444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia digital advertising market represents one of Southeast Asia’s most dynamic and rapidly evolving digital ecosystems. With the world’s fourth-largest population and an increasingly connected consumer base, Indonesia has emerged as a critical battleground for digital marketing investments across the region. The market encompasses various digital advertising formats including search engine marketing, social media advertising, display advertising, video advertising, and mobile advertising platforms.

Digital transformation across Indonesia has accelerated significantly, driven by widespread smartphone adoption and improved internet infrastructure. The market demonstrates robust growth potential with digital advertising spending growing at a compound annual growth rate (CAGR) of 12.8%, significantly outpacing traditional advertising channels. This growth trajectory reflects the fundamental shift in consumer behavior toward digital platforms and the increasing sophistication of Indonesian businesses in leveraging digital marketing strategies.

Mobile-first adoption characterizes the Indonesian digital landscape, with mobile devices accounting for approximately 78% of total internet usage. This mobile-centric approach has shaped advertising strategies, with businesses prioritizing mobile-optimized campaigns and responsive advertising formats. The market’s unique characteristics include high social media engagement rates, preference for video content, and growing e-commerce integration, creating diverse opportunities for advertisers to reach Indonesian consumers effectively.

The Indonesia digital advertising market refers to the comprehensive ecosystem of online advertising activities, platforms, and services operating within Indonesia’s digital economy. This market encompasses all forms of digital marketing communications delivered through internet-connected devices, including computers, smartphones, tablets, and smart televisions, targeting Indonesian consumers and businesses.

Digital advertising in Indonesia includes multiple channels such as search engine advertising, social media marketing, display banner advertising, video advertising, influencer marketing, programmatic advertising, and mobile app advertising. The market involves various stakeholders including advertisers, advertising agencies, technology platforms, publishers, and media companies working together to create, distribute, and optimize digital marketing campaigns.

Market dynamics are influenced by Indonesia’s unique cultural diversity, with over 17,000 islands and hundreds of local languages creating complex targeting requirements. The digital advertising landscape must accommodate regional preferences, cultural sensitivities, and varying levels of digital literacy across different demographic segments, making it one of the most challenging yet rewarding markets in Southeast Asia.

Indonesia’s digital advertising market stands at the forefront of Southeast Asian digital transformation, characterized by exceptional growth momentum and evolving consumer engagement patterns. The market benefits from favorable demographic trends, including a young population with 65% of users under 35 years old, creating a digitally native consumer base that actively engages with online advertising content.

Key market drivers include accelerating internet penetration, expanding e-commerce adoption, and increasing smartphone accessibility across urban and rural areas. The COVID-19 pandemic significantly accelerated digital adoption, with businesses rapidly transitioning marketing budgets from traditional to digital channels. This shift has created sustained demand for digital advertising services and platforms.

Social media platforms dominate the advertising landscape, with Indonesian users spending an average of 3.2 hours daily on social media platforms. This high engagement rate has made social media advertising the largest segment within the digital advertising market, followed by search engine marketing and display advertising. Video content consumption has particularly surged, driving demand for video advertising formats.

Market challenges include regulatory uncertainties, data privacy concerns, and the need for localized content creation. However, these challenges are offset by significant opportunities in emerging technologies such as artificial intelligence, programmatic advertising, and advanced targeting capabilities that enable more precise and effective advertising campaigns.

Strategic insights reveal several critical trends shaping Indonesia’s digital advertising landscape:

Internet penetration expansion serves as the primary catalyst driving Indonesia’s digital advertising market growth. With internet users growing at 8.1% annually, the expanding digital audience creates larger addressable markets for advertisers. Improved telecommunications infrastructure, including 4G network expansion and emerging 5G deployment, enhances user experience and enables more sophisticated advertising formats.

E-commerce boom significantly contributes to digital advertising demand, as online retailers invest heavily in customer acquisition and retention campaigns. The integration of social commerce features within popular platforms creates new advertising opportunities, allowing businesses to reach consumers at various stages of the purchasing journey. This trend has particularly benefited small and medium enterprises seeking cost-effective marketing solutions.

Smartphone affordability has democratized internet access across Indonesia’s diverse socioeconomic segments. As smartphone prices decrease and financing options improve, previously underserved populations gain access to digital platforms, expanding the potential audience for digital advertising campaigns. This trend is particularly pronounced in tier-2 and tier-3 cities, creating new market opportunities.

