444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia data center construction market represents one of Southeast Asia’s most dynamic and rapidly expanding technology infrastructure sectors. Indonesia’s digital transformation has accelerated significantly, driven by increasing internet penetration, cloud adoption, and the growing demand for digital services across the archipelago. The market demonstrates robust growth momentum with a projected compound annual growth rate of 12.5% CAGR through the forecast period, positioning Indonesia as a critical hub for regional data center development.

Strategic geographic positioning makes Indonesia an attractive destination for international data center investments, serving as a gateway to the broader Southeast Asian market. The country’s digital economy expansion has created substantial demand for modern data center facilities, with enterprises increasingly requiring sophisticated infrastructure to support their digital operations. Government initiatives promoting digitalization and foreign investment have further catalyzed market growth, creating favorable conditions for both domestic and international data center developers.

Market dynamics indicate strong demand across multiple sectors, including telecommunications, banking, e-commerce, and government services. The increasing adoption of cloud computing services and the proliferation of mobile devices have created unprecedented data storage and processing requirements. Edge computing deployment is gaining traction as organizations seek to reduce latency and improve service delivery across Indonesia’s diverse geographical landscape.

The Indonesia data center construction market refers to the comprehensive ecosystem encompassing the planning, design, construction, and deployment of data center facilities across Indonesia. This market includes various facility types ranging from hyperscale data centers operated by major cloud service providers to smaller enterprise data centers serving specific organizational needs. The construction aspect involves specialized infrastructure development including power systems, cooling technologies, security implementations, and network connectivity solutions.

Data center construction in Indonesia encompasses both greenfield developments and brownfield expansions, incorporating advanced technologies such as modular construction techniques and sustainable building practices. The market includes various stakeholders including construction companies, technology vendors, real estate developers, and facility management service providers. Regulatory compliance and adherence to international standards form critical components of the construction process, ensuring facilities meet operational efficiency and security requirements.

Indonesia’s data center construction market has emerged as a cornerstone of the nation’s digital infrastructure development strategy. The market benefits from strong government support through various digitalization initiatives and favorable investment policies designed to attract international technology companies. Jakarta and surrounding areas continue to dominate construction activity, accounting for approximately 65% of total market share, while emerging regions like Surabaya and Bandung are gaining momentum as secondary hubs.

Investment flows from major global cloud service providers have significantly boosted construction activity, with several hyperscale facilities under development or recently completed. The market demonstrates increasing sophistication in terms of energy efficiency, sustainability practices, and advanced cooling technologies. Local construction capabilities have evolved rapidly to meet international standards, supported by partnerships with global technology vendors and engineering firms.

Market challenges include land availability in prime locations, power grid reliability, and skilled workforce development. However, these challenges are being addressed through strategic government initiatives and private sector investments in infrastructure development. The outlook remains highly positive, with MarkWide Research projecting sustained growth driven by digital transformation across multiple industry sectors.

Strategic market insights reveal several critical trends shaping Indonesia’s data center construction landscape:

Digital transformation acceleration across Indonesian enterprises serves as the primary driver for data center construction demand. Organizations are increasingly migrating to cloud-based solutions and require robust infrastructure to support their digital operations. The rapid growth of e-commerce platforms and digital payment systems has created substantial demand for reliable data processing and storage capabilities.

Government digitalization initiatives including the implementation of electronic government services and smart city projects have significantly boosted infrastructure requirements. The Indonesia Digital Roadmap 2045 emphasizes the critical role of data centers in achieving national digital transformation goals. Regulatory support through favorable investment policies and streamlined permitting processes has encouraged both domestic and international investments.

Internet penetration growth continues to drive demand, with mobile internet usage reaching 73% penetration rate across the population. The proliferation of Internet of Things (IoT) devices and smart applications requires sophisticated data processing capabilities. 5G network deployment is creating additional demand for edge computing facilities to support low-latency applications and services.

Foreign investment attraction has been facilitated by Indonesia’s strategic position as a regional hub for Southeast Asian operations. Major global technology companies are establishing regional data center presence to serve local and regional markets effectively. The growing demand for data localization compliance has further accelerated domestic construction activity.

