444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Indonesia automotive lubricant market represents one of Southeast Asia’s most dynamic and rapidly expanding sectors, driven by the country’s robust automotive industry and increasing vehicle ownership rates. Indonesia’s position as the largest automotive market in Southeast Asia has created substantial demand for high-quality lubricants across passenger cars, commercial vehicles, and motorcycles. The market demonstrates impressive growth momentum with a projected compound annual growth rate (CAGR) of 6.2% through the forecast period, reflecting the nation’s economic development and urbanization trends.

Market dynamics in Indonesia are particularly influenced by the country’s massive motorcycle population, which accounts for approximately 85% of total vehicle registrations. This unique market composition creates distinct opportunities for lubricant manufacturers specializing in two-wheeler applications. The automotive lubricant sector encompasses engine oils, transmission fluids, brake fluids, and specialty lubricants, with synthetic and semi-synthetic formulations gaining increasing market share as consumers become more quality-conscious.

Regional distribution shows concentration in major urban centers including Jakarta, Surabaya, and Bandung, where vehicle density and maintenance awareness are highest. The market benefits from Indonesia’s strategic location as a manufacturing hub for global automotive brands, creating demand for both original equipment manufacturer (OEM) and aftermarket lubricant products.

The Indonesia automotive lubricant market refers to the comprehensive ecosystem of lubricating products specifically designed for automotive applications within Indonesia’s transportation sector. This market encompasses all types of lubricants used in passenger vehicles, commercial trucks, buses, motorcycles, and specialty automotive equipment operating throughout the Indonesian archipelago.

Automotive lubricants serve critical functions including reducing friction between moving parts, dissipating heat, preventing corrosion, and maintaining optimal engine performance. In the Indonesian context, these products must meet specific requirements related to tropical climate conditions, varying fuel quality, and diverse driving patterns ranging from urban congestion to rural terrain navigation.

The market includes multiple product categories such as engine oils (mineral, semi-synthetic, and fully synthetic), gear oils, hydraulic fluids, coolants, and specialized lubricants for different vehicle types. Distribution channels span from authorized dealerships and service centers to independent workshops, retail outlets, and increasingly, digital platforms catering to Indonesia’s growing e-commerce adoption.

Indonesia’s automotive lubricant market stands as a cornerstone of the nation’s automotive ecosystem, characterized by robust growth prospects and evolving consumer preferences toward premium products. The market’s expansion is fundamentally driven by Indonesia’s position as Southeast Asia’s largest automotive market, with vehicle sales consistently showing positive growth trends despite periodic economic fluctuations.

Key market drivers include rapid urbanization, increasing disposable income, and growing awareness of vehicle maintenance importance. The motorcycle segment dominates lubricant consumption, representing approximately 70% of total market volume, while the passenger car segment shows the highest value growth potential due to premiumization trends.

Market transformation is evident in the shift toward synthetic and semi-synthetic lubricants, driven by improved engine technologies and consumer education about long-term cost benefits. International brands maintain strong market presence alongside emerging local players who leverage competitive pricing and localized distribution networks.

Future outlook remains optimistic, supported by government initiatives promoting automotive industry development, infrastructure improvements, and the gradual introduction of electric vehicles creating new lubricant application opportunities in hybrid and electric vehicle segments.

Strategic market insights reveal several critical factors shaping Indonesia’s automotive lubricant landscape:

Market maturity indicators suggest Indonesia is transitioning from a price-sensitive market toward value-based purchasing decisions, creating opportunities for premium product positioning and enhanced customer service offerings.

Primary market drivers propelling Indonesia’s automotive lubricant sector include robust automotive industry growth, supported by the country’s emergence as a regional manufacturing hub. Vehicle production expansion by major automotive manufacturers has created substantial demand for both factory-fill and aftermarket lubricant products.

Economic development across Indonesia’s major cities has resulted in increased vehicle ownership rates, with middle-class expansion driving demand for personal transportation. This demographic shift creates sustained lubricant demand as vehicle parc continues growing at approximately 8% annually.

Infrastructure development initiatives, including road network expansion and urban transportation projects, have increased vehicle utilization rates and consequently lubricant consumption. The government’s focus on improving connectivity between islands and regions has stimulated commercial vehicle activity, boosting demand for heavy-duty lubricants.

