444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia IoT market represents one of Southeast Asia’s most dynamic and rapidly evolving technology landscapes, driven by the country’s massive population, increasing digital adoption, and government initiatives toward digital transformation. Indonesia’s IoT ecosystem encompasses a diverse range of applications spanning smart cities, industrial automation, healthcare, agriculture, and consumer electronics, positioning the nation as a key player in the regional Internet of Things revolution.

Market dynamics in Indonesia reflect the country’s unique characteristics as the world’s fourth most populous nation with over 270 million inhabitants and an archipelago structure comprising more than 17,000 islands. This geographical complexity creates both challenges and opportunities for IoT deployment, particularly in areas such as remote monitoring, logistics optimization, and infrastructure management. The market is experiencing robust growth, with analysts projecting a compound annual growth rate (CAGR) of 22.5% through the forecast period.

Digital infrastructure development has accelerated significantly, supported by major telecommunications investments and the rollout of 5G networks across key urban centers. The Indonesian government’s commitment to achieving digital economy targets has created a favorable environment for IoT adoption, with initiatives such as the National Digital Transformation Strategy and Industry 4.0 roadmap driving implementation across various sectors.

Enterprise adoption of IoT solutions has gained momentum, particularly in manufacturing, oil and gas, mining, and palm oil industries that form the backbone of Indonesia’s economy. Smart manufacturing initiatives are showing productivity improvements of up to 35% in early adopter facilities, while agricultural IoT applications are helping optimize crop yields and resource utilization across the vast agricultural landscape.

The Indonesia IoT market refers to the comprehensive ecosystem of interconnected devices, sensors, platforms, and services that enable data collection, analysis, and automated decision-making across various industries and applications within Indonesian territory. This market encompasses hardware components such as sensors and connectivity modules, software platforms for data management and analytics, and services including system integration, consulting, and maintenance.

IoT implementation in Indonesia involves the deployment of smart devices and systems that can communicate autonomously, collect real-time data, and provide actionable insights to improve operational efficiency, reduce costs, and enhance user experiences. The market includes both business-to-business (B2B) applications for industrial and commercial use, as well as business-to-consumer (B2C) solutions for smart homes and personal devices.

Key components of the Indonesian IoT market include connectivity solutions leveraging cellular, Wi-Fi, and satellite networks, edge computing capabilities for local data processing, cloud-based analytics platforms, and artificial intelligence integration for predictive insights. The market also encompasses specialized solutions tailored to Indonesia’s unique requirements, such as disaster management systems, maritime monitoring, and tropical agriculture optimization.

Indonesia’s IoT market is experiencing unprecedented growth driven by digital transformation initiatives, increasing smartphone penetration, and government support for Industry 4.0 adoption. The market demonstrates strong potential across multiple verticals, with manufacturing, smart cities, and agriculture emerging as primary growth drivers contributing to the overall expansion trajectory.

Key market indicators show robust adoption rates, with IoT device penetration reaching 18% of the total addressable market and continuing to accelerate. The telecommunications sector has invested heavily in network infrastructure, enabling widespread connectivity that supports IoT deployment across urban and rural areas. Major Indonesian conglomerates are implementing comprehensive IoT strategies to modernize operations and improve competitiveness.

Government initiatives play a crucial role in market development, with the Ministry of Industry promoting smart manufacturing adoption and the Ministry of Communication and Information Technology supporting digital infrastructure expansion. These efforts have resulted in increased IoT project implementations by 45% year-over-year, demonstrating strong momentum in market development.

Competitive landscape features a mix of international technology providers, local system integrators, and emerging Indonesian IoT companies. Strategic partnerships between global vendors and local partners are accelerating market penetration and solution customization for Indonesian requirements. The market shows particular strength in sectors where Indonesia has natural advantages, such as natural resource management and agricultural optimization.

Market segmentation reveals distinct growth patterns across different application areas and technology categories. The following key insights highlight the most significant trends and opportunities:

Technology adoption patterns show strong preference for solutions that address Indonesia’s specific challenges, including geographic dispersion, infrastructure limitations, and diverse industry requirements. Cloud-based IoT platforms are particularly popular due to their scalability and cost-effectiveness for Indonesian enterprises.

