444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The Indian alternative medicine market represents one of the world’s most comprehensive and rapidly expanding healthcare sectors, deeply rooted in traditional healing practices that span thousands of years. India’s alternative medicine landscape encompasses diverse therapeutic systems including Ayurveda, Homeopathy, Unani, Siddha, and Naturopathy, collectively known as AYUSH systems. The market demonstrates remarkable growth momentum, driven by increasing consumer preference for natural healing methods and growing awareness of holistic healthcare approaches.

Market dynamics indicate substantial expansion across both domestic and international segments, with the sector experiencing a robust CAGR of 16.8% over recent years. The integration of traditional knowledge with modern scientific validation has positioned India as a global leader in alternative medicine manufacturing and export. Government initiatives through the Ministry of AYUSH have significantly strengthened the sector’s infrastructure, research capabilities, and regulatory framework.

Consumer adoption patterns reveal a fundamental shift toward preventive healthcare and natural wellness solutions, particularly accelerated by recent global health challenges. The market encompasses pharmaceutical preparations, wellness products, therapeutic services, and educational programs, creating a comprehensive ecosystem that serves both traditional practitioners and modern healthcare consumers seeking natural alternatives.

The Indian alternative medicine market refers to the comprehensive commercial ecosystem encompassing traditional healing systems, natural therapeutic products, wellness services, and holistic healthcare solutions that operate alongside or as alternatives to conventional allopathic medicine. This market includes manufacturing, distribution, retail, and service provision across various traditional medicine systems recognized and regulated by Indian authorities.

Alternative medicine systems in India primarily include Ayurveda, which focuses on balancing body energies through natural herbs and lifestyle practices; Homeopathy, utilizing highly diluted substances to stimulate healing; Unani medicine, based on Greek and Arabic medical traditions; Siddha, a Tamil traditional system; and Naturopathy, emphasizing natural healing processes. These systems collectively form the foundation of India’s alternative healthcare approach.

Market scope extends beyond pharmaceutical products to include wellness centers, spa services, educational institutions, research facilities, and export operations. The sector serves diverse consumer segments ranging from traditional users seeking cultural healthcare practices to modern consumers pursuing natural wellness solutions and international markets demanding authentic Indian alternative medicine products.

India’s alternative medicine market stands as a cornerstone of the nation’s healthcare industry, combining ancient wisdom with contemporary market dynamics to create unprecedented growth opportunities. The sector has evolved from traditional practice-based systems to a sophisticated commercial ecosystem that serves millions of consumers domestically while establishing significant international presence.

Key market drivers include increasing health consciousness among consumers, with 73% of urban populations showing preference for natural healthcare solutions. Government support through policy initiatives, infrastructure development, and research funding has created favorable conditions for market expansion. The integration of digital technologies and e-commerce platforms has enhanced market accessibility and consumer reach.

Competitive landscape features established pharmaceutical companies, traditional medicine manufacturers, wellness service providers, and emerging startups focusing on innovative product development and market penetration strategies. The sector demonstrates strong export potential, with Indian alternative medicine products gaining recognition in international markets for their quality, authenticity, and therapeutic effectiveness.

Future prospects indicate continued robust growth driven by expanding consumer base, technological integration, research advancement, and global market penetration. The market is positioned to capitalize on growing worldwide interest in natural healthcare solutions and India’s established expertise in traditional medicine systems.

Market segmentation analysis reveals diverse growth patterns across different alternative medicine categories, with Ayurveda maintaining the largest market share while Homeopathy demonstrates rapid expansion in urban markets. Consumer demographics show increasing adoption among younger populations seeking preventive healthcare solutions.

Consumer behavior patterns indicate strong preference for preventive healthcare approaches, with alternative medicine systems offering comprehensive wellness solutions that address both physical and mental health aspects. The market benefits from cultural acceptance and traditional knowledge systems that provide authentic therapeutic foundations.

