444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The insurance advertising market is a vital component of the overall insurance industry, playing a crucial role in promoting insurance products and services to potential customers. Insurance companies heavily rely on advertising strategies to build brand awareness, attract new customers, and maintain customer loyalty. This market analysis aims to provide insights into the current state of the insurance advertising market, key trends, market dynamics, and future outlook.

Meaning

Insurance advertising refers to the promotional activities and strategies employed by insurance companies to communicate their offerings to the target audience. It encompasses various channels such as television, radio, print media, digital platforms, social media, and direct marketing. Insurance companies leverage advertising campaigns to educate consumers about insurance policies, highlight benefits, establish trust, and differentiate themselves from competitors.

Executive Summary

The insurance advertising market has witnessed significant growth in recent years, driven by factors such as increased competition, rising consumer awareness, and technological advancements. With the expansion of digital platforms, insurance companies have diversified their advertising strategies to reach a wider audience and engage with potential customers in more personalized ways. This report analyzes the market trends, drivers, restraints, opportunities, and provides valuable insights for industry participants and stakeholders.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The insurance advertising market operates in a dynamic environment influenced by several factors. These dynamics include changing consumer preferences, advancements in technology, regulatory developments, competitive landscape, and economic conditions. Insurance companies need to adapt their advertising strategies to align with evolving market dynamics to stay relevant and gain a competitive edge.

Regional Analysis

The insurance advertising market varies across regions due to cultural differences, regulatory frameworks, market maturity, and consumer behavior. North America and Europe have well-established insurance industries and robust advertising landscapes. Asia Pacific and Latin America offer significant growth potential with expanding insurance markets and increasing consumer awareness. Emerging economies in these regions present opportunities for insurance companies to invest in targeted advertising campaigns to capture market share.

Competitive Landscape

Leading Companies in the Insurance Advertising Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

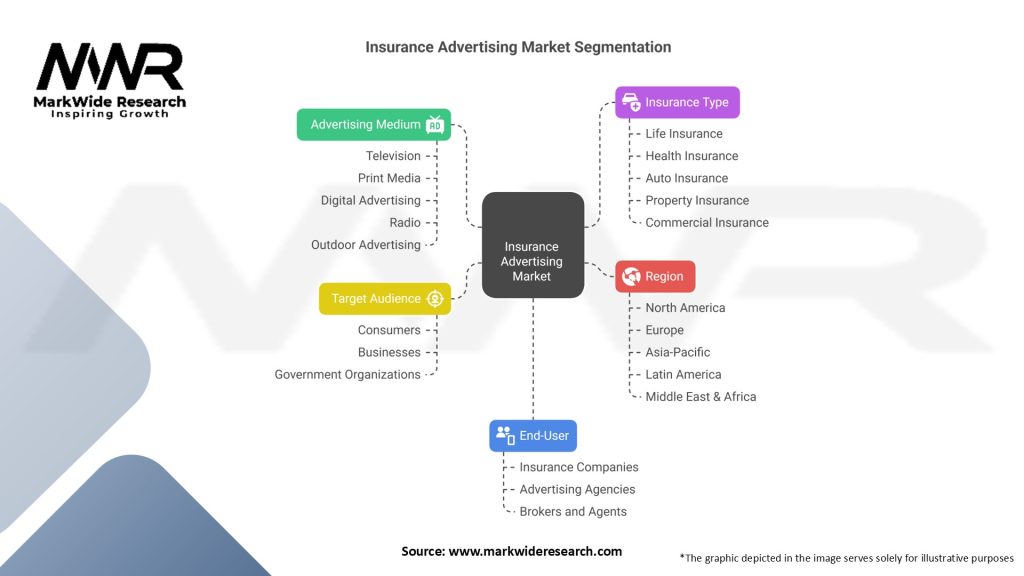

Segmentation

The insurance advertising market can be segmented based on various criteria such as insurance type, advertising channel, target audience, and geographical region. Segmenting the market enables insurance companies to tailor their advertising efforts based on specific customer segments and enhance the effectiveness of their campaigns.

Category-wise Insights

Different insurance categories require distinct advertising approaches. Life insurance advertising focuses on long-term financial security, family protection, and emotional messaging. Health insurance advertising emphasizes the importance of medical coverage, wellness programs, and preventive care. Property and casualty insurance advertising highlights asset protection, risk mitigation, and swift claims settlement. Understanding category-specific insights helps insurance companies create impactful advertising campaigns aligned with customer needs.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has significantly impacted the insurance advertising market. Insurance companies had to adjust their advertising strategies to address consumer concerns related to the pandemic and highlight the importance of insurance coverage in uncertain times. Digital advertising channels became even more critical as people shifted to online platforms. The pandemic also emphasized the need for insurance companies to communicate their support and commitment to customers, fostering trust and loyalty.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the insurance advertising market looks promising, driven by technological advancements, evolving consumer behavior, and the increasing importance of insurance coverage. Insurance companies will continue to invest in digital advertising, personalization, and data-driven marketing to deliver targeted and engaging experiences. The integration of AI technologies, the rise of influencer marketing, and the exploration of emerging advertising channels will shape the future of insurance advertising.

Conclusion

The insurance advertising market is a dynamic and competitive landscape where insurance companies employ various strategies to promote their products and services. Understanding market trends, consumer preferences, and technological advancements is essential for insurance companies to design effective advertising campaigns. Embracing digital transformation, personalization, and data-driven marketing will be crucial for success in the evolving insurance advertising landscape. By leveraging innovative approaches, collaborating with industry partners, and staying abreast of emerging trends, insurance companies can navigate the market successfully and capture the attention of their target audience.

What is Insurance Advertising?

Insurance advertising refers to the strategies and methods used by insurance companies to promote their products and services to potential customers. This includes various forms of media such as television, online platforms, print, and social media to reach diverse audiences.

Who are the key players in the Insurance Advertising Market?

Key players in the Insurance Advertising Market include companies like Geico, State Farm, Allstate, and Progressive, which utilize innovative advertising strategies to attract customers. These companies often compete on brand recognition and customer service, among others.

What are the main drivers of growth in the Insurance Advertising Market?

The growth of the Insurance Advertising Market is driven by increasing competition among insurers, the rise of digital marketing channels, and changing consumer preferences towards personalized advertising. Additionally, the growing importance of online presence is reshaping advertising strategies.

What challenges does the Insurance Advertising Market face?

Challenges in the Insurance Advertising Market include regulatory constraints, the need for compliance with advertising standards, and the difficulty in measuring the effectiveness of advertising campaigns. These factors can hinder the ability of companies to effectively reach their target audiences.

What opportunities exist in the Insurance Advertising Market?

Opportunities in the Insurance Advertising Market include the expansion of digital platforms, the use of data analytics for targeted advertising, and the potential for innovative marketing strategies such as influencer partnerships. These trends can help companies better engage with consumers.

What trends are shaping the Insurance Advertising Market?

Current trends in the Insurance Advertising Market include the increasing use of social media for brand engagement, the integration of artificial intelligence in ad targeting, and a focus on sustainability in advertising messages. These trends reflect changing consumer expectations and technological advancements.

Insurance Advertising Market:

| Segmentation | Details |

|---|---|

| Advertising Medium | Television, Print Media, Digital Advertising (Online Ads, Social Media), Radio, Outdoor Advertising, Others |

| Insurance Type | Life Insurance, Health Insurance, Auto Insurance, Property Insurance, Commercial Insurance, Others |

| Target Audience | Consumers, Businesses, Government Organizations, Others |

| End-User | Insurance Companies, Advertising Agencies, Brokers and Agents, Others |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Insurance Advertising Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at