444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Private health insurance in Indonesia has witnessed significant growth in recent years, driven by a rising demand for better healthcare services and increasing awareness about the benefits of health coverage. With a population of over 270 million people, Indonesia represents a substantial market for private health insurance providers. This article provides an in-depth analysis of the Indonesia private health insurance market, including key insights, market drivers, restraints, opportunities, regional analysis, competitive landscape, segmentation, industry trends, and future outlook.

Meaning

Private health insurance refers to insurance coverage that individuals or organizations purchase to protect themselves against the financial burden of medical expenses. In Indonesia, private health insurance policies are offered by various insurance companies and cover a range of healthcare services, including hospitalization, outpatient care, medication, and preventive care. These policies typically provide policyholders with the flexibility to choose their healthcare providers and access quality medical treatment.

Executive Summary

The private health insurance market in Indonesia has experienced substantial growth over the past few years, driven by factors such as increasing disposable income, a growing middle class, and rising healthcare costs. The market is characterized by intense competition among insurance providers, who are constantly innovating their products and services to attract and retain customers. Despite challenges related to affordability and access to quality healthcare, the private health insurance market in Indonesia is poised for further expansion in the coming years.

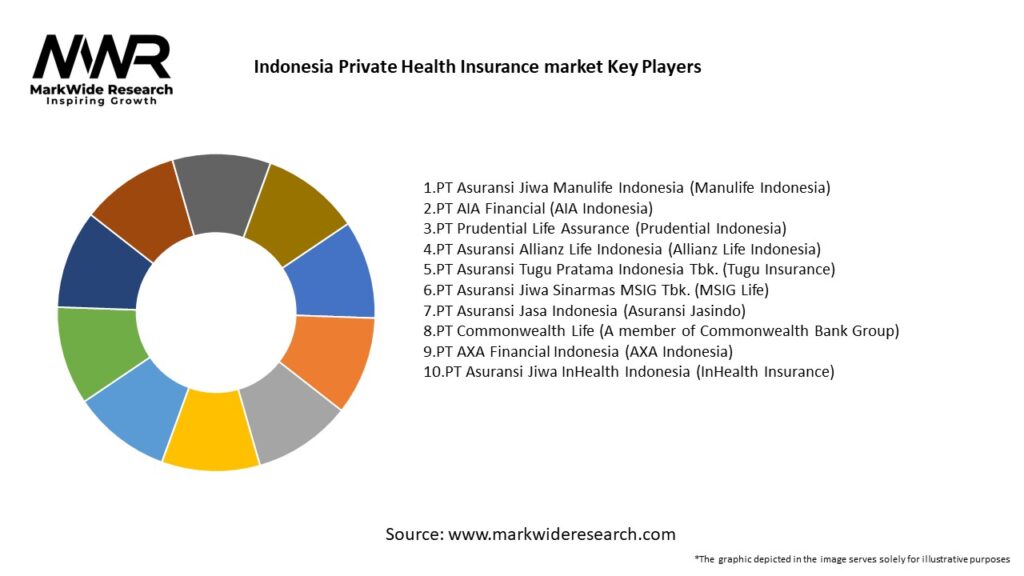

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Indonesia private health insurance market is dynamic and characterized by intense competition among insurance providers. Market dynamics are influenced by factors such as changing consumer preferences, regulatory developments, advancements in technology, and macroeconomic conditions. Insurance companies are continuously adapting their strategies to gain a competitive edge, enhance customer engagement, and expand their market share.

Regional Analysis

The private health insurance market in Indonesia exhibits regional variations in terms of penetration, demand, and healthcare infrastructure. Urban areas, such as Jakarta, Surabaya, and Bandung, have higher insurance penetration due to greater awareness and access to healthcare facilities. Rural regions, on the other hand, present untapped opportunities for insurance providers to expand their operations and increase coverage.

Competitive Landscape

Leading Companies in Indonesia Private Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

