444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia plastic bottles market represents a dynamic and rapidly evolving sector within Southeast Asia’s packaging industry. Indonesia’s growing economy and expanding consumer base have positioned the country as a significant player in the regional plastic packaging landscape. The market encompasses various bottle types including water bottles, beverage containers, pharmaceutical packaging, and personal care product containers.

Market dynamics indicate robust growth driven by urbanization, rising disposable incomes, and changing consumer lifestyles. The Indonesian market benefits from a large population base exceeding 270 million people, creating substantial demand for packaged goods. Growth projections suggest the market will expand at a compound annual growth rate (CAGR) of 6.2% over the forecast period, reflecting strong fundamentals and increasing industrial capacity.

Manufacturing capabilities within Indonesia have strengthened significantly, with both domestic and international companies establishing production facilities. The market serves not only local demand but also exports to neighboring countries, leveraging Indonesia’s strategic location and competitive manufacturing costs. Sustainability initiatives are increasingly influencing market development, with companies investing in recycling technologies and eco-friendly alternatives.

The Indonesia plastic bottles market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of plastic bottle containers within Indonesia’s borders. This market includes various plastic bottle types manufactured from different polymer materials such as polyethylene terephthalate (PET), high-density polyethylene (HDPE), and polypropylene (PP).

Market scope extends beyond simple container manufacturing to include the entire value chain from raw material sourcing to end-user consumption. The sector serves multiple industries including beverages, pharmaceuticals, personal care, household products, and industrial applications. Technological integration within the market encompasses advanced blow molding techniques, injection molding processes, and innovative design capabilities that meet diverse customer requirements.

Economic significance of this market lies in its contribution to Indonesia’s manufacturing sector and its role in supporting the country’s fast-moving consumer goods (FMCG) industry. The market facilitates trade, supports employment, and contributes to Indonesia’s position as a regional manufacturing hub in Southeast Asia.

Indonesia’s plastic bottles market demonstrates exceptional growth potential driven by demographic advantages and economic development. The market benefits from a young, increasingly urban population with growing purchasing power and evolving consumption patterns. Key growth drivers include expanding beverage consumption, pharmaceutical sector growth, and rising demand for packaged personal care products.

Manufacturing infrastructure continues to strengthen with significant investments in production capacity and technology upgrades. Local manufacturers are enhancing their capabilities while international companies establish regional production bases to serve both domestic and export markets. Market penetration rates for packaged beverages have reached 78% in urban areas, indicating substantial market maturity in key segments.

Sustainability concerns are reshaping market dynamics, with increasing focus on recyclable materials and circular economy principles. Government initiatives promoting environmental responsibility are influencing production methods and consumer preferences. The market is experiencing a transition toward more sustainable packaging solutions while maintaining growth momentum across traditional segments.

Strategic market insights reveal several critical trends shaping Indonesia’s plastic bottles landscape:

Market maturation varies significantly across regions, with Java and Sumatra showing advanced development while eastern regions present emerging opportunities. Consumer preferences are evolving toward premium packaging solutions, creating opportunities for value-added products and innovative designs.

Demographic advantages serve as the primary catalyst for market expansion. Indonesia’s large and growing population, combined with increasing urbanization rates, creates sustained demand for packaged goods. Rising disposable incomes enable consumers to purchase branded products requiring quality packaging solutions, driving market growth across multiple segments.

Industrial development across Indonesia supports market expansion through improved manufacturing capabilities and supply chain efficiency. Government initiatives promoting industrial growth and foreign investment have attracted significant capital to the packaging sector. Infrastructure improvements facilitate better distribution networks, enabling market penetration into previously underserved regions.

Lifestyle changes associated with modernization drive increased consumption of packaged beverages, personal care products, and convenience foods. Health consciousness among consumers promotes demand for bottled water and health-focused beverages, supporting market growth. Tourism industry growth creates additional demand for portable packaging solutions, particularly in hospitality and retail sectors.

