444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia container glass market represents a dynamic and rapidly evolving sector within Southeast Asia’s packaging industry. Container glass manufacturing in Indonesia has experienced substantial growth driven by increasing consumer demand for sustainable packaging solutions and the expansion of food and beverage industries. The market encompasses various glass container types including bottles, jars, and specialty containers used across multiple industries including beverages, food processing, pharmaceuticals, and cosmetics.

Market dynamics indicate robust expansion with the sector growing at a compound annual growth rate (CAGR) of 6.2% over the recent forecast period. This growth trajectory reflects Indonesia’s position as one of the fastest-growing economies in Southeast Asia, coupled with rising urbanization rates and changing consumer preferences toward premium packaging solutions. The beverage segment dominates market consumption, accounting for approximately 65% of total container glass demand, while food packaging represents another significant portion of market utilization.

Manufacturing capabilities within Indonesia have expanded significantly, with domestic production facilities increasing their capacity to meet growing local demand while reducing dependency on imports. The market benefits from abundant raw material availability, including silica sand and limestone, which are essential components for glass manufacturing. Sustainability trends have further accelerated market growth as consumers and businesses increasingly prioritize recyclable and environmentally friendly packaging alternatives.

The Indonesia container glass market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of glass containers used for packaging various products across multiple industries within Indonesia’s domestic and export markets. This market includes all forms of glass packaging solutions ranging from beverage bottles and food jars to pharmaceutical vials and cosmetic containers manufactured or consumed within Indonesian territory.

Container glass specifically denotes hollow glass products designed for containing, preserving, and protecting various substances including liquids, solids, and semi-solid materials. These containers are manufactured through specialized glass forming processes including blow molding, press-and-blow techniques, and narrow-neck press-and-blow methods. The market encompasses both clear and colored glass containers, with varying sizes, shapes, and functional specifications tailored to specific industry requirements and consumer preferences.

Market scope extends beyond mere manufacturing to include the entire value chain from raw material sourcing and processing to final product delivery and recycling. The Indonesian market particularly emphasizes local production capabilities, import substitution strategies, and export potential development. Industry stakeholders include glass manufacturers, packaging companies, end-user industries, raw material suppliers, and recycling facilities that collectively contribute to the market’s comprehensive ecosystem.

Indonesia’s container glass market demonstrates exceptional growth potential driven by robust domestic demand and expanding manufacturing capabilities. The market has evolved from primarily import-dependent to increasingly self-sufficient, with local production facilities meeting approximately 78% of domestic demand. This transformation reflects strategic investments in manufacturing infrastructure and technology advancement within the Indonesian glass industry.

Key market drivers include rapid urbanization, growing middle-class population, increasing health consciousness leading to premium packaging preferences, and government initiatives supporting local manufacturing development. The food and beverage sector remains the primary demand generator, with alcoholic beverages, soft drinks, and processed food products driving consistent container glass consumption. Additionally, the pharmaceutical and cosmetics industries contribute significantly to market growth through specialized container requirements.

Competitive landscape features both international players and domestic manufacturers, with increasing emphasis on technology transfer and local capacity building. Market consolidation trends indicate strategic partnerships between global glass manufacturers and Indonesian companies, facilitating knowledge transfer and production efficiency improvements. Sustainability initiatives have become central to market development, with recycling rates improving to approximately 42% of total glass container consumption, supporting circular economy principles.

Future prospects remain highly positive, supported by Indonesia’s economic growth trajectory, expanding consumer base, and increasing export opportunities to neighboring Southeast Asian markets. The market benefits from favorable demographics, with a young population driving consumption patterns and preference shifts toward premium packaging solutions.

Market segmentation analysis reveals distinct consumption patterns across various end-user industries, with beverage applications maintaining dominant market share. The following key insights characterize the Indonesian container glass market:

Consumer behavior patterns indicate increasing preference for premium glass packaging, particularly among urban populations. This trend supports market premiumization and value addition opportunities for manufacturers focusing on design innovation and functional enhancements.

