444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The Indian defense market represents one of the most dynamic and rapidly evolving defense ecosystems globally, characterized by substantial modernization initiatives and strategic capability enhancement programs. India’s defense sector has emerged as a critical component of national security infrastructure, driven by evolving geopolitical challenges and technological advancement requirements. The market encompasses comprehensive defense capabilities including land systems, naval platforms, aerospace technologies, and emerging domains such as cyber warfare and space defense.

Strategic modernization programs have positioned India among the world’s largest defense markets, with significant emphasis on indigenous manufacturing capabilities and technology transfer initiatives. The sector demonstrates robust growth trajectory with 8.2% CAGR projected over the forecast period, reflecting sustained government commitment to defense capability enhancement. Make in India initiatives have fundamentally transformed the market landscape, encouraging domestic manufacturing and reducing import dependency across critical defense platforms.

Defense procurement policies emphasize indigenous development and manufacturing, creating substantial opportunities for both domestic and international defense contractors. The market benefits from comprehensive modernization programs across all service branches, including the Indian Army, Navy, and Air Force, each pursuing advanced capability acquisition programs aligned with contemporary threat environments.

The Indian defense market refers to the comprehensive ecosystem encompassing defense equipment procurement, indigenous manufacturing, technology development, and strategic capability enhancement initiatives undertaken by India’s defense establishment. This market includes all aspects of defense-related activities from research and development to manufacturing, procurement, and maintenance of military systems and platforms.

Defense market dynamics in India involve complex interactions between government policy frameworks, indigenous manufacturing capabilities, international partnerships, and strategic requirements driven by regional security considerations. The market encompasses traditional defense segments including land-based systems, naval platforms, aerospace technologies, and emerging domains such as cyber defense, electronic warfare, and space-based capabilities.

Indigenous defense manufacturing has become a cornerstone of India’s defense market strategy, emphasizing self-reliance and technological sovereignty while maintaining strategic partnerships with international defense contractors. The market operates within comprehensive policy frameworks designed to balance immediate capability requirements with long-term strategic autonomy objectives.

India’s defense market demonstrates exceptional growth potential driven by comprehensive modernization programs and strategic policy initiatives emphasizing indigenous manufacturing capabilities. The market benefits from substantial government investment in defense infrastructure, technology development, and capability enhancement programs across all service branches. Strategic partnerships with international defense contractors complement domestic manufacturing initiatives, creating a balanced approach to capability development.

Key market drivers include evolving threat environments, border security requirements, and technological advancement needs across traditional and emerging warfare domains. The market shows strong momentum with 65% indigenous content targets driving domestic manufacturing growth and creating opportunities for technology transfer and joint development programs. Defense exports have emerged as a significant growth area, with India targeting expanded market presence in friendly nations.

Market segmentation reveals strong demand across land systems, naval platforms, aerospace technologies, and emerging domains including cyber defense and space capabilities. The sector benefits from comprehensive policy support, including streamlined procurement processes, offset obligations, and strategic partnership frameworks designed to accelerate capability development while promoting indigenous manufacturing.

Strategic market insights reveal fundamental transformation in India’s defense procurement and manufacturing landscape, driven by policy reforms and modernization imperatives. The market demonstrates strong growth across multiple segments, with particular emphasis on indigenous capability development and technology transfer initiatives.

Primary market drivers encompass strategic security requirements, modernization imperatives, and policy initiatives promoting indigenous defense manufacturing capabilities. The market benefits from comprehensive government support for defense capability enhancement and technology development programs.

Geopolitical considerations drive sustained investment in defense capabilities, with border security requirements and regional threat environments necessitating advanced military systems and platforms. Modernization programs across all service branches create substantial demand for contemporary defense technologies, from traditional platforms to emerging warfare capabilities including cyber defense and space-based systems.

Make in India initiatives serve as fundamental market drivers, promoting indigenous manufacturing capabilities while reducing import dependency. These programs create opportunities for technology transfer, joint development projects, and domestic manufacturing expansion across critical defense segments. Strategic partnerships with international defense contractors complement indigenous development efforts, facilitating advanced technology acquisition and local manufacturing capabilities.

Export market development has emerged as a significant driver, with India targeting expanded defense exports to friendly nations. This initiative creates additional demand for indigenous defense products while supporting domestic manufacturing growth and technological advancement.

Market restraints include complex procurement processes, technology transfer challenges, and capability development timelines that may impact market growth dynamics. Bureaucratic procedures and lengthy approval processes can delay critical procurement decisions and capability development programs, affecting market momentum.

