444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia life and non-life insurance market represents one of Southeast Asia’s most dynamic and rapidly evolving financial services sectors. With a population exceeding 270 million people and a growing middle class, Indonesia presents substantial opportunities for insurance providers across both life and general insurance segments. The market has demonstrated consistent growth momentum, driven by increasing awareness of financial protection, regulatory reforms, and digital transformation initiatives.

Market penetration in Indonesia remains relatively low compared to developed markets, indicating significant potential for expansion. The insurance density and penetration rates show considerable room for improvement, with life insurance penetration at approximately 2.1% of GDP and non-life insurance at around 0.7% of GDP. This presents a compelling opportunity for both domestic and international insurers to capture market share in an underserved population.

Digital transformation has become a key catalyst for market growth, with insurtech companies and traditional insurers investing heavily in technology-driven solutions. The COVID-19 pandemic accelerated the adoption of digital insurance products and services, fundamentally changing customer expectations and market dynamics. Mobile-first strategies and digital distribution channels have gained prominence as consumers increasingly prefer convenient, accessible insurance solutions.

Regulatory developments continue to shape the market landscape, with the Financial Services Authority (OJK) implementing progressive policies to enhance market stability, consumer protection, and industry growth. These regulatory initiatives have created a more conducive environment for innovation while maintaining prudential standards across the insurance sector.

The Indonesia life and non-life insurance market refers to the comprehensive ecosystem of insurance products, services, and providers operating within Indonesia’s financial services sector. This market encompasses life insurance products that provide financial protection against mortality risks, as well as non-life insurance covering property, casualty, health, and other general insurance needs of individuals and businesses.

Life insurance in Indonesia includes traditional whole life policies, term life insurance, unit-linked products, and annuities designed to provide financial security for beneficiaries. These products serve as essential financial planning tools for Indonesian families, offering protection against income loss due to premature death or disability while building long-term savings and investment value.

Non-life insurance encompasses a broad spectrum of coverage including motor vehicle insurance, property insurance, marine cargo insurance, fire insurance, personal accident coverage, and various commercial lines. This segment addresses the diverse risk management needs of Indonesia’s growing economy, supporting business continuity and individual asset protection across multiple sectors.

Market participants include domestic insurance companies, international insurers, takaful providers offering Sharia-compliant products, reinsurers, insurance brokers, agents, and emerging insurtech companies. The market operates under the supervision of Indonesia’s Financial Services Authority, ensuring compliance with regulatory standards and consumer protection requirements.

Indonesia’s insurance market stands at a pivotal juncture, characterized by robust growth potential, evolving consumer preferences, and transformative technological adoption. The market benefits from favorable demographic trends, including a large young population, expanding middle class, and increasing urbanization rates that drive demand for comprehensive insurance coverage.

Key growth drivers include rising disposable incomes, enhanced financial literacy initiatives, regulatory support for market development, and the proliferation of digital distribution channels. The government’s commitment to financial inclusion has created additional momentum, with various programs aimed at expanding insurance accessibility across different socioeconomic segments.

Market challenges persist in the form of low insurance awareness in rural areas, price sensitivity among consumers, complex regulatory requirements, and intense competition among market players. However, these challenges are being addressed through innovative product development, strategic partnerships, and targeted marketing initiatives designed to educate and engage underserved populations.

Digital transformation has emerged as a critical success factor, with companies investing in artificial intelligence, data analytics, mobile applications, and automated underwriting systems. This technological evolution is reshaping customer experiences, operational efficiency, and risk assessment capabilities across the insurance value chain.

Future prospects remain highly favorable, with industry analysts projecting sustained growth driven by economic development, demographic advantages, and continued regulatory support. The market is expected to benefit from increasing integration with banking services, expansion of microinsurance products, and growing demand for specialized coverage in emerging sectors.

Market dynamics in Indonesia’s insurance sector reveal several critical insights that shape industry strategies and growth trajectories. The following key insights provide a comprehensive understanding of market fundamentals:

Economic growth serves as the primary catalyst for Indonesia’s insurance market expansion, with sustained GDP growth creating favorable conditions for increased insurance spending. Rising per capita incomes enable more Indonesian families to allocate resources toward financial protection and long-term savings products, driving demand across both life and non-life insurance segments.

Demographic advantages position Indonesia uniquely for insurance market growth, with a large working-age population entering their peak earning years. This demographic transition creates substantial demand for life insurance products as individuals seek to protect their families’ financial security while building retirement savings through insurance-linked investment products.

