444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia study of data center water consumption market represents a critical research domain that examines the water usage patterns, efficiency metrics, and sustainability initiatives within Indonesia’s rapidly expanding digital infrastructure sector. As the archipelago nation continues its digital transformation journey, data centers have emerged as essential infrastructure components supporting cloud computing, digital services, and technological advancement across various industries.

Indonesia’s data center landscape has experienced remarkable growth, driven by increasing internet penetration rates of approximately 73.7% and rising demand for digital services. This expansion has brought heightened focus on water consumption patterns, as data centers require substantial cooling systems to maintain optimal operating temperatures for servers and networking equipment.

Water consumption analysis in Indonesian data centers reveals complex relationships between cooling efficiency, environmental impact, and operational sustainability. The tropical climate conditions across Indonesia’s major islands create unique challenges for data center operators, necessitating comprehensive water management strategies that balance performance requirements with environmental responsibility.

Research initiatives examining water consumption patterns have identified significant opportunities for efficiency improvements, with studies indicating potential water usage reductions of 35-45% through advanced cooling technologies and optimized water management systems. These findings underscore the importance of continued research and development in sustainable data center operations.

The Indonesia study of data center water consumption market refers to the comprehensive research ecosystem focused on analyzing, measuring, and optimizing water usage patterns within data center facilities across Indonesia’s diverse geographical regions. This market encompasses research methodologies, monitoring technologies, consulting services, and sustainability solutions specifically designed to address water consumption challenges in tropical data center environments.

Water consumption studies in this context involve systematic examination of cooling system efficiency, water usage intensity metrics, and environmental impact assessments. These studies provide critical insights for data center operators, policymakers, and technology providers seeking to implement sustainable practices while maintaining operational excellence.

Market participants include research institutions, environmental consulting firms, data center operators, cooling technology providers, and government agencies working collaboratively to establish best practices for water management in Indonesia’s growing digital infrastructure sector.

Indonesia’s data center water consumption research market has gained significant momentum as digital infrastructure expansion accelerates across the archipelago. The market encompasses diverse research activities ranging from baseline consumption studies to advanced efficiency optimization programs, reflecting the growing awareness of environmental sustainability in the technology sector.

Key market characteristics include increasing investment in research and development initiatives, growing collaboration between academic institutions and industry stakeholders, and rising adoption of water-efficient cooling technologies. The market demonstrates strong growth potential, supported by government sustainability mandates and corporate environmental responsibility commitments.

Research findings consistently highlight opportunities for substantial water consumption reductions through technology upgrades and operational improvements. Studies indicate that modern cooling systems can achieve 40-50% greater water efficiency compared to traditional approaches, driving increased interest in research-backed optimization strategies.

Market dynamics are influenced by regulatory developments, technological innovations, and growing environmental awareness among data center operators. The integration of artificial intelligence and machine learning technologies in water management systems represents a significant trend shaping research priorities and market development.

Critical insights from Indonesia’s data center water consumption research reveal several important trends and opportunities:

Digital transformation acceleration across Indonesia serves as the primary driver for data center water consumption research. As businesses increasingly rely on cloud services, artificial intelligence, and digital platforms, the demand for data center capacity continues growing, necessitating comprehensive water management studies to ensure sustainable expansion.

Environmental sustainability mandates from government agencies and international organizations create strong incentives for water consumption optimization research. Indonesian data center operators face increasing pressure to demonstrate environmental responsibility, driving investment in research-backed efficiency improvements and sustainable cooling technologies.

Climate change considerations amplify the importance of water conservation research, as rising temperatures and changing precipitation patterns affect cooling system requirements. Data center operators recognize the need for adaptive water management strategies based on comprehensive consumption studies and climate impact assessments.

Corporate sustainability commitments from major technology companies operating in Indonesia drive demand for detailed water consumption analysis and optimization solutions. These commitments often include specific water usage reduction targets, requiring research-backed strategies to achieve measurable improvements.

Technological innovation opportunities in cooling systems, water recycling, and efficiency monitoring create market demand for research services that evaluate new technologies and implementation strategies. The potential for significant operational cost savings through water optimization motivates continued research investment.

Limited research infrastructure in certain Indonesian regions constrains comprehensive water consumption studies, particularly in emerging data center markets outside major metropolitan areas. The lack of standardized monitoring equipment and measurement protocols can limit research accuracy and comparability across different facilities.

