444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia food service market represents one of Southeast Asia’s most dynamic and rapidly expanding culinary landscapes, driven by a growing middle class, urbanization trends, and evolving consumer preferences. Indonesia’s food service sector encompasses a diverse range of establishments including restaurants, cafes, fast food chains, catering services, and street food vendors that collectively serve the nation’s 270 million inhabitants. The market demonstrates remarkable resilience and adaptability, with traditional Indonesian cuisine coexisting alongside international food concepts and modern dining experiences.

Market dynamics indicate substantial growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This expansion reflects Indonesia’s economic development, changing lifestyle patterns, and increasing disposable income among urban populations. The food service industry has become increasingly sophisticated, incorporating digital technologies, delivery platforms, and innovative business models that cater to diverse consumer segments across the archipelago.

Regional distribution shows significant concentration in major urban centers, with Jakarta, Surabaya, Bandung, and Medan accounting for approximately 65% of total food service establishments. However, emerging opportunities in secondary cities and tourist destinations are driving market expansion beyond traditional metropolitan areas, creating new avenues for growth and investment in the Indonesian food service landscape.

The Indonesia food service market refers to the comprehensive ecosystem of commercial establishments and businesses that prepare, serve, and deliver food and beverages to consumers for immediate consumption or takeaway purposes. This market encompasses traditional restaurants, modern dining establishments, quick service restaurants, cafes, catering companies, food trucks, and digital food delivery platforms that collectively form Indonesia’s vibrant culinary industry.

Food service operations in Indonesia range from small-scale warung (local eateries) and street food vendors that preserve traditional culinary heritage to sophisticated international restaurant chains and contemporary dining concepts that reflect global food trends. The market includes both formal establishments with proper licensing and informal food vendors that contribute significantly to the country’s food culture and economic activity.

Market participants include independent restaurant owners, franchise operators, hotel and resort food services, institutional catering providers, and emerging cloud kitchen concepts that leverage technology to reach consumers through delivery platforms. This diverse landscape reflects Indonesia’s rich culinary traditions while embracing modern food service innovations and international dining concepts.

Indonesia’s food service market demonstrates exceptional growth potential driven by demographic advantages, economic development, and evolving consumer behaviors. The sector benefits from a young population with increasing purchasing power, rapid urbanization, and growing acceptance of dining out as a lifestyle choice rather than merely a necessity.

Key growth drivers include the expansion of shopping malls and commercial districts, rising tourism activity, and the proliferation of food delivery platforms that have transformed consumer access to diverse culinary options. The market shows particular strength in quick service restaurants, casual dining, and specialty coffee segments, with international brands increasingly recognizing Indonesia as a strategic market for expansion.

Digital transformation has become a defining characteristic of the market, with approximately 78% of food service establishments now utilizing some form of digital ordering or delivery platform. This technological adoption has accelerated significantly, creating new revenue streams and enabling smaller operators to reach broader customer bases without substantial infrastructure investments.

Market challenges include regulatory complexities, supply chain inefficiencies, and intense competition among operators. However, these challenges are offset by substantial opportunities in underserved markets, growing demand for premium dining experiences, and increasing interest in healthy and sustainable food options among Indonesian consumers.

Consumer behavior analysis reveals significant shifts in dining preferences, with Indonesian consumers increasingly seeking diverse culinary experiences, convenience, and value for money. The market demonstrates strong demand for both authentic local cuisine and international food concepts, creating opportunities for operators who can successfully blend traditional and modern offerings.

Demographic advantages serve as the primary catalyst for Indonesia’s food service market expansion, with a population exceeding 270 million people and a median age of 30 years creating substantial demand for diverse dining options. The country’s young demographic profile correlates strongly with higher frequency of dining out and willingness to try new culinary experiences.

Economic development has significantly improved purchasing power across Indonesian society, with the expanding middle class driving increased spending on food and dining experiences. Rising disposable income enables consumers to allocate larger portions of their budgets to restaurant meals, premium ingredients, and convenience-oriented food services.

Urbanization trends continue to reshape Indonesian society, with approximately 56% of the population now living in urban areas where food service establishments are more concentrated and accessible. Urban lifestyles often necessitate dining out due to longer working hours, smaller living spaces, and limited time for home cooking, creating sustained demand for food service options.