Technology transfer limitations pose challenges for indigenous capability development, particularly in advanced defense technologies where international partners may restrict complete technology sharing. Skill development requirements in advanced manufacturing and technology domains create capacity constraints that may limit rapid market expansion.

Financial constraints and budget allocation challenges can impact the pace of modernization programs and capability development initiatives. Infrastructure limitations in defense manufacturing and testing facilities may restrict the scale and speed of indigenous production capabilities.

Regulatory complexities and compliance requirements for defense manufacturing and exports can create barriers for market participants, particularly smaller domestic manufacturers seeking to enter the defense sector. Quality assurance and certification processes for defense products require substantial investment and expertise, potentially limiting market participation.

Substantial market opportunities exist across multiple defense segments, driven by modernization requirements and indigenous manufacturing initiatives. Emerging technologies including artificial intelligence, autonomous systems, and advanced materials present significant opportunities for innovation and capability development.

Export market expansion offers considerable growth potential, with India targeting increased defense exports to friendly nations and strategic partners. This opportunity encompasses both traditional defense platforms and emerging technologies, creating demand for indigenous defense products in international markets.

Technology development partnerships with international defense contractors create opportunities for advanced capability acquisition while supporting indigenous manufacturing growth. Joint development programs enable access to cutting-edge technologies while building domestic expertise and manufacturing capabilities.

Private sector participation in defense manufacturing presents substantial opportunities for domestic companies to contribute to indigenous capability development. Startup ecosystem development in defense technologies creates opportunities for innovation and technological advancement across emerging warfare domains.

Maintenance and lifecycle support services for defense platforms represent growing opportunities as India’s defense inventory expands and modernizes. Training and simulation systems development offers additional market opportunities supporting capability enhancement programs.

Market dynamics reflect complex interactions between government policy frameworks, strategic requirements, and industrial capabilities that shape India’s defense sector evolution. Policy reforms have fundamentally altered market dynamics, emphasizing indigenous manufacturing while maintaining strategic international partnerships.

Demand dynamics are driven by comprehensive modernization programs across all service branches, with particular emphasis on contemporary threat environments and emerging warfare domains. The market demonstrates strong momentum with 75% procurement preference for indigenous products under revised defense procurement procedures.

Supply dynamics have evolved significantly with enhanced domestic manufacturing capabilities and strategic partnerships facilitating technology transfer and local production. Industrial capacity expansion supports growing demand while reducing import dependency across critical defense segments.

Competitive dynamics involve both domestic and international defense contractors, with increasing emphasis on indigenous capabilities and technology transfer requirements. Innovation dynamics drive continuous advancement in defense technologies, with substantial investment in research and development capabilities supporting next-generation defense systems.

Comprehensive research methodology employed for analyzing India’s defense market encompasses primary and secondary research approaches, providing detailed insights into market dynamics, competitive landscape, and growth opportunities. Primary research involves extensive consultations with defense industry stakeholders, government officials, and subject matter experts across various defense segments.

Secondary research incorporates analysis of government publications, defense policy documents, procurement announcements, and industry reports to establish comprehensive market understanding. Data validation processes ensure accuracy and reliability of market insights through cross-referencing multiple sources and expert verification.

Market analysis framework includes quantitative and qualitative assessment methodologies, examining market trends, growth drivers, challenges, and opportunities across different defense segments. Forecasting models incorporate historical data analysis, current market trends, and future growth projections based on policy initiatives and strategic requirements.

Stakeholder analysis encompasses government agencies, defense manufacturers, technology providers, and end-users to provide comprehensive market perspective. Regional analysis considers geographical factors, strategic requirements, and industrial capabilities across different regions within India.

Regional analysis reveals significant variations in defense manufacturing capabilities, strategic requirements, and industrial development across different regions of India. Northern regions demonstrate strong defense manufacturing presence with established industrial clusters and government facilities supporting land systems and aerospace technologies.

Western regions show robust defense industrial development with 35% market share in indigenous defense manufacturing, particularly in naval systems and aerospace components. These regions benefit from established industrial infrastructure and proximity to major defense establishments and testing facilities.

Southern regions have emerged as significant defense manufacturing hubs with substantial private sector participation and technology development capabilities. The region demonstrates strong growth in aerospace, electronics, and advanced materials manufacturing for defense applications.

Eastern regions focus primarily on traditional defense manufacturing and maintenance capabilities, with growing emphasis on modernization and technology upgradation programs. Strategic location advantages support border security requirements and regional defense capabilities.

Central regions serve as important defense manufacturing and testing centers with established government facilities and growing private sector participation. The region benefits from strategic location advantages and comprehensive infrastructure supporting various defense manufacturing activities.