Primary growth drivers propelling the Indian alternative medicine market include fundamental shifts in consumer healthcare preferences, supported by increasing awareness of natural healing benefits and growing skepticism toward synthetic pharmaceutical approaches. The rising prevalence of lifestyle-related health conditions has created substantial demand for holistic treatment options that address root causes rather than symptoms.

Government policy support through the Ministry of AYUSH has established comprehensive frameworks for research, education, and industry development. Policy initiatives include infrastructure development, research funding, international promotion, and regulatory standardization that collectively strengthen market foundations. The establishment of dedicated research institutions and academic programs has enhanced the sector’s scientific credibility.

Digital transformation has revolutionized market accessibility, with e-commerce platforms, telemedicine services, and mobile applications connecting consumers with alternative medicine products and practitioners. Technology integration has enabled better inventory management, quality control, and consumer education, expanding market reach beyond traditional geographical limitations.

Global health consciousness trends have increased international demand for natural healthcare solutions, positioning India as a preferred supplier of authentic alternative medicine products. The COVID-19 pandemic has particularly accelerated interest in immunity-boosting natural products and preventive healthcare approaches, creating new market opportunities.

Scientific validation efforts through clinical research and modern testing methods have enhanced the credibility of traditional medicine systems, attracting educated consumers and healthcare professionals who seek evidence-based natural treatment options.

Regulatory challenges present significant constraints to market growth, including complex approval processes, varying quality standards, and inconsistent enforcement mechanisms across different states and product categories. The lack of standardized protocols for traditional medicine evaluation creates uncertainty for manufacturers and consumers alike.

Quality control issues remain persistent challenges, with concerns about product authenticity, contamination, and standardization affecting consumer confidence and international market acceptance. The absence of comprehensive testing facilities and quality assurance systems in some regions limits market expansion potential.

Limited scientific evidence for certain traditional practices and products creates skepticism among healthcare professionals and educated consumers who demand clinical validation. The gap between traditional knowledge and modern scientific proof presents ongoing challenges for market credibility and acceptance.

Competition from allopathic medicine continues to influence consumer choices, particularly for acute medical conditions where conventional treatments demonstrate faster results. The established healthcare infrastructure and insurance coverage for allopathic treatments create competitive disadvantages for alternative medicine systems.

Skilled practitioner shortage limits service quality and market expansion, with inadequate training programs and certification processes affecting the availability of qualified alternative medicine professionals. This constraint particularly impacts rural areas and emerging market segments.

Export market expansion presents substantial growth opportunities, with increasing global demand for authentic Indian alternative medicine products. International markets, particularly in developed countries, show growing acceptance of natural healthcare solutions, creating significant revenue potential for Indian manufacturers and service providers.

Technology integration opportunities include artificial intelligence applications for personalized treatment recommendations, blockchain for supply chain transparency, and IoT devices for health monitoring and treatment tracking. These technological advances can enhance treatment effectiveness and consumer experience while creating new business models.

Wellness tourism development offers opportunities to combine alternative medicine treatments with travel experiences, attracting international visitors seeking authentic healing experiences. The development of specialized wellness destinations and integrated healthcare facilities can capture this growing market segment.

Research and development investments in clinical studies, product innovation, and treatment standardization can unlock new market segments and enhance existing product effectiveness. Collaboration between traditional practitioners and modern researchers can accelerate innovation and market acceptance.

Corporate wellness programs present opportunities for alternative medicine integration into workplace health initiatives, preventive care programs, and employee wellness benefits. The growing corporate focus on employee health and productivity creates new market channels and revenue streams.

Supply chain dynamics in the Indian alternative medicine market reflect complex interactions between traditional knowledge holders, raw material suppliers, manufacturers, distributors, and end consumers. The market demonstrates unique characteristics where ancient practices meet modern commercial requirements, creating both opportunities and challenges for stakeholders.

Demand patterns show seasonal variations aligned with traditional health practices and cultural festivals, while also responding to modern health trends and lifestyle changes. Consumer preferences increasingly favor products with scientific validation, quality certifications, and transparent sourcing information.

Pricing dynamics vary significantly across product categories and market segments, with premium products commanding higher prices through quality differentiation and brand positioning. The market supports diverse pricing strategies from affordable traditional preparations to premium wellness products targeting affluent consumers.

