444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia commercial construction market represents one of Southeast Asia’s most dynamic and rapidly expanding construction sectors, driven by robust economic growth, urbanization trends, and significant infrastructure development initiatives. Indonesia’s commercial construction industry encompasses a diverse range of projects including office buildings, retail complexes, hospitality facilities, healthcare infrastructure, and mixed-use developments across the archipelago’s major urban centers.

Market dynamics indicate that Indonesia’s commercial construction sector is experiencing unprecedented growth, with Jakarta, Surabaya, Bandung, and Medan leading the development surge. The sector benefits from favorable government policies, foreign direct investment inflows, and the country’s strategic position as a regional economic hub. Construction activities are particularly concentrated in Java, which accounts for approximately 68% of total commercial construction projects nationwide.

Key market drivers include Indonesia’s expanding middle class, rapid urbanization rates exceeding 4.1% annually, and the government’s commitment to infrastructure modernization through various national development programs. The sector demonstrates resilience and adaptability, incorporating sustainable building practices and advanced construction technologies to meet evolving market demands and environmental standards.

The Indonesia commercial construction market refers to the comprehensive sector encompassing the planning, design, development, and construction of non-residential buildings and infrastructure projects intended for business, retail, hospitality, healthcare, and mixed-use commercial purposes across Indonesia’s diverse geographical landscape.

Commercial construction projects in Indonesia typically include office towers, shopping centers, hotels, hospitals, educational facilities, industrial complexes, and integrated mixed-use developments. The market involves various stakeholders including developers, contractors, architects, engineers, suppliers, and government entities working collaboratively to deliver modern commercial infrastructure that supports Indonesia’s economic growth objectives.

Market scope extends beyond traditional construction activities to encompass project financing, regulatory compliance, environmental sustainability initiatives, and post-construction facility management services. The sector plays a crucial role in Indonesia’s economic development by creating employment opportunities, attracting foreign investment, and establishing modern commercial infrastructure that enhances business competitiveness and urban livability standards.

Indonesia’s commercial construction market demonstrates remarkable growth momentum, positioning itself as a cornerstone of the nation’s economic development strategy. The sector benefits from strong government support, increasing private sector investment, and favorable demographic trends that drive demand for modern commercial infrastructure across major urban centers.

Market performance reflects Indonesia’s broader economic expansion, with commercial construction activities contributing significantly to GDP growth and employment generation. The sector attracts substantial foreign direct investment, particularly from Singapore, Japan, China, and South Korea, bringing advanced construction technologies and international best practices to Indonesian projects.

Key growth segments include office developments responding to multinational corporation expansion, retail infrastructure supporting Indonesia’s growing consumer market, and hospitality projects capitalizing on tourism growth. The market demonstrates increasing sophistication in project delivery, with 72% of major commercial projects now incorporating green building standards and smart building technologies.

Future prospects remain highly favorable, supported by Indonesia’s strategic location, young demographic profile, and government commitment to infrastructure modernization. The sector continues evolving toward sustainable construction practices, digital integration, and innovative financing mechanisms that enhance project viability and market accessibility.

Strategic market insights reveal several critical factors shaping Indonesia’s commercial construction landscape:

Economic expansion serves as the primary driver for Indonesia’s commercial construction market, with sustained GDP growth creating demand for modern business infrastructure. The country’s transition toward a service-based economy necessitates sophisticated office complexes, retail facilities, and mixed-use developments that support evolving business requirements and consumer preferences.

Urbanization trends significantly impact market dynamics, as rural-to-urban migration creates demand for commercial infrastructure in expanding metropolitan areas. Population growth in major cities drives retail construction, while increasing disposable income levels support hospitality and entertainment facility development across key urban markets.

Government initiatives play a crucial role through infrastructure development programs, regulatory reforms, and investment incentives that encourage commercial construction activities. The National Strategic Projects program includes numerous commercial components, while special economic zones provide attractive investment opportunities for developers and international partners.

Foreign direct investment continues driving market expansion, with multinational corporations establishing regional headquarters and operational centers requiring modern office facilities. Tourism sector growth generates demand for hospitality infrastructure, while expanding manufacturing activities create needs for industrial and logistics facilities that complement commercial development projects.