Export opportunities within ASEAN markets provide additional growth avenues for Indonesian manufacturers. The country’s competitive manufacturing costs and strategic location enable effective regional market penetration, supporting domestic industry expansion.

Environmental concerns represent the most significant challenge facing the plastic bottles market. Growing awareness of plastic pollution and its environmental impact creates pressure for sustainable alternatives. Regulatory restrictions on single-use plastics and increasing environmental compliance requirements add operational complexity and costs for manufacturers.

Raw material price volatility affects production costs and profit margins throughout the value chain. Fluctuations in petroleum prices directly impact plastic resin costs, creating uncertainty for manufacturers and potentially affecting end-user pricing. Supply chain disruptions can significantly impact production schedules and market stability.

Competition from alternative packaging materials including glass, aluminum, and biodegradable options challenges traditional plastic bottle dominance. Consumer preference shifts toward eco-friendly packaging solutions may limit growth in conventional plastic bottle segments. Recycling infrastructure limitations in many regions create challenges for implementing circular economy principles.

Economic uncertainties and potential downturns can affect consumer spending patterns, particularly for non-essential packaged goods. Currency fluctuations impact import costs for raw materials and manufacturing equipment, affecting overall market competitiveness.

Sustainability innovation presents substantial opportunities for market differentiation and growth. Companies developing biodegradable alternatives, improving recycling processes, and implementing circular economy principles can capture environmentally conscious market segments. Government support for sustainable packaging initiatives creates favorable conditions for innovative solutions.

Rural market penetration offers significant expansion potential as infrastructure development and income growth reach previously underserved areas. Digital transformation enables better market reach and customer engagement, particularly through e-commerce platforms and direct-to-consumer channels. Premium product segments show strong growth potential as consumer sophistication increases.

Export market development within ASEAN and beyond provides opportunities for capacity utilization and revenue diversification. Indonesia’s competitive advantages in manufacturing costs and strategic location support international market expansion. Value-added services including custom packaging solutions and integrated supply chain management create additional revenue streams.

Pharmaceutical sector growth driven by healthcare expansion and aging demographics creates specialized packaging opportunities. Personal care market evolution toward premium and specialized products requires innovative packaging solutions, supporting market development in higher-value segments.

Supply chain evolution reflects increasing sophistication and integration across the Indonesian plastic bottles market. Manufacturers are developing closer relationships with raw material suppliers while expanding distribution networks to reach emerging markets. Technological advancement in production processes enables greater efficiency and product quality improvements.

Competitive intensity continues to increase as both domestic and international players expand their presence. Market consolidation trends are emerging as larger companies acquire smaller manufacturers to achieve economies of scale and market coverage. Innovation cycles are accelerating, with companies investing heavily in research and development to maintain competitive advantages.

Regulatory environment evolution significantly influences market dynamics, with increasing focus on environmental compliance and product safety standards. Consumer behavior shifts toward sustainability and quality create new market requirements that companies must address through product innovation and operational changes.

Economic integration within ASEAN markets facilitates cross-border trade and investment, creating opportunities for market expansion and operational optimization. Digital transformation impacts all aspects of the value chain from production planning to customer engagement and supply chain management.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes extensive interviews with industry executives, manufacturers, distributors, and end-users across different market segments. Secondary research incorporates analysis of industry reports, government statistics, trade publications, and company financial statements.

Data collection methods combine quantitative surveys with qualitative interviews to capture both statistical trends and strategic insights. Market sizing utilizes bottom-up and top-down approaches to validate findings and ensure accuracy. Regional analysis covers all major Indonesian provinces and urban centers to provide comprehensive geographic coverage.

Industry expert consultations provide specialized knowledge on technical aspects, regulatory requirements, and market trends. Supply chain analysis examines the entire value chain from raw material suppliers to end consumers, identifying key dynamics and relationships. Competitive intelligence gathering includes analysis of company strategies, product portfolios, and market positioning.

Validation processes ensure data accuracy through cross-referencing multiple sources and expert review. Trend analysis incorporates historical data patterns with forward-looking projections based on identified market drivers and constraints.

