444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia residential real estate market represents one of Southeast Asia’s most dynamic and rapidly evolving property sectors, driven by robust economic growth, urbanization trends, and a growing middle class. Indonesia’s residential property landscape encompasses diverse segments ranging from affordable housing units to luxury developments across major metropolitan areas including Jakarta, Surabaya, Bandung, and emerging secondary cities.

Market dynamics in Indonesia’s residential sector reflect the country’s demographic advantages, with over 270 million inhabitants creating substantial housing demand. The market experiences consistent growth momentum, supported by government initiatives promoting homeownership and infrastructure development projects that enhance property accessibility and value appreciation potential.

Regional distribution shows Jakarta and surrounding areas commanding approximately 35% market share, while secondary cities demonstrate accelerating growth rates as urbanization spreads beyond traditional metropolitan centers. The residential market benefits from favorable demographic trends, including a young population with increasing purchasing power and evolving lifestyle preferences driving demand for modern housing solutions.

Investment patterns indicate strong domestic demand complemented by selective foreign investment in premium segments, creating a balanced market environment that supports sustainable growth across various price points and property types.

The Indonesia residential real estate market refers to the comprehensive ecosystem of residential property development, sales, and investment activities encompassing single-family homes, apartments, condominiums, and mixed-use residential projects across Indonesia’s diverse geographic regions.

This market encompasses primary and secondary property transactions, rental markets, property management services, and related financial services that facilitate homeownership and residential investment. The sector includes various property categories from government-subsidized affordable housing programs to high-end luxury developments targeting affluent buyers and international investors.

Market participants include property developers, real estate agents, financial institutions, government agencies, construction companies, and end-users comprising both domestic residents and foreign buyers eligible under Indonesian property ownership regulations.

Indonesia’s residential real estate market demonstrates remarkable resilience and growth potential, supported by fundamental economic and demographic drivers that create sustained housing demand across multiple market segments. The sector benefits from government policy support, infrastructure investments, and evolving consumer preferences that favor modern residential developments with integrated amenities.

Key market characteristics include strong domestic demand driven by urbanization trends, with approximately 56% of the population now residing in urban areas and this percentage continuing to increase annually. The market shows particular strength in affordable and mid-range housing segments, reflecting the expanding middle class and government initiatives promoting homeownership accessibility.

Growth drivers encompass demographic advantages, economic development, infrastructure improvements, and supportive regulatory frameworks that encourage both domestic and foreign investment in residential properties. The market demonstrates adaptability to changing consumer needs, with developers increasingly focusing on sustainable building practices and smart home technologies.

Regional expansion beyond traditional metropolitan areas creates new opportunities, as secondary cities experience rapid development and improved connectivity through infrastructure projects that enhance their attractiveness for residential investment and development.

Strategic market insights reveal several critical factors shaping Indonesia’s residential real estate landscape and future development trajectory:

Economic growth momentum serves as the primary driver for Indonesia’s residential real estate market, with sustained GDP expansion supporting income growth and homebuying capacity across various demographic segments. The country’s economic diversification and industrial development create employment opportunities that translate into housing demand in both urban and suburban areas.

Population dynamics contribute significantly to market growth, as Indonesia’s large and young population creates natural demand for housing units. The demographic structure, with a substantial portion of the population entering prime homebuying age, ensures sustained market demand over the medium to long term.

Urbanization trends accelerate residential development needs, as rural-to-urban migration continues at approximately 2.3% annually, requiring new housing supply in metropolitan areas and emerging urban centers. This migration pattern creates opportunities for developers to address diverse housing needs across different income levels.

Government initiatives including the One Million Houses program and various subsidized housing schemes provide market support while addressing affordable housing needs. These programs create stable demand foundations and encourage private sector participation in residential development projects.

Infrastructure investments enhance property values and accessibility, with major transportation projects, utility improvements, and digital connectivity upgrades making previously underdeveloped areas attractive for residential development and investment.