Regulatory complexity presents significant challenges for commercial construction projects, with multiple approval processes, varying local regulations, and bureaucratic procedures that can extend project timelines and increase development costs. Land acquisition difficulties in prime urban locations create constraints for developers, particularly in Jakarta and other major cities where available commercial land is increasingly scarce and expensive.

Infrastructure limitations in certain regions restrict commercial development opportunities, as inadequate transportation networks, power supply constraints, and telecommunications infrastructure can impact project viability. Skilled labor shortages affect construction quality and project schedules, particularly for specialized trades and advanced construction techniques requiring technical expertise.

Financing challenges impact smaller developers and regional projects, as access to construction financing remains limited and interest rates can affect project economics. Environmental regulations are becoming increasingly stringent, requiring additional compliance measures and potentially increasing construction costs for commercial developments.

Market volatility related to global economic conditions, currency fluctuations, and commodity price variations can impact construction material costs and project profitability. Competition intensity among developers and contractors creates pricing pressures that may affect profit margins and project quality standards across the commercial construction sector.

Smart building technologies present substantial opportunities for commercial construction companies to differentiate their offerings and meet evolving tenant expectations. Integration of IoT systems, energy management solutions, and automated building controls creates value-added propositions that command premium pricing and enhance long-term asset performance.

Sustainable construction practices offer competitive advantages as environmental consciousness increases among tenants and investors. Green building certifications, renewable energy integration, and sustainable material usage create opportunities for specialized contractors and suppliers to capture growing market segments focused on environmental responsibility.

Regional expansion opportunities exist in secondary cities experiencing economic growth and infrastructure development. Palembang, Balikpapan, Batam, and other emerging urban centers offer attractive development prospects with lower land costs and supportive local government policies encouraging commercial investment.

Public-private partnerships create opportunities for commercial construction companies to participate in large-scale infrastructure projects combining public facilities with commercial components. Mixed-use developments, transportation hubs, and integrated urban complexes offer substantial project opportunities that leverage both public infrastructure needs and commercial market demand.

Supply and demand dynamics in Indonesia’s commercial construction market reflect the country’s rapid economic development and urbanization trends. Demand drivers include expanding business activities, growing retail sectors, and increasing tourism, while supply factors encompass construction capacity, material availability, and skilled labor resources.

Competitive dynamics feature both domestic and international players competing across various market segments. Local construction companies leverage market knowledge and cost advantages, while international firms bring advanced technologies and global best practices. Strategic partnerships between local and foreign companies are increasingly common, combining complementary strengths and capabilities.

Technology integration is reshaping market dynamics through digital construction methods, advanced project management systems, and innovative building materials. Construction productivity improvements of approximately 15-20% are achievable through technology adoption, creating competitive advantages for early adopters and driving industry-wide modernization efforts.

Market cycles influence construction activity levels, with economic expansion periods driving increased development while economic uncertainty may temporarily slow project initiation. Risk management strategies become crucial for market participants to navigate cyclical variations and maintain sustainable business operations throughout different market conditions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Indonesia’s commercial construction market. Primary research activities include structured interviews with industry executives, project developers, contractors, and government officials to gather firsthand market intelligence and validate secondary research findings.

Secondary research encompasses analysis of government statistics, industry reports, company financial statements, and regulatory documents to establish market baselines and identify trends. Data triangulation methods ensure information accuracy by cross-referencing multiple sources and validating findings through different analytical approaches.

Market segmentation analysis examines various construction categories, geographic regions, and project types to provide detailed market insights. Quantitative analysis focuses on construction volumes, project values, and market share distributions, while qualitative assessment explores market trends, competitive dynamics, and future opportunities.

Expert consultation with industry professionals, academic researchers, and market analysts provides additional perspectives on market developments and future projections. Field research activities include site visits to major commercial construction projects to observe construction practices, technology implementation, and market conditions firsthand.

Java Island dominates Indonesia’s commercial construction market, accounting for approximately 70% of total commercial construction activity due to economic concentration and infrastructure advantages. Jakarta Metropolitan Area leads development with numerous office towers, shopping centers, and mixed-use projects, while Surabaya and Bandung contribute significantly to regional commercial construction volumes.