Digital transformation initiatives across Indonesian enterprises are creating substantial demand for IoT solutions. Companies are recognizing the competitive advantages of data-driven operations and automated processes, leading to increased investment in IoT technologies. The government’s Industry 4.0 roadmap provides additional momentum by offering incentives and support for digital modernization projects.

Infrastructure development represents a major market driver, with significant investments in telecommunications networks, data centers, and digital infrastructure. The expansion of 4G coverage to remote areas and the introduction of 5G networks in major cities are enabling more sophisticated IoT applications. Network coverage improvements have reached 95% of populated areas, creating opportunities for widespread IoT deployment.

Economic diversification efforts are driving IoT adoption as Indonesia seeks to reduce dependence on commodity exports and develop higher-value industries. Manufacturing companies are implementing smart factory solutions to improve productivity and quality, while service sectors are adopting IoT for customer experience enhancement and operational optimization.

Urbanization trends create demand for smart city solutions as Indonesian cities face challenges related to traffic congestion, waste management, and resource optimization. Local governments are investing in IoT-enabled systems for traffic monitoring, environmental sensing, and public service delivery. The smart city market segment is experiencing growth rates exceeding 28% annually.

Environmental sustainability concerns are driving adoption of IoT solutions for energy management, waste reduction, and environmental monitoring. Indonesian companies are implementing IoT systems to track carbon emissions, optimize resource usage, and comply with environmental regulations, creating new market opportunities for green technology providers.

Infrastructure limitations in remote areas continue to pose challenges for comprehensive IoT deployment across Indonesia’s vast archipelago. While urban centers have adequate connectivity, many rural and remote locations lack the network infrastructure necessary to support advanced IoT applications. This geographic digital divide limits market penetration in certain regions and applications.

Cybersecurity concerns represent a significant restraint, as many Indonesian organizations lack the expertise and resources to implement robust IoT security measures. High-profile security breaches and data privacy incidents have created hesitation among potential adopters, particularly in sensitive sectors such as healthcare and financial services. The complexity of securing distributed IoT networks adds to implementation challenges.

Skills shortage in IoT-related technologies limits market growth, as Indonesian companies struggle to find qualified personnel for IoT system design, implementation, and maintenance. The rapid pace of technological change requires continuous training and development, creating additional costs and complexity for organizations pursuing IoT initiatives.

Initial investment costs can be prohibitive for smaller Indonesian companies, particularly when considering the total cost of ownership including hardware, software, integration services, and ongoing maintenance. Many organizations find it challenging to justify IoT investments without clear return on investment calculations and proven business cases.

Regulatory uncertainty in some areas creates hesitation among potential IoT adopters. While the Indonesian government generally supports digital transformation, specific regulations regarding data privacy, cross-border data flows, and IoT device standards are still evolving, creating compliance challenges for businesses.

Smart agriculture presents enormous opportunities given Indonesia’s position as a major agricultural producer. IoT applications for precision farming, livestock monitoring, and supply chain optimization can significantly improve productivity and sustainability in the agricultural sector. The integration of IoT with traditional farming practices offers potential for yield improvements of 25-40% in various crops.

Maritime and logistics applications offer substantial growth potential due to Indonesia’s geography as an archipelago nation with extensive shipping and logistics requirements. IoT solutions for vessel tracking, cargo monitoring, and port optimization can address critical challenges in the maritime industry while improving efficiency and safety.

Disaster management represents a unique opportunity for IoT deployment, given Indonesia’s exposure to natural disasters such as earthquakes, tsunamis, and volcanic eruptions. Early warning systems, environmental monitoring, and emergency response coordination can benefit significantly from IoT technologies, creating both social value and commercial opportunities.

Energy sector modernization offers significant potential as Indonesia transitions toward renewable energy sources and improves grid efficiency. Smart grid implementations, renewable energy monitoring, and energy storage optimization present substantial market opportunities for IoT solution providers.

Healthcare digitization is accelerating, creating opportunities for remote patient monitoring, telemedicine support, and medical device connectivity. The COVID-19 pandemic has highlighted the importance of digital health solutions, driving increased acceptance and adoption of IoT-enabled healthcare technologies.