Regulatory complexities present challenges for both developers and buyers, particularly regarding foreign ownership restrictions and land acquisition procedures that can slow development timelines and limit market participation for international investors seeking residential properties.

Infrastructure limitations in certain regions constrain development potential, as inadequate transportation networks, utility systems, and digital connectivity can limit the attractiveness of otherwise promising residential development locations.

Financing constraints affect market accessibility, with mortgage availability and interest rates sometimes limiting homebuying capacity for middle and lower-income segments, despite government efforts to improve financing accessibility through various programs.

Construction cost pressures impact development economics, as material price volatility, labor shortages in certain regions, and compliance costs related to building standards and environmental regulations can affect project viability and pricing strategies.

Economic volatility creates periodic market uncertainty, with currency fluctuations, inflation pressures, and global economic conditions occasionally affecting buyer confidence and investment decisions in the residential property sector.

Secondary city development presents substantial opportunities as infrastructure improvements and economic decentralization make previously overlooked markets attractive for residential investment and development, offering potentially higher returns and lower competition compared to established metropolitan areas.

Affordable housing segment offers significant growth potential, supported by government programs and the expanding middle class seeking homeownership opportunities. Developers focusing on cost-effective solutions while maintaining quality standards can capture substantial market share in this underserved segment.

Technology integration creates opportunities for innovative residential developments incorporating smart home features, energy management systems, and digital connectivity solutions that appeal to tech-savvy buyers and command premium pricing.

Sustainable development represents a growing opportunity as environmental awareness increases and green building certifications become more valued by buyers seeking energy-efficient and environmentally responsible housing options.

Mixed-use developments offer attractive investment opportunities by combining residential units with commercial, retail, and recreational facilities, creating integrated communities that appeal to modern lifestyle preferences and generate multiple revenue streams.

Supply and demand dynamics in Indonesia’s residential market reflect the interplay between rapid urbanization, economic growth, and development capacity constraints. Demand consistently outpaces supply in prime locations, creating upward pressure on property values while encouraging developers to explore new markets and innovative housing solutions.

Price dynamics vary significantly across regions and property types, with Jakarta and major metropolitan areas experiencing steady appreciation while secondary cities show more volatile but potentially higher growth rates. The market demonstrates resilience to economic fluctuations, with residential properties generally maintaining value better than other asset classes.

Investment flows show increasing sophistication, with institutional investors, real estate investment trusts, and foreign capital participating alongside traditional individual buyers and local developers. This diversification of market participants contributes to market stability and professional development practices.

Development cycles reflect both market demand and regulatory approval processes, with successful projects typically requiring 2-4 years from conception to completion. Developers increasingly focus on pre-sales strategies and phased development approaches to manage market risks and capital requirements effectively.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Indonesia’s residential real estate market dynamics, trends, and future prospects. The research approach combines quantitative data analysis with qualitative market intelligence gathering from diverse industry sources.

Primary research activities include structured interviews with key market participants including property developers, real estate agents, financial institutions, government officials, and end-users to gather firsthand insights into market conditions, challenges, and opportunities across different regions and market segments.

Secondary research components encompass analysis of government statistics, industry reports, regulatory documents, and economic indicators that influence residential real estate market performance. This includes examination of demographic trends, economic data, infrastructure development plans, and policy initiatives affecting the housing sector.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis of market trends, and verification of findings with industry experts and market participants to provide reliable and actionable market intelligence.

Jakarta metropolitan area dominates Indonesia’s residential real estate market, accounting for approximately 35% of total market activity and representing the most mature and sophisticated property market in the country. The region benefits from economic concentration, infrastructure development, and diverse housing options ranging from affordable apartments to luxury developments.

Surabaya and East Java represent the second-largest regional market, with strong industrial development and port activities driving residential demand. The region shows consistent growth in both affordable and mid-range housing segments, supported by economic diversification and infrastructure improvements.

Bandung and West Java demonstrate rapid residential development, benefiting from proximity to Jakarta while offering more affordable land costs and attractive lifestyle amenities. The region attracts both commuters and local residents seeking quality housing options at competitive prices.

