444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The institutional investor market plays a crucial role in the global financial landscape. It refers to the segment of investors who manage large pools of capital on behalf of organizations such as pension funds, insurance companies, endowments, and sovereign wealth funds. These institutional investors typically have a long-term investment horizon and aim to generate consistent returns while managing risks effectively.

Meaning

The institutional investor market encompasses a wide range of financial institutions and entities that allocate significant funds into various asset classes. These investors often have substantial resources and expertise to conduct thorough research and due diligence before making investment decisions. The institutional investor market operates on a professional level and is subject to regulatory frameworks that ensure transparency and protect the interests of investors.

Executive Summary

The institutional investor market has witnessed significant growth and evolution in recent years. With the globalization of financial markets and increased access to information, institutional investors have become major players in the investment landscape. They have the potential to shape market trends, influence corporate governance practices, and drive sustainable investment strategies.

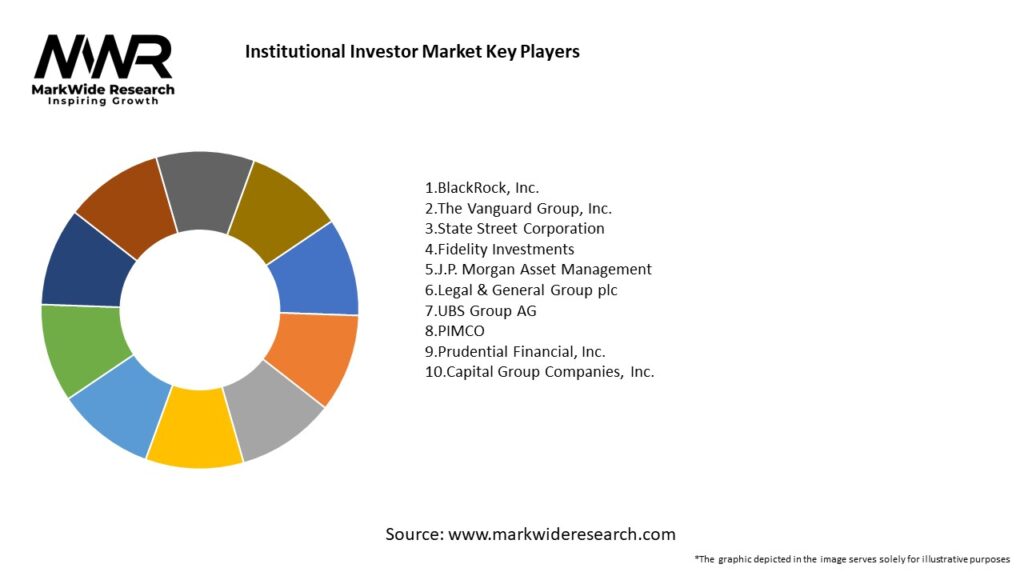

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The institutional investor market is characterized by a complex interplay of various factors that shape its dynamics. These dynamics include changing investor preferences, regulatory developments, technological advancements, and global economic conditions. Understanding and adapting to these dynamics is crucial for institutional investors to succeed in this evolving landscape.

Regional Analysis

The institutional investor market is global in nature, with significant activity taking place in various regions around the world. Different regions have unique market dynamics, regulatory frameworks, and investor preferences that influence the behavior of institutional investors. A comprehensive regional analysis provides insights into specific opportunities and challenges faced by institutional investors in different parts of the world.

Competitive Landscape

Leading Companies in the Institutional Investor Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The institutional investor market can be segmented based on various criteria, including investor type, asset class preferences, investment strategies, and geographic focus. Each segment has distinct characteristics and investment requirements, which impact the strategies and approaches employed by institutional investors.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a profound impact on the institutional investor market. It led to heightened market volatility, liquidity challenges, and changes in investor behavior. Institutional investors had to navigate these uncertainties while reassessing their investment strategies and risk management practices.

Key Industry Developments

Analyst Suggestions

Future Outlook

The institutional investor market is expected to continue evolving in the coming years. Key trends such as sustainable investing, technological advancements, and regulatory reforms will shape the landscape. Institutional investors will need to adapt to these trends while focusing on generating consistent returns, managing risks, and meeting the evolving needs of their clients.

Conclusion

The institutional investor market plays a critical role in the global financial system. Institutional investors manage large pools of capital on behalf of organizations, driving economic growth, and providing funding for various investment opportunities. Despite the challenges and uncertainties, the market presents significant opportunities for institutional investors to generate attractive returns, influence corporate governance practices, and contribute to a more sustainable and inclusive financial ecosystem. By embracing innovation, adopting responsible investment practices, and staying abreast of market dynamics, institutional investors can position themselves for long-term success in this dynamic and evolving market.

What is Institutional Investor?

Institutional investors are organizations that invest large sums of money on behalf of their members or clients. They include entities such as pension funds, insurance companies, endowments, and mutual funds, which play a significant role in the financial markets by providing liquidity and stability.

What are the key players in the Institutional Investor Market?

Key players in the Institutional Investor Market include large financial institutions such as BlackRock, Vanguard, and State Street Global Advisors. These firms manage substantial assets and influence market trends through their investment strategies, among others.

What are the growth factors driving the Institutional Investor Market?

The Institutional Investor Market is driven by factors such as increasing global wealth, the growing need for retirement savings, and the demand for diversified investment portfolios. Additionally, advancements in technology and data analytics are enhancing investment strategies and decision-making processes.

What challenges does the Institutional Investor Market face?

Challenges in the Institutional Investor Market include regulatory pressures, market volatility, and the need for transparency in investment practices. These factors can impact investment performance and the ability to meet client expectations.

What opportunities exist in the Institutional Investor Market?

Opportunities in the Institutional Investor Market include the rise of sustainable investing, which focuses on environmental, social, and governance (ESG) criteria, and the increasing interest in alternative investments such as private equity and real estate. These trends are reshaping investment strategies and attracting new capital.

What trends are shaping the Institutional Investor Market?

Trends in the Institutional Investor Market include the growing adoption of technology for investment management, the shift towards passive investment strategies, and the increasing focus on ESG factors. These trends are influencing how institutional investors allocate their assets and engage with stakeholders.

Institutional Investor Market

| Segmentation Details | Description |

|---|---|

| Investor Type | Pension Funds, Hedge Funds, Endowments, Family Offices |

| Asset Class | Equities, Fixed Income, Real Estate, Commodities |

| Investment Strategy | Value Investing, Growth Investing, Indexing, Active Management |

| Transaction Size | Small Cap, Mid Cap, Large Cap, Mega Cap |

Leading Companies in the Institutional Investor Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at