Tourism growth contributes substantially to market expansion, with both domestic and international visitors seeking authentic Indonesian culinary experiences alongside familiar international food options. The government’s focus on tourism development has created opportunities for food service operators in popular destinations across the archipelago.

Technology integration has revolutionized market accessibility and operational efficiency, with food delivery platforms, mobile payment systems, and social media marketing enabling even small operators to reach broader customer bases and compete effectively with larger establishments.

Regulatory complexity presents ongoing challenges for food service operators, with multiple licensing requirements, health and safety regulations, and local government policies that can vary significantly across Indonesia’s diverse administrative regions. Compliance costs and bureaucratic processes can be particularly burdensome for smaller operators and new market entrants.

Supply chain inefficiencies impact operational costs and menu consistency, particularly for establishments requiring imported ingredients or specialized products. Indonesia’s geographic complexity as an archipelago nation creates logistical challenges that can affect ingredient availability and pricing stability across different regions.

Intense competition has led to market saturation in prime locations, driving up rental costs and making it increasingly difficult for new operators to establish profitable businesses. The proliferation of food service options has also fragmented consumer attention and loyalty, requiring higher marketing investments to maintain market share.

Labor challenges include skills shortages in specialized culinary roles, high turnover rates, and increasing wage expectations that pressure profit margins. The food service industry’s demanding work environment and irregular hours can make it difficult to attract and retain qualified staff, particularly in competitive urban markets.

Economic volatility can significantly impact consumer spending on discretionary items like restaurant meals, with currency fluctuations affecting the cost of imported ingredients and equipment. Economic uncertainty may cause consumers to reduce dining frequency or trade down to less expensive options during challenging periods.

Underserved markets in secondary cities and emerging urban centers present substantial expansion opportunities for food service operators willing to adapt their concepts to local preferences and economic conditions. These markets often have less competition and lower operational costs while maintaining growing consumer bases with increasing disposable income.

Health and wellness trends create opportunities for operators who can successfully incorporate nutritious, organic, and sustainable food options into their menus. Indonesian consumers are becoming increasingly health-conscious, creating demand for restaurants that offer transparent ingredient sourcing and healthier preparation methods.

Digital innovation continues to present new opportunities for market participation and customer engagement, with cloud kitchens, virtual restaurants, and AI-powered customer service systems enabling more efficient operations and broader market reach. The integration of loyalty programs and personalized marketing through digital platforms offers significant potential for customer retention and revenue growth.

Cultural fusion concepts that blend Indonesian culinary traditions with international influences appeal to consumers seeking unique dining experiences. Operators who can successfully create innovative menu items that respect local tastes while offering novel presentations and flavor combinations can differentiate themselves in competitive markets.

Sustainable practices are becoming increasingly important to environmentally conscious consumers, creating opportunities for restaurants that implement eco-friendly packaging, waste reduction programs, and locally sourced ingredients. These initiatives can serve as powerful marketing differentiators while contributing to long-term operational sustainability.

Supply and demand dynamics in Indonesia’s food service market reflect the complex interplay between growing consumer appetite for dining experiences and the challenges of meeting this demand efficiently and profitably. The market demonstrates strong demand elasticity, with consumers showing willingness to pay premium prices for quality, convenience, and unique experiences.

Competitive dynamics have intensified as both domestic and international operators recognize Indonesia’s market potential, leading to increased innovation in menu development, service delivery, and customer experience. This competition has generally benefited consumers through improved quality, more diverse options, and competitive pricing strategies.

Technology dynamics continue to reshape market operations, with approximately 85% of urban consumers now using food delivery apps regularly. This technological integration has created new business models, changed consumer expectations, and required traditional operators to adapt their service delivery methods to remain competitive.

Pricing dynamics reflect the market’s diverse consumer base, with successful operators often employing tiered pricing strategies that cater to different income segments. The ability to offer value at multiple price points has become crucial for market success, particularly in economically diverse urban environments.