Infrastructure limitations present significant challenges for data center construction, particularly regarding power grid reliability and capacity. Electricity supply constraints in certain regions limit the scale and location options for large-scale facilities. The need for backup power systems and redundant infrastructure increases construction costs and complexity.

Land availability in prime locations, especially within Jakarta and surrounding areas, has become increasingly scarce and expensive. Zoning regulations and urban planning restrictions limit suitable locations for data center development. The competition for industrial land with other sectors has driven up acquisition costs significantly.

Skilled workforce shortage in specialized data center construction and operations poses ongoing challenges. The need for technical expertise in areas such as cooling systems, power management, and network infrastructure requires substantial training investments. Construction timeline delays often result from the limited availability of qualified contractors and technicians.

Environmental considerations including tropical climate challenges require specialized cooling solutions and weather-resistant construction materials. Natural disaster risks such as earthquakes and flooding necessitate additional structural reinforcements and safety measures. Regulatory compliance with environmental standards and building codes adds complexity to the construction process.

Emerging regional markets outside Jakarta present substantial growth opportunities as digital adoption spreads across Indonesia’s diverse geography. Cities like Surabaya, Bandung, and Medan are experiencing increased demand for local data center facilities. The development of secondary hubs offers cost advantages and reduced competition for resources.

Edge computing deployment represents a significant opportunity as organizations seek to improve service delivery and reduce latency. The construction of smaller, distributed facilities can serve local markets more effectively while supporting the broader digital ecosystem. 5G network rollout will create additional demand for edge computing infrastructure across urban and rural areas.

Sustainability initiatives create opportunities for innovative construction approaches and green technology integration. The growing emphasis on renewable energy adoption opens markets for solar-powered and energy-efficient facilities. Carbon neutrality commitments from major technology companies drive demand for environmentally responsible construction practices.

Government partnerships for smart city development and digital infrastructure projects offer substantial opportunities for construction companies. Public-private partnerships can facilitate large-scale infrastructure development while sharing investment risks. The potential for export-oriented facilities serving regional markets presents additional growth avenues.

Supply and demand dynamics in Indonesia’s data center construction market reflect the rapid pace of digital transformation across multiple sectors. Demand significantly outpaces supply in key metropolitan areas, creating favorable conditions for construction companies and developers. The market demonstrates strong pricing power due to limited availability of suitable facilities and high barriers to entry.

Technology evolution continuously shapes construction requirements, with facilities needing to accommodate increasingly sophisticated hardware and software systems. Modular construction approaches are gaining traction as they offer 35% faster deployment compared to traditional methods. The integration of artificial intelligence and automation technologies into facility design is becoming standard practice.

Competitive dynamics involve both international construction firms and local companies developing specialized capabilities. Strategic partnerships between global technology providers and local construction companies are becoming increasingly common. The market shows consolidation trends as smaller players seek partnerships or acquisition opportunities to compete effectively.

Investment patterns indicate strong capital flows from both domestic and international sources, with foreign direct investment accounting for approximately 60% of total market investment. Real estate investment trusts (REITs) are emerging as important funding sources for data center construction projects. The availability of project financing has improved significantly as financial institutions recognize the sector’s growth potential.

Comprehensive market analysis was conducted using a multi-faceted research approach combining primary and secondary data sources. Primary research included structured interviews with key industry stakeholders including construction companies, technology vendors, real estate developers, and government officials. Secondary research encompassed analysis of industry reports, government publications, and company financial statements.

Data collection methods included surveys of industry participants, analysis of construction permits and project announcements, and examination of investment flows and market transactions. Quantitative analysis focused on market sizing, growth projections, and segment performance metrics. Qualitative insights were gathered through expert interviews and industry roundtable discussions.

Market validation was performed through triangulation of multiple data sources and cross-verification with industry experts. Statistical modeling was employed to develop growth projections and market forecasts. The research methodology ensures comprehensive coverage of all major market segments and geographical regions within Indonesia.

Analytical frameworks included Porter’s Five Forces analysis, SWOT assessment, and competitive positioning evaluation. Trend analysis examined historical market performance and identified key growth drivers and restraints. The methodology provides actionable insights for industry participants and stakeholders seeking to understand market dynamics and opportunities.