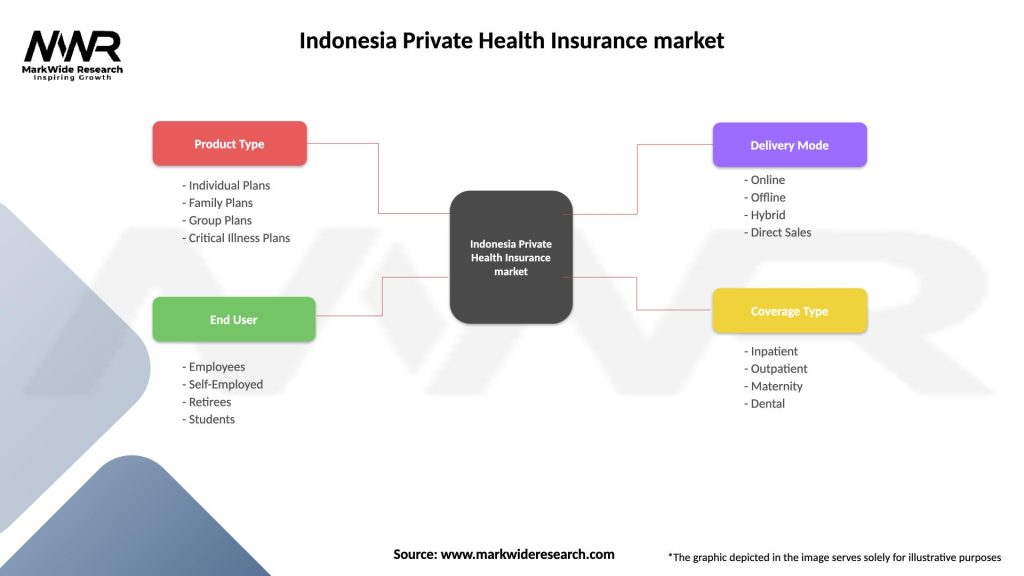

Segmentation

The private health insurance market in Indonesia can be segmented based on various factors, including type of coverage, target customer segment, and distribution channel. Types of coverage include individual health insurance, family health insurance, and group health insurance for organizations. Target customer segments may include young professionals, families, senior citizens, and expatriates. Distribution channels can include insurance agents, bancassurance, online platforms, and partnerships with healthcare providers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has significantly impacted the private health insurance market in Indonesia. The pandemic led to an increased awareness of the importance of health coverage and the need for financial protection against unforeseen medical expenses. Insurance companies have responded by offering COVID-19 coverage, telemedicine services, and digital health solutions to cater to the changing needs of customers during the pandemic. However, the economic downturn caused by the pandemic has also affected affordability and consumer spending, posing challenges to the widespread adoption of private health insurance.

Key Industry Developments

Analyst Suggestions

Future Outlook

The private health insurance market in Indonesia is expected to continue its growth trajectory in the coming years. Factors such as rising healthcare costs, increasing awareness, and government support are likely to drive market expansion. Insurance providers that prioritize affordability, transparency, customer engagement, and innovation will be well-positioned to capitalize on the growing demand for private health insurance. Expansion into rural areas, collaboration with healthcare providers, and the integration of digital technologies will be key strategies for future success in the market.

Conclusion

The Indonesia private health insurance market presents significant opportunities for insurance providers to tap into a growing demand for healthcare coverage. While challenges related to affordability and access to quality healthcare persist, the market is poised for further growth. With the rising awareness about the benefits of private health insurance and the increasing willingness of individuals to invest in their health, insurance companies have an opportunity to tailor their products and services to meet the evolving needs of customers. By embracing innovation, collaborating with stakeholders, and addressing affordability concerns, insurance providers can navigate the dynamic market landscape and achieve long-term success in the Indonesia private health insurance market.

What is Private Health Insurance?

Private Health Insurance refers to insurance coverage that individuals purchase to cover their medical expenses, offering a range of services from hospital stays to outpatient care. It provides an alternative to public health systems and can enhance access to healthcare services.

What are the key players in the Indonesia Private Health Insurance market?

Key players in the Indonesia Private Health Insurance market include Allianz Indonesia, Prudential Indonesia, and AXA Mandiri, among others. These companies offer various health insurance products tailored to meet the needs of different consumer segments.

What are the main drivers of growth in the Indonesia Private Health Insurance market?

The main drivers of growth in the Indonesia Private Health Insurance market include an increasing middle-class population, rising healthcare costs, and greater awareness of health issues among consumers. Additionally, the expansion of healthcare facilities contributes to the demand for private insurance.

What challenges does the Indonesia Private Health Insurance market face?

The Indonesia Private Health Insurance market faces challenges such as regulatory hurdles, a lack of consumer trust, and competition from public health services. These factors can hinder the growth and adoption of private health insurance products.

What opportunities exist in the Indonesia Private Health Insurance market?

Opportunities in the Indonesia Private Health Insurance market include the potential for digital health solutions, the introduction of innovative insurance products, and partnerships with healthcare providers. These can enhance service delivery and attract more customers.

What trends are shaping the Indonesia Private Health Insurance market?

Trends shaping the Indonesia Private Health Insurance market include the rise of telemedicine, personalized health plans, and a focus on preventive care. These trends reflect changing consumer preferences and advancements in healthcare technology.

Indonesia Private Health Insurance market

| Segmentation Details | Description |

|---|---|

| Product Type | Individual Plans, Family Plans, Group Plans, Critical Illness Plans |

| End User | Employees, Self-Employed, Retirees, Students |

| Delivery Mode | Online, Offline, Hybrid, Direct Sales |

| Coverage Type | Inpatient, Outpatient, Maternity, Dental |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Indonesia Private Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at