Economic growth serves as the fundamental driver propelling Indonesia’s container glass market expansion. The country’s robust GDP growth, expanding manufacturing sector, and increasing per capita income create favorable conditions for packaging industry development. Urbanization trends significantly impact market dynamics, with urban populations demonstrating higher consumption rates of packaged products requiring glass containers.

Consumer preference shifts toward premium and sustainable packaging solutions drive market growth. Indonesian consumers increasingly associate glass packaging with product quality, safety, and environmental responsibility. This perception particularly influences purchasing decisions in the food and beverage sector, where glass containers command premium pricing compared to alternative packaging materials.

Industry expansion across key end-user sectors creates sustained demand for container glass products. The beverage industry, including both alcoholic and non-alcoholic segments, continues expanding driven by tourism growth, changing lifestyle patterns, and increasing disposable income. Food processing industry development, supported by government initiatives and foreign investment, generates additional demand for glass packaging solutions.

Government support through industrial development policies, investment incentives, and import substitution strategies encourages domestic glass manufacturing capacity expansion. Regulatory frameworks promoting local content requirements in various industries indirectly support container glass market growth. Infrastructure development including transportation networks and industrial zones facilitates market expansion and operational efficiency improvements.

Export opportunities within the ASEAN region and beyond provide additional growth drivers for Indonesian container glass manufacturers. Competitive production costs, strategic location, and improving product quality enable Indonesian companies to compete effectively in regional markets.

High capital requirements for establishing glass manufacturing facilities present significant barriers to market entry. Container glass production requires substantial investments in specialized equipment, technology, and infrastructure, limiting the number of potential new entrants. Energy costs represent another major constraint, as glass manufacturing is energy-intensive, and fluctuating energy prices impact production economics and profitability.

Competition from alternative packaging materials including plastic, aluminum, and flexible packaging solutions challenges glass container market share. These alternatives often offer cost advantages, lighter weight, and enhanced convenience features that appeal to certain consumer segments and applications. Transportation costs associated with glass containers’ weight and fragility create logistical challenges and additional expenses for manufacturers and end users.

Raw material price volatility affects production costs and market stability. While Indonesia has abundant raw material resources, price fluctuations in key inputs including soda ash, limestone, and energy sources impact manufacturing economics. Environmental regulations regarding emissions and waste management require ongoing investments in compliance systems and environmental protection measures.

Skilled labor shortage in specialized glass manufacturing processes constrains production capacity expansion and operational efficiency. The technical nature of glass production requires experienced workers, and training programs require time and investment. Import competition from established glass manufacturing countries with advanced technologies and economies of scale presents ongoing competitive pressure.

Economic uncertainties and currency fluctuations impact investment decisions and market planning. Global economic conditions, trade policies, and exchange rate variations influence both domestic demand and export competitiveness for Indonesian container glass manufacturers.

Sustainability trends create substantial opportunities for container glass market expansion. Growing environmental awareness among consumers and businesses drives demand for recyclable and eco-friendly packaging solutions. Glass containers’ infinite recyclability and premium environmental profile position them favorably against alternative packaging materials. Circular economy initiatives supported by government policies and corporate sustainability commitments further enhance market opportunities.

Premium packaging demand presents significant growth opportunities, particularly in the beverage and cosmetics sectors. Indonesian consumers increasingly associate glass packaging with product quality and brand prestige, creating opportunities for value-added products and premium pricing strategies. Craft beverage industry growth, including craft beer and artisanal spirits, generates demand for specialized glass containers with unique designs and functional features.

Export market development offers substantial expansion opportunities for Indonesian manufacturers. The country’s strategic location within Southeast Asia, competitive production costs, and improving product quality enable market penetration in neighboring countries. ASEAN economic integration facilitates trade and reduces barriers for Indonesian glass container exports.

Technology advancement opportunities include automation, digitalization, and smart manufacturing implementations that enhance production efficiency and product quality. Industry 4.0 technologies enable predictive maintenance, quality optimization, and operational cost reduction. Investment in advanced manufacturing technologies creates competitive advantages and market differentiation opportunities.