High implementation costs for advanced water monitoring and optimization systems create barriers for smaller data center operators seeking to participate in comprehensive consumption studies. The initial investment required for research-grade monitoring equipment and analysis capabilities may exceed available budgets for some market participants.

Technical complexity challenges in tropical environments require specialized expertise that may not be readily available across all Indonesian regions. The unique climate conditions and infrastructure considerations demand research approaches that account for local environmental factors and operational constraints.

Data standardization issues across different data center operators and research initiatives can limit the effectiveness of comparative studies and industry-wide optimization efforts. Inconsistent measurement methodologies and reporting standards may reduce the value of research findings for broader market application.

Regulatory uncertainty regarding water usage standards and environmental compliance requirements can create hesitation among potential research participants. The evolving nature of sustainability regulations may affect long-term research planning and investment decisions.

Government sustainability initiatives present significant opportunities for research organizations and technology providers to collaborate on comprehensive water consumption optimization programs. Indonesian authorities are increasingly supportive of research projects that contribute to national environmental goals and sustainable development objectives.

International collaboration potential exists for Indonesian research institutions to partner with global data center operators and technology companies seeking tropical climate expertise. These partnerships can provide access to advanced research methodologies and funding opportunities while contributing to global sustainability knowledge.

Technology innovation applications in artificial intelligence, machine learning, and Internet of Things systems create opportunities for advanced water consumption monitoring and optimization solutions. The integration of smart technologies with traditional cooling systems represents a growing research and commercial opportunity.

Regional expansion possibilities exist as data center development spreads beyond Java to other Indonesian islands, creating demand for localized water consumption studies and optimization strategies. Each region presents unique climate and infrastructure challenges requiring specialized research approaches.

Industry standardization leadership opportunities allow Indonesian research institutions and companies to contribute to global best practices for tropical data center water management. Establishing Indonesia as a center of excellence for tropical data center research could attract international investment and collaboration.

Market dynamics in Indonesia’s data center water consumption research sector reflect the complex interplay between technological advancement, environmental responsibility, and economic considerations. The rapid growth of digital infrastructure creates both opportunities and challenges for sustainable water management practices.

Competitive pressures among data center operators drive innovation in water efficiency technologies and management practices. Companies seek competitive advantages through superior environmental performance, creating demand for research services that identify optimization opportunities and validate efficiency improvements.

Regulatory evolution continues shaping market dynamics as Indonesian authorities develop more comprehensive environmental standards for data center operations. These regulatory changes create both compliance requirements and opportunities for research organizations to support industry adaptation efforts.

Technology convergence between cooling systems, monitoring technologies, and data analytics platforms creates new possibilities for comprehensive water management solutions. The integration of multiple technology domains requires interdisciplinary research approaches and collaborative development efforts.

Investment patterns show increasing focus on sustainability-oriented research and development, with both public and private funding sources prioritizing projects that demonstrate measurable environmental benefits. This trend supports continued market growth and innovation in water consumption optimization.

Comprehensive research methodologies employed in Indonesia’s data center water consumption studies utilize multi-faceted approaches combining quantitative measurement, qualitative analysis, and predictive modeling. These methodologies ensure accurate assessment of current consumption patterns while identifying optimization opportunities and future trends.

Data collection protocols involve systematic monitoring of water usage across different cooling system components, including chillers, cooling towers, and heat exchangers. Standardized measurement procedures ensure consistency and comparability across different facilities and research initiatives.

Climate analysis integration accounts for Indonesia’s diverse tropical conditions, incorporating temperature, humidity, and seasonal variation data into consumption models. This approach enables development of climate-specific optimization strategies and efficiency benchmarks.

Technology assessment frameworks evaluate the performance and efficiency of various cooling technologies under Indonesian operating conditions. These assessments provide data center operators with evidence-based guidance for technology selection and upgrade decisions.

Stakeholder engagement processes involve collaboration with data center operators, technology providers, and regulatory agencies to ensure research relevance and practical applicability. This collaborative approach enhances the value and adoption of research findings across the industry.

Java Island dominance characterizes the regional distribution of data center water consumption research activities, with approximately 70% of studies concentrated in Jakarta, Surabaya, and Bandung metropolitan areas. This concentration reflects the high density of data center facilities and research institutions in Java’s major urban centers.

