444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia OOH and DOOH market represents one of Southeast Asia’s most dynamic advertising landscapes, experiencing unprecedented growth driven by rapid urbanization and digital transformation. Out-of-home advertising in Indonesia encompasses traditional billboards, transit advertising, and street furniture, while digital out-of-home (DOOH) includes LED displays, digital billboards, and interactive kiosks strategically positioned across major metropolitan areas.

Market dynamics indicate robust expansion with the sector growing at a 12.5% CAGR, significantly outpacing traditional media channels. The Indonesian advertising ecosystem has witnessed a fundamental shift toward outdoor advertising solutions, with DOOH adoption rates reaching 38% penetration in major cities like Jakarta, Surabaya, and Bandung. This growth trajectory reflects Indonesia’s position as the world’s fourth most populous country with over 270 million inhabitants concentrated in urban centers.

Digital transformation has revolutionized the Indonesian OOH landscape, with programmatic advertising capabilities and real-time content management systems becoming standard offerings. The integration of mobile connectivity and data analytics has enhanced campaign effectiveness, enabling advertisers to deliver targeted messaging based on demographic insights and location intelligence. Consumer engagement rates for DOOH campaigns have increased by 45% compared to traditional static displays, demonstrating the medium’s effectiveness in capturing audience attention.

The Indonesia OOH and DOOH market refers to the comprehensive ecosystem of outdoor advertising solutions deployed across Indonesia’s urban and suburban landscapes, encompassing both traditional static displays and advanced digital advertising platforms. Out-of-home advertising represents any visual advertising media found outside consumers’ homes, including billboards, transit advertising, street furniture, and venue-based displays strategically positioned to maximize audience exposure and brand visibility.

Digital out-of-home advertising specifically encompasses electronic displays, LED screens, interactive kiosks, and smart advertising solutions that leverage digital technology to deliver dynamic content, real-time messaging, and interactive consumer experiences. These platforms utilize advanced content management systems, programmatic advertising capabilities, and data analytics to optimize campaign performance and audience engagement across Indonesia’s diverse geographic and demographic segments.

Market participants include media owners, advertising agencies, technology providers, content creators, and brand advertisers who collectively contribute to the ecosystem’s growth and innovation. The sector serves as a critical bridge between traditional advertising methodologies and modern digital marketing strategies, enabling brands to reach Indonesia’s expanding consumer base through strategically positioned outdoor advertising touchpoints.

Indonesia’s OOH and DOOH market stands as a testament to the country’s rapid economic development and urbanization trends, with the sector experiencing remarkable growth across all major metropolitan areas. Digital transformation initiatives have accelerated market evolution, with technology adoption rates increasing by 52% over the past three years as media owners invest in advanced display technologies and programmatic advertising capabilities.

Key market drivers include Indonesia’s expanding middle class, increased consumer spending power, and the government’s infrastructure development programs that have enhanced urban connectivity and accessibility. The rise of e-commerce platforms and digital payment systems has created new advertising opportunities, with technology companies and financial services providers becoming major contributors to OOH advertising spend.

Regional distribution shows Jakarta commanding 35% market share, followed by Surabaya and Bandung with significant concentrations of premium advertising inventory. The emergence of secondary cities as economic hubs has created expansion opportunities for OOH operators, with tier-two cities showing 28% growth rates in advertising infrastructure development.

Competitive dynamics feature both international media companies and local operators competing for premium locations and advertiser relationships. The market has witnessed consolidation trends as operators seek to achieve economies of scale and expand their geographic footprint across Indonesia’s archipelago structure.

Strategic market insights reveal fundamental shifts in Indonesia’s advertising landscape, with outdoor media gaining prominence as consumers spend increasing time outside their homes due to urbanization and lifestyle changes. Consumer behavior patterns indicate extended commute times and increased mobility, creating expanded opportunities for OOH advertising exposure and brand engagement.

Market maturation has led to increased sophistication in campaign planning and execution, with advertisers demanding measurable results and return on investment metrics. The integration of artificial intelligence and machine learning algorithms has enhanced targeting capabilities and content optimization, enabling more effective audience engagement strategies.

Economic growth serves as the primary catalyst for Indonesia’s OOH and DOOH market expansion, with the country’s GDP growth supporting increased advertising expenditure across all sectors. Urbanization trends have concentrated population density in major metropolitan areas, creating high-value advertising locations with substantial audience reach and engagement potential.