Secondary cities including Medan, Makassar, Semarang, and Palembang show accelerating residential market growth, with infrastructure investments and economic development creating new opportunities for property development and investment. These markets offer higher growth potential but require careful market analysis and local expertise.

Emerging markets in tourist destinations like Bali, Yogyakarta, and coastal areas present specialized opportunities for residential development targeting both domestic and international buyers seeking lifestyle properties and investment opportunities in unique locations.

Market leadership in Indonesia’s residential real estate sector encompasses both large-scale developers and specialized regional players, creating a competitive environment that drives innovation and market development across various segments and geographic regions.

Competitive strategies focus on differentiation through location selection, design innovation, amenity integration, and pricing strategies that appeal to specific target market segments while maintaining profitability and market share growth.

By Property Type: The residential market segments into distinct categories serving different buyer preferences and income levels, each with unique characteristics and growth dynamics.

By Price Range: Market segmentation reflects Indonesia’s diverse economic demographics and varying purchasing power across different regions and buyer categories.

By Location: Geographic segmentation reflects varying market dynamics, development costs, and buyer preferences across Indonesia’s diverse regions and urban centers.

Affordable housing category demonstrates the strongest growth momentum, supported by government initiatives and expanding middle-class purchasing power. This segment benefits from standardized development approaches, government subsidies, and financing support that makes homeownership accessible to broader population segments. Market penetration in this category reaches approximately 42% of total residential transactions, reflecting its critical importance in addressing Indonesia’s housing needs.

Mid-range residential developments show consistent performance, appealing to established middle-class buyers seeking quality housing with modern amenities. This category benefits from balanced supply-demand dynamics and represents the largest segment by transaction volume, offering developers stable returns and buyers good value propositions.

Luxury residential segment demonstrates selective growth, concentrated in prime locations and targeting high-net-worth individuals and foreign buyers. Despite representing a smaller transaction volume, this category contributes significantly to market value and drives innovation in design, amenities, and sustainable building practices.

Mixed-use residential projects gain increasing popularity, combining residential units with commercial, retail, and recreational facilities to create integrated communities. This category appeals to modern lifestyle preferences and offers developers multiple revenue streams while providing residents with convenient access to various services and amenities.

Property developers benefit from sustained market demand, supportive government policies, and opportunities for innovation in design, technology integration, and sustainable development practices. The market offers diverse development opportunities across various segments and regions, enabling portfolio diversification and risk management.

Financial institutions gain from expanding mortgage markets, growing middle-class purchasing power, and government support for homeownership financing. The residential real estate sector provides stable lending opportunities with collateral backing and contributes to financial sector growth and profitability.

Construction companies benefit from consistent project pipelines, infrastructure development requirements, and opportunities to develop specialized expertise in residential construction techniques and sustainable building practices that command premium pricing.

Real estate agents and brokers capitalize on market growth through increased transaction volumes, professional service demand, and opportunities to develop specialized expertise in different market segments and geographic regions.

Government entities achieve policy objectives including housing accessibility, urban development, economic growth, and tax revenue generation while addressing social needs through affordable housing programs and infrastructure development initiatives.

End-users and investors benefit from wealth building opportunities, homeownership accessibility, rental income potential, and portfolio diversification through residential real estate investments that historically provide inflation protection and long-term value appreciation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation reshapes Indonesia’s residential real estate market, with online property platforms, virtual tours, and digital marketing becoming standard practices. Technology adoption accelerates at approximately 28% annually, transforming how properties are marketed, sold, and managed while improving market efficiency and accessibility for both buyers and sellers.

Sustainable development practices gain momentum as environmental awareness increases and green building certifications become more valued by buyers. Developers increasingly incorporate energy-efficient designs, renewable energy systems, and sustainable materials to meet evolving market preferences and regulatory requirements.

Mixed-use development concepts become more prevalent, with integrated communities combining residential, commercial, retail, and recreational facilities to create comprehensive lifestyle environments. This trend reflects changing consumer preferences for convenience and community-oriented living arrangements.