Technological advancement in automotive engines requires more sophisticated lubricant formulations, driving market value growth even as volume growth moderates. Modern engines with tighter tolerances and extended service intervals create opportunities for premium synthetic lubricants.

Consumer awareness regarding vehicle maintenance importance has increased significantly, supported by educational campaigns from lubricant manufacturers and automotive service providers. This awareness translates into more frequent oil changes and preference for quality products over purely price-based decisions.

Market constraints facing Indonesia’s automotive lubricant sector include economic volatility that periodically impacts consumer spending on vehicle maintenance. Currency fluctuations affect import costs for base oils and additives, creating pricing pressures for manufacturers and distributors.

Price sensitivity remains a significant challenge, particularly in rural markets where consumers prioritize lowest-cost options over quality considerations. This dynamic limits premium product penetration and affects overall market value growth potential.

Counterfeit products pose ongoing challenges, with fake lubricants undermining consumer confidence and creating unfair competition for legitimate manufacturers. The prevalence of counterfeit products is estimated at approximately 15% of total market volume, particularly affecting lower-priced segments.

Infrastructure limitations in remote areas create distribution challenges, increasing logistics costs and limiting market reach for organized players. Poor road conditions in certain regions also affect product quality during transportation and storage.

Regulatory complexity across different regions within Indonesia creates compliance challenges for manufacturers, particularly regarding environmental standards and product specifications. Varying local regulations can complicate market entry strategies for new players.

Significant opportunities exist within Indonesia’s automotive lubricant market, particularly in the rapidly expanding electric and hybrid vehicle segments. As Indonesia positions itself as a regional electric vehicle manufacturing hub, demand for specialized lubricants for electric vehicle applications presents new growth avenues.

Digital transformation opportunities include e-commerce platform development, mobile applications for service scheduling, and digital marketing strategies targeting younger consumers. Online lubricant sales show promising growth potential with increasing internet penetration and smartphone adoption.

Premium segment expansion offers substantial value creation opportunities as Indonesian consumers become more quality-conscious and willing to invest in superior products. Synthetic lubricant adoption rates remain below regional averages, indicating significant upside potential.

Rural market penetration represents an untapped opportunity, with improved distribution networks and localized marketing strategies potentially unlocking substantial volume growth. Rural areas show increasing motorization rates as economic development spreads beyond major cities.

Service integration opportunities include developing comprehensive maintenance packages, loyalty programs, and partnerships with automotive service providers to create value-added offerings beyond traditional product sales.

Market dynamics in Indonesia’s automotive lubricant sector reflect the complex interplay between economic growth, technological advancement, and changing consumer preferences. Competitive intensity has increased as both international and domestic players vie for market share through product innovation and strategic partnerships.

Supply chain evolution shows increasing localization as manufacturers establish production facilities within Indonesia to reduce costs and improve supply security. This trend has resulted in approximately 60% of lubricant demand being met through domestic production capacity.

Consumer behavior patterns demonstrate gradual shifts toward premium products, driven by increased awareness of total cost of ownership rather than initial purchase price. This behavioral change creates opportunities for value-based marketing strategies and premium product positioning.

Regulatory environment continues evolving with stricter environmental standards and quality requirements, pushing manufacturers toward more sophisticated formulations and sustainable practices. These regulatory changes create both challenges and opportunities for market participants.

Technology integration within the lubricant industry includes IoT applications for monitoring oil condition, predictive maintenance solutions, and digital platforms for customer engagement. These technological advances are reshaping traditional business models and creating new revenue streams.

Comprehensive research methodology employed for analyzing Indonesia’s automotive lubricant market incorporates multiple data collection approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, retailers, and end consumers across different market segments.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial statements to establish market baselines and validate primary findings. MarkWide Research utilizes proprietary databases and analytical frameworks to ensure comprehensive market coverage.

Data triangulation methods verify information accuracy through cross-referencing multiple sources and applying statistical validation techniques. Market sizing calculations incorporate bottom-up and top-down approaches to ensure consistency and reliability.

Regional analysis includes field research across major Indonesian cities and provinces to capture local market dynamics and consumer preferences. This geographical approach ensures comprehensive understanding of market variations across Indonesia’s diverse regions.

