444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia IT services market represents one of Southeast Asia’s most dynamic and rapidly expanding technology sectors, driven by accelerating digital transformation initiatives across industries. Indonesia’s IT services landscape encompasses a comprehensive range of solutions including cloud computing, cybersecurity, software development, system integration, and managed services. The market demonstrates robust growth momentum, with analysts projecting a compound annual growth rate (CAGR) of 12.8% through the forecast period, reflecting the nation’s commitment to becoming a digital economy powerhouse.

Digital infrastructure development and government-led digitalization programs have positioned Indonesia as a key technology hub in the ASEAN region. The market benefits from a large domestic consumer base, increasing smartphone penetration rates of 77% among the population, and growing enterprise demand for digital solutions. Cloud adoption rates have surged significantly, with businesses increasingly migrating from traditional on-premises systems to cloud-based platforms to enhance operational efficiency and scalability.

Enterprise digital transformation initiatives across banking, telecommunications, manufacturing, and retail sectors continue to fuel demand for sophisticated IT services. The market landscape features a diverse ecosystem of local technology providers, multinational corporations, and emerging startups, all contributing to Indonesia’s position as a regional technology leader with substantial growth potential.

The Indonesia IT services market refers to the comprehensive ecosystem of technology-based solutions and services provided to businesses, government entities, and consumers across the Indonesian archipelago. This market encompasses various service categories including consulting, implementation, maintenance, and support services designed to enhance organizational efficiency through technology adoption.

IT services in Indonesia span multiple domains including cloud computing solutions, cybersecurity services, software development and customization, system integration, data analytics, artificial intelligence implementation, and managed IT services. The market serves diverse industry verticals ranging from financial services and telecommunications to manufacturing, healthcare, education, and government sectors.

Market participants include established multinational technology companies, domestic IT service providers, specialized consulting firms, and innovative startups offering niche solutions. The ecosystem supports Indonesia’s broader digital economy objectives while addressing specific local market requirements and regulatory compliance needs.

Indonesia’s IT services sector stands at the forefront of the nation’s digital transformation journey, characterized by unprecedented growth opportunities and evolving market dynamics. The sector benefits from strong government support through various digital economy initiatives, substantial foreign investment, and a rapidly expanding domestic technology adoption rate.

Key growth drivers include accelerating cloud migration trends, increasing cybersecurity awareness following rising digital threats, and widespread adoption of mobile-first strategies across industries. The market demonstrates particular strength in financial technology services, e-commerce solutions, and government digitalization projects, with fintech adoption rates reaching 88% among Indonesian consumers.

Market consolidation trends are emerging as larger players acquire specialized service providers to expand their capabilities and geographic reach. The competitive landscape remains fragmented yet dynamic, with opportunities for both established players and innovative newcomers to capture market share through differentiated service offerings and strategic partnerships.

Future market trajectory appears highly promising, supported by Indonesia’s young demographic profile, increasing internet penetration, and government commitments to digital infrastructure development. The sector is expected to play a crucial role in achieving Indonesia’s vision of becoming a leading digital economy in Southeast Asia.

Strategic market analysis reveals several critical insights shaping the Indonesia IT services landscape. The following key insights provide comprehensive understanding of market dynamics:

Digital transformation acceleration serves as the primary catalyst driving Indonesia’s IT services market expansion. Organizations across all sectors are recognizing the imperative to modernize their technology infrastructure to remain competitive in an increasingly digital marketplace. This transformation encompasses everything from basic digitization of manual processes to sophisticated implementation of artificial intelligence and machine learning solutions.

Government digitalization initiatives represent another significant market driver, with various public sector agencies implementing comprehensive digital transformation programs. These initiatives include e-government services, smart city projects, digital identity systems, and online public service delivery platforms. The government’s commitment to achieving digital economy contribution of 20% to GDP by 2030 creates substantial opportunities for IT service providers.