Affordable housing innovation drives market development, with developers exploring modular construction, standardized designs, and cost-effective building techniques to address housing accessibility while maintaining profitability and quality standards.

Smart home integration becomes increasingly important, with buyers seeking properties equipped with modern technology including home automation systems, high-speed internet connectivity, and energy management solutions that enhance convenience and operational efficiency.

Government policy initiatives continue shaping market development, with recent programs expanding affordable housing access, streamlining development approvals, and encouraging sustainable building practices through incentives and regulatory frameworks that support market growth.

Infrastructure investments transform market dynamics, with major transportation projects, utility improvements, and digital connectivity upgrades enhancing property accessibility and value appreciation potential across various regions and development areas.

Foreign investment regulations evolve to balance market openness with domestic interests, creating opportunities for international capital participation while maintaining market stability and ensuring benefits for local stakeholders and communities.

Technology platform development revolutionizes property marketing and transactions, with leading companies launching comprehensive digital solutions that streamline buying processes, improve market transparency, and enhance customer experience throughout the property acquisition journey.

Sustainability certifications become more prominent, with green building standards and energy efficiency requirements influencing development practices and buyer preferences, creating competitive advantages for developers adopting sustainable practices.

MarkWide Research recommends that market participants focus on diversification strategies that balance established metropolitan markets with emerging secondary city opportunities, enabling risk management while capitalizing on higher growth potential in developing regions.

Technology integration should be prioritized by developers and real estate professionals, with investments in digital marketing platforms, virtual tour capabilities, and smart home features becoming essential for competitive positioning and market success.

Sustainable development practices deserve increased attention, as environmental considerations become more important to buyers and regulatory requirements evolve. Early adoption of green building standards can create competitive advantages and premium pricing opportunities.

Partnership strategies with financial institutions, government agencies, and technology providers can enhance market access, improve financing solutions, and accelerate development timelines while sharing risks and expertise across different market segments.

Market research and local expertise become increasingly critical for success in secondary cities and emerging markets, where understanding local preferences, regulations, and economic conditions can determine project success and investment returns.

Long-term growth prospects for Indonesia’s residential real estate market remain highly positive, supported by fundamental demographic and economic drivers that ensure sustained housing demand across multiple market segments and geographic regions. Market expansion is projected to continue at approximately 6.8% CAGR over the next five years, driven by urbanization, economic growth, and government support initiatives.

Secondary city development will likely accelerate as infrastructure investments improve connectivity and economic opportunities expand beyond traditional metropolitan centers. These markets offer significant growth potential for developers and investors willing to invest in local market knowledge and long-term development strategies.

Technology integration will become increasingly sophisticated, with artificial intelligence, virtual reality, and Internet of Things applications transforming property development, marketing, and management practices. Early adopters of these technologies will likely gain competitive advantages and premium market positioning.

Sustainability requirements will become more stringent, with green building standards and energy efficiency becoming standard expectations rather than premium features. Developers must adapt to these evolving requirements to maintain market competitiveness and regulatory compliance.

MWR analysis indicates that market consolidation may occur in certain segments, with successful developers expanding market share through strategic acquisitions, partnerships, and geographic expansion while smaller players focus on niche markets and specialized development approaches.

Indonesia’s residential real estate market presents compelling opportunities for sustained growth and development, supported by robust demographic trends, economic expansion, and supportive government policies that create favorable conditions for both developers and investors across various market segments.

Market fundamentals remain strong, with urbanization trends, middle-class expansion, and infrastructure development providing solid foundations for continued market growth. The diversity of opportunities across different property types, price ranges, and geographic regions enables market participants to develop balanced strategies that manage risks while capitalizing on growth potential.

Success factors for market participants include embracing technology integration, adopting sustainable development practices, understanding local market dynamics, and maintaining flexibility to adapt to evolving consumer preferences and regulatory requirements. The market rewards innovation, quality, and strategic positioning while punishing complacency and outdated approaches.

