444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia e-services market represents one of Southeast Asia’s most dynamic and rapidly expanding digital ecosystems. With a population exceeding 270 million people and increasing internet penetration rates reaching 73.7% in 2024, Indonesia has emerged as a critical hub for digital transformation across various service sectors. The market encompasses a comprehensive range of digital services including e-commerce platforms, digital banking solutions, online education services, telemedicine platforms, and government digital services.

Digital adoption in Indonesia has accelerated significantly, driven by widespread smartphone usage, improved internet infrastructure, and changing consumer behaviors. The country’s unique archipelagic geography, spanning over 17,000 islands, has made digital services particularly valuable for connecting remote communities and providing access to essential services. Mobile-first adoption has been a defining characteristic, with over 89% of internet users accessing services primarily through mobile devices.

Government initiatives such as the Digital Indonesia 2045 roadmap and various smart city projects have created a supportive regulatory environment for e-services growth. The market benefits from a young, tech-savvy population with 65% of users under 35 years old, creating substantial demand for innovative digital solutions across education, healthcare, financial services, and entertainment sectors.

The Indonesia e-services market refers to the comprehensive ecosystem of digital service platforms and solutions that enable electronic delivery of various services to consumers, businesses, and government entities across the Indonesian archipelago. This market encompasses all forms of digitally-enabled services including online transactions, digital content delivery, virtual consultations, electronic government services, and cloud-based business solutions.

E-services in the Indonesian context include diverse categories such as digital financial services, online marketplace platforms, educational technology solutions, telehealth services, digital entertainment platforms, and government-to-citizen service portals. These services leverage internet connectivity, mobile applications, and digital payment systems to provide convenient, accessible, and efficient service delivery mechanisms that transcend geographical barriers inherent in Indonesia’s island-based geography.

Indonesia’s e-services market demonstrates exceptional growth momentum, positioning itself as a regional leader in digital service adoption and innovation. The market’s expansion is fundamentally driven by increasing smartphone penetration, improving digital infrastructure, and evolving consumer preferences toward convenient, accessible digital solutions. Key growth drivers include the government’s digital transformation initiatives, rising middle-class purchasing power, and the accelerated adoption of digital services following the global pandemic.

Market segmentation reveals strong performance across multiple verticals, with e-commerce, digital financial services, and online education leading adoption rates. The competitive landscape features both domestic champions and international players, creating a dynamic environment that fosters innovation and service diversification. Regional distribution shows concentrated activity in major urban centers like Jakarta, Surabaya, and Bandung, while rural penetration continues to expand through improved connectivity and mobile-first service designs.

Future projections indicate sustained growth potential, supported by ongoing infrastructure investments, regulatory reforms, and increasing digital literacy rates. The market’s trajectory suggests continued expansion across both traditional service categories and emerging sectors such as Internet of Things (IoT) services, artificial intelligence applications, and blockchain-based solutions.

Strategic analysis of Indonesia’s e-services market reveals several critical insights that define its current trajectory and future potential:

Infrastructure development serves as a primary catalyst for Indonesia’s e-services market expansion. The government’s commitment to improving internet connectivity through projects like the Palapa Ring fiber optic network has significantly enhanced service accessibility across remote islands. 4G network coverage now reaches over 95% of populated areas, while 5G deployment in major cities is accelerating the adoption of bandwidth-intensive services.

Demographic advantages provide substantial market momentum, with Indonesia’s young population demonstrating high digital service adoption rates. The growing middle class, estimated to reach 135 million people by 2030, represents a significant consumer base for premium e-services. Digital literacy programs implemented by both government and private sectors have increased user confidence in digital platforms.

Regulatory support through initiatives like the Electronic Transaction Law and various fintech regulations has created a stable framework for e-services growth. The government’s Digital Indonesia 2045 vision emphasizes digital transformation across all sectors, providing policy backing for continued market expansion. Tax incentives for technology companies and startup-friendly regulations have attracted significant investment in the e-services ecosystem.