Infrastructure development programs, including the construction of new highways, mass transit systems, and commercial complexes, have created premium advertising inventory opportunities. The government’s smart city initiatives have facilitated the deployment of digital advertising infrastructure, with regulatory support for innovative outdoor advertising solutions and technology integration.

Consumer lifestyle changes reflect increased mobility and outdoor activities, with Indonesians spending more time commuting and engaging in social activities outside their homes. The rise of shopping malls, entertainment venues, and transportation hubs has created diverse advertising environments that cater to different demographic segments and consumer behaviors.

Digital adoption across Indonesia has accelerated demand for interactive and engaging advertising experiences, with consumers expecting technology-enhanced brand interactions. The proliferation of smartphone usage and social media engagement has created opportunities for integrated marketing campaigns that combine OOH advertising with digital touchpoints and online engagement strategies.

Brand competition intensity has driven advertisers to seek innovative ways to capture consumer attention and differentiate their messaging. The effectiveness of OOH advertising in building brand awareness and driving consumer action has attracted increased investment from both domestic and international brands seeking to establish market presence in Indonesia.

Regulatory challenges present significant obstacles for OOH and DOOH market expansion, with complex permitting processes and varying local regulations across Indonesia’s numerous provinces and municipalities. Zoning restrictions and aesthetic guidelines limit advertising placement opportunities in certain areas, particularly in heritage districts and residential neighborhoods where outdoor advertising faces strict limitations.

Infrastructure limitations in secondary cities and rural areas constrain market expansion opportunities, with inadequate power supply and internet connectivity affecting DOOH deployment capabilities. The archipelago geography of Indonesia creates logistical challenges for equipment installation and maintenance, increasing operational costs and complexity for media operators.

Economic volatility and currency fluctuations impact advertiser spending patterns, with businesses reducing marketing budgets during periods of economic uncertainty. The dependence on imported technology and equipment exposes operators to foreign exchange risks and supply chain disruptions that can affect profitability and expansion plans.

Competition from digital media channels, particularly social media advertising and online platforms, has intensified pressure on OOH operators to demonstrate clear value propositions and measurable results. The shift toward performance-based advertising models has challenged traditional OOH pricing structures and required investment in advanced measurement and analytics capabilities.

Environmental concerns and sustainability requirements have increased scrutiny of outdoor advertising installations, with communities and authorities demanding eco-friendly solutions and reduced visual pollution. The need for energy-efficient operations and sustainable practices has increased investment requirements and operational complexity for market participants.

Programmatic advertising represents a transformative opportunity for Indonesia’s OOH and DOOH market, with automated buying and selling platforms enabling more efficient inventory management and campaign optimization. Real-time bidding systems and audience data integration create opportunities for premium pricing and enhanced advertiser value propositions.

Smart city development initiatives across major Indonesian cities create opportunities for integrated digital infrastructure that combines advertising capabilities with public services and information systems. Government partnerships for digital signage networks and public information displays offer revenue diversification and long-term contract opportunities for market operators.

E-commerce growth has created new advertiser categories seeking to reach consumers through outdoor advertising channels, with online retailers and delivery services becoming significant contributors to advertising demand. The integration of QR codes and mobile payment systems enables direct conversion tracking and enhanced campaign measurement capabilities.

Tourism recovery following global travel restrictions presents opportunities for hospitality and tourism-related advertising, with airports, hotels, and tourist destinations requiring updated advertising infrastructure and content management systems. International brand expansion into Indonesian markets creates demand for premium advertising locations and sophisticated campaign execution capabilities.

Technology innovation in areas such as augmented reality, facial recognition, and interactive displays offers opportunities to create unique advertising experiences that command premium pricing and enhanced advertiser engagement. The development of 5G networks will enable more sophisticated content delivery and real-time interaction capabilities.

Supply and demand dynamics in Indonesia’s OOH and DOOH market reflect the interplay between limited premium advertising locations and growing advertiser demand for outdoor media exposure. Inventory scarcity in high-traffic areas has driven premium pricing for prime locations, while secondary locations offer growth opportunities at more accessible price points.

Technology evolution continues to reshape market dynamics, with digital transformation enabling more flexible content management, dynamic pricing models, and enhanced measurement capabilities. The shift from static to digital displays has improved inventory utilization rates by 65%, allowing multiple advertisers to share premium locations through time-based scheduling and rotation systems.