Temporal analysis covers historical market performance, current market conditions, and future projections based on identified trends and drivers. Forecasting models incorporate economic indicators, demographic trends, and industry-specific factors to project market evolution.

Regional market distribution across Indonesia shows significant concentration in Java, which accounts for approximately 65% of total lubricant consumption due to its high population density and industrial concentration. Jakarta and surrounding areas represent the largest single market, driven by extensive vehicle populations and high maintenance service density.

Sumatra region demonstrates strong growth potential, particularly in industrial lubricants due to expanding palm oil and mining operations. The region’s commercial vehicle population creates substantial demand for heavy-duty lubricants and specialized industrial applications.

Eastern Indonesia markets, including Kalimantan and Sulawesi, show emerging opportunities as infrastructure development and economic growth accelerate. These regions currently represent approximately 20% of national consumption but demonstrate above-average growth rates.

Urban versus rural dynamics reveal distinct consumption patterns, with urban areas showing higher premium product penetration and more frequent maintenance intervals. Rural markets prioritize value-oriented products but show increasing quality awareness as economic conditions improve.

Distribution network analysis indicates varying channel effectiveness across regions, with organized retail stronger in urban areas while traditional trade remains dominant in rural markets. Regional logistics capabilities significantly impact product availability and pricing strategies.

Competitive landscape in Indonesia’s automotive lubricant market features a mix of global multinational corporations and strong local players, creating a dynamic and competitive environment. Market leadership is distributed among several key players, each with distinct competitive advantages and market positioning strategies.

Competitive strategies include product differentiation through advanced formulations, extensive distribution network development, strategic partnerships with automotive manufacturers, and aggressive marketing campaigns targeting specific consumer segments.

Market consolidation trends show increasing collaboration between international brands and local distributors to leverage combined strengths in market knowledge and operational capabilities.

Market segmentation analysis reveals distinct categories based on product type, application, and distribution channels. Product-based segmentation includes engine oils, transmission fluids, brake fluids, coolants, and specialty lubricants, each with specific market dynamics and growth patterns.

By Product Type:

By Vehicle Type:

By Distribution Channel:

Engine oil category dominates the Indonesian automotive lubricant market, with mineral oils maintaining the largest volume share despite growing synthetic adoption. Conventional mineral oils remain popular due to cost considerations, particularly in the motorcycle segment where price sensitivity is highest.

Semi-synthetic lubricants represent the fastest-growing category, offering improved performance at moderate price premiums. This segment appeals to consumers seeking better protection without full synthetic pricing, showing annual growth rates exceeding 12%.

Fully synthetic oils demonstrate strong growth in premium passenger car applications, driven by modern engine requirements and extended service intervals. Despite higher initial costs, synthetic oils gain acceptance through total cost of ownership benefits.

Motorcycle-specific lubricants constitute a unique category addressing Indonesia’s massive two-wheeler population. These products require specialized formulations for air-cooled engines and varying quality fuel conditions prevalent in the Indonesian market.

Commercial vehicle lubricants show increasing sophistication as fleet operators recognize maintenance cost optimization opportunities. Heavy-duty formulations designed for Indonesian operating conditions create differentiation opportunities for manufacturers.

Industry participants in Indonesia’s automotive lubricant market benefit from multiple value creation opportunities across the supply chain. Manufacturers gain access to Southeast Asia’s largest automotive market with diverse application requirements and growing premium segment demand.

Distributors and retailers benefit from steady demand growth, supported by increasing vehicle populations and improving maintenance awareness. The market’s resilience during economic fluctuations provides stable revenue streams for channel partners.

Automotive service providers leverage lubricant partnerships to enhance service offerings and create additional revenue streams through maintenance packages and customer loyalty programs. Integration with lubricant suppliers enables comprehensive vehicle care solutions.

End consumers benefit from improved product availability, competitive pricing through market competition, and enhanced product quality as manufacturers invest in advanced formulations. Educational initiatives improve consumer understanding of maintenance best practices.

Government stakeholders benefit from increased tax revenues, employment generation in manufacturing and distribution sectors, and improved air quality through advanced lubricant formulations that reduce emissions and improve fuel efficiency.