Sumatra region presents growing opportunities, particularly in Medan, Palembang, and Pekanbaru, where economic development and population growth drive commercial infrastructure demand. The region benefits from natural resource industries and strategic location for trade with Malaysia and Singapore, creating demand for business facilities and logistics infrastructure.

Kalimantan experiences commercial construction growth driven by mining, plantation, and energy sectors, with Balikpapan and Samarinda leading development activities. The region’s economic diversification efforts create opportunities for retail, hospitality, and office developments supporting expanding service sectors.

Eastern Indonesia including Sulawesi, Papua, and Maluku represents emerging markets with significant growth potential. Government infrastructure programs and regional development initiatives are creating demand for commercial facilities, though market development remains in early stages compared to western regions. Makassar serves as the primary commercial hub for eastern Indonesia, experiencing increased construction activity supporting regional economic growth.

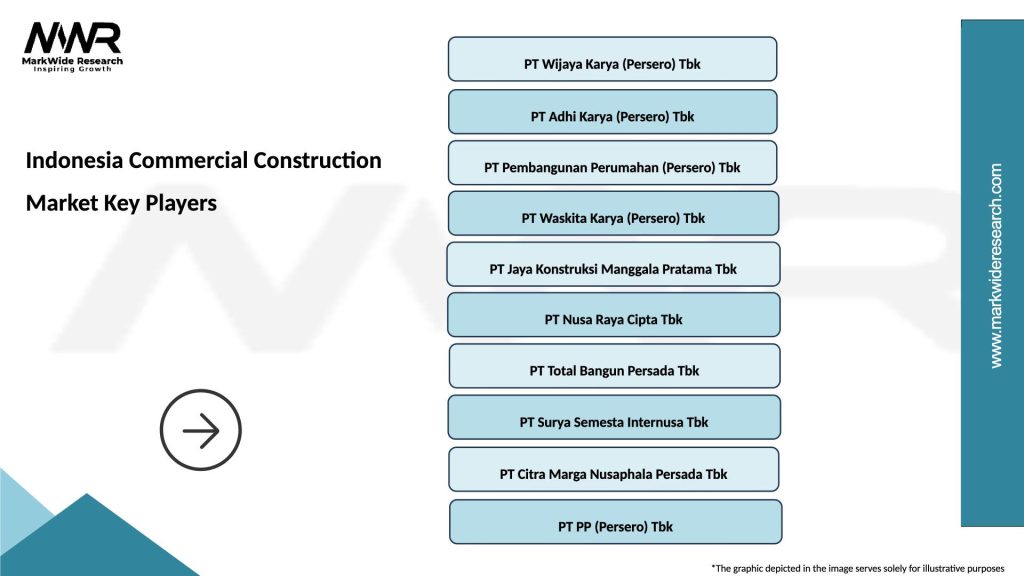

Market leadership in Indonesia’s commercial construction sector features a mix of established domestic companies and prominent international firms competing across various project segments and geographic markets.

Competitive strategies focus on technology adoption, sustainable construction practices, and strategic partnerships to enhance market positioning and project delivery capabilities.

By Project Type:

By Construction Method:

By Geographic Region:

Office Construction Segment demonstrates robust growth driven by multinational corporation expansion and domestic business development. Grade A office buildings command premium rents and attract international tenants, while flexible office spaces and co-working facilities represent emerging market segments responding to changing work patterns and startup ecosystem growth.

Retail Construction Category evolves with changing consumer preferences and e-commerce integration. Traditional shopping malls incorporate experiential retail concepts, while lifestyle centers and outlet malls gain popularity. Omnichannel retail facilities combining physical stores with distribution capabilities serve evolving retail strategies.

Hospitality Construction Sector benefits from Indonesia’s tourism growth and business travel expansion. Business hotels serve corporate markets in major cities, while resort developments capitalize on leisure tourism in destinations like Bali, Lombok, and Bintan. Budget hotel chains expand rapidly to serve growing domestic travel markets.

Healthcare Construction Market responds to increasing healthcare demand and medical tourism opportunities. Private hospital developments feature advanced medical technologies and international standard facilities, while specialized medical centers serve specific healthcare needs and attract regional patients seeking quality medical services.

