444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Information Management for Offshore Projects is a critical aspect of modern business operations, particularly in the context of the offshore industry. Offshore projects involve a wide range of activities, such as oil and gas exploration, renewable energy projects, marine construction, and telecommunications installations, among others. These projects often face unique challenges due to their remote and harsh environments, making effective information management essential for their success.

Meaning

Information Management for Offshore Projects refers to the process of collecting, organizing, storing, and utilizing data and information relevant to various aspects of offshore projects. This includes project planning, risk assessment, safety protocols, environmental considerations, regulatory compliance, progress tracking, resource management, and decision-making. The ultimate goal is to ensure that accurate and timely information is available to all stakeholders, facilitating smooth operations and enhancing project outcomes.

Executive Summary

The Information Management for Offshore Projects market has witnessed significant growth in recent years, driven by the expansion of offshore activities and advancements in technology. Effective information management solutions have become a key priority for offshore project operators and stakeholders, given the complexity and scale of such projects. This comprehensive report delves into the key insights, market drivers, restraints, opportunities, regional analysis, and competitive landscape of the market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Digital twins & integrated engineering data platforms are becoming central, and information management systems are pivoting as the backbone.

Offshore wind and energy transition projects disproportionately drive new IM demand, especially in Europe, Asia-Pacific, and North America inland.

Regulatory and safety compliance (e.g. for environmental permits, inspections, structural integrity audits) require robust audit trails and records retention.

Data fragmentation and silos remain major barriers; successful projects consolidate data across disciplines early.

Remote operations and connectivity constraints make offline-capable, sync-enabled solutions essential.

Mergers, consortiums, and joint ventures in offshore projects necessitate interoperable information-sharing platforms.

Market Drivers

Growth in Offshore Renewable and Oil & Gas Projects: Developers of wind farms, floating solar, tidal, and deepwater fields require robust data platforms.

Digitization Mandates: Operators demand digital transformation for cost control, faster decision-making, and remote operations capability.

Regulation & Safety Oversight: Stringent environmental and safety standards demand traceable documentation and audit-ready systems.

Lifecycle Data Handover Needs: As assets transition from construction to operations, accurate as-built data is essential for maintenance and decommissioning.

Complex Stakeholder Ecosystems: International contractors, vendors, engineering houses, and regulators require controlled collaborative platforms rather than ad hoc file exchange.

Market Restraints

Legacy Data & Technical Debt: Many offshore players rely on old systems or paper records, making integration and migration costly.

Connectivity Challenges at Sea: Low or intermittent bandwidth offshore makes real-time collaboration difficult.

Cybersecurity Risk: Offshore platforms are vulnerable; information systems need hardened security against intrusion and data loss.

Cultural Resistance: Engineers and operations teams may resist new systems compared to familiar document workflows.

Cost and Complexity: High upfront costs for deploying scalable, secure systems for offshore contexts may discourage small and mid‑tier projects.

Market Opportunities

Offshore Renewables Projects: Wind, floating PV, wave energy all require new IM platforms, especially in emerging regions.

Decommissioning & Legacy Data Management: Aging offshore assets require data consolidation and archival tools.

AI & Automated Document Extraction: Natural language processing and computer vision to auto-tag drawings, extract metadata, and index reports.

Digital Twin Integration: Linking IM platforms to real-time operational systems for hybrid engineering-to-operations workflows.

Interoperability Standards and Platforms: Creating common data schemas (e.g. ISO 15926) for cross-vendor, multi-project data flows.

Market Dynamics

Supply-Side Factors:

Vendors evolve from pure DMS or PDM providers into full marine engineering data platforms, bundling services and consulting.

Partnerships between IM software firms and engineering contractors or cloud providers accelerate deployment models.

Modular, scalable offshore-capable systems gain favor over monolithic solutions.

Demand-Side Factors:

Operators seek turnkey platforms that unify design, survey, operation, and inspection data.

Contractors demand consistency and easier data exchange across multi-scope projects.

Regulators increasingly expect electronic submissions and audit-ready records—pressure for better IM.

Economic & Policy Factors:

Governments promoting offshore wind and marine energy allocate budgets that include digital infrastructure.

Emphasis on sustainability and decommissioning accountability encourages robust records management.

Financing terms on large projects may demand strong digital and risk-control offerings from contractors.

Regional Analysis

North Sea / UK / Europe: A mature region where offshore wind and oil & gas developers require integrated IM capabilities; high adoption of digital twin–backed systems.

Asia-Pacific (China, Taiwan, India, Australia): Rapid offshore wind expansion; local governments push digital offshore management platforms.

North America / Gulf of Mexico: Deepwater oil & gas projects demand robust IM, while offshore wind development in U.S. East Coast introduces new IM demand.

Latin America (Brazil, Argentina): Offshore oil & gas, combined with nascent offshore renewables, drive emerging IM investments.