Strengths:

Weaknesses:

Opportunities:

Threats:

Synthetic lubricant adoption represents the most significant trend reshaping Indonesia’s automotive lubricant market. Consumer education initiatives by manufacturers have successfully demonstrated synthetic oil benefits, resulting in accelerating adoption rates despite higher initial costs.

Digital integration across the lubricant value chain includes mobile applications for service scheduling, IoT-enabled oil monitoring systems, and e-commerce platforms for direct consumer sales. These digital solutions enhance customer engagement and create new business models.

Sustainability focus drives development of bio-based lubricants and recycling programs, responding to increasing environmental awareness among consumers and regulatory requirements. MWR analysis indicates growing demand for environmentally friendly formulations.

Service bundling trends show lubricant manufacturers partnering with service providers to offer comprehensive maintenance packages, creating customer loyalty and recurring revenue streams beyond traditional product sales.

Localization strategies include establishing domestic production facilities, developing Indonesia-specific formulations, and creating localized marketing campaigns that resonate with Indonesian consumers’ preferences and values.

Recent industry developments highlight the dynamic nature of Indonesia’s automotive lubricant market. Manufacturing capacity expansion by major players reflects confidence in long-term market growth prospects and commitment to serving local demand.

Strategic partnerships between international lubricant brands and local automotive manufacturers have created exclusive supply agreements and co-branded product offerings. These collaborations leverage combined expertise in product development and market access.

Technology investments include advanced blending facilities, quality control laboratories, and research and development centers focused on tropical climate formulations. These investments enhance product quality and enable rapid response to market requirements.

Distribution network expansion efforts focus on reaching underserved markets through innovative channel strategies, including mobile service units and rural distribution partnerships with local entrepreneurs.

Regulatory compliance initiatives address evolving environmental standards and quality requirements, with manufacturers investing in cleaner production processes and advanced formulation technologies to meet new specifications.

Strategic recommendations for success in Indonesia’s automotive lubricant market emphasize the importance of balancing premium product development with value-oriented offerings for price-sensitive segments. Market participants should focus on building strong distribution networks that can effectively reach both urban and rural markets.

Product portfolio optimization should include motorcycle-specific formulations given the segment’s dominance in Indonesian transportation. Companies should also prepare for electric vehicle lubricant requirements as the EV market develops.

Digital transformation investments are essential for future competitiveness, including e-commerce capabilities, customer relationship management systems, and digital marketing platforms targeting younger consumers who increasingly influence purchasing decisions.

Partnership strategies with local distributors, automotive manufacturers, and service providers can accelerate market penetration and create competitive advantages through combined capabilities and market knowledge.

Sustainability initiatives should be integrated into long-term planning, including development of bio-based products, recycling programs, and environmentally responsible manufacturing processes that align with growing environmental consciousness.

Future market prospects for Indonesia’s automotive lubricant sector remain highly positive, supported by fundamental growth drivers including continued economic development, urbanization, and vehicle market expansion. Long-term growth projections indicate sustained demand increases across all major product categories.

Electric vehicle integration will create new market dynamics as Indonesia positions itself as a regional EV manufacturing hub. While traditional lubricant demand may moderate in the long term, specialized EV lubricants and hybrid vehicle applications will create new opportunities.

Premium market development shows accelerating potential as Indonesian consumers become more quality-conscious and willing to invest in superior products. MarkWide Research projects synthetic lubricant market share could reach 35% by 2030, representing substantial value growth opportunities.

Digital transformation will continue reshaping market dynamics, with online sales channels, digital marketing, and IoT-enabled services becoming increasingly important for competitive success. Companies that successfully integrate digital capabilities will gain significant advantages.

Regional expansion opportunities exist as infrastructure development and economic growth spread beyond Java to other Indonesian regions, creating new markets for lubricant manufacturers and distributors willing to invest in market development.

Indonesia’s automotive lubricant market presents compelling opportunities for growth and value creation, driven by the country’s position as Southeast Asia’s largest automotive market and continued economic development. The market’s unique characteristics, including motorcycle dominance and tropical operating conditions, create specific requirements that successful participants must address through tailored strategies.

Market evolution toward premium products, digital integration, and sustainability focus creates both challenges and opportunities for industry participants. Companies that can effectively balance these trends while maintaining competitive positioning across diverse market segments will achieve sustainable success.