Pharmaceutical sector growth driven by healthcare expansion and aging population trends creates specialized container glass demand. Medical packaging requirements for safety, sterility, and regulatory compliance present opportunities for high-value product development and market penetration.

Supply chain dynamics within Indonesia’s container glass market reflect the interplay between raw material availability, manufacturing capacity, and end-user demand patterns. The market benefits from abundant local raw material resources, reducing dependency on imports and providing cost advantages. Manufacturing consolidation trends indicate increasing market concentration among larger players who can achieve economies of scale and invest in advanced technologies.

Demand patterns show seasonal variations particularly in beverage applications, with peak consumption during holiday periods and summer months. Regional demand distribution concentrates in major urban centers including Jakarta, Surabaya, and Medan, where industrial activity and consumer markets are most developed. This geographic concentration influences logistics strategies and manufacturing location decisions.

Price dynamics reflect raw material costs, energy prices, and competitive pressures from alternative packaging materials. Glass container pricing typically maintains premium positioning compared to plastic alternatives, justified by superior product protection, recyclability, and brand image enhancement. Value chain optimization efforts focus on reducing production costs while maintaining quality standards and environmental compliance.

Innovation cycles drive market evolution through new product development, manufacturing process improvements, and sustainability enhancements. Customer collaboration between glass manufacturers and end-user industries facilitates customized solutions and long-term partnership development. According to MarkWide Research analysis, innovation investments have increased by approximately 23% annually among leading Indonesian glass manufacturers.

Regulatory dynamics influence market development through environmental standards, safety requirements, and trade policies. Compliance with international quality standards enables export market access and enhances competitive positioning in domestic markets.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Indonesia’s container glass market. Primary research includes structured interviews with industry executives, manufacturers, distributors, and end-user companies to gather firsthand market intelligence and validate secondary research findings.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial statements to establish market baselines and identify trends. Data triangulation methods cross-reference multiple information sources to ensure accuracy and reliability of market insights and projections.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing production capacity, consumption patterns, trade flows, and end-user demand to establish comprehensive market parameters. Segmentation analysis examines market divisions by product type, application, end-user industry, and geographic region to provide detailed market understanding.

Competitive analysis includes company profiling, market share assessment, and strategic positioning evaluation of key market participants. Trend analysis identifies emerging patterns, technological developments, and market evolution drivers that influence future market development.

Expert validation processes involve consultation with industry specialists, academic researchers, and market analysts to verify research findings and ensure comprehensive market coverage. Quality assurance protocols maintain research standards and ensure deliverable accuracy and reliability.

Java region dominates Indonesia’s container glass market, accounting for approximately 72% of total market consumption. This concentration reflects the region’s industrial development, population density, and economic activity levels. Greater Jakarta area serves as the primary market hub, hosting major manufacturing facilities, distribution centers, and end-user industries.

Surabaya metropolitan area represents the second-largest regional market, benefiting from its position as East Java’s industrial center and major port city. The region’s beverage industry concentration and food processing activities drive substantial container glass demand. Manufacturing presence in the region includes both domestic and international glass container producers.

Sumatra region shows growing market importance, particularly in North Sumatra around Medan and South Sumatra near Palembang. Palm oil industry development and expanding food processing activities create demand for glass packaging solutions. The region’s strategic location for export activities enhances its market significance.

Kalimantan and Sulawesi regions represent emerging markets with growing industrial development and urbanization trends. Mining industry presence and expanding consumer markets drive gradual container glass demand growth. Infrastructure development in these regions supports market expansion potential.

Regional distribution networks concentrate around major ports and transportation hubs, with logistics efficiency varying significantly between developed and emerging regions. Market penetration strategies adapt to regional characteristics, consumer preferences, and distribution infrastructure capabilities.

Market competition features a mix of international corporations and domestic manufacturers, with increasing collaboration through joint ventures and technology transfer agreements. The competitive environment emphasizes production efficiency, product quality, and customer service excellence.