Competitive pressures have intensified as international media companies enter the Indonesian market, bringing advanced technology platforms and global best practices. Local operators have responded by forming strategic partnerships and investing in technology upgrades to maintain competitive positioning and market share.

Advertiser expectations have evolved toward demanding measurable results, transparent pricing, and integrated campaign capabilities that connect OOH advertising with digital marketing channels. Performance metrics and attribution modeling have become critical factors in advertiser decision-making processes and budget allocation strategies.

Economic cycles influence market dynamics through their impact on advertiser spending patterns and consumer behavior, with economic growth periods driving increased advertising investment and market expansion. The resilience of OOH advertising during economic downturns has been demonstrated through its ability to maintain audience reach when other media channels experience reduced engagement.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into Indonesia’s OOH and DOOH market landscape. Primary research included structured interviews with industry executives, media owners, advertising agencies, and technology providers to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompassed analysis of industry reports, government statistics, regulatory documents, and company financial statements to establish market baselines and validate primary research findings. Data triangulation methods ensured consistency and accuracy across multiple information sources and research approaches.

Market sizing methodologies utilized bottom-up and top-down approaches to estimate market dimensions and growth trajectories, incorporating factors such as advertising spend allocation, inventory availability, and pricing trends. Statistical modeling and regression analysis supported growth projections and scenario planning for different market conditions.

Stakeholder engagement included participation in industry conferences, trade shows, and professional associations to gather insights from market participants and observe emerging trends. Field research involved site visits to major advertising locations and technology installations to assess market conditions and competitive dynamics firsthand.

Data validation processes included cross-referencing multiple sources, expert review panels, and sensitivity analysis to ensure research findings accurately reflect market realities and provide reliable insights for strategic decision-making. Continuous monitoring of market developments ensures research findings remain current and relevant to evolving market conditions.

Jakarta metropolitan area dominates Indonesia’s OOH and DOOH market with 42% market concentration, reflecting the capital city’s status as the country’s economic and commercial center. Premium advertising locations along major thoroughfares, business districts, and shopping centers command the highest rates and attract multinational advertisers seeking maximum exposure and brand visibility.

Surabaya represents the second-largest market with 18% market share, serving as the commercial hub for East Java and surrounding regions. The city’s industrial base and growing consumer market have attracted significant advertising investment, with both traditional and digital OOH formats experiencing steady growth and development.

Bandung has emerged as a significant market with 12% share, driven by its role as an educational center and technology hub. The city’s young demographic profile and creative industries have created demand for innovative advertising formats and interactive digital displays that engage tech-savvy consumers.

Medan serves as the primary market for North Sumatra with 8% market share, benefiting from its position as a regional commercial center and gateway to Southeast Asia. The city’s strategic location and growing economy have supported expansion of both traditional and digital OOH advertising infrastructure.

Secondary cities including Semarang, Yogyakarta, and Makassar collectively represent 20% market share, with each city offering unique opportunities based on local economic conditions and demographic characteristics. These markets have shown strong growth potential as Indonesia’s economic development spreads beyond major metropolitan areas, creating new opportunities for OOH advertising expansion and investment.

Market leadership in Indonesia’s OOH and DOOH sector is characterized by a mix of international media companies and established local operators who have built extensive networks and strong advertiser relationships. Competitive positioning depends on factors including geographic coverage, technology capabilities, premium location access, and service quality.

Strategic partnerships between international technology providers and local operators have become increasingly common, enabling access to advanced advertising platforms while leveraging local market knowledge and relationships. Consolidation trends have emerged as operators seek to achieve economies of scale and expand their geographic footprint across Indonesia’s diverse markets.

Innovation leadership has become a key differentiator, with companies investing in advanced display technologies, data analytics capabilities, and interactive advertising solutions to attract premium advertisers and command higher rates. The ability to provide integrated marketing solutions that combine OOH with digital channels has become increasingly important for competitive success.

Technology segmentation divides the Indonesia OOH and DOOH market into distinct categories based on display technology and functionality. Traditional static displays continue to represent a significant portion of inventory, particularly in secondary markets and cost-sensitive advertising segments where digital solutions may not be economically viable.