Seasonal dynamics influence market performance, with religious holidays, school schedules, and weather patterns creating predictable fluctuations in demand. Successful operators have learned to anticipate and capitalize on these patterns through targeted marketing campaigns and seasonal menu adjustments.

Market research approach for analyzing Indonesia’s food service sector employs comprehensive primary and secondary research methodologies designed to capture the market’s complexity and regional variations. The research framework incorporates quantitative data collection through surveys and transaction analysis alongside qualitative insights gathered through interviews and focus groups with industry participants.

Data collection methods include structured interviews with restaurant owners, franchise operators, and industry executives across major Indonesian cities to understand operational challenges, growth strategies, and market trends. Consumer surveys capture dining preferences, spending patterns, and satisfaction levels across different demographic segments and geographic regions.

Secondary research sources encompass government statistics, industry association reports, and trade publications that provide context for market sizing, regulatory environment analysis, and competitive landscape assessment. Financial data from publicly traded food service companies offers insights into profitability trends and investment patterns within the sector.

Regional analysis methodology ensures comprehensive coverage of Indonesia’s diverse market conditions by examining food service trends in major metropolitan areas, secondary cities, and tourist destinations. This geographic approach recognizes the significant variations in consumer preferences, economic conditions, and competitive dynamics across different regions.

Validation processes include cross-referencing multiple data sources, conducting follow-up interviews to verify key findings, and utilizing industry expert panels to review conclusions and recommendations. This multi-layered validation approach ensures research accuracy and reliability for strategic decision-making purposes.

Jakarta metropolitan area dominates Indonesia’s food service landscape, accounting for approximately 35% of total market activity and serving as the primary entry point for international food service brands. The capital region’s sophisticated consumer base, high disposable income levels, and extensive commercial infrastructure create ideal conditions for premium dining concepts and innovative food service models.

East Java region, anchored by Surabaya, represents the second-largest food service market with strong demand for both traditional Indonesian cuisine and modern dining concepts. The region’s industrial base and growing middle class support diverse food service operations, from street food vendors to upscale restaurants catering to business professionals and tourists.

West Java markets, including Bandung and surrounding cities, demonstrate particular strength in cafe culture and creative dining concepts that appeal to the region’s young, educated population. The area’s proximity to Jakarta and its reputation as an educational center create unique opportunities for innovative food service concepts and social dining experiences.

Central Java and Yogyakarta markets emphasize cultural authenticity and traditional cuisine while gradually embracing modern food service trends. These regions offer opportunities for operators who can successfully blend traditional Javanese culinary heritage with contemporary presentation and service standards.

Sumatra markets, led by Medan, show growing sophistication in food service offerings, with increasing demand for international cuisine and modern dining experiences. The region’s economic development and cultural diversity create opportunities for food service operators willing to adapt to local preferences and market conditions.

Bali and tourist destinations maintain unique market dynamics driven by international tourism and expatriate communities, supporting premium restaurants, international cuisine, and innovative dining concepts that cater to diverse cultural preferences and higher spending power.

Market leadership in Indonesia’s food service sector is distributed among various categories of operators, from large international chains to successful local restaurant groups and innovative digital-first concepts. The competitive environment rewards adaptability, local market understanding, and effective use of technology to reach and serve customers.

Competitive strategies increasingly focus on digital integration, menu localization, and customer experience enhancement. Successful operators invest heavily in food delivery partnerships, mobile ordering systems, and social media marketing to maintain relevance with tech-savvy Indonesian consumers.

Market consolidation trends show larger operators acquiring successful local concepts or forming strategic partnerships to expand their market reach and operational capabilities. This consolidation creates opportunities for mid-sized operators to either scale up through partnerships or focus on niche market segments.

By Service Type: The Indonesia food service market segments into distinct categories based on service delivery models and customer interaction patterns. Quick service restaurants lead market share due to their convenience and affordability, while full-service restaurants cater to consumers seeking comprehensive dining experiences.

By Cuisine Type: Market segmentation reflects Indonesia’s cultural diversity and growing international influences, with traditional Indonesian cuisine maintaining strong market presence alongside expanding international food categories.

By Location Type: Geographic and venue-based segmentation reflects varying consumer behaviors and operational requirements across different location categories within Indonesian markets.