Competitive strategies emphasize technological advancement, capacity expansion, and market diversification. Strategic partnerships between international and domestic companies facilitate knowledge transfer, technology access, and market penetration. Investment patterns show increasing focus on automation, environmental compliance, and product innovation.

Market share dynamics indicate gradual consolidation among larger players while maintaining opportunities for specialized niche manufacturers. Differentiation strategies include custom design capabilities, rapid delivery, technical support, and sustainability initiatives.

Product type segmentation divides the Indonesian container glass market into distinct categories based on container design and functionality:

Application segmentation categorizes market demand based on end-use industries:

Size segmentation reflects container capacity requirements:

Beverage category maintains market leadership with consistent growth driven by Indonesia’s expanding beverage industry. Beer bottles represent a significant portion of this segment, supported by growing craft beer culture and tourism industry development. Soft drink bottles show steady demand despite competition from alternative packaging materials, with premium brands preferring glass containers for brand positioning.

Food packaging category demonstrates robust growth potential, particularly in processed food applications. Sauce and condiment jars benefit from Indonesia’s rich culinary tradition and increasing commercial food production. Preserve jars show growing demand driven by artisanal food producers and premium product positioning.

Pharmaceutical category exhibits steady growth supported by healthcare sector expansion and regulatory requirements for safe packaging. Injectable vials represent high-value applications requiring specialized manufacturing capabilities and quality certifications. Tablet bottles show consistent demand growth aligned with pharmaceutical industry development.

Cosmetics category presents premium market opportunities with emphasis on design innovation and brand differentiation. Perfume bottles command premium pricing and require specialized manufacturing techniques. Skincare jars benefit from growing beauty consciousness and premium product positioning trends.

Industrial category includes specialized applications requiring custom solutions and technical expertise. Chemical containers must meet strict safety and regulatory requirements, creating barriers to entry but ensuring stable demand from qualified suppliers.

Manufacturers benefit from Indonesia’s growing domestic market, abundant raw materials, and competitive production costs. Economies of scale opportunities exist for companies investing in modern manufacturing facilities and advanced technologies. Export potential provides additional revenue streams and market diversification opportunities within the ASEAN region.

End-user industries gain access to reliable, high-quality packaging solutions that enhance product protection and brand image. Sustainability benefits support corporate environmental commitments and consumer preference alignment. Local sourcing reduces supply chain risks and transportation costs while supporting domestic economic development.

Investors find attractive opportunities in a growing market with strong fundamentals and government support for industrial development. Technology transfer partnerships provide access to advanced manufacturing capabilities and market expertise. Long-term growth prospects supported by demographic trends and economic development create favorable investment conditions.

Government stakeholders benefit from industrial development, employment creation, and import substitution achievements. Tax revenue generation and export earnings contribute to economic development objectives. Environmental benefits from increased glass recycling support sustainability goals and circular economy initiatives.

Consumers access higher quality packaging that ensures product safety and freshness while supporting environmental sustainability. Product variety increases as manufacturers invest in design innovation and customization capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping Indonesia’s container glass market. Circular economy principles drive increased focus on glass recycling, with recycling rates improving steadily as infrastructure develops. Corporate sustainability commitments from major brands create demand for environmentally responsible packaging solutions.

Design innovation trends emphasize unique bottle shapes, colors, and functional features that differentiate products and enhance brand appeal. Lightweight glass development reduces transportation costs while maintaining container strength and functionality. Smart packaging integration includes features like QR codes and NFC technology embedded in glass containers.

Automation advancement transforms manufacturing processes through robotics, artificial intelligence, and predictive maintenance systems. Quality control automation ensures consistent product standards and reduces defect rates. Production efficiency improvements through automation help Indonesian manufacturers compete with international suppliers.

Customization demand increases as brands seek unique packaging solutions for product differentiation. Small batch production capabilities enable manufacturers to serve niche markets and specialized applications. Rapid prototyping technologies accelerate new product development cycles.

