444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia data center cooling market represents a rapidly expanding segment within Southeast Asia’s digital infrastructure landscape. As Indonesia continues its digital transformation journey, the demand for efficient cooling solutions in data centers has experienced unprecedented growth, driven by increasing cloud adoption, digital services expansion, and the country’s strategic position as a regional technology hub. The market encompasses various cooling technologies including air conditioning systems, liquid cooling solutions, and innovative hybrid approaches designed to maintain optimal operating temperatures in data center facilities.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 12.5% as organizations prioritize energy-efficient cooling solutions. The tropical climate of Indonesia presents unique challenges for data center operators, necessitating advanced cooling technologies that can operate effectively in high-temperature, high-humidity environments while maintaining cost-effectiveness and energy efficiency.

Key market drivers include the rapid digitalization of Indonesian businesses, government initiatives supporting digital infrastructure development, and increasing investments from global technology companies establishing regional data center operations. The market benefits from Indonesia’s growing internet penetration rate of 73.7% and the expanding e-commerce sector, which collectively drive demand for reliable data center infrastructure and associated cooling solutions.

The Indonesia data center cooling market refers to the comprehensive ecosystem of technologies, products, and services designed to maintain optimal temperature and humidity levels within data center facilities across Indonesia. This market encompasses traditional cooling methods such as computer room air conditioning (CRAC) units, precision air conditioning systems, and advanced solutions including liquid cooling, free cooling, and hybrid cooling technologies specifically adapted for Indonesia’s tropical climate conditions.

Data center cooling is critical for ensuring the reliable operation of servers, storage systems, and networking equipment, preventing overheating that could lead to system failures, data loss, and significant operational disruptions. In Indonesia’s context, cooling solutions must address the challenges posed by consistently high ambient temperatures, elevated humidity levels, and the need for energy-efficient operations to manage operational costs effectively.

Indonesia’s data center cooling market is experiencing transformative growth as the country positions itself as a digital economy leader in Southeast Asia. The market is characterized by increasing adoption of energy-efficient cooling technologies, with air-based cooling solutions currently dominating approximately 68% of the market share, while liquid cooling and hybrid solutions are gaining traction among hyperscale data center operators.

Key market trends include the shift toward sustainable cooling practices, integration of artificial intelligence for cooling optimization, and the adoption of modular cooling systems that offer scalability and flexibility. Major international cooling technology providers are establishing local partnerships and manufacturing capabilities to serve the growing Indonesian market more effectively.

Regional distribution shows Jakarta and surrounding areas accounting for 45% of cooling system deployments, followed by Surabaya and other major urban centers. The market benefits from supportive government policies promoting digital infrastructure development and foreign investment in technology sectors, creating favorable conditions for continued expansion.

Strategic insights reveal several critical factors shaping the Indonesia data center cooling market landscape:

Digital transformation initiatives across Indonesian enterprises serve as the primary catalyst for data center cooling market expansion. Government programs promoting digital economy development, including the Making Indonesia 4.0 initiative, drive substantial investments in digital infrastructure, directly increasing demand for reliable cooling solutions.

Cloud adoption acceleration among Indonesian businesses necessitates expanded data center capacity, with cloud services penetration reaching 35% and growing rapidly. This trend requires sophisticated cooling systems capable of supporting high-density computing environments and variable workload patterns characteristic of cloud infrastructure.

E-commerce growth in Indonesia, particularly following the COVID-19 pandemic, has created unprecedented demand for data processing and storage capabilities. Major e-commerce platforms and digital payment systems require robust data center infrastructure with reliable cooling systems to ensure continuous service availability and optimal performance.

International investment from global technology companies establishing regional operations in Indonesia drives demand for world-class data center facilities. These investments bring advanced cooling technology requirements and best practices that elevate overall market standards and drive innovation adoption.

High initial capital investment requirements for advanced cooling systems present significant barriers for smaller data center operators and enterprises. The cost of implementing energy-efficient cooling technologies, while offering long-term operational savings, requires substantial upfront investment that may challenge budget-constrained organizations.

Technical expertise shortage in Indonesia’s cooling technology sector limits market growth potential. The specialized knowledge required for designing, installing, and maintaining advanced cooling systems creates dependency on international expertise and increases implementation costs for local operators.

Infrastructure limitations in certain Indonesian regions, including unreliable power supply and limited telecommunications connectivity, constrain data center development and associated cooling system deployments. These infrastructure gaps particularly affect expansion into secondary cities and rural areas.