Urbanization trends continue to accelerate insurance adoption, as urban populations typically demonstrate higher insurance awareness and purchasing power. The migration from rural to urban areas exposes more Indonesians to modern financial services, including comprehensive insurance coverage for homes, vehicles, and personal assets.

Regulatory support from the Financial Services Authority has created a conducive environment for market growth through progressive policies that encourage innovation while maintaining consumer protection standards. Recent regulatory initiatives have simplified product approval processes, enhanced digital distribution capabilities, and promoted financial inclusion across underserved segments.

Digital transformation has revolutionized insurance accessibility and customer experience, enabling insurers to reach previously underserved populations through mobile platforms and online distribution channels. The proliferation of smartphones and internet connectivity has made insurance products more accessible to Indonesia’s tech-savvy younger generation.

Financial literacy initiatives by government agencies, industry associations, and individual insurers have significantly improved public understanding of insurance benefits. These educational programs have been particularly effective in urban areas, contributing to increased voluntary insurance purchases beyond mandatory coverage requirements.

Low insurance penetration remains a fundamental challenge, with cultural factors and limited awareness constraining market growth in many regions. Traditional Indonesian society often relies on family and community support systems, reducing perceived need for formal insurance protection among certain demographic segments.

Price sensitivity significantly impacts market expansion, particularly among lower-income populations who view insurance premiums as discretionary expenses. Economic volatility and inflation concerns can lead to policy lapses and reduced new business generation, especially in the life insurance segment where long-term commitment is required.

Complex regulatory environment creates operational challenges for insurers, with multiple licensing requirements, capital adequacy standards, and compliance obligations that can slow market entry and product innovation. Smaller insurers may struggle to meet evolving regulatory requirements, potentially limiting competition and market diversity.

Distribution challenges persist in reaching Indonesia’s geographically dispersed population across thousands of islands. Traditional agent networks face difficulties in serving remote areas, while digital distribution channels may be limited by internet connectivity and digital literacy constraints in rural regions.

Claims settlement concerns among consumers can undermine market confidence, particularly when lengthy processing times or disputed claims create negative publicity. Historical issues with claim payments have contributed to skepticism about insurance value, requiring ongoing industry efforts to rebuild trust.

Competition from alternative financial products poses challenges for insurance providers, as banking products, mutual funds, and informal savings mechanisms may appear more attractive to cost-conscious consumers. The lack of tax incentives for insurance products in some categories further reduces their competitiveness against alternative investment options.

Untapped rural markets represent enormous growth potential, with millions of Indonesians lacking access to basic insurance coverage. Innovative distribution models, including mobile insurance units, agent networks, and partnerships with rural banks, can unlock these underserved segments through affordable, relevant insurance products.

Digital innovation opportunities abound in areas such as artificial intelligence-powered underwriting, blockchain-based claims processing, and Internet of Things integration for risk assessment. These technological advances can reduce operational costs, improve customer experience, and enable new product categories that were previously unfeasible.

Microinsurance expansion offers significant potential to serve Indonesia’s large population of informal workers, small business owners, and low-income families. Simplified products with affordable premiums and streamlined processes can dramatically expand market reach while contributing to financial inclusion objectives.

Bancassurance partnerships present substantial cross-selling opportunities, leveraging existing banking relationships to distribute insurance products more efficiently. Indonesia’s extensive banking network provides ready access to millions of potential insurance customers who already demonstrate financial services engagement.

Sharia-compliant products address the needs of Indonesia’s large Muslim population, with takaful insurance offerings experiencing growing acceptance. The development of innovative Islamic insurance products can capture market share among religiously conscious consumers who prefer Sharia-compliant financial services.

Corporate insurance growth opportunities emerge from Indonesia’s expanding business sector, with companies requiring comprehensive coverage for property, liability, cyber risks, and employee benefits. The growth of small and medium enterprises creates particular demand for affordable commercial insurance packages.

Competitive intensity continues to escalate as both domestic and international insurers vie for market share in Indonesia’s attractive insurance landscape. This competition drives innovation in product development, pricing strategies, and customer service delivery, ultimately benefiting consumers through improved offerings and competitive premiums.

Customer expectations are evolving rapidly, influenced by digital experiences in other sectors and changing lifestyle preferences. Modern Indonesian consumers demand seamless digital interactions, instant policy issuance, transparent pricing, and efficient claims processing, forcing insurers to modernize their operational capabilities.

