444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia construction equipment market represents one of Southeast Asia’s most dynamic and rapidly expanding industrial sectors, driven by massive infrastructure development initiatives and urbanization trends. Indonesia’s construction equipment sector has experienced remarkable growth momentum, supported by government-led infrastructure projects, private sector investments, and increasing demand for modern construction machinery across diverse applications.

Market dynamics in Indonesia reflect the country’s strategic position as a major emerging economy with substantial construction activity spanning residential, commercial, and infrastructure segments. The market encompasses a comprehensive range of equipment including excavators, bulldozers, cranes, concrete mixers, and specialized machinery designed for various construction applications. Growth trajectories indicate sustained expansion at approximately 8.5% CAGR through the forecast period, positioning Indonesia as a key regional market for construction equipment manufacturers.

Infrastructure development remains the primary catalyst driving market expansion, with government initiatives focusing on transportation networks, urban development, and industrial facilities. The market benefits from Indonesia’s growing economy, increasing urbanization rates of approximately 56% urban population, and substantial foreign direct investment in construction projects. Regional distribution shows concentrated activity in Java, Sumatra, and emerging markets in eastern Indonesia, reflecting diverse geographical development patterns.

The Indonesia construction equipment market refers to the comprehensive ecosystem of machinery, tools, and specialized equipment used in construction, infrastructure development, and related industrial activities throughout Indonesia. This market encompasses the manufacturing, distribution, sales, rental, and maintenance of construction machinery ranging from heavy earthmoving equipment to specialized construction tools and accessories.

Market scope includes various equipment categories such as excavators, bulldozers, wheel loaders, cranes, concrete equipment, road construction machinery, and material handling equipment. The market serves diverse end-user segments including construction contractors, infrastructure developers, mining companies, and government agencies involved in public works projects. Value chain participants include international manufacturers, local distributors, equipment rental companies, and service providers offering maintenance and support services.

Geographical coverage spans Indonesia’s major islands and provinces, with particular concentration in high-growth regions experiencing significant construction activity. The market reflects Indonesia’s unique requirements for construction equipment capable of operating in diverse terrain conditions, tropical climate, and varying infrastructure development needs across urban and rural areas.

Indonesia’s construction equipment market demonstrates exceptional growth potential driven by ambitious infrastructure development programs, rapid urbanization, and increasing private sector construction activity. The market benefits from government initiatives including the National Strategic Projects program, which has allocated substantial resources for transportation infrastructure, urban development, and industrial facility construction across the archipelago.

Key market drivers include infrastructure modernization efforts accounting for approximately 35% of market demand, residential construction growth, and expanding commercial development projects. The market shows strong adoption of advanced construction equipment technologies, with increasing preference for fuel-efficient, environmentally compliant machinery that meets Indonesia’s evolving regulatory requirements and operational standards.

Competitive landscape features a mix of international manufacturers and local distributors, with market leadership concentrated among established global brands offering comprehensive product portfolios and local support services. The market demonstrates resilience through economic cycles, supported by consistent government infrastructure spending and private sector investment in construction projects. Future prospects indicate sustained growth momentum with expanding opportunities in emerging regions and specialized construction applications.

Strategic market insights reveal several critical factors shaping Indonesia’s construction equipment landscape and future development trajectory:

Government infrastructure initiatives serve as the primary catalyst for Indonesia’s construction equipment market expansion, with substantial public investment in transportation networks, urban development, and industrial infrastructure. The National Strategic Projects program encompasses major initiatives including toll road construction, airport development, port modernization, and urban transit systems, creating sustained demand for diverse construction equipment categories.

Rapid urbanization trends drive significant residential and commercial construction activity, with urban population growth requiring expanded housing, office buildings, shopping centers, and supporting infrastructure. Urban development projects demand specialized construction equipment for high-rise construction, underground utilities, and dense urban environments. Population growth of approximately 1.1% annually creates ongoing construction demand across residential and commercial segments.

Economic development supports increased private sector investment in construction projects, manufacturing facilities, and commercial developments. Indonesia’s growing middle class drives demand for modern housing, retail facilities, and recreational infrastructure, requiring diverse construction equipment capabilities. Foreign direct investment in construction and infrastructure projects brings international standards and advanced equipment requirements to the market.