Rising cybersecurity awareness continues to drive demand for specialized security services as organizations face increasingly sophisticated cyber threats. The growing frequency and complexity of cyberattacks have made cybersecurity a top priority for businesses of all sizes, creating sustained demand for security consulting, implementation, and managed security services.

Cloud adoption momentum remains a powerful market driver as businesses seek to reduce infrastructure costs, improve scalability, and enhance operational flexibility. The shift from capital expenditure to operational expenditure models appeals to organizations looking to optimize their technology investments while maintaining competitive capabilities.

Skilled talent shortage represents the most significant constraint facing Indonesia’s IT services market, with demand for qualified technology professionals consistently outpacing supply. This shortage affects service delivery capabilities, increases operational costs, and limits market expansion potential for many service providers. The gap is particularly pronounced in emerging technology areas such as artificial intelligence, cybersecurity, and cloud architecture.

Infrastructure limitations in certain regions continue to pose challenges for comprehensive IT service delivery. While major urban centers enjoy robust connectivity and infrastructure, rural and remote areas often lack the necessary technological foundation to support advanced IT services. This digital divide limits market penetration and creates service delivery complexities.

Regulatory compliance complexity presents ongoing challenges as businesses navigate evolving data protection, privacy, and cybersecurity regulations. The implementation of new regulatory frameworks requires significant investment in compliance systems and processes, potentially slowing adoption of certain IT services while increasing implementation costs.

Budget constraints among small and medium enterprises limit their ability to invest in comprehensive IT services, restricting market growth potential in this important segment. Many SMEs struggle to justify the initial investment required for digital transformation initiatives, despite recognizing their long-term benefits.

Emerging technology adoption presents substantial opportunities for IT service providers to develop specialized capabilities in artificial intelligence, Internet of Things, blockchain, and edge computing. These technologies are gaining traction across various industries, creating demand for implementation, integration, and support services. Early movers in these areas can establish competitive advantages and capture premium market positioning.

Industry-specific solution development offers significant growth potential as businesses seek tailored technology solutions that address unique sector requirements. Healthcare digitalization, educational technology, agricultural technology, and tourism technology represent particularly promising vertical markets with specific needs and substantial growth potential.

Regional expansion opportunities exist for established service providers to extend their reach into underserved markets across Indonesia’s diverse archipelago. The development of digital infrastructure in secondary cities and rural areas creates new market segments for IT service providers willing to invest in local presence and capabilities.

Partnership and acquisition strategies present opportunities for market consolidation and capability expansion. Strategic partnerships between local and international providers can combine global expertise with local market knowledge, while acquisitions can rapidly expand service portfolios and geographic coverage.

Competitive intensity in Indonesia’s IT services market continues to escalate as both domestic and international players vie for market share in this rapidly growing sector. The market dynamics are characterized by price competition, service differentiation strategies, and continuous innovation to meet evolving customer demands. Market fragmentation levels remain high, with numerous players serving different segments and specializations.

Technology evolution pace significantly influences market dynamics, with service providers required to continuously update their capabilities and service offerings to remain relevant. The rapid advancement of cloud technologies, artificial intelligence, and cybersecurity solutions creates both opportunities and challenges for market participants. Companies that successfully adapt to technological changes gain competitive advantages, while those that lag behind risk market share erosion.

Customer expectations evolution drives market participants to enhance service quality, reduce delivery timelines, and provide more comprehensive solutions. Clients increasingly demand integrated service offerings that combine multiple technology domains, requiring service providers to expand their capabilities or develop strategic partnerships. Service delivery efficiency improvements of 35% have become standard expectations in competitive bidding processes.

Pricing pressure dynamics reflect the competitive nature of the market, with clients becoming more sophisticated in their procurement processes and demanding greater value from their IT service investments. This pressure encourages innovation, operational efficiency improvements, and the development of outcome-based service models that align provider incentives with client success metrics.