COVID-19 acceleration permanently shifted consumer behaviors toward digital services, with many users maintaining their digital habits post-pandemic. This behavioral change has created sustained demand across healthcare, education, and retail sectors, establishing digital services as essential rather than optional solutions.

Digital divide challenges remain significant, particularly between urban and rural areas. While major cities enjoy robust internet connectivity, remote islands and rural communities still face infrastructure limitations that restrict e-services access. Internet speed variations across different regions create inconsistent user experiences and limit the deployment of advanced digital services.

Cybersecurity concerns pose ongoing challenges for market growth, with increasing incidents of data breaches and online fraud affecting consumer confidence. The lack of comprehensive cybersecurity frameworks and limited awareness among users about digital security practices create vulnerabilities that can impede market expansion.

Regulatory complexity across different service sectors sometimes creates compliance challenges for e-services providers. Varying regulations between provinces and evolving digital governance frameworks can create uncertainty for businesses seeking to scale their operations nationally. Data localization requirements and privacy regulations, while necessary, can increase operational costs for service providers.

Skills gap in digital competencies affects both service providers and users. Limited availability of skilled technology professionals can constrain innovation and service quality, while user education remains necessary to maximize e-services adoption across all demographic segments.

Rural market penetration represents the largest untapped opportunity for e-services expansion. With improving connectivity and government initiatives to bridge the digital divide, rural areas offer significant growth potential for basic digital services including mobile banking, e-commerce, and telemedicine. Agricultural technology services specifically present opportunities to serve Indonesia’s large farming community.

Industry 4.0 integration creates opportunities for B2B e-services targeting manufacturing, logistics, and supply chain optimization. As Indonesian businesses modernize their operations, demand for cloud computing, data analytics, and IoT-enabled services continues to grow. Smart city initiatives across major urban centers offer opportunities for integrated digital service platforms.

Cross-border e-services present expansion opportunities, particularly in serving Indonesian diaspora communities and facilitating trade with ASEAN partners. Digital services that support international commerce, remittances, and cross-cultural communication can leverage Indonesia’s strategic position in Southeast Asia.

Emerging technologies such as artificial intelligence, blockchain, and augmented reality create opportunities for next-generation e-services. These technologies can enhance existing services and enable entirely new service categories, particularly in education, entertainment, and professional services sectors.

Competitive intensity in Indonesia’s e-services market continues to drive innovation and service improvement. The presence of both local champions and international players creates a dynamic environment where companies must continuously evolve their offerings to maintain market position. Super-app strategies have become prevalent, with leading platforms integrating multiple services to increase user engagement and retention.

Investment flows into the e-services sector remain robust, with both domestic and foreign investors recognizing the market’s growth potential. Venture capital funding, strategic partnerships, and government investment programs provide the financial foundation for continued innovation and expansion. Merger and acquisition activity has increased as companies seek to consolidate market positions and expand service capabilities.

Technology evolution drives continuous market transformation, with advances in mobile technology, cloud computing, and data analytics enabling new service possibilities. The adoption of artificial intelligence and machine learning technologies is enhancing service personalization and operational efficiency across various e-services categories.

Consumer behavior shifts toward digital-first preferences create both opportunities and challenges for service providers. While digital adoption rates continue rising, consumer expectations for service quality, security, and convenience also increase, requiring continuous investment in platform capabilities and user experience optimization.

Comprehensive market analysis for Indonesia’s e-services sector employs multiple research methodologies to ensure accurate and actionable insights. Primary research involves extensive surveys and interviews with key stakeholders including service providers, technology vendors, government officials, and end users across different demographic segments and geographic regions.

Secondary research incorporates analysis of government statistics, industry reports, company financial statements, and regulatory documents to establish market baselines and trend analysis. Data triangulation methods ensure research accuracy by cross-referencing multiple information sources and validating findings through expert consultations.

Quantitative analysis utilizes statistical modeling to project market trends, growth rates, and adoption patterns across different service categories and regions. Qualitative research through focus groups and in-depth interviews provides contextual understanding of user behaviors, preferences, and barriers to adoption.