Middle East / Gulf States: Oil & gas operations emphasize data governance, with emerging interest in offshore platforms and marine energy.

Competitive Landscape

Leading Companies in the Information Management for Offshore Projects Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Solution Type:

Document & Drawing Management

Engineering Data Repositories / Model Management

Project Collaboration Platforms

Operations & Maintenance Data Hubs

Digital Twin Integration & Analytics Layers

By Deployment Model:

On-Premises / On‑Platform

Cloud / Hybrid

Edge-enabled (local nodes + sync)

By End User:

Offshore Oil & Gas Operators

Offshore Wind / Marine Energy Developers

EPC Contractors / Engineering Houses

Marine Service & Inspection Providers

Regulators / Certification Bodies

By Phase:

Construction & Commissioning

Operation & Maintenance

Decommissioning & Legacy Archiving

Category-wise Insights

Document & Drawing Management: Core use case—versions, revisions, access control, transmittals, markups—must scale under project complexity.

Engineering Data Repositories: Storage and linking of 3D models, metadata, simulation results, inspection history.

Project Collaboration Platforms: Multi-disciplinary, cross-contractor data exchange in a controlled, traceable environment.

Operations & Maintenance Hubs: Integration of sensor data, inspection reports, maintenance logs, real-time system outputs into a consolidated IM.

Digital Twin & Analytics Layers: Data pipelines feeding visualization, predictive models, anomaly detection, and engineering forecasting.

Key Benefits for Industry Participants and Stakeholders

Improved Efficiency & Reduced Rework: Single sources of truth reduce duplication, errors, and version conflicts.

Enhanced Collaboration: Stakeholders across geographies can efficiently share data under permissions and audit controls.

Regulatory & Safety Compliance: Audit logs, traceability, and document retention support compliance with safety and environmental rules.

Lifecycle Data Continuity: As projects shift from build to operation, accurate recorded data supports maintenance and decision-making.

Risk Mitigation: Better data governance reduces the potential for data loss, miscommunication, or regulatory non-conformance.

SWOT Analysis

Strengths:

Strong alignment with the digital transformation imperatives in offshore engineering.

Growing demand driven by complexity and regulation.

Ability to integrate multiple data sources into unified platforms.

Weaknesses:

High cost and complexity of deployment in remote, offshore environments.

Resistance from legacy users accustomed to file-based workflows.

Vulnerability to connectivity, cybersecurity, and remote access constraints.

Opportunities:

Expansion into offshore renewables and emerging marine energy sectors.

AI-driven indexing, search, and automated document tagging features.

Standardized schemas and interoperability enabling cross-project data reuse.

Modular, subscription-based IM platforms reducing adoption barriers for medium-scale projects.

Threats:

Disruption from lightweight, simplified platforms if they match key user needs.

Cyberattacks targeting offshore systems or data in transit.

Cost overruns or failures in IM deployment eroding stakeholder confidence.

Rapid evolution of future marine fuels and asset types requiring adaptation.

Market Key Trends

Integration with Digital Twins: IM systems become the backbone feeding real-time and historical data into simulation and operational models.

Edge + Cloud Hybrid Models: Offshore nodes operate locally (disconnected) and sync to cloud systems when links permit.

AI & Automation: Natural language processing, image recognition, and auto-indexing reduce manual tagging and classification burden.

Open Standards & Data Interoperability: Adoption of ISO 15926, API-based exchange, and vendor-agnostic data models.

Subscription and Modular Licensing: Shift from license-heavy models to consumption-based or modules allowing scaling with project size.

Key Industry Developments

Collaborative Offshore Data Platforms: Projects where operators and contractors join common IM frameworks for the full asset lifecycle.

Edge Sync Clients Launched: New product offerings that buffer data locally and sync when connectivity is reestablished.

AI-Powered Document Parsing: Vendors delivering auto-tagging, search-by-content, and document clustering workflows.

Digital Twin–IM Coupling: Integrated solutions where IM platform also hosts or interfaces with the asset digital twin.

Interoperability Consortiums: Offshore alliances and industry bodies promoting unified data exchange and best practices.

Analyst Suggestions

Start IM Implementation Early: Deploy foundational systems in the design phase to avoid costly migration later.

Favor Modular & Scalable Architecture: Choose platforms that allow incremental deployment and flexibility across project phases.

Prioritize Security & Edge Capability: Ensure cyber-hardened solutions with offline sync and sandboxed local modes.

Invest in Change Management: Train users, involve stakeholders, and build adoption practices to reduce resistance.

Embrace Standards and Integration: Implement open APIs and data models to future-proof against vendor lock-in and ease expansion.

Future Outlook

The Information Management for Offshore Projects Market is poised for robust growth as offshore infrastructure increasingly leans into digital operations and asset management. IM platforms will evolve into central nervous systems linking engineering, operations, maintenance, and decommissioning streams. Adoption will accelerate with maturity in AI, open standards, and better offshore connectivity.