Sumatra region development shows growing research activity as data center expansion accelerates in Medan and Palembang. The unique climate conditions and infrastructure characteristics of Sumatra create distinct research opportunities and challenges compared to Java-based studies.

Bali and Lombok represent emerging research markets driven by tourism industry digitalization and growing technology sector presence. These islands offer opportunities for studying water consumption patterns in smaller-scale data center operations and distributed computing environments.

Eastern Indonesia potential remains largely untapped for comprehensive water consumption research, despite growing digital infrastructure development in cities like Makassar and Manado. The expansion of research activities to these regions could provide valuable insights into diverse climate impacts and operational considerations.

Regional collaboration initiatives are developing between different Indonesian provinces to share research findings and best practices. These collaborative efforts enhance the overall effectiveness of water consumption optimization programs and support national sustainability objectives.

Research institutions leading Indonesia’s data center water consumption studies include both academic and commercial organizations:

Market competition focuses on research quality, practical applicability, and industry collaboration capabilities. Leading organizations differentiate themselves through comprehensive methodologies, advanced monitoring technologies, and strong relationships with data center operators.

By Research Type:

By Data Center Type:

By Geographic Scope:

Cooling System Analysis reveals significant variations in water consumption efficiency across different technology categories. Traditional air-cooled systems demonstrate higher water usage intensity compared to advanced liquid cooling solutions, with efficiency differences of 40-50% under Indonesian climate conditions.

Facility Size Impact studies show economies of scale in water management, with larger data centers achieving better water use effectiveness through centralized cooling systems and advanced optimization technologies. Hyperscale facilities typically demonstrate 25-35% better water efficiency compared to smaller enterprise data centers.

Geographic Climate Variations create distinct water consumption patterns across Indonesia’s diverse regions. Coastal facilities benefit from higher humidity levels that can reduce cooling loads, while inland locations face greater challenges in achieving optimal water efficiency.

Technology Integration Categories examine the effectiveness of combining multiple water conservation approaches, including heat recovery systems, water recycling technologies, and intelligent monitoring platforms. Integrated approaches typically achieve 30-45% greater efficiency improvements compared to single-technology implementations.

Operational Practice Analysis identifies best practices in water management that can be implemented across different data center categories. These practices include predictive maintenance programs, real-time monitoring systems, and staff training initiatives that collectively contribute to significant efficiency improvements.

Data center operators gain comprehensive insights into water consumption optimization opportunities, enabling significant operational cost reductions and improved environmental performance. Research findings support informed decision-making regarding technology upgrades, operational improvements, and sustainability initiatives.

Technology providers benefit from detailed performance data and market intelligence that guide product development and marketing strategies. Research results validate technology effectiveness and provide competitive differentiation opportunities in the Indonesian market.

Government agencies receive evidence-based information supporting policy development and regulatory framework establishment. Research findings contribute to national sustainability goals and environmental protection initiatives while supporting economic development objectives.

Environmental organizations gain access to comprehensive data supporting advocacy efforts and sustainability programs. Research results provide measurable metrics for tracking progress toward environmental goals and identifying areas requiring additional attention.

Academic institutions develop specialized expertise in tropical data center research, creating opportunities for international collaboration and funding. Research programs contribute to educational objectives while supporting industry development and innovation.

Investment community receives detailed market intelligence supporting investment decisions in data center infrastructure and sustainability technologies. Research findings help identify promising opportunities and assess market risks in Indonesia’s growing digital economy.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents a transformative trend in data center water consumption research, with machine learning algorithms enabling predictive analysis and real-time optimization. MarkWide Research analysis indicates that AI-powered water management systems can achieve efficiency improvements of 25-40% compared to traditional approaches.

Sustainability Reporting Standards are evolving to include more comprehensive water consumption metrics and environmental impact assessments. Data center operators increasingly require detailed research support to meet reporting requirements and demonstrate environmental responsibility to stakeholders.

Edge Computing Expansion creates new research opportunities as distributed data center architectures require localized water management strategies. The proliferation of smaller facilities across Indonesia’s diverse regions necessitates adapted research methodologies and optimization approaches.