By Format:

By Location:

By Advertiser Category:

Digital billboard segment has experienced the most rapid growth within Indonesia’s OOH market, with adoption rates increasing by 58% as advertisers seek dynamic content capabilities and enhanced audience engagement. LED technology improvements have reduced operational costs while improving display quality and reliability, making digital solutions more accessible to a broader range of advertisers and locations.

Transit advertising remains a cornerstone of the Indonesian OOH market, benefiting from extensive public transportation networks and high commuter volumes in major cities. Bus rapid transit systems and commuter rail networks provide captive audiences with extended exposure times, making transit advertising particularly effective for brand awareness campaigns and detailed messaging.

Shopping mall advertising has evolved to incorporate sophisticated digital displays and interactive experiences that complement the retail environment. Consumer dwell time in malls provides opportunities for extended brand engagement, with advertisers utilizing proximity marketing and location-based services to enhance campaign effectiveness and conversion rates.

Highway billboard advertising continues to serve as a primary brand awareness medium, particularly for automotive, consumer goods, and tourism advertisers seeking broad reach across diverse demographic segments. Strategic location selection and creative excellence remain critical success factors for highway advertising campaigns in Indonesia’s competitive market environment.

Interactive advertising formats have gained traction among technology and retail advertisers seeking to create memorable brand experiences and direct consumer engagement. Augmented reality displays and touch-screen kiosks enable product demonstrations and information sharing that traditional static displays cannot provide, justifying premium pricing and enhanced advertiser value.

Advertisers benefit from Indonesia’s OOH and DOOH market through access to high-impact advertising opportunities that reach consumers during their daily activities and decision-making moments. Brand visibility and awareness building capabilities of outdoor advertising provide essential support for integrated marketing campaigns and long-term brand development strategies.

Media owners enjoy stable revenue streams from long-term advertising contracts and premium location assets that appreciate in value over time. Technology investments in digital displays and programmatic platforms enable higher inventory utilization rates and dynamic pricing models that optimize revenue generation across different market conditions and advertiser demand patterns.

Technology providers benefit from growing demand for advanced display systems, content management platforms, and measurement solutions that enhance advertising effectiveness and operational efficiency. Innovation opportunities in areas such as artificial intelligence, data analytics, and interactive technologies create ongoing business development and partnership possibilities.

Consumers experience enhanced urban environments through well-designed advertising installations that provide information, entertainment, and aesthetic improvements to public spaces. Interactive advertising and location-based services offer practical benefits such as wayfinding, local information, and promotional offers that add value to consumer experiences.

Government stakeholders benefit from increased tax revenue, urban development, and smart city infrastructure that advertising installations can provide. Public-private partnerships for digital signage and information systems create opportunities for improved public services while generating revenue for municipal governments and supporting economic development objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Programmatic advertising has emerged as a transformative trend in Indonesia’s DOOH market, with automated buying and selling platforms enabling real-time inventory optimization and audience targeting. Data integration from mobile devices, traffic patterns, and demographic analytics allows advertisers to deliver contextually relevant messaging that enhances campaign effectiveness and return on investment.

Interactive advertising experiences are gaining prominence as advertisers seek to create memorable brand engagements that differentiate their messaging from competitors. Augmented reality displays, touch-screen interfaces, and mobile integration enable consumers to interact directly with advertising content, providing measurable engagement metrics and enhanced brand recall.

Sustainability initiatives have become increasingly important as operators invest in solar-powered displays, energy-efficient LED technology, and environmentally responsible operations. Green advertising solutions appeal to environmentally conscious advertisers and help operators reduce operational costs while meeting corporate social responsibility objectives.

Cross-platform integration connects OOH advertising with digital marketing channels, social media campaigns, and mobile applications to create cohesive brand experiences across multiple touchpoints. QR codes, NFC technology, and location-based services enable seamless transitions between outdoor advertising exposure and online engagement or purchase activities.

Artificial intelligence and machine learning applications are enhancing content optimization, audience measurement, and campaign performance analysis. Predictive analytics help advertisers and media owners make data-driven decisions about content scheduling, pricing strategies, and inventory allocation to maximize campaign effectiveness and revenue generation.

Technology partnerships between international display manufacturers and Indonesian operators have accelerated the deployment of advanced DOOH solutions across major metropolitan areas. Strategic alliances enable access to cutting-edge display technology, content management systems, and programmatic advertising platforms that enhance competitive positioning and advertiser value propositions.

