Key Market Insights

-

Fuel Mix Trends: Fuel-fired units still represent about 65% of global installations, but electric and hybrid units are growing at 10–12% annually due to decarbonization goals.

-

Modular Design Adoption: Over 40% of new industrial systems use modular, skid-mounted packages allowing rapid deployment and scalability.

-

Control Automation: Integrated building-management and process-control connectivity is now standard in 55% of commercial and industrial hot air systems.

-

Energy Efficiency Gains: High-efficiency condensing heat exchangers and variable-speed blowers deliver up to 20% energy savings versus legacy equipment.

-

Aftermarket Services: Retrofits for low-NOₓ burners, advanced controls, and heat recovery add 25–30% to market value annually.

Market Drivers

-

Regulatory Standards: Emission limits (NOₓ, CO) and efficiency mandates (e.g., Europe’s Ecodesign, U.S. DOE furnace standards) spur equipment upgrades.

-

Industrial Growth: Expansion in food processing, automotive paint shops, textiles, and chemical manufacturing fuels demand for process‐air heaters and dryers.

-

Building Retrofit Wave: Aging commercial HVAC systems require replacement with energy-efficient hot air units to meet green building certifications.

-

Cold‐Climate Needs: Rising construction in northern latitudes and cold chains amplifies need for reliable space heating and freeze protection systems.

-

Decentralized Heating: Preference for zone-based, demand-driven heating pushes modular, ductless hot air units in warehouses and large retail spaces.

Market Restraints

-

High Capital Costs: Premium for condensing or hybrid systems can exceed 20–30% versus basic non-condensing units, slowing adoption in cost-sensitive markets.

-

Fuel Price Volatility: Fluctuating natural gas and diesel costs complicate ROI calculations for fuel-fired systems.

-

Installation Complexity: Ductwork, ventilation, and safety clearances add to installation time and expense, particularly in retrofit scenarios.

-

Alternative Technologies: Heat pumps and radiant heating compete aggressively in moderate climates and high-efficiency building designs.

-

Maintenance Requirements: Burner servicing, exchanger cleaning, and controls calibration demand skilled technicians, increasing lifecycle costs.

Market Opportunities

-

Hybrid Integration: Combining heat pumps with auxiliary burners offers both electric and fuel flexibility, appealing in jurisdictions with dynamic electricity pricing.

-

IoT and Analytics: Advanced monitoring, predictive maintenance, and AI-driven optimization platforms can reduce downtime and boost efficiency.

-

Waste‐Heat Recovery: Retrofitting with heat‐recovery modules to capture flue gas heat opens process‐air and building‐heating synergies.

-

Clean‐Fuel Adaptation: Hydrogen-ready burners and biofuel compatibility position suppliers for emerging clean‐energy transitions.

-

Emerging Market Expansion: Rapid industrialization in Southeast Asia, Latin America, and Africa creates new greenfield demand for modular hot air systems.

Market Dynamics

-

OEM–Integrator Partnerships: Equipment suppliers collaborate with HVAC installers and system integrators to deliver turnkey hot air solutions.

-

Subscription Models: As-a-Service offerings—including equipment, installation, and maintenance—emerge for fleet heating and large process applications.

-

Technology Lifecycle: Condensing heat exchangers and variable‐speed drives are moving from “premium” to “standard” within a five-year window.

-

Circular Economy: Demand for recyclable heat exchanger materials and remanufactured equipment is growing under sustainability commitments.

-

Digital Twin Usage: Virtual models of hot air systems enable scenario testing for efficiency upgrades and capacity planning.

Regional Analysis

-

North America: Strong retrofit market driven by industrial plants and cold‐storage facilities; electric heat gaining share in commercial fit‐outs.

-

Europe: Leading in condensing natural gas systems and hydrogen‐ready burners; strict Ecodesign and F-Gas regulations.

-

Asia-Pacific: Fastest volume growth, especially in China and India’s food processing and automotive sectors; moderate efficiency standards.

-

Latin America: Growth tied to new manufacturing zones; fuel-fired systems dominate given lower grid reliability.