Regulatory complexity surrounding environmental standards, import procedures, and technology certification processes can delay cooling system implementations and increase compliance costs for market participants.

Green data center initiatives present substantial opportunities for cooling technology providers offering sustainable solutions. Indonesian organizations increasingly prioritize environmental responsibility, creating demand for cooling systems utilizing natural refrigerants, renewable energy integration, and waste heat recovery technologies.

Edge computing expansion across Indonesia’s archipelago creates opportunities for distributed cooling solutions designed for smaller, remote data center facilities. The need for low-latency services in various Indonesian islands drives demand for edge data centers with specialized cooling requirements.

Government digitalization projects including smart city initiatives, digital identity systems, and e-governance platforms require substantial data center infrastructure investments, creating opportunities for cooling system providers to participate in large-scale public sector projects.

Manufacturing sector digitalization in Indonesia’s industrial regions presents opportunities for cooling solutions supporting industrial IoT applications, manufacturing execution systems, and supply chain digitalization initiatives requiring robust data processing capabilities.

Competitive dynamics in the Indonesia data center cooling market reflect a balance between established international providers and emerging local players. Global cooling technology leaders leverage their technological expertise and established customer relationships, while local companies compete on cost-effectiveness, rapid deployment capabilities, and intimate knowledge of Indonesian market conditions.

Technology evolution drives continuous market transformation, with artificial intelligence integration enabling predictive cooling optimization, reducing energy consumption by 15-20% compared to traditional cooling management approaches. Machine learning algorithms analyze environmental conditions, IT load patterns, and equipment performance to optimize cooling system operations automatically.

Supply chain considerations significantly impact market dynamics, particularly regarding component availability, import logistics, and local manufacturing capabilities. The COVID-19 pandemic highlighted supply chain vulnerabilities, prompting market participants to develop more resilient sourcing strategies and local partnership networks.

Customer expectations continue evolving toward comprehensive cooling solutions that integrate seamlessly with existing data center infrastructure while providing real-time monitoring, predictive maintenance capabilities, and energy efficiency optimization features.

Primary research methodology employed comprehensive data collection through structured interviews with key market participants, including data center operators, cooling system manufacturers, technology integrators, and industry consultants operating within the Indonesian market. This approach provided direct insights into market trends, challenges, and growth opportunities from stakeholders actively engaged in market activities.

Secondary research involved extensive analysis of industry reports, government publications, trade association data, and company financial statements to validate primary research findings and establish comprehensive market understanding. Sources included Indonesian Ministry of Communication and Information Technology reports, industry association publications, and cooling technology manufacturer documentation.

Market sizing methodology utilized bottom-up and top-down approaches, analyzing data center capacity growth, cooling system replacement cycles, and new installation requirements across various market segments. This methodology ensured accurate representation of market dynamics and growth projections.

Data validation processes included triangulation of information sources, expert panel reviews, and statistical analysis to ensure research accuracy and reliability. MarkWide Research employed rigorous quality control measures throughout the research process to maintain data integrity and analytical precision.

Jakarta metropolitan area dominates the Indonesian data center cooling market, accounting for approximately 45% of total cooling system deployments. The region benefits from concentrated business activity, superior telecommunications infrastructure, and proximity to major international submarine cable landing points, making it the preferred location for hyperscale data center facilities requiring advanced cooling solutions.

Surabaya and East Java represent the second-largest regional market, capturing 18% of cooling system installations. The region’s industrial base, growing technology sector, and government support for digital infrastructure development drive steady demand for data center cooling solutions, particularly among manufacturing companies implementing Industry 4.0 initiatives.

Bandung and West Java contribute 12% of market activity, supported by the region’s educational institutions, technology startups, and proximity to Jakarta’s business ecosystem. The area’s cooler climate compared to other Indonesian regions provides some natural advantages for data center cooling efficiency.

Other regional markets including Medan, Makassar, and Denpasar collectively account for 25% of cooling system deployments, with growth driven by regional economic development, tourism industry digitalization, and government decentralization initiatives promoting technology infrastructure development outside Java.

Market leadership in Indonesia’s data center cooling sector reflects a diverse ecosystem of international technology providers and local system integrators. The competitive landscape is characterized by strategic partnerships, technology localization initiatives, and comprehensive service offerings designed to address Indonesia’s unique market requirements.