Digital payment adoption facilitates seamless online transactions, reducing friction in the customer journey from advertisement exposure to purchase completion. The widespread acceptance of digital wallets and mobile payment solutions has increased consumer confidence in online shopping, driving demand for performance-based advertising campaigns that directly link advertising spend to sales outcomes.

Regulatory uncertainties pose significant challenges to digital advertising market growth in Indonesia. Evolving data protection regulations, content restrictions, and advertising standards create compliance complexities for both domestic and international advertisers. The implementation of new digital taxation policies affects advertising platform operations and pricing structures, potentially impacting market accessibility for smaller advertisers.

Digital literacy gaps across different demographic segments limit market penetration in certain regions. While urban areas demonstrate high digital engagement, rural populations may lack the technical skills necessary to effectively interact with digital advertising content. This disparity creates challenges for advertisers seeking nationwide reach and requires specialized strategies for different market segments.

Infrastructure limitations in remote areas restrict internet connectivity quality and speed, affecting the delivery and performance of digital advertising campaigns. Inconsistent network coverage can lead to poor user experiences with rich media advertising content, potentially reducing campaign effectiveness and return on investment for advertisers targeting these regions.

Ad blocking adoption among tech-savvy users presents challenges for traditional display advertising formats. As consumers become more aware of privacy concerns and advertising intrusiveness, the adoption of ad-blocking technologies may impact reach and frequency metrics for certain advertising campaigns, requiring advertisers to develop more engaging and less intrusive advertising approaches.

Artificial intelligence integration presents substantial opportunities for enhancing advertising effectiveness and efficiency. AI-powered targeting algorithms, predictive analytics, and automated optimization tools enable advertisers to achieve better campaign performance while reducing manual management requirements. Machine learning applications in audience segmentation and creative optimization offer competitive advantages for early adopters.

Voice search optimization represents an emerging opportunity as smart speakers and voice assistants gain popularity among Indonesian consumers. Advertisers who develop voice-optimized advertising strategies and content can capture early market share in this growing segment. Voice commerce integration creates additional touchpoints for advertising engagement and conversion.

Augmented reality advertising offers innovative ways to engage consumers through immersive brand experiences. As smartphone capabilities improve and AR technology becomes more accessible, advertisers can create interactive campaigns that blend digital content with real-world environments, particularly effective for retail, automotive, and lifestyle brands.

Cross-border e-commerce growth creates opportunities for international brands to enter the Indonesian market through digital advertising channels. The increasing acceptance of international products and services, combined with improved logistics and payment solutions, enables foreign advertisers to effectively reach Indonesian consumers through localized digital marketing campaigns.

Competitive intensity continues to escalate as both local and international players vie for market share in Indonesia’s digital advertising landscape. Global technology giants compete with regional specialists and local startups, creating a dynamic ecosystem that drives innovation and service improvement. This competition benefits advertisers through improved platform capabilities, competitive pricing, and enhanced targeting options.

Consumer behavior evolution significantly influences advertising strategies and platform development. Indonesian consumers demonstrate increasing sophistication in digital interactions, expecting personalized, relevant, and non-intrusive advertising experiences. This evolution drives demand for advanced targeting capabilities, creative personalization, and privacy-compliant advertising solutions.

Technology convergence blurs traditional boundaries between advertising channels, creating integrated marketing ecosystems. The convergence of social media, e-commerce, entertainment, and communication platforms enables advertisers to create cohesive cross-platform campaigns that follow consumers throughout their digital journey, improving campaign effectiveness and measurement accuracy.

Economic fluctuations impact advertising spending patterns, with businesses adjusting digital marketing budgets based on economic conditions. However, digital advertising often demonstrates greater resilience compared to traditional advertising during economic downturns, as businesses seek more measurable and cost-effective marketing solutions. According to MarkWide Research analysis, digital advertising maintains growth momentum even during challenging economic periods.

Primary research methodologies employed in analyzing Indonesia’s digital advertising market include comprehensive surveys of advertising agencies, in-depth interviews with platform executives, and focus group discussions with target consumers. These primary sources provide current market insights, emerging trend identification, and qualitative understanding of market dynamics affecting advertising effectiveness and consumer engagement patterns.

Secondary research encompasses analysis of industry reports, government statistics, platform transparency reports, and academic studies related to digital marketing in Indonesia. This research foundation provides historical context, market sizing validation, and trend analysis necessary for comprehensive market understanding. Data triangulation ensures accuracy and reliability of market insights and projections.

Quantitative analysis includes statistical modeling of advertising spend patterns, performance metrics analysis, and correlation studies between economic indicators and digital advertising growth. Advanced analytics techniques help identify market drivers, forecast future trends, and quantify the impact of various factors on market development.