Digital transformation includes e-commerce integration, digital marketing, and online customer service platforms. Supply chain digitalization improves inventory management, demand forecasting, and logistics optimization. MWR data indicates that digital technology adoption has increased by 34% among Indonesian glass manufacturers over the past two years.

Capacity expansion projects across major manufacturers indicate strong confidence in market growth prospects. New manufacturing facilities incorporate advanced technologies and environmental compliance systems. Investment announcements from both domestic and international companies demonstrate continued market development commitment.

Technology partnerships between Indonesian companies and international glass manufacturers facilitate knowledge transfer and capability building. Joint venture formations combine local market knowledge with advanced manufacturing expertise. Licensing agreements provide access to proprietary technologies and production processes.

Sustainability initiatives include glass recycling program development, energy efficiency improvements, and environmental compliance upgrades. Circular economy projects create closed-loop systems for glass container reuse and recycling. Carbon footprint reduction programs align with global environmental commitments.

Product innovation launches introduce new container designs, functional features, and specialized applications. Premium product lines target high-value market segments with enhanced design and functionality. Custom solution development serves specific customer requirements and niche applications.

Market consolidation activities include mergers, acquisitions, and strategic partnerships that reshape competitive dynamics. Vertical integration strategies enable companies to control supply chains and improve cost efficiency. Horizontal expansion broadens product portfolios and market coverage.

Investment prioritization should focus on advanced manufacturing technologies that improve production efficiency and product quality. Automation investments provide long-term competitive advantages through cost reduction and quality consistency. Environmental compliance investments ensure regulatory adherence and support sustainability positioning.

Market diversification strategies should explore export opportunities within Southeast Asia while strengthening domestic market positions. Product portfolio expansion into high-value segments like pharmaceuticals and cosmetics offers growth potential. Customer relationship development through technical support and customization capabilities builds competitive moats.

Partnership development with international technology providers accelerates capability building and market competitiveness. Strategic alliances with end-user industries create stable demand relationships and growth opportunities. Supply chain optimization through vertical integration or strategic partnerships improves cost structure and reliability.

Sustainability leadership positions companies favorably for future market developments and regulatory changes. Recycling infrastructure investment supports circular economy principles and cost reduction. Energy efficiency improvements reduce operational costs and environmental impact.

Talent development programs address skilled labor shortages and build manufacturing expertise. Training partnerships with educational institutions create sustainable talent pipelines. Knowledge management systems preserve and transfer critical manufacturing expertise.

Long-term growth prospects for Indonesia’s container glass market remain highly positive, supported by robust economic fundamentals and favorable demographic trends. Market expansion is projected to continue at a steady growth rate of 5.8% CAGR over the next five years, driven by sustained domestic demand and emerging export opportunities.

Technology evolution will transform manufacturing processes through Industry 4.0 implementations, artificial intelligence integration, and advanced automation systems. Production efficiency improvements will enhance competitiveness against international suppliers and alternative packaging materials. Quality standardization will reach international levels, enabling broader export market access.

Sustainability integration will become increasingly central to market development, with recycling rates projected to reach 55% by 2028. Circular economy principles will drive innovation in recycling technologies and closed-loop systems. Environmental regulations will continue tightening, requiring ongoing compliance investments.

Market consolidation trends will likely continue, with larger players gaining market share through economies of scale and technological advantages. Strategic partnerships between domestic and international companies will facilitate technology transfer and market development. Vertical integration opportunities will emerge as companies seek supply chain control and cost optimization.

Export market development will accelerate as Indonesian manufacturers achieve quality parity with international suppliers while maintaining cost advantages. ASEAN market integration will facilitate regional trade expansion and market access. According to MarkWide Research projections, export volumes could increase by 45% over the next five years as production capabilities mature and quality standards improve.

Indonesia’s container glass market represents a dynamic and rapidly evolving sector with substantial growth potential driven by strong domestic demand, expanding manufacturing capabilities, and emerging export opportunities. The market benefits from abundant raw material resources, government support for industrial development, and favorable demographic trends that support sustained consumption growth.