Market segmentation analysis employs demographic, geographic, and behavioral criteria to identify distinct user groups and service categories. Technology assessment includes evaluation of infrastructure capabilities, platform performance metrics, and innovation trends that influence market development.

Java Island dominance characterizes Indonesia’s e-services market distribution, with the region accounting for approximately 58% of total market activity. Jakarta, as the capital and economic center, leads in advanced e-services adoption including fintech, enterprise solutions, and digital entertainment platforms. Surabaya and Bandung serve as secondary hubs, particularly strong in e-commerce and educational technology services.

Sumatra region demonstrates growing e-services adoption, particularly in Medan and Palembang, driven by expanding internet infrastructure and rising economic activity. The region shows strong performance in agricultural technology services and mobile banking solutions that serve both urban and rural communities.

Eastern Indonesia including Sulawesi, Kalimantan, and Papua represents emerging markets with significant growth potential. While current adoption rates remain lower than western regions, government infrastructure investments and targeted digital inclusion programs are accelerating e-services penetration. Mobile-first solutions prove particularly effective in these regions due to limited fixed-line internet infrastructure.

Bali and Nusa Tenggara regions benefit from tourism-driven digital service demand, with strong adoption of travel-related e-services, digital payments, and hospitality technology platforms. The regions serve as testing grounds for innovative tourism technology solutions that can be scaled nationally.

Market leadership in Indonesia’s e-services sector is characterized by strong domestic players alongside strategic international partnerships. The competitive environment fosters innovation through diverse business models and service approaches:

Service category segmentation reveals diverse market composition with distinct growth patterns and user demographics across different e-services verticals:

By Service Type:

By User Segment:

E-commerce services maintain market leadership through continuous innovation in user experience, payment integration, and logistics solutions. The category benefits from Indonesia’s growing middle class and increasing consumer confidence in online transactions. Social commerce integration and live streaming shopping features have enhanced user engagement and conversion rates.

Digital financial services demonstrate the highest growth rates, driven by government financial inclusion initiatives and increasing smartphone adoption. Mobile wallet penetration has reached critical mass in urban areas, while rural expansion continues through agent banking networks and simplified user interfaces designed for first-time digital users.

Transportation and logistics services have evolved beyond basic ride-hailing to comprehensive mobility ecosystems. Integration with e-commerce fulfillment, food delivery, and last-mile logistics has created synergies that improve service efficiency and user convenience across multiple touchpoints.

Educational technology services experienced accelerated adoption during the pandemic and have maintained growth through improved content quality and interactive learning features. The category serves both formal education institutions and individual skill development needs, with particular strength in language learning and professional certification programs.

Service providers benefit from Indonesia’s large addressable market and growing digital adoption rates, creating opportunities for rapid user base expansion and revenue growth. The market’s diversity allows for specialized service offerings while super-app strategies enable cross-selling and increased customer lifetime value.

Technology vendors gain access to a dynamic market that demands continuous innovation and platform scalability. The competitive environment drives demand for advanced technology solutions including cloud infrastructure, artificial intelligence capabilities, and cybersecurity systems.

Investors find attractive opportunities in a market with strong fundamentals including demographic advantages, government support, and increasing digital maturity. The presence of successful local companies alongside growth potential in underserved segments creates diverse investment options across risk profiles.

Consumers benefit from increased service accessibility, competitive pricing, and continuous innovation driven by market competition. Digital services provide solutions to Indonesia’s geographic challenges while offering convenience and efficiency improvements over traditional service delivery methods.

Government entities leverage e-services platforms to improve citizen services, increase administrative efficiency, and support economic development goals. Digital service adoption contributes to financial inclusion, small business empowerment, and overall economic digitization objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Super-app ecosystem development continues to reshape Indonesia’s e-services landscape, with leading platforms integrating multiple service categories to increase user engagement and create comprehensive digital experiences. This trend drives higher user retention rates and enables more effective monetization through cross-service synergies.

Artificial intelligence integration is becoming prevalent across various e-services categories, enhancing personalization, fraud detection, and customer service capabilities. Machine learning algorithms improve recommendation engines, optimize logistics routing, and enable predictive analytics for better business decision-making.