Competitive landscape in India’s defense market encompasses both domestic and international players, with increasing emphasis on indigenous capabilities and strategic partnerships. Market leaders demonstrate strong positioning across multiple defense segments with comprehensive product portfolios and manufacturing capabilities.

Strategic partnerships between domestic and international companies have become increasingly important, facilitating technology transfer and capability development while supporting indigenous manufacturing objectives.

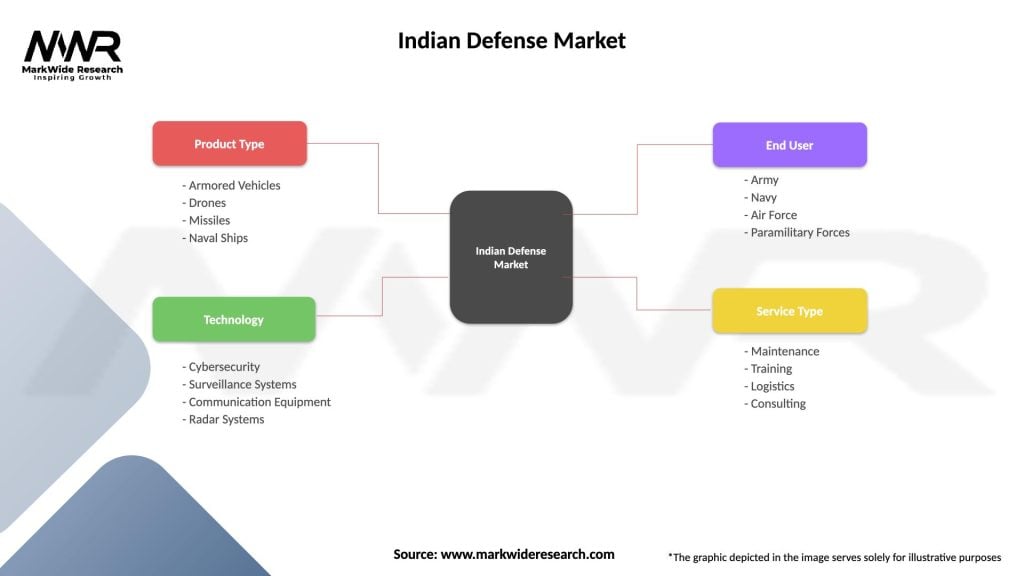

Market segmentation reveals diverse defense requirements across multiple categories, each demonstrating distinct growth patterns and strategic importance. Platform-based segmentation encompasses land systems, naval platforms, aerospace technologies, and emerging domain capabilities.

By Platform Type:

By Technology Domain:

By End User:

Land systems category demonstrates strong demand driven by border security requirements and modernization programs. Armored vehicle development shows particular strength with indigenous design and manufacturing capabilities expanding rapidly. The segment benefits from comprehensive upgrade programs and new platform development initiatives.

Naval systems category exhibits robust growth with substantial shipbuilding programs and indigenous manufacturing expansion. Submarine development programs represent significant opportunities with technology transfer initiatives and domestic manufacturing requirements. The segment shows 28% growth rate in indigenous manufacturing capabilities.

Aerospace category demonstrates exceptional potential with fighter aircraft programs, helicopter development, and unmanned systems initiatives. Indigenous aircraft development programs create substantial opportunities for domestic manufacturers and technology partners. The segment benefits from comprehensive modernization requirements across multiple platforms.

Electronics and communication category shows strong growth driven by advanced sensor requirements, communication systems, and electronic warfare capabilities. Radar system development presents significant opportunities with indigenous design and manufacturing initiatives supporting various platform requirements.

Emerging technologies category exhibits exceptional growth potential with cyber defense, space systems, and artificial intelligence applications gaining prominence. These segments represent future warfare capabilities with substantial investment and development opportunities.

Industry participants benefit from substantial market opportunities created by India’s defense modernization programs and indigenous manufacturing initiatives. Domestic manufacturers gain access to comprehensive technology transfer programs and strategic partnerships with international defense contractors, enhancing their capabilities and market position.

International defense contractors benefit from access to India’s substantial defense market while contributing to indigenous capability development through technology transfer and local manufacturing partnerships. Strategic partnership frameworks provide long-term business opportunities while supporting India’s self-reliance objectives.

Technology providers gain opportunities to participate in advanced defense programs while contributing to India’s technological advancement in critical defense domains. Research and development collaboration creates opportunities for innovation and capability enhancement across emerging warfare technologies.