Circular Economy Principles influence research priorities, with increasing focus on water recycling, heat recovery, and waste reduction strategies. These principles drive development of integrated solutions that maximize resource efficiency across all data center operations.

Climate Adaptation Research gains importance as changing weather patterns affect cooling requirements and water availability. Long-term studies examine climate change impacts and develop adaptive strategies for sustainable data center operations under evolving environmental conditions.

Government Policy Initiatives have introduced new environmental standards for data center operations, creating increased demand for water consumption research and compliance support services. These policies establish minimum efficiency requirements and reporting obligations that drive market growth.

Technology Innovation Programs launched by major data center operators include significant investments in water optimization research and development. These programs focus on developing solutions specifically adapted to Indonesian climate conditions and operational requirements.

Academic Research Expansion has seen Indonesian universities establishing specialized data center sustainability programs and research centers. These initiatives enhance the country’s research capabilities and support industry development through trained professionals and innovative solutions.

International Collaboration Projects connect Indonesian researchers with global expertise and funding sources, accelerating research progress and technology transfer. These partnerships contribute to knowledge sharing and best practice development across different climate regions.

Industry Association Formation has created formal networks for sharing research findings and coordinating optimization efforts across the Indonesian data center industry. These associations facilitate collaboration and standardization while promoting sustainable practices.

Research Investment Prioritization should focus on developing comprehensive baseline studies across all Indonesian regions to establish accurate consumption benchmarks and identify optimization opportunities. This foundational research will support more targeted efficiency improvement initiatives and technology development efforts.

Technology Integration Strategies should emphasize combining multiple water conservation approaches rather than implementing isolated solutions. Integrated systems typically achieve superior results and provide better return on investment for data center operators seeking comprehensive optimization.

Stakeholder Collaboration Enhancement requires stronger partnerships between research institutions, data center operators, and technology providers. These collaborative relationships ensure research relevance while accelerating the practical application of findings across the industry.

Standardization Development should establish consistent measurement protocols and reporting standards to improve research comparability and industry-wide optimization efforts. Standardized approaches will enhance the value of research investments and support policy development initiatives.

International Positioning opportunities exist for Indonesia to become a regional center of excellence for tropical data center research. This positioning could attract international investment and collaboration while supporting domestic industry development and export opportunities.

Market growth prospects for Indonesia’s data center water consumption research sector remain highly positive, driven by continued digital infrastructure expansion and increasing environmental awareness. The market is expected to experience sustained growth as data center capacity requirements continue expanding across the archipelago.

Technology advancement integration will transform research methodologies and optimization capabilities over the coming years. Advanced monitoring systems, predictive analytics, and automated optimization platforms will enable more sophisticated and effective water management strategies.

Regional expansion opportunities will drive research activities beyond current concentration areas to serve emerging data center markets across Indonesia’s diverse regions. This expansion will require adapted research approaches that account for local climate conditions and infrastructure characteristics.

Regulatory evolution will continue shaping market dynamics as Indonesian authorities develop more comprehensive environmental standards for data center operations. These regulatory changes will create both compliance requirements and opportunities for research organizations to support industry adaptation.

International collaboration growth will enhance Indonesia’s research capabilities while contributing to global knowledge development in tropical data center sustainability. These partnerships will provide access to advanced technologies and methodologies while establishing Indonesia as a recognized expertise center.

MWR projections indicate that water consumption research will become increasingly integrated with broader sustainability initiatives, creating opportunities for comprehensive environmental impact assessment and optimization services. This integration will expand market scope and enhance the strategic value of research activities.

Indonesia’s data center water consumption research market represents a critical component of the nation’s sustainable digital infrastructure development strategy. As data center capacity continues expanding to support economic growth and digital transformation, comprehensive water management research becomes increasingly essential for environmental protection and operational efficiency.

Market dynamics reflect the complex interplay between technological innovation, environmental responsibility, and economic development objectives. The growing recognition of water conservation importance among data center operators, combined with supportive government policies and advancing research capabilities, creates favorable conditions for continued market growth and development.

Research findings consistently demonstrate significant opportunities for water consumption optimization through technology upgrades, operational improvements, and integrated management approaches. These opportunities provide compelling incentives for continued investment in research and development activities while supporting broader sustainability objectives.

Future success in this market will depend on continued collaboration between research institutions, industry stakeholders, and government agencies. The development of standardized methodologies, expansion of research capabilities to underserved regions, and integration of advanced technologies will be critical factors determining long-term market growth and impact.