Key success factors for market participants include technology investment, quality improvement, sustainability leadership, and strategic partnership development. Companies that successfully navigate the competitive landscape while building advanced manufacturing capabilities will be well-positioned to capitalize on market opportunities. Innovation focus on product design, manufacturing efficiency, and environmental sustainability will drive competitive differentiation and market leadership.

Future market development will be shaped by sustainability trends, technology advancement, and regional market integration within Southeast Asia. The sector’s evolution from import dependence to export capability demonstrates the potential for continued growth and international competitiveness. Strategic investments in manufacturing infrastructure, technology, and human capital development will determine long-term market success and competitive positioning in the global container glass industry.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

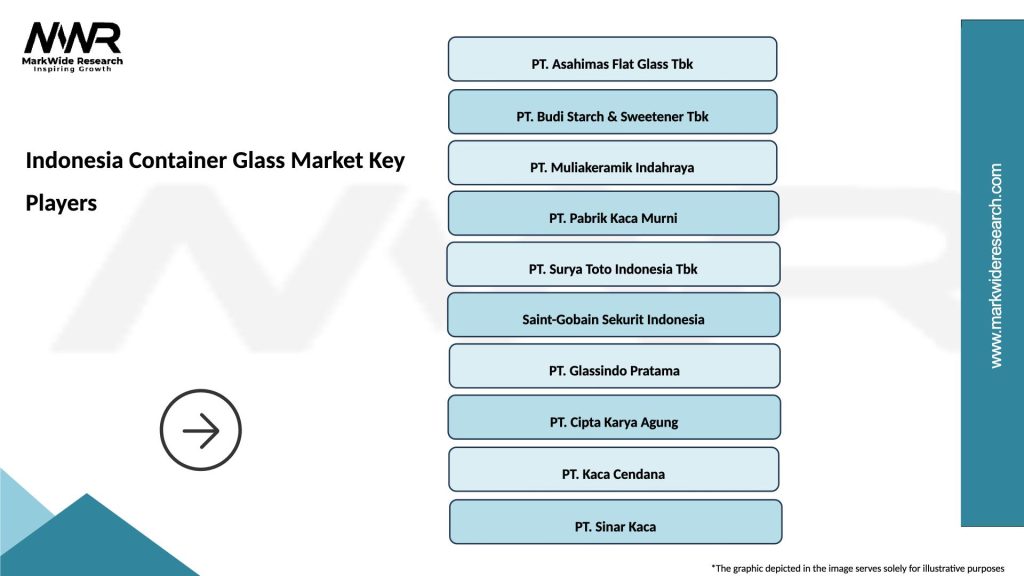

What are the key players in the Indonesia Container Glass Market?

Key players in the Indonesia Container Glass Market include PT. Asahimas Flat Glass Tbk, PT. Budi Starch & Sweetener Tbk, and PT. Muliakeramik Indahraya, among others.

What are the growth factors driving the Indonesia Container Glass Market?

The growth of the Indonesia Container Glass Market is driven by increasing demand for sustainable packaging solutions, the rise in the beverage industry, and a growing preference for glass over plastic due to health and environmental concerns.

What challenges does the Indonesia Container Glass Market face?

The Indonesia Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials, and fluctuations in raw material prices, which can impact profitability.

What opportunities exist in the Indonesia Container Glass Market?

Opportunities in the Indonesia Container Glass Market include expanding the use of recycled glass, innovations in lightweight glass technology, and increasing exports to meet global demand for eco-friendly packaging.

What trends are shaping the Indonesia Container Glass Market?

Trends in the Indonesia Container Glass Market include a shift towards sustainable packaging, the introduction of smart packaging solutions, and the growing popularity of premium glass containers in the food and beverage sector.

Indonesia Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Jugs, Vials |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Grade | Standard, Premium, Recycled, Specialty |

| Packaging Type | Bulk, Retail, Custom, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at