-

Middle East & Africa: Demand in GCC for large‐scale paint curing ovens and petrochemical process heaters; electrification limited by power costs.

Competitive Landscape

Leading Companies in the Industrial Monitor Market:

- Siemens AG

- ABB Ltd.

- Honeywell International Inc.

- Rockwell Automation, Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- General Electric Company

- Advantech Co., Ltd.

- EIZO Corporation

- Panasonic Corporation

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

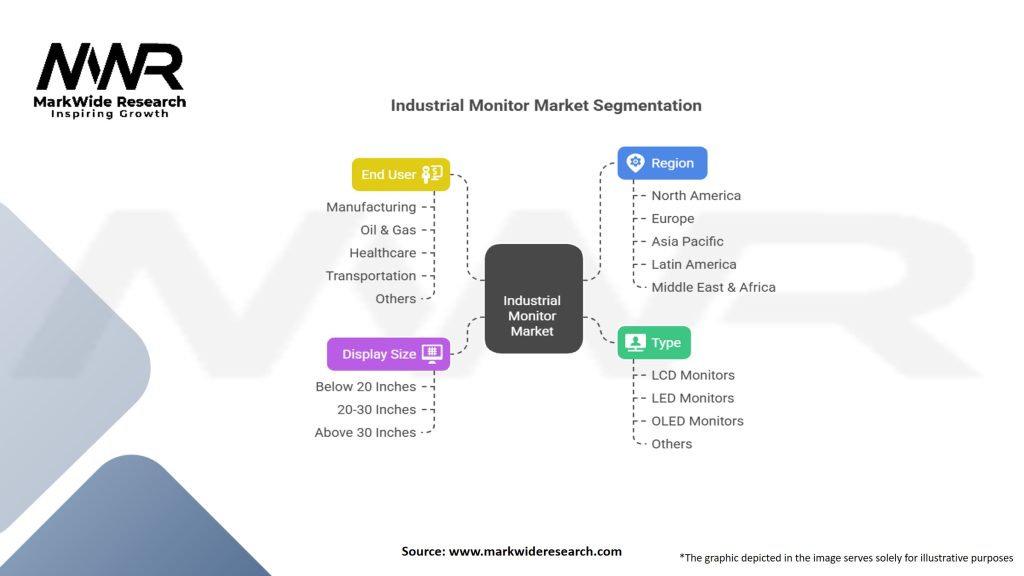

Segmentation

-

By Heat Source: Gas‐Fired Burners, Electric Resistance, Heat Pump Hybrids, Oil‐Fired Units

-

By Application: Industrial Process Heating (Drying, Curing), Commercial HVAC, Residential Furnaces, Agriculture & Greenhouses

-

By Configuration: Packaged Unit Heaters, Ducted Systems, Direct‐Fire Units, Unit Heaters (T-Style, Cabinet)

-

By Distribution: OEM Direct, System Integrators, HVAC Distributors, E-commerce

Category-wise Insights

-

Gas‐Fired Packaged Heaters: High capacity (100–2,000 kW), modular designs for factory floors, with condensing and non‐condensing options.

-

Electric Unit Heaters: Ideal for small to mid-size spaces (5–50 kW), fast response, silent operation, used in offices and retail.

-

Hybrid Heat Pumps: Heat pump primary with burner backup, offering COPs >3 in moderate climates, rising in data centers and green buildings.

-

Process‐Air Dryers: Custom drying ovens with recirculating hot air for food, pharmaceutical, and chemical production lines.

-

Greenhouse Heaters: Propane and gas infrared or forced‐air systems maintaining precise plant‐growth temperatures.

Key Benefits for Industry Participants and Stakeholders

-

Energy Savings: High‐efficiency exchangers and controls cut fuel or electricity use by 15–25%.

-

Improved Air Quality: Filtration and clean‐burn burners reduce particulates, aiding compliance with workplace air standards.

-

Operational Uptime: Redundant burner designs and remote monitoring minimize unplanned downtime in critical processes.

-

Rapid Deployment: Modular packaged units allow quick installation and commissioning in new facilities or line expansions.