Java region dominates the Indonesian plastic bottles market, accounting for approximately 58% of total consumption due to high population density and industrial concentration. Major cities including Jakarta, Surabaya, and Bandung serve as primary consumption centers with well-developed distribution networks. Manufacturing capacity in Java represents the highest concentration of production facilities, benefiting from infrastructure advantages and skilled workforce availability.

Sumatra region represents the second-largest market segment with 22% market share, driven by economic development in Medan, Palembang, and Pekanbaru. Natural resource industries in Sumatra create demand for industrial packaging applications while growing urban populations drive consumer goods packaging requirements. Export activities from Sumatra ports support regional trade development.

Kalimantan region shows emerging market potential with 12% market share and accelerating growth rates. Mining and plantation industries create specialized packaging demands while urban development drives consumer market expansion. Infrastructure development projects improve market accessibility and distribution efficiency.

Eastern Indonesia regions including Sulawesi, Papua, and smaller islands represent 8% combined market share but demonstrate high growth potential. Government development initiatives and improving infrastructure create opportunities for market expansion. Tourism development in these regions supports hospitality-related packaging demand.

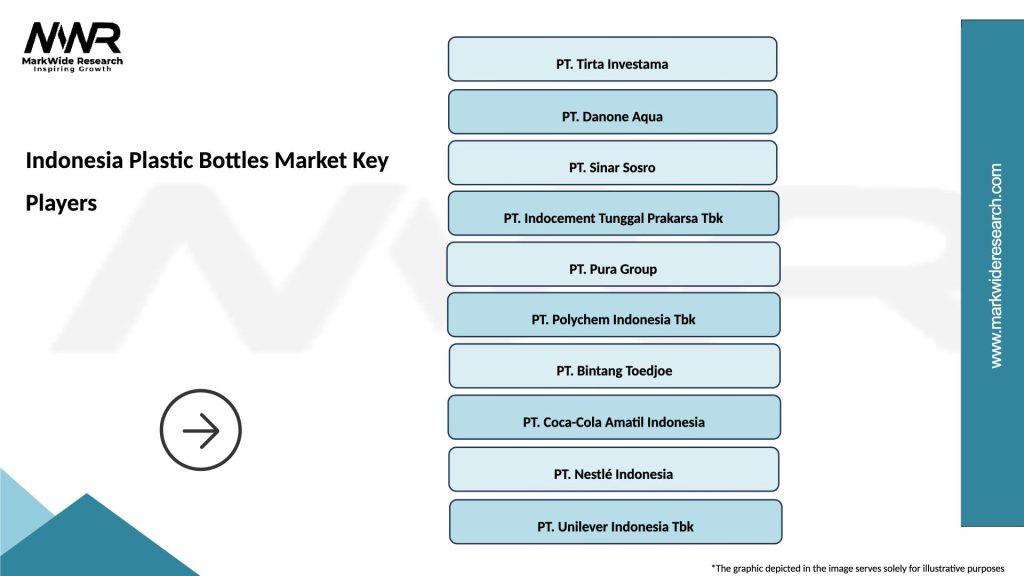

Market leadership is distributed among several key players combining domestic manufacturers with international companies. The competitive environment reflects both scale advantages and specialized market positioning strategies.

Competitive strategies focus on capacity expansion, technology upgrades, and sustainability initiatives. Market consolidation trends are evident as larger players acquire smaller manufacturers to achieve scale economies and market coverage. Innovation competition intensifies around sustainable packaging solutions and advanced manufacturing technologies.

By Material Type:

By Application:

By Capacity:

Beverage packaging category demonstrates the strongest growth dynamics with water bottles leading consumption patterns. Premium water brands are gaining market share as health consciousness increases among Indonesian consumers. Functional beverages including sports drinks and enhanced waters create opportunities for specialized packaging solutions with unique design requirements.

Personal care packaging reflects evolving consumer preferences toward premium and specialized products. Local brands are competing effectively with international companies by offering culturally relevant products in attractive packaging. Men’s grooming products represent a rapidly growing segment requiring distinctive packaging approaches.