Jakarta Metropolitan Area dominates Indonesia’s data center construction market, accounting for approximately 65% of total construction activity. The region benefits from superior infrastructure including reliable power supply, extensive fiber connectivity, and proximity to major business centers. Land scarcity and high costs are driving some development to surrounding areas including Tangerang and Bekasi.

West Java Province represents the second-largest market, with Bandung emerging as a significant secondary hub. The region offers cost advantages compared to Jakarta while maintaining good connectivity and infrastructure. Government support for regional development has encouraged data center investments in West Java’s industrial zones.

East Java led by Surabaya is experiencing rapid growth in data center construction, driven by the region’s industrial base and growing digital economy. The area serves as a strategic location for companies seeking to serve eastern Indonesian markets. Port connectivity and logistics infrastructure provide additional advantages for data center operations.

Emerging regions including Central Java, North Sumatra, and South Sulawesi are beginning to attract data center investments as digital adoption spreads. These areas offer significant cost advantages and access to local markets. Infrastructure development in these regions is gradually improving, making them more viable for data center construction.

Market leadership is shared among several key players combining international expertise with local market knowledge:

Competitive strategies focus on strategic location selection, advanced technology integration, and comprehensive service offerings. Partnerships and joint ventures are common as companies seek to combine international expertise with local market knowledge and regulatory compliance capabilities.

By Facility Type:

By Construction Type:

By End-User Industry:

Hyperscale data centers represent the fastest-growing category, driven by major cloud service providers establishing regional presence. These facilities require specialized construction expertise and significant capital investment but offer substantial long-term revenue potential. Power requirements for hyperscale facilities often exceed 20MW, necessitating dedicated electrical infrastructure.

Enterprise data centers continue to show steady demand as organizations seek dedicated infrastructure for mission-critical applications. These facilities typically feature higher customization levels and specialized security requirements. Hybrid cloud strategies are driving demand for enterprise facilities that can integrate with public cloud services.

Colocation facilities serve as an important market segment, particularly for small and medium enterprises seeking professional data center services without full facility investment. These facilities require flexible design approaches to accommodate diverse client requirements. Managed services integration is becoming increasingly important for colocation providers.

Edge computing facilities represent an emerging category with significant growth potential as 5G networks expand and IoT applications proliferate. These smaller facilities require distributed construction strategies and standardized design approaches. Automation and remote management capabilities are essential for edge facility operations.

Construction companies benefit from sustained demand and premium pricing for specialized data center construction services. The market offers long-term project pipelines and opportunities to develop specialized expertise in high-growth technology infrastructure. Recurring revenue opportunities through facility management and maintenance services provide additional value streams.

Real estate developers gain access to a high-value asset class with stable rental income and strong appreciation potential. Data center properties typically command premium lease rates and long-term tenant commitments. Portfolio diversification into technology infrastructure reduces exposure to traditional real estate market volatility.

Technology vendors benefit from increased demand for specialized data center equipment and systems. The market provides opportunities for innovative product development and long-term customer relationships. Service revenue streams through installation, maintenance, and upgrades offer recurring income potential.

Government stakeholders benefit from increased foreign investment, job creation, and enhanced digital infrastructure capabilities. Data center construction supports economic development goals and improves national competitiveness in the digital economy. Tax revenue generation and technology transfer provide additional economic benefits.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration has become a dominant trend, with new facilities incorporating renewable energy systems and energy-efficient technologies. Green building certifications are increasingly required by major tenants and investors. Carbon neutrality commitments from technology companies are driving demand for environmentally responsible construction practices.

Modular construction adoption is accelerating as developers seek faster deployment times and cost efficiencies. Prefabricated components allow for standardized designs and improved quality control. Scalability advantages of modular approaches enable phased facility expansion based on demand growth.

Edge computing proliferation is creating demand for smaller, distributed facilities closer to end users. 5G network deployment requires edge infrastructure to support low-latency applications. IoT device growth necessitates local processing capabilities and distributed data storage.

Artificial intelligence integration in facility design and operations is becoming standard practice. Predictive maintenance systems reduce operational costs and improve reliability. Automated facility management enables more efficient operations and reduced staffing requirements.