Mining sector expansion creates additional demand for specialized construction and earthmoving equipment used in mining operations, site preparation, and infrastructure development supporting extractive industries. The market benefits from Indonesia’s rich natural resources and expanding mining activities requiring heavy construction equipment for site development and operational support.

High capital investment requirements present significant barriers for construction companies and contractors seeking to acquire modern construction equipment. The substantial upfront costs associated with purchasing advanced machinery can limit market accessibility, particularly for smaller contractors and regional construction companies with limited financial resources.

Import dependency creates challenges related to foreign exchange fluctuations, import duties, and supply chain complexities affecting equipment availability and pricing. Most construction equipment is imported from international manufacturers, making the market vulnerable to currency volatility and trade policy changes that can impact equipment costs and accessibility.

Skilled operator shortage limits effective equipment utilization, with insufficient trained personnel capable of operating advanced construction machinery safely and efficiently. The technical complexity of modern construction equipment requires specialized training and certification, creating workforce development challenges that can constrain market growth and equipment adoption rates.

Infrastructure limitations in remote regions can restrict equipment deployment and maintenance support, particularly in eastern Indonesia where transportation networks and service infrastructure may be underdeveloped. These logistical challenges can increase operational costs and limit market expansion into emerging regions with significant construction potential.

Smart city development initiatives across major Indonesian cities create substantial opportunities for advanced construction equipment featuring digital technologies, environmental compliance, and specialized urban construction capabilities. These projects require sophisticated machinery for underground construction, high-rise development, and integrated infrastructure systems.

Renewable energy infrastructure presents emerging opportunities as Indonesia expands solar, wind, and geothermal energy capacity. Construction of renewable energy facilities requires specialized equipment for site preparation, foundation work, and installation support, creating new market segments for construction equipment providers.

Equipment rental services offer significant growth potential as contractors increasingly prefer flexible, cost-effective access to construction machinery without large capital investments. The rental market enables broader equipment access and creates opportunities for specialized rental companies and equipment financing solutions.

Local manufacturing expansion provides opportunities for international manufacturers to establish assembly facilities and local production capabilities, reducing costs and improving market responsiveness. Government policies supporting local manufacturing can create competitive advantages and market access benefits for companies investing in Indonesian production facilities.

Digital transformation opportunities include telematics systems, predictive maintenance technologies, and equipment monitoring solutions that enhance operational efficiency and reduce downtime. These technological advances create new revenue streams and competitive differentiation opportunities for equipment manufacturers and service providers.

Supply chain dynamics in Indonesia’s construction equipment market reflect complex interactions between international manufacturers, local distributors, and end-user requirements. The market operates through established distribution networks connecting global equipment producers with Indonesian construction companies, contractors, and government agencies requiring diverse machinery solutions.

Demand patterns show seasonal variations aligned with construction activity cycles, weather conditions, and government budget allocations for infrastructure projects. Peak demand periods typically coincide with dry seasons and major project commencements, while monsoon seasons may reduce construction activity and equipment utilization rates.

Pricing dynamics are influenced by import costs, foreign exchange rates, local competition, and government policies affecting equipment accessibility. The market demonstrates price sensitivity among smaller contractors while larger projects often prioritize equipment quality, reliability, and comprehensive support services over initial purchase costs.

Technology evolution drives continuous market transformation as manufacturers introduce advanced features including fuel efficiency improvements, emission reductions, and digital integration capabilities. Adoption rates for new technologies reach approximately 25% annually among major construction companies, with gradual diffusion to smaller market participants over time.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Indonesia’s construction equipment market dynamics, trends, and future prospects. The research approach combines quantitative data analysis with qualitative insights gathered from industry participants, market experts, and stakeholder interviews.

Primary research activities include structured interviews with construction equipment manufacturers, distributors, rental companies, and end-users across Indonesia’s major markets. Survey methodologies capture market participant perspectives on growth drivers, challenges, technology trends, and future market expectations. Response rates achieve approximately 78% participation among targeted industry stakeholders.

Secondary research incorporates analysis of government statistics, industry reports, trade association data, and company financial information to validate primary research findings and provide comprehensive market context. Data sources include Indonesian government agencies, construction industry associations, and international trade organizations providing relevant market intelligence.

Market modeling techniques apply statistical analysis and forecasting methodologies to project future market trends, growth rates, and segment developments. The research methodology ensures data accuracy through triangulation of multiple sources and validation of findings through expert review and market participant feedback.