Regulatory evolution shapes market dynamics through ongoing policy updates that balance consumer protection with industry growth objectives. Recent regulatory changes have enhanced market transparency, strengthened capital requirements, and promoted digital innovation while maintaining prudential oversight standards.

Technology disruption is fundamentally altering traditional insurance business models, with insurtech startups challenging established players through innovative products and distribution methods. Traditional insurers are responding by investing in digital transformation initiatives and forming strategic partnerships with technology companies.

Economic cycles influence market performance, with periods of economic growth driving increased insurance demand while economic downturns can lead to policy cancellations and reduced new business. Insurers must develop resilient business models that can adapt to varying economic conditions while maintaining profitability.

Social trends including increased health consciousness, environmental awareness, and financial planning sophistication are creating new insurance product categories and coverage requirements. These evolving social dynamics present both opportunities and challenges for insurers seeking to remain relevant to changing consumer needs.

Comprehensive market analysis was conducted using a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and reliability of market insights. The methodology incorporated quantitative analysis of market trends, regulatory developments, and competitive dynamics alongside qualitative assessment of industry challenges and opportunities.

Primary research involved extensive interviews with industry executives, regulatory officials, distribution partners, and consumers across different demographic segments. These stakeholder consultations provided valuable insights into market dynamics, emerging trends, and strategic priorities that shape the Indonesian insurance landscape.

Secondary research encompassed analysis of regulatory filings, industry reports, financial statements, and market data from authoritative sources including the Financial Services Authority, Indonesian Insurance Association, and various industry publications. This comprehensive data collection ensured thorough coverage of market fundamentals and historical trends.

Market segmentation analysis examined the insurance market across multiple dimensions including product types, distribution channels, customer segments, and geographic regions. This detailed segmentation approach enabled identification of specific growth opportunities and market dynamics within different market subsectors.

Competitive landscape assessment involved detailed analysis of major market participants, their strategic positioning, product portfolios, and market share dynamics. This competitive intelligence provided insights into industry best practices, emerging competitive threats, and potential consolidation trends.

Data validation processes ensured accuracy and reliability of research findings through cross-referencing multiple sources, statistical analysis of trends, and expert review of conclusions. MarkWide Research analysts applied rigorous quality control measures to maintain the highest standards of market intelligence.

Java Island dominates Indonesia’s insurance market, accounting for approximately 65% of total premium volume due to its high population density, economic concentration, and advanced financial services infrastructure. Jakarta, as the capital city, serves as the primary hub for insurance company headquarters, regulatory oversight, and major commercial activities.

Sumatra region represents the second-largest insurance market, driven by significant economic activity in oil and gas, palm oil, and mining sectors. The region’s industrial base creates substantial demand for commercial insurance products, while growing urban centers like Medan and Palembang drive personal insurance adoption.

Kalimantan shows strong growth potential in commercial insurance segments, supported by natural resource extraction industries and expanding infrastructure development. The region’s economic growth has attracted increased insurance investment, particularly in property and casualty coverage for industrial operations.

Sulawesi and Eastern Indonesia remain underserved markets with significant growth opportunities, despite lower current insurance penetration rates. Government infrastructure development programs and regional economic growth initiatives are creating new demand for both personal and commercial insurance products.

Urban versus rural dynamics reveal substantial disparities in insurance adoption, with major cities showing penetration rates 4-5 times higher than rural areas. This geographic divide presents both challenges and opportunities for insurers seeking to expand their market reach through innovative distribution strategies.

Regional regulatory variations require insurers to adapt their strategies to local market conditions while maintaining compliance with national standards. Provincial governments increasingly recognize insurance’s role in economic development, leading to supportive policies that encourage market expansion.

Market leadership in Indonesia’s insurance sector is shared among several major domestic and international players, each with distinct competitive advantages and strategic positioning. The competitive landscape reflects a mix of established traditional insurers and emerging digital-first companies.

Competitive strategies vary significantly among market participants, with some focusing on digital innovation and customer experience while others emphasize traditional distribution strength and product breadth. The emergence of insurtech companies is creating additional competitive pressure and driving industry-wide digital transformation initiatives.