Future prospects indicate continued market evolution toward greater sophistication, sustainability, and technology integration, creating opportunities for forward-thinking developers, investors, and service providers who can anticipate and respond to changing market conditions and consumer expectations in Indonesia’s dynamic residential real estate sector.

What is Indonesia Residential Real Estate?

Indonesia Residential Real Estate refers to the sector that encompasses the buying, selling, and renting of residential properties such as houses, apartments, and condominiums within Indonesia.

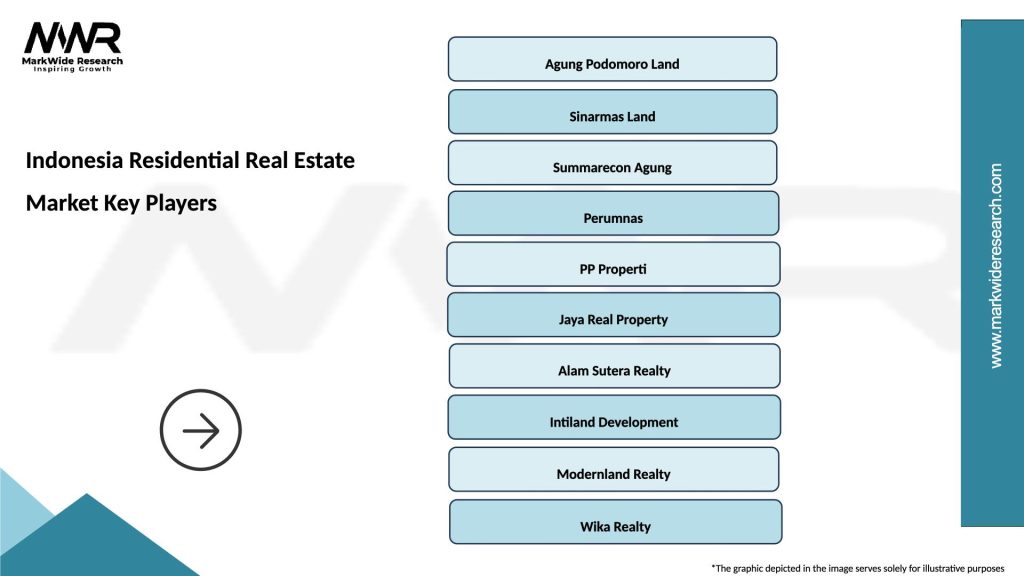

What are the key players in the Indonesia Residential Real Estate Market?

Key players in the Indonesia Residential Real Estate Market include companies like Ciputra Development, Agung Podomoro Land, and Summarecon Agung, among others.

What are the main drivers of growth in the Indonesia Residential Real Estate Market?

The main drivers of growth in the Indonesia Residential Real Estate Market include urbanization, increasing disposable incomes, and a growing middle class seeking home ownership.

What challenges does the Indonesia Residential Real Estate Market face?

Challenges in the Indonesia Residential Real Estate Market include regulatory hurdles, fluctuating property prices, and limited access to financing for potential buyers.

What opportunities exist in the Indonesia Residential Real Estate Market?

Opportunities in the Indonesia Residential Real Estate Market include the development of affordable housing projects, investment in smart home technologies, and the potential for growth in suburban areas.

What trends are shaping the Indonesia Residential Real Estate Market?

Trends shaping the Indonesia Residential Real Estate Market include a shift towards sustainable building practices, increased demand for integrated living spaces, and the rise of digital platforms for property transactions.

Indonesia Residential Real Estate Market

| Segmentation Details | Description |

|---|---|

| Property Type | Apartment, Villa, Townhouse, Bungalow |

| Price Range | Below IDR 500 Million, IDR 500 Million – IDR 1 Billion, IDR 1 Billion – IDR 2 Billion, Above IDR 2 Billion |

| Location | Jakarta, Bali, Surabaya, Bandung |

| Buyer Type | First-time Buyers, Investors, Expats, Families |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia Residential Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at