Offshore wind, floating assets, subsea electrification, and hybrid energy systems will all intensify demand for integrated information management. Legacy oil & gas operators and new marine energy developers will compete on data-driven operational excellence. Providers that balance robustness, ease-of-use, security, and modular scale will dominate. The market’s future lies in unifying distributed data flows, enabling smarter decisions, and sustaining offshore asset value over decades.

Conclusion

The Information Management for Offshore Projects Market is critical infrastructure for the digital transformation of marine engineering and operations. Properly deployed, these systems amplify collaboration, enable compliance, reduce risk, and support lifecycle value capture. As offshore industries grow in complexity and scale, mastering information is not optional—it is a strategic advantage. Stakeholders who embed IM early, adopt open practices, invest in AI tools, and ensure operational resilience will lead the transition into the next era of offshore infrastructure and energy.

What is Information Management for Offshore Projects?

Information Management for Offshore Projects refers to the systematic handling of data and information related to offshore projects, including planning, execution, and monitoring. It encompasses tools and processes that ensure effective communication, data storage, and retrieval among stakeholders involved in offshore operations.

What are the key companies in the Information Management for Offshore Projects market?

Key companies in the Information Management for Offshore Projects market include Aconex, Bentley Systems, and SAP, which provide software solutions for project management and data integration. These companies focus on enhancing collaboration and efficiency in offshore project execution, among others.

What are the drivers of growth in the Information Management for Offshore Projects market?

The growth of the Information Management for Offshore Projects market is driven by the increasing complexity of offshore projects, the need for real-time data access, and the rising demand for efficient project management solutions. Additionally, advancements in digital technologies are facilitating better data management practices.

What challenges does the Information Management for Offshore Projects market face?

Challenges in the Information Management for Offshore Projects market include data security concerns, the integration of legacy systems with new technologies, and the need for skilled personnel to manage sophisticated information systems. These factors can hinder the effective implementation of information management solutions.

What opportunities exist in the Information Management for Offshore Projects market?

Opportunities in the Information Management for Offshore Projects market include the adoption of cloud-based solutions, the integration of artificial intelligence for data analysis, and the growing emphasis on sustainability practices. These trends can enhance operational efficiency and decision-making in offshore projects.

What trends are shaping the Information Management for Offshore Projects market?

Trends shaping the Information Management for Offshore Projects market include the increasing use of mobile technologies for on-site data access, the rise of collaborative platforms for stakeholder engagement, and the implementation of advanced analytics for project performance monitoring. These innovations are transforming how information is managed in offshore environments.

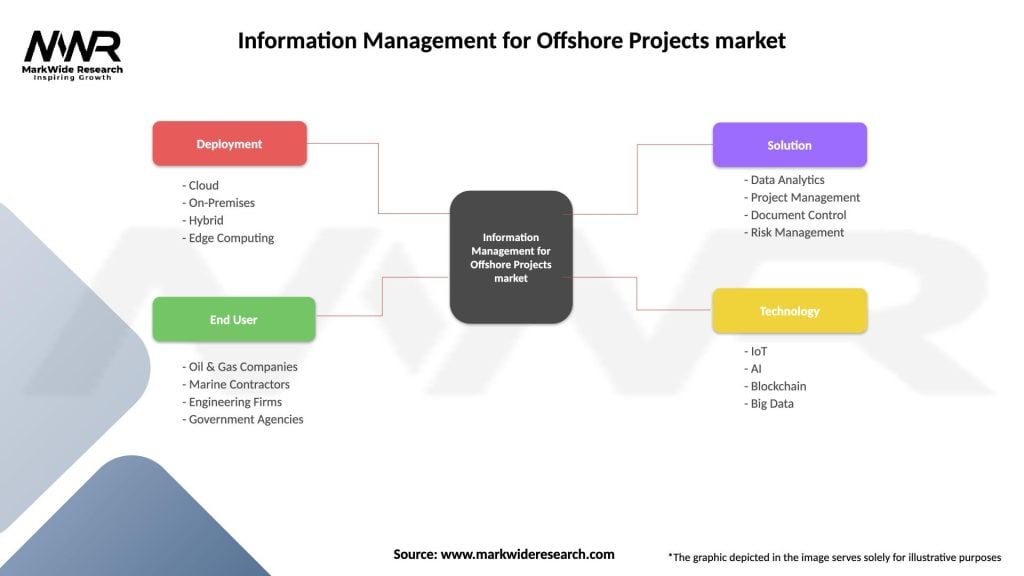

Information Management for Offshore Projects market

| Segmentation Details | Description |

|---|---|

| Deployment | Cloud, On-Premises, Hybrid, Edge Computing |

| End User | Oil & Gas Companies, Marine Contractors, Engineering Firms, Government Agencies |

| Solution | Data Analytics, Project Management, Document Control, Risk Management |

| Technology | IoT, AI, Blockchain, Big Data |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Information Management for Offshore Projects Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at