Strategic positioning of Indonesia as a center of excellence for tropical data center research could provide significant economic and environmental benefits while contributing to global sustainability knowledge. The unique climate conditions and growing digital infrastructure create distinctive research opportunities that can attract international collaboration and investment.

What is Data Center Water Consumption?

Data Center Water Consumption refers to the amount of water used by data centers for cooling and other operational processes. This includes water used in cooling towers, chillers, and other systems that manage heat generated by servers and equipment.

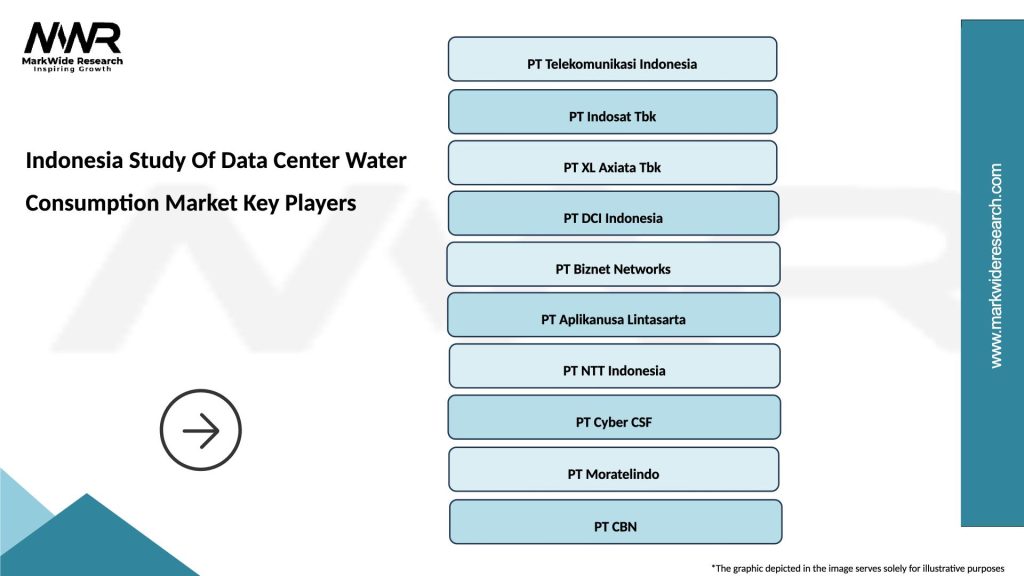

What are the key players in the Indonesia Study Of Data Center Water Consumption Market?

Key players in the Indonesia Study Of Data Center Water Consumption Market include companies like PT Telekomunikasi Indonesia, DigitalOcean, and Alibaba Cloud, among others.

What are the main drivers of the Indonesia Study Of Data Center Water Consumption Market?

The main drivers include the increasing demand for cloud services, the growth of digital infrastructure, and the need for efficient cooling solutions in data centers. These factors contribute to higher water consumption as data centers expand.

What challenges does the Indonesia Study Of Data Center Water Consumption Market face?

Challenges include water scarcity in certain regions, regulatory pressures regarding water usage, and the environmental impact of high water consumption. These factors can hinder the growth of data centers in water-sensitive areas.

What opportunities exist in the Indonesia Study Of Data Center Water Consumption Market?

Opportunities include the development of water-efficient cooling technologies, the implementation of recycling systems, and partnerships with local governments to promote sustainable water use. These innovations can enhance operational efficiency and reduce environmental impact.

What trends are shaping the Indonesia Study Of Data Center Water Consumption Market?

Trends include the adoption of green data center practices, increased investment in water conservation technologies, and a shift towards hybrid cooling solutions. These trends reflect a growing awareness of sustainability in the data center industry.

Indonesia Study Of Data Center Water Consumption Market

| Segmentation Details | Description |

|---|---|

| Type | Colocation, Managed Services, Cloud Services, Hybrid Solutions |

| End User | Telecommunications, Financial Services, Government, Healthcare |

| Technology | Cooling Systems, Water Recycling, Monitoring Solutions, Filtration Systems |

| Application | Data Storage, Disaster Recovery, Cloud Computing, Virtualization |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia Study Of Data Center Water Consumption Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at