics to drive decision-making.

Insurance Automation market

| Segmentation Details | Description |

|---|---|

| Technology | Artificial Intelligence, Machine Learning, Robotic Process Automation, Natural Language Processing |

| End User | Insurance Companies, Brokers, Underwriters, Claims Adjusters |

| Deployment | Cloud-Based, On-Premises, Hybrid, SaaS |

| Service Type | Consulting, Implementation, Support, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Insurance Automation Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at