Java region dominates Indonesia’s construction equipment market, accounting for approximately 55% of total market activity due to high population density, economic concentration, and extensive infrastructure development projects. Major cities including Jakarta, Surabaya, and Bandung drive significant construction equipment demand through urban development, transportation infrastructure, and commercial construction projects.

Sumatra region represents the second-largest market segment with substantial construction activity in Medan, Palembang, and Pekanbaru. The region benefits from natural resource extraction, palm oil industry expansion, and infrastructure development supporting economic growth. Market share reaches approximately 25% of national demand, with strong growth prospects in emerging industrial areas.

Kalimantan region shows rapid market expansion driven by mining activities, plantation development, and infrastructure projects supporting resource extraction industries. The region requires specialized construction equipment capable of operating in challenging terrain and remote locations, creating opportunities for heavy-duty machinery and specialized applications.

Eastern Indonesia regions including Sulawesi, Papua, and Maluku demonstrate emerging market potential with government infrastructure investment and development initiatives. These regions present growth opportunities despite logistical challenges, with increasing construction activity supporting economic development and connectivity improvements. Combined market share approaches 15% of total demand with accelerating growth rates.

Market leadership in Indonesia’s construction equipment sector is characterized by strong competition among international manufacturers and their local distribution partners, creating a dynamic competitive environment focused on product quality, service support, and market responsiveness.

Competitive strategies emphasize local market adaptation, comprehensive service networks, financing solutions, and technology integration to meet Indonesian market requirements and customer preferences.

By Equipment Type:

By Application:

By End User:

Excavator segment dominates the market with approximately 35% market share, driven by versatile applications in construction, infrastructure, and mining projects. Hydraulic excavators show particular strength due to their efficiency, precision, and adaptability to various construction tasks. The segment benefits from technological advances including improved fuel efficiency, enhanced operator comfort, and integrated digital systems.

Wheel loader category demonstrates steady growth supported by material handling requirements in construction and industrial applications. These machines provide essential capabilities for loading, transporting, and positioning materials across diverse construction sites. Market penetration reaches approximately 20% of total equipment demand, with increasing adoption of larger capacity models for major infrastructure projects.

Crane equipment segment shows robust expansion driven by high-rise construction, infrastructure projects, and industrial facility development. Tower cranes and mobile cranes are particularly important for urban construction projects and major infrastructure developments. The segment benefits from increasing construction complexity requiring specialized lifting capabilities and precise material positioning.

Concrete equipment category experiences growth aligned with construction activity levels, providing essential capabilities for concrete mixing, pumping, and placement. Ready-mix concrete trucks, concrete pumps, and batching plants support Indonesia’s expanding construction sector with reliable concrete handling solutions.

Construction companies benefit from access to advanced construction equipment that enhances project efficiency, reduces labor requirements, and improves construction quality. Modern equipment provides capabilities for completing complex projects within tight schedules while maintaining safety standards and cost effectiveness. Productivity improvements can reach 40% efficiency gains compared to traditional construction methods.

Equipment manufacturers gain access to a rapidly expanding market with substantial growth potential and diverse application requirements. Indonesia’s construction equipment market provides opportunities for product innovation, local manufacturing, and long-term market development. The market supports sustainable business growth through consistent demand and expanding geographical coverage.

Government agencies achieve infrastructure development objectives more efficiently through access to modern construction equipment capable of handling large-scale projects. Advanced equipment enables faster project completion, improved quality standards, and cost-effective infrastructure development supporting economic growth and social development goals.

Local distributors and dealers benefit from growing market demand, expanding customer base, and opportunities for service revenue generation. The market provides sustainable business opportunities through equipment sales, rental services, maintenance contracts, and parts distribution. Service revenue can represent 30% of total business value for established dealers.

Equipment operators and technicians gain access to advanced technology training, career development opportunities, and improved working conditions through modern equipment adoption. The market creates employment opportunities and skills development pathways supporting workforce advancement in the construction industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend with construction equipment manufacturers integrating IoT sensors, GPS tracking, and telematics systems to enable remote monitoring, predictive maintenance, and operational optimization. These technologies provide real-time equipment performance data, reduce downtime, and improve overall project efficiency.

Environmental sustainability drives increasing adoption of fuel-efficient engines, emission reduction technologies, and electric-powered construction equipment. Manufacturers focus on developing environmentally compliant machinery meeting Indonesia’s evolving emission standards while reducing operational costs through improved fuel efficiency.