Supply chain dynamics in the Indonesian IoT market are characterized by a complex ecosystem of international technology vendors, local distributors, system integrators, and service providers. Global IoT platform providers are establishing local partnerships to better serve Indonesian customers and comply with local requirements. This collaborative approach is accelerating market development and solution customization.

Competitive intensity is increasing as more players enter the Indonesian market, driven by its growth potential and large addressable market. International vendors are competing with local companies that offer advantages in terms of market knowledge, customer relationships, and cost competitiveness. This competition is driving innovation and improving solution quality while putting pressure on pricing.

Technology evolution continues to reshape market dynamics, with emerging technologies such as artificial intelligence, machine learning, and edge computing becoming integral components of IoT solutions. The integration of these advanced technologies is enabling more sophisticated applications and creating new value propositions for customers.

Customer behavior is evolving as Indonesian organizations become more sophisticated in their IoT requirements and expectations. Early adopters are moving beyond pilot projects to large-scale implementations, while new entrants are benefiting from lessons learned and proven use cases. This maturation is driving demand for more comprehensive and integrated IoT solutions.

Investment patterns show increasing venture capital and private equity interest in Indonesian IoT companies, providing funding for innovation and market expansion. Government support through various digital transformation programs is complementing private investment, creating a favorable environment for market growth and development.

Data collection for Indonesian IoT market analysis employs a comprehensive multi-source approach combining primary research, secondary data analysis, and industry expert consultations. Primary research includes structured interviews with key stakeholders across the IoT value chain, including technology vendors, system integrators, end-users, and government officials involved in digital transformation initiatives.

Market sizing methodology utilizes bottom-up and top-down approaches to validate market estimates and growth projections. Bottom-up analysis examines individual market segments, application areas, and technology categories to build comprehensive market models. Top-down analysis leverages macroeconomic indicators, digital transformation spending patterns, and comparative analysis with similar markets in the region.

Industry surveys conducted among Indonesian enterprises provide insights into IoT adoption patterns, investment priorities, and implementation challenges. Survey respondents represent diverse industries and company sizes, ensuring comprehensive coverage of market dynamics and trends. Response validation and cross-referencing ensure data accuracy and reliability.

Secondary research incorporates analysis of government publications, industry reports, company financial statements, and technology vendor announcements. This information is synthesized with primary research findings to create a comprehensive understanding of market conditions and future prospects.

Expert validation involves consultation with industry experts, technology specialists, and market analysts to verify findings and validate conclusions. This peer review process ensures research quality and provides additional insights into market nuances and emerging trends.

Jakarta and surrounding areas dominate the Indonesian IoT market, accounting for approximately 45% of total market activity. The capital region benefits from superior infrastructure, concentration of major enterprises, and government initiatives. Smart city projects in Jakarta are driving significant IoT deployments in traffic management, environmental monitoring, and public services.

Java island represents the largest regional market due to its high population density, industrial concentration, and advanced infrastructure. Major manufacturing centers in West Java and East Java are implementing Industry 4.0 solutions, while cities like Surabaya and Bandung are pursuing smart city initiatives that incorporate extensive IoT deployments.

Sumatra region shows strong growth potential, particularly in natural resource industries such as palm oil, mining, and petroleum. IoT applications for plantation management, environmental monitoring, and industrial automation are gaining traction. The region accounts for approximately 20% of national IoT implementations.

Kalimantan (Borneo) presents unique opportunities for IoT deployment in mining, forestry, and agriculture sectors. The challenging geography and remote locations create demand for satellite-based IoT solutions and edge computing capabilities. Government initiatives to develop the new capital city in East Kalimantan are expected to drive significant IoT investments.

Eastern Indonesia regions including Sulawesi, Papua, and the eastern islands represent emerging markets with significant growth potential. While current IoT adoption is limited by infrastructure constraints, government development programs and natural resource projects are creating new opportunities for IoT deployment in remote monitoring and management applications.

Market leadership in the Indonesian IoT sector is distributed among several categories of players, each bringing distinct advantages and capabilities to the market:

Local system integrators play crucial roles in market development by providing implementation services, customization, and ongoing support. Companies such as Metrodata Electronics, Multipolar Technology, and Datacomm Diangraha are building strong IoT practices and partnerships with international vendors.