Government stakeholders benefit from enhanced defense capabilities, reduced import dependency, and strengthened indigenous manufacturing base. Economic benefits include job creation, technology development, and export potential supporting broader economic objectives.

End users benefit from advanced defense capabilities, improved operational effectiveness, and enhanced security infrastructure. Training and support programs ensure optimal utilization of defense systems while building indigenous expertise and capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Indigenous manufacturing emphasis represents the most significant trend shaping India’s defense market, with comprehensive policy support for domestic capability development and reduced import dependency. Make in India initiatives drive fundamental transformation in defense procurement and manufacturing approaches.

Technology transfer acceleration has become a critical trend with strategic partnerships facilitating advanced capability acquisition while supporting indigenous manufacturing growth. Joint development programs enable access to cutting-edge technologies while building domestic expertise and manufacturing capabilities.

Export market development emerges as a significant trend with India targeting expanded defense exports to friendly nations. This trend creates additional demand for indigenous defense products while supporting domestic manufacturing growth and technological advancement.

Emerging technology integration shows strong momentum with artificial intelligence, autonomous systems, and advanced materials gaining prominence in defense applications. Cyber defense capabilities development represents a growing trend addressing contemporary threat environments.

Private sector participation expansion demonstrates substantial growth with enhanced role of private companies in defense manufacturing and development. Startup ecosystem development in defense technologies creates opportunities for innovation and technological advancement.

Digital transformation in defense systems and processes represents a growing trend with 52% adoption rate in advanced digital technologies across defense platforms and support systems.

Recent industry developments demonstrate accelerated progress in indigenous defense capabilities and strategic partnerships. Major procurement programs have been launched across all service branches, emphasizing indigenous manufacturing and technology transfer requirements.

Strategic partnership agreements with international defense contractors have facilitated advanced technology acquisition and local manufacturing capabilities. MarkWide Research analysis indicates substantial progress in technology transfer programs and joint development initiatives across multiple defense segments.

Defense export initiatives have gained momentum with successful delivery of indigenous defense products to friendly nations. Manufacturing capacity expansion by both public and private sector companies supports growing demand and export opportunities.

Technology development programs in emerging domains including cyber defense, space systems, and artificial intelligence applications have been accelerated. Research and development investment has increased substantially, supporting innovation and capability advancement across critical defense technologies.

Policy framework evolution continues with streamlined procurement processes and enhanced strategic partnership models designed to accelerate capability development while promoting indigenous manufacturing.

Strategic recommendations for market participants emphasize the importance of aligning with India’s indigenous manufacturing objectives while building comprehensive capabilities across multiple defense segments. Technology transfer partnerships should be prioritized to gain access to India’s substantial defense market while contributing to domestic capability development.

Investment in research and development capabilities represents a critical success factor, particularly in emerging technologies including artificial intelligence, autonomous systems, and cyber defense. Long-term strategic partnerships with Indian companies and government agencies provide sustainable market access and growth opportunities.

Export market development should be considered as a complementary strategy to domestic market participation, leveraging India’s growing defense export capabilities and strategic relationships. Quality assurance and certification capabilities must be prioritized to meet international standards and competitive requirements.

Skill development programs and workforce enhancement initiatives should be integrated into business strategies to support advanced manufacturing and technology development requirements. MWR analysis suggests that companies investing in comprehensive capability development and strategic partnerships will achieve optimal market positioning.

Future outlook for India’s defense market remains exceptionally positive, driven by sustained government commitment to modernization programs and indigenous manufacturing capabilities. Strategic policy support will continue to drive market growth while creating opportunities for both domestic and international defense contractors.

Technology advancement will accelerate across all defense segments, with particular emphasis on emerging domains including cyber defense, space systems, and artificial intelligence applications. Indigenous manufacturing capabilities are projected to expand significantly with 85% domestic content targets driving comprehensive capability development.

Export market growth represents substantial future opportunity with India targeting expanded defense exports to friendly nations and strategic partners. International partnerships will continue to play important roles in technology transfer and capability development while supporting indigenous manufacturing objectives.

Investment in defense infrastructure and manufacturing capabilities will accelerate, supporting growing demand and export opportunities. Private sector participation will expand substantially, contributing to innovation and technological advancement across multiple defense segments.

MarkWide Research projects sustained market growth driven by comprehensive modernization programs, policy support, and strategic partnerships that will position India among the world’s leading defense markets and manufacturing hubs.

India’s defense market represents one of the most dynamic and rapidly evolving defense ecosystems globally, characterized by substantial modernization initiatives, indigenous manufacturing emphasis, and strategic capability enhancement programs. The market demonstrates exceptional growth potential driven by comprehensive government support, policy reforms, and sustained investment in defense capabilities across all service branches.