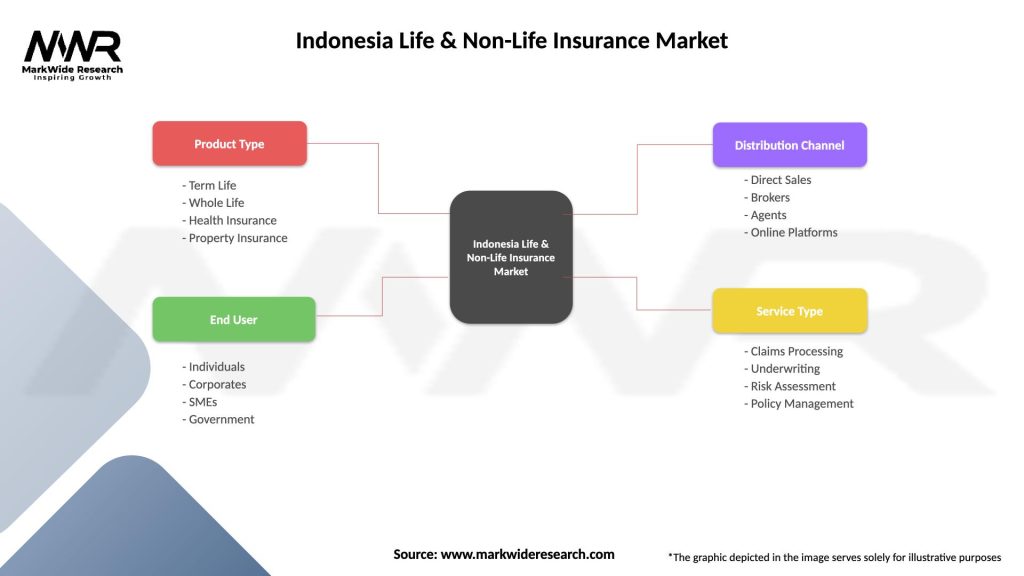

By Product Type:

By Distribution Channel:

By Customer Segment:

Life Insurance Segment demonstrates strong growth potential driven by increasing financial planning awareness and demographic advantages. Unit-linked products have gained popularity among younger consumers seeking investment-linked insurance solutions, while traditional whole life policies remain preferred by conservative investors prioritizing guaranteed benefits.

Motor Insurance represents the largest non-life insurance category, benefiting from Indonesia’s expanding automotive market and mandatory third-party liability requirements. The segment faces pricing pressure due to intense competition, but opportunities exist in comprehensive coverage and value-added services like roadside assistance and vehicle tracking.

Health Insurance shows exceptional growth prospects as healthcare costs rise and medical awareness increases among Indonesian consumers. The COVID-19 pandemic significantly accelerated demand for health coverage, creating opportunities for innovative products addressing specific health risks and telemedicine integration.

Property Insurance benefits from Indonesia’s construction boom and increasing property ownership among the middle class. Natural disaster risks in Indonesia create substantial demand for comprehensive property coverage, though affordability remains a challenge for lower-income property owners.

Commercial Lines experience steady growth driven by business expansion, regulatory requirements, and increasing risk awareness among Indonesian companies. Cyber insurance and professional liability coverage represent emerging opportunities as businesses become more sophisticated in their risk management approaches.

Microinsurance emerges as a critical growth category, addressing the needs of Indonesia’s large informal economy and low-income populations. Simple, affordable products distributed through innovative channels can significantly expand market reach while contributing to financial inclusion objectives.

Insurance Companies benefit from Indonesia’s substantial growth opportunities, demographic advantages, and supportive regulatory environment. The large underserved population provides extensive potential for market expansion, while digital transformation enables more efficient operations and improved customer engagement.

Consumers gain access to comprehensive financial protection products that address diverse risk management needs while building long-term wealth through insurance-linked investment options. Increased competition among insurers results in better products, competitive pricing, and enhanced customer service standards.

Distribution Partners including agents, brokers, and bancassurance partners benefit from growing market demand and expanding product portfolios that create multiple revenue opportunities. Digital distribution channels provide additional income streams and operational efficiency improvements.

Regulatory Authorities achieve financial stability objectives through a well-developed insurance sector that contributes to economic resilience and consumer protection. A robust insurance market supports broader financial inclusion goals and economic development initiatives.

Economic Development benefits from insurance market growth through increased domestic savings mobilization, capital market development, and risk transfer mechanisms that support business investment and economic expansion. Insurance companies serve as significant institutional investors in Indonesian capital markets.