Pharmaceutical packaging maintains steady growth driven by healthcare sector expansion and aging demographics. Generic drug manufacturers create demand for cost-effective packaging solutions while maintaining quality standards. Traditional medicine packaging represents a unique market segment combining modern packaging with traditional product formulations.

Industrial packaging applications benefit from Indonesia’s manufacturing sector growth and natural resource industries. Chemical storage solutions require specialized materials and safety features, creating opportunities for high-value applications. Automotive industry growth supports demand for fluid packaging and maintenance product containers.

Manufacturers benefit from Indonesia’s large domestic market providing stable demand and growth opportunities. Cost advantages in labor and raw materials enable competitive pricing while maintaining profitability. Government support for industrial development creates favorable operating conditions and investment incentives.

Distributors and retailers benefit from growing consumer markets and expanding distribution networks. E-commerce growth creates new distribution channels and customer engagement opportunities. Brand owners can leverage Indonesia’s manufacturing capabilities for both domestic and export markets.

Consumers gain access to improved product quality and variety through market competition and innovation. Price competitiveness resulting from local manufacturing makes packaged goods more accessible. Product safety improvements through better packaging protect consumer health and product integrity.

Environmental stakeholders benefit from increasing industry focus on sustainability and recycling initiatives. Employment generation in manufacturing and related industries supports economic development. Technology transfer from international companies enhances local capabilities and knowledge.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the Indonesian plastic bottles market. Companies are investing heavily in recycling technologies, biodegradable alternatives, and circular economy principles. Consumer awareness of environmental issues drives demand for eco-friendly packaging solutions, creating market opportunities for innovative companies.

Digital integration across the value chain enables better supply chain management, customer engagement, and operational efficiency. Smart packaging technologies including QR codes and NFC chips provide enhanced consumer experiences and brand protection capabilities. E-commerce growth requires specialized packaging solutions for shipping and handling requirements.

Premiumization trends reflect growing consumer sophistication and willingness to pay for quality packaging. Design innovation becomes increasingly important for brand differentiation and consumer appeal. Customization capabilities enable manufacturers to serve niche markets and specialized applications effectively.

Regional integration within ASEAN markets facilitates cross-border trade and investment opportunities. Technology advancement in manufacturing processes improves efficiency, quality, and sustainability performance. Health and wellness focus drives demand for specialized packaging solutions supporting product integrity and consumer safety.

Major capacity expansions across leading manufacturers reflect confidence in market growth potential. Indorama Ventures announced significant investment in PET production capacity to serve both domestic and export markets. International companies continue establishing and expanding Indonesian operations to capture market opportunities.

Sustainability initiatives gain momentum with companies launching recycling programs and sustainable product lines. Government partnerships support waste management improvements and circular economy development. MarkWide Research indicates that sustainability investments have increased by 35% annually across major market participants.

Technology partnerships between local and international companies facilitate knowledge transfer and capability enhancement. Automation investments improve production efficiency and product quality while reducing labor dependency. Digital transformation projects enhance supply chain visibility and customer service capabilities.

Regulatory developments include new environmental standards and plastic waste management requirements. Industry associations work collaboratively with government agencies to develop practical implementation approaches. Export market development initiatives support Indonesian manufacturers’ regional expansion efforts.

Strategic recommendations for market participants focus on sustainability leadership and operational excellence. Companies should prioritize investments in recycling technologies and sustainable product development to capture environmentally conscious market segments. Innovation capabilities must be strengthened to meet evolving consumer preferences and regulatory requirements.

Market expansion strategies should target underserved rural markets while strengthening urban market positions. Distribution network optimization can improve market coverage and operational efficiency. Export market development provides opportunities for capacity utilization and revenue diversification beyond domestic markets.

Technology investments in automation and digital systems can improve competitiveness and operational efficiency. Supply chain integration with key customers and suppliers creates competitive advantages and market stability. Talent development programs ensure adequate skilled workforce availability for industry growth.