Competitive strategies focus on local partnership development, technology adaptation for tropical conditions, and comprehensive service offerings including installation, maintenance, and optimization services. Market leaders invest in local technical training programs and establish regional service centers to enhance customer support capabilities.

By Technology:

By Data Center Type:

By End-User Industry:

Air-based cooling systems maintain market dominance due to their proven reliability, established maintenance expertise, and cost-effectiveness for moderate-density computing environments. These systems benefit from continuous technological improvements including variable speed fans, advanced filtration systems, and intelligent control algorithms optimized for tropical conditions.

Liquid cooling solutions are experiencing accelerated adoption, particularly in hyperscale data centers and high-performance computing environments. The technology offers superior cooling efficiency for high-density server configurations, with adoption rates increasing 28% annually as organizations seek to optimize space utilization and energy consumption.

Hybrid cooling approaches represent the fastest-growing segment, combining the reliability of air-based systems with the efficiency advantages of liquid cooling technologies. These solutions provide flexibility to optimize cooling strategies based on seasonal variations, load patterns, and specific application requirements.

Free cooling integration gains traction despite Indonesia’s tropical climate, with innovative approaches leveraging nighttime temperature differentials and advanced heat exchanger technologies to achieve energy savings during favorable ambient conditions.

Data center operators benefit from advanced cooling solutions through reduced operational costs, improved system reliability, and enhanced energy efficiency. Modern cooling systems offer Power Usage Effectiveness (PUE) improvements of 15-25% compared to legacy systems, directly impacting operational profitability and environmental sustainability goals.

Technology providers gain access to Indonesia’s rapidly expanding digital infrastructure market, with opportunities for long-term service contracts, technology localization initiatives, and strategic partnerships with local system integrators. The market offers substantial revenue potential through equipment sales, maintenance services, and optimization consulting.

End-user organizations achieve improved IT infrastructure reliability, reduced downtime risks, and enhanced operational efficiency through advanced cooling solutions. These benefits translate to better customer service delivery, reduced business continuity risks, and improved competitive positioning in digital markets.

Government stakeholders benefit from enhanced digital infrastructure capabilities supporting economic development, improved public service delivery, and achievement of national digitalization objectives. Advanced cooling technologies contribute to energy efficiency goals and environmental sustainability initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence integration in cooling system management represents a transformative trend, with AI-powered optimization algorithms reducing energy consumption while maintaining optimal operating conditions. These systems learn from historical data, weather patterns, and IT load variations to predict cooling requirements and adjust operations proactively.

Sustainability focus drives adoption of eco-friendly refrigerants, energy-efficient technologies, and waste heat recovery systems. Indonesian organizations increasingly prioritize environmental responsibility, with 62% of data center operators implementing sustainability initiatives including advanced cooling technologies.

Modular cooling architectures gain popularity due to their scalability, flexibility, and reduced implementation complexity. These solutions enable data center operators to deploy cooling capacity incrementally, aligning with business growth and reducing initial capital requirements.

Predictive maintenance adoption leverages IoT sensors and analytics platforms to monitor cooling system performance continuously, identifying potential issues before they impact operations. This approach reduces maintenance costs and improves system reliability significantly.

Liquid cooling mainstream adoption accelerates as server densities increase and organizations seek maximum cooling efficiency. Advanced liquid cooling solutions offer superior thermal management for high-performance computing applications and AI workloads.

Strategic partnerships between international cooling technology providers and Indonesian system integrators enhance market penetration and service delivery capabilities. These collaborations combine global technological expertise with local market knowledge and service networks.

Technology localization initiatives include establishment of local manufacturing facilities, regional service centers, and technical training programs. Major cooling system providers invest in Indonesian operations to reduce costs, improve service delivery, and support market expansion.

Innovation in tropical climate optimization drives development of cooling solutions specifically designed for Indonesia’s environmental conditions. These innovations include advanced humidity control, corrosion-resistant materials, and energy-efficient operation in high ambient temperatures.

Government infrastructure investments in digital connectivity, power grid improvements, and technology parks create favorable conditions for data center development and associated cooling system deployments. MWR analysis indicates these investments significantly impact market growth trajectories.

Market entry strategies should prioritize local partnership development and technology adaptation for Indonesian conditions. Successful market participants invest in understanding local requirements, regulatory environment, and customer preferences while maintaining global technology standards and service quality.