-

Decarbonization Pathways: Transition to electric or hydrogen‐ready heat sources supports corporate net-zero commitments.

SWOT Analysis

Strengths:

-

Proven technology with broad application scope.

-

Steady aftermarket services for maintenance and controls upgrades.

-

Strong OEM integration with building and process automation.

Weaknesses:

-

High initial capex for premium, high-efficiency systems.

-

Dependence on fuel infrastructure in remote industrial sites.

-

Maintenance complexity in high-temperature, corrosive process environments.

Opportunities:

-

Growing hybrid and electric heating segments under decarbonization programs.

-

Expansion of IoT and AI controls to optimize performance and predictive maintenance.

-

Retrofitting legacy systems with condensing units for immediate efficiency gains.

Threats:

-

Competition from alternative heating methods (infrared, radiant heating, heat pumps).

-

Volatile energy prices impacting operating economics of fuel-fired units.

-

Regulatory shifts that favor electrification over combustion in certain regions.

Market Key Trends

-

Condensing Heat Exchangers: Moving from premium to mainstream; recovery of latent heat from flue gases.

-

Variable-Speed Drives: Matched blower speeds to real-time load for maximum energy efficiency.

-

Digital Controls: Cloud-based monitoring, remote firmware updates, and AI-driven performance optimization.

-

Hydrogen-Ready Burners: Pilot programs and burner designs compatible with 20–100% hydrogen blends.

-

Heat Recovery Modules: Integration of economizers and desiccant wheels capturing waste heat for process pre-heating.

Covid-19 Impact

The pandemic initially slowed construction and industrial capital projects, reducing new hot air system orders in 2020. However, increased focus on indoor air quality in commercial and healthcare facilities drove retrofit of higher-efficiency systems and advanced filtration. Supply-chain disruptions spurred OEMs to localize production and stock critical spare parts. Post-pandemic recovery has seen a rebound in manufacturing capex and HVAC upgrades, sustaining market momentum.

Key Industry Developments

-

Modine’s Condensing Unit Launch (2023): Introduced a 95%+ AFUE packaged heater with integrated variable-speed blower and IoT control module.

-

Trane’s Hybrid Rooftop Unit (2022): Combined heat pump and gas burner in a single skid, simplifying installation in commercial buildings.

-

Rite-Hite Smart Controls (2024): Rolled out AI-powered warehouse heating controls that learn occupancy and outdoor conditions.

-

Honeywell Hydrogen Boiler Pilot (2021): Demonstrated 100% H₂ burner operation in an industrial hot air unit under the H2ME program.

Analyst Suggestions

-

Prioritize Hybrid Solutions: Accelerate development of multi-fuel and electric-combustion hybrid systems for resilience and cost savings.

-

Leverage Digital Services: Bundle AI-based monitoring and predictive maintenance subscriptions with equipment sales.

-

Focus on Modular Retrofitting: Offer turnkey retrofit kits for condensing upgrades and controls modernization on existing hardware.

-

Expand Clean-Fuel Readiness: Certify products for hydrogen and biogas operation to align with emerging energy infrastructures.

-

Strengthen Regional Footprint: Localize assembly and service networks in Asia-Pacific and Latin America to meet rising demand.

Future Outlook

Through 2030, the Hot Air System market is expected to grow at a global CAGR of 6–7%, fueled by ongoing industrial expansion, building-efficiency retrofits, and decarbonization efforts. Electric and hybrid systems will capture increasing share in regions with clean power and strong emissions targets. Smart, connected heating platforms offering energy optimization and remote management will differentiate leading suppliers. Investment in heat-recovery integration and hydrogen-ready technologies will position the market for sustained growth amid evolving regulatory and environmental landscapes.

Conclusion

The Global Hot Air System market stands at the intersection of process efficiency, regulatory compliance, and sustainability goals. As industries and commercial building owners seek cost-effective, low-emission heating solutions, hybrid and electric-combustion systems with advanced controls will lead future deployments. Manufacturers that combine modular design, digital services, and clean-fuel readiness will win in a market driven by energy efficiency imperatives and the transition toward net-zero operations.