Quick Service Restaurant segment demonstrates the strongest growth momentum, driven by urbanization, busy lifestyles, and increasing acceptance of fast food as a regular dining option. This category benefits from standardized operations, efficient service delivery, and strong brand recognition that appeals to time-conscious Indonesian consumers.

Casual dining establishments show steady growth as middle-class consumers seek dining experiences that balance quality, atmosphere, and value. This segment succeeds by offering diverse menu options, comfortable environments, and pricing that accommodates regular dining frequency among working professionals and families.

Coffee and cafe culture has experienced remarkable expansion, with specialty coffee shops becoming social gathering places for young professionals and students. This category benefits from Instagram-worthy presentations, premium beverage quality, and environments conducive to work and social interaction.

Food delivery optimization has become crucial across all categories, with successful operators investing in packaging solutions, delivery logistics, and digital marketing to capture the growing demand for convenient food access. This trend has particularly benefited smaller operators who can now reach customers without expensive physical locations.

Traditional cuisine modernization represents a significant opportunity, with operators successfully updating classic Indonesian dishes through contemporary presentation, premium ingredients, and modern service standards while maintaining authentic flavors that resonate with local consumers.

Restaurant operators benefit from Indonesia’s large and growing consumer market, which provides substantial revenue opportunities for businesses that can effectively serve diverse customer segments. The market’s size and demographic trends support sustainable business growth for operators who understand local preferences and adapt their concepts accordingly.

Franchise systems find Indonesia particularly attractive due to the market’s receptiveness to proven business models and the availability of qualified local partners who understand regional market dynamics. Successful franchising enables rapid market expansion while leveraging local expertise and relationships.

Food suppliers and distributors benefit from the expanding food service sector through increased demand for ingredients, equipment, and support services. The market’s growth creates opportunities for suppliers who can provide consistent quality, reliable delivery, and competitive pricing across Indonesia’s diverse geographic regions.

Technology providers find significant opportunities in helping food service operators modernize their operations through point-of-sale systems, inventory management, delivery integration, and customer relationship management tools. The market’s rapid digital adoption creates sustained demand for technological solutions.

Real estate developers benefit from the food service sector’s demand for prime locations in shopping centers, commercial districts, and residential areas. Food service establishments often serve as anchor tenants that attract foot traffic and enhance the overall appeal of commercial developments.

Employment generation represents a significant benefit for Indonesian society, with the food service sector providing jobs across skill levels and contributing to economic development in both urban and rural areas through supply chain activities and local sourcing initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration continues to reshape Indonesia’s food service landscape, with operators increasingly adopting comprehensive technology solutions that integrate ordering, payment, inventory management, and customer relationship management. This trend has accelerated significantly, with MarkWide Research indicating that digital integration has become essential for competitive success in major Indonesian markets.

Health and wellness focus is gaining momentum among Indonesian consumers, driving demand for restaurants that offer nutritious menu options, transparent ingredient sourcing, and sustainable practices. This trend particularly resonates with younger demographics and urban professionals who prioritize health-conscious dining choices.

Local cuisine innovation represents a significant trend where operators modernize traditional Indonesian dishes through contemporary presentation, premium ingredients, and Instagram-worthy plating while maintaining authentic flavors. This approach successfully bridges traditional culinary heritage with modern dining expectations.

Delivery-first concepts have emerged as a dominant trend, with many new operators launching cloud kitchens and virtual restaurants optimized specifically for delivery platforms rather than traditional dine-in experiences. This model reduces operational costs while maximizing reach through digital channels.

Sustainability initiatives are becoming increasingly important, with leading operators implementing eco-friendly packaging, waste reduction programs, and locally sourced ingredients to appeal to environmentally conscious consumers and reduce operational environmental impact.

Experience-driven dining trends show consumers seeking unique, shareable experiences that extend beyond food quality to include ambiance, service innovation, and social media appeal. Successful operators create memorable experiences that encourage customer loyalty and social sharing.

Major franchise expansions have characterized recent industry developments, with international food service brands accelerating their Indonesian market entry through strategic partnerships with local operators who understand regional preferences and regulatory requirements. These expansions often involve significant menu localization and operational adaptation.