Hybrid cloud strategies are influencing facility design requirements as organizations seek seamless integration between private and public cloud services. Interconnectivity capabilities are becoming critical facility features. Multi-cloud support requires flexible infrastructure designs.

Major investment announcements from global cloud service providers have significantly boosted market confidence and construction activity. Google Cloud’s expansion into Indonesia represents a substantial commitment to the local market. Amazon Web Services has announced plans for additional regional infrastructure development.

Government policy initiatives including the Digital Indonesia 2045 roadmap have created favorable conditions for data center investment. Regulatory streamlining has reduced approval timelines for construction projects. Foreign investment incentives have attracted international developers and operators.

Technology partnerships between international companies and local firms have accelerated market development. Knowledge transfer programs are improving local construction capabilities and technical expertise. Joint venture formations combine international experience with local market knowledge.

Infrastructure improvements including power grid enhancements and fiber network expansion have improved facility development conditions. Smart city initiatives in major metropolitan areas create additional demand for data center services. 5G network rollout is driving edge computing infrastructure requirements.

Sustainability certifications and green building standards are becoming mandatory for major projects. Renewable energy integration is increasingly required by international tenants and investors. Energy efficiency standards are driving innovation in cooling and power management technologies.

Strategic location selection should prioritize areas with reliable power infrastructure and fiber connectivity while considering future expansion potential. MWR analysis indicates that secondary cities offer significant cost advantages and reduced competition for resources. Due diligence processes should thoroughly evaluate local infrastructure capabilities and regulatory requirements.

Partnership strategies with local companies can provide valuable market knowledge and regulatory compliance support. Joint ventures enable risk sharing while combining international expertise with local capabilities. Technology partnerships with equipment vendors can provide competitive advantages and preferred pricing.

Sustainability planning should be integrated from the initial design phase to meet evolving tenant requirements and regulatory standards. Renewable energy integration can provide long-term cost advantages and competitive differentiation. Green building certifications are becoming essential for attracting major international tenants.

Modular construction approaches should be evaluated for their potential to reduce deployment times and construction costs. Standardized designs can improve efficiency while maintaining flexibility for customization. Scalability planning enables phased development based on market demand.

Risk management strategies should address natural disaster risks, regulatory changes, and market volatility. Insurance coverage and structural reinforcements are essential for Indonesian market conditions. Diversification strategies across multiple regions and facility types can reduce concentration risks.

Long-term growth prospects for Indonesia’s data center construction market remain highly positive, supported by continued digital transformation and government infrastructure initiatives. MarkWide Research projects sustained growth momentum with increasing sophistication in facility design and construction practices. Market maturation will likely lead to improved efficiency and standardization across the industry.

Technology evolution will continue to shape construction requirements, with artificial intelligence and machine learning integration becoming standard features. Edge computing expansion will create demand for distributed facility networks across Indonesia’s diverse geography. 5G network deployment will drive additional infrastructure requirements and investment opportunities.

Regional development beyond Jakarta will accelerate as digital adoption spreads and infrastructure improves in secondary markets. Government smart city initiatives will create additional demand for data center services across multiple urban centers. Rural connectivity improvements may eventually extend market opportunities to previously underserved areas.

Sustainability requirements will become increasingly stringent, driving innovation in green construction practices and renewable energy integration. Carbon neutrality commitments from major technology companies will influence facility design and operational requirements. Circular economy principles may impact construction material selection and facility lifecycle management.

Investment flows are expected to remain strong, with both domestic and international capital supporting market expansion. Real estate investment trusts and infrastructure funds will likely play increasingly important roles in project financing. Public-private partnerships may emerge as important mechanisms for large-scale infrastructure development.

Indonesia’s data center construction market represents a compelling growth opportunity driven by rapid digital transformation, government support, and strategic geographic positioning. The market demonstrates strong fundamentals with sustained demand growth across multiple sectors and facility types. Investment opportunities span from hyperscale facilities serving global cloud providers to edge computing infrastructure supporting local applications.

Market challenges including infrastructure limitations and skilled workforce shortages are being addressed through strategic investments and partnerships. Government initiatives continue to create favorable conditions for both domestic and international market participants. Technology evolution and sustainability requirements are driving innovation in construction practices and facility design.