Comprehensive market analysis for Indonesia’s IT services sector employs multiple research methodologies to ensure accuracy and reliability of findings. The research approach combines primary data collection through industry surveys, executive interviews, and focus group discussions with secondary research utilizing industry reports, government publications, and financial disclosures from public companies.

Primary research activities include structured interviews with key industry stakeholders including IT service providers, enterprise clients, government officials, and technology vendors. Survey methodologies capture quantitative data on market trends, adoption rates, spending patterns, and growth projections across different industry segments and geographic regions.

Secondary research sources encompass industry association reports, government statistical databases, academic research publications, and company financial statements. This multi-source approach ensures comprehensive coverage of market dynamics while providing validation for primary research findings through data triangulation techniques.

Data validation processes include cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and applying statistical analysis techniques to identify trends and patterns. The methodology ensures that market insights reflect actual conditions while providing reliable foundations for strategic decision-making by industry participants.

Jakarta metropolitan area dominates Indonesia’s IT services market, accounting for approximately 45% of total market activity due to its concentration of multinational corporations, government agencies, and financial institutions. The capital region benefits from superior digital infrastructure, abundant skilled talent, and proximity to key decision-makers, making it the primary hub for IT service delivery and innovation.

Surabaya and surrounding East Java represents the second-largest regional market, driven by manufacturing industry digitalization and growing service sector adoption of technology solutions. The region’s industrial base creates substantial demand for enterprise resource planning, supply chain management, and manufacturing execution systems, contributing approximately 18% of national market share.

Bandung technology corridor has emerged as a significant center for software development and IT services, leveraging its concentration of technical universities and growing startup ecosystem. The region specializes in custom software development, mobile application creation, and digital creative services, contributing to Indonesia’s position as a regional technology hub.

Emerging regional markets including Medan, Makassar, and Denpasar are experiencing rapid growth as businesses in these areas embrace digital transformation. Government initiatives to develop digital infrastructure in secondary cities are creating new opportunities for IT service providers willing to establish local presence and serve regional market needs.

Rural and remote area penetration remains limited but represents significant long-term growth potential as digital infrastructure development continues. Mobile-first service delivery models and satellite connectivity improvements are gradually expanding market reach into previously underserved areas across the Indonesian archipelago.

Market leadership dynamics in Indonesia’s IT services sector reflect a diverse competitive landscape featuring established multinational corporations, growing domestic players, and innovative startups. The competitive environment encourages continuous innovation and service enhancement while providing clients with diverse options for their technology needs.

Leading market participants include:

Competitive strategies focus on service differentiation, industry specialization, and strategic partnerships to capture market opportunities. Companies are investing heavily in talent development, technology capabilities, and local market presence to strengthen their competitive positions in this dynamic market environment.

Service type segmentation reveals distinct market categories with varying growth trajectories and competitive dynamics. The Indonesia IT services market encompasses multiple service categories, each addressing specific client needs and market opportunities.

By Service Type:

By Industry Vertical:

By Organization Size:

Cloud services category demonstrates the strongest growth momentum within Indonesia’s IT services market, driven by businesses seeking operational flexibility and cost optimization. Organizations are increasingly adopting hybrid cloud strategies that combine public cloud benefits with private cloud security, creating opportunities for specialized cloud integration and management services. Cloud migration projects typically generate follow-on managed services contracts, providing sustainable revenue streams for service providers.

Cybersecurity services segment experiences sustained high demand as organizations respond to escalating cyber threats and regulatory compliance requirements. The category encompasses threat assessment, security architecture design, implementation services, and ongoing managed security operations. Security service adoption rates have increased by 42% annually as businesses recognize cybersecurity as a critical business enabler rather than merely a cost center.

Digital transformation consulting represents a high-value category where experienced providers command premium pricing for strategic guidance and implementation expertise. This segment requires deep industry knowledge, change management capabilities, and proven methodologies for successful technology adoption. Clients increasingly seek partners who can provide end-to-end transformation support rather than point solutions.