Emerging Indonesian IoT companies are developing specialized solutions for local market requirements. These companies often focus on specific verticals such as agriculture, maritime, or smart cities, leveraging deep understanding of local challenges and requirements.

By Technology:

By Application:

By Industry Vertical:

Industrial IoT segment demonstrates the strongest growth momentum, driven by manufacturing companies’ need to improve efficiency and competitiveness. Smart factory implementations are showing average productivity improvements of 30%, encouraging broader adoption across Indonesian manufacturing sectors. Predictive maintenance applications are particularly popular, helping companies reduce downtime and maintenance costs.

Smart city applications are gaining significant traction as Indonesian cities face urbanization challenges. Traffic management systems using IoT sensors and analytics are being deployed in major cities, while environmental monitoring networks help address air quality and waste management issues. Government support and funding are accelerating smart city IoT deployments.

Agricultural IoT represents a high-potential segment given Indonesia’s agricultural economy. Palm oil plantation monitoring, aquaculture management, and precision farming applications are showing strong adoption rates. IoT solutions help optimize resource usage, improve crop yields, and ensure sustainable farming practices.

Healthcare IoT adoption accelerated significantly during the COVID-19 pandemic, with remote patient monitoring and telemedicine applications gaining widespread acceptance. Medical device connectivity and hospital asset tracking are emerging as key growth areas within the healthcare IoT segment.

Consumer IoT market is expanding rapidly among Indonesia’s growing middle class, with smart home devices and wearables showing strong demand. E-commerce platforms are facilitating consumer IoT adoption by making devices more accessible and affordable to Indonesian consumers.

Enterprise customers benefit from IoT implementations through improved operational efficiency, reduced costs, and enhanced decision-making capabilities. MarkWide Research analysis indicates that Indonesian companies implementing comprehensive IoT solutions achieve average cost reductions of 15-25% within the first two years of deployment.

Technology vendors gain access to a large and growing market with diverse application opportunities. The Indonesian market offers potential for both standardized solutions and customized applications tailored to local requirements. Vendors establishing strong local partnerships and support capabilities achieve competitive advantages.

System integrators benefit from increasing demand for IoT implementation services, consulting, and ongoing support. The complexity of IoT deployments creates opportunities for specialized service providers who can navigate technical and business challenges.

Government agencies achieve improved public service delivery, enhanced urban management, and better resource utilization through IoT implementations. Smart city initiatives enable more responsive and efficient government operations while improving citizen satisfaction.

Citizens and consumers benefit from improved services, enhanced safety, and greater convenience through IoT-enabled applications. Smart city systems improve traffic flow and reduce pollution, while consumer IoT devices enhance lifestyle and productivity.

Investors find attractive opportunities in the growing Indonesian IoT market, with potential for significant returns as the market matures and scales. The combination of large market size, growth potential, and government support creates favorable investment conditions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Edge computing adoption is accelerating as Indonesian organizations recognize the benefits of local data processing for IoT applications. This trend is particularly important given Indonesia’s geographic challenges and the need for real-time processing in remote locations. Edge computing reduces latency and bandwidth requirements while improving system reliability.

Artificial intelligence integration with IoT systems is becoming increasingly common, enabling more sophisticated analytics and automated decision-making. Indonesian companies are implementing AI-powered IoT solutions for predictive maintenance, quality control, and operational optimization, achieving significant performance improvements.

5G network deployment is enabling new categories of IoT applications requiring high-speed, low-latency connectivity. Early 5G implementations in major Indonesian cities are supporting advanced IoT use cases in manufacturing, healthcare, and smart cities, demonstrating the potential for broader market transformation.

Sustainability focus is driving adoption of IoT solutions for environmental monitoring, energy management, and resource optimization. Indonesian companies are increasingly using IoT to track and reduce their environmental impact, responding to regulatory requirements and stakeholder expectations.

Platform consolidation is occurring as organizations seek integrated IoT solutions rather than point solutions. This trend is driving demand for comprehensive IoT platforms that can support multiple applications and use cases within a single organization.

Security-first approach is becoming standard practice as organizations recognize the importance of cybersecurity in IoT deployments. Security considerations are being integrated into IoT solution design from the beginning rather than added as an afterthought.