Technology Providers find substantial opportunities in supporting insurance industry digital transformation through innovative solutions in areas such as artificial intelligence, blockchain, mobile applications, and data analytics platforms that enhance operational efficiency and customer experience.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Strategies are transforming the Indonesian insurance landscape, with companies investing heavily in mobile applications, online platforms, and automated processes. This trend accelerated significantly during the COVID-19 pandemic as consumers embraced digital channels for insurance purchases and service interactions.

Personalization and Customization of insurance products are becoming increasingly important as Indonesian consumers seek coverage that matches their specific needs and circumstances. Insurers are leveraging data analytics and artificial intelligence to develop tailored products and pricing strategies that resonate with different customer segments.

Ecosystem Partnerships are emerging as a key strategic trend, with insurers collaborating with e-commerce platforms, ride-sharing services, and other digital ecosystems to embed insurance products into customer journeys. These partnerships enable insurers to reach new customer segments and provide contextual insurance solutions.

Sustainability and ESG Focus is gaining momentum in Indonesia’s insurance market, with companies developing products that support environmental protection and social responsibility objectives. Climate-related insurance products and sustainable investment options are becoming more prominent in insurer portfolios.

Instant Insurance solutions are meeting consumer demands for immediate coverage and simplified purchasing processes. On-demand insurance products that can be activated instantly through mobile applications are particularly popular among younger Indonesian consumers.

Health and Wellness Integration represents a growing trend, with insurers offering wellness programs, preventive care benefits, and health monitoring services as part of comprehensive insurance packages. This approach helps reduce claims costs while providing additional value to policyholders.

Regulatory Modernization initiatives by the Financial Services Authority have streamlined product approval processes, enhanced digital distribution capabilities, and promoted innovation in the insurance sector. Recent regulatory updates have created a more conducive environment for insurtech companies and digital transformation initiatives.

Market Consolidation activities have increased as smaller insurers seek scale advantages through mergers and acquisitions. This consolidation trend is creating stronger, more competitive market participants while potentially reducing overall market fragmentation.

International Expansion by Indonesian insurers into regional markets demonstrates growing confidence and capability within the domestic industry. These expansion efforts provide valuable experience and diversification benefits for Indonesian insurance companies.

Technology Partnerships between traditional insurers and technology companies have accelerated digital transformation initiatives. These collaborations are enabling rapid deployment of advanced technologies including artificial intelligence, blockchain, and Internet of Things applications.

Product Innovation initiatives have resulted in the launch of numerous new insurance products addressing emerging risks and customer needs. Recent innovations include cyber insurance, pandemic coverage, and climate-related insurance products tailored to Indonesian market conditions.

Distribution Channel Evolution continues with the development of new partnership models, digital marketplaces, and direct-to-consumer platforms. These distribution innovations are expanding market reach while reducing operational costs for insurance providers.

Market Entry Strategies for new participants should focus on digital-first approaches that leverage Indonesia’s high mobile penetration and growing comfort with online financial services. MarkWide Research analysis suggests that companies entering the market should prioritize mobile-optimized platforms and simplified product offerings that address specific Indonesian consumer needs.

Product Development initiatives should emphasize affordability, simplicity, and relevance to Indonesian lifestyles and risk profiles. Successful products will likely combine traditional insurance benefits with modern digital features and value-added services that enhance customer engagement and retention.

Distribution Strategy recommendations include developing multi-channel approaches that combine traditional agent networks with digital platforms and strategic partnerships. Companies should invest in agent training and digital tools that enable hybrid distribution models serving diverse customer preferences.

Technology Investment priorities should focus on customer-facing applications, automated underwriting systems, and data analytics capabilities that improve operational efficiency and customer experience. Insurers should also consider partnerships with insurtech companies to accelerate digital transformation initiatives.

Market Expansion efforts should target underserved geographic regions and demographic segments through innovative distribution models and localized product offerings. Rural market penetration requires patient capital investment and culturally sensitive approaches to product design and marketing.

Risk Management strategies must account for Indonesia’s exposure to natural disasters, economic volatility, and regulatory changes. Insurers should develop robust reinsurance programs, diversified investment portfolios, and flexible business models that can adapt to changing market conditions.

Long-term growth prospects for Indonesia’s insurance market remain highly favorable, supported by demographic advantages, economic development, and increasing financial sophistication among consumers. The market is expected to experience sustained expansion as insurance penetration rates gradually converge toward regional benchmarks over the next decade.