Strategic transformation from import-dependent to indigenous manufacturing-focused approach has fundamentally altered market dynamics, creating substantial opportunities for both domestic and international defense contractors. Technology transfer initiatives and strategic partnerships facilitate advanced capability acquisition while supporting domestic manufacturing growth and technological advancement.

Future prospects remain exceptionally positive with sustained government commitment to defense modernization, indigenous manufacturing expansion, and export market development. The market benefits from comprehensive policy support, strategic partnerships, and growing private sector participation that will drive continued growth and capability enhancement across all defense segments, positioning India as a major global defense market and manufacturing hub.

What is Indian Defense?

Indian Defense refers to the military capabilities, strategies, and systems employed by India to protect its national interests and ensure security. This includes various branches such as the Army, Navy, and Air Force, along with defense procurement and technology development.

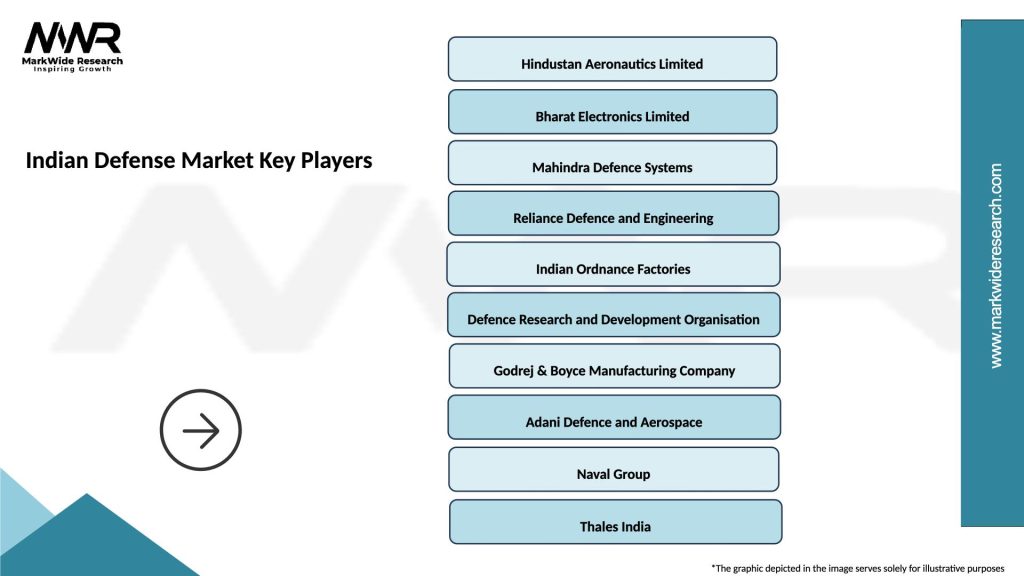

What are the key players in the Indian Defense Market?

The Indian Defense Market features several prominent companies, including Hindustan Aeronautics Limited (HAL), Bharat Electronics Limited (BEL), and Tata Advanced Systems. These companies are involved in manufacturing aircraft, naval vessels, and advanced electronics, among others.

What are the growth factors driving the Indian Defense Market?

The Indian Defense Market is driven by factors such as increasing geopolitical tensions, modernization of armed forces, and a focus on self-reliance in defense production. Additionally, government initiatives like ‘Make in India’ are encouraging domestic manufacturing.

What challenges does the Indian Defense Market face?

The Indian Defense Market faces challenges such as bureaucratic delays in procurement processes, reliance on foreign technology, and budget constraints. These issues can hinder timely upgrades and the development of indigenous capabilities.

What opportunities exist in the Indian Defense Market?

Opportunities in the Indian Defense Market include the expansion of defense exports, collaboration with foreign firms for technology transfer, and the development of advanced defense systems. The growing emphasis on cybersecurity and unmanned systems also presents new avenues for growth.

What trends are shaping the Indian Defense Market?

Trends in the Indian Defense Market include increased investment in research and development, a shift towards digital warfare capabilities, and the integration of artificial intelligence in defense systems. Additionally, there is a growing focus on sustainability and green technologies in defense operations.

Indian Defense Market

| Segmentation Details | Description |

|---|---|

| Product Type | Armored Vehicles, Drones, Missiles, Naval Ships |

| Technology | Cybersecurity, Surveillance Systems, Communication Equipment, Radar Systems |

| End User | Army, Navy, Air Force, Paramilitary Forces |

| Service Type | Maintenance, Training, Logistics, Consulting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indian Defense Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at