Qualitative assessment involves expert interviews with industry leaders, regulatory analysis, and cultural factor evaluation that influences advertising effectiveness in Indonesia’s diverse market. This qualitative dimension provides context for quantitative findings and helps explain market phenomena that purely statistical analysis might overlook.

Java Island dominance characterizes Indonesia’s digital advertising market distribution, with Jakarta, Surabaya, and Bandung accounting for approximately 68% of total digital advertising spend. This concentration reflects the region’s economic importance, higher internet penetration rates, and greater concentration of businesses with substantial marketing budgets. Java’s advanced digital infrastructure supports sophisticated advertising campaigns and higher engagement rates.

Sumatra’s emerging potential represents significant growth opportunities, particularly in cities like Medan, Palembang, and Pekanbaru. The region demonstrates increasing internet adoption and growing e-commerce activity, creating expanding markets for digital advertising. Local businesses in Sumatra increasingly recognize digital marketing benefits, driving demand for advertising services and platforms.

Eastern Indonesia development shows promising trends despite infrastructure challenges. Cities in Sulawesi, Kalimantan, and Papua demonstrate growing digital engagement, though at lower absolute levels compared to western regions. Government infrastructure development initiatives and private sector investments in telecommunications are gradually improving digital advertising market conditions in these areas.

Regional customization requirements vary significantly across Indonesia’s diverse geographic and cultural landscape. Advertisers must adapt campaigns to local languages, cultural preferences, and economic conditions. Successful regional strategies often involve partnerships with local agencies and influencers who understand specific market nuances and consumer behaviors.

Market leadership in Indonesia’s digital advertising sector involves both global technology platforms and specialized regional players:

Competitive differentiation occurs through platform-specific features, targeting capabilities, creative formats, and local market expertise. Companies invest heavily in local partnerships, Indonesian language support, and culturally relevant advertising solutions to maintain competitive advantages in this diverse market.

By Platform Type:

By Industry Vertical:

By Business Size:

Search advertising maintains strong performance in Indonesia, particularly for high-intent commercial queries. Indonesian consumers frequently use search engines for product research and price comparison, making search advertising effective for capturing purchase-ready audiences. Local language optimization and mobile-friendly ad formats prove crucial for search campaign success.

Social media advertising demonstrates exceptional engagement rates, with Indonesian users among the most active social media participants globally. Platform-specific strategies prove essential, as user behavior varies significantly between Facebook, Instagram, TikTok, and other platforms. Video content and interactive formats consistently outperform static advertising creative.

Mobile advertising represents the fastest-growing category, driven by smartphone-first internet adoption patterns. App install campaigns, mobile web advertising, and location-based targeting show strong performance metrics. Mobile advertising formats must account for varying screen sizes, network speeds, and user interaction patterns across different device categories.

Programmatic advertising gains traction among sophisticated advertisers seeking efficiency and scale. Real-time bidding platforms enable precise audience targeting and automated optimization, though transparency and brand safety concerns require careful vendor selection and campaign monitoring. MWR data indicates programmatic adoption accelerating among enterprise advertisers.

Advertisers benefit from Indonesia’s digital advertising market through access to highly engaged audiences, sophisticated targeting capabilities, and measurable campaign performance. The market offers cost-effective customer acquisition compared to traditional advertising channels, with detailed analytics enabling continuous optimization and improved return on investment.

Publishers and content creators gain monetization opportunities through various advertising formats and revenue-sharing models. The growing advertiser demand creates competitive rates for quality inventory, while programmatic advertising platforms provide automated revenue optimization. Local content creators particularly benefit from brand partnership opportunities and influencer marketing campaigns.

Technology platforms experience substantial revenue growth from advertising services, with Indonesia representing one of the fastest-growing markets globally. Platform operators invest in local infrastructure, customer support, and market-specific features to capture increasing advertiser spending and maintain competitive positioning.

Consumers receive more relevant and personalized advertising experiences through advanced targeting and creative optimization. Digital advertising often provides valuable information about products and services, special offers, and local business discovery. Interactive advertising formats create engaging experiences that add entertainment value beyond traditional promotional content.

Strengths:

Weaknesses:

Opportunities:

Threats:

Video-first content strategy dominates Indonesian digital advertising trends, with short-form video content achieving exceptional engagement rates. Platforms like TikTok and Instagram Reels drive this trend, requiring advertisers to adapt creative strategies for vertical video formats and mobile-optimized viewing experiences. Live streaming integration creates real-time advertising opportunities.