Mixed-Use Development Category represents the fastest-growing segment, with integrated urban complexes combining multiple functions to maximize land utilization and create vibrant urban environments. These projects often include residential towers, office spaces, retail areas, and recreational facilities in comprehensive developments.

Developers and Investors benefit from Indonesia’s strong economic fundamentals, growing middle class, and supportive government policies that create favorable investment conditions. Market opportunities span multiple sectors and geographic regions, allowing portfolio diversification and risk management strategies.

Construction Companies gain access to substantial project pipelines and opportunities for business expansion across various commercial construction segments. Technology adoption and sustainable construction practices create competitive advantages and premium pricing opportunities in sophisticated market segments.

Material Suppliers benefit from consistent demand growth and opportunities to introduce innovative construction materials and systems. Local sourcing preferences and import substitution policies create advantages for domestic suppliers while international suppliers can establish local partnerships and manufacturing facilities.

Financial Institutions find attractive lending opportunities in commercial construction projects with strong fundamentals and experienced developers. Project financing, construction loans, and long-term mortgages represent substantial business opportunities in Indonesia’s expanding commercial construction market.

Government Entities achieve economic development objectives through commercial construction activities that create employment, generate tax revenues, and attract foreign investment. Urban development goals are supported by modern commercial infrastructure that enhances city competitiveness and livability standards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable Construction Practices are becoming mainstream in Indonesia’s commercial construction market, with green building certifications increasingly required for premium projects. Energy-efficient systems, sustainable materials, and waste reduction strategies are standard considerations in modern commercial developments, driven by environmental awareness and regulatory requirements.

Smart Building Technologies gain widespread adoption as tenants demand advanced building systems and connectivity features. IoT integration, automated building controls, and digital infrastructure become essential components of competitive commercial properties, enhancing operational efficiency and tenant satisfaction levels.

Mixed-Use Development Concepts dominate new commercial projects as developers maximize land utilization and create comprehensive urban environments. Integrated complexes combining residential, office, retail, and recreational components provide convenience and lifestyle benefits that attract tenants and visitors.

Modular and Prefabricated Construction methods gain acceptance for their efficiency and quality advantages. Factory-built components reduce construction timelines and improve quality control, while standardized building systems enable cost optimization and faster project delivery across multiple developments.

Digital Construction Management transforms project delivery through Building Information Modeling (BIM), project management software, and digital collaboration platforms. These technologies improve coordination, reduce errors, and enhance communication among project stakeholders throughout the construction process.

Government Infrastructure Initiatives continue supporting commercial construction growth through the National Strategic Projects program and regional development policies. Special Economic Zones create attractive investment opportunities with streamlined regulations and infrastructure support for commercial developments.

Foreign Investment Expansion brings international expertise and capital to Indonesia’s commercial construction market. Japanese, Chinese, Korean, and Singaporean companies establish significant market presence through direct investments, joint ventures, and strategic partnerships with local developers and contractors.

Technology Transfer Programs enhance local construction capabilities through partnerships with international firms. Advanced construction methods, project management systems, and sustainable building practices are increasingly adopted by Indonesian construction companies through technology transfer arrangements.

Financial Market Development improves access to construction financing through Real Estate Investment Trusts (REITs), infrastructure bonds, and specialized construction lending programs. These financial innovations support larger commercial construction projects and enable broader market participation.

Regulatory Modernization efforts streamline approval processes and reduce bureaucratic barriers for commercial construction projects. Online permit systems, one-stop service centers, and regulatory harmonization initiatives improve business environment conditions for construction industry participants.

Market Entry Strategies should focus on establishing local partnerships and understanding regulatory requirements before committing significant resources to Indonesian commercial construction markets. Joint ventures with established local companies provide market knowledge, regulatory expertise, and established relationships that facilitate successful market entry.

Technology Investment recommendations emphasize adopting digital construction methods and sustainable building practices to maintain competitive positioning. BIM implementation, project management systems, and green construction capabilities become essential for competing in premium market segments and attracting international clients.

Geographic Diversification strategies should consider opportunities in secondary cities where competition is less intense and government support is available. Regional expansion beyond Java Island offers attractive development prospects with lower land costs and supportive local policies encouraging commercial investment.