Future success in this market will depend on strategic location selection, partnership development, and adaptation to evolving technology requirements. Companies that can effectively combine international expertise with local market knowledge while maintaining focus on sustainability and efficiency will be best positioned for long-term success. The Indonesia data center construction market offers substantial opportunities for growth and value creation in the expanding digital economy.

What is Data Center Construction?

Data Center Construction refers to the process of building facilities that house computer systems and associated components, such as telecommunications and storage systems. These facilities are designed to support the operations of data centers, which are critical for data management and processing in various industries.

What are the key players in the Indonesia Data Center Construction Market?

Key players in the Indonesia Data Center Construction Market include companies like NTT Ltd., Digital Realty, and Telkom Indonesia, which are involved in the development and management of data centers. These companies focus on providing robust infrastructure and services to meet the growing demand for data processing and storage solutions, among others.

What are the growth factors driving the Indonesia Data Center Construction Market?

The Indonesia Data Center Construction Market is driven by factors such as the increasing demand for cloud services, the rise of e-commerce, and the growing need for data storage solutions. Additionally, government initiatives to enhance digital infrastructure contribute to market growth.

What challenges does the Indonesia Data Center Construction Market face?

Challenges in the Indonesia Data Center Construction Market include high construction costs, regulatory hurdles, and the need for skilled labor. These factors can impact project timelines and overall market development.

What opportunities exist in the Indonesia Data Center Construction Market?

Opportunities in the Indonesia Data Center Construction Market include the expansion of 5G networks, increasing investments in smart city projects, and the growing trend of digital transformation across various sectors. These developments are expected to drive demand for new data center facilities.

What trends are shaping the Indonesia Data Center Construction Market?

Trends shaping the Indonesia Data Center Construction Market include the adoption of green building practices, the integration of advanced cooling technologies, and the rise of modular data center designs. These trends aim to enhance energy efficiency and reduce the environmental impact of data center operations.

Indonesia Data Center Construction Market

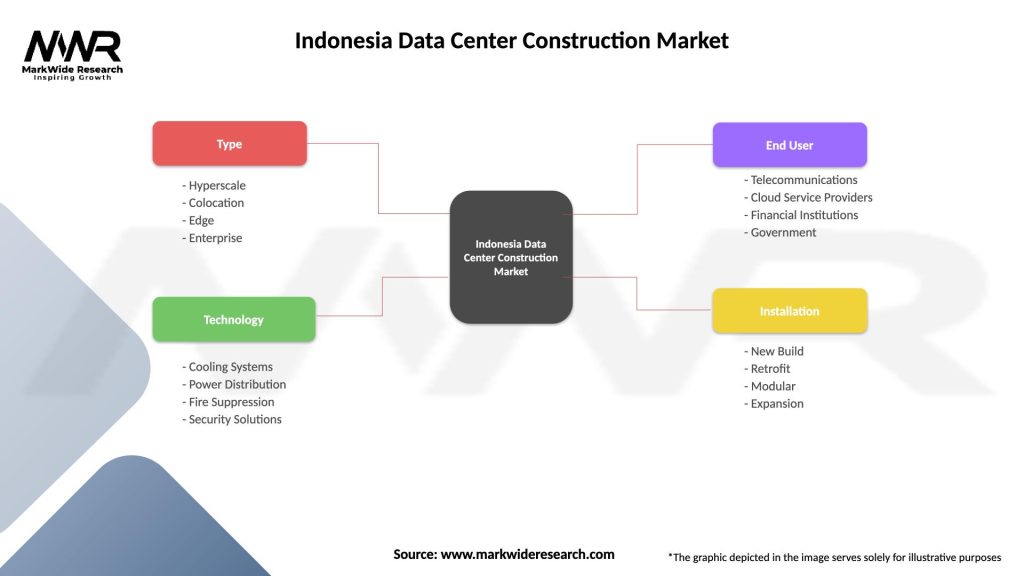

| Segmentation Details | Description |

|---|---|

| Type | Hyperscale, Colocation, Edge, Enterprise |

| Technology | Cooling Systems, Power Distribution, Fire Suppression, Security Solutions |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government |

| Installation | New Build, Retrofit, Modular, Expansion |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia Data Center Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at