Social commerce integration blurs boundaries between social media and e-commerce platforms, enabling seamless shopping experiences within social environments. This trend reduces friction in the customer journey from advertisement exposure to purchase completion, improving conversion rates and advertising effectiveness for retail and consumer goods advertisers.

Influencer marketing evolution shifts toward micro and nano-influencers who demonstrate higher engagement rates and authentic connections with niche audiences. Brands increasingly prefer working with multiple smaller influencers rather than single celebrity endorsements, creating more diverse and cost-effective influencer marketing strategies.

Privacy-first advertising emerges as consumers become more aware of data collection practices. Advertisers adapt strategies to rely less on third-party cookies and more on first-party data, contextual targeting, and privacy-compliant audience building techniques. This trend drives innovation in advertising technology and measurement methodologies.

Platform feature expansions continue reshaping Indonesia’s digital advertising landscape, with major platforms introducing new advertising formats, targeting options, and measurement capabilities. Recent developments include enhanced video advertising tools, augmented reality ad formats, and improved cross-platform campaign management systems.

Local partnership initiatives strengthen international platforms’ market presence through collaborations with Indonesian businesses, agencies, and content creators. These partnerships provide cultural insights, local market expertise, and distribution channels necessary for effective advertising campaign execution in Indonesia’s diverse market.

Regulatory compliance updates reflect government efforts to balance digital economy growth with consumer protection and fair competition. New regulations address data privacy, content standards, and taxation policies affecting digital advertising operations. Industry participants actively engage with regulators to ensure balanced policy development.

Technology infrastructure investments by telecommunications companies and government initiatives improve internet connectivity and speed across Indonesia. These improvements enable more sophisticated advertising formats, better user experiences, and expanded market reach for digital advertising campaigns, particularly benefiting video and interactive advertising formats.

Market entry strategies for new advertisers should prioritize mobile-first approaches and local market understanding. MarkWide Research recommends starting with social media advertising to build brand awareness before expanding to search and display advertising channels. Cultural sensitivity and Indonesian language optimization prove crucial for campaign success.

Budget allocation optimization suggests balancing brand awareness and performance marketing objectives through diversified platform strategies. Advertisers should allocate approximately 60% of budgets to proven platforms while reserving 40% for testing emerging channels and innovative advertising formats. Regular performance analysis enables data-driven budget reallocation.

Creative strategy development must account for Indonesia’s cultural diversity and regional preferences. Successful campaigns often feature local talent, Indonesian language content, and culturally relevant messaging. Video content should be optimized for mobile viewing with clear calls-to-action and engaging storytelling that resonates with local audiences.

Measurement and analytics implementation requires comprehensive tracking across multiple touchpoints and platforms. Advertisers should invest in attribution modeling, customer lifetime value analysis, and cross-platform performance measurement to optimize campaign effectiveness and demonstrate return on investment to stakeholders.

Market growth trajectory indicates continued expansion driven by increasing internet penetration, smartphone adoption, and digital commerce development. The market is projected to maintain robust growth rates exceeding 12% annually over the next five years, supported by favorable demographic trends and improving digital infrastructure across Indonesia.

Technology advancement integration will reshape advertising capabilities through artificial intelligence, machine learning, and automation technologies. These developments will enable more precise targeting, dynamic creative optimization, and predictive analytics that improve campaign performance while reducing manual management requirements for advertisers.

Platform ecosystem evolution suggests increasing consolidation and integration between advertising, e-commerce, and entertainment platforms. This convergence will create more comprehensive advertising solutions but may also increase competition and require advertisers to adapt strategies for integrated platform environments.

Regulatory framework development will likely bring greater clarity and standardization to digital advertising practices in Indonesia. While this may introduce compliance requirements, it should also increase advertiser confidence and create more stable market conditions for long-term strategic planning and investment.

Indonesia’s digital advertising market represents one of Southeast Asia’s most compelling growth opportunities, characterized by exceptional demographic advantages, rapid technology adoption, and evolving consumer behaviors that favor digital engagement. The market’s trajectory reflects broader digital transformation trends while maintaining unique characteristics that require specialized approaches and local market understanding.

Strategic success factors in this market include mobile-first optimization, cultural sensitivity, platform diversification, and continuous performance measurement. Advertisers who invest in understanding Indonesian consumer preferences, leverage local partnerships, and adapt to emerging technology trends position themselves for sustained growth in this dynamic market environment.