Distribution channels encompass traditional outlets like local practitioners and herbal shops alongside modern retail formats including pharmacies, supermarkets, and online platforms. The integration of multiple distribution channels has enhanced market accessibility while creating competitive pressures on traditional distribution methods.

Innovation cycles in the market balance respect for traditional knowledge with modern product development needs. Companies invest in research to validate traditional formulations while developing new products that meet contemporary consumer expectations for convenience, efficacy, and safety.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Indian alternative medicine market. The research approach combines quantitative data collection with qualitative analysis to provide holistic understanding of market dynamics, consumer behavior, and industry trends.

Primary research methods include structured interviews with industry stakeholders, consumer surveys across diverse demographic segments, and expert consultations with traditional medicine practitioners, regulatory officials, and industry leaders. Field studies in key manufacturing regions provide ground-level insights into production processes and supply chain dynamics.

Secondary research sources encompass government publications, industry reports, academic studies, trade association data, and regulatory filings. Analysis of historical data trends, policy documents, and international trade statistics provides context for market evolution and future projections.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis of survey responses, and expert review of findings. The methodology addresses potential biases and limitations while maintaining research integrity and reliability.

Analytical frameworks applied include market segmentation analysis, competitive positioning studies, consumer behavior modeling, and trend analysis. These frameworks enable comprehensive understanding of market structure, growth drivers, and strategic opportunities for industry participants.

Northern India demonstrates strong market presence with 28% regional market share, driven by established Ayurvedic manufacturing centers in states like Uttarakhand and Himachal Pradesh. The region benefits from abundant medicinal plant resources and traditional knowledge centers that support both domestic consumption and export manufacturing.

Western India leads in market innovation and commercial development, with Maharashtra and Gujarat hosting major pharmaceutical companies and research institutions. The region’s industrial infrastructure and proximity to international ports facilitate export operations and technology integration initiatives.

Southern India shows exceptional growth in wellness tourism and traditional medicine education, with Kerala’s Ayurvedic treatments and Tamil Nadu’s Siddha system attracting national and international attention. The region maintains 35% market share in wellness services and medical tourism segments.

Eastern India focuses on traditional medicine research and academic development, with West Bengal and Odisha contributing significantly to homeopathic medicine manufacturing and education. The region’s cultural affinity for alternative medicine supports strong domestic consumption patterns.

Central India serves as a crucial raw material supply region, with Madhya Pradesh and Chhattisgarh providing medicinal plants and herbs to manufacturers across the country. The region’s agricultural focus and forest resources support sustainable supply chain development for the alternative medicine industry.

Market leadership in the Indian alternative medicine sector is distributed among established pharmaceutical companies, traditional medicine specialists, and emerging wellness brands that leverage different competitive strategies and market positioning approaches.

Competitive strategies include product innovation, quality certification, brand building, distribution expansion, and international market development. Companies invest in research and development to validate traditional formulations while developing new products that meet modern consumer expectations.

Market consolidation trends show increasing merger and acquisition activity as companies seek to expand product portfolios, enhance distribution capabilities, and achieve economies of scale in manufacturing and marketing operations.

By Medicine System: The market segments into distinct traditional medicine categories, each with unique characteristics, consumer bases, and growth patterns that reflect cultural preferences and therapeutic approaches.

By Product Type: Market categorization based on product formats and applications reveals diverse consumer preferences and usage patterns across different demographic segments.

By Distribution Channel: Market access through various retail and service channels reflects evolving consumer shopping behaviors and preferences for product availability and convenience.

Ayurvedic pharmaceuticals represent the most established category with comprehensive product ranges addressing various health conditions. This segment benefits from extensive traditional knowledge, established manufacturing infrastructure, and growing scientific validation through clinical research and modern testing methods.

Homeopathic medicines demonstrate strong growth momentum, particularly in urban markets where consumers seek gentle, side-effect-free treatment options for chronic conditions. The segment shows 65% consumer satisfaction rates and increasing acceptance among healthcare professionals for complementary treatment approaches.