Technology investment priorities should focus on energy-efficient solutions, AI-powered optimization, and modular architectures that provide flexibility and scalability. Organizations should evaluate cooling technologies based on total cost of ownership rather than initial capital requirements alone.

Service capability development represents a critical success factor, with customers increasingly valuing comprehensive support including installation, maintenance, optimization, and emergency response services. Building local service capabilities enhances customer satisfaction and creates recurring revenue opportunities.

Sustainability integration should be incorporated into all cooling solution offerings, as environmental responsibility becomes increasingly important for Indonesian organizations. This includes eco-friendly refrigerants, energy efficiency optimization, and waste heat recovery capabilities.

Market growth trajectory indicates continued expansion driven by Indonesia’s digital transformation momentum, with cooling system deployments expected to maintain strong growth rates exceeding 12% annually through the forecast period. This growth reflects sustained investment in digital infrastructure and increasing adoption of advanced cooling technologies.

Technology evolution will emphasize artificial intelligence integration, sustainability enhancement, and efficiency optimization. Future cooling solutions will incorporate machine learning algorithms, renewable energy integration, and advanced materials designed specifically for tropical climate operation.

Market consolidation may occur as smaller players seek partnerships with established technology providers to compete effectively. This trend could lead to enhanced service capabilities and more comprehensive solution offerings for Indonesian customers.

Regional expansion beyond Java will accelerate as digital infrastructure development spreads across Indonesia’s archipelago. Edge computing requirements and government decentralization initiatives will drive cooling system demand in secondary cities and remote regions.

MarkWide Research projects that liquid cooling adoption will reach 25% market share within five years, driven by increasing server densities and efficiency requirements. This shift represents significant opportunities for technology providers offering advanced liquid cooling solutions.

Indonesia’s data center cooling market presents exceptional growth opportunities driven by rapid digital transformation, government support for technology infrastructure, and increasing international investment in regional data center facilities. The market benefits from strong fundamentals including growing internet penetration, expanding e-commerce sector, and accelerating cloud adoption across various industries.

Success factors for market participants include technology adaptation for tropical conditions, local partnership development, comprehensive service capabilities, and sustainability integration. Organizations that effectively address Indonesia’s unique climate challenges while providing energy-efficient, scalable cooling solutions will capture the greatest market opportunities.

Future market development will be characterized by continued technology innovation, increasing adoption of AI-powered optimization, and expansion beyond traditional data center hubs into edge computing applications. The market’s evolution toward more sustainable, efficient cooling solutions aligns with Indonesia’s broader environmental and economic development objectives, creating a foundation for sustained long-term growth.

What is Data Center Cooling?

Data Center Cooling refers to the methods and technologies used to maintain optimal temperature and humidity levels in data centers, ensuring the efficient operation of servers and IT equipment. Effective cooling is crucial for preventing overheating and ensuring reliability in data center operations.

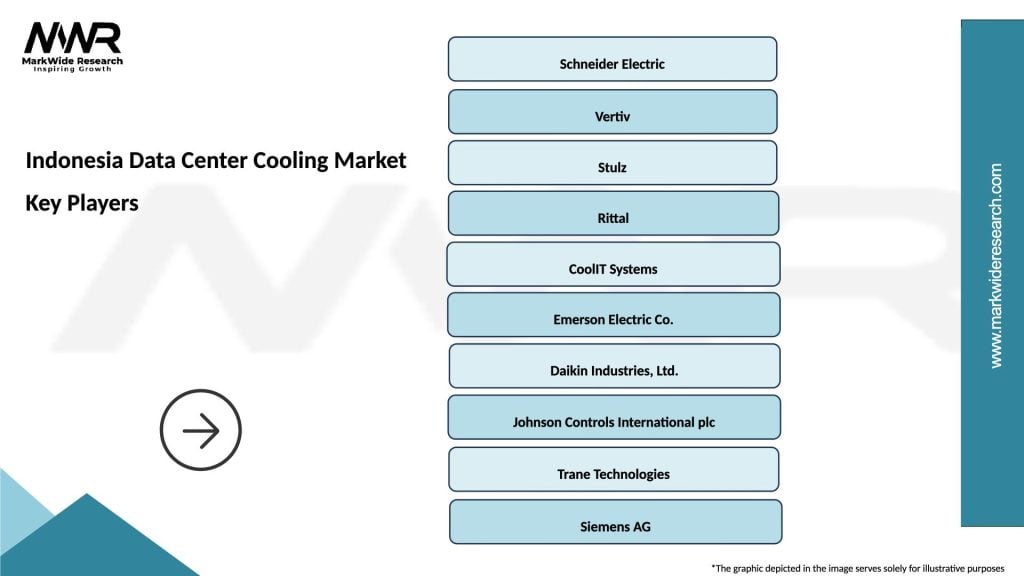

What are the key players in the Indonesia Data Center Cooling Market?