Financing Optimization approaches should explore various funding sources including international development banks, private equity, and local financial institutions. Project financing structures that match cash flows with debt service requirements enhance project viability and reduce financial risks.

Risk Management strategies must address regulatory, environmental, and market risks through comprehensive planning and appropriate insurance coverage. MarkWide Research analysis suggests that successful market participants develop robust risk management frameworks that address Indonesia’s unique market characteristics and potential challenges.

Long-term growth prospects for Indonesia’s commercial construction market remain highly favorable, supported by sustained economic expansion, demographic advantages, and continued urbanization trends. Market evolution toward more sophisticated construction methods and sustainable building practices will create opportunities for companies that invest in advanced capabilities and technologies.

Sector transformation will be driven by technology adoption, environmental considerations, and changing user preferences for flexible, connected, and sustainable commercial spaces. Smart building integration and sustainable construction practices will become standard requirements rather than premium features, reshaping competitive dynamics and market expectations.

Regional development patterns indicate expanding opportunities beyond traditional urban centers as economic growth spreads to secondary cities and emerging regions. Infrastructure improvements and government development programs will create new commercial construction opportunities in previously underserved markets across the archipelago.

Market maturation will likely result in increased consolidation among construction companies, with larger firms acquiring specialized capabilities and expanding geographic coverage. International partnerships and technology transfer arrangements will continue playing important roles in market development and capability enhancement.

Investment flows are expected to remain strong, with both domestic and international capital supporting commercial construction growth. MWR projections indicate that market fundamentals will support continued expansion, though growth rates may moderate as the market matures and base effects diminish over time.

Indonesia’s commercial construction market represents one of Southeast Asia’s most compelling growth opportunities, driven by strong economic fundamentals, favorable demographics, and supportive government policies. The market demonstrates remarkable resilience and adaptability, incorporating advanced technologies and sustainable practices while maintaining robust growth momentum across multiple sectors and geographic regions.

Market participants who successfully navigate regulatory complexities, invest in advanced capabilities, and develop strategic partnerships are well-positioned to capitalize on substantial growth opportunities. The sector’s evolution toward smart building technologies, sustainable construction practices, and integrated development concepts creates competitive advantages for forward-thinking companies that embrace innovation and market transformation.

Future success in Indonesia’s commercial construction market will depend on understanding local market dynamics, maintaining financial flexibility, and developing comprehensive risk management strategies. Companies that combine international expertise with local market knowledge, while investing in technology and sustainable practices, will be best positioned to achieve long-term success in this dynamic and rapidly expanding market.

What is Indonesia Commercial Construction?

Indonesia Commercial Construction refers to the sector involved in the building and renovation of commercial properties such as offices, retail spaces, and industrial facilities within Indonesia.

What are the key players in the Indonesia Commercial Construction Market?

Key players in the Indonesia Commercial Construction Market include companies like PT Wijaya Karya, PT Pembangunan Perumahan, and PT Adhi Karya, among others.

What are the main drivers of growth in the Indonesia Commercial Construction Market?

The main drivers of growth in the Indonesia Commercial Construction Market include urbanization, increasing foreign investment, and government infrastructure initiatives aimed at boosting economic development.

What challenges does the Indonesia Commercial Construction Market face?

Challenges in the Indonesia Commercial Construction Market include regulatory hurdles, fluctuating material costs, and a shortage of skilled labor, which can impact project timelines and budgets.

What opportunities exist in the Indonesia Commercial Construction Market?

Opportunities in the Indonesia Commercial Construction Market include the development of smart buildings, sustainable construction practices, and the expansion of e-commerce logistics facilities to meet growing demand.

What trends are shaping the Indonesia Commercial Construction Market?

Trends shaping the Indonesia Commercial Construction Market include the adoption of green building technologies, increased use of prefabrication methods, and a focus on digital transformation in project management.

Indonesia Commercial Construction Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cement, Steel, Aggregates, Bricks |

| Technology | Modular Construction, Prefabrication, 3D Printing, Smart Building |

| End User | Government, Commercial, Residential, Infrastructure |

| Installation | On-site, Off-site, Hybrid, Turnkey |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia Commercial Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at