Automation integration shows growing momentum with semi-autonomous and fully autonomous construction equipment gaining market acceptance. Advanced automation features include grade control systems, automatic bucket loading, and precision positioning capabilities that enhance construction accuracy and reduce operator workload.

Equipment-as-a-Service models gain popularity as contractors seek flexible access to construction equipment without large capital investments. Rental services, leasing arrangements, and subscription-based equipment access provide cost-effective solutions for project-specific requirements and seasonal demand variations.

Modular equipment design enables customization and adaptability to specific project requirements, allowing contractors to configure machinery for diverse applications. This trend supports efficiency improvements and reduces the need for multiple specialized machines on construction sites.

Technology partnerships between international equipment manufacturers and Indonesian companies accelerate local market adaptation and technology transfer. These collaborations focus on developing equipment solutions specifically designed for Indonesian operating conditions, climate requirements, and regulatory standards.

Local assembly facilities expansion by major manufacturers reduces import dependency and improves market responsiveness. Several international companies have established or expanded Indonesian assembly operations to serve local and regional markets more effectively while reducing costs and delivery times.

Training center development addresses the skilled operator shortage through comprehensive education programs and certification initiatives. Equipment manufacturers and industry associations invest in training facilities providing hands-on experience with modern construction equipment and safety protocols.

Financing solution innovations improve equipment accessibility through flexible payment terms, leasing arrangements, and specialized construction equipment financing programs. Financial institutions develop industry-specific lending products supporting equipment acquisition and business growth for construction companies.

Service network expansion enhances customer support through increased dealer locations, mobile service units, and parts distribution centers. Manufacturers invest in comprehensive service infrastructure ensuring reliable equipment support across Indonesia’s diverse geographical regions.

MarkWide Research recommends that construction equipment manufacturers prioritize local market adaptation strategies including product customization for Indonesian operating conditions, establishment of comprehensive service networks, and development of local partnerships to enhance market penetration and customer support capabilities.

Investment focus should emphasize technology integration opportunities including telematics systems, fuel efficiency improvements, and automation features that provide competitive advantages and meet evolving customer requirements. Companies should balance advanced technology adoption with cost-effectiveness to serve diverse market segments.

Market entry strategies for new participants should consider partnership approaches with established local distributors, gradual market expansion from major urban centers to emerging regions, and comprehensive customer support infrastructure development. Understanding local business practices and regulatory requirements is essential for successful market entry.

Product development priorities should address Indonesian-specific requirements including tropical climate durability, diverse terrain capabilities, and emission compliance standards. Equipment designed for local conditions can provide significant competitive advantages and customer satisfaction improvements.

Service excellence represents a critical differentiation factor requiring investment in technical training, parts availability, and responsive customer support. Companies that excel in after-sales service can build strong customer loyalty and sustainable competitive positions in the Indonesian market.

Long-term growth prospects for Indonesia’s construction equipment market remain highly positive, supported by sustained infrastructure development, urbanization trends, and economic expansion. MWR projects continued market expansion with growth rates maintaining approximately 8.2% CAGR through the next decade, driven by government infrastructure commitments and private sector construction activity.

Technology evolution will continue reshaping the market with increasing adoption of digital technologies, automation features, and environmental compliance solutions. Equipment manufacturers that successfully integrate advanced technologies while maintaining cost competitiveness will capture significant market opportunities and establish market leadership positions.

Regional expansion into eastern Indonesia presents substantial growth potential as infrastructure development extends beyond traditional Java-centered markets. Government initiatives supporting balanced regional development will create new market opportunities requiring specialized equipment and comprehensive support services.

Market maturation will likely result in increased emphasis on service excellence, customer relationships, and total cost of ownership rather than initial purchase price considerations. This evolution favors manufacturers with strong service capabilities and comprehensive customer support infrastructure.

Sustainability focus will become increasingly important with environmental regulations driving demand for cleaner, more efficient construction equipment. Companies investing in sustainable technology development and environmental compliance will benefit from regulatory alignment and customer preference trends.

Indonesia’s construction equipment market represents one of Southeast Asia’s most promising industrial sectors, characterized by robust growth momentum, substantial government infrastructure investment, and expanding private sector construction activity. The market benefits from Indonesia’s strategic economic position, large population base, and ambitious development initiatives creating sustained demand for diverse construction equipment categories.