Herbal cosmetics have emerged as a high-growth category, combining traditional beauty knowledge with modern formulation techniques. Consumer preference for natural and chemical-free beauty products drives significant market expansion, with products featuring traditional ingredients like turmeric, neem, and aloe vera gaining popularity.

Wellness services including spa treatments, panchakarma therapies, and holistic health consultations represent growing market segments that combine traditional healing practices with modern wellness concepts. These services attract both domestic consumers seeking authentic treatments and international wellness tourists.

Nutraceutical products bridge the gap between traditional medicine and modern nutrition science, offering consumers convenient ways to incorporate traditional health benefits into contemporary lifestyles. This category shows particular strength in immunity-boosting and stress-management products.

Manufacturers benefit from growing market demand, government policy support, and expanding export opportunities that create multiple revenue streams and business growth potential. The sector offers opportunities for product innovation, brand development, and market expansion across domestic and international segments.

Healthcare practitioners gain from increasing consumer acceptance of alternative medicine systems, creating expanded practice opportunities and professional recognition. The integration of traditional and modern healthcare approaches provides practitioners with comprehensive treatment options for patient care.

Consumers receive access to natural healthcare solutions that offer holistic treatment approaches, preventive care options, and cultural healthcare practices that align with traditional values and modern wellness needs. Alternative medicine provides cost-effective healthcare alternatives with minimal side effects.

Government stakeholders benefit from sector growth through increased tax revenues, export earnings, employment generation, and healthcare cost reduction. The sector supports rural development through medicinal plant cultivation and traditional knowledge preservation initiatives.

Investors find attractive opportunities in a growing market with strong fundamentals, government support, and expanding consumer base. The sector offers diverse investment options across manufacturing, retail, services, and technology integration segments.

Research institutions gain opportunities for traditional knowledge documentation, clinical validation studies, and product development research that bridges traditional wisdom with modern scientific methods. Academic collaboration enhances research capabilities and funding opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents a fundamental trend reshaping the Indian alternative medicine market, with telemedicine consultations, mobile health applications, and e-commerce platforms revolutionizing how consumers access products and services. MarkWide Research indicates that digital adoption in the sector has accelerated significantly, with online sales showing remarkable growth patterns.

Scientific validation initiatives are gaining momentum as companies and research institutions invest in clinical studies to prove the efficacy of traditional formulations. This trend bridges the gap between traditional knowledge and modern medical requirements, enhancing credibility and market acceptance among educated consumers and healthcare professionals.

Personalized medicine approaches are emerging as practitioners and companies develop customized treatment protocols based on individual constitution, health conditions, and lifestyle factors. This trend aligns with traditional medicine principles while meeting modern consumer expectations for personalized healthcare solutions.

Sustainable sourcing practices are becoming increasingly important as companies focus on ethical procurement of medicinal plants, fair trade practices, and environmental conservation. Consumer awareness of sustainability issues drives demand for responsibly sourced alternative medicine products.

Integration with conventional healthcare shows growing acceptance as hospitals and clinics incorporate alternative medicine treatments into comprehensive care programs. This trend creates new opportunities for collaboration between traditional practitioners and modern healthcare providers.

Wellness lifestyle positioning transforms alternative medicine from treatment-focused to prevention and wellness-oriented approaches, appealing to health-conscious consumers seeking holistic lifestyle solutions rather than just therapeutic interventions.

Regulatory framework strengthening through the Ministry of AYUSH has established comprehensive guidelines for manufacturing, quality control, and marketing of alternative medicine products. Recent policy initiatives include mandatory quality certifications, standardized testing protocols, and enhanced export facilitation measures.

Research infrastructure expansion includes the establishment of new research institutes, clinical trial facilities, and academic programs dedicated to alternative medicine studies. Government and private sector investments in research capabilities have enhanced the sector’s scientific credibility and innovation potential.

International collaboration initiatives have strengthened India’s position in global alternative medicine markets through partnerships with international institutions, participation in global health forums, and bilateral agreements for traditional medicine cooperation with various countries.