Social commerce expansion leverages Indonesia’s high social media usage rates to create new e-commerce channels. Live streaming shopping, influencer partnerships, and social media integration are transforming how consumers discover and purchase products through digital platforms.

Financial inclusion acceleration through digital services continues expanding access to banking and payment services for previously underserved populations. MarkWide Research analysis indicates that digital financial services are particularly effective in reaching rural communities and small business owners who lack access to traditional banking infrastructure.

Sustainability focus is emerging as companies integrate environmental and social responsibility into their e-services offerings. Green logistics, carbon footprint tracking, and sustainable consumption features are becoming important differentiators in the competitive landscape.

Strategic partnerships between local and international companies have accelerated market development, bringing global expertise while maintaining local market understanding. These collaborations often focus on technology transfer, market expansion, and service innovation that benefits from combined capabilities.

Regulatory framework evolution includes new guidelines for digital banking, data protection, and platform economy governance. The government’s balanced approach aims to foster innovation while ensuring consumer protection and market stability.

Infrastructure investments in 5G networks, data centers, and submarine cable systems are enhancing the technical foundation for advanced e-services. These improvements enable higher-quality video services, real-time applications, and IoT-based solutions.

Fintech innovation continues with new solutions for micro-lending, insurance technology, and blockchain-based financial services. These developments particularly benefit small businesses and individual consumers who require flexible, accessible financial products.

Cross-border expansion by Indonesian e-services companies into other Southeast Asian markets demonstrates the maturity and competitiveness of local platforms. This trend creates opportunities for regional service integration and knowledge sharing.

Market entry strategies should prioritize mobile-first design and local market adaptation, considering Indonesia’s unique cultural and geographic characteristics. Companies entering the market should focus on building strong local partnerships and understanding regional preferences across different islands and communities.

Investment priorities should emphasize cybersecurity capabilities, user experience optimization, and rural market penetration strategies. MWR recommends that companies allocate significant resources to security infrastructure and user education programs to build trust and confidence in digital services.

Technology adoption should focus on scalable, cloud-based solutions that can handle Indonesia’s large user base and geographic diversity. Companies should prioritize technologies that work effectively with varying internet speeds and device capabilities across different regions.

Regulatory compliance requires proactive engagement with government agencies and industry associations to stay informed about evolving regulations. Companies should invest in legal and compliance capabilities to navigate the complex regulatory environment effectively.

Talent development initiatives should address the skills gap in digital technologies through training programs, university partnerships, and knowledge transfer initiatives. Building local technical capabilities is essential for sustainable growth and innovation in the Indonesian market.

Long-term growth prospects for Indonesia’s e-services market remain highly positive, supported by continued demographic advantages, infrastructure improvements, and government digitization initiatives. The market is expected to maintain robust growth rates as digital adoption spreads to underserved segments and new service categories emerge.

Technology evolution will drive the next phase of market development, with artificial intelligence, 5G networks, and Internet of Things creating opportunities for more sophisticated and integrated service offerings. These technologies will enable new business models and improve service quality across all categories.

Regional integration within ASEAN will create opportunities for cross-border e-services expansion, with Indonesia positioned as a key hub for regional digital service delivery. This integration will benefit from improving connectivity and harmonized regulatory frameworks across Southeast Asian markets.

Sustainability considerations will become increasingly important as environmental awareness grows and regulations evolve. E-services companies that integrate sustainability into their operations and service offerings will likely gain competitive advantages in the evolving market landscape.

Market maturation will lead to increased specialization and premium service offerings as basic digital services become commoditized. Companies will need to focus on innovation, user experience, and value-added services to maintain growth and profitability in the competitive environment.

Indonesia’s e-services market represents one of Southeast Asia’s most compelling digital transformation stories, characterized by rapid growth, innovation, and expanding accessibility across diverse service categories. The market’s success stems from a unique combination of favorable demographics, government support, infrastructure development, and entrepreneurial innovation that has created a thriving digital ecosystem.