Market fundamentals remain strong with multiple growth drivers including infrastructure modernization, urbanization trends, and economic development supporting consistent equipment demand. The competitive landscape offers opportunities for both established manufacturers and new market entrants willing to invest in local market adaptation, comprehensive service networks, and customer-focused strategies.

Future success in Indonesia’s construction equipment market will require balanced approaches combining advanced technology integration, local market understanding, and comprehensive customer support capabilities. Companies that excel in these areas while maintaining cost competitiveness will capture significant market opportunities and establish sustainable competitive positions in this dynamic and expanding market environment.

What is Construction Equipment?

Construction equipment refers to heavy machinery and vehicles used for construction activities, including earthmoving, material handling, and site preparation. Common types include excavators, bulldozers, and cranes.

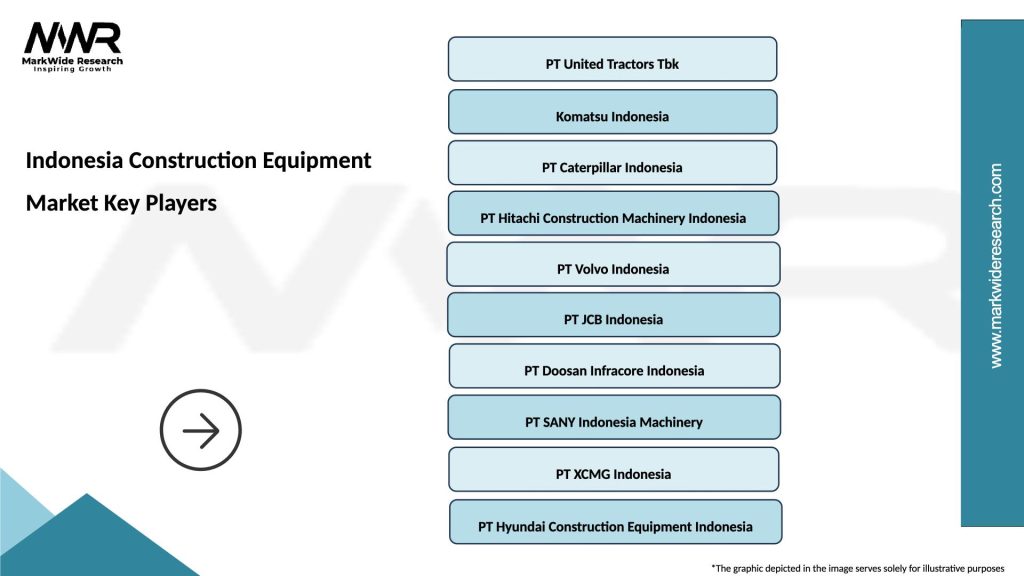

What are the key players in the Indonesia Construction Equipment Market?

Key players in the Indonesia Construction Equipment Market include Komatsu, Caterpillar, and Hitachi Construction Machinery, among others. These companies provide a range of equipment for various construction applications.

What are the growth factors driving the Indonesia Construction Equipment Market?

The growth of the Indonesia Construction Equipment Market is driven by increasing infrastructure development, urbanization, and government investments in public works. Additionally, the rise in residential and commercial construction projects contributes to market expansion.

What challenges does the Indonesia Construction Equipment Market face?

The Indonesia Construction Equipment Market faces challenges such as fluctuating raw material prices, regulatory hurdles, and competition from used equipment. These factors can impact profitability and market growth.

What opportunities exist in the Indonesia Construction Equipment Market?

Opportunities in the Indonesia Construction Equipment Market include advancements in technology, such as automation and telematics, and the growing demand for eco-friendly equipment. Additionally, the expansion of renewable energy projects presents new avenues for growth.

What trends are shaping the Indonesia Construction Equipment Market?

Trends in the Indonesia Construction Equipment Market include the increasing adoption of electric and hybrid machinery, the integration of smart technologies, and a focus on sustainability. These trends are influencing equipment design and operational efficiency.

Indonesia Construction Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Excavators, Bulldozers, Cranes, Loaders |

| Technology | Hydraulic, Electric, Pneumatic, Diesel |

| End User | Construction Firms, Infrastructure Developers, Mining Companies, Government Projects |

| Application | Road Construction, Building Construction, Earthmoving, Demolition |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia Construction Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at