Regulatory developments have included updated guidelines for digital advertising installations and streamlined permitting processes in select municipalities. Government support for smart city initiatives has created opportunities for public-private partnerships that combine advertising revenue with public information services and urban infrastructure improvements.

Market consolidation activities have included mergers and acquisitions as operators seek to achieve economies of scale and expand their geographic coverage. Investment activity from private equity firms and strategic investors has provided capital for technology upgrades and market expansion initiatives across Indonesia’s diverse regional markets.

Innovation launches have introduced new advertising formats including transparent LED displays, curved screens, and holographic projection systems that create unique visual experiences and premium advertising opportunities. Content creation tools and campaign management platforms have become more sophisticated, enabling advertisers to create and deploy dynamic content more efficiently.

Industry standardization efforts have focused on measurement methodologies, audience research standards, and technical specifications for digital displays. Professional associations and industry groups have worked to establish best practices and ethical guidelines that support market development and advertiser confidence in OOH advertising effectiveness.

MarkWide Research recommends that market participants focus on technology integration and data analytics capabilities to remain competitive in Indonesia’s evolving OOH and DOOH landscape. Investment priorities should emphasize programmatic advertising platforms, audience measurement systems, and interactive display technologies that provide measurable value to advertisers and justify premium pricing strategies.

Geographic expansion into secondary cities presents significant growth opportunities as Indonesia’s economic development spreads beyond major metropolitan areas. Strategic planning should consider local market conditions, regulatory requirements, and partnership opportunities that can facilitate successful market entry and sustainable operations in emerging markets.

Partnership strategies with technology providers, content creators, and advertising agencies can enhance service offerings and competitive positioning. Collaboration opportunities include joint ventures for technology development, shared infrastructure investments, and integrated marketing solutions that combine OOH with digital advertising channels.

Sustainability initiatives should be integrated into long-term strategic planning to address environmental concerns and operational cost optimization. Green technology adoption including solar power, energy-efficient displays, and sustainable materials can differentiate operators and appeal to environmentally conscious advertisers and communities.

Regulatory engagement with government authorities and industry associations can help shape favorable policy environments and streamline operational requirements. Proactive participation in regulatory discussions and industry standardization efforts can influence market development and create competitive advantages for engaged market participants.

Market growth projections indicate continued expansion of Indonesia’s OOH and DOOH market driven by sustained economic development, urbanization trends, and digital transformation initiatives. Technology evolution will enable more sophisticated advertising solutions and enhanced measurement capabilities that attract increased advertiser investment and market participation.

Digital transformation will accelerate with 5G network deployment enabling real-time content delivery, interactive experiences, and enhanced data analytics capabilities. Artificial intelligence integration will optimize content scheduling, audience targeting, and campaign performance while reducing operational costs and improving advertiser return on investment.

Market maturation will lead to increased consolidation as operators seek economies of scale and enhanced competitive positioning. International expansion by successful Indonesian operators into regional markets may create new growth opportunities and revenue diversification strategies for market leaders.

Advertiser sophistication will continue to increase demand for measurable results, integrated marketing solutions, and innovative advertising formats that create memorable brand experiences. Performance-based pricing models and attribution measurement will become standard requirements for premium advertising inventory and long-term advertiser relationships.

Regulatory evolution is expected to support market development through streamlined permitting processes, smart city integration opportunities, and standardized measurement methodologies. MWR analysis suggests that favorable regulatory environments will accelerate market growth and attract increased investment in advertising infrastructure and technology platforms across Indonesia’s diverse regional markets.

Indonesia’s OOH and DOOH market represents a dynamic and rapidly evolving advertising landscape that offers significant opportunities for growth and innovation. Market fundamentals including large population base, urbanization trends, and economic development provide strong foundations for continued expansion and investment in outdoor advertising infrastructure and technology platforms.

Digital transformation has revolutionized the sector through programmatic advertising capabilities, interactive experiences, and data-driven campaign optimization that enhance advertiser value and consumer engagement. Technology adoption will continue to drive market evolution as operators invest in advanced display systems, content management platforms, and measurement solutions that differentiate their offerings and justify premium pricing.

Competitive dynamics favor operators who can successfully integrate technology innovation with strong local market knowledge and advertiser relationships. Strategic partnerships and consolidation activities will shape market structure as participants seek to achieve economies of scale and expand their geographic coverage across Indonesia’s diverse regional markets.