Key success factors include the mobile-first approach that aligns with Indonesian consumer preferences, the development of super-app ecosystems that provide integrated service experiences, and the focus on financial inclusion that has brought digital services to previously underserved populations. These factors have established Indonesia as a regional leader in digital service adoption and innovation.

Future opportunities remain substantial, particularly in rural market expansion, industry digitization, and emerging technology integration. The market’s continued evolution will depend on addressing infrastructure gaps, enhancing cybersecurity capabilities, and maintaining the balance between innovation and regulation that has supported growth to date. With strong fundamentals and continued investment in digital infrastructure, Indonesia’s e-services market is well-positioned for sustained growth and regional leadership in the digital economy transformation.

What is E-Services?

E-Services refer to the delivery of services through electronic means, often via the internet. This includes a wide range of applications such as online banking, e-commerce, and digital customer support.

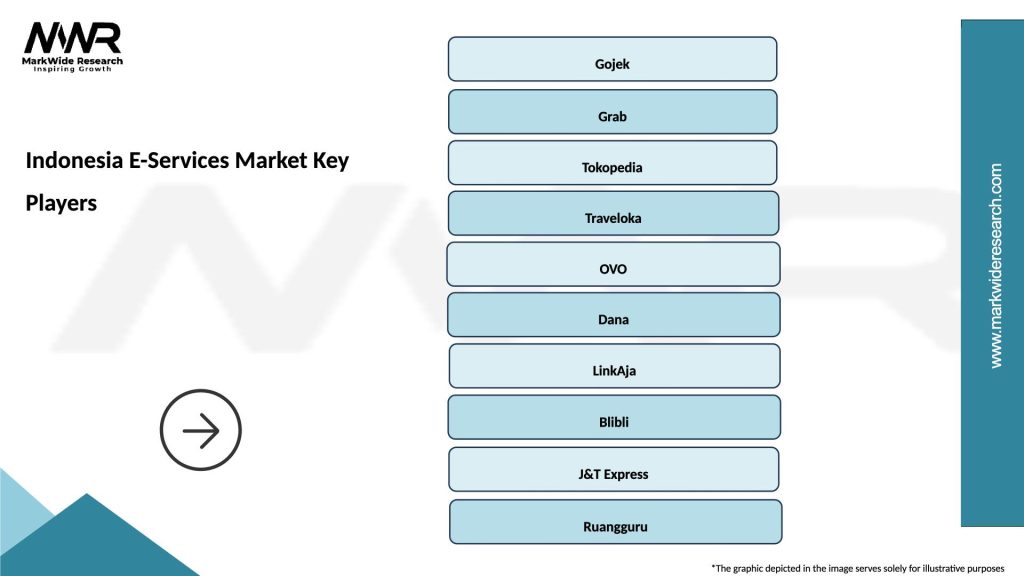

What are the key players in the Indonesia E-Services Market?

Key players in the Indonesia E-Services Market include Gojek, Tokopedia, and Grab, which provide various digital services such as ride-hailing, e-commerce, and food delivery, among others.

What are the growth factors driving the Indonesia E-Services Market?

The growth of the Indonesia E-Services Market is driven by increasing internet penetration, a growing smartphone user base, and the rising demand for convenient online services across various sectors.

What challenges does the Indonesia E-Services Market face?

Challenges in the Indonesia E-Services Market include regulatory hurdles, cybersecurity concerns, and the need for infrastructure improvements to support digital transactions effectively.

What opportunities exist in the Indonesia E-Services Market?

The Indonesia E-Services Market presents opportunities for innovation in fintech, expansion of digital payment solutions, and the growth of e-learning platforms, catering to the evolving needs of consumers.

What trends are shaping the Indonesia E-Services Market?

Trends in the Indonesia E-Services Market include the rise of mobile applications, increased adoption of artificial intelligence for customer service, and a shift towards personalized digital experiences.

Indonesia E-Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | E-Commerce, Online Banking, Digital Payment, Cloud Services |

| Customer Type | Individuals, Small Businesses, Corporates, Government |

| Technology | Mobile Apps, Web Platforms, APIs, Blockchain |

| End User | Retailers, Service Providers, Financial Institutions, Educational Institutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia E-Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at