Technology adoption programs support digital transformation in the sector through initiatives promoting e-commerce platforms, telemedicine services, and digital marketing capabilities for traditional medicine practitioners and manufacturers.

Quality certification systems have been implemented to ensure product safety, efficacy, and authenticity. These systems include Good Manufacturing Practices (GMP) certification, organic certification, and international quality standards compliance for export products.

Educational program expansion includes new degree courses, professional certification programs, and continuing education initiatives that enhance the availability of qualified practitioners and researchers in alternative medicine systems.

Investment prioritization should focus on research and development capabilities that can validate traditional formulations through modern scientific methods. Companies investing in clinical studies and product standardization will gain competitive advantages in both domestic and international markets.

Digital strategy implementation becomes crucial for market success, with companies needing to develop comprehensive online presence, e-commerce capabilities, and digital marketing strategies. The integration of technology with traditional medicine practices offers significant differentiation opportunities.

Quality assurance systems require immediate attention as consumer expectations and regulatory requirements continue to evolve. Companies should invest in modern testing facilities, quality control processes, and certification programs to ensure product reliability and market acceptance.

International market development presents substantial growth opportunities for companies with strong product portfolios and quality credentials. Strategic partnerships, export facilitation, and international marketing initiatives can unlock significant revenue potential.

Sustainability initiatives should be integrated into business strategies to address growing consumer concerns about environmental impact and ethical sourcing. Companies adopting sustainable practices will benefit from enhanced brand reputation and consumer loyalty.

Talent development programs are essential for addressing the skilled practitioner shortage and ensuring service quality. Investment in training programs, certification systems, and professional development initiatives will support long-term market growth.

Market growth trajectory indicates continued expansion driven by increasing health consciousness, government support, and growing international acceptance of Indian alternative medicine systems. The sector is positioned for sustained growth with projected CAGR of 15.2% over the next five years, supported by favorable demographic trends and policy initiatives.

Technology integration will accelerate market transformation through artificial intelligence applications, personalized treatment recommendations, and digital health monitoring systems. These technological advances will enhance treatment effectiveness while improving accessibility and convenience for consumers.

Global market penetration will expand significantly as international consumers increasingly seek natural healthcare alternatives. Indian companies with strong quality credentials and authentic products are well-positioned to capture growing international demand, particularly in developed markets.

Research advancement will continue to validate traditional medicine practices through clinical studies and modern testing methods. MWR analysis suggests that scientific validation will be crucial for mainstream healthcare integration and professional acceptance of alternative medicine systems.

Regulatory evolution will strengthen quality standards and consumer protection while facilitating market growth through streamlined approval processes and export promotion initiatives. Enhanced regulatory frameworks will improve market credibility and international competitiveness.

Innovation opportunities will emerge from the convergence of traditional knowledge with modern technology, creating new product categories, service models, and treatment approaches that meet evolving consumer expectations and healthcare needs.

The Indian alternative medicine market stands at a transformative juncture where ancient wisdom meets modern commercial opportunities, creating unprecedented potential for growth and innovation. The sector’s deep cultural roots, combined with increasing scientific validation and government support, position it as a cornerstone of India’s healthcare industry with significant domestic and international prospects.

Market fundamentals remain strong, supported by growing consumer preference for natural healthcare solutions, expanding research capabilities, and favorable policy environments that encourage sector development. The integration of traditional knowledge with modern technology and quality standards creates sustainable competitive advantages for Indian companies in global markets.

Future success will depend on continued investment in research and development, quality assurance systems, and digital transformation initiatives that enhance market accessibility and consumer confidence. Companies that successfully balance respect for traditional knowledge with modern market requirements will capture the greatest opportunities in this dynamic and expanding sector.

The Indian alternative medicine market represents not just a commercial opportunity but a cultural heritage that contributes to global healthcare diversity and wellness solutions, positioning India as a leader in natural and holistic healthcare approaches for generations to come.

What is Indian Alternative Medicine?