Key players in the Indonesia Data Center Cooling Market include Schneider Electric, Vertiv, and STULZ, which provide various cooling solutions and technologies tailored for data centers. These companies focus on energy efficiency and innovative cooling systems, among others.

What are the main drivers of the Indonesia Data Center Cooling Market?

The main drivers of the Indonesia Data Center Cooling Market include the rapid growth of data centers due to increased digitalization, the rising demand for cloud services, and the need for energy-efficient cooling solutions. Additionally, regulatory pressures for sustainability are pushing companies to adopt advanced cooling technologies.

What challenges does the Indonesia Data Center Cooling Market face?

The Indonesia Data Center Cooling Market faces challenges such as high initial investment costs for advanced cooling systems and the complexity of integrating new technologies with existing infrastructure. Additionally, the fluctuating energy prices can impact operational costs for data center operators.

What opportunities exist in the Indonesia Data Center Cooling Market?

Opportunities in the Indonesia Data Center Cooling Market include the increasing adoption of green technologies and the development of innovative cooling solutions that enhance energy efficiency. Furthermore, the expansion of cloud computing and big data analytics presents significant growth potential for cooling providers.

What trends are shaping the Indonesia Data Center Cooling Market?

Trends shaping the Indonesia Data Center Cooling Market include the shift towards liquid cooling solutions, the integration of artificial intelligence for monitoring and optimizing cooling systems, and the growing emphasis on sustainability and energy efficiency. These trends are driving innovation and investment in the sector.

Indonesia Data Center Cooling Market

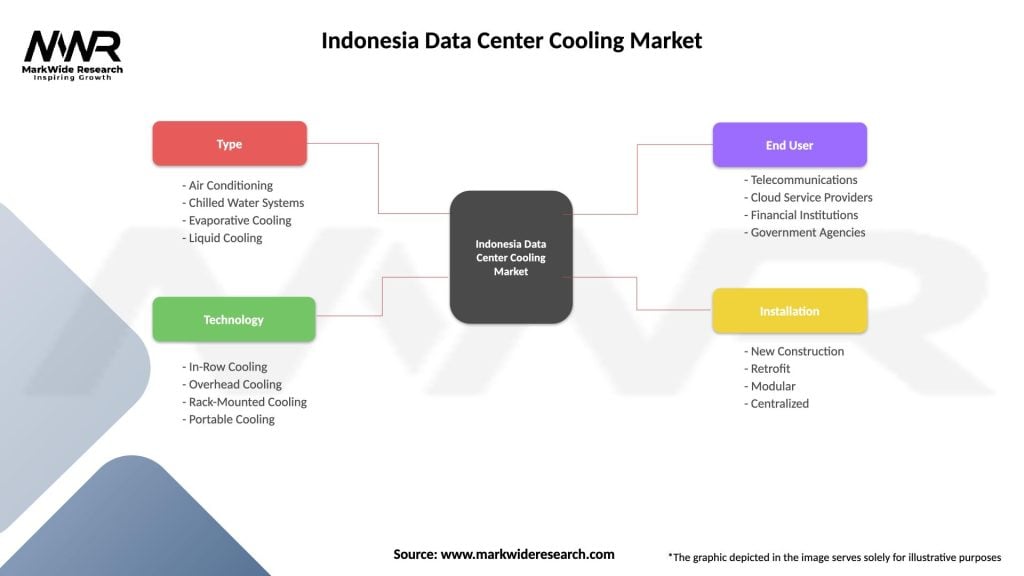

| Segmentation Details | Description |

|---|---|

| Type | Air Conditioning, Chilled Water Systems, Evaporative Cooling, Liquid Cooling |

| Technology | In-Row Cooling, Overhead Cooling, Rack-Mounted Cooling, Portable Cooling |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government Agencies |

| Installation | New Construction, Retrofit, Modular, Centralized |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia Data Center Cooling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at