444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The industrial flux market is integral to various manufacturing processes, providing essential materials for welding, soldering, and metalworking applications. Fluxes facilitate the removal of oxides, impurities, and contaminants from metal surfaces, ensuring strong and clean welds. This market serves diverse industries such as automotive, construction, aerospace, and electronics, contributing to the efficient production of high-quality components and structures.

Meaning

Industrial flux refers to a chemical compound used in welding, soldering, and metalworking processes to improve joint quality and prevent oxidation. It acts as a cleaning agent, removing surface impurities and promoting metallurgical bonding between metals. Industrial fluxes come in various forms, including powders, pastes, and liquids, and are essential for ensuring the integrity and reliability of welded and soldered joints in manufacturing.

Executive Summary

The industrial flux market has witnessed steady growth, driven by the increasing demand for high-quality welded and soldered components across industries. Key factors such as technological advancements, stringent quality standards, and the rise of automation have contributed to market expansion. However, challenges such as environmental regulations and raw material costs require industry participants to innovate and adapt to changing market dynamics.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The industrial flux market operates in a dynamic environment shaped by technological advancements, regulatory developments, and shifting consumer preferences. Market dynamics such as increasing demand for precision welding, expansion of infrastructure projects, and the rise of additive manufacturing drive market growth, while challenges such as raw material price volatility and environmental concerns require industry participants to adapt and innovate to maintain competitiveness.

Regional Analysis

The industrial flux market exhibits regional variations influenced by factors such as industrialization, infrastructure development, and manufacturing activity. Key regions such as North America, Europe, Asia-Pacific, and Latin America have distinct market characteristics and growth drivers, with opportunities for flux manufacturers to capitalize on regional demand trends and market dynamics.

Competitive Landscape

Leading Companies in the Industrial Flux Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

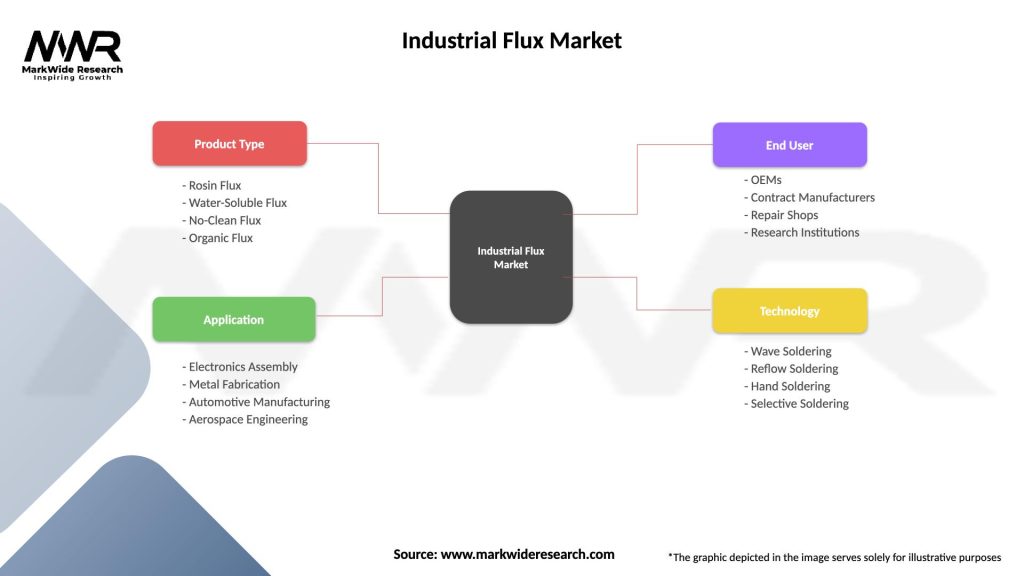

Segmentation

The industrial flux market can be segmented based on various factors such as product type, application, end-user industry, and geography. Segmentation enables flux manufacturers to target specific market segments and develop customized solutions tailored to unique application requirements, enhancing market competitiveness and customer satisfaction.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The industrial flux market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis provides insights into the industrial flux market’s strengths, weaknesses, opportunities, and threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the industrial flux market, disrupting global supply chains, and manufacturing operations initially. However, the market quickly recovered as industries adapted to the new normal, with increased emphasis on automation, digitalization, and remote monitoring to ensure business continuity and operational efficiency. The pandemic also highlighted the importance of resilience and flexibility in supply chain management, leading to increased investments in technology and innovation.

Key Industry Developments

Analyst Suggestions

Future Outlook

The industrial flux market is poised for steady growth in the coming years, driven by increasing demand for high-quality welded and soldered components across industries such as automotive, aerospace, construction, and electronics. Factors such as technological advancements, regulatory compliance, and the expansion of emerging markets will shape the market’s future trajectory, presenting opportunities for flux manufacturers to innovate, collaborate, and expand their global footprint.

Conclusion

In conclusion, the industrial flux market plays a crucial role in various manufacturing processes, providing essential materials for welding, soldering, and metalworking applications. Despite challenges such as raw material price volatility and environmental concerns, the market continues to grow, driven by technological advancements, regulatory compliance, and the expansion of emerging markets. By investing in research and development, collaborating with end-users, and focusing on sustainability, flux manufacturers can capitalize on growth opportunities and maintain competitiveness in the dynamic global market landscape.

What is Industrial Flux?

Industrial flux refers to materials used in various manufacturing processes to facilitate the joining of metals, improve the flow of molten materials, and prevent oxidation. It plays a crucial role in welding, soldering, and brazing applications across multiple industries.

What are the key players in the Industrial Flux Market?

Key players in the Industrial Flux Market include companies like Harris Products Group, Lincoln Electric, and ESAB. These companies are known for their innovative flux solutions and extensive product offerings, among others.

What are the main drivers of growth in the Industrial Flux Market?

The growth of the Industrial Flux Market is driven by increasing demand for welding and soldering in construction and automotive industries, as well as advancements in flux formulations that enhance performance and efficiency.

What challenges does the Industrial Flux Market face?

The Industrial Flux Market faces challenges such as stringent environmental regulations regarding chemical emissions and the need for continuous innovation to meet evolving industry standards and customer requirements.

What opportunities exist in the Industrial Flux Market?

Opportunities in the Industrial Flux Market include the development of eco-friendly flux products and the expansion into emerging markets where industrialization is on the rise, particularly in Asia and Africa.

What trends are shaping the Industrial Flux Market?

Trends in the Industrial Flux Market include the increasing adoption of automation in manufacturing processes and the growing focus on sustainability, leading to the development of low-fume and non-toxic flux materials.

Industrial Flux Market

| Segmentation Details | Description |

|---|---|

| Product Type | Rosin Flux, Water-Soluble Flux, No-Clean Flux, Organic Flux |

| Application | Electronics Assembly, Metal Fabrication, Automotive Manufacturing, Aerospace Engineering |

| End User | OEMs, Contract Manufacturers, Repair Shops, Research Institutions |

| Technology | Wave Soldering, Reflow Soldering, Hand Soldering, Selective Soldering |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Industrial Flux Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at