Indian Alternative Medicine refers to various traditional healing practices and therapies that are used in India, including Ayurveda, Yoga, Unani, and Siddha. These practices focus on holistic health and wellness, emphasizing the balance of body, mind, and spirit.

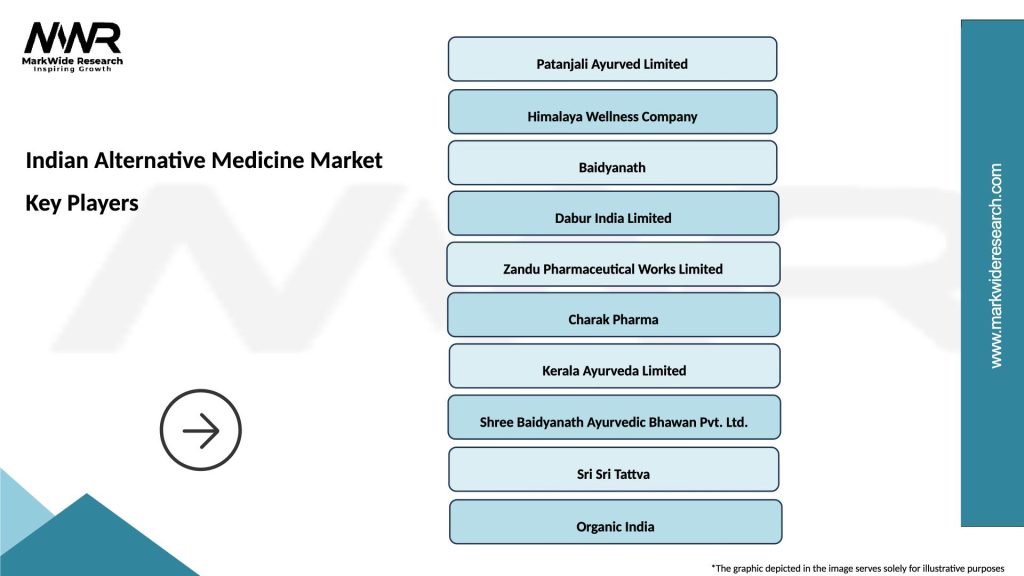

What are the key players in the Indian Alternative Medicine Market?

Key players in the Indian Alternative Medicine Market include Patanjali Ayurved, Himalaya Wellness, Dabur India, and Baidyanath. These companies are known for their extensive range of herbal products, Ayurvedic medicines, and wellness solutions, among others.

What are the growth factors driving the Indian Alternative Medicine Market?

The Indian Alternative Medicine Market is driven by increasing consumer awareness of natural and holistic health solutions, a growing preference for preventive healthcare, and the rising popularity of wellness tourism. Additionally, the integration of alternative medicine into mainstream healthcare is contributing to market growth.

What challenges does the Indian Alternative Medicine Market face?

The Indian Alternative Medicine Market faces challenges such as regulatory hurdles, a lack of standardized practices, and skepticism from some segments of the population regarding the efficacy of alternative treatments. These factors can hinder wider acceptance and integration into conventional healthcare systems.

What opportunities exist in the Indian Alternative Medicine Market?

Opportunities in the Indian Alternative Medicine Market include the expansion of online platforms for product distribution, increasing collaborations between traditional and modern healthcare providers, and the growing trend of personalized medicine. These factors can enhance accessibility and consumer engagement.

What trends are shaping the Indian Alternative Medicine Market?

Trends shaping the Indian Alternative Medicine Market include the rise of organic and natural products, increased research and development in alternative therapies, and the incorporation of technology in treatment methods. Additionally, there is a growing interest in wellness retreats and holistic health programs.

Indian Alternative Medicine Market

| Segmentation Details | Description |

|---|---|

| Product Type | Ayurveda, Homeopathy, Unani, Naturopathy |

| Delivery Mode | Oral, Topical, Inhalation, Injection |

| End User | Individuals, Clinics, Wellness Centers, Hospitals |

| Application | Chronic Diseases, Preventive Care, Mental Health, Pain Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indian Alternative Medicine Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at