Managed services category offers attractive recurring revenue models for IT service providers while providing clients with predictable operational costs and access to specialized expertise. The segment includes infrastructure management, application support, help desk services, and proactive monitoring solutions that ensure optimal system performance and availability.

Service providers benefit from Indonesia’s expanding IT services market through multiple value creation opportunities. The growing market provides revenue expansion potential, opportunities for service portfolio diversification, and the ability to develop specialized expertise in high-demand areas. Established providers can leverage their experience and capabilities to capture larger market share while newer entrants can focus on niche specializations or underserved market segments.

Enterprise clients gain significant advantages from the competitive IT services landscape, including access to diverse solution options, competitive pricing, and specialized expertise that may not be available internally. The market’s maturity enables businesses to select providers that best match their specific requirements, industry focus, and budget constraints while benefiting from proven implementation methodologies and best practices.

Government entities benefit from enhanced service delivery capabilities, improved citizen engagement platforms, and more efficient public sector operations through strategic IT service partnerships. Digital government initiatives supported by experienced service providers can accelerate public sector transformation while ensuring compliance with security and regulatory requirements.

Economic stakeholders including investors, financial institutions, and development agencies benefit from the sector’s contribution to Indonesia’s digital economy growth. The IT services market creates high-value employment opportunities, attracts foreign investment, and supports the development of local technology capabilities that enhance national competitiveness in the global digital economy.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a dominant trend reshaping Indonesia’s IT services landscape, with organizations seeking AI-powered solutions to enhance operational efficiency and customer experiences. Service providers are developing specialized AI implementation capabilities, machine learning model development services, and intelligent automation solutions that transform traditional business processes. AI adoption rates among Indonesian enterprises have reached 28%, indicating substantial growth potential for AI-focused service offerings.

Hybrid work technology solutions continue gaining traction as organizations maintain flexible work arrangements established during the pandemic. This trend drives demand for collaboration platforms, virtual desktop infrastructure, cloud-based productivity tools, and secure remote access solutions. IT service providers are developing comprehensive hybrid work enablement services that address both technology and security requirements.

Sustainability-focused IT services are becoming increasingly important as organizations prioritize environmental responsibility and energy efficiency. Green IT consulting, carbon footprint assessment, sustainable technology architecture design, and energy-efficient infrastructure solutions represent growing service categories that align with corporate sustainability objectives.

Industry-specific platform development reflects the market’s evolution toward specialized solutions that address unique sector requirements. Healthcare technology platforms, educational technology solutions, agricultural technology systems, and tourism technology applications demonstrate the trend toward vertical-specific service offerings that command premium pricing and create competitive barriers.

Outcome-based service models are gaining popularity as clients seek service providers who share accountability for business results rather than simply delivering technology implementations. This trend encourages innovation, efficiency improvements, and closer client-provider partnerships while aligning service provider incentives with client success metrics.

Strategic partnership formations between local and international IT service providers are reshaping the competitive landscape, combining global expertise with local market knowledge. These partnerships enable comprehensive service delivery capabilities while providing clients with access to international best practices and proven methodologies adapted for Indonesian market conditions.

Government digital infrastructure investments continue accelerating, with major initiatives including the national data center development program, digital identity system implementation, and smart city pilot projects across multiple regions. These developments create substantial opportunities for IT service providers while establishing foundations for broader digital economy growth.

Cybersecurity capability expansion represents a critical industry development as service providers invest heavily in security operations centers, threat intelligence capabilities, and specialized security expertise. MarkWide Research analysis indicates that cybersecurity service investments have increased by 65% annually as providers respond to growing client security requirements and regulatory compliance needs.

Cloud service localization initiatives by major international cloud providers are establishing local data centers and service delivery capabilities within Indonesia. These developments reduce latency, address data sovereignty requirements, and create opportunities for local IT service providers to develop specialized cloud integration and management services.

Startup ecosystem growth in the technology sector is fostering innovation and creating new service categories that address specific market needs. Emerging companies are developing niche solutions in areas such as financial technology, educational technology, and agricultural technology, contributing to the overall market dynamism and innovation pace.