Technology platform integration has become standard practice, with most successful food service operators now maintaining presence on multiple delivery platforms while developing their own digital ordering capabilities. This multi-channel approach ensures maximum customer accessibility and revenue optimization.

Investment in automation is increasing among larger operators who seek to address labor shortages and improve operational efficiency through kitchen automation, self-service ordering systems, and inventory management technology. These investments help maintain service quality while controlling labor costs.

Sustainable sourcing initiatives have gained prominence as operators respond to consumer environmental concerns and regulatory pressures by implementing local sourcing programs, reducing food waste, and adopting eco-friendly packaging solutions throughout their operations.

Market consolidation activities include acquisitions of successful local restaurant concepts by larger operators seeking to expand their market presence and diversify their portfolio offerings. This consolidation trend creates opportunities for mid-sized operators to either scale up or focus on specialized market niches.

Regulatory compliance improvements have been implemented across the industry in response to enhanced food safety requirements and business licensing procedures, with operators investing in staff training, facility upgrades, and documentation systems to meet evolving standards.

Market entry strategies should prioritize understanding local consumer preferences and adapting international concepts to Indonesian tastes while maintaining core brand values. Successful market entry typically requires partnerships with experienced local operators who understand regulatory requirements and cultural nuances.

Digital integration investment represents a critical success factor, with operators needing to develop comprehensive online presence across delivery platforms, social media channels, and proprietary digital ordering systems. This investment should be viewed as essential infrastructure rather than optional enhancement.

Location strategy optimization should consider both traditional high-traffic areas and emerging opportunities in secondary cities where competition is less intense and operational costs are more manageable. Successful operators often employ a mixed location strategy that balances premium and emerging markets.

Menu development approaches should emphasize local taste preferences while offering unique value propositions that differentiate operators from competitors. Successful menu strategies often combine familiar Indonesian flavors with innovative presentations and premium ingredients.

Operational efficiency focus becomes increasingly important as competition intensifies and costs rise, requiring operators to invest in technology, staff training, and process optimization to maintain profitability while delivering consistent customer experiences.

Partnership development with local suppliers, delivery platforms, and technology providers can significantly enhance operational capabilities and market reach while reducing the complexity of managing multiple vendor relationships independently.

Growth trajectory projections indicate continued expansion of Indonesia’s food service market, driven by demographic advantages, economic development, and evolving consumer preferences that favor convenience and dining experiences. MWR analysis suggests the market will maintain robust growth momentum with a projected CAGR of 7.5% over the next five years.

Technology integration advancement will likely accelerate, with artificial intelligence, automated ordering systems, and predictive analytics becoming standard tools for successful food service operations. These technological capabilities will enable more personalized customer experiences and improved operational efficiency.

Market maturation trends suggest increasing sophistication in consumer preferences, with demand growing for premium ingredients, authentic culinary experiences, and sustainable practices. This maturation creates opportunities for operators who can deliver elevated experiences while maintaining accessible pricing.

Regional expansion opportunities will continue developing as infrastructure improvements and economic growth extend beyond major metropolitan areas, creating new markets for food service operators willing to adapt their concepts to local conditions and preferences.

Sustainability requirements are expected to become more stringent, with operators needing to implement comprehensive environmental programs covering packaging, waste management, energy usage, and ingredient sourcing to meet consumer expectations and regulatory requirements.

Competition intensification will likely continue as both domestic and international operators recognize Indonesia’s market potential, requiring existing operators to continuously innovate and improve their value propositions to maintain market position and profitability.

Indonesia’s food service market represents one of Southeast Asia’s most promising opportunities for growth and investment, supported by favorable demographics, economic development, and cultural openness to diverse culinary experiences. The market’s substantial size, growing middle class, and rapid digital adoption create ideal conditions for both established operators and new market entrants who can effectively serve Indonesian consumer preferences.

Success factors in this dynamic market include understanding local tastes, embracing digital technology, maintaining operational efficiency, and adapting to evolving consumer expectations around health, sustainability, and experience quality. Operators who can balance these requirements while delivering consistent value will find significant opportunities for profitable growth across Indonesia’s diverse regional markets.