Digital transformation will continue to reshape the industry landscape, with artificial intelligence, machine learning, and automation becoming standard components of insurance operations. Companies that successfully integrate these technologies will gain significant competitive advantages in customer acquisition, risk assessment, and operational efficiency.

Regulatory evolution is expected to support continued market development while maintaining appropriate consumer protection and prudential oversight standards. Future regulatory initiatives will likely focus on promoting innovation, enhancing market competition, and supporting financial inclusion objectives.

Market consolidation trends may accelerate as smaller insurers seek scale advantages and international players evaluate strategic opportunities in Indonesia’s attractive market. This consolidation could result in a more concentrated but competitive market structure with stronger, more capable participants.

Product innovation will likely focus on addressing emerging risks such as cyber threats, climate change impacts, and demographic shifts. Insurers will need to develop sophisticated risk modeling capabilities and flexible product platforms that can adapt to evolving customer needs and risk landscapes.

Regional integration opportunities may emerge as ASEAN economic integration progresses, potentially creating cross-border insurance opportunities and regulatory harmonization initiatives. Indonesian insurers with strong domestic positions may be well-positioned to benefit from regional expansion opportunities.

Indonesia’s life and non-life insurance market represents one of Southeast Asia’s most compelling growth opportunities, characterized by substantial demographic advantages, supportive regulatory environment, and increasing consumer sophistication. The market’s current low penetration rates indicate enormous potential for expansion across all insurance categories and customer segments.

Digital transformation has emerged as a critical success factor, enabling insurers to reach underserved populations, improve operational efficiency, and enhance customer experiences. Companies that successfully integrate technology into their business models while maintaining strong customer relationships will be best positioned for long-term success in this dynamic market.

Strategic priorities for market participants should include investment in digital capabilities, development of affordable and relevant products, expansion of distribution networks, and building strong risk management frameworks. The companies that can effectively balance innovation with operational excellence will capture the greatest share of Indonesia’s insurance market growth potential.

Future success in Indonesia’s insurance market will require deep understanding of local consumer needs, regulatory requirements, and competitive dynamics. As the market continues to evolve and mature, opportunities will increasingly favor companies that demonstrate commitment to the Indonesian market through localized strategies, long-term investment, and genuine value creation for all stakeholders in this promising and dynamic insurance landscape.

What is Indonesia Life & Non-Life Insurance?

Indonesia Life & Non-Life Insurance refers to the insurance services that provide financial protection against risks related to life and various non-life events, such as property damage, health issues, and liability. This sector plays a crucial role in the financial stability and risk management of individuals and businesses in Indonesia.

What are the key players in the Indonesia Life & Non-Life Insurance Market?

Key players in the Indonesia Life & Non-Life Insurance Market include companies like Prudential Indonesia, Allianz Indonesia, and AXA Mandiri. These companies offer a range of insurance products catering to both individual and corporate clients, among others.

What are the growth factors driving the Indonesia Life & Non-Life Insurance Market?

The growth of the Indonesia Life & Non-Life Insurance Market is driven by increasing awareness of insurance benefits, a growing middle class, and the expansion of digital insurance platforms. Additionally, regulatory support and economic development contribute to market growth.

What challenges does the Indonesia Life & Non-Life Insurance Market face?

The Indonesia Life & Non-Life Insurance Market faces challenges such as low insurance penetration rates, regulatory complexities, and competition from alternative financial products. These factors can hinder market expansion and consumer adoption.

What opportunities exist in the Indonesia Life & Non-Life Insurance Market?

Opportunities in the Indonesia Life & Non-Life Insurance Market include the potential for product innovation, the rise of insurtech solutions, and increasing demand for customized insurance products. These trends can enhance customer engagement and expand market reach.

What trends are shaping the Indonesia Life & Non-Life Insurance Market?

Trends shaping the Indonesia Life & Non-Life Insurance Market include the integration of technology in underwriting and claims processing, a focus on sustainability in insurance products, and the growing importance of customer experience. These trends are influencing how insurers operate and engage with clients.

Indonesia Life & Non-Life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Term Life, Whole Life, Health Insurance, Property Insurance |

| End User | Individuals, Corporates, SMEs, Government |

| Distribution Channel | Direct Sales, Brokers, Agents, Online Platforms |

| Service Type | Claims Processing, Underwriting, Risk Assessment, Policy Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia Life & Non-Life Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at