Service portfolio diversification represents a critical strategic priority for IT service providers seeking sustainable competitive advantages in Indonesia’s dynamic market. MWR analysts recommend that providers develop capabilities across multiple service categories rather than focusing solely on traditional offerings, enabling them to capture opportunities in high-growth areas such as artificial intelligence, cybersecurity, and cloud services.

Talent development investment should receive immediate attention from industry participants, given the significant skills shortage constraining market growth. Companies should establish comprehensive training programs, university partnerships, and certification initiatives that develop local talent while reducing dependence on expensive expatriate expertise. Strategic talent acquisition through competitive compensation packages and career development opportunities can provide competitive advantages in securing skilled professionals.

Regional market expansion strategies offer substantial growth potential for established service providers willing to invest in local presence and capabilities outside major urban centers. Successful regional expansion requires understanding of local business cultures, development of appropriate service delivery models, and establishment of local partnerships that facilitate market entry and client relationship development.

Industry specialization focus can provide differentiation opportunities and premium pricing potential for service providers willing to develop deep vertical expertise. Healthcare, financial services, manufacturing, and government sectors offer particularly attractive specialization opportunities with specific technology requirements and substantial growth potential.

Innovation investment priorities should emphasize emerging technologies that align with client digital transformation objectives while providing competitive differentiation. Artificial intelligence, Internet of Things, blockchain, and edge computing represent technology areas where early capability development can establish market leadership positions and capture premium pricing opportunities.

Long-term growth trajectory for Indonesia’s IT services market appears highly favorable, supported by sustained digital transformation momentum, government digitalization initiatives, and increasing technology adoption across all economic sectors. The market is expected to maintain robust growth rates as businesses recognize technology’s critical role in competitive success and operational efficiency.

Technology evolution impact will continue reshaping service requirements and creating new market opportunities. Artificial intelligence, machine learning, Internet of Things, and edge computing technologies will generate demand for specialized implementation and support services while potentially disrupting traditional service delivery models. Emerging technology adoption rates are projected to increase by 25% annually across Indonesian enterprises, creating substantial opportunities for innovative service providers.

Market consolidation trends are expected to accelerate as larger players acquire specialized capabilities and smaller providers seek scale advantages through strategic partnerships or mergers. This consolidation will create more comprehensive service providers capable of addressing complex client requirements while potentially reducing competitive intensity in certain market segments.

Regional development initiatives will gradually expand market opportunities beyond traditional urban centers, creating new revenue streams for service providers willing to adapt their delivery models for diverse geographic markets. Infrastructure improvements and government digitalization programs will support this geographic market expansion while contributing to Indonesia’s overall digital economy development.

International market integration opportunities may emerge as Indonesian IT service providers develop capabilities and scale sufficient to compete in regional markets. The ASEAN economic integration and Indonesia’s growing technology reputation could facilitate expansion into neighboring markets while attracting additional foreign investment in the domestic IT services sector.

Indonesia’s IT services market represents one of Southeast Asia’s most compelling growth opportunities, characterized by strong fundamentals, supportive government policies, and increasing enterprise recognition of technology’s strategic importance. The market’s diverse ecosystem of service providers, ranging from established multinational corporations to innovative local startups, creates a dynamic competitive environment that benefits clients through diverse solution options and competitive pricing.

Strategic market drivers including digital transformation acceleration, government digitalization initiatives, cybersecurity awareness, and cloud adoption momentum provide sustainable foundations for continued growth. While challenges such as talent shortages and infrastructure limitations exist, the market’s overall trajectory remains highly positive with substantial opportunities for both established players and new entrants willing to invest in capabilities and local market presence.

Future success factors will likely include service portfolio diversification, talent development investment, regional expansion strategies, industry specialization focus, and continuous innovation in emerging technology areas. Companies that successfully navigate these strategic priorities while maintaining operational excellence and client satisfaction will be well-positioned to capture the significant opportunities available in Indonesia’s expanding IT services market.