Strategic success factors include comprehensive distribution network development, product portfolio optimization for local requirements, digital capability building, and strategic partnerships that leverage combined strengths. The market’s resilience and growth potential make it an attractive destination for continued investment and expansion efforts by both domestic and international players.

What is Automotive Lubricant?

Automotive lubricant refers to substances used to reduce friction between surfaces in automotive engines and machinery, enhancing performance and longevity. These lubricants include engine oils, transmission fluids, and greases, which are essential for the smooth operation of vehicles.

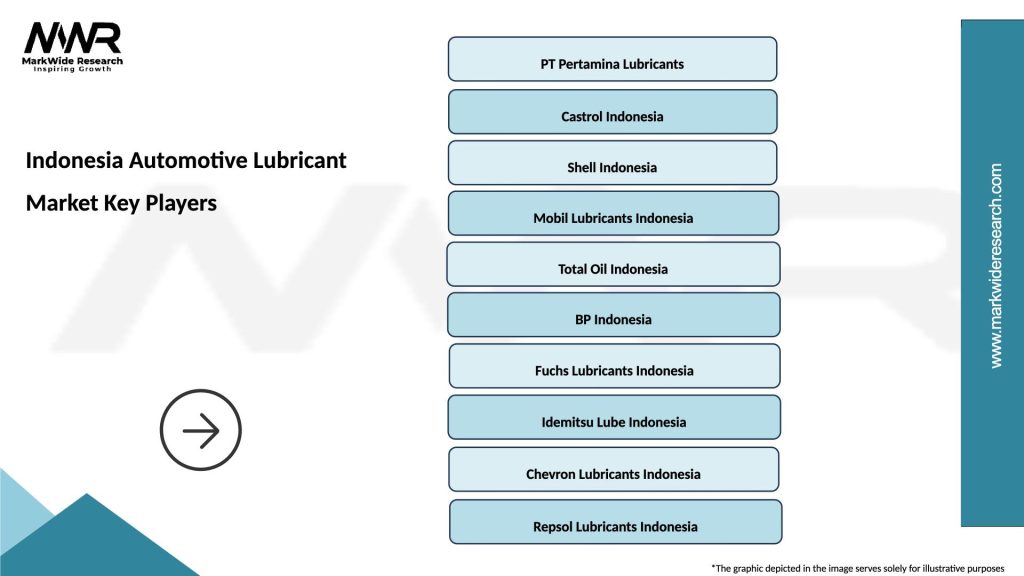

What are the key players in the Indonesia Automotive Lubricant Market?

Key players in the Indonesia Automotive Lubricant Market include Pertamina, Shell, and Castrol, which offer a range of products tailored for various automotive applications. These companies compete on product quality, innovation, and distribution networks among others.

What are the growth factors driving the Indonesia Automotive Lubricant Market?

The growth of the Indonesia Automotive Lubricant Market is driven by increasing vehicle ownership, rising demand for high-performance lubricants, and advancements in automotive technology. Additionally, the expansion of the automotive sector in Indonesia contributes to the market’s growth.

What challenges does the Indonesia Automotive Lubricant Market face?

The Indonesia Automotive Lubricant Market faces challenges such as fluctuating raw material prices and stringent environmental regulations. These factors can impact production costs and compliance for lubricant manufacturers.

What opportunities exist in the Indonesia Automotive Lubricant Market?

Opportunities in the Indonesia Automotive Lubricant Market include the growing trend towards synthetic lubricants and eco-friendly products. Additionally, the rise of electric vehicles presents new avenues for lubricant innovation and development.

What trends are shaping the Indonesia Automotive Lubricant Market?

Trends in the Indonesia Automotive Lubricant Market include the increasing adoption of advanced engine oils and the shift towards sustainable lubricants. Innovations in formulation and packaging are also becoming prominent as manufacturers respond to consumer preferences.

Indonesia Automotive Lubricant Market

| Segmentation Details | Description |

|---|---|

| Product Type | Engine Oil, Transmission Fluid, Gear Oil, Hydraulic Oil |

| End User | OEMs, Aftermarket Providers, Dealerships, Fleet Operators |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Heavy-Duty Trucks |

| Grade | Mineral, Synthetic, Semi-Synthetic, Bio-Based |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indonesia Automotive Lubricant Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at