Government initiatives continue to shape market development, with the Ministry of Industry launching new programs to support smart manufacturing adoption. The Indonesia 4.0 roadmap provides specific targets and incentives for IoT implementation across priority industries, creating structured demand for IoT solutions.

Telecommunications infrastructure investments are accelerating, with major operators expanding 4G coverage and beginning 5G deployments. These infrastructure improvements are enabling more sophisticated IoT applications and expanding market reach to previously underserved areas.

Strategic partnerships between international technology vendors and local companies are increasing, facilitating market entry and solution localization. These partnerships combine global technology expertise with local market knowledge and customer relationships.

Startup ecosystem development is contributing to market innovation, with numerous Indonesian IoT startups developing specialized solutions for local market requirements. Government support for entrepreneurship and venture capital investment are fostering this innovation ecosystem.

Industry standards development is progressing, with Indonesian organizations participating in international IoT standardization efforts while developing local standards for specific applications and industries. This standardization work is improving interoperability and reducing implementation complexity.

Skills development programs are being implemented by universities, government agencies, and private companies to address the IoT skills shortage. These programs are training engineers, technicians, and business professionals in IoT technologies and applications.

Market entry strategies for international vendors should emphasize local partnerships and solution customization to address Indonesia’s unique requirements. Understanding local business practices, regulatory environment, and customer preferences is essential for success in the Indonesian market.

Technology focus should prioritize solutions that address Indonesia’s specific challenges, such as geographic dispersion, infrastructure limitations, and diverse industry requirements. Edge computing, satellite connectivity, and ruggedized hardware are particularly important for Indonesian deployments.

Investment priorities should include local talent development, customer support capabilities, and solution localization. Companies that invest in building local expertise and support infrastructure are more likely to achieve long-term success in the Indonesian market.

Vertical specialization can provide competitive advantages, particularly in sectors where Indonesia has unique characteristics such as palm oil, mining, and maritime industries. Deep industry expertise and specialized solutions can command premium pricing and customer loyalty.

Security emphasis is crucial given the cybersecurity concerns in the Indonesian market. Vendors should prioritize security features and provide comprehensive security consulting and support services to address customer concerns and regulatory requirements.

Ecosystem development through partnerships with local system integrators, consultants, and service providers can accelerate market penetration and improve customer success rates. Building a strong partner ecosystem is essential for scaling operations in Indonesia’s diverse and complex market.

Market trajectory for the Indonesian IoT sector remains strongly positive, with MWR projecting continued robust growth driven by digital transformation acceleration and infrastructure development. The market is expected to mature significantly over the next five years, with enterprise adoption moving from pilot projects to large-scale implementations.

Technology evolution will continue to shape market development, with emerging technologies such as artificial intelligence, machine learning, and advanced analytics becoming standard components of IoT solutions. The integration of these technologies will enable more sophisticated applications and create new value propositions for customers.

Infrastructure development will remove current barriers to IoT adoption, with 5G network expansion and improved connectivity reaching remote areas. This infrastructure improvement will enable new categories of IoT applications and expand the addressable market significantly.

Industry transformation will accelerate as Indonesian companies recognize the competitive advantages of IoT adoption. Manufacturing, agriculture, and natural resource industries are expected to lead this transformation, with IoT adoption rates projected to reach 65% among large enterprises within five years.

Innovation ecosystem development will contribute to market growth through local solution development and customization. The combination of international technology expertise and local innovation will create unique solutions tailored to Indonesian market requirements.

Regulatory framework maturation will provide greater clarity and confidence for IoT investments. Government support for digital transformation will continue, with new policies and incentives encouraging broader IoT adoption across industries and applications.

The Indonesia IoT market represents one of Southeast Asia’s most compelling technology opportunities, driven by the country’s large population, economic growth, and government commitment to digital transformation. Despite challenges related to geographic complexity and infrastructure limitations, the market demonstrates strong growth potential across multiple sectors and applications.

Market fundamentals remain solid, with increasing enterprise adoption, improving infrastructure, and supportive government policies creating favorable conditions for continued expansion. The combination of local innovation and international technology expertise is producing solutions tailored to Indonesian requirements while maintaining global standards and capabilities.