What is IT Services?

IT Services encompass a range of services related to information technology, including software development, IT consulting, and system integration. These services are essential for businesses to manage their IT infrastructure and improve operational efficiency.

What are the key players in the Indonesia IT Services Market?

Key players in the Indonesia IT Services Market include companies like Telkom Indonesia, Indosat Ooredoo, and XL Axiata, which provide various IT solutions and services. These companies are known for their contributions to telecommunications and digital services, among others.

What are the growth factors driving the Indonesia IT Services Market?

The Indonesia IT Services Market is driven by factors such as the increasing adoption of cloud computing, the rise of digital transformation initiatives, and the growing demand for cybersecurity solutions. These elements are reshaping how businesses operate and interact with technology.

What challenges does the Indonesia IT Services Market face?

Challenges in the Indonesia IT Services Market include a shortage of skilled IT professionals, rapid technological changes, and regulatory compliance issues. These factors can hinder the growth and efficiency of IT service providers.

What opportunities exist in the Indonesia IT Services Market?

Opportunities in the Indonesia IT Services Market include the expansion of e-commerce, the increasing need for data analytics, and the growth of mobile applications. These trends present significant potential for IT service providers to innovate and capture new business.

What trends are shaping the Indonesia IT Services Market?

Trends shaping the Indonesia IT Services Market include the rise of artificial intelligence, the shift towards remote work solutions, and the increasing focus on sustainable IT practices. These trends are influencing how services are delivered and consumed in the market.

Indonesia IT Services Market

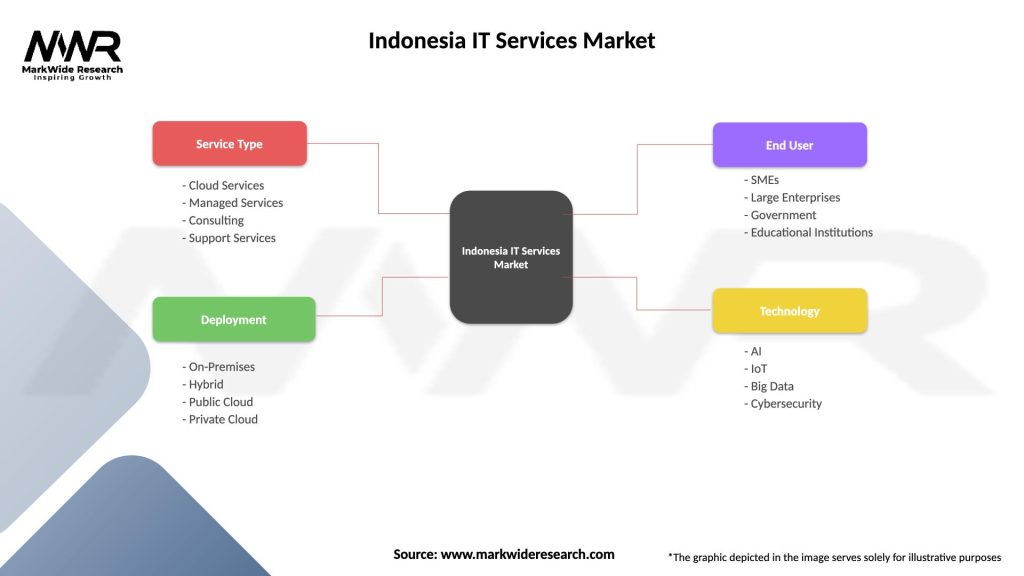

| Segmentation Details | Description |

|---|---|

| Service Type | Cloud Services, Managed Services, Consulting, Support Services |

| Deployment | On-Premises, Hybrid, Public Cloud, Private Cloud |

| End User | SMEs, Large Enterprises, Government, Educational Institutions |

| Technology | AI, IoT, Big Data, Cybersecurity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia IT Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at