Future prospects remain highly positive, with continued urbanization, rising disposable income, and technological advancement supporting sustained market expansion. The industry’s evolution toward more sophisticated operations, diverse cuisine options, and enhanced customer experiences positions Indonesia’s food service sector for continued growth and development in the coming years, making it an attractive market for strategic investment and expansion initiatives.

What is Indonesia Food Service?

Indonesia Food Service refers to the sector that encompasses all businesses involved in preparing and serving food and beverages to consumers. This includes restaurants, cafes, catering services, and food delivery services, among others.

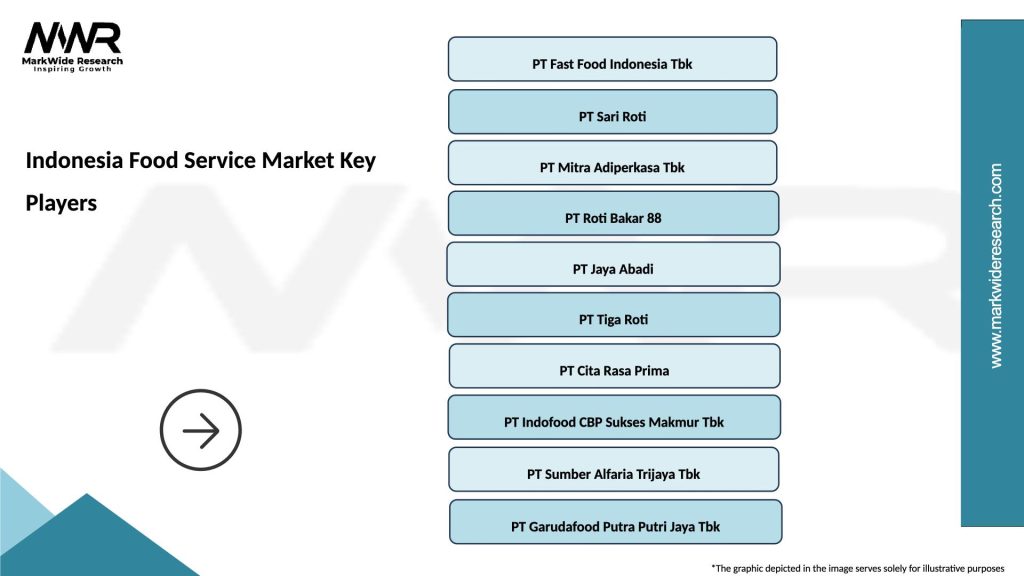

What are the key players in the Indonesia Food Service Market?

Key players in the Indonesia Food Service Market include companies like PT Fast Food Indonesia Tbk, Domino’s Pizza Indonesia, and McDonald’s Indonesia, among others. These companies compete in various segments such as quick-service restaurants and casual dining.

What are the main drivers of growth in the Indonesia Food Service Market?

The main drivers of growth in the Indonesia Food Service Market include the rising urban population, increasing disposable incomes, and changing consumer preferences towards dining out and food delivery services. Additionally, the growth of the tourism sector also contributes to market expansion.

What challenges does the Indonesia Food Service Market face?

The Indonesia Food Service Market faces challenges such as intense competition, fluctuating food prices, and regulatory hurdles. Additionally, the impact of economic fluctuations can affect consumer spending on dining out.

What opportunities exist in the Indonesia Food Service Market?

Opportunities in the Indonesia Food Service Market include the growing trend of online food delivery, the rise of health-conscious dining options, and the potential for expansion into untapped rural areas. These factors can drive innovation and new business models.

What trends are shaping the Indonesia Food Service Market?

Trends shaping the Indonesia Food Service Market include the increasing popularity of plant-based menus, the integration of technology in ordering and delivery processes, and a focus on sustainability practices. These trends reflect changing consumer preferences and environmental awareness.

Indonesia Food Service Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fast Food, Casual Dining, Fine Dining, Cafés |

| Customer Type | Families, Young Adults, Business Professionals, Tourists |

| Service Type | Dine-in, Takeaway, Delivery, Catering |

| Price Tier | Economy, Mid-range, Premium, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia Food Service Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at