Future prospects for the Indonesian IoT market are highly positive, with opportunities spanning industrial automation, smart cities, agriculture, healthcare, and consumer applications. Organizations that invest in understanding local requirements, building appropriate partnerships, and developing comprehensive solutions are well-positioned to succeed in this dynamic and growing market. The convergence of technological advancement, economic development, and digital transformation initiatives positions Indonesia as a key IoT market in the Asia-Pacific region.

What is IoT?

IoT, or the Internet of Things, refers to the network of interconnected devices that communicate and exchange data with each other. In Indonesia, IoT applications span various sectors, including agriculture, healthcare, and smart cities.

What are the key players in the Indonesia IoT Market?

Key players in the Indonesia IoT Market include companies like Telkom Indonesia, Smartfren Telecom, and XL Axiata, which are actively involved in providing IoT solutions and services. These companies focus on sectors such as telecommunications, smart home technologies, and industrial IoT, among others.

What are the growth factors driving the Indonesia IoT Market?

The Indonesia IoT Market is driven by factors such as increasing smartphone penetration, the rise of smart cities, and the growing demand for automation in industries like manufacturing and agriculture. Additionally, government initiatives to promote digital transformation play a significant role.

What challenges does the Indonesia IoT Market face?

Challenges in the Indonesia IoT Market include concerns over data security and privacy, limited infrastructure in rural areas, and the need for regulatory frameworks to support IoT deployment. These factors can hinder the widespread adoption of IoT technologies.

What opportunities exist in the Indonesia IoT Market?

The Indonesia IoT Market presents opportunities in sectors such as smart agriculture, healthcare monitoring, and urban mobility solutions. As businesses and governments invest in IoT technologies, there is potential for innovation and improved efficiency across various industries.

What trends are shaping the Indonesia IoT Market?

Trends in the Indonesia IoT Market include the increasing integration of AI and machine learning with IoT devices, the growth of edge computing, and the expansion of 5G networks. These trends are enhancing the capabilities and applications of IoT solutions in the region.

Indonesia IoT Market

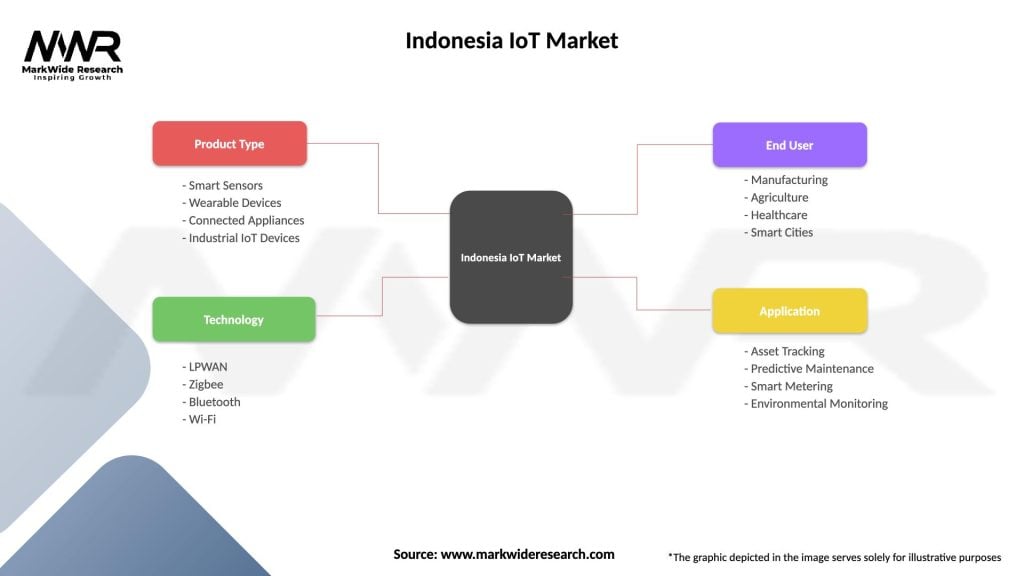

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Sensors, Wearable Devices, Connected Appliances, Industrial IoT Devices |

| Technology | LPWAN, Zigbee, Bluetooth, Wi-Fi |

| End User | Manufacturing, Agriculture, Healthcare, Smart Cities |

| Application | Asset Tracking, Predictive Maintenance, Smart Metering, Environmental Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia IoT Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at