Future success in Indonesia’s OOH and DOOH market will depend on the ability to adapt to changing advertiser requirements, embrace technological innovation, and navigate regulatory environments while maintaining operational efficiency and profitability. Market participants who can effectively balance these requirements while delivering measurable value to advertisers and engaging experiences for consumers will be best positioned to capitalize on the significant growth opportunities that Indonesia’s expanding economy and urbanization trends continue to provide.

What is OOH and DOOH?

OOH stands for Out-Of-Home advertising, which includes any advertising that reaches the consumer while they are outside their home. DOOH, or Digital Out-Of-Home, refers to digital screens used for advertising in public spaces, such as billboards and transit displays.

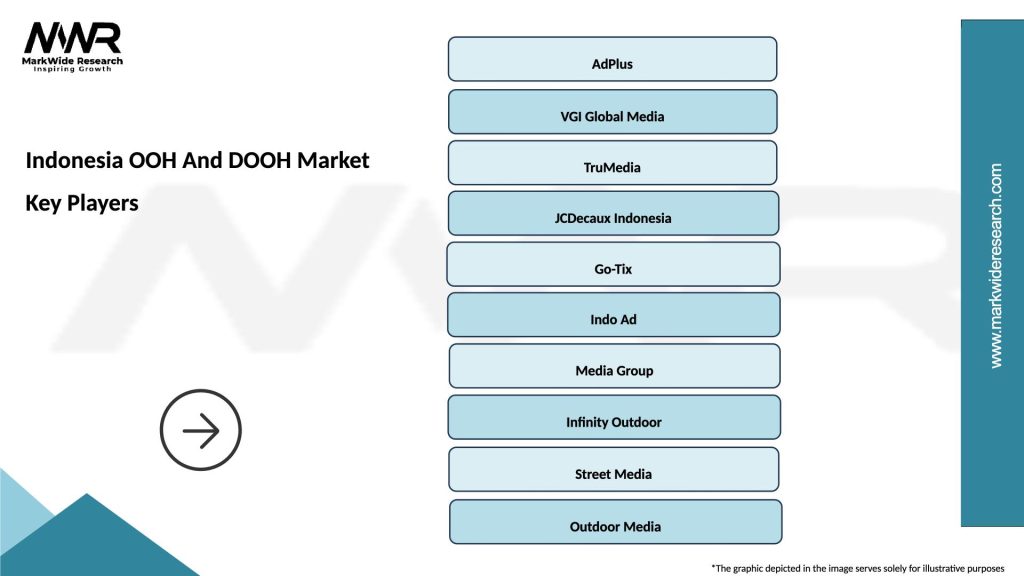

What are the key players in the Indonesia OOH And DOOH Market?

Key players in the Indonesia OOH And DOOH Market include companies like Katalis, AdPlus, and VGI Global Media, which provide various advertising solutions across different platforms, including billboards and digital displays, among others.

What are the growth factors driving the Indonesia OOH And DOOH Market?

The growth of the Indonesia OOH And DOOH Market is driven by increasing urbanization, the rise of digital technology, and the growing demand for targeted advertising. Additionally, the expansion of retail and entertainment sectors contributes to the market’s growth.

What challenges does the Indonesia OOH And DOOH Market face?

The Indonesia OOH And DOOH Market faces challenges such as regulatory restrictions, competition from digital media, and the need for continuous technological upgrades. These factors can impact the effectiveness and reach of advertising campaigns.

What opportunities exist in the Indonesia OOH And DOOH Market?

Opportunities in the Indonesia OOH And DOOH Market include the integration of advanced technologies like augmented reality and programmatic advertising, as well as the potential for growth in rural areas. Additionally, the increasing focus on sustainability in advertising presents new avenues for innovation.

What trends are shaping the Indonesia OOH And DOOH Market?

Trends shaping the Indonesia OOH And DOOH Market include the rise of interactive and immersive advertising experiences, the use of data analytics for targeted campaigns, and the growing popularity of mobile integration. These trends are enhancing consumer engagement and advertising effectiveness.

Indonesia OOH And DOOH Market

| Segmentation Details | Description |

|---|---|

| Product Type | Billboards, Transit Advertising, Street Furniture, Digital Displays |

| Technology | LED, LCD, Projection, Interactive Screens |

| End User | Retailers, Advertisers, Event Organizers, Government Agencies |

| Distribution Channel | Direct Sales, Online Platforms, Agencies, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia OOH And DOOH Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at