Partnership strategies with international companies can facilitate technology transfer and market access. Government engagement helps shape favorable regulatory environments and industry development policies. Sustainability reporting and transparency initiatives build stakeholder confidence and market credibility.

Long-term market prospects remain highly positive driven by demographic advantages and economic development trends. Population growth and urbanization will continue supporting demand expansion across all market segments. Economic development in eastern Indonesia regions creates new market opportunities and geographic diversification potential.

Sustainability transformation will accelerate with increasing regulatory requirements and consumer awareness. Circular economy implementation becomes essential for long-term market participation and competitive advantage. MWR projections indicate that sustainable packaging solutions will capture 40% market share within the next decade.

Technology advancement will continue reshaping manufacturing processes and product capabilities. Automation adoption will increase efficiency while addressing labor cost pressures. Digital integration across the value chain will become standard practice for competitive companies.

Regional market integration within ASEAN will create larger addressable markets and operational scale opportunities. Export potential remains substantial as Indonesian manufacturers develop competitive advantages in cost and quality. Innovation cycles will accelerate as companies compete for market leadership through product differentiation and technological advancement.

Indonesia’s plastic bottles market presents exceptional growth opportunities driven by strong demographic fundamentals and economic development trends. The market benefits from a large and growing consumer base, expanding manufacturing capabilities, and strategic geographic positioning for regional market access. Sustainability transformation represents both a challenge and opportunity, requiring industry adaptation while creating competitive advantages for innovative companies.

Market dynamics favor companies that can effectively balance growth objectives with environmental responsibility. Technology advancement and operational excellence become increasingly important for maintaining competitive positions in an evolving market landscape. Regional integration and export development provide additional growth avenues beyond the substantial domestic market.

Future success will depend on companies’ ability to adapt to changing consumer preferences, regulatory requirements, and competitive pressures while maintaining operational efficiency and profitability. The Indonesian plastic bottles market offers substantial opportunities for stakeholders who can navigate these dynamics effectively and position themselves for long-term growth and sustainability.

What is Plastic Bottles?

Plastic bottles are containers made from various types of plastic, commonly used for packaging liquids such as beverages, cleaning products, and personal care items. They are lightweight, durable, and can be molded into various shapes and sizes.

What are the key players in the Indonesia Plastic Bottles Market?

Key players in the Indonesia Plastic Bottles Market include Danone, Coca-Cola Amatil, and Mayora Indah, among others. These companies are involved in the production and distribution of plastic bottles for various applications, including soft drinks and bottled water.

What are the growth factors driving the Indonesia Plastic Bottles Market?

The Indonesia Plastic Bottles Market is driven by increasing consumer demand for packaged beverages, the growth of the food and beverage industry, and rising awareness of convenience packaging. Additionally, urbanization and changing lifestyles contribute to market expansion.

What challenges does the Indonesia Plastic Bottles Market face?

The Indonesia Plastic Bottles Market faces challenges such as environmental concerns regarding plastic waste, regulatory pressures for sustainable packaging, and competition from alternative materials like glass and metal. These factors can impact production and consumer preferences.

What opportunities exist in the Indonesia Plastic Bottles Market?

Opportunities in the Indonesia Plastic Bottles Market include the development of biodegradable and recyclable plastic options, innovations in bottle design for enhanced functionality, and the expansion of e-commerce channels for beverage distribution. These trends can lead to new market segments.

What trends are shaping the Indonesia Plastic Bottles Market?

Trends shaping the Indonesia Plastic Bottles Market include a shift towards sustainable packaging solutions, increased use of recycled materials, and the adoption of smart packaging technologies. These trends reflect growing consumer awareness and demand for environmentally friendly products.

Indonesia Plastic Bottles Market

| Segmentation Details | Description |

|---|---|

| Product Type | PET, HDPE, LDPE, PVC |

| End User | Food & Beverage, Personal Care, Household, Pharmaceuticals |

| Packaging Type | Single-Serve, Multi-Pack, Bulk, Custom |

| Form | Rigid, Flexible, Blister, Composite |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia Plastic Bottles Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at