Future market development will be shaped by infrastructure improvements, regulatory clarity, and technology innovation that enhances advertising effectiveness while respecting consumer privacy preferences. The market’s continued evolution presents ongoing opportunities for both established players and new entrants willing to invest in comprehensive market understanding and localized advertising strategies that resonate with Indonesia’s diverse and engaged digital audience.

What is Digital Advertising?

Digital advertising refers to the use of online platforms and technologies to promote products or services. It encompasses various formats such as display ads, social media marketing, search engine marketing, and video advertising, all aimed at reaching consumers through digital channels.

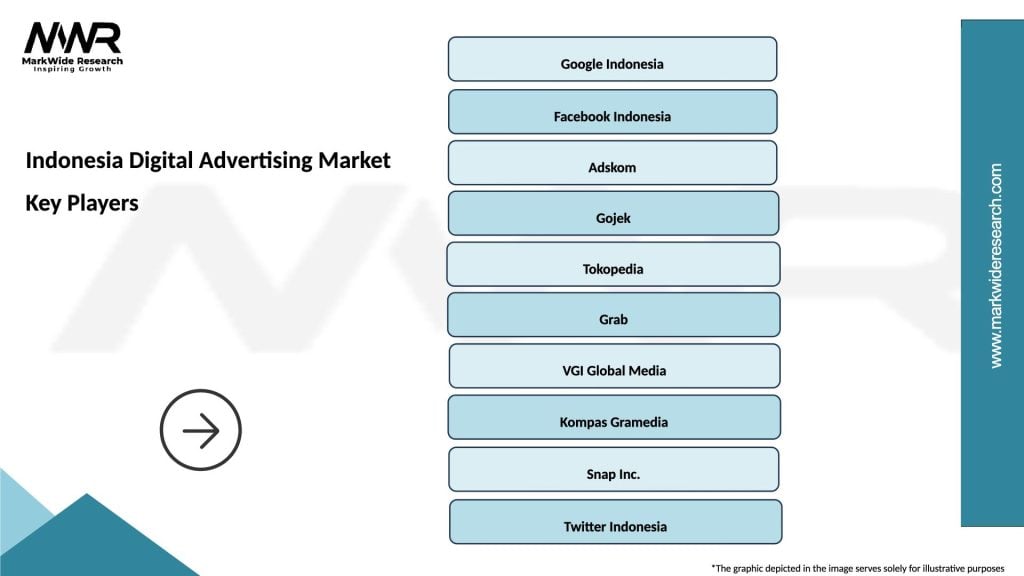

What are the key players in the Indonesia Digital Advertising Market?

Key players in the Indonesia Digital Advertising Market include companies like Gojek, Tokopedia, and Grab, which leverage digital platforms for advertising. Additionally, global firms such as Google and Facebook play significant roles in shaping the advertising landscape in Indonesia, among others.

What are the growth factors driving the Indonesia Digital Advertising Market?

The growth of the Indonesia Digital Advertising Market is driven by increasing internet penetration, the rise of mobile device usage, and the growing popularity of social media platforms. Additionally, businesses are increasingly recognizing the importance of digital marketing for reaching their target audiences effectively.

What challenges does the Indonesia Digital Advertising Market face?

The Indonesia Digital Advertising Market faces challenges such as intense competition among advertisers, issues related to data privacy, and the need for continuous adaptation to rapidly changing consumer behaviors. These factors can complicate campaign effectiveness and ROI measurement.

What opportunities exist in the Indonesia Digital Advertising Market?

Opportunities in the Indonesia Digital Advertising Market include the expansion of e-commerce, the increasing use of artificial intelligence for targeted advertising, and the potential for innovative ad formats such as augmented reality. These trends can enhance engagement and conversion rates for advertisers.

What trends are shaping the Indonesia Digital Advertising Market?

Trends shaping the Indonesia Digital Advertising Market include the growing emphasis on personalized advertising, the rise of influencer marketing, and the integration of video content into advertising strategies. These trends reflect changing consumer preferences and the need for brands to connect more authentically with their audiences.

Indonesia Digital Advertising Market

| Segmentation Details | Description |

|---|---|

| Product Type | Display Ads, Video Ads, Social Media Ads, Search Ads |

| Customer Type | Small Businesses, Large Enterprises, E-commerce, Startups |

| Platform | Mobile, Desktop, Social Media, Streaming Services |

| Ad Format | Native Ads, Banner Ads, Sponsored Content, Retargeting Ads |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia Digital Advertising Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at